Featured image for Car Insurance For 16 Year Old

Image source: agilerates.com

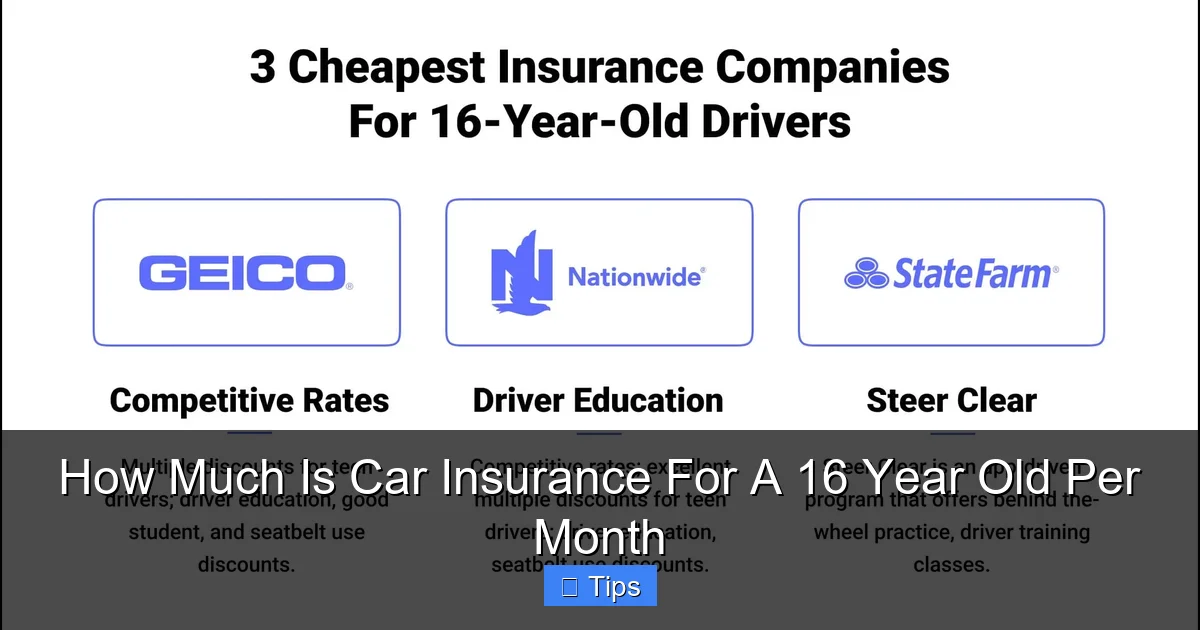

Car insurance for a 16-year-old is notoriously expensive, often costing hundreds of dollars per month due to their inexperience and higher risk. Expect premiums to range significantly, with figures commonly between $150 and $600+ monthly, influenced by factors like location, vehicle type, and even gender. However, pursuing discounts for good grades, driver’s education, and bundling policies can significantly help lower these steep costs.

The exhilarating moment a teenager earns their driver’s license is a rite of passage, a symbol of newfound freedom and independence. For 16-year-olds across the country, getting behind the wheel represents a significant milestone, opening doors to social activities, part-time jobs, and the simple joy of cruising with friends. However, this exciting chapter often comes with a stark financial reality that can quickly temper the initial euphoria: the cost of car insurance.

Parents and teens alike are often shocked by the premium quotes for newly licensed drivers. It’s no secret that insurance for young drivers, especially those under 18, is significantly more expensive than for experienced adults. The question that quickly surfaces for many families is, “How much is car insurance for a 16 year old per month?” This isn’t just a minor expense; it can be a substantial addition to the household budget, requiring careful planning and consideration.

Understanding the factors that contribute to these high costs, exploring average monthly expenses, and discovering effective strategies to reduce premiums are crucial steps for any family navigating this new terrain. This comprehensive guide will delve into the intricacies of car insurance for a 16-year-old, providing practical insights and actionable tips to help you manage this significant financial commitment. By the end, you’ll have a clearer picture of what to expect and how to make car insurance for a 16-year-old per month more manageable.

“`html

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 The Harsh Reality: Why Insurance is So Expensive for 16-Year-Olds

- 4 Key Factors That Influence a 16-Year-Old’s Car Insurance Premiums

- 5 Average Car Insurance Costs for 16-Year-Olds (Monthly Breakdown)

- 6 Strategies to Significantly Reduce Car Insurance Costs for 16-Year-Olds

- 7 The Long-Term Perspective: How Insurance Costs Evolve

- 8 Conclusion

- 9 Frequently Asked Questions

- 9.1 What is the average car insurance cost for a 16-year-old per month?

- 9.2 Why is car insurance for a 16-year-old so expensive?

- 9.3 What factors influence the monthly car insurance cost for a 16-year-old?

- 9.4 How can a 16-year-old reduce their monthly car insurance premium?

- 9.5 Is there a difference in car insurance costs for a 16-year-old male versus female?

- 9.6 Can a 16-year-old get their own car insurance policy, or must they be on a parent’s policy?

Key Takeaways

- Expect high costs: 16-year-old car insurance is typically very expensive.

- Good grades save money: Maintain academic excellence for student discounts.

- Choose a safe, older car: Vehicle type significantly impacts premium costs.

- Join a parent’s policy: This is generally the most affordable option.

- Compare multiple quotes: Shop around extensively to find the best rates.

- Explore usage-based programs: Telematics can reward safe driving habits.

- Understand state requirements: Ensure your coverage meets legal minimums.

“`

📑 Table of Contents

- The Harsh Reality: Why Insurance is So Expensive for 16-Year-Olds

- Key Factors That Influence a 16-Year-Old’s Car Insurance Premiums

- Average Car Insurance Costs for 16-Year-Olds (Monthly Breakdown)

- Strategies to Significantly Reduce Car Insurance Costs for 16-Year-Olds

- The Long-Term Perspective: How Insurance Costs Evolve

- Conclusion

The Harsh Reality: Why Insurance is So Expensive for 16-Year-Olds

Before diving into the numbers for how much is car insurance for a 16 year old per month, it’s essential to understand why these costs are so high. Insurance companies operate on risk assessment. The higher the perceived risk, the higher the premium. Unfortunately for 16-year-olds, they fall into the highest-risk category for several compelling reasons, making car insurance for a 16 year old per month a significant hurdle.

Lack of Driving Experience

The most straightforward reason is the lack of experience. A 16-year-old, by definition, has just received their license and has minimal, if any, unsupervised driving hours under their belt. This inexperience translates directly into a higher likelihood of making errors on the road, misjudging situations, and reacting incorrectly to unexpected hazards. Insurance companies have decades of data showing a direct correlation between inexperience and accident frequency. This foundational lack of experience is the primary driver behind the high costs of car insurance for a 16 year old per month.

Higher Accident Rates and Severity

Statistics consistently show that drivers aged 16 to 19 have significantly higher crash rates than any other age group. According to the Centers for Disease Control and Prevention (CDC), the motor vehicle crash death rate for male drivers aged 16-19 was twice that of female drivers in the same age group in 2020. Teen drivers are also more prone to fatal crashes due to a combination of inexperience, risk-taking behaviors, and lower seat belt usage. When crashes do occur with young drivers, they often involve higher speeds, more passengers, and a greater likelihood of severe injuries or fatalities, leading to more expensive claims. This elevated risk of costly payouts is a major factor in determining how much is car insurance for a 16 year old per month.

Increased Likelihood of Risky Driving Behaviors

Beyond simple inexperience, 16-year-olds are also more susceptible to risky driving behaviors. These can include speeding, distracted driving (texting, using cell phones, interacting with passengers), driving under the influence of alcohol or drugs, and not wearing seatbelts. Peer pressure can exacerbate these tendencies, leading young drivers to take chances they might otherwise avoid. For insurance providers, these behaviors are red flags, indicating a higher probability of an incident. Consequently, calculating how much is car insurance for a 16 year old per month must account for these behavioral risks.

Cognitive Development Factors

It’s not just about rebellious behavior; the adolescent brain is still developing. The prefrontal cortex, responsible for impulse control, risk assessment, and decision-making, isn’t fully mature until the mid-20s. This biological reality means that even well-intentioned 16-year-olds may genuinely struggle with assessing risks as effectively as an adult, leading to choices that increase their accident potential. Insurers are acutely aware of these developmental stages when setting premiums for a demographic asking, “how much is car insurance for a 16 year old per month?”

In essence, insurance companies don’t see a responsible individual; they see a statistical probability based on age, experience, and documented risk factors. This actuarial reality makes car insurance for a 16-year-old per month one of the most expensive line items for new drivers.

Key Factors That Influence a 16-Year-Old’s Car Insurance Premiums

While age and inexperience are overarching factors, many specific variables further fine-tune how much is car insurance for a 16 year old per month. Understanding these elements can help families identify areas where they might be able to influence costs.

Visual guide about Car Insurance For 16 Year Old

Image source: carinsurancecomparison.com

Driver-Specific Factors

- Driving Record: Even a new driver can quickly accumulate marks on their record. Tickets for speeding, distracted driving, or any at-fault accidents will drastically increase how much car insurance for a 16 year old per month will cost. Maintaining a clean record from day one is paramount.

- Gender: Historically, young male drivers pay more for car insurance than young female drivers. This is due to statistical data indicating that young males tend to be involved in more severe accidents. While some states are moving away from gender-based pricing, it remains a factor in many regions.

- Grades (Good Student Discount): Many insurers offer a “Good Student Discount” for drivers who maintain a B average (3.0 GPA) or higher. This discount acknowledges that students who are responsible in academics are often more responsible behind the wheel, making it an excellent way to reduce how much is car insurance for a 16 year old per month.

- Driver’s Education Completion: Completing an approved driver’s education course can often qualify a 16-year-old for a discount. These courses provide valuable instruction beyond basic licensing requirements, demonstrating a commitment to safe driving practices.

Vehicle-Specific Factors

- Type of Car: The car a 16-year-old drives has a significant impact on premiums.

- Sports Cars/High-Performance Vehicles: These are inherently more expensive to insure due to their higher purchase price, higher repair costs, and statistical association with speeding and accidents.

- Luxury Cars: Similar to sports cars, luxury vehicles come with higher repair and replacement costs.

- Older, Lower-Value Cars: While seemingly cheaper to insure, if they lack modern safety features, they might not offer as much of a discount as one might think.

- Safe, Reliable Sedans/SUVs: Cars with strong safety ratings, lower theft rates, and affordable parts will generally be less expensive to insure. The type of car is a key determinant in how much is car insurance for a 16 year old per month.

- Safety Features: Cars equipped with advanced safety features like anti-lock brakes (ABS), electronic stability control (ESC), adaptive cruise control, lane departure warning, and automatic emergency braking can qualify for discounts.

- Anti-Theft Devices: Vehicles with factory-installed or aftermarket anti-theft systems (alarms, tracking devices, immobilizers) are less likely to be stolen, which can lower comprehensive coverage costs and impact how much is car insurance for a 16 year old per month.

Policy-Specific Factors

- Coverage Limits and Deductibles: Higher coverage limits (e.g., $100,000/$300,000 liability instead of state minimums) provide greater protection but also increase premiums. Conversely, choosing a higher deductible (the amount you pay out-of-pocket before insurance kicks in) can lower monthly premiums, but means more personal expense if an accident occurs.

- Type of Coverage: A full coverage policy (liability, collision, and comprehensive) will be significantly more expensive than a liability-only policy. While liability is legally required, collision and comprehensive cover damage to your own vehicle.

Geographical Factors

- Location: Where a 16-year-old lives and drives plays a role. Urban areas with higher traffic density, increased accident rates, and higher theft rates typically have more expensive insurance than rural areas. Specific ZIP codes within a city can even have different rates based on local crime statistics and accident frequency.

- State Minimum Requirements: Each state mandates minimum liability coverage. States with higher minimum requirements generally have higher base premiums, affecting how much is car insurance for a 16 year old per month.

Parental/Household Factors

- Parents’ Driving Record: If a 16-year-old is added to a parent’s policy, the parents’ clean driving records can help mitigate the overall increase. A parent with a history of accidents or violations may see a higher jump in premiums when adding a teen.

- Other Drivers on the Policy: The number of drivers and cars on a multi-car policy can influence discounts. Adding a 16-year-old to an existing multi-car policy is often cheaper than a standalone policy.

- Credit Score (of policyholder): While not directly tied to the 16-year-old, the primary policyholder’s credit score can significantly impact rates in many states. Insurers use credit-based insurance scores as a predictor of claim likelihood.

Each of these factors combines to create a unique risk profile, which then dictates how much car insurance for a 16 year old per month will ultimately cost.

Average Car Insurance Costs for 16-Year-Olds (Monthly Breakdown)

The core question remains: “How much is car insurance for a 16 year old per month?” The answer, unfortunately, is highly variable. There’s no single price, as the factors discussed above create a wide spectrum of costs. However, we can provide some realistic ranges and scenarios to give you a better idea.

Visual guide about Car Insurance For 16 Year Old

Image source: usinsuranceagents.com

Generally speaking, adding a 16-year-old driver to an existing family policy is almost always the most cost-effective option. A standalone policy for a 16-year-old, if even offered by an insurer, would be astronomically expensive.

On average, families can expect their car insurance premiums to increase by 100% to 160% when adding a 16-year-old driver to an existing policy. This means if a family was paying $150 per month, their new total could easily jump to $300-$400 per month or more. This significant increase answers how much is car insurance for a 16 year old per month when added to a policy.

To provide a more granular breakdown, here are some illustrative average monthly cost ranges for full coverage, considering various scenarios. These figures are estimates and can vary wildly based on location, specific insurer, vehicle type, and all the factors mentioned previously.

Illustrative Monthly Car Insurance Costs for 16-Year-Olds

The figures below represent approximate monthly costs based on national averages and common scenarios for full coverage policies. Keep in mind that individual quotes will differ significantly.

| Scenario | Average Monthly Cost (Range) | Notes |

|---|---|---|

| Adding to Parent’s Policy (Female, Good Grades, Safe Car) | $180 – $350 | Often the lowest cost option due to discounts and lower statistical risk for female drivers. |

| Adding to Parent’s Policy (Male, Good Grades, Safe Car) | $220 – $450 | Typically higher than for females due to higher statistical risk, even with good grades. |

| Adding to Parent’s Policy (Any Gender, Average Grades, Mid-Range Car) | $250 – $500 | More common scenario, costs reflecting standard risk factors. |

| Standalone Policy (Hypothetical, Any Gender, Safe Car) | $400 – $800+ | Extremely rare for insurers to offer; significantly higher due to no shared risk with experienced drivers. |

| High-Risk Scenario (e.g., Male, Poor Grades, Sports Car, Urban Area) | $500 – $1,000+ | Combination of multiple high-risk factors driving costs to extreme levels. |

As you can see, the range for how much is car insurance for a 16 year old per month can be immense, often starting at nearly $200 and quickly soaring to $500 or more, especially for males or those in high-risk situations. This is why exploring every possible discount and strategy is crucial.

Geographic Impact on Costs

The state and even the specific zip code where you live will dramatically affect the answer to how much is car insurance for a 16 year old per month. For example:

- Higher Cost States: States like Michigan, Florida, Louisiana, and New York often have some of the highest car insurance rates in the nation due to factors like high accident rates, dense populations, and complex insurance laws.

- Lower Cost States: States like Ohio, Iowa, and Idaho tend to have lower average rates.

Even within a single state, urban areas will almost always have higher premiums than rural areas due to increased traffic, crime rates, and potential for accidents. Therefore, the answer to how much is car insurance for a 16 year old per month is deeply rooted in location.

Strategies to Significantly Reduce Car Insurance Costs for 16-Year-Olds

While car insurance for a 16-year-old per month will inevitably be expensive, there are many proactive steps families can take to mitigate these costs. Implementing these strategies can make a substantial difference in your monthly premiums.

Visual guide about Car Insurance For 16 Year Old

Image source: usinsuranceagents.com

1. Keep Them on a Parent’s Policy

This is arguably the most impactful strategy. Adding a 16-year-old to an existing family policy is almost always cheaper than having them get their own standalone policy. Here’s why:

- Multi-Car Discount: Most insurers offer discounts for insuring multiple vehicles with them.

- Multi-Driver Discount: Having multiple drivers on one policy can also lead to savings.

- Experience Mitigation: The risk of the inexperienced 16-year-old is averaged with the lower risk of the experienced adult drivers on the policy.

- Policyholder Credit Score: The parents’ (likely better) credit score is used to calculate premiums, which can lead to lower rates compared to a young person with no credit history.

This single action can shave hundreds off how much is car insurance for a 16 year old per month.

2. Choose the Right Car

The type of car a 16-year-old drives is a huge factor. To keep costs down, opt for a vehicle that is:

- Safe and Reliable: Look for cars with high safety ratings from organizations like the IIHS (Insurance Institute for Highway Safety) and NHTSA (National Highway Traffic Safety Administration). Insurers favor vehicles that protect occupants and are less likely to be involved in severe accidents.

- Economical to Repair: Parts availability and labor costs for specific models impact collision and comprehensive claims. Avoid exotic or luxury brands that require specialized parts and mechanics.

- Lower Horsepower: Cars with smaller engines and lower horsepower are less likely to be driven at high speeds, reducing accident risk.

- Not a Target for Theft: Some car models are more frequently stolen than others. Check theft statistics for your area.

Avoid sports cars, highly modified vehicles, or luxury brands at all costs for a 16-year-old. A used, safe sedan or small SUV is usually the best choice to manage how much is car insurance for a 16 year old per month.

3. Leverage Discounts

Actively ask your insurer about all available discounts. Here are some of the most common that apply to young drivers:

- Good Student Discount: As mentioned, a B average (3.0 GPA) or higher can significantly reduce premiums. Ensure you provide proof (report card, transcript) regularly.

- Driver’s Education Discount: Completing an approved driver’s education program can lead to savings.

- Telematics/Usage-Based Insurance (UBI) Programs: Many insurers offer devices or apps that monitor driving habits (speed, braking, mileage, time of day driven). Safe driving can earn discounts. This is an excellent way for a 16-year-old to directly influence their monthly premiums.

- Anti-Theft Device Discount: If the car has an alarm, immobilizer, or tracking device, you might qualify for a discount.

- Low Mileage Discount: If the 16-year-old doesn’t drive very often or limits their driving to short distances, some insurers offer a discount for low annual mileage.

- Bundling Discounts: If you bundle your car insurance with homeowners, renters, or life insurance with the same provider, you can often save on both policies.

- Student Away at School Discount: If the 16-year-old (or older student) attends college more than 100 miles from home without a car, they may qualify for a discount.

Always inquire about every possible discount to keep how much is car insurance for a 16 year old per month as low as possible.

4. Opt for Higher Deductibles

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in for a claim. Choosing a higher deductible (e.g., $1,000 instead of $500) will lower your monthly premiums. However, this means you’ll pay more upfront if there’s an accident. Evaluate your financial situation and risk tolerance before making this choice.

5. Maintain a Clean Driving Record

This is paramount. Any tickets (speeding, distracted driving, reckless driving) or at-fault accidents will cause premiums to skyrocket, potentially negating any discounts you’ve secured. For a 16-year-old, even one minor infraction can have a disproportionately large impact on how much is car insurance for a 16 year old per month. Emphasize safe and responsible driving habits from day one.

6. Consider Limiting Coverage (Carefully)

For older, lower-value cars, it might make financial sense to drop collision and comprehensive coverage. If the car’s market value is less than the cost of your deductible plus a few months of premiums, it might not be worth insuring against damage to the vehicle itself. However, you must always maintain your state’s minimum liability coverage. This strategy should be carefully considered, as it leaves you financially responsible for damage to your own car in an accident. Always consider the value of the vehicle when evaluating how much is car insurance for a 16 year old per month if dropping physical damage coverage.

7. Shop Around Extensively

Do not settle for the first quote you receive. Insurance rates vary significantly between providers for the exact same coverage. Get quotes from at least 3-5 different insurance companies, including large national carriers, smaller regional insurers, and online-only providers. Consider using an independent insurance agent who can shop multiple carriers for you. This competitive shopping can reveal substantial differences in how much is car insurance for a 16 year old per month.

By diligently applying these strategies, families can significantly ease the financial burden of car insurance for a 16-year-old per month.

The Long-Term Perspective: How Insurance Costs Evolve

While the initial cost of car insurance for a 16-year-old per month can feel overwhelming, it’s important to remember that these high premiums are not permanent. Insurance costs tend to decrease significantly as a driver gains experience and matures. This long-term perspective can offer some reassurance.

Age and Experience Reduce Premiums

The biggest factor in premium reduction, after maintaining a clean driving record, is simply aging. As drivers move past the statistically riskiest ages (16-19), their rates begin to drop. You’ll typically see noticeable decreases around the following milestones:

- Age 18-19: Minor reductions start to appear as the driver gets slightly more experience.

- Age 20-21: More substantial drops often occur, assuming a clean driving record.

- Age 25: This is generally the age when car insurance rates stabilize and align more closely with those of experienced adult drivers. The “teen driver” surcharge typically disappears entirely.

Each year of safe, incident-free driving builds a positive driving history, which directly translates into lower premiums. The initial answer to how much is car insurance for a 16 year old per month will not be the same answer at 18, 21, or 25.

Importance of Continuous Coverage

Maintaining continuous car insurance coverage, even if the 16-year-old drives infrequently, is crucial. Gaps in coverage can lead to higher premiums in the future, as insurers view it as a higher risk. Consistently paying premiums and having an active policy demonstrates responsible behavior to insurance providers.

Building a Good Driving History

From the moment a 16-year-old gets their license, they begin building their driving history. This history is their resume to insurance companies. A history free of accidents, moving violations, and claims is invaluable for securing the lowest possible rates in the future. Educating teens about the financial implications of their driving choices can be a powerful motivator for safe driving.

Therefore, while the initial sticker shock of how much is car insurance for a 16 year old per month can be significant, remember that it’s an investment in their future driving independence. By choosing wisely and driving responsibly, those high costs will gradually fall, rewarding years of safe habits with more affordable premiums.

Conclusion

The journey to obtaining a driver’s license at 16 is an exciting one, but it also ushers in a significant financial responsibility: car insurance. The question “How much is car insurance for a 16 year old per month?” often reveals a cost that can be daunting for many families, easily ranging from $200 to over $500 monthly when added to an existing policy, and potentially much higher for standalone coverage. This steep price reflects the undeniable fact that 16-year-olds represent the highest risk group for insurers due to their inexperience, higher accident rates, and propensity for risky behaviors.

However, understanding the factors that influence these premiums – from the type of car they drive and their academic performance to their geographical location and the parent’s driving record – empowers families to make informed decisions. More importantly, there are numerous actionable strategies to help mitigate these costs. Adding a 16-year-old to a parent’s policy, selecting a safe and practical car, proactively seeking out discounts like the Good Student or Driver’s Ed discount, and seriously considering telematics programs can collectively make a substantial difference in how much car insurance for a 16 year old per month will cost. Above all, maintaining a clean driving record from day one is the most critical factor for long-term savings.

Remember that these high premiums are not forever. As a 16-year-old driver gains experience and matures, and with a history of safe driving, insurance costs will gradually decrease, often significantly by the age of 25. By approaching this challenge with knowledge, strategy, and a strong emphasis on responsible driving, families can navigate the complexities of car insurance for a 16-year-old per month, making this exciting milestone both achievable and sustainable.

Frequently Asked Questions

What is the average car insurance cost for a 16-year-old per month?

The average car insurance cost for a 16-year-old per month can range significantly, often falling between $150 to $400 or more, depending on various factors. This is typically when they are added to a family policy, as getting a standalone policy would be substantially higher.

Why is car insurance for a 16-year-old so expensive?

Car insurance for a 16-year-old is expensive primarily due to their lack of driving experience and higher statistical risk of accidents. Insurers see new, young drivers as a significant liability, leading to higher premiums to offset potential claims.

What factors influence the monthly car insurance cost for a 16-year-old?

Several factors influence the monthly car insurance cost for a 16-year-old, including the type of car driven, geographic location, coverage limits, and deductible amounts. Additionally, the student’s academic performance, completion of driver’s education, and even gender can play a role.

A 16-year-old can reduce their monthly car insurance premium by maintaining good grades to qualify for a good student discount, completing a certified driver’s education course, and driving a safer, older, and less expensive car. Staying on a parent’s multi-car policy is also generally much cheaper than obtaining a separate policy.

Is there a difference in car insurance costs for a 16-year-old male versus female?

Historically, car insurance costs for 16-year-old males have been higher than for females due to statistical data suggesting males in this age group are involved in more serious accidents. While this trend still exists in many areas, some states have gender-neutral pricing regulations or insurers are starting to equalize rates based on other risk factors.

Can a 16-year-old get their own car insurance policy, or must they be on a parent’s policy?

While technically possible in some scenarios, it’s generally not practical or affordable for a 16-year-old to get their own car insurance policy. Most insurers require a parent or legal guardian to be the primary policyholder, with the 16-year-old listed as a driver on the family’s existing policy, which is typically far more cost-effective.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.