Featured image for Is 550 A Good Credit Score To Buy A Car

Image source: creditsecrets.com

A credit score of 550 is considered poor, making it challenging to qualify for a standard auto loan and likely resulting in very high interest rates. You can still buy a car, but securing financing will require strategies like a substantial down payment or seeking a subprime lender.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Is 550 A Good Credit Score To Buy A Car? Find Out Now

- 4 What Does a 550 Credit Score Really Mean?

- 5 The Real Cost of Buying a Car With a 550 Credit Score

- 6 Your Car Loan Options With a 550 Credit Score

- 7 Data Table: Car Loan Scenarios With Different Credit Scores

- 8 Action Plan: How to Prepare and Improve Your Chances

- 9 Rebuilding Your Credit After the Purchase

- 10 Conclusion: The Honest Truth About a 550 Credit Score and Car Buying

- 11 Frequently Asked Questions

- 11.1 Is a 550 credit score good enough to buy a car?

- 11.2 What kind of interest rates come with a 550 credit score for a car loan?

- 11.3 Can I get approved for an auto loan with a 550 credit score?

- 11.4 How can I improve my chances of buying a car with a 550 credit score?

- 11.5 Should I buy a car if I have a 550 credit score?

- 11.6 What are alternatives to traditional loans with a 550 credit score?

Key Takeaways

- A 550 score is subprime: Car loans are possible but come with high costs.

- Expect high interest rates: This significantly increases your total repayment amount.

- Increase your down payment: It improves approval odds and lowers payments.

- Shop around for lenders: Compare banks, credit unions, and online lenders.

- Consider a co-signer: A good credit co-signer secures better loan terms.

- Improve your credit first: Even a small score boost saves money.

- Explore alternative options: Look into buy-here-pay-here dealers if needed.

📑 Table of Contents

- Is 550 A Good Credit Score To Buy A Car? Find Out Now

- What Does a 550 Credit Score Really Mean?

- The Real Cost of Buying a Car With a 550 Credit Score

- Your Car Loan Options With a 550 Credit Score

- Data Table: Car Loan Scenarios With Different Credit Scores

- Action Plan: How to Prepare and Improve Your Chances

- Rebuilding Your Credit After the Purchase

- Conclusion: The Honest Truth About a 550 Credit Score and Car Buying

Is 550 A Good Credit Score To Buy A Car? Find Out Now

So, you’re thinking about buying a car, and you just checked your credit score. The number 550 is staring back at you. Your heart might have sunk a little. Is that a good score? Can you even get a car loan? The uncertainty is real, and I get it.

Maybe you’re dreaming of a reliable sedan for your commute or a rugged SUV for family trips. That dream feels close, but this three-digit number feels like a big, heavy door that’s only slightly ajar. Let’s be honest with each other right from the start: a 550 credit score is considered “poor” by lenders like FICO and VantageScore.

But—and this is a very important “but”—it doesn’t mean the door is locked and the key is thrown away. It simply means you need a different game plan. Buying a car with a 550 credit score is absolutely possible, but it comes with significant challenges and costs. This guide is your roadmap. We’re going to walk through what that score really means, what to expect at the dealership, and, most importantly, how to navigate the process without getting taken for a ride.

What Does a 550 Credit Score Really Mean?

Think of your credit score like a financial report card. A 550 tells lenders you’ve had some trouble in the past. It’s a signal that lending you money carries a higher risk. But it’s not a permanent label or a reflection of your character; it’s just a snapshot of your financial history.

Visual guide about Is 550 A Good Credit Score To Buy A Car

Image source: peerloansonline.com

Why Your Score Might Be at 550

Credit scores are built on five main factors. Understanding which ones are hurting your score is the first step to fixing it. With a 550, you’re likely seeing a few of these issues:

- Payment History (35%): This is the biggest piece of the pie. Late payments, collections accounts, or even a charge-off from a past loan or credit card will drastically lower your score.

- Amounts Owed (30%): This is your credit utilization. If your credit cards are maxed out or you have high balances compared to your limits, it hurts your score.

- Length of Credit History (15%): You might have a very short credit history or only a few accounts. Young borrowers often see lower scores because of this.

- Credit Mix (10%): Lenders like to see you can handle different types of credit—like a credit card (revolving credit) and a student loan (installment loan). A lack of variety can be a minor negative.

- New Credit (10%): Applying for several new credit cards or loans in a short time can cause small, temporary dips in your score.

The key takeaway? A 550 credit score is often the result of missed payments and high debt. The good news is that these are things you can improve over time.

How Lenders See a 550 Credit Score

When a bank or finance company sees a 550, they immediately think “subprime borrower.” This isn’t a personal insult; it’s a lending category. It means they will likely approve you for a loan, but at a much higher interest rate to offset the risk they’re taking. They’re not saying “no.” They’re saying “yes, but it’ll cost you more.”

The Real Cost of Buying a Car With a 550 Credit Score

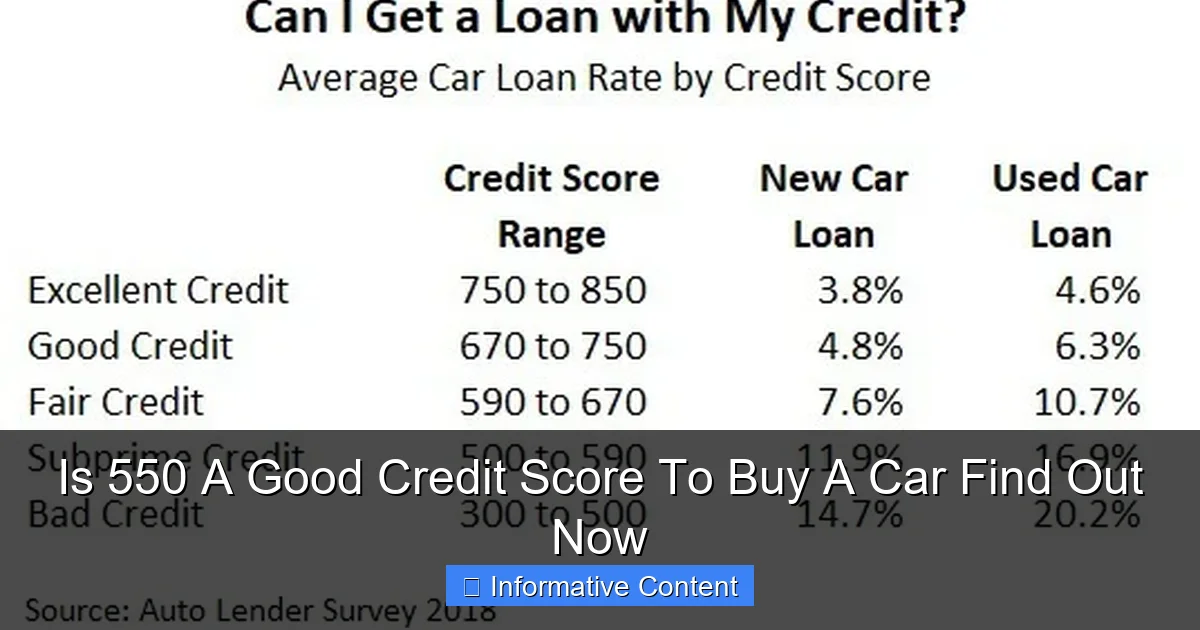

This is the most critical section. The biggest impact of a 550 credit score isn’t on your approval chances—it’s on your wallet. Let’s break down the true cost.

Visual guide about Is 550 A Good Credit Score To Buy A Car

Image source: i0.wp.com

Higher Interest Rates: The Monthly Payment Killer

Interest rates are where your score hits hardest. While someone with excellent credit might get a 5% APR, with a 550 credit score, you could be looking at rates of 15%, 20%, or even higher. This dramatically increases the total amount you pay for the car.

Here’s a real example: Let’s say you want to finance a $20,000 car for 60 months (5 years).

- With a 5% APR (good credit), your monthly payment is about $377. Total interest paid: $2,645.

- With an 18% APR (poor credit), your monthly payment jumps to about $508. Total interest paid: $10,455.

That’s a difference of $131 more every month and over $7,800 more in total interest for the exact same car! That extra money is the direct cost of a low score.

Larger Down Payment Requirements

Lenders will almost certainly ask for a bigger down payment. They want you to have more “skin in the game” to reduce their risk. While someone with good credit might put down 10% or less, you should be prepared to put down at least 15-20%, or even more if you can. For that $20,000 car, that’s $3,000 to $4,000 upfront. Saving for this is one of the most powerful things you can do.

Less Favorable Loan Terms

You might also face shorter loan terms (like 48 months instead of 72), which makes the monthly payment even higher. Some lenders may also require you to purchase additional insurance products. Read every line of the contract.

Your Car Loan Options With a 550 Credit Score

Despite the challenges, you have paths forward. Not all are created equal, so it’s crucial to know your options.

Visual guide about Is 550 A Good Credit Score To Buy A Car

Image source: images.ctfassets.net

1. “Buy-Here-Pay-Here” Dealerships

These are dealerships that finance the car themselves. They often advertise “No Credit Check!” or “Everyone Approved!” While they are the most likely to work with a 550 credit score, be extremely cautious.

The Pros: Easy approval. They look at your income and job more than your credit.

The Cons: Very high interest rates (often 25%+), older/higher-mileage cars, mandatory GPS trackers or starter interrupt devices (so they can disable the car if you’re late), and they rarely report your payments to credit bureaus, so your on-time payments won’t help rebuild your credit.

Tip: Consider this only as an absolute last resort and plan to refinance or replace the car as soon as your credit improves.

2. Special Finance Departments at Major Dealerships

Many big brand dealerships have a special finance manager who works with a network of subprime lenders. This is often a better route than Buy-Here-Pay-Here.

The Pros: You might get a newer, more reliable car. The lender will report payments to the credit bureaus, helping you build credit. The process is more formal and regulated.

The Cons: Rates are still high. You’ll need proof of stable income and residency. The lender will heavily scrutinize your debt-to-income ratio.

3. Credit Unions

This can be a hidden gem. Local credit unions are member-owned and often have more flexible lending standards than big banks. If you can become a member (usually based on where you live, work, or worship), it’s worth applying.

The Pros: They may offer lower rates to subprime borrowers than other institutions. They provide personal service and financial counseling.

The Cons: Approval is not guaranteed. You may still need a strong down payment and proof of income.

4. Getting a Co-Signer

This is one of the best ways to overcome a 550 credit score. A co-signer with good credit essentially guarantees the loan for you.

The Pros: You will qualify for a much lower interest rate, saving thousands. It helps you rebuild credit with on-time payments.

The Cons: It’s a massive ask. You are putting your co-signer’s excellent credit at risk. If you miss a payment, it damages their credit score. It can strain personal relationships.

Only do this if you are 100% confident in your ability to make every single payment on time.

Data Table: Car Loan Scenarios With Different Credit Scores

This table shows the dramatic financial impact of your credit score on a $20,000, 60-month loan. Seeing the numbers side-by-side makes the cost of a 550 credit score clear.

| Credit Tier | Estimated APR | Monthly Payment | Total Interest Paid | Total Car Cost |

|---|---|---|---|---|

| Excellent (720-850) | 5% | $377 | $2,645 | $22,645 |

| Good (680-719) | 7% | $396 | $3,760 | $23,760 |

| Fair (580-669) | 12% | $445 | $6,696 | $26,696 |

| Poor (550) | 18% | $508 | $10,455 | $30,455 |

Note: These are illustrative examples. Your actual rate will depend on the lender, your income, down payment, and other factors.

Action Plan: How to Prepare and Improve Your Chances

Don’t just walk onto a lot hoping for the best. Preparation is your superpower when you have a 550 credit score.

Before You Shop: The 3-Step Prep

- Check Your Full Credit Report: Get free reports from AnnualCreditReport.com. Look for errors (wrong balances, accounts that aren’t yours) and dispute them. Knowing what’s there is step one.

- Save for a Substantial Down Payment: Aim for 20% or more. This lowers the loan amount, shows the lender you’re serious, and can help you qualify for a slightly better rate.

- Get Pre-Qualified: Many online lenders and credit unions offer a soft-check pre-qualification. This gives you an estimate of your possible rate and loan amount without hurting your score. It also gives you a bargaining tool at the dealership.

Choosing the Right Car

Be realistic. Now is not the time for your dream sports car.

- Focus on Reliability & Value: Look for used cars known for longevity, like certain models from Honda, Toyota, or Hyundai. A cheaper, reliable car means a smaller loan.

- Keep the Loan Term Short: While a 72-month loan lowers the monthly payment, you pay way more in interest and risk being “upside down” (owing more than the car is worth) for years. Aim for the shortest term you can afford.

- Get an Independent Inspection: Before buying any used car, pay a trusted mechanic $100-$150 to inspect it. It could save you from a financial disaster.

Rebuilding Your Credit After the Purchase

Getting the car is just the beginning. Use this as a launching pad to leave that 550 credit score in the dust.

Your Auto Loan is a Credit-Building Tool

This is the silver lining. An auto loan is an “installment loan,” which is a great type of credit for your score mix. Making every single payment on time is the fastest way to rebuild your payment history, which is 35% of your score. Set up autopay so you never forget.

Other Smart Moves to Boost Your Score

- Tackle Credit Card Debt: Work on paying down balances. Getting your credit utilization below 30% (and ideally below 10%) can give your score a quick boost.

- Become an Authorized User: Ask a family member with excellent credit and responsible habits if they will add you as an authorized user on their old credit card. Their good history can be added to your report.

- Consider a Secured Credit Card: You put down a cash deposit (e.g., $300) which becomes your credit limit. Use it for a small bill each month and pay it off in full. It reports to the bureaus and builds positive history.

Within 12-24 months of consistent, on-time payments on your car loan and other debts, you could see your score climb into the “fair” or even “good” range. At that point, you could refinance your auto loan to get a much lower interest rate.

Conclusion: The Honest Truth About a 550 Credit Score and Car Buying

So, is a 550 a good credit score to buy a car? No, it’s not. It’s a significant hurdle that will make the process more expensive and stressful.

But is it possible to buy a car with a 550 credit score? Absolutely, yes. Thousands of people do it every year. The key is to go in with your eyes wide open. Understand that the true cost is in the sky-high interest, not just the sticker price. Arm yourself with a large down payment, realistic expectations, and a firm budget.

Think of this purchase not just as getting a vehicle, but as the first major step in rebuilding your financial foundation. That car loan, handled responsibly, is your ticket out of the subprime category. Make those payments like clockwork, work on your other debts, and watch your score rise. Your next car purchase, a few years from now, will be a completely different—and much more affordable—story.

You can do this. Just be smart, be prepared, and don’t settle for the first offer. Your future self, with a better credit score and more money in the bank, will thank you.

Frequently Asked Questions

Is a 550 credit score good enough to buy a car?

A 550 credit score is considered poor, making it challenging but not impossible to buy a car. You will likely face higher interest rates and may need to provide a larger down payment to secure financing.

What kind of interest rates come with a 550 credit score for a car loan?

With a 550 credit score, expect interest rates to be high, often ranging from 10% to 20% or more. This is because lenders view you as a higher risk, leading to costlier loan terms over time.

Can I get approved for an auto loan with a 550 credit score?

Yes, approval is possible through subprime lenders or specialized dealerships that work with poor credit. However, be prepared for stricter conditions, such as shorter repayment periods and higher fees.

How can I improve my chances of buying a car with a 550 credit score?

To boost your chances, save for a significant down payment and correct any errors on your credit report. Consider adding a co-signer with better credit to make your application more attractive to lenders.

Should I buy a car if I have a 550 credit score?

Buying a car with a 550 credit score can lead to expensive long-term costs due to high interest. It may be smarter to delay the purchase and improve your credit first, or opt for a reliable used vehicle to minimize debt.

What are alternatives to traditional loans with a 550 credit score?

If you have a 550 credit score, explore alternatives like buy-here-pay-here dealerships or saving to pay in cash for a cheaper car. Always compare offers carefully to avoid unfavorable terms and prioritize rebuilding your credit.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.