Featured image for Is 700 A Good Credit Score To Buy A Car

Image source: thecreditpeople.com

A 700 credit score is absolutely good for buying a car, placing you in the prime range for approval and competitive interest rates. You’ll likely secure favorable loan terms, but to unlock the absolute lowest rates, consider improving your score further or negotiating with multiple lenders.

So, you’re thinking about buying a car. You’ve been saving up, browsing listings, and dreaming of that new set of wheels. Then, you check your credit score. It’s 700. A wave of questions hits you. Is this good enough? Will I get approved? What kind of interest rate will I pay? I’ve been in that exact spot, staring at my laptop, feeling both excited and a little nervous. Let’s talk it through, friend to friend.

A 700 credit score is like getting a B+ on a big test. It’s solid. It’s above average. You should feel good about it. In the world of credit, it shows lenders you’re responsible. You likely pay your bills on time and manage your debt well. But when it comes to buying a car, a 700 credit score is a starting point, not a final answer. It opens doors, but knowing how to walk through them can save you serious money.

This post is your guide. We’ll explore what a 700 credit score really means for your car-buying journey. We’ll look at loan approvals, interest rates, and smart steps to take. My goal is to give you clear, honest insights so you can drive off the lot with confidence and a great deal. Let’s get started.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Does a 700 Credit Score Really Mean?

- 4 How Lenders View a 700 Credit Score for Auto Loans

- 5 What Interest Rates Can You Expect with a 700 Credit Score?

- 6 Steps to Take Before Buying a Car with a 700 Credit Score

- 7 Common Pitfalls to Avoid When Financing a Car

- 8 Beyond the Score: Other Factors That Matter

- 9 Conclusion

- 10 Frequently Asked Questions

- 10.1 Is a 700 credit score good for buying a car?

- 10.2 What interest rate can I expect with a 700 credit score?

- 10.3 Can I get approved for a car loan with a 700 credit score?

- 10.4 How does a 700 credit score compare to other scores for auto loans?

- 10.5 What factors besides credit score affect car loan terms?

- 10.6 Should I improve my credit score before buying a car if it’s 700?

Key Takeaways

- Yes, it’s a good score: A 700 credit score is considered good for car buying.

- Qualifies for competitive interest rates: You’ll likely secure lower APRs on auto loans.

- Enhances your negotiating power: Use this score to negotiate better loan terms.

- Shop around for the best deal: Compare offers from multiple lenders to maximize savings.

- Get pre-approved beforehand: Streamline the process and know your budget with pre-approval.

- Maintain your credit health: Avoid new debt and pay bills on time.

- Consider other financial factors: Income and down payment also affect loan approval.

📑 Table of Contents

- What Does a 700 Credit Score Really Mean?

- How Lenders View a 700 Credit Score for Auto Loans

- What Interest Rates Can You Expect with a 700 Credit Score?

- Steps to Take Before Buying a Car with a 700 Credit Score

- Common Pitfalls to Avoid When Financing a Car

- Beyond the Score: Other Factors That Matter

- Conclusion

What Does a 700 Credit Score Really Mean?

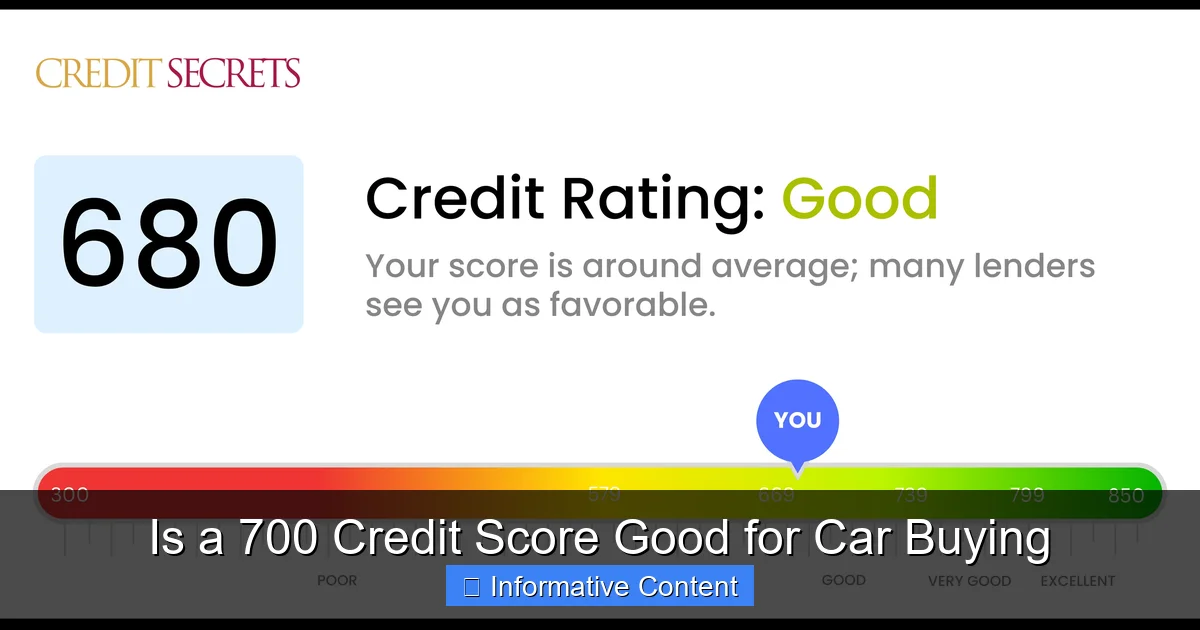

First, let’s break down that number. Credit scores range from 300 to 850. They are a snapshot of your financial trustworthiness. A 700 credit score sits in a very interesting place.

Understanding Credit Score Tiers

Lenders often group scores into tiers. Here’s a common breakdown:

- Poor: 300-579

- Fair: 580-669

- Good: 670-739

- Very Good: 740-799

- Excellent: 800-850

Your 700 credit score is firmly in the “Good” category. It’s above the national average, which hovers around 715. This means you’re seen as a reliable borrower. But you’re not quite in the “Very Good” tier yet. That small gap can sometimes mean a difference in loan terms.

The Story Behind Your 700 Credit Score

Your score is built on five main factors: payment history, amounts owed, length of credit history, new credit, and credit mix. With a 700 credit score, you probably have a history of on-time payments. You might have a few credit cards and maybe a student loan or mortgage. But there might be a blemish or two. Perhaps a credit card balance is above 30% of its limit. Or maybe you opened a new account recently. These things hold you back from a higher score. Knowing this helps you understand what lenders see.

Why a 700 Credit Score is a Strong Foundation

Think of a 700 credit score as a strong foundation for a house. It’s stable and secure. For car buying, it tells lenders you’re a low-to-moderate risk. You are very likely to get loan offers. But to get the absolute best rates, you might need to build a little higher. The good news? You’re already on solid ground.

How Lenders View a 700 Credit Score for Auto Loans

When you apply for a car loan, lenders don’t just see a number. They see a profile. A 700 credit score paints a specific picture for them.

Visual guide about Is 700 A Good Credit Score To Buy A Car

Image source: creditcards.com

Approval Odds: You’re in a Good Spot

With a 700 credit score, your approval odds for an auto loan are excellent. Most mainstream lenders—banks, credit unions, captive finance companies (like Toyota Financial)—will welcome your application. You are considered a “prime” or sometimes “near-prime” borrower. This means you represent a acceptable risk. Approval is almost a given, assuming your income and other debts are in check.

Prime vs. Near-Prime: The Fine Line

Some lenders draw a line at 720 for their best “prime” rates. With a 700 credit score, you might be classified as “near-prime” by some institutions. This isn’t bad. It just means you might not get the rock-bottom rates reserved for those with scores above 740. But you are far from “subprime.” You will have multiple competitive offers to choose from.

The Lender’s Checklist Beyond Your Score

Your 700 credit score is the headline, but lenders read the full article. They will also closely examine:

- Debt-to-Income Ratio (DTI): This is your monthly debt payments divided by your gross monthly income. A DTI below 36% is ideal.

- Employment History: Stable, consistent income reassures lenders.

- Loan-to-Value Ratio (LTV): This compares the loan amount to the car’s value. A larger down payment improves your LTV.

So, while a 700 credit score is a powerful asset, it works as part of a team with your other financial details.

What Interest Rates Can You Expect with a 700 Credit Score?

This is the million-dollar question. Or, more accurately, the thousand-dollar question. The interest rate on your auto loan directly affects your monthly payment and total cost. Let’s see what a 700 credit score typically gets you.

Visual guide about Is 700 A Good Credit Score To Buy A Car

Image source: flik.eco

Current Auto Loan Interest Rates by Credit Score

Rates change daily, but to give you a realistic idea, here’s a table based on recent national averages for a 60-month loan. This data helps you see where a 700 credit score lands.

| Credit Score Range | Average APR for New Car Loans | Average APR for Used Car Loans |

|---|---|---|

| 720-850 (Excellent) | 3.5% – 4.5% | 4.0% – 5.5% |

| 690-719 (Good) | 4.0% – 5.0% | 5.0% – 6.5% |

| 660-689 (Fair) | 5.0% – 6.5% | 6.5% – 8.0% |

| 620-659 (Subprime) | 7.0% – 10.0% | 9.0% – 12.0% |

| 300-619 (Poor) | 10.0%+ | 12.0%+ |

As you can see, a 700 credit score typically falls into the 690-719 bracket. This means you can reasonably expect an Annual Percentage Rate (APR) between 4% and 5% for a new car, and between 5% and 6.5% for a used car. These are good rates. They are much better than what someone with a fair score would get.

Real-World Example: The Cost of a 700 Credit Score

Let’s make this real. Imagine you’re financing $30,000 for a new car with a 60-month loan.

- At a 4% APR (toward the better end of your range), your monthly payment would be about $552.

- At a 5% APR (toward the higher end), your monthly payment would be about $566.

That’s only a $14 difference per month. But over five years, that extra 1% in interest costs you an additional $840. This shows why shopping for the best rate matters, even with a good 700 credit score.

Factors That Influence Your Specific Rate

Your exact rate will depend on more than just your 700 credit score. The loan term matters. A 36-month loan often has a lower rate than a 72-month loan. The car’s age and mileage matter. New cars get better rates than older used cars. The lender matters. Credit unions often offer lower rates than banks or dealers. Always get multiple quotes.

Steps to Take Before Buying a Car with a 700 Credit Score

Your 700 credit score is a tool. To use it effectively, you need a plan. Here are actionable steps to take before you ever visit a dealership.

Visual guide about Is 700 A Good Credit Score To Buy A Car

Image source: creditsecrets.com

1. Audit Your Credit Report

Go to AnnualCreditReport.com and get free reports from Equifax, Experian, and TransUnion. Scan every line for errors. Is there a late payment you know you made on time? Is an old account still showing as open? Disputing and fixing one error could boost your 700 credit score by a few points. Every point can help.

2. Get Pre-Approved from Multiple Lenders

This is your secret weapon. With a 700 credit score, apply for pre-approval from two or three places: a local credit union, an online lender, and perhaps your bank. Pre-approval gives you a real interest rate offer and loan amount. It turns you from a hopeful buyer into a prepared buyer. You can walk into the dealership knowing exactly what you can afford.

3. Set a Firm Budget (And Stick To It)

Use the 20/4/10 rule as a smart guideline:

- 20% Down: Aim for a down payment of at least 20% of the car’s price.

- 4-Year Loan: Try to finance for no longer than 48 months.

- 10% of Income: Keep your total monthly auto expenses (loan payment, insurance, gas) under 10% of your gross income.

This rule prevents you from overextending yourself. With a 700 credit score, you might qualify for a bigger loan than is wise. Your budget is your reality check.

4. Choose Your Car Type Wisely

New cars depreciate fast but have lower loan rates. Used cars are cheaper but have higher rates. With a 700 credit score, you have great options for both. Calculate the total cost of ownership for each car you consider. Sometimes, a certified pre-owned car offers the best value with a rate your 700 credit score can secure.

Common Pitfalls to Avoid When Financing a Car

Even with a good 700 credit score, it’s easy to make expensive mistakes. Here are the traps to steer clear of.

Pitfall 1: Obsessing Over the Monthly Payment Alone

Dealers love to ask, “What monthly payment can you afford?” This is a trick. They can lower your payment by stretching your loan to 72 or 84 months. You’ll pay much more in interest. Always negotiate the car’s final price first, then the interest rate, and then talk loan term. Know the total loan cost.

Pitfall 2: Skipping the Fine Print on Dealer Financing

Dealer financing can be convenient. Sometimes they have manufacturer-sponsored low rates. But often, they mark up the rate from the bank to earn a commission. With your 700 credit score, you have the power to compare. Never assume the dealer’s rate is the best. Show them your pre-approval offer and ask them to beat it.

Pitfall 3: Forgetting the Full Cost of Ownership

A car payment is just one expense. Insurance, maintenance, fuel, and registration all add up. A more expensive car often costs more to insure. Before you commit, get insurance quotes. Factor in everything. Your 700 credit score gets you the loan, but your monthly budget has to cover all the costs.

Pitfall 4: Making a Big Credit Move Right Before Applying

In the months before your car loan application, avoid opening new credit cards or taking out other loans. Each “hard inquiry” can ding your score a few points. You want your 700 credit score to be as strong as possible when lenders check it. Keep your credit activity calm and steady.

Beyond the Score: Other Factors That Matter

Your 700 credit score is crucial, but it’s not the whole story. Lenders look at the complete financial picture you present.

Your Down Payment: The Bigger, The Better

A large down payment does two great things. First, it reduces the amount you need to borrow. Second, it shows the lender you have skin in the game. With a 700 credit score, a down payment of 20% or more can often help you secure an interest rate at the lower end of your range. It compensates for any slight weaknesses in your credit profile.

Income and Job Stability: Proof You Can Pay

Lenders want to see steady income. If you’ve been at your job for two years or more, that’s a big plus. They will ask for recent pay stubs or tax returns. Even with a stellar 700 credit score, sporadic income can raise red flags. Be ready to document your earnings.

Cosigners: A Potential Boost

If you’re young or have a thin credit file alongside your 700 credit score, adding a cosigner with excellent credit can sometimes get you a significantly lower rate. But this is a serious commitment for them. It should only be considered if absolutely necessary and with clear communication.

The Car Itself: Collateral Matters

The car is collateral for the loan. Lenders prefer financing newer, reliable models that hold their value. If you’re using a 700 credit score to buy a 10-year-old car with high mileage, the rate might be higher because the lender’s risk is higher if they have to repossess and sell it.

Conclusion

So, is a 700 credit score good for buying a car? The answer is a resounding yes. It’s a strong, respectable score that puts you in the driver’s seat for your auto loan journey. You will likely be approved. You will get competitive interest rates. You have options.

But remember, a 700 credit score is your leverage, not your limit. Use it wisely. Do your homework. Get pre-approved. Set a firm budget. Negotiate with confidence. Avoid the common traps. By taking these steps, you transform your good credit into a great deal.

Buying a car is a big step. It’s okay to feel a mix of emotions. But with your 700 credit score and the knowledge you now have, you can approach this process with clarity and calm. You’ve worked hard for that score. Now, let it work hard for you. Happy driving!

Frequently Asked Questions

Is a 700 credit score good for buying a car?

Yes, a 700 credit score is generally considered good for car buying. It should qualify you for competitive interest rates and favorable loan terms from most lenders.

What interest rate can I expect with a 700 credit score?

With a 700 credit score, you can typically expect auto loan interest rates in the range of 4% to 6% for new vehicles. Actual rates depend on the lender, loan term, and market conditions.

Can I get approved for a car loan with a 700 credit score?

Yes, a 700 credit score is more than sufficient for auto loan approval from most financial institutions. Lenders see this score as a sign of low risk and reliable credit management.

How does a 700 credit score compare to other scores for auto loans?

A 700 credit score falls into the “good” category, often securing better rates than average scores but not the absolute best. Scores above 720 may unlock slightly lower interest rates.

What factors besides credit score affect car loan terms?

Beyond your credit score, lenders evaluate your debt-to-income ratio, employment stability, and the down payment amount. The car’s age and mileage can also influence the loan offer.

Should I improve my credit score before buying a car if it’s 700?

While a 700 credit score is good, boosting it to 720+ could marginally improve your rates. If you have time, review your credit report for errors and pay down existing debts to potentially increase your score.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.