Featured image for How Much Is Car Insurance For A 19 Year Old

Image source: lh4.googleusercontent.com

Car insurance for a 19-year-old is notoriously expensive, often costing thousands annually due to their high-risk status. Key factors like vehicle choice, location, and driving history drastically impact the rate, but comparing multiple quotes and leveraging discounts can unlock significant savings.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Unlock Savings: How Much Is Car Insurance For A 19 Year Old?

- 4 Why Is Car Insurance So Expensive for a 19-Year-Old?

- 5 Key Factors That Determine Your Premium

- 6 Real Numbers: How Much Is Car Insurance For A 19 Year Old on Average?

- 7 Proven Strategies to Slash Your Insurance Costs

- 8 Understanding Your Policy: More Than Just the Price

- 9 Taking Action: Your Roadmap to Affordable Coverage

- 10 Conclusion: Your Journey to Smart, Affordable Insurance Starts Now

- 11 Frequently Asked Questions

- 11.1 How much is car insurance for a 19 year old?

- 11.2 Why is car insurance so expensive for teenagers?

- 11.3 How can a 19 year old get cheaper car insurance?

- 11.4 What factors affect car insurance rates for a 19 year old?

- 11.5 Is it better for a 19 year old to have their own policy?

- 11.6 Can a 19 year old lower costs with a specific type of car?

Key Takeaways

- Shop Around: Compare quotes from multiple insurers for the best rate.

- Maintain Good Grades: A high GPA often qualifies for student discounts.

- Take Driver’s Ed: Completing a course can significantly lower your premium.

- Choose Your Car Carefully: Safer, less expensive cars cost less to insure.

- Consider a Family Policy: Being added to a parent’s plan may save money.

- Drive Safely: A clean driving record is crucial for affordable rates.

- Ask About Discounts: Inquire for all available savings like bundling policies.

📑 Table of Contents

- Unlock Savings: How Much Is Car Insurance For A 19 Year Old?

- Why Is Car Insurance So Expensive for a 19-Year-Old?

- Key Factors That Determine Your Premium

- Real Numbers: How Much Is Car Insurance For A 19 Year Old on Average?

- Proven Strategies to Slash Your Insurance Costs

- Understanding Your Policy: More Than Just the Price

- Taking Action: Your Roadmap to Affordable Coverage

- Conclusion: Your Journey to Smart, Affordable Insurance Starts Now

Unlock Savings: How Much Is Car Insurance For A 19 Year Old?

Hey there. So, you’re 19. You’ve got your license, maybe your first car, and a serious case of freedom on your mind. But then comes the not-so-fun part: finding out how much is car insurance for a 19 year old.

If you just got a quote and your jaw is still on the floor, I get it. I’ve been there. You’re probably thinking, “I’m a good driver! Why does it cost this much?” It feels unfair, like a tax on being young. But here’s the good news: while the numbers might seem scary, they aren’t a mystery. And more importantly, they aren’t set in stone.

This isn’t just another dry financial article. Think of this as your friendly guide through the jungle of auto insurance for young adults. We’re going to break down exactly why the costs are what they are, what you can realistically expect to pay, and—most crucially—the real, actionable secrets to bringing that price down. Let’s unlock those savings together.

Why Is Car Insurance So Expensive for a 19-Year-Old?

Before we talk numbers, we need to talk about “why.” Understanding this is your first step to beating the high-cost system. Insurance companies aren’t picking on you personally. They operate on risk, and cold, hard data tells a clear story.

Visual guide about How Much Is Car Insurance For A 19 Year Old

Image source: i.pinimg.com

The Statistics Tell the Story

Simply put, inexperienced drivers are more likely to get into accidents. The National Highway Traffic Safety Administration (NHTSA) shows that drivers aged 16-24 have the highest crash rate per mile driven. At 19, you’re past the very highest-risk teen years, but you still have only a few years of real-world driving under your belt. To an insurer, that means a higher probability they’ll have to pay out a claim.

Risk Factors That Insurers See

It’s not just about age. Insurers look at a whole profile. For a 19-year-old, that profile often includes things like:

- Limited Driving History: You haven’t had years to prove you’re safe.

- Life Stage: Many 19-year-olds are in college, which can mean late nights, distracted driving, or parking in high-traffic areas.

- Vehicle Choice: Spoiler alert: that sporty coupe you love is a red flag for insurers.

- Credit History: In most states, insurers can use a credit-based insurance score. At 19, you likely have a thin file, which can count against you.

Key Factors That Determine Your Premium

Now that we know the “why,” let’s look at the levers you can actually pull. Your final price isn’t just “the 19-year-old price.” It’s a unique mix of these factors.

Visual guide about How Much Is Car Insurance For A 19 Year Old

Image source: agilerates.com

Your Location (It’s Huge)

Where you live and park your car overnight is a massive factor. If you’re in a dense urban area with high traffic, theft rates, and repair costs, your premium will be much higher than if you live in a quiet rural town. Even your zip code matters.

The Car You Drive

This is one of your biggest control points. Insuring a used, safe, and modest sedan like a Honda Civic or Toyota Corolla is worlds cheaper than insuring a new Mustang or a flashy SUV with high repair costs. Safety ratings and theft rates for the specific model are key data points for insurers.

Your Driving Record (The Clean Slate Advantage)

At 19, you have a golden opportunity: a clean record. A single ticket or at-fault accident can cause your already-high premium to skyrocket. Protecting your clean record is the most powerful financial move you can make right now.

Coverage Types and Deductibles

Are you getting state-minimum liability or full coverage? Choosing a higher deductible (the amount you pay out-of-pocket in a claim) can lower your monthly premium, but make sure it’s an amount you could actually afford in an emergency.

Discounts You Might Qualify For

This is the treasure chest! Insurers offer a variety of discounts, many tailor-made for young drivers. We’ll dive deep into these later, but think: good student, distant student, driver training, and telematics programs.

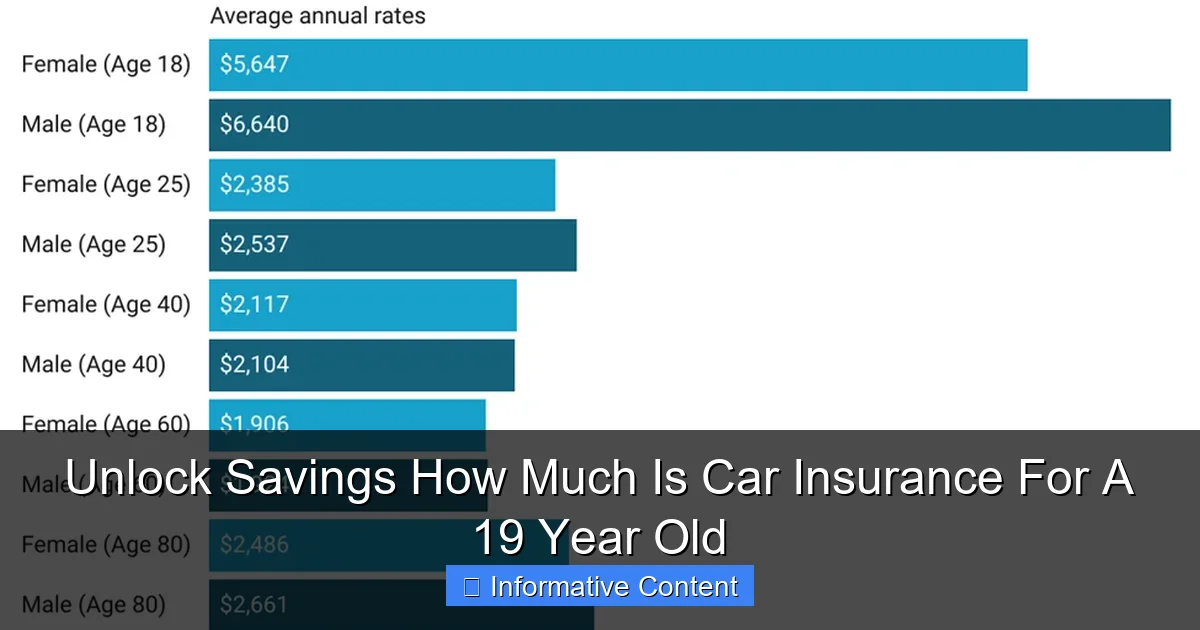

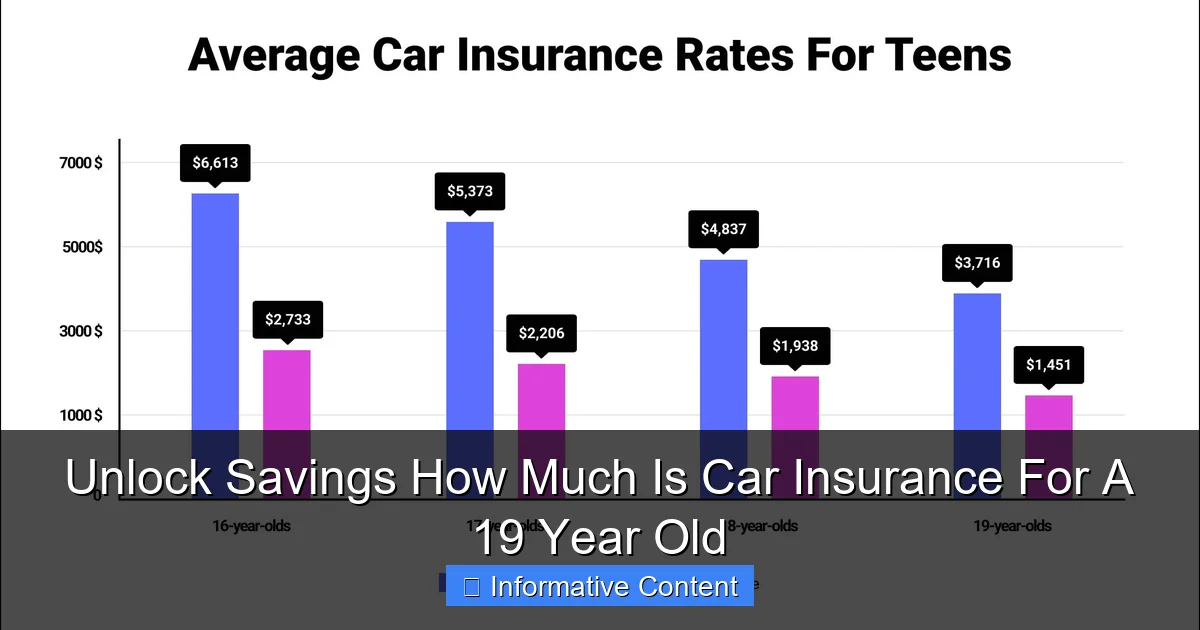

Real Numbers: How Much Is Car Insurance For A 19 Year Old on Average?

Let’s talk concrete numbers. Remember, these are national averages. Your personal quote could be higher or lower based on the factors we just discussed.

Visual guide about How Much Is Car Insurance For A 19 Year Old

Image source: miamicoverage.com

For a 19-year-old driver, average full-coverage premiums are often two to three times higher than the national average for all drivers. If the average driver pays about $2,000 per year, a 19-year-old could easily see quotes from $3,500 to over $6,000 annually.

Data Table: Estimated Annual Premiums for a 19-Year-Old

The table below illustrates how key factors change the annual cost. These are illustrative estimates based on composite national data to show the *relative impact* of each variable.

| Scenario | Vehicle Type | Coverage Level | Estimated Annual Premium |

|---|---|---|---|

| 19-Year-Old Male, Clean Record | Used Sedan (e.g., 2015 Honda Civic) | State Minimum Liability | $2,800 – $4,000 |

| 19-Year-Old Female, Clean Record | Used Sedan (e.g., 2015 Honda Civic) | State Minimum Liability | $2,500 – $3,700 |

| 19-Year-Old Male, Clean Record | Used Sedan (e.g., 2015 Honda Civic) | Full Coverage | $4,500 – $6,500 |

| 19-Year-Old Male, Clean Record | New Sports Car | Full Coverage | $7,000 – $10,000+ |

| 19-Year-Old with One At-Fault Accident | Used Sedan | Full Coverage | $6,500 – $9,000 |

Note: Gender is still a rating factor in most states. Always shop around, as quotes vary wildly between companies.

Proven Strategies to Slash Your Insurance Costs

Feeling overwhelmed by those numbers? Don’t be. This is where you take control. Here are the most effective ways to answer “how much is car insurance for a 19 year old” with a much smaller number.

Embrace the Good Student Discount

This is a no-brainer. If you’re a full-time student (high school or college) maintaining a B average or a 3.0 GPA, you can typically save 10-25%. Insurers see good grades as a sign of responsibility. Have your transcript ready when you shop.

Consider a Telematics Program

Also called usage-based insurance, these programs use an app or a plug-in device to monitor your driving. They track things like smooth braking, speed, and phone use. If you’re a safe driver (and most people think they are!), this can lead to significant discounts, sometimes over 20%. Popular programs include Progressive’s Snapshot, State Farm’s Drive Safe & Save, and Allstate’s Drivewise.

Choose Your Vehicle Wisely

Repeat after me: “My first car is a tool, not a trophy.” Opt for a used car with high safety ratings, low repair costs, and no sporty pretensions. Insurance Institute for Highway Safety (IIHS) “Top Safety Pick” lists are your best friend.

Explore the Distant Student Discount

If you’re going to college more than 100 miles away from home and not taking your car, you may qualify. Your parents’ policy could list you as a “distant student,” which slashes the cost since you’ll only drive when home on breaks.

Bundle Policies and Raise Your Deductible

If your parents have homeowners or renters insurance, see if adding you to their auto policy (or bundling your own renters insurance if you live separately) nets a multi-policy discount. Also, opting for a $1,000 deductible instead of a $500 one can lower your premium—just have a plan to cover that higher deductible if needed.

Complete a Defensive Driving Course

Some states and insurers offer a discount for completing an accredited defensive driving course. It’s a weekend investment that pays off for years and makes you a better driver.

Understanding Your Policy: More Than Just the Price

Finding the cheapest quote is great, but you need to understand what you’re buying. The right coverage protects you from financial disaster.

Liability Coverage: Your Legal Backbone

This is required by law. It pays for damage and injuries you cause to others. Don’t just get the state minimums—they are often far too low. A serious accident could cost hundreds of thousands. 100/300/100 is a much safer starting point ($100k per person, $300k per accident for injuries, $100k for property damage).

Collision and Comprehensive: Protecting Your Car

If you’re financing or leasing, the lender will require these. Collision covers accidents with another car or object. Comprehensive covers “other stuff” like theft, fire, hail, or hitting a deer. If your car is old and paid off, you might consider dropping these to save money.

Uninsured/Underinsured Motorist Coverage

This is critical. It protects you if you’re hit by a driver with no insurance or not enough insurance. Given how many people drive without adequate coverage, this is non-negotiable for your own safety.

Taking Action: Your Roadmap to Affordable Coverage

Knowledge is power, but action gets you the savings. Here’s your step-by-step plan to tackle the question of how much is car insurance for a 19 year old, for real.

Step 1: Gather Your Info. Have your driver’s license, vehicle VIN, and (if applicable) your current policy and academic transcript ready.

Step 2: Get Quotes, Lots of Them. Prices vary incredibly between companies for young drivers. Get quotes from at least 5-7 insurers. Use online quote tools, but also call a few independent insurance agents who can shop multiple companies for you.

Step 3: Compare Apples to Apples. Make sure every quote has the exact same coverage types, limits, and deductibles. A cheaper quote might just be less coverage.

Step 4: Ask About Every Single Discount. Go down the list: good student, distant student, defensive driving, telematics, multi-policy, anti-theft device, paid-in-full discount. Don’t be shy.

Step 5: Prioritize Your Financial Safety. Choosing slightly higher liability limits might only cost a few dollars more per month but can save you from ruin. Don’t cut critical corners just to get the absolute lowest price today.

Conclusion: Your Journey to Smart, Affordable Insurance Starts Now

So, how much is car insurance for a 19 year old? As we’ve seen, it’s a complex question with a range of answers. Yes, the starting point is high. That’s the reality of being a new driver. But it is absolutely not the final word.

By now, you’re not just a 19-year-old looking for insurance—you’re an informed consumer. You know that your car choice, your grades, your driving habits, and your willingness to shop around have a direct and powerful impact on your premium. You have the tools to move from a statistic to an exception.

Start today. Get those quotes. Ask about every discount. Make the smart, sometimes boring, choices with your first car. The savings you unlock now will fund your freedom for years to come. Drive safe, drive smart, and enjoy the road ahead.

Frequently Asked Questions

How much is car insurance for a 19 year old?

On average, car insurance for a 19 year old can cost between $2,000 to $4,000 per year, but this varies based on location, vehicle, and driving history. To unlock savings, it’s crucial to compare quotes from multiple insurers to find the best rate.

Why is car insurance so expensive for teenagers?

Car insurance is costly for 19 year olds because insurers see them as high-risk due to limited driving experience and higher accident rates. This perceived risk leads to higher premiums to cover potential claims.

How can a 19 year old get cheaper car insurance?

A 19 year old can reduce costs by maintaining a clean driving record, taking defensive driving courses, and choosing a safe, modest vehicle. Exploring discounts for good grades or bundling policies with parents can also help unlock savings.

What factors affect car insurance rates for a 19 year old?

Factors include driving record, location, vehicle type, credit score, and annual mileage. Insurers also consider gender and whether the driver has completed safety courses, all influencing the final premium.

Is it better for a 19 year old to have their own policy?

It’s often more affordable for a 19 year old to stay on a parent’s policy if possible, as individual policies are pricier. However, if they own their car or live independently, a separate policy may be necessary.

Can a 19 year old lower costs with a specific type of car?

Yes, opting for a used, safe, and low-performance car can significantly lower car insurance for a 19 year old. Insurers typically charge less for vehicles with high safety ratings and lower repair costs.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.