Featured image for How Much Is Car Insurance For 2 Cars Per Month

Image source: momwithaprep.com

Insuring two cars typically costs less per vehicle than insuring one car alone, with average monthly premiums ranging from $200 to $300 for a standard policy. You can secure significant savings through a multi-car discount, often between 10% to 25%, by bundling vehicles with the same provider. For your exact rate, always compare personalized quotes, as factors like your driving record, location, and chosen coverage tiers dramatically impact the final cost.

In This Article

- 1 What Does Car Insurance For 2 Cars Cost Monthly

- 1.1 Key Takeaways

- 1.2 📑 Table of Contents

- 1.3 The Basics of Insuring Two Cars

- 1.4 Key Factors That Influence Your Premium

- 1.5 Average Costs and Real-World Examples

- 1.6 How to Save Money on Multi-Car Policies

- 1.7 Choosing the Right Coverage for Two Vehicles

- 1.8 Final Thoughts and Next Steps

- 1.9 Frequently Asked Questions

- 1.9.1 What is the average monthly cost for car insurance for 2 cars?

- 1.9.2 How can I save money on car insurance for two cars?

- 1.9.3 Does car insurance for 2 cars cost less per vehicle than insuring one?

- 1.9.4 What factors affect the monthly cost of insuring two cars?

- 1.9.5 Are there discounts available for car insurance for 2 cars?

- 1.9.6 Is it better to insure two cars on one policy or separately?

What Does Car Insurance For 2 Cars Cost Monthly

Let me tell you a story. Last year, my family became a two-car household. We needed a reliable sedan for my daily commute and a sturdy SUV for weekend trips and hauling kids. It was exciting, but when I first started shopping for insurance, my head spun. I kept wondering, “How much is car insurance for 2 cars per month going to set us back?” If you’re in the same boat, you know that feeling—the mix of necessity and budget anxiety.

You’re not alone. Millions of families juggle multiple vehicles, and understanding the cost isn’t always straightforward. It’s more than just doubling a single-car premium. Factors like discounts, driver history, and where you live play huge roles. In this guide, I’ll walk you through everything, from average costs to smart savings tips, all based on my research and real-world experience.

By the end, you’ll have a clear picture of what to expect for your monthly car insurance for 2 cars cost. We’ll keep it simple, skip the jargon, and focus on what truly matters for your wallet and peace of mind. So, grab a coffee, and let’s dive in!

Key Takeaways

- Bundle both cars: One policy often unlocks a multi-car discount, lowering monthly costs.

- Shop around annually: Comparing quotes from several insurers can secure the best rate.

- Raise your deductibles: This reduces monthly premiums but increases your out-of-pocket expense.

- Maintain clean driving records: Good history for all drivers significantly lowers premiums.

- Choose vehicles carefully: Insuring two safer, modest cars is cheaper than high-value models.

- Report low mileage: Less annual driving on both cars can mean lower rates.

- Seek every discount: Ask about bundling, safety features, and loyalty to maximize savings.

📑 Table of Contents

The Basics of Insuring Two Cars

When you start looking into car insurance for 2 cars cost monthly, the first thing to understand is how insurers view multiple vehicles. It’s not just two separate policies; it’s often a bundled deal that can work in your favor.

What Exactly is a Multi-Car Policy?

A multi-car policy is simply one insurance plan that covers two or more vehicles under the same account. Think of it like buying in bulk—insurers often reward you with discounts for bringing more business their way. Instead of managing two separate bills, you get one monthly or annual statement, which makes life a lot easier.

For example, when I bundled my sedan and SUV, I called my agent and provided details for both cars. They combined them into a single policy, and voilà—I saw savings right away. This is a common approach for families, couples, or even roommates sharing vehicles.

Key Benefits of Bundling Two Cars

Why go for a multi-car policy? Here are the perks I noticed:

- Discounts Galore: Most companies offer a multi-car discount, which can slash your overall premium by 10% to 25%. That’s real money back in your pocket.

- Simplified Management: One renewal date, one payment, and one point of contact. It cuts down on paperwork and hassle.

- Potential for Higher Coverage Limits: Sometimes, bundling allows you to afford better coverage across both vehicles without breaking the bank.

However, it’s not always a win-win. If one car has a high-risk driver, like a teenager, it might bump up the cost for both. That’s why understanding the details is crucial when estimating your monthly car insurance for 2 cars cost.

Key Factors That Influence Your Premium

Your monthly car insurance for 2 cars cost isn’t a fixed number. It dances around based on several factors. Here’s what really moves the needle, from my experience.

Visual guide about How Much Is Car Insurance For 2 Cars Per Month

Image source: carinsuranceguidebook.com

Driver Profiles and History

Who’s behind the wheel matters a ton. Insurers look at age, driving record, and even credit score in some states. For instance, adding a young driver to your policy can increase the cost significantly. When my nephew got his license, his parents saw their premium jump by 50% for their two cars.

Tips: Maintain a clean driving record and ask about good-driver discounts. If you have a teen, consider a safe-driving app that tracks habits for potential savings.

Vehicle Types and Usage

The cars themselves play a big role. A flashy sports car will cost more to insure than a modest minivan. Also, how you use them—like long commutes versus occasional pleasure drives—affects the risk assessment.

In my case, the SUV used for weekend trips had a slightly lower premium than the sedan for daily work travel, because mileage was lower. Always be honest about usage; misreporting can lead to issues later.

Location and Local Laws

Where you live is huge. Urban areas with higher traffic and theft rates often mean higher premiums. State laws also dictate minimum coverage levels, which set the baseline cost.

For example, when I moved from a rural town to a city, my car insurance for 2 cars cost monthly went up by about 20%. It’s wise to check local averages and consider parking security to mitigate this.

Average Costs and Real-World Examples

Let’s talk numbers. What can you actually expect to pay? Remember, these are averages—your situation might differ, but they give a solid starting point.

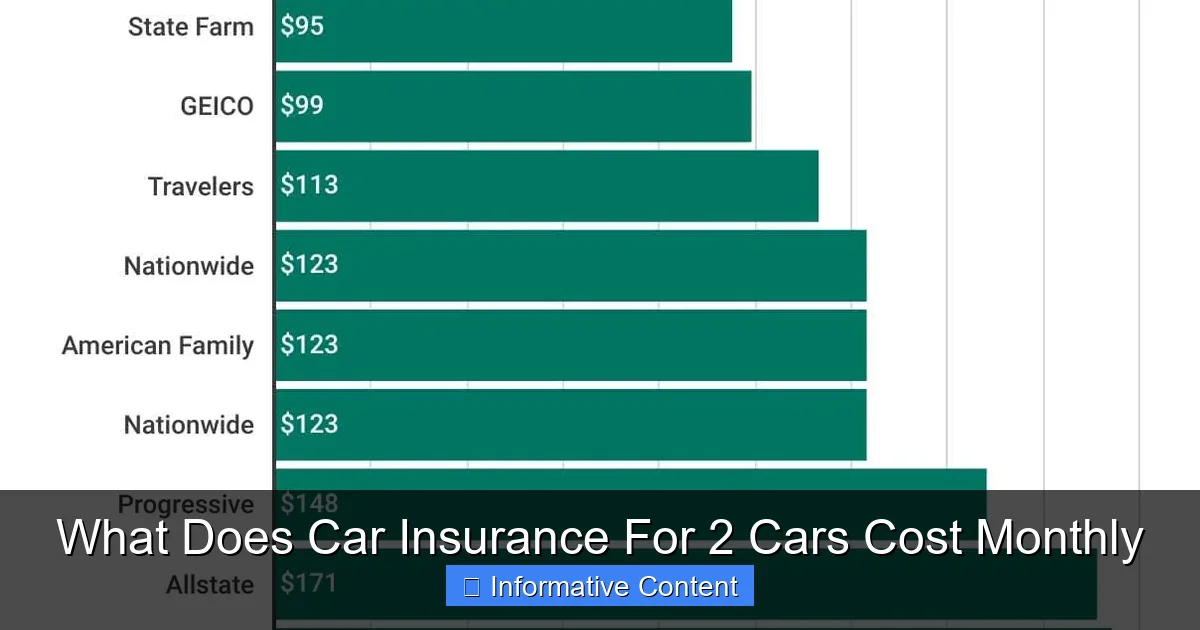

Visual guide about How Much Is Car Insurance For 2 Cars Per Month

Image source: carglassadvisor.com

National Averages and State Variations

Nationally, the average monthly car insurance for 2 cars cost ranges from $200 to $400, depending on coverage levels. But state-by-state, it swings widely. Below is a table with estimated averages based on recent industry data. Keep in mind, these are for a standard policy with two mid-range sedans and drivers with good records.

| State | Estimated Average Monthly Cost for Two Cars |

|---|---|

| California | $280 |

| Texas | $320 |

| Florida | $350 |

| Ohio | $220 |

| New York | $300 |

| Illinois | $250 |

These figures highlight how location impacts your car insurance for 2 cars cost monthly. Always get localized quotes for accuracy.

Sample Scenarios for Different Families

To make it real, here are two examples from people I know:

- The Young Couple: Mark and Lisa, both 30, with two used Hondas in suburban Georgia. They pay around $180 per month for full coverage, thanks to multi-car and safe-driver discounts.

- The Family of Four: The Chen family in Michigan has a minivan and a compact car, with one teen driver. Their monthly car insurance for 2 cars cost jumps to $450 due to the teen’s higher risk profile.

See how scenarios shift? Your own factors will paint your unique picture.

How to Save Money on Multi-Car Policies

Who doesn’t love saving money? When it comes to car insurance for 2 cars cost monthly, small tweaks can lead to big savings. Here’s what worked for me and others.

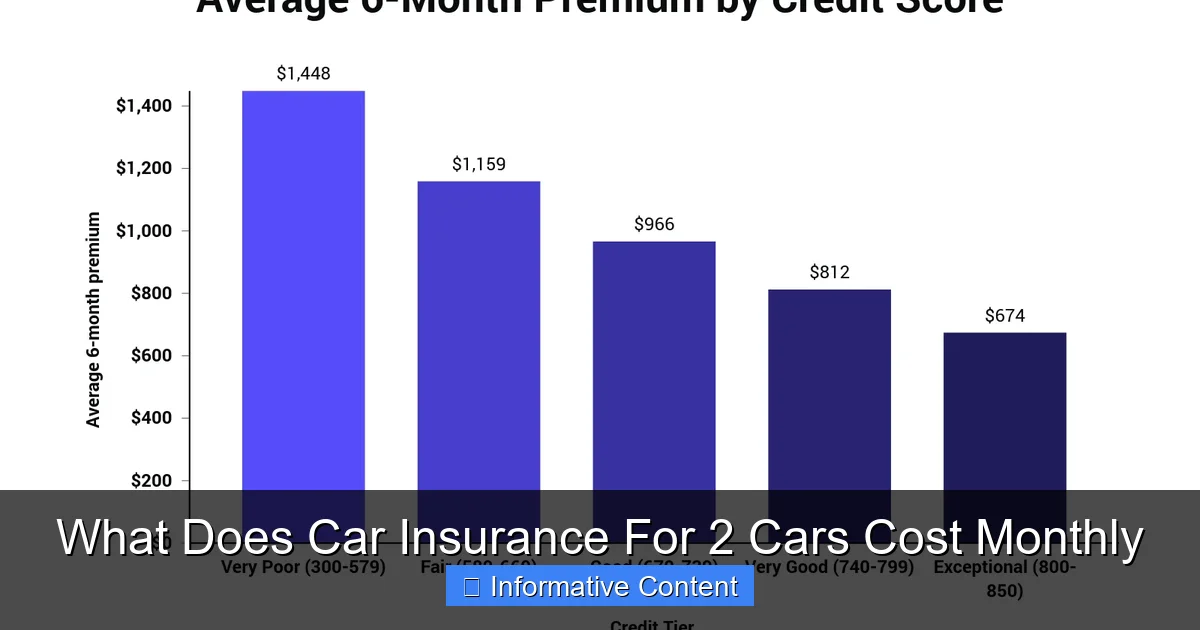

Visual guide about How Much Is Car Insurance For 2 Cars Per Month

Image source: doubxab0r1mke.cloudfront.net

Discounts You Shouldn’t Miss

Insurers offer more discounts than you might think. Always ask about these:

- Multi-Car Discount: The obvious one, but it’s often automatic when you bundle.

- Bundling with Home Insurance: Combining auto and home policies can save another 10-20%.

- Pay-in-Full Discount: Paying your premium annually instead of monthly might cut costs by 5-10%.

- Safe Driver Programs: Usage-based telematics can lower bills if you drive safely.

I saved nearly 30% by combining my two cars with my home insurance and paying upfront. It felt like a win!

Adjusting Coverage Smartly

You don’t always need the highest coverage. For older cars, consider dropping collision or comprehensive if the car’s value is low. But never skimp on liability—it’s crucial for protection.

Tip: Review your policies annually. When my SUV hit 10 years old, I reduced its coverage, which shaved $40 off my monthly car insurance for 2 cars cost. Just ensure you’re still adequately protected.

Choosing the Right Coverage for Two Vehicles

Balancing cost and protection is key. Your monthly car insurance for 2 cars cost should reflect your needs, not just the cheapest option.

Understanding Coverage Levels

Basic policies include liability, but full coverage adds collision and comprehensive. For two cars, assess each vehicle’s role. Maybe the primary car needs full coverage, while the secondary one can do with less.

In my case, I opted for full coverage on both because we rely on them heavily. But for a spare car used rarely, a lighter policy might make sense. Discuss with an agent to tailor it.

Balancing Cost and Protection

Don’t just chase low premiums. A too-cheap policy might leave you vulnerable in an accident. Look for reputable insurers with good customer service, even if they cost a bit more.

I learned this the hard way when a friend had a claim denied due to unclear terms. Now, I read the fine print and choose companies with strong financial ratings. It’s worth the peace of mind.

Final Thoughts and Next Steps

We’ve covered a lot! From factors affecting your premium to practical savings tips, you now have a roadmap for understanding your monthly car insurance for 2 cars cost. It’s a blend of art and science—personalized to your life.

Remember, the best way to get an accurate number is to shop around. Get quotes from at least three insurers, mention all discounts, and be honest about your details. Costs can vary wildly, so a little effort can save you hundreds per year.

Ultimately, insuring two cars is about smart choices. Don’t stress—use this guide as a starting point, and you’ll find a plan that fits your budget and coverage needs. Happy driving!

Frequently Asked Questions

What is the average monthly cost for car insurance for 2 cars?

The average monthly cost for car insurance for two cars typically ranges from $200 to $500, but this can vary based on factors like location, driver history, and coverage choices. To get a precise estimate, it’s best to request quotes from multiple insurers with your specific details.

How can I save money on car insurance for two cars?

You can save money by bundling both vehicles on one policy to secure a multi-car discount. Additionally, maintaining a clean driving record, increasing deductibles, and inquiring about other discounts like for safety features or bundling with home insurance can further reduce your monthly premium.

Does car insurance for 2 cars cost less per vehicle than insuring one?

Yes, car insurance for 2 cars often costs less per vehicle due to multi-car discounts offered by insurers. By insuring multiple cars together, you can benefit from reduced rates compared to purchasing separate policies for each car.

What factors affect the monthly cost of insuring two cars?

Key factors include the ages and driving records of all drivers, the make and model of the vehicles, your location, and the coverage limits you select. Other elements like credit score and annual mileage also play a role in determining your final monthly premium.

Are there discounts available for car insurance for 2 cars?

Yes, most insurance companies provide a multi-car discount when you insure two or more vehicles on the same policy. You may also qualify for additional discounts such as safe driver, multi-policy, or discounts for anti-theft devices, which can lower your overall cost.

Is it better to insure two cars on one policy or separately?

Insuring two cars on one policy is usually more cost-effective because it qualifies for multi-car discounts. Insuring them separately often results in higher total premiums, as you might miss out on bundled savings and pay individual policy fees.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.