Featured image for How Much Is Car Insurance For A 23 Year Old

Image source: forbes.com

Car insurance for 23-year-olds is often expensive, with premiums reflecting their higher risk category. Key factors like your driving record, vehicle choice, and location dramatically influence the final cost. By comparing multiple quotes and leveraging discounts, young drivers can find more affordable coverage.

In This Article

- 1 Discover How Much Is Car Insurance For A 23 Year Old

- 1.1 Key Takeaways

- 1.2 📑 Table of Contents

- 1.3 Why Car Insurance Costs More for 23-Year-Olds

- 1.4 Average Cost of Car Insurance for a 23 Year Old

- 1.5 Factors That Affect Your Premium

- 1.6 How to Save Money on Car Insurance

- 1.7 Choosing the Right Coverage

- 1.8 Real-Life Examples and Tips

- 1.9 Conclusion

- 1.10 Frequently Asked Questions

- 1.10.1 What is the average cost of car insurance for a 23-year-old?

- 1.10.2 Why is car insurance so expensive for 23-year-olds?

- 1.10.3 How can I lower my car insurance rates at 23?

- 1.10.4 Does gender affect how much is car insurance for a 23 year old?

- 1.10.5 What factors influence how much car insurance costs for a 23-year-old?

- 1.10.6 Is car insurance cheaper for 23-year-olds with a clean driving record?

Discover How Much Is Car Insurance For A 23 Year Old

Hey there! If you’re 23 and just got your first car or are finally off your parents’ policy, you’re probably staring at insurance quotes and wondering, “Why is this so expensive?” I get it. When I was 23, I remember the shock of seeing my first solo car insurance bill. It felt like a rite of passage—and not a fun one. But don’t worry, you’re not alone. Figuring out car insurance for a 23 year old can be confusing, but it’s totally manageable once you break it down.

In this post, I’ll walk you through everything you need to know about car insurance costs at 23. We’ll talk about why rates are what they are, what you can expect to pay, and, most importantly, how to save money. Think of this as a friendly chat from someone who’s been there. By the end, you’ll feel more confident navigating the world of auto insurance. Let’s dive in!

Key Takeaways

- Age is a major cost factor: Rates drop significantly at age 25.

- Shop around aggressively: Premiums vary wildly between different insurers.

- Your driving record is critical: A clean record is your best discount.

- Choose your vehicle wisely: Sporty cars drastically increase your premium.

- Increase your deductible strategically: This can lower your monthly payment.

- Maintain good credit where allowed: It often leads to lower rates.

- Ask about all possible discounts: Bundling, good student, or safe driver programs.

📑 Table of Contents

Why Car Insurance Costs More for 23-Year-Olds

First things first: why does car insurance for a 23 year old often come with a higher price tag? It all boils down to risk. Insurance companies use data to predict how likely you are to file a claim. Unfortunately, drivers in their early twenties are statistically more likely to be involved in accidents. It’s not personal—it’s just numbers.

When you’re 23, you might still be building your driving history. Insurers see less experience on the road as a bigger risk. Also, at this age, many people are finishing college, starting new jobs, or moving cities. All these changes can affect your rates. But here’s the good news: as you get older and build a clean driving record, your premiums will drop. Understanding this can help you make smarter choices now.

The Role of Age and Experience

Age is a huge factor. Drivers under 25 typically pay more. At 23, you’re right in that sweet spot where insurers start to see you as slightly less risky than a teen but still not as safe as a 30-year-old. Your experience level matters too. If you got your license at 16, you have seven years of experience. But if you got it later, say at 20, insurers might view you as a novice.

I recall a friend who waited until 21 to get her license. Her first quote for car insurance for a 23 year old was sky-high because she only had two years of experience. She had to shop around and take a defensive driving course to bring costs down. So, your personal timeline plays a part.

Statistical Risks and Insurance Models

Insurers rely on crash data. According to studies, young drivers are overrepresented in accidents. This isn’t to scare you—it’s just the reality companies use to set prices. They look at things like speeding tickets, DUIs, and even your credit score in some states. All these elements feed into their risk models.

For example, if you live in a busy city with lots of traffic, your risk goes up. Or if you drive a sporty car, insurers might think you’re more prone to speed. It’s all about assessing likelihood. Knowing this can help you see why your quote is what it is and what you can do to improve it.

Average Cost of Car Insurance for a 23 Year Old

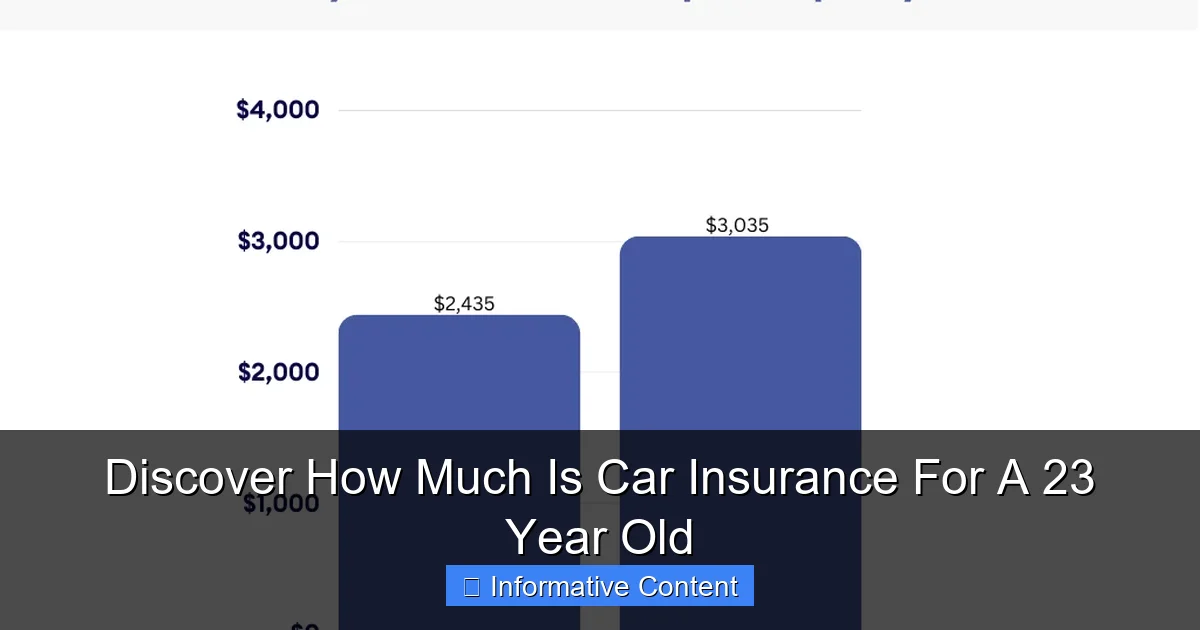

So, let’s talk numbers. How much is car insurance for a 23 year old on average? It varies a lot based on where you live, what you drive, and your personal history. But to give you a ballpark, national averages can help set expectations.

Visual guide about How Much Is Car Insurance For A 23 Year Old

Image source: livewell.com

On average, a 23-year-old driver might pay between $1,800 and $3,000 per year for full coverage. That’s roughly $150 to $250 per month. For minimum liability coverage, it could be $800 to $1,500 per year. But remember, these are just averages. Your actual cost could be higher or lower.

Breakdown by Coverage Type

Coverage type makes a big difference. Full coverage usually includes liability, collision, and comprehensive. It’s more expensive but offers better protection. Liability-only is cheaper but only covers damage you cause to others. As a 23-year-old, if you’re financing a car, lenders often require full coverage.

Here’s a simple breakdown:

- Liability Insurance: Covers others’ injuries and property damage. Average cost for a 23 year old: $100-$200 per month.

- Collision Insurance: Covers damage to your car from accidents. Adds about $50-$150 per month.

- Comprehensive Insurance: Covers theft, vandalism, natural disasters. Adds around $30-$100 per month.

When I was 23, I opted for full coverage because my car was new. It cost me about $200 a month. But a buddy with an old beater went liability-only and paid under $100. It’s all about your situation.

Data Table: Sample Annual Premiums by State

To give you a clearer picture, here’s a table showing estimated average annual costs for full coverage car insurance for a 23 year old in different states. These are based on typical driver profiles and might vary for you.

| State | Average Annual Premium | Notes |

|---|---|---|

| California | $2,400 | High population density can raise rates. |

| Texas | $2,800 | Severe weather and urban areas impact costs. |

| Ohio | $1,900 | Lower average due to less traffic congestion. |

| Florida | $3,000 | High risk of theft and natural disasters. |

| Illinois | $2,200 | Mix of urban and rural areas affects pricing. |

Keep in mind, these are rough estimates. Always get personalized quotes. Your cost for car insurance for a 23 year old will depend on your specific details.

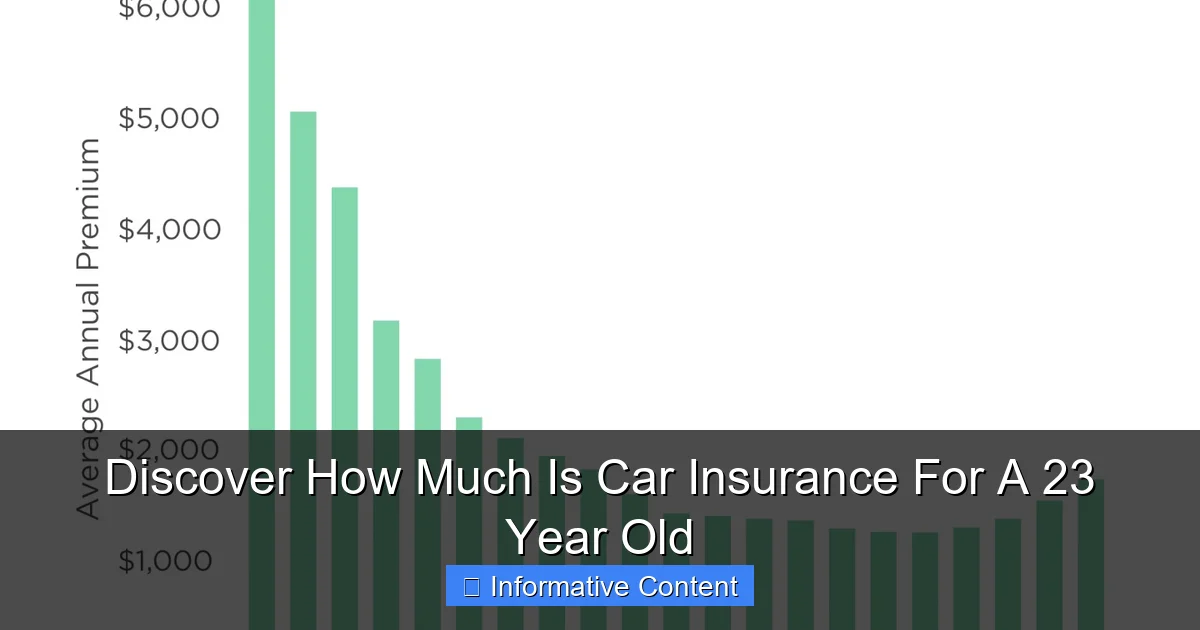

Factors That Affect Your Premium

Now, let’s dig into the factors that insurers look at when setting your rate. Knowing these can help you understand your quote and even lower it. It’s like having a cheat sheet for car insurance for a 23 year old.

Visual guide about How Much Is Car Insurance For A 23 Year Old

Image source: i2.wp.com

Your Driving Record

This is a big one. A clean driving record with no accidents or tickets can save you hundreds. Even one speeding ticket can bump up your premium. Insiders see violations as red flags. So, drive safely—it pays off literally.

I learned this the hard way. At 22, I got a ticket for rolling through a stop sign. When I renewed my policy at 23, my rate jumped by 20%. It took three years of clean driving to bring it back down.

Your Vehicle Type

The car you drive matters a lot. Safe, reliable cars with good safety ratings are cheaper to insure. Sport cars, luxury vehicles, and cars with high theft rates cost more. Insurers think about repair costs and how likely the car is to be in an accident.

For instance, a 23-year-old driving a used Honda Civic will pay less for car insurance than someone with a new Ford Mustang. Before buying a car, check insurance costs. It can save you surprise expenses later.

Your Location

Where you live affects your rate. Urban areas with more traffic, theft, and accidents have higher premiums. Rural areas tend to be cheaper. Also, state laws vary—some states have no-fault insurance, which can be more expensive.

If you move, update your address with your insurer. When I moved from a suburb to a city at 23, my car insurance went up by 15% just because of the zip code change.

Your Credit Score

In most states, insurers use credit-based insurance scores. They believe people with better credit are less likely to file claims. As a 23-year-old, you might still be building credit, so this can be a challenge.

Improving your credit score can lower your premium. Pay bills on time, keep credit card balances low, and check your credit report for errors. Every bit helps when calculating car insurance for a 23 year old.

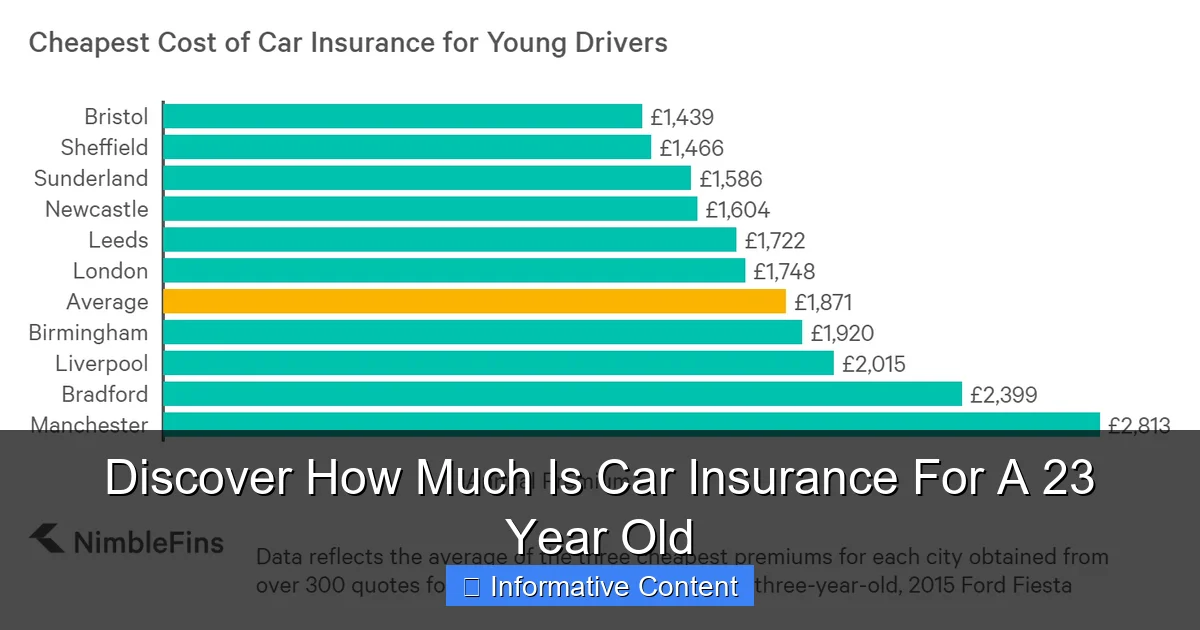

How to Save Money on Car Insurance

Okay, so car insurance for a 23 year old can be pricey, but there are plenty of ways to save. Let’s talk about practical tips to cut costs without skimping on coverage.

Visual guide about How Much Is Car Insurance For A 23 Year Old

Image source: res.cloudinary.com

Shop Around and Compare Quotes

This is the number one tip. Don’t just stick with the first company you find. Get quotes from at least three different insurers. Prices can vary wildly. Use online comparison tools or talk to an independent agent.

When I was 23, I saved over $500 a year by switching companies. It took an hour of my time, but it was worth it. Make it a habit to shop around every year at renewal.

Take Advantage of Discounts

Insurers offer discounts that many people miss. Here are some common ones for young drivers:

- Good Student Discount: If you’re in college and have good grades, you could save up to 15%.

- Safe Driver Discount: For maintaining a clean record.

- Bundling Discount: Combine auto and renters insurance for a lower rate.

- Pay-in-Full Discount: Pay your annual premium upfront instead of monthly.

- Usage-Based Insurance: Use a telematics device to prove safe driving habits.

Ask your insurer about all available discounts. Sometimes, they won’t apply them unless you request.

Increase Your Deductible

Your deductible is what you pay out of pocket before insurance kicks in. By raising it, say from $500 to $1,000, you can lower your premium. Just make sure you have enough savings to cover the deductible if you need to file a claim.

This worked for me. I increased my deductible and saved about 10% on my premium. It felt like a smart trade-off since I had an emergency fund.

Maintain a Clean Driving Record

I mentioned this earlier, but it’s worth repeating. Safe driving is the best long-term strategy to reduce car insurance costs. Avoid tickets and accidents. Consider taking a defensive driving course—it might earn you a discount and make you a safer driver.

Choosing the Right Coverage

With car insurance for a 23 year old, picking the right coverage is crucial. You don’t want to overpay, but you also don’t want to be underinsured. Let’s balance cost and protection.

Assessing Your Needs

Think about your situation. Do you own your car outright or is it financed? If financed, you’ll likely need full coverage. What’s the value of your car? If it’s old and worth less than a few thousand dollars, liability-only might suffice.

Also, consider your assets. If you cause an accident and don’t have enough liability coverage, you could be personally sued. As a 23-year-old, you might not have much now, but protecting future earnings is smart.

Understanding Policy Terms

Read the fine print. Know what your policy covers and excludes. Key terms include:

- Bodily Injury Liability: Covers medical costs for others you injure.

- Property Damage Liability: Covers damage to others’ property.

- Uninsured/Underinsured Motorist Coverage: Protects you if someone without insurance hits you.

- Personal Injury Protection (PIP): Covers your medical expenses, regardless of fault.

When I first bought car insurance at 23, I skipped uninsured motorist coverage to save money. Later, I learned that in my state, many drivers were uninsured. I added it back for peace of mind.

Customizing Your Policy

Don’t be afraid to tailor your policy. Work with an agent to adjust limits and add-ons based on your budget and risk tolerance. For example, if you drive rarely, a low-mileage discount might apply.

Remember, the cheapest car insurance for a 23 year old isn’t always the best. Balance affordability with adequate coverage.

Real-Life Examples and Tips

To make this more relatable, let’s look at some real-life scenarios. These examples show how different choices impact car insurance for a 23 year old.

Example 1: The Recent College Grad

Meet Alex, a 23-year-old who just graduated and got a job in Austin, Texas. He buys a used 2018 Toyota Camry. He has a clean driving record but average credit. He shops around and gets quotes from three companies. By bundling with renters insurance and taking a good student discount (from his last semester), he secures full coverage for $2,200 a year. His tip: always ask about discounts, even after graduation.

Example 2: The City Dweller

Sam is 23 and lives in Chicago. She drives a 2015 Honda Fit for her commute. Because of city risks, her initial quote for car insurance was $3,000 a year. She opts for a higher deductible and enrolls in a usage-based program that tracks her driving. Her safe habits lower her premium to $2,400. Her tip: consider telematics if you’re a confident driver.

Example 3: The Rural Driver

Jordan lives in a small town in Ohio and drives a 2010 Ford F-150 for work. With a clean record and low mileage, he finds liability-only coverage for $900 a year. He saves by paying annually and maintaining good credit. His tip: in rural areas, minimal coverage might be enough, but always assess your risks.

Practical Tips to Implement Now

- Set a Budget: Decide how much you can afford for car insurance each month and shop within that range.

- Review Annually: Your needs change, so review your policy every year. You might qualify for new discounts.

- Drive Safely: It’s the best way to keep costs down over time.

- Seek Advice: Talk to friends or family about their experiences with car insurance for a 23 year old.

Conclusion

Figuring out car insurance for a 23 year old might seem daunting, but it’s a manageable step toward independence. Remember, costs are high because of risk, but they don’t have to break the bank. By understanding factors like your driving record, vehicle type, and location, you can make informed decisions.

Shop around, leverage discounts, and choose coverage that fits your life. As you grow older and build a solid driving history, your premiums will decrease. For now, take control of your insurance journey. You’ve got this! If you have questions, drop them in the comments—I’m happy to help based on my own experiences.

Thanks for reading, and here’s to safe and affordable driving at 23 and beyond!

Frequently Asked Questions

What is the average cost of car insurance for a 23-year-old?

The average cost of car insurance for a 23-year-old typically ranges from $2,000 to $3,000 annually, but this can vary based on state, driving record, and vehicle. Rates generally start to decrease after age 25 as drivers gain more experience and are seen as less risky by insurers.

Why is car insurance so expensive for 23-year-olds?

Car insurance is expensive for 23-year-olds because they are statistically more likely to be involved in accidents due to less driving experience. Insurers charge higher premiums to offset this perceived risk, which can lead to costs being significantly above average for younger drivers.

How can I lower my car insurance rates at 23?

You can lower your car insurance rates at 23 by maintaining a clean driving record, taking defensive driving courses, and asking about discounts for good students or safe drivers. Additionally, comparing quotes from multiple insurers and choosing a vehicle with high safety ratings can help reduce premiums.

Does gender affect how much is car insurance for a 23 year old?

Yes, gender often affects how much car insurance costs for a 23 year old, as young male drivers typically face higher rates due to higher accident statistics. However, some states prohibit gender-based pricing, so it’s best to check local laws and shop around for the best rate.

What factors influence how much car insurance costs for a 23-year-old?

Factors include driving history, credit score, location, vehicle type, and annual mileage. Your coverage limits and deductibles also play a key role in determining the final premium for a 23-year-old driver.

Is car insurance cheaper for 23-year-olds with a clean driving record?

Yes, car insurance is usually cheaper for 23-year-olds with a clean driving record, as it signals lower risk to insurance companies. A history without accidents or violations can qualify you for safe driver discounts and significantly lower your annual premiums.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.