Featured image for At Fault Car Accident Liability

Image source: autoinsurance.org

While an at-fault car accident is highly unlikely to directly make you lose your house, it’s not impossible if damages far exceed your insurance coverage. In such cases, a successful lawsuit could target personal assets, potentially forcing the sale of your home’s equity to satisfy the judgment. This underscores the critical importance of robust liability limits and umbrella policies to protect your most valuable asset.

The sudden screech of tires, the horrifying crunch of metal, and the sickening jolt of impact – for many, an at-fault car accident is a nightmare scenario. Beyond the immediate physical injuries and vehicle damage, a chilling question often looms in the minds of those responsible: “Can an at fault car accident make me lose my house?” It’s a terrifying prospect, fueled by uncertainty and fear of financial ruin.

The idea of losing your most significant asset, your home, because of a momentary lapse in judgment or an unfortunate miscalculation on the road, can be paralyzing. While car insurance is designed to protect you in such situations, its protection isn’t limitless. There are specific circumstances where the consequences of an at-fault car accident can extend far beyond higher premiums and minor repairs, potentially putting your personal assets, including your cherished home, directly in the line of fire.

This comprehensive guide aims to demystify this complex and often distressing topic. We will explore the intricate interplay between liability, insurance coverage, state laws, and personal assets, offering clarity on when and how an at-fault car accident could indeed jeopardize your home. Our goal is to equip you with the knowledge to understand the risks and, more importantly, to proactively protect yourself from the devastating financial fallout of a severe accident. Don’t let the fear of an at-fault car accident consume you; empower yourself with information.

Understanding Liability and Damages in At-Fault Accidents

Before we can delve into the specific threat to your home, it’s crucial to understand the foundational concepts of liability and damages in the context of an at-fault car accident. These terms dictate who is responsible for the financial repercussions and what those repercussions entail.

Defining “At Fault”

In simple terms, being “at fault” means you are legally responsible for causing an accident. This determination is usually made by law enforcement at the scene, insurance adjusters during their investigation, or, in some cases, by a court of law. Factors contributing to fault often include speeding, distracted driving, failing to yield, running a red light, or driving under the influence. If you are found to be at fault, you are legally obligated to compensate the other parties for their losses and damages.

Types of Damages in a Car Accident

The financial impact of an at-fault car accident can be extensive, encompassing various categories of damages. Understanding these helps illustrate why the costs can escalate rapidly and potentially make you lose your house.

- Property Damage: This covers the cost to repair or replace the other party’s vehicle and any other property damaged in the accident (e.g., fences, mailboxes, buildings).

- Bodily Injury: This is often the most significant and costly component. It includes medical bills (hospital stays, doctor visits, surgery, medication, rehabilitation), future medical expenses, and even long-term care for severe injuries.

- Lost Wages/Earning Capacity: If the injured party cannot work due to their injuries, you may be liable for their lost income, both current and future.

- Pain and Suffering: This non-economic damage compensates the injured party for physical pain, emotional distress, mental anguish, loss of enjoyment of life, and other non-tangible impacts of their injuries. These amounts can be substantial, especially in cases of permanent disability or disfigurement.

- Punitive Damages: In rare cases where the at-fault driver’s conduct was egregious (e.g., extreme recklessness, drunk driving), a court may award punitive damages. These are not meant to compensate the victim but to punish the negligent driver and deter similar behavior. Punitive damages can significantly increase the total financial burden and are often not covered by standard car insurance policies, directly exposing your personal assets.

The Concept of Negligence

Most car accident claims hinge on the legal concept of negligence. To prove negligence, the injured party (the plaintiff) must demonstrate four elements:

- The at-fault driver owed a duty of care to others on the road (e.g., to drive safely).

- The at-fault driver breached that duty (e.g., by speeding).

- This breach directly caused the accident and the plaintiff’s injuries.

- The plaintiff suffered actual damages as a result.

If these elements are established, the at-fault driver is legally responsible for the damages, which can be devastating enough to make you lose your house.

The Role of Car Insurance: Your Primary Defense

Your car insurance policy is your first and most critical line of defense against the financial fallout of an at-fault car accident. Understanding its components and limitations is paramount to protecting your personal assets, including your home.

Visual guide about At Fault Car Accident Liability

Image source: walkermackenzielaw.com

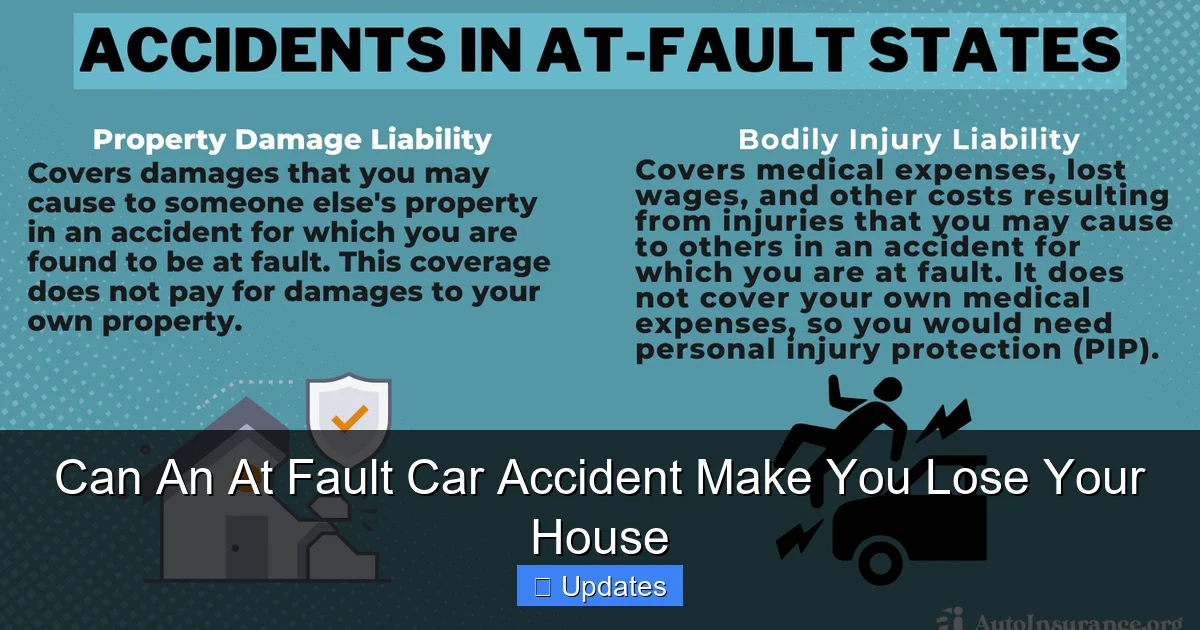

Mandatory Minimum Coverage

Almost every state requires drivers to carry a minimum amount of liability insurance. This coverage is designed to pay for damages you cause to others in an at-fault accident. The two main components are:

- Bodily Injury Liability (BIL): This covers medical expenses, lost wages, and pain and suffering for others injured in an accident you cause. It’s usually expressed as two numbers, like $25,000/$50,000. The first number is the maximum amount paid per person, and the second is the maximum paid per accident.

- Property Damage Liability (PDL): This covers damage to another person’s property, primarily their vehicle, if you are at fault. It’s expressed as a single number, like $10,000.

These minimums are often woefully inadequate, especially in serious accidents. For example, if minimum BIL is $25,000 per person and a severe at-fault car accident causes $100,000 in medical bills for one person, you are personally liable for the remaining $75,000.

Understanding Policy Limits

Policy limits are the maximum amounts your insurance company will pay out for a covered claim. Anything beyond these limits becomes your personal responsibility. For a severe at-fault car accident, especially one involving multiple injuries or permanent disability, damages can easily exceed standard policy limits of $50,000/$100,000/$25,000 or even $100,000/$300,000/$50,000.

Practical Example: Imagine you cause an at-fault car accident. Your bodily injury liability limit is $50,000 per person. The other driver sustains severe injuries, incurring $200,000 in medical expenses and lost wages. Your insurance will pay $50,000. You are now personally responsible for the remaining $150,000. If you don’t have that cash readily available, your personal assets, including your house, could be targeted.

Types of Additional Coverage to Consider

To mitigate the risk of an at-fault car accident forcing you to lose your house, consider these crucial additional coverages:

- Higher Liability Limits: This is the most straightforward way to increase your protection. Many insurance professionals recommend limits significantly higher than state minimums, often $250,000/$500,000/$100,000, especially if you have significant assets to protect.

- Umbrella Policy: An umbrella policy provides an extra layer of liability coverage beyond the limits of your auto and home insurance. These policies typically offer $1 million to $5 million in additional protection for a relatively low premium. If your car insurance limits are exhausted after an at-fault car accident, your umbrella policy kicks in before your personal assets are touched. This is often the strongest defense against financial ruin and potentially losing your house.

- Uninsured/Underinsured Motorist (UM/UIM): While this doesn’t protect you if you are at fault, it’s vital for protecting yourself and your family if another at-fault driver with insufficient or no insurance causes an accident with you.

The Insurance Company’s Role in a Claim

When you’re involved in an at-fault car accident, your insurance company has a duty to defend you. This means they will investigate the claim, negotiate with the injured party, and, if necessary, provide legal representation in court. They will pay up to your policy limits to settle valid claims. However, if a settlement or judgment exceeds those limits, their responsibility ends, and your personal assets become exposed.

When Insurance Isn’t Enough: Personal Assets at Risk

This is where the direct threat of an at-fault car accident making you lose your house becomes very real. When the damages from an accident surpass your car insurance coverage, the injured party or their insurance company will look to recover the remaining balance from your personal assets.

Visual guide about At Fault Car Accident Liability

Image source: torhoermanlaw.com

Excess Liability and Personal Exposure

As discussed, if the cost of damages (medical bills, lost wages, pain and suffering, property damage) exceeds your liability insurance limits, you become personally responsible for the difference. This excess liability can be hundreds of thousands, or even millions, of dollars in cases involving severe injuries or fatalities caused by an at-fault car accident. This is the precise moment when the phrase “lose your house” starts to ring true.

The Threat of Lawsuits and Judgments

If you cannot pay the excess liability out-of-pocket, the injured party’s next step is often to file a lawsuit against you. If they win the lawsuit, the court will issue a “judgment” against you. A judgment is a legally binding order compelling you to pay a specific amount of money to the plaintiff. This judgment carries significant weight and can lead to aggressive collection efforts.

What Assets Can Be Targeted?

Once a judgment is obtained, the plaintiff can pursue various methods to collect the debt from your personal assets. These can include:

- Bank Account Levies: Funds can be seized directly from your checking and savings accounts.

- Wage Garnishments: A portion of your paycheck can be legally withheld and sent directly to the plaintiff.

- Investment Accounts: Stocks, bonds, and other investments can be liquidated.

- Other Valuable Property: Luxury vehicles, boats, vacation homes, and other significant assets can be seized and sold.

- Your Primary Residence: This is where the fear of an at-fault car accident leading to you losing your house materializes. If other assets are insufficient, or if it is the most significant asset, the plaintiff can seek to place a lien on your home.

Foreclosure and Liens on Your Home

A “lien” is a legal claim placed on your property, including your home, as security for a debt. If a judgment is placed against you, the plaintiff can record a judgment lien on your real estate. This lien doesn’t immediately force you to sell your house, but it makes it very difficult to sell or refinance without satisfying the debt. If you fail to satisfy the judgment, the lienholder can eventually force the sale of your home through a process similar to foreclosure to collect what you owe. This is a direct pathway to losing your house due to an at-fault car accident. Even if you don’t lose it immediately, the financial strain and legal battles can be immense.

Protecting Your Home: Strategies and Legal Safeguards

The good news is that there are proactive measures and legal protections in place to help shield your home from the financial devastation of a severe at-fault car accident. Taking these steps seriously can be the difference between financial stability and losing your house.

Visual guide about At Fault Car Accident Liability

Image source: autoinsurance.org

The Importance of Adequate Insurance Coverage

Reiterating a critical point: the single most effective way to protect your home and other assets is to carry sufficient insurance coverage. Review your auto liability limits with your insurance agent annually. Consider raising them significantly beyond state minimums, especially if your net worth includes substantial equity in your home. An umbrella insurance policy is often considered indispensable for anyone with significant assets. It provides millions in additional liability protection for a relatively modest annual premium, acting as a robust shield against losing your house in the event of an at-fault car accident.

Tip: Don’t just look at the premium cost. Balance it against the potential financial ruin of an uncovered claim. A few hundred extra dollars a year can literally save your home.

Understanding Homestead Exemptions

Many states offer “homestead exemptions,” which protect a portion or, in some cases, all of the equity in your primary residence from creditors. These laws are designed to prevent individuals from becoming homeless due to financial hardship. However, the amount of protection varies dramatically by state:

- Some states (e.g., Florida, Texas, Iowa, Kansas, Oklahoma, South Dakota) offer unlimited homestead exemptions, meaning your home’s equity is largely protected regardless of its value.

- Other states offer limited exemptions, protecting only a few thousand or tens of thousands of dollars in equity.

- A few states offer no homestead exemption at all.

It’s crucial to understand your state’s specific homestead exemption laws. While a homestead exemption can offer significant protection, it typically doesn’t cover all types of debt (e.g., mortgages, property taxes, or debts arising from fraud). Moreover, if the judgment against you is large enough, and your equity exceeds the exemption, a portion of your home could still be at risk, potentially forcing a sale or making you lose your house.

Asset Protection Planning

For individuals with substantial assets, more advanced asset protection strategies might be considered. These often involve legal structures like trusts or limited liability companies (LLCs). These strategies are complex, require careful planning with an attorney, and must be established well in advance of any potential claim. They are not a quick fix after an at-fault car accident but can be powerful tools for long-term financial security.

Warning: Attempting to transfer assets out of your name after an accident has occurred or a lawsuit has been filed can be considered fraudulent conveyance and may result in severe legal penalties.

Prompt Legal Counsel

If you are involved in an at-fault car accident where serious injuries or property damage occurred, and especially if a lawsuit is threatened or filed, immediately consult with an experienced personal injury defense attorney. Your insurance company will likely provide a lawyer, but having independent counsel can be beneficial, particularly if the claim amount is approaching or exceeding your policy limits. An attorney can advise you on your rights, negotiate with the plaintiff’s lawyers, and help explore all available options to prevent losing your house.

Navigating the Aftermath: Steps to Take After an At-Fault Accident

Being involved in an at-fault car accident can be a harrowing experience. Knowing the right steps to take afterward can significantly influence the outcome, potentially mitigating financial risks and helping prevent you from losing your house.

Reporting the Accident and Contacting Your Insurer

Immediately after ensuring everyone’s safety and contacting emergency services if needed, report the accident to your car insurance company. Do not delay. Your policy likely has a clause requiring prompt notification. Provide accurate, factual information about what happened, but avoid admitting fault or speculating. Your insurance company will open a claim, assign an adjuster, and begin their investigation.

Tip: Even if the accident seems minor, report it. You never know when seemingly minor injuries might develop into serious conditions, leading to large claims later.

Cooperating with Your Insurance Company (and Lawyers)

Cooperate fully with your insurance adjuster and any legal counsel they provide. This includes providing statements, answering questions, and sharing any requested documentation. Remember, their primary goal is to settle the claim within your policy limits. However, if they believe the claim is baseless or excessive, they will defend you in court. If a lawsuit is filed, your insurer will appoint an attorney to represent you. It is crucial to work closely with this attorney, providing all necessary information and attending all required legal proceedings.

Seeking Legal Representation for Yourself

While your insurance company provides defense counsel, there might be situations where you should consider retaining your own attorney, especially if:

- The damages claimed significantly exceed your policy limits.

- You believe your insurance company is not adequately defending your interests or is urging you to accept a settlement that might not be in your best long-term interest.

- There are allegations of egregious conduct (e.g., drunk driving) that could lead to punitive damages, which your insurance may not cover.

An independent attorney can advise you on your personal liability exposure, asset protection strategies, and potential implications for your home outside of what your insurance company’s counsel might cover.

Considering Settlement Options

In cases where damages are likely to exceed your policy limits, your insurance company may try to negotiate a settlement. If the injured party’s attorney is willing to settle for an amount within your policy limits, your insurance company will generally pay it to protect you from personal liability. However, if the demand is higher, you might be asked to contribute financially. This is a critical point where legal advice from your own attorney becomes invaluable. They can help you evaluate settlement offers, understand the risks of going to trial, and explore options to minimize your personal financial exposure and prevent you from losing your house.

Beyond the Immediate: Long-Term Financial and Emotional Impact

The repercussions of an at-fault car accident extend far beyond the immediate legal and financial battles. Understanding these long-term impacts is crucial for rebuilding your life and ensuring lasting financial stability.

Credit Score and Future Insurance Premiums

Even if you avoid losing your house, a significant at-fault car accident can severely impact your financial future. If a judgment is placed against you and you make payments over time, or if your wages are garnished, it will negatively affect your credit score. A poor credit score can make it harder to obtain loans, secure housing, or even get certain jobs. Furthermore, being found at fault in an accident, especially a severe one, will almost certainly lead to substantially higher car insurance premiums for several years. Some insurers may even choose not to renew your policy, forcing you to seek high-risk insurance, which is considerably more expensive.

Emotional Toll and Stress Management

Beyond the financial strains, experiencing an at-fault car accident, especially one with serious consequences for others, can take a tremendous emotional toll. Guilt, anxiety, stress over potential financial ruin, and fear of losing your house can lead to significant mental health challenges. It’s important to acknowledge these feelings and seek support if needed, whether from friends, family, or mental health professionals. Managing stress effectively can help you navigate the complex legal and financial processes more clearly.

Rebuilding Financial Stability

If you face a substantial judgment or significant out-of-pocket expenses, rebuilding your financial stability will be a long process. This might involve:

- Budgeting and Expense Reduction: Cutting unnecessary expenses to free up funds for payments or savings.

- Debt Management: Working with financial advisors to create a plan for managing any new debts incurred.

- Increased Savings: Prioritizing rebuilding your emergency fund and other savings.

- Financial Planning: Revisiting your long-term financial goals and adjusting them based on your new circumstances.

The goal is always to prevent an at-fault car accident from leading to financial ruin, but if it does, a clear strategy for recovery is essential.

Hypothetical Scenarios of Damages vs. Insurance Coverage

To further illustrate how an at-fault car accident can lead to personal financial exposure and the risk of losing your house, consider these hypothetical scenarios comparing typical damages with various insurance coverage levels:

These scenarios highlight the critical gap between minimum coverage and the reality of severe accident costs. In Scenario C and D, the uninsured amount directly exposes your personal assets, including your home, to judgment and collection efforts. This demonstrates why many people fear that an at-fault car accident will make them lose their house.

Conclusion

The fear that an at-fault car accident could make you lose your house is not unfounded. While car insurance is your primary defense, there are indeed situations where the financial aftermath of a severe accident can exceed your policy limits, putting your personal assets, including your cherished home, at significant risk. The interplay of liability, escalating medical costs, legal judgments, and state-specific homestead exemptions can create a precarious situation for any at-fault driver.

However, understanding these risks is the first step toward effective protection. The most powerful shield against financial ruin is adequate car insurance coverage, particularly high liability limits and a comprehensive umbrella policy. These proactive measures, combined with a clear understanding of your state’s homestead exemptions and prompt legal consultation if an accident occurs, can significantly reduce your exposure and safeguard your home.

An at-fault car accident is undoubtedly a stressful and potentially life-altering event. By prioritizing robust insurance coverage, understanding your legal responsibilities, and knowing how to navigate the aftermath, you can mitigate the most severe financial consequences. While no one ever wants to be in such a position, being prepared offers peace of mind and significantly lessens the chances that you will ultimately lose your house.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Frequently Asked Questions

- 3.1 Can an at fault car accident directly lead to me losing my house?

- 3.2 How does my car insurance protect my home after an at fault car accident?

- 3.3 What happens if the damages from an at fault car accident exceed my insurance limits?

- 3.4 Are there steps I can take to protect my house from an at fault car accident lawsuit?

- 3.5 Does the severity of injuries or a fatality in an at fault car accident increase the risk of losing my home?

- 3.6 How quickly can an at fault car accident lead to a lawsuit risking my home?

Key Takeaways

- Review liability limits: Ensure your auto insurance coverage is adequate.

- Understand homestead exemptions: Protect your primary residence from creditors.

- High-value assets are vulnerable: Insufficient insurance can expose your home.

- Excess judgments target assets: Personal wealth, including equity, is at risk.

- Consult an attorney immediately: Seek legal guidance after a serious accident.

- Don’t ignore legal notices: Promptly respond to lawsuits or debt collections.

- Umbrella insurance adds protection: Consider extra coverage for significant assets.

📑 Table of Contents

- Understanding Liability and Damages in At-Fault Accidents

- The Role of Car Insurance: Your Primary Defense

- When Insurance Isn’t Enough: Personal Assets at Risk

- Protecting Your Home: Strategies and Legal Safeguards

- Navigating the Aftermath: Steps to Take After an At-Fault Accident

- Beyond the Immediate: Long-Term Financial and Emotional Impact

- Hypothetical Scenarios of Damages vs. Insurance Coverage

- Conclusion

Frequently Asked Questions

Can an at fault car accident directly lead to me losing my house?

Yes, in severe cases where the damages and injuries exceed your insurance coverage, your personal assets, including your house, could be at risk. A court judgment against you might compel the sale of assets to satisfy the debt if you lack sufficient other funds.

How does my car insurance protect my home after an at fault car accident?

Your liability insurance is the primary protection, covering damages and injuries you’re responsible for up to your policy limits. If the total damages are greater than your coverage, the injured party can pursue your personal assets, which may include your home.

What happens if the damages from an at fault car accident exceed my insurance limits?

If your insurance coverage isn’t sufficient, you become personally responsible for the remaining balance. The injured party or their insurance company can sue you to recover these additional costs, potentially targeting your personal assets like savings, investments, or your home.

Are there steps I can take to protect my house from an at fault car accident lawsuit?

It’s crucial to have adequate liability insurance coverage, including umbrella policies, to cover potential large claims. Consulting with an attorney and a financial advisor early can help explore asset protection strategies specific to your situation and state laws.

Does the severity of injuries or a fatality in an at fault car accident increase the risk of losing my home?

Absolutely. Accidents involving severe injuries or fatalities often result in very high damage awards for medical expenses, lost wages, and pain and suffering, greatly increasing the likelihood that claims will exceed standard insurance limits and put your home at risk.

How quickly can an at fault car accident lead to a lawsuit risking my home?

A lawsuit can be filed relatively quickly after an accident, but the legal process can take months or even years to resolve. During this time, your assets, including your home, could be subject to liens or ultimately be used to satisfy a judgment if you are found liable and damages exceed your insurance coverage.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.