Leasing a car lets you drive a new vehicle for a set period—typically 24 to 36 months—with lower monthly payments than buying. Instead of owning the car, you pay for its depreciation during the lease term, plus fees and interest, giving you flexibility and access to the latest models.

So, you’re thinking about getting a new car—but instead of buying, you’re curious about leasing. Maybe you’ve heard friends talk about lower monthly payments or how they get a shiny new ride every few years. Or maybe you’re just tired of dealing with repairs on an older vehicle and want something reliable with the latest tech. Whatever your reason, leasing a car might be a smart move—if you understand how it works.

Leasing a car isn’t the same as buying. It’s more like renting a vehicle for a long period, usually two to four years. Instead of paying off the entire value of the car, you only pay for the portion it loses in value during your lease term—called depreciation. Plus, you’ll pay interest (often called “rent charge”) and some fees. At the end of the lease, you return the car (assuming it’s in good condition and within mileage limits), and you’re free to walk away—or lease another vehicle.

But here’s the thing: leasing isn’t for everyone. It works best if you like driving new cars, don’t put a ton of miles on your vehicle, and prefer predictable monthly costs. If you’re someone who loves customizing your ride, drives cross-country every weekend, or plans to keep a car for 10 years, leasing might not be the right fit. Still, for many drivers—especially those who want luxury features without the luxury price tag—leasing can be a great option.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is Car Leasing?

- 4 How the Leasing Process Works

- 5 Pros and Cons of Leasing a Car

- 6 Understanding Lease Fees and Costs

- 7 Tips for Getting the Best Lease Deal

- 8 What Happens at the End of a Lease?

- 9 Is Leasing Right for You?

- 10 Final Thoughts

- 11 Frequently Asked Questions

Key Takeaways

- Leasing is like renting a car long-term: You pay for the vehicle’s depreciation during the lease period, not the full price.

- Lower monthly payments: Lease payments are usually 20–30% less than loan payments for the same car.

- Mileage limits apply: Most leases include 10,000 to 15,000 miles per year; going over incurs extra fees.

- Wear and tear guidelines matter: Excessive damage or modifications can result in end-of-lease charges.

- No equity at the end: You don’t own the car when the lease ends, but you can often buy it or lease a new one.

- Gap insurance is usually included: This protects you if the car is totaled or stolen during the lease.

- Early termination can be costly: Ending a lease early often triggers penalties, so plan carefully.

📑 Table of Contents

What Is Car Leasing?

At its core, car leasing is a type of long-term rental agreement. You’re essentially borrowing a vehicle from a leasing company (often the car manufacturer’s finance arm, like Toyota Financial Services or Ford Credit) for a set period. During that time, you make monthly payments to cover the car’s depreciation, plus finance charges and taxes.

Think of it this way: when you buy a car, you’re paying for the whole thing—even the parts that won’t wear out for decades. But when you lease, you’re only paying for the part that actually gets used up during your time with the car. For example, if a $40,000 car is expected to be worth $24,000 after three years, you’ll pay for that $16,000 drop in value, plus fees and interest.

Leasing is popular because it offers lower monthly payments compared to buying. You’re not building equity like you would with a loan, but you’re also not tied down to one vehicle for years. Most leases last 24, 36, or 48 months, and at the end, you simply return the car—no selling, no trade-in hassle.

How Leasing Differs from Buying

The biggest difference between leasing and buying is ownership. When you buy a car—whether with cash or a loan—you own it outright (or you’re working toward ownership). Once the loan is paid off, the car is yours, and you can keep it, sell it, or trade it in whenever you want.

With leasing, you never own the car. You’re essentially paying to use it for a few years. This means you don’t build any equity, and you’ll always have a car payment unless you go without a vehicle altogether. However, because you’re only paying for depreciation (not the full value), your monthly payments are typically much lower.

Another key difference is maintenance. Most leased cars are under warranty for the entire lease term, so repairs are usually covered. This can save you money on unexpected fixes. In contrast, once you own a car outright, you’re responsible for all maintenance and repairs—even if the car is older and out of warranty.

Who Should Consider Leasing?

Leasing makes the most sense for people who:

– Want a new car every few years

– Prefer lower monthly payments

– Don’t drive more than 12,000–15,000 miles per year

– Like having the latest safety and tech features

– Don’t want to deal with selling or trading in a car

It’s also a good option if you’re a business owner who can deduct lease payments as a business expense (check with your accountant). On the flip side, leasing isn’t ideal if you drive a lot, love modifying your car, or plan to keep it long-term.

How the Leasing Process Works

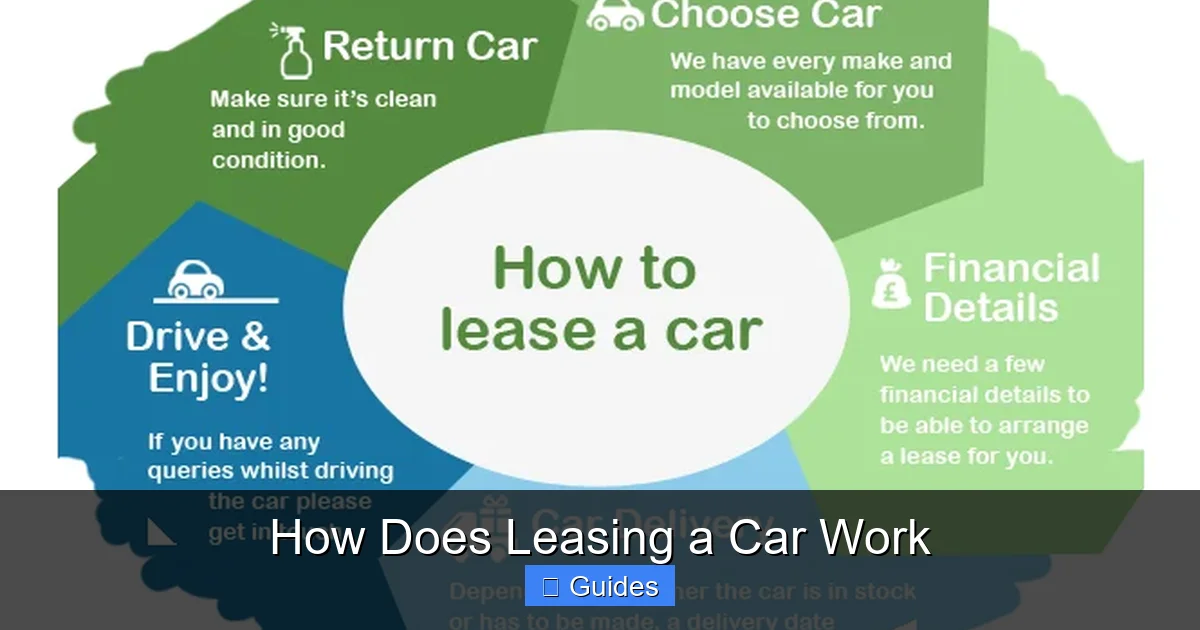

Visual guide about How Does Leasing a Car Work

Image source: leasecar.uk

Leasing a car follows a similar path to buying, but with a few key differences. Here’s a step-by-step breakdown of how it typically goes:

First, you shop for the car you want—just like you would if you were buying. You can lease new or certified pre-owned vehicles, though new cars are far more common. Once you’ve picked a model, you negotiate the price with the dealer. This is called the “capitalized cost,” and it’s one of the most important numbers in your lease.

Next, the leasing company (called the “lessor”) determines the car’s residual value—what it’s expected to be worth at the end of the lease. For example, a car with a 60% residual value after three years means it’s projected to be worth 60% of its original price. The difference between the capitalized cost and the residual value is your depreciation—the main part of your monthly payment.

Then, the lessor adds in finance charges (based on your credit and the money factor, which is like an interest rate), taxes, and fees. All of this gets divided over the lease term to give you your monthly payment.

Before you sign, you’ll also agree on mileage limits, wear-and-tear guidelines, and whether you want to add extras like maintenance packages or gap insurance (more on that later).

Key Lease Terms You Need to Know

To understand your lease agreement, you’ll need to know a few key terms:

– **Capitalized Cost:** The negotiated price of the car. Lower is better.

– **Residual Value:** The car’s estimated value at the end of the lease. Higher residuals mean lower payments.

– **Money Factor:** The lease’s interest rate, expressed as a decimal (e.g., 0.0025). Multiply by 2,400 to get an approximate APR.

– **Lease Term:** How long you’ll have the car (usually 24–48 months).

– **Mileage Allowance:** How many miles you can drive per year (typically 10,000–15,000).

– **Disposition Fee:** A charge (often $300–$500) if you return the car at the end of the lease.

– **Acquisition Fee:** An upfront fee (usually $500–$1,000) to start the lease.

Example: Breaking Down a Lease Payment

Let’s say you’re leasing a $35,000 car with a 36-month term and a 60% residual value. That means the car is expected to be worth $21,000 after three years.

– Depreciation: $35,000 – $21,000 = $14,000

– Monthly depreciation: $14,000 ÷ 36 = $389

– Money factor: 0.0020 (≈ 4.8% APR)

– Finance charge: ($35,000 + $21,000) × 0.0020 = $112

– Total monthly payment (before taxes/fees): $389 + $112 = $501

Add in taxes, fees, and any add-ons, and your final payment might be around $550 per month. Compare that to a loan payment on the same car—likely $600–$700 or more—and you can see why leasing is appealing.

Pros and Cons of Leasing a Car

Visual guide about How Does Leasing a Car Work

Image source: thebalancemoney.com

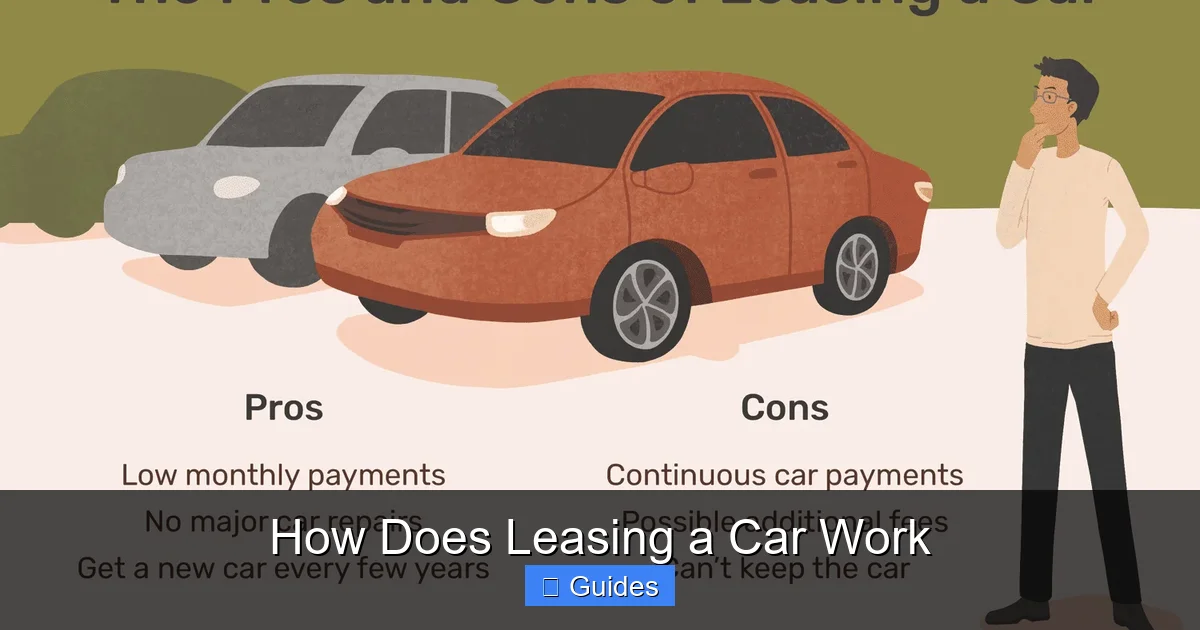

Like any financial decision, leasing has its ups and downs. Let’s look at the biggest advantages and disadvantages so you can decide if it’s right for you.

Advantages of Leasing

**Lower Monthly Payments:** This is the #1 reason people lease. Because you’re only paying for depreciation (not the full value), your payments are usually 20–30% lower than a loan for the same car.

**Drive a New Car More Often:** Most leases last 2–4 years, so you can upgrade to a new model every few years with the latest tech, safety features, and styling.

**Lower Repair Costs:** Leased cars are typically under warranty for the entire lease term, so major repairs are covered. Some leases even include maintenance packages.

**No Selling Hassle:** When the lease ends, you just return the car. No need to worry about trade-in value, private sales, or depreciation.

**Tax Benefits for Businesses:** If you use the car for work, you may be able to deduct a portion of your lease payments (consult a tax professional).

Disadvantages of Leasing

**No Ownership:** You don’t build equity. At the end of the lease, you have nothing to show for your payments except a few years of driving.

**Mileage Restrictions:** Most leases limit you to 10,000–15,000 miles per year. Going over can cost $0.10–$0.25 per mile.

**Wear and Tear Fees:** You’re responsible for excessive damage. Small scratches are usually fine, but dents, stains, or modifications can lead to charges.

**Early Termination Fees:** Ending a lease early is expensive. You’ll likely have to pay the remaining payments or a hefty penalty.

**Customization Limits:** You can’t modify a leased car (like adding a spoiler or tinting windows) without risking end-of-lease fees.

**Long-Term Cost:** If you lease continuously, you’ll always have a car payment. Buying and keeping a car for 8–10 years is usually cheaper in the long run.

Understanding Lease Fees and Costs

Visual guide about How Does Leasing a Car Work

Image source: dcdws.blob.core.windows.net

Leasing isn’t just about monthly payments. There are several fees and costs to be aware of before you sign on the dotted line.

Upfront Costs

When you start a lease, you’ll usually pay:

– **Acquisition Fee:** $500–$1,000, charged by the leasing company to set up the lease.

– **Down Payment (Cap Cost Reduction):** Optional, but reduces your monthly payment. Not recommended—it’s better to keep cash on hand.

– **First Month’s Payment:** Due at signing.

– **Security Deposit:** Sometimes required, especially if you have poor credit (often refundable).

– **Taxes and Registration:** Varies by state.

Some dealers offer “sign-and-drive” leases with $0 down, but these often come with higher monthly payments.

Monthly Costs

Your monthly payment covers:

– Depreciation

– Finance charges (money factor)

– Taxes (in most states)

These are calculated based on the capitalized cost, residual value, money factor, and lease term.

End-of-Lease Costs

When your lease ends, you may face:

– **Disposition Fee:** $300–$500 for processing the return.

– **Excess Mileage Fees:** $0.10–$0.25 per mile over your limit.

– **Wear and Tear Charges:** For damage beyond “normal use.”

– **Early Termination Fee:** If you end the lease early.

Optional Add-Ons

You can often add:

– **Maintenance Packages:** Cover oil changes, tire rotations, etc.

– **Gap Insurance:** Usually included, but double-check. Covers the difference if the car is totaled.

– **Excess Wear Protection:** Pays for minor damage at the end of the lease.

These can increase your monthly payment but may save money in the long run.

Tips for Getting the Best Lease Deal

Leasing doesn’t have to be confusing—or expensive. With the right strategy, you can get a great deal and avoid common pitfalls.

Negotiate the Capitalized Cost

Just like when buying, you should negotiate the price of the car. The lower the capitalized cost, the lower your monthly payment. Use tools like Kelley Blue Book or Edmunds to find the invoice price and aim to pay close to that.

Check the Residual Value

Cars with high residual values (60% or more after 3 years) cost less to lease. Luxury brands like Lexus and Mercedes often have strong residuals. Avoid cars that depreciate quickly.

Watch the Money Factor

The money factor is like an interest rate. Ask the dealer to convert it to an APR (multiply by 2,400). If it’s over 5%, shop around. Good credit usually gets you a lower rate.

Choose the Right Lease Term

Shorter leases (24–36 months) often have better deals because the car is newer and under warranty. But longer leases may have lower monthly payments. Match the term to your driving habits.

Avoid a Large Down Payment

Putting money down (called a “cap cost reduction”) lowers your payment but increases your risk. If the car is totaled early, you may not get that money back. It’s usually better to keep cash in the bank.

Read the Fine Print

Make sure you understand mileage limits, wear-and-tear policies, and end-of-lease options. Ask questions if anything is unclear.

Consider Lease-End Options

At the end of your lease, you can:

– Return the car and walk away (pay any fees)

– Buy the car at the residual value

– Lease a new car from the same dealer

Know your options ahead of time so you’re not rushed at the end.

What Happens at the End of a Lease?

The end of a lease can be exciting—or stressful—depending on how prepared you are. Here’s what typically happens:

About 90 days before your lease ends, the leasing company will send you a notice with your options. You’ll usually have three choices:

1. **Return the Car:** Schedule an inspection, clean it up, and return it. Pay any excess mileage or damage fees, plus the disposition fee.

2. **Buy the Car:** You can purchase the vehicle at its residual value (the pre-set price). This is a good option if the car is in great shape and the residual is lower than market value.

3. **Lease a New Car:** Many people use the end of one lease to start another. Dealers often offer incentives to keep you in their brand.

Before returning the car, get a pre-inspection. Most leasing companies offer this for free or a small fee. A third-party inspector will check for damage and estimate any charges. This helps you avoid surprises.

If you’re close to your mileage limit, consider buying extra miles upfront (cheaper than paying per mile later). Or, if you’re under, you might get a small credit—though this is rare.

Handling Excess Wear and Tear

“Normal wear and tear” is allowed, but what counts as “excessive” varies. Generally:

– Small scratches and dings are OK

– Large dents, paint damage, or interior stains may be charged

– Tires must have sufficient tread

– Modifications (like aftermarket wheels) must be removed

Take photos before returning the car to document its condition.

Is Leasing Right for You?

Leasing a car isn’t a one-size-fits-all solution. It works best for people who value lower payments, new technology, and hassle-free ownership. But if you drive a lot, love your cars, or want to build equity, buying might be better.

Ask yourself:

– Do I drive less than 15,000 miles per year?

– Do I like having a new car every few years?

– Can I afford the monthly payment and potential end-of-lease fees?

– Am I okay with not owning the car?

If you answered “yes” to most of these, leasing could be a smart choice. But if you’re unsure, talk to a financial advisor or compare total costs over 5–7 years (leasing vs. buying and keeping).

Remember: the goal is to make a decision that fits your lifestyle and budget—not just the lowest monthly payment.

Final Thoughts

Leasing a car can be a smart, cost-effective way to drive a new vehicle with lower payments and fewer repair worries. It’s not ownership, but it offers flexibility, predictability, and access to the latest models. By understanding how leasing works—depreciation, fees, mileage limits, and end-of-lease options—you can make an informed decision and avoid costly mistakes.

Whether you’re leasing your first car or switching from buying, take your time, read the contract carefully, and ask questions. With the right approach, leasing can be a great way to enjoy the ride—without the long-term commitment.

Frequently Asked Questions

Can I lease a used car?

Yes, some dealerships offer certified pre-owned (CPO) leases, but they’re less common than new car leases. These often come with shorter terms and higher interest rates.

What happens if I go over my mileage limit?

You’ll be charged per mile—usually $0.10 to $0.25—when you return the car. To avoid this, buy extra miles upfront or choose a higher mileage allowance.

Can I end my lease early?

Yes, but it’s usually expensive. You may have to pay the remaining payments or a termination fee. Some leases allow transfers to another person.

Do I need gap insurance when leasing?

Most leases include gap insurance automatically, but always confirm. It covers the difference if the car is totaled and the insurance payout is less than what you owe.

Can I negotiate a lease?

Absolutely. You can negotiate the capitalized cost, money factor, and even the residual value (in some cases). The more you know, the better deal you’ll get.

What if I want to buy the car at the end of the lease?

You can purchase it at the residual value listed in your contract. This price is set when you sign the lease, so it’s locked in—even if market values change.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.