Leasing a car means paying to use a vehicle for a set period—typically 2–4 years—without owning it. You make monthly payments based on the car’s expected depreciation, enjoy lower monthly costs than buying, and return it at the end of the lease term.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Does Leasing a Car Mean? A Complete Guide

- 4 How Car Leasing Works: The Basics

- 5 Leasing vs. Buying: What’s the Difference?

- 6 Pros and Cons of Leasing a Car

- 7 Who Should Consider Leasing a Car?

- 8 Tips for Getting the Best Car Lease Deal

- 9 What Happens at the End of a Lease?

- 10 Is Leasing a Car Right for You?

- 11 Frequently Asked Questions

Key Takeaways

- Leasing is like long-term renting: You pay to use the car, not own it, for a fixed time and mileage.

- Lower monthly payments: Lease payments are usually cheaper than loan payments because you’re only paying for the vehicle’s depreciation during the lease.

- Mileage and wear restrictions apply: Most leases limit how many miles you can drive and charge fees for excessive wear or damage.

- No equity buildup: Since you don’t own the car, you won’t build any value or trade-in equity like you would with a purchase.

- Early termination fees: Ending a lease early can be costly due to penalties and remaining payments.

- Ideal for tech-savvy drivers: Leasing lets you drive newer models with the latest safety and tech features every few years.

- Gap insurance is often included: Many leases include gap coverage, protecting you if the car is totaled or stolen.

📑 Table of Contents

What Does Leasing a Car Mean? A Complete Guide

So, you’re thinking about getting a new car—but instead of buying outright or financing with a loan, you’ve heard people talk about “leasing.” Maybe you’ve seen ads promising low monthly payments or the chance to drive a luxury vehicle for less. But what does leasing a car actually mean?

At its core, leasing a car is like renting a vehicle for an extended period—usually 24 to 48 months. Instead of purchasing the car and building ownership over time, you pay to use it during the lease term. Think of it as a long-term rental agreement with specific rules about mileage, maintenance, and condition. When the lease ends, you return the car to the dealership (or leasing company), and your contract is complete—unless you choose to buy it or lease a new one.

Leasing has become increasingly popular, especially among drivers who want to drive newer models with advanced technology, lower repair risks, and predictable monthly costs. But it’s not for everyone. While leasing offers financial flexibility and access to premium vehicles, it also comes with limitations like mileage caps and no ownership at the end. Understanding the full picture—how leasing works, what it costs, and whether it fits your lifestyle—is essential before signing on the dotted line.

How Car Leasing Works: The Basics

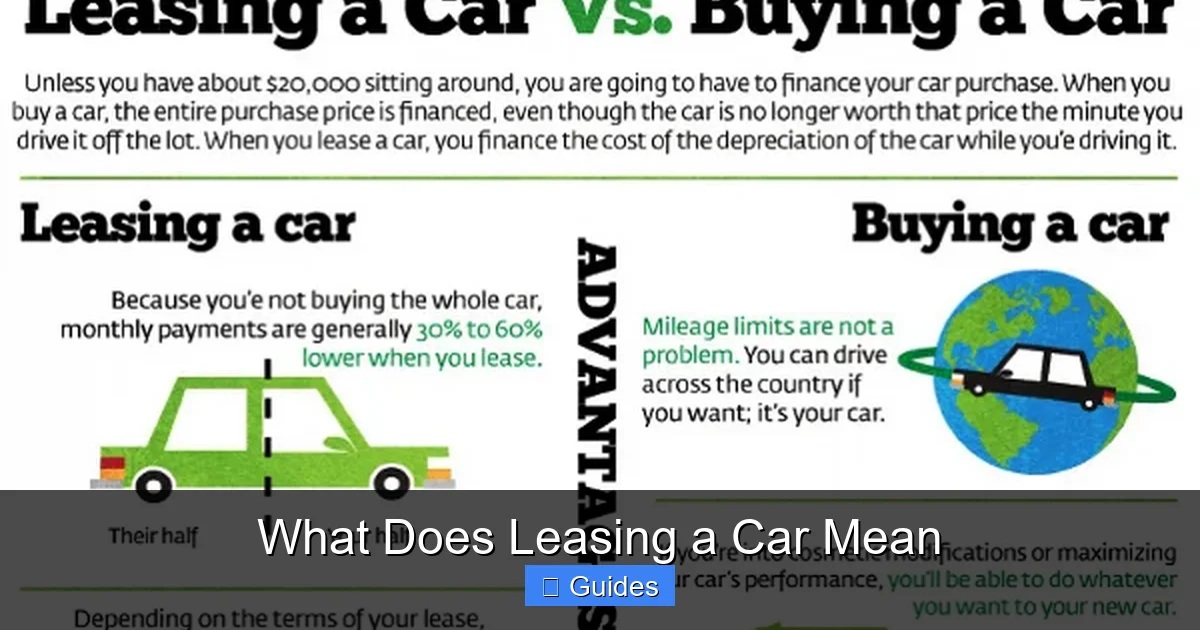

Visual guide about What Does Leasing a Car Mean

Image source: leasesacar.com

Let’s break it down in simple terms. When you lease a car, you’re essentially paying for its expected loss in value—called depreciation—over the lease period. You don’t pay the full price of the car. Instead, your monthly payments cover the difference between the car’s starting price (the capitalized cost) and its estimated value at the end of the lease (the residual value).

For example, imagine you lease a car that costs $40,000 new. The leasing company estimates that after three years, the car will be worth $24,000. That means it will depreciate by $16,000 over the lease term. Your monthly payments will be based on that $16,000, plus interest (called the money factor), taxes, and fees.

The Lease Agreement: What’s Included?

When you sign a lease, you’ll receive a detailed contract outlining all the terms. Here’s what you’ll typically find:

- Lease term: How long you’ll have the car (e.g., 36 months).

- Monthly payment: The amount you pay each month, including depreciation, interest, and taxes.

- Mileage limit: The maximum number of miles you can drive per year (usually 10,000 to 15,000). Going over incurs a per-mile fee.

- Capitalized cost: The negotiated price of the car (similar to the purchase price).

- Residual value: The car’s estimated worth at the end of the lease.

- Money factor: The interest rate expressed as a decimal (multiply by 2,400 to get an approximate APR).

- Acquisition fee: An upfront charge (often $500–$1,000) to start the lease.

- Disposition fee: A fee charged when you return the car (typically $300–$500).

Down Payment and Fees

Many leases require an initial payment, often called a “down payment” or “cap cost reduction.” This reduces your monthly payments but increases your upfront cost. For example, putting $3,000 down on a $400/month lease might lower it to $300/month. However, this money is not refundable—it’s applied directly to the lease balance.

Other common fees include:

- Security deposit: Sometimes required, refundable if no damage occurs.

- First month’s payment: Usually due at signing.

- Title and registration fees: Paid to your state.

- Documentation fee: Charged by the dealer for processing paperwork.

Leasing vs. Buying: What’s the Difference?

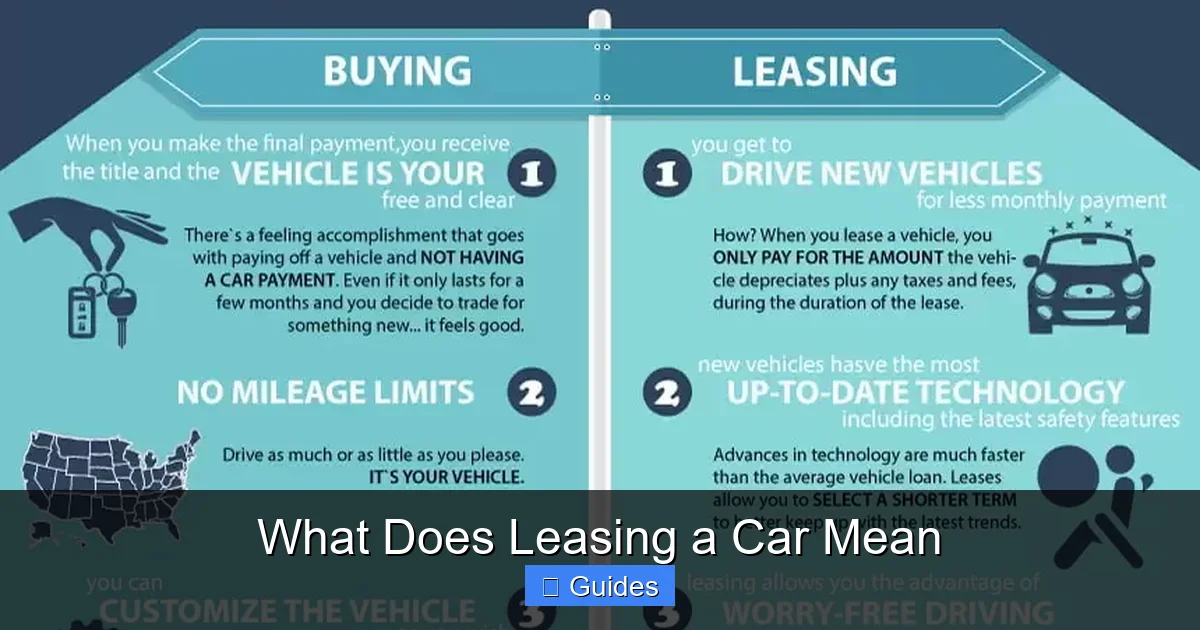

Visual guide about What Does Leasing a Car Mean

Image source: brandongaille.com

One of the biggest decisions car shoppers face is whether to lease or buy. Both have pros and cons, and the right choice depends on your financial goals, driving habits, and lifestyle.

Ownership and Equity

When you buy a car—either with cash or a loan—you own it once the loan is paid off. That means you can sell it, trade it in, or keep driving it for years. You build equity over time, and the car becomes an asset (even if it depreciates).

With leasing, you never own the car. You’re essentially paying for the right to use it. At the end of the lease, you return it (unless you choose to buy it). There’s no equity, no resale value, and no long-term ownership benefit.

Monthly Payments and Upfront Costs

Leasing typically offers lower monthly payments than buying. Why? Because you’re only paying for depreciation, not the full value of the car. For example, a $50,000 luxury SUV might cost $600/month to finance over 60 months, but only $450/month to lease for 36 months.

However, leasing often requires more upfront costs. While some “sign-and-drive” deals require little to no down payment, many leases ask for several thousand dollars at signing to reduce monthly payments.

Maintenance and Warranty Coverage

Most leased cars are under the manufacturer’s warranty for the entire lease term. That means repairs due to defects or normal wear are usually covered. Some leases even include maintenance packages, covering oil changes, tire rotations, and brake inspections.

When you buy a car, you’re responsible for all maintenance once the warranty expires. While you can budget for this, unexpected repairs can add up—especially with older vehicles.

Flexibility and Long-Term Costs

Leasing offers flexibility. At the end of the lease, you can return the car and walk away, lease a new model, or buy the car at its residual value. This is ideal for people who like driving new cars every few years.

But over the long term, leasing can be more expensive. If you lease continuously, you’ll always have a car payment—unlike owning a paid-off vehicle. Buying a car and keeping it for 10+ years often costs less in the long run.

Pros and Cons of Leasing a Car

Visual guide about What Does Leasing a Car Mean

Image source: eautolease.com

Like any financial decision, leasing has advantages and disadvantages. Let’s look at both sides to help you decide if it’s right for you.

Advantages of Leasing

- Lower monthly payments: Since you’re only paying for depreciation, lease payments are often 20–30% lower than loan payments for the same car.

- Drive a newer car more often: Most leases last 2–4 years, so you can upgrade to the latest models with updated safety features, infotainment systems, and fuel efficiency.

- Lower repair costs: Leased vehicles are typically under warranty, so major repairs are covered. Some leases include maintenance plans.

- No trade-in hassle: At the end of the lease, you simply return the car—no need to sell or trade it in.

- Tax benefits for business use: If you use the car for work, you may be able to deduct a portion of lease payments as a business expense (consult a tax professional).

- Gap insurance included: Most leases include gap coverage, which pays the difference between what you owe and the car’s value if it’s totaled.

Disadvantages of Leasing

- No ownership: You don’t build equity, and you’ll always have a car payment if you keep leasing.

- Mileage restrictions: Exceeding the annual mileage limit (e.g., 12,000 miles) results in fees—often $0.10 to $0.25 per mile.

- Wear and tear fees: You’re charged for excessive damage, such as large dents, stains, or tire wear beyond normal use.

- Early termination penalties: Ending a lease early can cost thousands in fees and remaining payments.

- Customization limits: Most leases prohibit modifications like aftermarket parts, paint jobs, or performance upgrades.

- Higher long-term cost: If you lease continuously, you’ll pay more over time than if you bought and kept a car.

Who Should Consider Leasing a Car?

Leasing isn’t for everyone—but it can be a smart choice for certain drivers. Here’s who benefits most from leasing:

Tech Enthusiasts and Early Adopters

If you love having the latest gadgets, safety features, and infotainment systems, leasing lets you upgrade every few years. You’ll always be driving a car with modern tech, from adaptive cruise control to wireless Apple CarPlay.

Low-Mileage Drivers

People who drive fewer than 10,000–12,000 miles per year are ideal candidates for leasing. Since mileage limits are a big factor, low-mileage drivers are less likely to incur overage fees.

Business Professionals

Executives and salespeople who need a reliable, professional-looking vehicle for work may benefit from leasing. The lower monthly payments and tax deductions (if applicable) can make it a cost-effective option.

Those Who Hate Car Maintenance

If you dread oil changes, brake jobs, or unexpected repairs, leasing can reduce stress. Most leased cars are under warranty, and some include maintenance packages.

People Who Want Predictable Costs

Leasing offers fixed monthly payments and known end-of-lease costs. There are no surprises like major repairs or depreciation drops—making budgeting easier.

Tips for Getting the Best Car Lease Deal

If you decide leasing is right for you, here’s how to get the best possible deal:

Negotiate the Capitalized Cost

Just like when buying, you can negotiate the price of the car. A lower capitalized cost means lower monthly payments. Research the car’s invoice price and aim to lease it at or below that number.

Check the Residual Value

The residual value is the car’s estimated worth at the end of the lease. A higher residual means lower depreciation and lower payments. Luxury brands and popular models often have strong residuals.

Compare Money Factors

The money factor is the lease equivalent of an interest rate. Ask for it in writing and convert it to an APR by multiplying by 2,400. Shop around for the best rate—your credit score plays a big role.

Watch Out for Excess Fees

Some dealers add unnecessary fees like “advertising fees” or “dealer prep.” Ask for a breakdown and question anything that seems inflated.

Consider a Shorter Lease Term

A 24-month lease may have slightly higher monthly payments than a 36-month lease, but it gives you more flexibility and reduces the risk of excessive wear or mileage overage.

Read the Fine Print

Understand all terms, including mileage limits, wear guidelines, and end-of-lease options. Don’t sign until you’re confident you understand everything.

What Happens at the End of a Lease?

When your lease term ends, you have three main options:

Return the Car

This is the most common choice. You return the vehicle to the dealership, pay any applicable fees (for excess mileage or damage), and walk away. You can then lease a new car or explore other options.

Buy the Car

You have the right to purchase the car at its residual value—the price set at the beginning of the lease. This can be a good deal if the car has held its value well or if you’ve grown attached to it.

Lease a New Car

Many lessees choose to lease a new vehicle from the same brand. Dealers often offer incentives like waived fees or loyalty discounts to keep you in their lineup.

Before returning the car, schedule a pre-inspection. The leasing company will assess the vehicle for wear and tear. Knowing what to expect helps you avoid surprises.

Is Leasing a Car Right for You?

Deciding whether to lease comes down to your priorities. Ask yourself:

- Do I drive less than 12,000 miles per year?

- Do I want lower monthly payments?

- Do I prefer driving a new car every few years?

- Am I okay with not owning the vehicle?

- Can I avoid excessive wear and mileage overages?

If you answered “yes” to most of these, leasing might be a great fit. But if you drive a lot, want to build equity, or plan to keep a car for many years, buying could be the better choice.

Leasing a car means trading ownership for flexibility, lower payments, and access to newer models. It’s not a one-size-fits-all solution—but for the right person, it’s a smart, convenient way to drive.

Frequently Asked Questions

Can you lease a used car?

Yes, some dealerships and leasing companies offer certified pre-owned vehicles for lease. These are typically late-model cars with low mileage and full warranty coverage, offering a middle ground between new and used.

What happens if you go over the mileage limit?

If you exceed your annual mileage limit, you’ll be charged a per-mile fee—usually between $0.10 and $0.25. For example, driving 2,000 extra miles on a 12,000-mile lease could cost $200–$500 at the end of the term.

Can you terminate a car lease early?

Yes, but it’s usually expensive. Early termination fees can include remaining payments, a penalty, and administrative costs. Some leases allow transfer to another person, which can reduce costs.

Do you need full coverage insurance when leasing?

Yes, leasing companies require comprehensive and collision coverage with low deductibles. This protects their asset in case of damage or theft. Gap insurance is often included but confirm with your lease agreement.

Can you negotiate a car lease?

Absolutely. You can negotiate the capitalized cost, money factor, and fees—just like when buying. Research the car’s value, compare offers, and don’t be afraid to walk away if the terms aren’t right.

Is leasing cheaper than buying in the long run?

Not usually. While monthly payments are lower, leasing continuously means you’ll always have a car payment. Buying and keeping a car for 8–10 years often costs less over time, especially if you avoid major repairs.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.