Leasing a car offers lower monthly payments and access to the latest models, but comes with mileage limits and no ownership equity. Understanding the pros and cons with leasing a car helps you decide if it fits your lifestyle and budget.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: Is Leasing a Car Right for You?

- 4 How Car Leasing Works: The Basics

- 5 Pros of Leasing a Car

- 6 Cons of Leasing a Car

- 7 Leasing vs. Buying: Which Is Better?

- 8 Tips for Getting the Best Lease Deal

- 9 Common Misconceptions About Leasing

- 10 Conclusion: Make the Right Choice for Your Lifestyle

- 11 Frequently Asked Questions

Key Takeaways

- Lower Monthly Payments: Leasing typically costs less per month than buying, freeing up cash for other expenses.

- Drive Newer Cars More Often: Lease terms usually last 2–4 years, letting you upgrade to a new vehicle frequently.

- Warranty Coverage Included: Most leases fall within the manufacturer’s warranty, reducing repair costs.

- Mileage and Wear Restrictions: Exceeding mileage limits or causing excessive wear can lead to hefty fees.

- No Ownership Equity: You don’t build equity like you would with a car loan, and you return the car at the end.

- Early Termination Fees: Ending a lease early can be expensive due to penalties and remaining payments.

- Customization Limits: Most leases prohibit modifications, so personalizing your ride may not be allowed.

📑 Table of Contents

Introduction: Is Leasing a Car Right for You?

So, you’re in the market for a new car. Maybe your old sedan is on its last legs, or you’re ready to upgrade to something sleeker, safer, or more fuel-efficient. As you start researching your options, you’ll quickly come across two main paths: buying or leasing. While buying gives you ownership and long-term value, leasing has become an increasingly popular alternative—especially for people who want lower monthly payments and the chance to drive a new vehicle every few years.

But before you sign on the dotted line, it’s important to understand the full picture. Leasing isn’t inherently good or bad—it’s a financial tool that works well for some and not so well for others. The key is knowing the pros and cons with leasing a car so you can make a smart, informed decision. In this guide, we’ll walk you through everything you need to know: from how leasing works to the hidden costs, benefits, and common pitfalls. By the end, you’ll have a clear idea of whether leasing fits your lifestyle, driving habits, and financial goals.

How Car Leasing Works: The Basics

Before diving into the advantages and disadvantages, let’s start with the fundamentals. Leasing a car is essentially renting it for a fixed period—typically 24 to 36 months, though 48-month leases are also common. Instead of paying off the entire value of the vehicle like you would with a loan, you’re only paying for the car’s depreciation during the lease term, plus interest and fees.

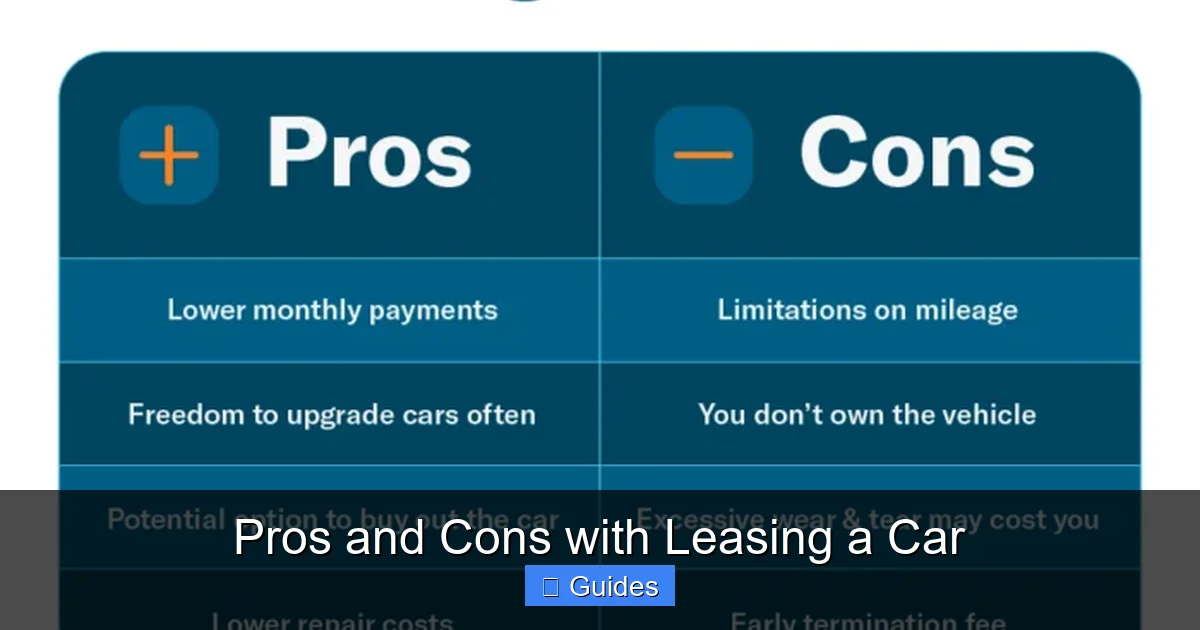

Visual guide about Pros and Cons with Leasing a Car

Image source: myayan.com

Understanding Depreciation and Residual Value

When you lease, the leasing company estimates how much the car will lose in value over the lease period. This is called the depreciation. For example, if a $30,000 car is expected to be worth $18,000 after three years, you’ll pay for that $12,000 drop in value, plus finance charges. The estimated value at the end of the lease is known as the residual value. The higher the residual value, the lower your monthly payments—because the car holds its value well.

Key Lease Terms You Should Know

- Capitalized Cost: This is the negotiated price of the car, similar to the purchase price when buying. A lower cap cost means lower payments.

- Money Factor: This is the lease’s interest rate, expressed as a decimal (e.g., 0.0025). Multiply it by 2,400 to get an approximate APR.

- Lease Term: The length of the lease, usually 2–4 years.

- Mileage Allowance: Most leases include an annual mileage limit (e.g., 10,000, 12,000, or 15,000 miles). Going over incurs fees, often $0.10–$0.25 per mile.

- Disposition Fee: A charge (typically $300–$500) for processing the return of the car at the end of the lease.

Example: A Real-World Lease Scenario

Let’s say you lease a 2024 Honda Accord for $32,000 with a 36-month term and a residual value of $19,200 (60% of the original price). Your monthly payment might be around $350, including taxes and fees. At the end of three years, you return the car—no equity built, but you’ve driven a nearly new vehicle with minimal upfront cost.

Pros of Leasing a Car

Now that you understand how leasing works, let’s explore the benefits. For many drivers, leasing offers a compelling mix of affordability, convenience, and flexibility. Here are the top advantages of choosing a lease over a purchase.

Visual guide about Pros and Cons with Leasing a Car

Image source: thebalance.com

1. Lower Monthly Payments

One of the biggest draws of leasing is the lower monthly cost. Since you’re only paying for the car’s depreciation—not its full value—your payments are typically 20% to 60% lower than a loan payment for the same vehicle. For example, a $500 monthly car loan might drop to $250–$350 with a lease. This frees up cash for savings, investments, or other expenses like travel or home improvements.

2. Drive a New Car Every Few Years

Love having the latest tech, safety features, and styling? Leasing lets you upgrade to a new model every 2–4 years. You’ll always be driving something modern, with up-to-date infotainment systems, advanced driver-assistance features (like lane-keeping assist and automatic emergency braking), and improved fuel efficiency. This is especially appealing if you enjoy variety or work in a field where image matters.

3. Lower Upfront Costs

Leases often require little to no down payment. Many dealers offer “sign-and-drive” deals where you pay only the first month’s payment, registration, and fees—sometimes as little as $500 total. This is a huge advantage if you’re short on cash or prefer to keep your savings intact. Compare that to buying, where a 10–20% down payment on a $30,000 car could be $3,000–$6,000.

4. Warranty Coverage for Most of the Lease

New cars come with comprehensive warranties—usually 3 years/36,000 miles for basic coverage and 5 years/60,000 miles for powertrain. Since most leases are 36 months or less, you’ll likely be covered for repairs due to defects or normal wear. This means fewer unexpected expenses and peace of mind. You won’t have to worry about costly transmission failures or engine issues during your lease.

5. No Hassle Selling or Trading In

When you buy a car, eventually you’ll need to sell it or trade it in—a process that can be time-consuming and stressful. With leasing, you simply return the car at the end of the term (assuming it’s in good condition and within mileage limits). No need to list it online, meet with buyers, or negotiate trade-in values. It’s a clean, straightforward exit.

6. Potential Tax Benefits for Business Use

If you use your leased car for business, you may be able to deduct a portion of the lease payments as a business expense. The IRS allows deductions based on the percentage of business use. For example, if you drive 60% for work, you can deduct 60% of the lease payments. This can significantly reduce your taxable income. (Always consult a tax professional for guidance.)

Cons of Leasing a Car

While leasing has clear benefits, it’s not without drawbacks. For some drivers, the limitations and long-term costs outweigh the perks. Here are the most significant downsides to consider.

Visual guide about Pros and Cons with Leasing a Car

Image source: endurancewarranty.com

1. No Ownership Equity

This is the biggest trade-off. When you lease, you’re essentially paying to use the car—not to own it. Once the lease ends, you have nothing to show for your payments. Unlike buying, where you build equity and can sell the car later, leasing offers no long-term asset. If you drive a lot and plan to keep a car for 8–10 years, buying usually makes more financial sense.

2. Mileage Restrictions and Overages

Leases come with strict mileage limits—typically 10,000 to 15,000 miles per year. If you exceed this, you’ll pay a per-mile fee, often $0.15 to $0.25. For example, driving 18,000 miles in a year on a 12,000-mile lease could cost you $900 in overage fees. If you have a long commute or enjoy road trips, this can add up quickly. Some leases offer higher mileage limits, but they come with higher monthly payments.

3. Wear and Tear Charges

At the end of the lease, the dealer will inspect the car for excessive wear and tear. Minor scratches or dings are usually acceptable, but things like large dents, torn upholstery, or damaged wheels may result in charges. These fees can range from $100 to over $1,000, depending on the damage. While you can minimize this by taking good care of the car, it’s still a risk.

4. Early Termination Fees

Need to get out of your lease early? It’s possible, but expensive. Most leases charge an early termination fee that covers the remaining payments plus administrative costs. For example, ending a 36-month lease after 18 months could cost $5,000 or more. Some leases allow you to transfer the lease to another person (lease assumption), but this depends on the lender and credit approval.

5. Customization Is Limited

Want to tint your windows, install a spoiler, or upgrade the sound system? Think twice. Most lease agreements prohibit modifications that alter the car’s appearance or performance. Even something as simple as aftermarket wheels could violate the terms. If you love personalizing your ride, leasing may feel restrictive.

6. You’re Always Making Car Payments

With leasing, you never truly “own” a car. Once one lease ends, you either lease another or buy a new vehicle—meaning you’re always paying for transportation. In contrast, buyers who pay off their loans can drive payment-free for years. Over a decade, this can mean tens of thousands in savings.

Leasing vs. Buying: Which Is Better?

So, how do you decide between leasing and buying? There’s no one-size-fits-all answer—it depends on your priorities. Let’s compare the two options side by side.

When Leasing Makes Sense

Leasing is ideal if you:

- Want lower monthly payments and minimal upfront costs.

- Enjoy driving a new car every few years with the latest features.

- Don’t drive more than 12,000–15,000 miles per year.

- Prefer not to deal with long-term maintenance or resale.

- Use the car for business and can deduct lease payments.

For example, a young professional who commutes 30 miles a day and values having a reliable, stylish car with modern tech might find leasing perfect.

When Buying Is the Better Choice

Buying (with a loan or cash) is better if you:

- Plan to keep the car for 6+ years.

- Drive more than 15,000 miles annually.

- Want to build equity and avoid perpetual payments.

- Like to customize or modify your vehicle.

- Prefer the freedom of no mileage or wear restrictions.

A family with a long commute or someone who enjoys weekend road trips might save more by buying and keeping a car long-term.

Hybrid Option: Lease with a Purchase Option

Some leases include a purchase option at the end, allowing you to buy the car at its residual value. This gives you flexibility—you can return it or keep it. If the car’s market value is higher than the residual, you could even sell it for a profit. However, this is rare and depends on market conditions.

Tips for Getting the Best Lease Deal

If you decide leasing is right for you, don’t just sign the first offer. With a little strategy, you can save hundreds or even thousands. Here’s how to get the best deal.

1. Negotiate the Capitalized Cost

Just like when buying, the cap cost is negotiable. Research the invoice price (what the dealer paid) and aim to lease at or below that. Use tools like Edmunds, Kelley Blue Book, or TrueCar to find fair market values. A lower cap cost directly reduces your monthly payment.

2. Choose a Higher Residual Value

Cars with high residual values (like Toyota, Honda, and Subaru) depreciate slower, leading to lower lease payments. Avoid brands with steep depreciation (e.g., luxury cars like BMW or Mercedes) unless you’re getting a great incentive.

3. Watch the Money Factor

The money factor is the lease’s interest rate. Ask the dealer to convert it to an APR for easier comparison. A money factor of 0.0025 equals a 6% APR. Shop around for the best rate—sometimes credit unions offer better terms than manufacturers.

4. Consider a Shorter Lease Term

Shorter leases (24 or 30 months) often have lower total costs and less risk of wear-and-tear charges. They also let you upgrade sooner. Just make sure the monthly payment fits your budget.

5. Avoid Excessive Fees

Watch out for unnecessary add-ons like “gap insurance” (often included free), “wear-and-tear protection,” or “maintenance packages.” These can inflate your cost. Only pay for what you truly need.

6. Time Your Lease Right

Dealers often offer the best lease deals at the end of the model year (August–October) or during holiday sales events. Manufacturers want to clear out inventory, so incentives are higher.

Common Misconceptions About Leasing

Despite its popularity, leasing is often misunderstood. Let’s clear up some common myths.

Myth 1: “Leasing Is Just Renting”

While leasing is similar to renting, it’s more structured. You sign a contract, pay for depreciation, and have specific terms. It’s not a month-to-month rental—it’s a long-term financial agreement with legal obligations.

Myth 2: “You Can’t Lease a Used Car”

Actually, many dealers offer certified pre-owned (CPO) leases. These come with warranties and lower prices, making them a smart option for budget-conscious drivers.

Myth 3: “Leasing Is Always More Expensive Long-Term”

Not necessarily. If you’d otherwise buy a new car every three years and sell it, leasing might cost about the same—especially when you factor in depreciation, interest, and resale hassle. It depends on your usage and market conditions.

Myth 4: “You Can’t Get Out of a Lease Early”

You can, but it costs money. However, lease transfer programs (like LeaseTrader or Swapalease) let you find someone to take over your payments, potentially avoiding early termination fees.

Conclusion: Make the Right Choice for Your Lifestyle

Leasing a car isn’t inherently better or worse than buying—it’s about what fits your life. The pros and cons with leasing a car come down to your driving habits, financial goals, and personal preferences. If you value lower payments, new technology, and hassle-free returns, leasing could be a great fit. But if you drive a lot, want to own your vehicle, or prefer long-term savings, buying might be the smarter move.

Take time to evaluate your needs. Run the numbers. Talk to dealers and lenders. And remember: the best decision is an informed one. Whether you lease or buy, the goal is the same—getting reliable, affordable transportation that makes your life easier.

Frequently Asked Questions

Can I negotiate a car lease?

Yes, you can negotiate key terms like the capitalized cost, money factor, and lease incentives. Just like buying, the sticker price isn’t set in stone. Research and compare offers to get the best deal.

What happens at the end of a car lease?

At the end of the lease, you return the car to the dealer. They’ll inspect it for excess wear and mileage. If everything’s in order, you pay any remaining fees and walk away—or you can lease or buy a new vehicle.

Can I buy my leased car at the end of the lease?

Yes, most leases include a purchase option. You can buy the car at its predetermined residual value. This is a good idea if the car is in great condition and the price is below market value.

Is it better to lease or buy a car?

It depends on your needs. Leasing offers lower payments and newer cars but no ownership. Buying builds equity and avoids mileage limits but costs more upfront. Consider your driving habits and financial goals.

Do I need gap insurance when leasing?

Most leases include gap coverage automatically, so you usually don’t need to buy it separately. Check your lease agreement to confirm.

Can I lease a car with bad credit?

It’s possible, but you’ll likely face higher money factors (interest rates) and may need a co-signer or larger down payment. Work on improving your credit before applying for the best terms.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.