Leasing a car for the first time can feel overwhelming, but it doesn’t have to be. This guide breaks down everything you need to know—from understanding lease terms to negotiating your deal—so you can drive off in a new car with confidence and clarity.

So, you’re thinking about leasing a car for the first time. Maybe you’ve been driving an old clunker for years, or you’re finally ready to upgrade to something newer, sleeker, and more reliable. You’ve heard leasing can be cheaper than buying, and you like the idea of driving a new car every few years. But where do you even start?

Leasing a car isn’t as complicated as it sounds—especially if you go in prepared. Unlike buying, where you pay off the entire value of the vehicle over time, leasing is more like renting a car for a set period, usually two to four years. You only pay for the portion of the car’s value that it loses while you’re driving it (that’s called depreciation), plus interest and fees. At the end of the lease, you return the car—no long-term commitment, no hassle of selling it yourself.

But here’s the catch: leasing isn’t for everyone. It works best if you want lower monthly payments, enjoy driving new models, and don’t put a ton of miles on your car. If you’re someone who loves customizing your ride or plans to keep a car for a decade, buying might be a better fit. But if you’re looking for a smart, flexible way to drive a new car without the long-term financial burden, leasing could be your golden ticket.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Understanding How Car Leasing Works

- 4 Preparing to Lease: What You Need to Know Before You Start

- 5 Key Lease Terms You Must Understand

- 6 Negotiating Your Lease Deal

- 7 Signing the Lease and Driving Off

- 8 What to Do at the End of Your Lease

- 9 Common Mistakes First-Time Leasers Make

- 10 Final Thoughts: Is Leasing Right for You?

- 11 Frequently Asked Questions

Key Takeaways

- Know the basics of leasing: A car lease is like a long-term rental where you pay for the vehicle’s depreciation during the lease term, not the full value.

- Check your credit score early: A higher credit score can help you qualify for lower monthly payments and better lease terms.

- Understand key lease terms: Familiarize yourself with terms like capitalized cost, residual value, money factor, and mileage limits.

- Compare leasing vs. buying: Leasing often means lower monthly payments and access to newer cars, but you don’t own the vehicle at the end.

- Negotiate the capitalized cost: Just like buying, you can and should negotiate the price of the car to lower your monthly lease payment.

- Watch out for fees and penalties: Be aware of acquisition fees, disposition fees, and charges for excess wear or mileage.

- Read the fine print: Always review the lease agreement carefully before signing to avoid surprises later.

📑 Table of Contents

- Understanding How Car Leasing Works

- Preparing to Lease: What You Need to Know Before You Start

- Key Lease Terms You Must Understand

- Negotiating Your Lease Deal

- Signing the Lease and Driving Off

- What to Do at the End of Your Lease

- Common Mistakes First-Time Leasers Make

- Final Thoughts: Is Leasing Right for You?

Understanding How Car Leasing Works

Before you sign on the dotted line, it’s important to understand exactly what a car lease is—and how it differs from buying.

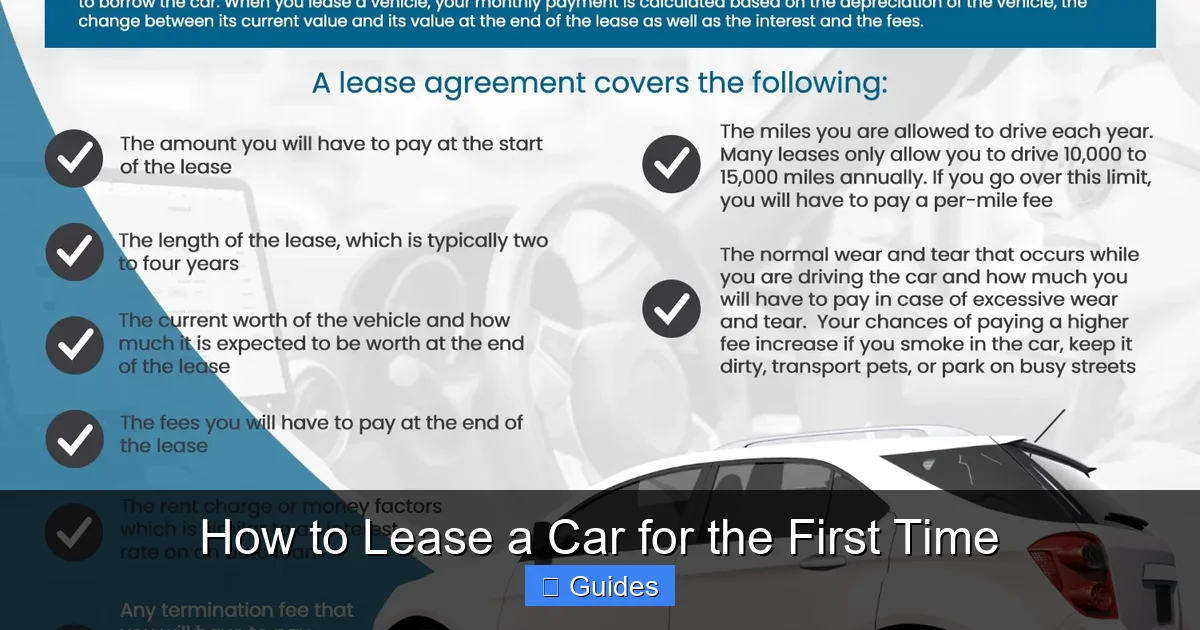

When you lease a car, you’re essentially paying to use it for a fixed period, typically 24, 36, or 48 months. You don’t own the car. Instead, you make monthly payments that cover the vehicle’s depreciation during your lease term, plus interest (called the “money factor”) and any fees. At the end of the lease, you return the car to the dealership, though some leases offer the option to buy the vehicle at its residual value.

Let’s break that down with an example. Say you lease a car worth $30,000 with a 36-month term and a residual value of 60%. That means the car is expected to be worth $18,000 after three years. You’re responsible for paying the difference—$12,000—plus interest and fees, spread over 36 months. That comes out to roughly $333 per month before taxes and fees, though your actual payment will depend on several factors (more on that later).

One of the biggest advantages of leasing is lower monthly payments compared to buying. Since you’re not paying off the entire value of the car, your payments are typically 20–30% lower than a loan payment for the same vehicle. You also get to drive a newer car with the latest safety features, tech, and warranty coverage. And because most leases fall within the manufacturer’s warranty period, you’re usually covered for major repairs.

But leasing isn’t all sunshine and rainbows. You’re limited in how many miles you can drive (usually 10,000 to 15,000 per year), and you’ll be charged extra if you go over. You also can’t modify the car—no custom paint jobs or aftermarket parts unless you remove them before returning it. And at the end of the lease, you don’t own anything. No equity, no asset, just a handshake and a handshake.

Leasing vs. Buying: Which Is Right for You?

This is the million-dollar question—or at least the $30,000 one. Should you lease or buy?

Let’s look at the pros and cons.

Leasing Pros:

- Lower monthly payments

- Drive a new car every few years

- Lower repair costs (covered under warranty)

- No need to sell or trade in the car later

- Potential tax benefits for business use

Leasing Cons:

- No ownership at the end

- Mileage restrictions

- Fees for excess wear and tear

- Long-term cost can be higher than buying

- Early termination fees

Buying Pros:

- Own the car outright after the loan is paid

- No mileage limits

- Freedom to modify or customize

- Can sell or trade in whenever you want

- Lower long-term cost if you keep the car long enough

Buying Cons:

- Higher monthly payments

- Depreciation hits hardest in the first few years

- Responsible for maintenance and repairs after warranty

- More hassle when it’s time to upgrade

So, which path should you take? If you value flexibility, lower payments, and driving the latest models, leasing might be perfect. But if you drive a lot, want to build equity, or plan to keep your car for many years, buying is probably the smarter move.

Preparing to Lease: What You Need to Know Before You Start

Visual guide about How to Lease a Car for the First Time

Image source: images.template.net

Now that you understand the basics, it’s time to get ready. Leasing a car isn’t something you should rush into. A little prep work can save you hundreds—or even thousands—of dollars.

Check Your Credit Score

Your credit score plays a huge role in your lease terms. The higher your score, the lower your interest rate (money factor), which means lower monthly payments.

Most leasing companies prefer a credit score of 660 or higher. If your score is in the 700s or 800s, you’ll qualify for the best deals—sometimes even $0 down offers. But if your score is below 600, you may still be able to lease, but expect higher payments and stricter terms.

Before you start shopping, pull your free credit report from AnnualCreditReport.com. Check for errors and dispute any inaccuracies. If your score is low, consider taking a few months to improve it—pay down credit card balances, make on-time payments, and avoid new credit applications.

Determine Your Budget

Just because you can lease a $500-a-month car doesn’t mean you should. Experts recommend that your total car expenses—lease payment, insurance, gas, and maintenance—shouldn’t exceed 15–20% of your take-home pay.

Use a lease calculator (many are free online) to estimate your monthly payment based on the car’s price, down payment, lease term, and interest rate. Don’t forget to factor in taxes and fees, which can add 10–15% to your payment.

Also, decide how much you’re willing to put down. A larger down payment (called a “cap cost reduction”) lowers your monthly payment, but it’s risky—if the car is totaled or stolen, you may not get that money back unless you have gap insurance.

Research Vehicles and Lease Deals

Not all cars are created equal when it comes to leasing. Some hold their value better than others, which means lower depreciation and lower lease payments.

Luxury brands like BMW, Mercedes, and Lexus often have strong residual values, making them cheaper to lease. Mainstream brands like Toyota and Honda also tend to lease well due to their reliability and popularity.

Check websites like Edmunds, Kelley Blue Book, and TrueCar for current lease deals and incentives. Manufacturers often run special promotions—like low money factors or waived acquisition fees—to move inventory. Timing matters: end-of-month, end-of-quarter, and end-of-year are prime times to find deals.

Also, consider certified pre-owned (CPO) vehicles. Some dealerships offer lease programs on CPO cars, which can give you a nearly new vehicle at a lower price.

Key Lease Terms You Must Understand

Visual guide about How to Lease a Car for the First Time

Image source: assets.website-files.com

Leasing comes with its own language. If you don’t understand the terms, you could end up overpaying or getting hit with surprise fees. Here are the most important ones to know.

Capitalized Cost

This is the price of the car you’re leasing—essentially the negotiated selling price. The lower the cap cost, the lower your monthly payment. Just like when buying, you can and should negotiate this number. Don’t accept the sticker price. Use pricing guides and online tools to find a fair market value.

Residual Value

This is the estimated value of the car at the end of the lease. It’s expressed as a percentage of the car’s original MSRP. For example, a $30,000 car with a 60% residual value will be worth $18,000 after the lease.

The higher the residual value, the lower your monthly payment—because you’re paying for less depreciation. Residual values are set by the leasing company and depend on the car’s make, model, and lease term.

Money Factor

This is the lease equivalent of an interest rate. It’s a small decimal (like 0.00250) that determines how much interest you’ll pay each month. To convert it to an approximate APR, multiply by 2,400. So 0.00250 × 2,400 = 6% APR.

A lower money factor means lower payments. Your credit score heavily influences this number.

Lease Term

This is how long you’ll lease the car—usually 24, 36, or 48 months. Shorter terms mean higher monthly payments but less interest paid overall. Longer terms have lower payments but cost more in the long run.

Choose a term that fits your lifestyle. If you like driving new cars often, a 24- or 36-month lease makes sense. If you want lower payments and don’t mind keeping the same car a bit longer, go for 48 months.

Mileage Limit

Most leases come with an annual mileage limit—typically 10,000, 12,000, or 15,000 miles. If you go over, you’ll be charged per mile (usually $0.10 to $0.25).

If you know you’ll drive more than the standard limit, ask about a higher mileage allowance. It will cost more upfront, but it’s cheaper than paying overage fees later.

Acquisition Fee

Also called the “bank fee,” this is a one-time charge (usually $500–$1,000) to set up your lease. It covers administrative costs. Some dealers may roll it into your monthly payment or waive it during promotions.

Disposition Fee

This fee (typically $300–$500) is charged when you return the car at the end of the lease. It covers the cost of reconditioning and resale. You can avoid it by buying the car or leasing another vehicle from the same dealer.

Wear and Tear

Leasing companies expect normal wear and tear—minor scratches, dings, and upholstery wear. But excessive damage (like large dents, torn seats, or broken glass) can result in charges.

Take photos of the car before you drive it off the lot. Keep records of any damage. And consider a lease-end protection plan to cover minor repairs.

Negotiating Your Lease Deal

Visual guide about How to Lease a Car for the First Time

Image source: eautolease.com

Many people think lease terms are set in stone. But just like buying, you can negotiate—especially the capitalized cost and money factor.

Negotiate the Price, Not the Payment

Dealers love to focus on monthly payments because it hides the real cost. Instead, negotiate the capitalized cost first. Use online pricing tools to find a fair price, then work from there.

For example, if a car’s MSRP is $30,000 and the invoice price is $28,000, aim to lease it for $27,500 or less. Every dollar you save on the cap cost reduces your monthly payment.

Ask for a Lower Money Factor

If your credit is good, ask the dealer to match the lowest money factor offered by the manufacturer. Some dealers mark up the rate to make extra profit—don’t let them.

You can also lower your money factor by making a larger down payment or rolling in negative equity from a trade-in (though this increases your overall cost).

Watch Out for Add-Ons

Dealers may try to sell you extras like extended warranties, paint protection, or tire insurance. These can add hundreds to your lease. Ask if they’re required—most aren’t. And remember, you’ll lose these benefits when you return the car.

Time Your Lease Right

End-of-month, end-of-quarter, and end-of-year are the best times to lease. Dealers are trying to meet sales goals and may offer better deals to close a contract.

Also, consider leasing during model-year clearance events. When new models arrive, dealers want to move old inventory—perfect time to score a deal.

Signing the Lease and Driving Off

You’ve done your research, negotiated the terms, and found the perfect car. Now it’s time to sign the lease and hit the road.

Read the Lease Agreement Carefully

Don’t just skim it. Read every line. Make sure the capitalized cost, residual value, money factor, mileage limit, and fees match what you agreed to.

Ask questions if anything is unclear. If the dealer refuses to explain or pressures you to sign quickly, walk away.

Understand Your Responsibilities

You’re responsible for maintaining the car according to the manufacturer’s schedule. Keep all service records. Use only approved repair shops if required.

You must also return the car in good condition, with no excess wear or damage. And return it on time—late returns can result in fees.

Consider Gap Insurance

If the car is totaled or stolen, your insurance may not cover the full lease balance. Gap insurance covers the difference. It’s usually included in the lease, but double-check.

Enjoy Your New Ride

Congratulations! You’ve successfully leased your first car. Drive safely, stay within your mileage limit, and take care of your vehicle. At the end of the lease, you can return it, buy it, or lease a new one.

What to Do at the End of Your Lease

Your lease is up. Now what?

You have three main options:

1. Return the car. This is the most common choice. Schedule an inspection, clean the car, and return it to the dealership. Pay any fees for excess wear, mileage, or the disposition fee.

2. Buy the car. You can purchase the vehicle at its residual value. This makes sense if the car has held its value well or if you’ve grown attached to it. You’ll need to finance the purchase or pay in cash.

3. Lease a new car. Many people lease again. You can lease the same model or upgrade to something new. Some dealers offer loyalty incentives for returning customers.

Before deciding, compare the car’s current market value to its residual value. If the market value is higher, you could buy it and sell it for a profit. If it’s lower, returning it might be smarter.

Common Mistakes First-Time Leasers Make

Even with the best intentions, first-time leasers often make avoidable mistakes. Here are the biggest ones to watch out for.

Not Reading the Fine Print

Leases are full of details. Skipping the fine print can lead to unexpected fees or penalties. Always read the full agreement.

Ignoring Mileage Limits

Driving too much? You’ll pay. Know your limit and track your miles. Consider a higher allowance if needed.

Putting Too Much Down

A large down payment lowers your monthly payment but increases your risk. If the car is totaled, you may not get that money back.

Not Maintaining the Car

Regular maintenance isn’t optional. Skipping oil changes or tire rotations can lead to wear-and-tear charges.

Assuming Leasing Is Always Cheaper

Leasing can cost more over time than buying—especially if you lease repeatedly. Do the math before committing.

Final Thoughts: Is Leasing Right for You?

Leasing a car for the first time doesn’t have to be scary. With the right knowledge and preparation, it can be a smart, affordable way to drive a new vehicle.

Remember: leasing is best for people who want lower payments, enjoy new cars, and don’t drive excessively. It’s not ideal if you want to own your car or customize it heavily.

Take your time, do your research, and don’t be afraid to negotiate. And always read the lease agreement before signing.

With these tips, you’re ready to lease your first car with confidence. Happy driving!

Frequently Asked Questions

Can I lease a car with bad credit?

Yes, but it may be more difficult and expensive. You might face higher interest rates, require a larger down payment, or need a co-signer. Improving your credit before leasing can help you get better terms.

What happens if I go over my mileage limit?

You’ll be charged a per-mile fee, typically between $0.10 and $0.25. For example, driving 2,000 extra miles at $0.15 per mile would cost $300. To avoid this, choose a higher mileage allowance when signing your lease.

Can I terminate my lease early?

It’s possible, but usually costly. Early termination fees can be high, and you may be responsible for remaining payments. Some leases offer transfer programs where another person takes over your lease.

Do I need full coverage insurance when leasing?

Yes. Leasing companies require comprehensive and collision coverage with low deductibles. This protects their asset in case of damage or theft. Check your policy before signing the lease.

Can I modify a leased car?

Generally, no. Most leases prohibit modifications like aftermarket parts or custom paint. If you do make changes, you must remove them and repair any damage before returning the car.

Is it better to lease or buy a car?

It depends on your lifestyle and financial goals. Leasing offers lower payments and new cars every few years, while buying builds equity and has no mileage limits. Consider your driving habits, budget, and long-term plans.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.