Leasing a car vs buying a car comes down to your lifestyle, budget, and long-term goals. Leasing offers lower monthly payments and new models every few years, while buying builds equity and freedom from mileage limits. Understanding the pros and cons helps you make the smartest financial choice.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Leasing a Car vs Buying a Car: Which Option Is Right for You?

- 4 What Is Leasing a Car?

- 5 What Is Buying a Car?

- 6 Cost Comparison: Leasing vs Buying

- 7 Lifestyle and Driving Habits: Which Option Fits You?

- 8 Hidden Fees and Fine Print: What to Watch For

- 9 Tax and Insurance Implications

- 10 Making the Right Choice for Your Situation

- 11 Final Thoughts: Leasing a Car vs Buying a Car

- 12 Frequently Asked Questions

Key Takeaways

- Leasing means lower monthly payments: You pay for the car’s depreciation during the lease term, not the full value, which typically results in smaller monthly costs compared to buying.

- Buying builds ownership and equity: Once you pay off your loan, the car is yours, and you can sell it, trade it, or keep it indefinitely—no restrictions on use.

- Leasing includes mileage limits and wear-and-tear rules: Most leases cap annual mileage (usually 10,000–15,000 miles), and excessive wear can lead to extra fees at return.

- Buying offers long-term savings: After the loan is paid off, you eliminate car payments and may enjoy years of free driving, especially with reliable vehicles.

- Leasing provides access to newer technology and safety features: With shorter terms (2–4 years), you can upgrade to the latest models more frequently.

- Buying involves higher upfront and long-term costs: Down payments, interest, insurance, and maintenance can add up, but you gain full control over the vehicle.

- Your driving habits and financial goals matter most: Frequent drivers or those who want to customize their car may prefer buying, while those wanting low payments and new cars every few years may lean toward leasing.

📑 Table of Contents

- Leasing a Car vs Buying a Car: Which Option Is Right for You?

- What Is Leasing a Car?

- What Is Buying a Car?

- Cost Comparison: Leasing vs Buying

- Lifestyle and Driving Habits: Which Option Fits You?

- Hidden Fees and Fine Print: What to Watch For

- Tax and Insurance Implications

- Making the Right Choice for Your Situation

- Final Thoughts: Leasing a Car vs Buying a Car

Leasing a Car vs Buying a Car: Which Option Is Right for You?

So, you’re in the market for a new car. You’ve narrowed down your choices, taken a few test drives, and now you’re faced with one of the biggest decisions: should you lease or buy? It’s a question that trips up even the most seasoned car shoppers. The truth is, there’s no one-size-fits-all answer. Whether you lease a car or buy a car depends on your personal situation, driving habits, and financial goals.

This guide will walk you through everything you need to know about leasing a car vs buying a car. We’ll break down the costs, benefits, and drawbacks of each option in plain English—no finance jargon, no confusing terms. By the end, you’ll have a clear picture of which path makes the most sense for you. Whether you’re a first-time buyer or a seasoned driver looking to upgrade, this comparison will help you make a confident, informed decision.

What Is Leasing a Car?

Leasing a car is essentially renting it for a fixed period, usually two to four years. Instead of paying off the entire value of the vehicle, you pay for its depreciation during the lease term, plus fees and interest. Think of it like a long-term rental with a contract. At the end of the lease, you return the car to the dealership—unless you choose to buy it outright.

Visual guide about Leasing a Car Vs Buying a Car

Image source: mycalcas.com

How Car Leasing Works

When you lease, the dealership (or leasing company) estimates how much the car will lose in value over the lease period. This amount, called the “depreciation,” becomes your monthly payment base. You’ll also pay a down payment (sometimes called a “cap cost reduction”), taxes, registration fees, and possibly an acquisition fee. Your monthly payment covers the depreciation, plus a finance charge (similar to interest).

For example, let’s say you lease a $35,000 SUV with an expected residual value (what it’s worth at the end of the lease) of $20,000 after three years. You’re essentially paying for the $15,000 in depreciation, spread over 36 months, plus fees. This usually results in lower monthly payments than buying the same car with a loan.

Pros of Leasing a Car

- Lower monthly payments: Since you’re only paying for the car’s depreciation, not its full value, monthly costs are typically 20–30% lower than a loan payment.

- Drive a new car every few years: Most leases last 2–4 years, so you can upgrade to the latest model with updated tech, safety features, and styling.

- Lower repair costs: Leased cars are usually under warranty for the entire lease term, so major repairs are covered.

- Little to no down payment: Many leases require little or no money down, making it easier to get into a new vehicle quickly.

- Tax advantages for business use: If you use the car for work, you may be able to deduct a portion of lease payments (consult a tax professional).

Cons of Leasing a Car

- No ownership: You don’t build equity. Once the lease ends, you have nothing to show for your payments unless you buy the car.

- Mileage restrictions: Most leases limit you to 10,000–15,000 miles per year. Exceeding this can cost $0.10–$0.25 per extra mile.

- Wear-and-tear fees: You’re responsible for excessive damage beyond “normal wear and tear,” which can include dents, scratches, or stained interiors.

- Early termination penalties: Ending a lease early can be expensive, often costing thousands in fees.

- Customization limits: You can’t modify a leased car (like adding a spoiler or changing the exhaust) without risking penalties.

What Is Buying a Car?

Buying a car means you’re purchasing it outright—either with cash or through a loan. Once the loan is paid off, the car is fully yours. You can drive it as much as you want, modify it, sell it, or keep it for decades. There are no mileage limits or return conditions. You own the asset, and that comes with both freedom and responsibility.

Visual guide about Leasing a Car Vs Buying a Car

Image source: burnsford.com

How Car Buying Works

When you buy, you either pay the full price upfront or finance it with an auto loan. If you finance, you’ll make monthly payments that include principal and interest until the loan is paid off. The length of the loan (typically 36–72 months) affects your monthly payment and total interest paid. Once the loan is complete, you own the car free and clear.

For example, if you buy that same $35,000 SUV with a 60-month loan at 5% interest, your monthly payment might be around $660. Over five years, you’ll pay about $39,600 total—$4,600 in interest. But after those five years, the car is yours, and you can keep driving it payment-free.

Pros of Buying a Car

- Ownership and equity: Once the loan is paid off, you own the car and can sell it for cash or trade it in.

- No mileage limits: Drive as much as you want—great for road trips, long commutes, or ride-sharing.

- Freedom to customize: Want to install a new sound system, lift the suspension, or repaint it? Go for it—no restrictions.

- Long-term savings: After the loan ends, you eliminate monthly payments. A well-maintained car can last 10+ years, saving you thousands.

- No wear-and-tear penalties: You’re free to use the car as you see fit. Scratches, dings, and high mileage don’t matter.

Cons of Buying a Car

- Higher monthly payments: Loan payments are typically higher than lease payments because you’re paying off the full value of the car.

- Higher upfront costs: Down payments, taxes, registration, and insurance can add up quickly.

- Depreciation hits hard: New cars lose 20–30% of their value in the first year and about 50% after three years. You’re absorbing that loss.

- Repair costs after warranty: Once the manufacturer’s warranty expires, you’re responsible for all maintenance and repairs.

- Older technology: You’re stuck with the same car for years, even if newer models have better features.

Cost Comparison: Leasing vs Buying

Let’s put leasing a car vs buying a car head-to-head with a real-world example. Say you’re choosing between a 2024 Honda Accord EX, priced at $32,000.

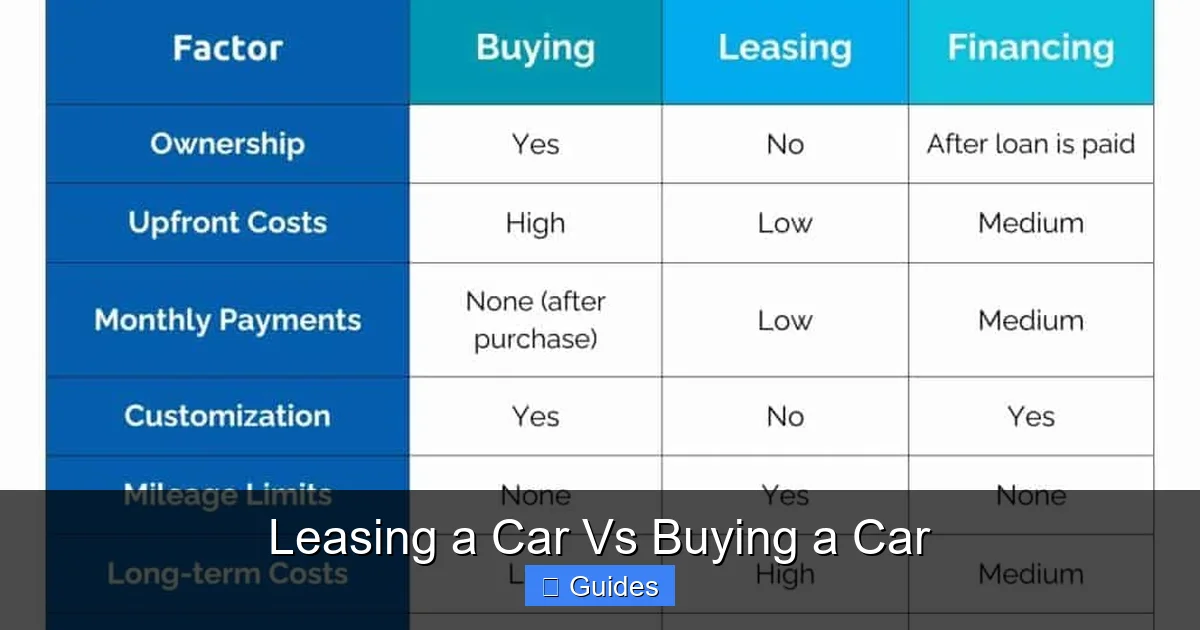

Visual guide about Leasing a Car Vs Buying a Car

Image source: capitalmotorcars.com

Leasing Scenario

- Lease term: 36 months

- Down payment: $2,000

- Monthly payment: $350

- Total paid over 3 years: $14,600 ($2,000 + $350 × 36)

- Mileage limit: 12,000 miles/year

- At end of lease: Return the car (or buy it for the residual value, say $18,000)

Buying Scenario

- Loan term: 60 months

- Down payment: $5,000

- Interest rate: 5%

- Monthly payment: $515

- Total paid over 5 years: $35,900 ($5,000 + $515 × 60)

- After 5 years: Car is paid off, worth about $15,000 (depending on condition and mileage)

At first glance, leasing seems cheaper—$14,600 vs. $35,900. But remember: with leasing, you have nothing to show for that money. With buying, you still own a car worth $15,000. Over time, buying often wins on value.

Long-Term Financial Impact

Let’s extend the timeline to 10 years. If you lease, you’ll likely lease three cars (3 years each), paying about $43,800 total ($14,600 × 3). You’ll always have a payment.

If you buy, you pay $35,900 over 5 years, then drive payment-free for the next 5 years. Even if you spend $2,000/year on maintenance, that’s $10,000—total cost: $45,900. But you still own a car worth $5,000–$8,000. And you’ve avoided three sets of down payments and fees.

The break-even point usually comes around year 6–7. After that, buying saves you money. But if you love driving new cars and can afford the ongoing payments, leasing might still make sense.

Lifestyle and Driving Habits: Which Option Fits You?

Your daily life plays a huge role in whether leasing a car or buying a car is the better choice. Let’s look at different scenarios.

You Drive a Lot (15,000+ Miles/Year)

If you have a long commute, deliver packages, or love road trips, leasing is probably not for you. Most leases cap mileage at 10,000–15,000 miles per year. Going over can cost $0.15–$0.25 per mile. For example, driving 20,000 miles in a year on a 12,000-mile lease could cost you $1,200 in overage fees. Buying gives you unlimited miles—no penalties, no stress.

You Want the Latest Tech and Safety Features

Car technology evolves fast. New models come with better infotainment systems, advanced driver-assistance features (like automatic braking and lane-keeping), and improved fuel efficiency. If staying up-to-date is important, leasing lets you upgrade every 2–4 years. Buying means you’re stuck with the same car for years—even if newer models have better safety ratings.

You Like to Customize Your Ride

Love adding performance parts, custom wheels, or a new paint job? Leasing won’t allow it. Most leases require the car to be returned in near-original condition. Any modifications must be reversed before return, or you’ll face fees. Buying gives you full creative control.

You Plan to Keep the Car Long-Term

If you’re the type who keeps cars for 10+ years, buying is almost always the better choice. You’ll pay off the loan and enjoy years of payment-free driving. Leasing means you’ll always have a car payment—forever, if you keep leasing.

You Have a Stable Income and Want Predictable Costs

Leasing offers predictable monthly payments and often includes maintenance packages. If you prefer knowing exactly what you’ll pay each month and don’t want surprises, leasing can provide peace of mind. Buying involves variable costs—insurance, repairs, fuel—that can fluctuate.

Hidden Fees and Fine Print: What to Watch For

Both leasing and buying come with fine print. Knowing what to look for can save you hundreds—or thousands.

Leasing Fees to Watch

- Acquisition fee: $500–$1,000, charged upfront to set up the lease.

- Disposition fee: $300–$500, charged when you return the car.

- Excess wear-and-tear charges: Dents, scratches, stained seats, or damaged tires can cost hundreds.

- Early termination fee: Ending the lease early can cost 2–3 times your monthly payment.

- Security deposit: Some leases require a refundable deposit (often one month’s payment).

Buying Fees to Watch

- Documentation fee: $100–$800, charged by the dealer for processing paperwork.

- Advertising fee: Some dealers add a “market adjustment” or “advertising fee” to the price.

- Pre-delivery inspection fee: $100–$300, for cleaning and inspecting the car before delivery.

- Extended warranty or add-ons: Dealers may push unnecessary packages (like paint protection or VIN etching) that add hundreds.

Always read the contract carefully. Ask questions. Negotiate fees when possible. And never sign anything you don’t fully understand.

Tax and Insurance Implications

Taxes and insurance also differ between leasing and buying—and they can affect your overall cost.

Tax Considerations

In most states, you pay sales tax on the full purchase price when you buy a car. When you lease, you typically pay tax only on the monthly payments. This can make leasing cheaper in high-tax states. However, some states (like Virginia and Texas) tax the full value of the car at lease signing, reducing the advantage.

If you use the car for business, leasing may offer better tax deductions. You can often deduct a portion of lease payments based on business use percentage. With buying, you can deduct depreciation and interest, but the rules are more complex. Always consult a tax professional.

Insurance Differences

Insurance requirements are similar for both options, but costs can vary. Leased cars often require higher coverage limits and gap insurance (which covers the difference between what you owe and the car’s value if it’s totaled). This can increase your premium.

When you buy, you can drop comprehensive and collision coverage once the car is paid off and older—though it’s not always wise. Newer cars cost more to insure, but older cars may need more repairs. Shop around for insurance quotes before deciding.

Making the Right Choice for Your Situation

So, how do you decide between leasing a car vs buying a car? Start by asking yourself these questions:

- How many miles do I drive per year?

- Do I want to own the car long-term?

- Can I afford higher monthly payments?

- Do I care about having the latest technology?

- Am I okay with always having a car payment?

- Do I plan to modify or personalize the vehicle?

If you answered “yes” to wanting ownership, driving a lot, or keeping the car long-term, buying is likely the better choice. If you prefer lower payments, new cars every few years, and don’t mind not owning, leasing might be right for you.

Also consider your financial health. Leasing can free up cash for other investments, but it doesn’t build wealth. Buying builds equity but ties up capital. If you’re saving for a house or paying off debt, leasing might offer more flexibility. If you’re financially stable and want long-term savings, buying wins.

Finally, don’t forget about resale value. Some cars hold their value better than others. Brands like Toyota, Honda, and Subaru depreciate slower, making them smarter buys. Luxury brands often lease well because they depreciate quickly—perfect for someone who wants a high-end car without the long-term cost.

Final Thoughts: Leasing a Car vs Buying a Car

There’s no universal winner in the leasing a car vs buying a car debate. Both options have clear benefits and drawbacks. The best choice depends on your lifestyle, driving habits, and financial goals.

Leasing is ideal if you want lower monthly payments, enjoy driving new cars, and don’t mind not owning. It’s great for people who value convenience, technology, and predictable costs. But it comes with restrictions and no long-term equity.

Buying is better if you drive a lot, plan to keep the car for many years, or want full ownership and customization freedom. It costs more upfront and has higher monthly payments, but it pays off in the long run with equity and payment-free driving.

Take your time. Do the math. Read the fine print. And choose the option that aligns with your life—not just your wallet. Whether you lease or buy, the right car is one that fits your needs, your budget, and your future.

Frequently Asked Questions

Is it better to lease or buy a car?

It depends on your needs. Leasing offers lower payments and new cars every few years, while buying builds equity and long-term savings. Consider your driving habits, budget, and how long you plan to keep the vehicle.

Can you negotiate a car lease?

Yes, you can negotiate the capitalized cost (price of the car), money factor (interest rate), and mileage allowance. Just like buying, leasing terms aren’t always set in stone—ask for better deals.

What happens at the end of a car lease?

You return the car to the dealership, pay any excess wear or mileage fees, and may have the option to buy the car at its residual value. You can also lease a new vehicle.

Do you build equity when you lease a car?

No, you don’t build equity when leasing. You’re paying for the car’s depreciation during the lease term, not its full value, so you have no ownership stake.

Can you lease a used car?

Yes, some dealerships and leasing companies offer certified pre-owned leases. These often have lower payments than new car leases but may come with higher interest rates.

Is leasing a car worth it in the long run?

Leasing can be worth it if you value lower payments and driving new cars frequently. However, over many years, buying usually costs less because you eliminate payments after the loan is paid off.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.