Leasing a car can be an affordable way to drive a new vehicle with lower monthly payments than buying. However, costs go beyond the monthly fee and include down payments, fees, mileage limits, and wear-and-tear charges. Understanding all expenses helps you make a smart, budget-friendly decision.

Thinking about leasing a car? You’re not alone. Many drivers are drawn to leasing because it offers the chance to drive a new, reliable vehicle every few years—without the long-term commitment of ownership. Whether you love having the latest tech, safety features, or just want lower monthly payments, leasing can be a smart financial move. But before you sign on the dotted line, it’s crucial to understand exactly how much leasing a car costs.

Unlike buying, where you eventually own the vehicle, leasing is more like renting. You pay to use the car for a set period—usually two to three years—and return it when the term ends. Because you’re only paying for the car’s depreciation during that time (plus fees and interest), your monthly payments are often significantly lower than if you were financing a purchase. That sounds great, right? But here’s the catch: leasing comes with rules, restrictions, and hidden costs that can add up fast if you’re not careful.

In this guide, we’ll break down every cost associated with leasing a car—from the initial fees to what you pay each month and what happens when your lease ends. We’ll also share practical tips to help you avoid common pitfalls and get the best deal possible. By the end, you’ll have a clear picture of whether leasing fits your lifestyle and budget.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is Car Leasing and How Does It Work?

- 4 Upfront Costs When Leasing a Car

- 5 Monthly Lease Payments: What You Pay Each Month

- 6 Mileage Limits and Excess Mileage Fees

- 7 End-of-Lease Costs and Fees

- 8 Hidden Costs and Fees to Watch Out For

- 9 Is Leasing Right for You? Final Considerations

- 10 Conclusion

- 11 Frequently Asked Questions

Key Takeaways

- Monthly payments are typically lower when leasing compared to financing a purchase, making it attractive for budget-conscious drivers.

- Upfront costs include a down payment, security deposit, and acquisition fee, which can total $2,000–$5,000 or more depending on the vehicle and deal.

- Mileage limits (usually 10,000–15,000 miles per year) apply, and exceeding them results in per-mile charges, often $0.10–$0.25.

- Wear and tear is monitored at lease end, and you may pay extra for excessive damage beyond normal use.

- Lease terms usually last 24 to 36 months, after which you return the car or buy it at a predetermined residual value.

- Gap insurance is usually included, protecting you if the car is totaled or stolen during the lease.

- Early termination can be costly, with penalties that may exceed remaining payments, so plan your timeline carefully.

📑 Table of Contents

What Is Car Leasing and How Does It Work?

Car leasing is a popular alternative to buying, especially for people who want to drive a new vehicle every few years without the hassle of selling or trading in. At its core, leasing is a long-term rental agreement. You agree to use the car for a fixed period—typically 24, 36, or 48 months—and pay for its depreciation during that time, plus interest and fees.

When you lease, the leasing company (often the car manufacturer’s finance arm) buys the vehicle and allows you to use it. You make monthly payments based on how much the car loses in value while you drive it. For example, if a $30,000 car is expected to be worth $18,000 after three years, you’ll pay for that $12,000 drop in value, spread over 36 months, plus interest and other charges.

At the end of the lease, you return the car to the dealership, usually with minimal hassle—assuming you’ve stayed within the agreed mileage and kept the vehicle in good condition. Alternatively, you can choose to buy the car at its predetermined “residual value,” which is set at the start of the lease.

One of the biggest appeals of leasing is lower monthly payments. Since you’re not paying off the entire value of the car, just the portion that depreciates, your out-of-pocket cost each month is often 20% to 40% less than a loan payment for the same vehicle. This makes leasing attractive for people who want a luxury or high-end model but can’t afford the full purchase price.

However, leasing isn’t for everyone. You don’t build equity, you’re limited in how much you can drive, and you’ll always have a car payment unless you choose to go without a vehicle. But for the right person—someone who values new technology, low maintenance, and predictable costs—leasing can be a smart choice.

Upfront Costs When Leasing a Car

Visual guide about How Much Does Leasing a Car Cost

Image source: cdn.shopify.com

Before you even drive off the lot, leasing a car requires several upfront payments. These aren’t optional—they’re part of the standard leasing process. Understanding these costs upfront helps you budget properly and avoid surprises.

Down Payment (Cap Cost Reduction)

The down payment, also called a capitalized cost reduction, is the largest upfront expense. It’s similar to a down payment when buying a car, but instead of reducing the loan amount, it lowers the monthly lease payments by reducing the amount you’re financing.

For example, if you’re leasing a $35,000 car and make a $3,000 down payment, your lease calculations will be based on $32,000. This can drop your monthly payment by $50 to $100 or more, depending on the interest rate and term.

While a larger down payment means lower monthly costs, it also means more money out of pocket at signing. Some leases advertise “$0 down,” but that usually means the down payment is rolled into the monthly payments or covered by incentives. Be cautious—low or no down payment deals often come with higher monthly payments or stricter terms.

Security Deposit

Many leasing companies require a refundable security deposit, typically equal to one month’s payment. This acts as a safeguard against excessive wear, damage, or missed payments. If you return the car in good condition and fulfill all lease terms, the deposit is refunded at the end.

Not all leases require a security deposit, especially if you have excellent credit. Some manufacturers waive it as part of a promotion. But if it’s required, expect to pay $300 to $600 upfront, depending on the vehicle and lease terms.

Acquisition Fee

The acquisition fee—also known as the bank fee or administrative fee—is a non-refundable charge for setting up the lease. It covers the cost of processing your application, credit check, and contract. This fee typically ranges from $500 to $1,000 and is often due at signing.

Some dealers allow you to roll this fee into your monthly payments, which reduces the upfront cost but increases the total amount you pay over the lease term. While convenient, rolling fees into payments means you’ll pay interest on them, so it’s usually better to pay upfront if you can afford it.

First Month’s Payment

Almost all leases require the first month’s payment at signing. This is standard practice and ensures you’re committed to the agreement. Depending on the vehicle and terms, this could be anywhere from $200 to $800.

Taxes, Registration, and Title Fees

You’ll also need to pay state and local taxes, registration, and title fees. These vary widely by location. In some states, you pay sales tax on the full value of the car upfront. In others, tax is applied only to your monthly payments. Registration and title fees typically range from $100 to $500, depending on your state and the vehicle’s value.

Example of Upfront Costs

Let’s say you’re leasing a mid-range SUV with a monthly payment of $450. Here’s what your upfront costs might look like:

– Down payment: $3,000

– Security deposit: $450

– Acquisition fee: $700

– First month’s payment: $450

– Taxes and registration: $600

Total upfront cost: $5,200

That’s a significant amount, even though your monthly payment is relatively low. Always ask for a full breakdown of all fees before signing.

Monthly Lease Payments: What You Pay Each Month

Visual guide about How Much Does Leasing a Car Cost

Image source: stormwisehailrepair.com

Your monthly lease payment is the most visible cost, but it’s not just a flat fee. It’s calculated using several factors, including the car’s depreciation, interest rate, and fees. Understanding how this number is determined helps you compare offers and negotiate better deals.

How Monthly Payments Are Calculated

Lease payments are based on three main components:

1. **Depreciation**: The difference between the car’s starting value (cap cost) and its residual value at the end of the lease. This is the largest part of your payment.

2. **Interest (Rent Charge)**: The cost of borrowing money, expressed as a money factor (similar to an interest rate).

3. **Taxes and Fees**: Sales tax (if applicable), licensing, and other recurring charges.

For example, if you lease a $36,000 car with a 36-month term and a residual value of $21,600 (60% of the original price), the depreciation is $14,400. Divided by 36 months, that’s $400 per month. Add interest (say, $50) and tax ($30), and your total monthly payment is $480.

Factors That Affect Your Monthly Payment

Several variables can increase or decrease your monthly cost:

– **Vehicle Price**: Higher-priced cars cost more to lease. Luxury brands like BMW, Mercedes, and Tesla often have higher payments.

– **Residual Value**: Cars that hold their value well (like Toyota, Honda, and Subaru) have lower depreciation and thus lower lease payments.

– **Money Factor**: This is the lease equivalent of an interest rate. A lower money factor means lower payments. It’s often listed as a decimal (e.g., 0.00250), which translates to 6% APR. Always ask for the APR to compare offers.

– **Lease Term**: Shorter leases (24 months) usually have higher monthly payments but lower total interest. Longer leases (36–48 months) spread costs out but may cost more overall.

– **Down Payment**: As mentioned, a larger down payment reduces monthly costs.

– **Incentives and Promotions**: Manufacturers often offer lease specials, such as reduced money factors, waived fees, or cash allowances, which can significantly lower payments.

Real-World Example

Let’s compare two popular sedans:

– **Honda Accord EX**: MSRP $32,000, residual 62%, money factor 0.00150 (3.6% APR), 36-month term, $2,000 down

Monthly payment: ~$380

– **BMW 3 Series**: MSRP $43,000, residual 58%, money factor 0.00200 (4.8% APR), 36-month term, $3,000 down

Monthly payment: ~$520

Even with a higher down payment, the BMW costs more per month due to higher depreciation and interest. But the Accord, while cheaper, may not offer the same luxury features.

Tips to Lower Your Monthly Payment

– **Negotiate the Cap Cost**: Just like when buying, you can negotiate the vehicle’s price. A lower cap cost means lower depreciation and payments.

– **Choose a Higher Residual Vehicle**: Research which models retain value best. Websites like Kelley Blue Book and Edmunds provide residual value data.

– **Shop for the Best Money Factor**: Dealers may mark up the money factor. Compare offers from multiple dealers or credit unions.

– **Consider a Longer Term**: Extending to 39 or 42 months can reduce monthly payments, but increases total cost.

– **Use Manufacturer Incentives**: Look for lease deals on the manufacturer’s website. These can save hundreds per month.

Mileage Limits and Excess Mileage Fees

Visual guide about How Much Does Leasing a Car Cost

Image source: horseracingsense.com

One of the most important—and often overlooked—aspects of leasing is the mileage limit. Every lease includes an annual mileage cap, typically between 10,000 and 15,000 miles. If you exceed this limit, you’ll be charged a per-mile fee at the end of the lease.

Standard Mileage Allowances

Most leases default to 12,000 miles per year. So a 36-month lease allows 36,000 total miles. Some dealers offer 10,000 or 15,000-mile options. Choosing a higher allowance increases your monthly payment but reduces the risk of overage fees.

For example:

– 10,000 miles/year: Lower monthly payment, higher risk of fees

– 15,000 miles/year: Higher monthly payment, lower risk

Excess Mileage Charges

If you go over your limit, expect to pay $0.10 to $0.25 per mile. That might not sound like much, but it adds up fast.

Example: You drive 14,000 miles in a year on a 12,000-mile lease. That’s 2,000 extra miles. At $0.15 per mile, you’ll pay $300 at lease end. Over three years, that could be $900.

How to Avoid Mileage Overages

– **Estimate Your Driving**: Track your annual mileage for a few months. Include commuting, road trips, and errands.

– **Choose the Right Allowance**: If you drive more than 12,000 miles a year, opt for 15,000 or even 20,000 (if available).

– **Buy Extra Miles Upfront**: Some leases let you prepay for additional miles at a discounted rate (e.g., $0.10 per mile instead of $0.20 later). This can save money if you know you’ll exceed the limit.

– **Consider a Shorter Lease**: If you drive a lot, a 24-month lease with a higher mileage limit may be cheaper than a 36-month lease with overage fees.

What Counts Toward Mileage?

All miles driven count—whether for work, pleasure, or delivery. Even if you’re not the primary driver, any miles put on the car by family members or friends count toward the total.

End-of-Lease Costs and Fees

When your lease ends, you’re not off the hook just because the monthly payments stop. Several end-of-lease costs can surprise unprepared drivers. Knowing what to expect helps you budget and avoid unnecessary charges.

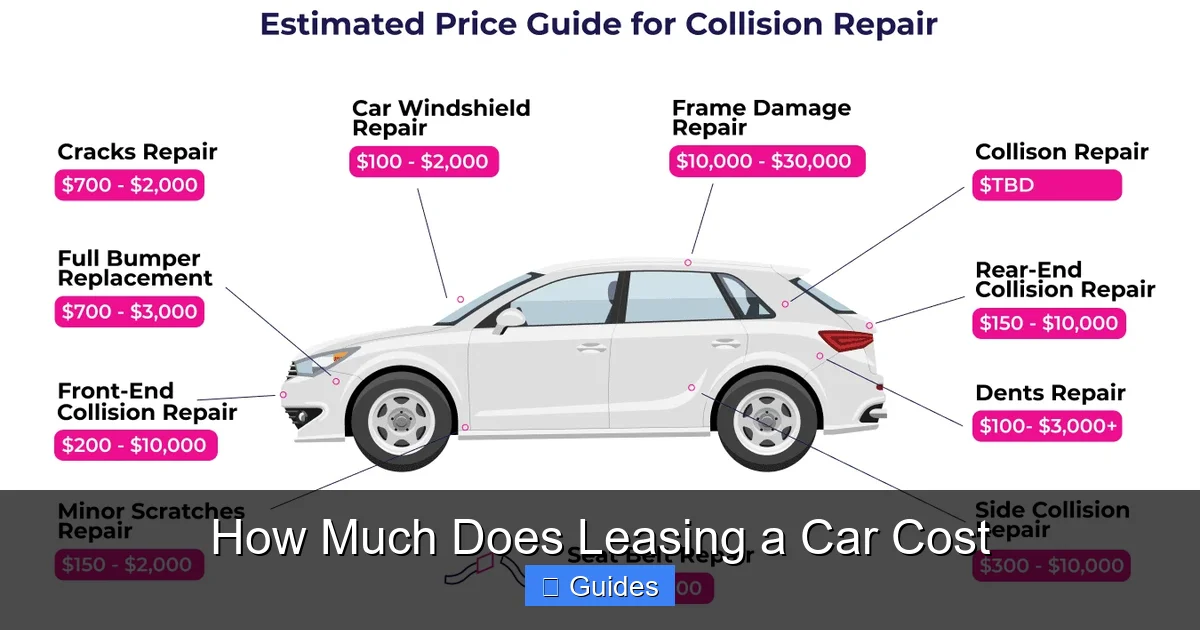

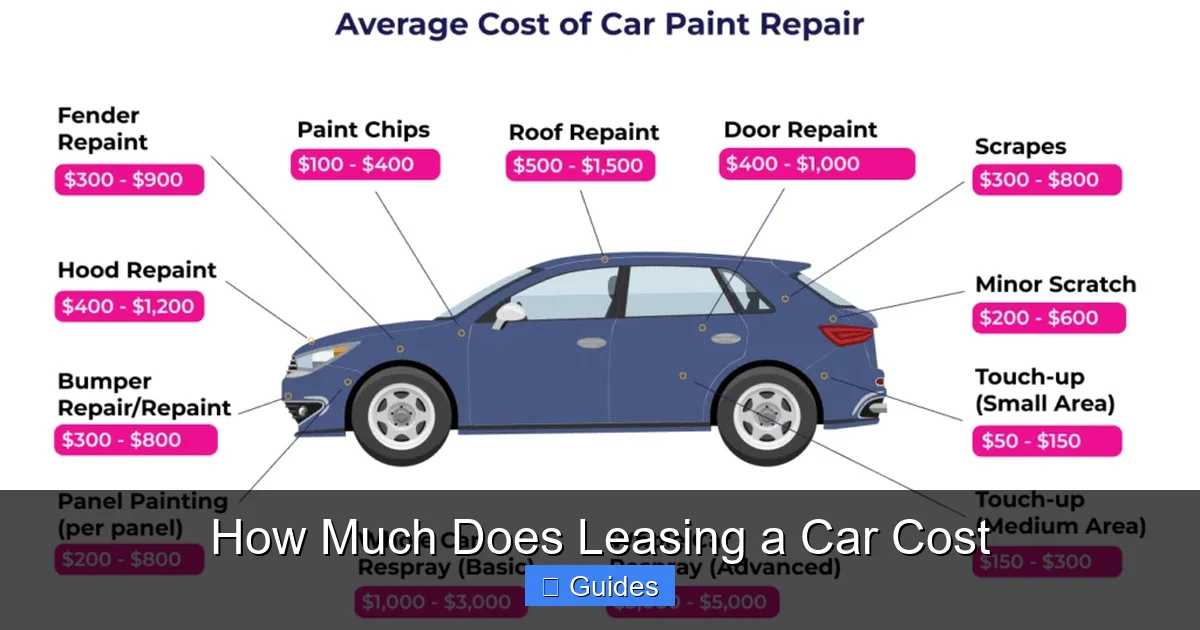

Wear and Tear Charges

Leasing companies expect some normal wear and tear—minor scratches, small dents, worn floor mats. But excessive damage will cost you. Common charges include:

– Paint damage beyond minor scratches

– Large dents or dings

– Torn or stained upholstery

– Broken glass or mirrors

– Excessively worn tires

Inspect the car thoroughly before returning it. Take photos and note any damage. Some dealers offer a pre-inspection service for a small fee, which can help you fix issues beforehand.

Disposition Fee

Most leases include a disposition fee—a charge for processing the return of the vehicle. This typically ranges from $300 to $500 and is non-negotiable. It covers cleaning, inspection, and paperwork.

Some leases waive this fee if you lease another vehicle from the same manufacturer. Always ask about this option.

Early Termination Fees

Ending your lease early is possible but expensive. You’ll likely pay the remaining monthly payments, plus a termination fee (often $500–$1,000). In some cases, the total cost can exceed $10,000.

Early termination is only worth it in extreme situations, like job loss or relocation. Otherwise, it’s usually better to wait it out or transfer the lease to someone else (if allowed).

Lease-End Options

At the end of your lease, you have three choices:

1. **Return the Car**: Pay any fees and walk away. This is the most common option.

2. **Buy the Car**: Purchase it at the residual value stated in your contract. This can be a good deal if the car’s market value is higher than the residual.

3. **Lease a New Car**: Many dealers encourage you to lease another vehicle, often with waived fees or incentives.

Hidden Costs and Fees to Watch Out For

Beyond the obvious costs, leasing includes several hidden or unexpected fees that can inflate your total expense. Being aware of these helps you avoid overpaying.

Excess Wear and Tear Guidelines

Leasing companies use strict standards to define “excessive” damage. For example:

– Scratches longer than 4 inches

– Dents deeper than a quarter

– Stains that can’t be cleaned

– Missing parts or accessories

These standards are often more stringent than what you’d expect from a private sale. Regular maintenance and careful driving can help minimize charges.

Gap Insurance

Most leases include gap insurance, which covers the difference between what you owe and the car’s value if it’s totaled or stolen. This is a major benefit of leasing—without it, you could owe thousands after an accident.

However, if your lease doesn’t include gap coverage (rare but possible), you’ll need to purchase it separately. Don’t skip this—it’s essential protection.

Maintenance and Repairs

While leasing, you’re responsible for routine maintenance—oil changes, tire rotations, brake pads, etc. Skipping maintenance can lead to wear-and-tear charges later.

Some leases include maintenance packages, especially on luxury brands. These can save money but may increase your monthly payment. Compare the cost of the package versus paying out of pocket.

Documentation and Processing Fees

Dealers may charge documentation fees (doc fees) for preparing paperwork. These range from $100 to $800 and vary by state. Some states cap doc fees, while others allow dealers to set their own.

Always ask for a breakdown of all fees. If a doc fee seems excessive, question it or shop elsewhere.

Late Payment Fees

Missing a lease payment can result in late fees ($25–$50) and damage your credit. Set up automatic payments to avoid this.

Is Leasing Right for You? Final Considerations

Leasing a car isn’t just about cost—it’s about lifestyle, priorities, and long-term goals. While the monthly payments are lower, you’re not building equity, and you’ll always have a car payment unless you choose to go without.

Leasing makes sense if:

– You want a new car every 2–3 years

– You drive fewer than 15,000 miles per year

– You prefer lower monthly payments

– You want the latest safety and tech features

– You don’t want to deal with selling or trading in a car

Leasing may not be ideal if:

– You drive a lot or have a long commute

– You like to customize your vehicle

– You plan to keep a car for many years

– You want to build equity or own outright

Ultimately, the decision comes down to your budget and preferences. Use online lease calculators to compare costs, read the fine print, and negotiate every part of the deal.

Conclusion

So, how much does leasing a car cost? The answer isn’t simple—it depends on the vehicle, your credit, the lease terms, and how you drive. But with the right knowledge, you can make an informed choice.

Upfront costs can range from $2,000 to $6,000, including down payments, fees, and taxes. Monthly payments are typically $300 to $600, depending on the car and terms. And end-of-lease fees for mileage, wear, and disposition can add hundreds more.

But leasing offers real benefits: lower payments, new technology, and peace of mind with warranty coverage and gap insurance. For the right driver, it’s a smart, affordable way to enjoy a reliable vehicle without the long-term commitment of ownership.

Before you lease, do your homework. Compare offers, read the contract carefully, and ask questions. With the right preparation, leasing can be a great financial move—not a hidden trap.

Frequently Asked Questions

How much does it typically cost to lease a car per month?

Monthly lease payments usually range from $300 to $600, depending on the vehicle, lease term, down payment, and interest rate. Luxury cars and SUVs tend to cost more, while economy models are on the lower end.

Is it cheaper to lease or buy a car?

Leasing often has lower monthly payments than buying, but you don’t build equity. Buying costs more upfront but saves money in the long run if you keep the car for many years. The best choice depends on your budget and driving habits.

Can you negotiate a car lease?

Yes, you can negotiate the capitalized cost (price of the car), money factor (interest rate), and fees—just like when buying. A lower cap cost and money factor mean lower monthly payments.

What happens if you go over your mileage limit?

You’ll be charged a per-mile fee, typically $0.10 to $0.25, at the end of the lease. For example, driving 2,000 extra miles could cost $200 to $500. To avoid this, choose a higher mileage allowance or prepay for extra miles.

Can you end a car lease early?

Yes, but it’s expensive. Early termination usually requires paying the remaining lease payments plus a fee. In some cases, you can transfer the lease to another person, which may reduce costs.

Do you pay sales tax when leasing a car?

Yes, but how it’s applied varies by state. Some states charge tax on the full vehicle price upfront, while others tax only the monthly payments. Check your local laws to understand how tax affects your lease cost.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.