Getting out of a car lease early isn’t impossible—it just takes planning and the right approach. Whether you’re facing financial hardship, job changes, or simply want a different vehicle, there are legal and cost-effective ways to exit your lease without breaking the bank.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How to Get Out of a Car Lease Early

- 4 Understand Your Lease Agreement First

- 5 Option 1: Transfer Your Lease (Lease Assumption)

- 6 Option 2: Buy Out the Lease Early

- 7 Option 3: Negotiate with Your Leasing Company

- 8 Option 4: Trade In the Leased Vehicle

- 9 Option 5: Use a Lease Buyout Company

- 10 Avoid These Common Mistakes

- 11 Final Thoughts: Choose the Right Path for You

- 12 Frequently Asked Questions

Key Takeaways

- Review your lease agreement first: Understand early termination clauses, fees, and mileage limits before taking action.

- Lease transfer (lease assumption) is often the best option: Let someone else take over your payments and responsibilities with lender approval.

- Negotiate with your leasing company: Many lenders are open to buyout offers or payment plans if you explain your situation honestly.

- Consider a lease buyout: Purchase the car yourself or trade it in at a dealership to end the lease early.

- Avoid defaulting: Missing payments can damage your credit and lead to repossession—always explore alternatives first.

- Use third-party services wisely: Companies like Swapalease or LeaseTrader can help find a qualified buyer, but read the fine print.

- Document everything: Keep records of all communications and agreements to protect yourself legally and financially.

📑 Table of Contents

- How to Get Out of a Car Lease Early

- Understand Your Lease Agreement First

- Option 1: Transfer Your Lease (Lease Assumption)

- Option 2: Buy Out the Lease Early

- Option 3: Negotiate with Your Leasing Company

- Option 4: Trade In the Leased Vehicle

- Option 5: Use a Lease Buyout Company

- Avoid These Common Mistakes

- Final Thoughts: Choose the Right Path for You

How to Get Out of a Car Lease Early

So, you signed a car lease thinking it was the perfect fit—low monthly payments, a shiny new ride, and no long-term commitment. But life happened. Maybe you lost your job, moved across the country, or realized the car just isn’t working for your lifestyle anymore. Now you’re stuck wondering: *Can I get out of this lease early?*

The short answer? Yes—but it’s not always simple or free. Unlike buying a car outright, leasing comes with strict terms and conditions. Breaking a lease early can trigger hefty fees, penalties, or even legal issues if not handled correctly. But don’t panic. With the right strategy, you can exit your lease early while minimizing costs and protecting your credit score.

In this guide, we’ll walk you through every practical and legal way to get out of a car lease early. Whether you’re looking to transfer the lease, buy the car, or negotiate a settlement, we’ve got you covered. We’ll also share real-life examples, insider tips, and red flags to avoid. By the end, you’ll know exactly what steps to take—and which ones to skip.

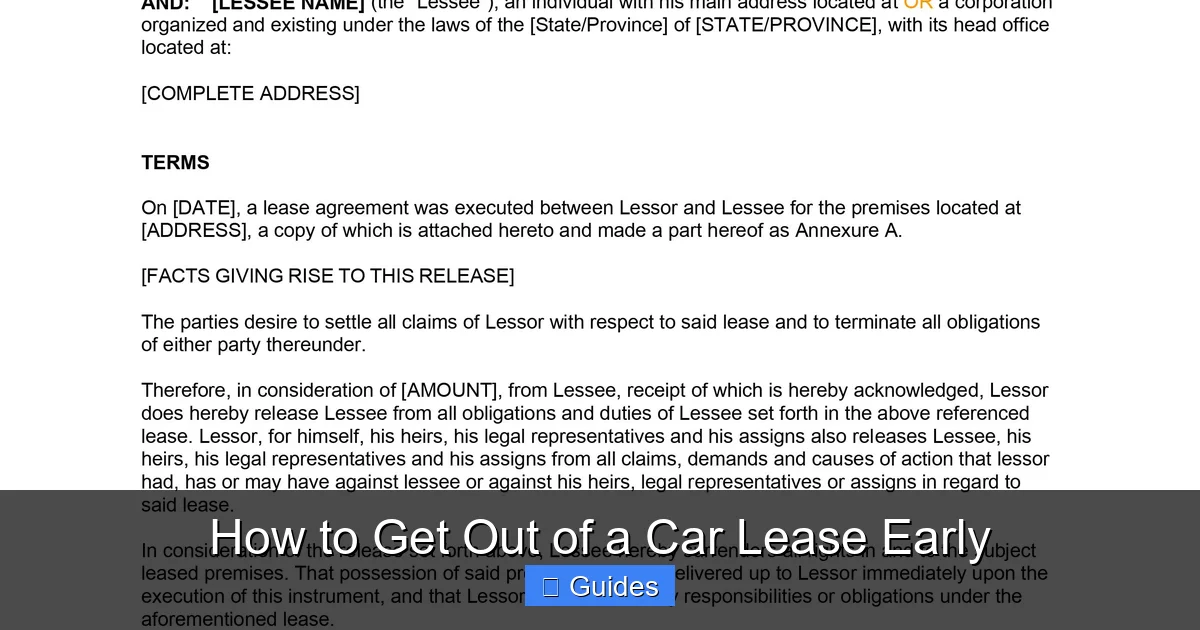

Understand Your Lease Agreement First

Visual guide about How to Get Out of a Car Lease Early

Image source: res.cloudinary.com

Before you do anything, grab your lease agreement and read it carefully. This document is your roadmap. It outlines your rights, responsibilities, and the consequences of ending the lease early. Skipping this step is like trying to navigate a maze with your eyes closed.

Key Clauses to Look For

Your lease will include several important sections. Pay close attention to:

– **Early Termination Clause**: This tells you whether you’re allowed to end the lease early and under what conditions. Some leases allow early exits with a fee, while others don’t permit it at all.

– **Disposition Fee**: This is a charge (usually $300–$500) you pay when returning the car at the end of the lease. It may still apply if you terminate early.

– **Mileage Limits**: Most leases cap your annual mileage (e.g., 10,000–15,000 miles). If you’ve already exceeded this, you could face per-mile charges of $0.10–$0.25.

– **Wear and Tear Guidelines**: Minor scratches are usually okay, but excessive damage can result in repair fees.

– **Early Termination Fee**: This is the big one. It’s often calculated as the remaining payments minus the car’s current residual value. For example, if you have 18 payments of $400 left ($7,200 total) and the car is worth $5,000, you might owe around $2,200.

Example: Reading Between the Lines

Let’s say you leased a 2022 Honda Accord for 36 months at $350 per month. You’re 12 months in and want out. Your lease says you can terminate early by paying “the present value of all remaining payments plus a $400 disposition fee.” That means you’d owe roughly $8,400 (24 x $350) minus any equity, plus the fee. Ouch.

But here’s the good news: many leasing companies are willing to work with you—especially if you’re proactive and honest. Don’t assume the worst. Call your lender and ask: *“What are my options if I need to end this lease early?”* You might be surprised by their flexibility.

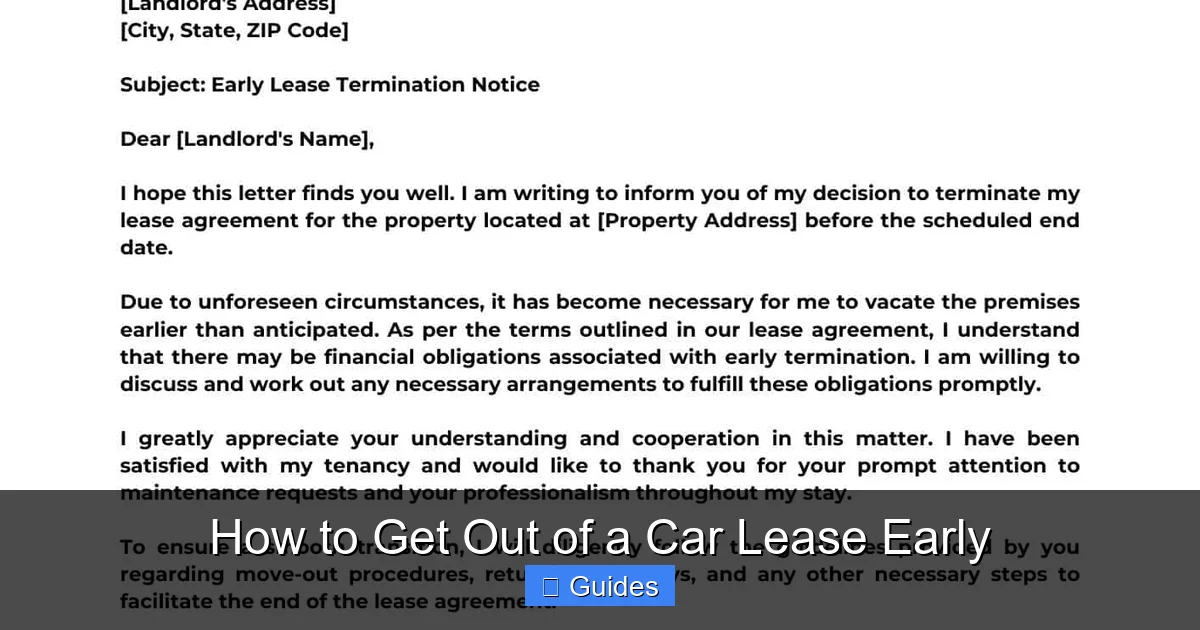

Option 1: Transfer Your Lease (Lease Assumption)

Visual guide about How to Get Out of a Car Lease Early

Image source: typecalendar.com

One of the most popular and cost-effective ways to get out of a car lease early is through a **lease transfer**, also known as lease assumption. This means finding someone else to take over your lease—your payments, your responsibilities, and your car.

How Lease Transfer Works

Here’s how it typically goes:

1. **Find a Qualified Buyer**: This could be a friend, family member, or someone found through a lease transfer website.

2. **Get Approval from the Leasing Company**: The new person must pass a credit check and meet the lender’s requirements.

3. **Sign the Transfer Agreement**: Once approved, both you and the new lessee sign paperwork to officially transfer the lease.

4. **Pay Any Transfer Fees**: Most lenders charge a fee (usually $200–$600) to process the transfer.

Pros and Cons of Lease Transfer

Pros:

– You’re off the hook for future payments.

– No need to buy the car or pay a huge termination fee.

– Can often be done quickly with the right platform.

Cons:

– You may still be liable if the new lessee defaults (check your agreement).

– Not all leases allow transfers—some are “non-transferable.”

– Finding a qualified buyer can take time.

Where to Find a Buyer

Several online platforms specialize in connecting lessees with potential buyers:

– **Swapalease.com**: One of the oldest and most trusted sites. They verify buyers and handle the paperwork.

– **LeaseTrader.com**: Offers tools to list your lease and connect with interested parties.

– **Cars.com Lease Transfer**: A newer option with a user-friendly interface.

When listing your lease, include details like:

– Monthly payment amount

– Remaining term (e.g., 24 months)

– Mileage used vs. allowed

– Vehicle condition and features

– Any incentives you’re offering (e.g., “$500 toward transfer fee”)

Real-Life Example: Sarah’s Success Story

Sarah leased a 2021 Toyota RAV4 for $320/month with 30,000 miles allowed over 36 months. After 18 months, she got a job that required a hybrid. She listed her lease on Swapalease and found a buyer within three weeks. The new lessee passed the credit check, paid the $400 transfer fee, and took over the remaining 18 payments. Sarah walked away with no debt and a clean record.

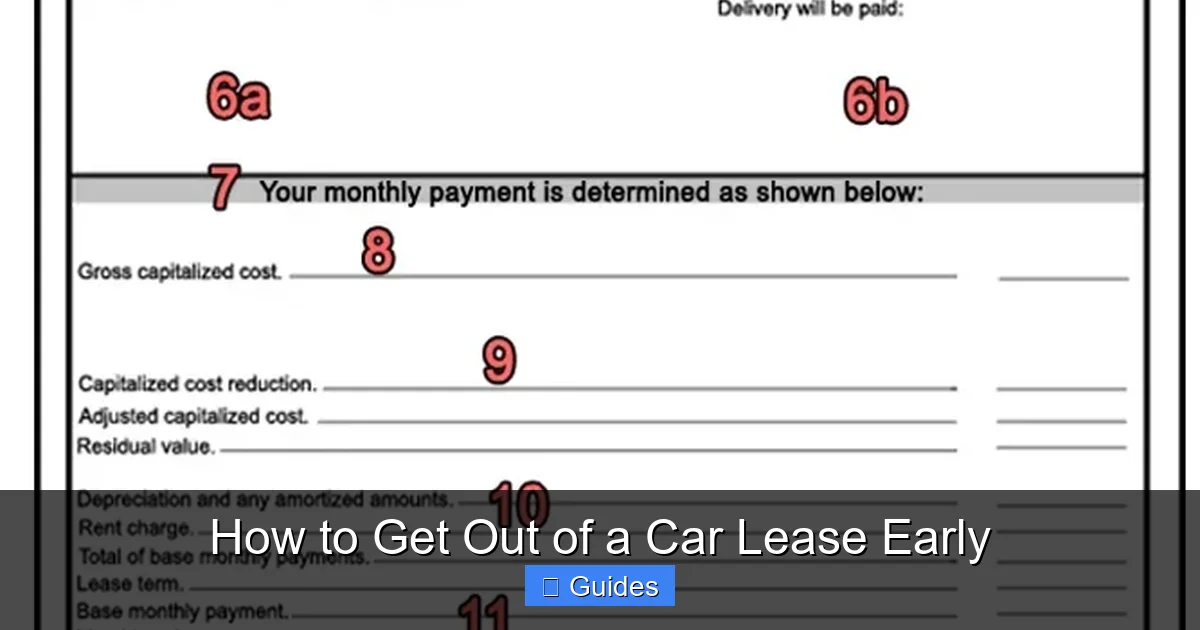

Option 2: Buy Out the Lease Early

Visual guide about How to Get Out of a Car Lease Early

Image source: templatearchive.com

Another way to get out of a car lease early is to **buy the vehicle outright**. This ends your lease immediately and gives you full ownership of the car.

How a Lease Buyout Works

When you lease a car, the leasing company estimates its value at the end of the term—this is called the **residual value**. At any point, you can purchase the car for that amount, plus any applicable taxes and fees.

For example, if your lease ends in 12 months and the residual value is $18,000, you can buy the car today for $18,000 (plus fees), even if you’re halfway through the lease.

Why Buy the Car?

You might consider a buyout if:

– The car is worth more than the residual value (you’re getting a deal).

– You love the car and want to keep it long-term.

– You plan to sell it later for a profit.

– You’re trading it in at a dealership for a new vehicle.

Steps to Buy Out Your Lease

1. **Contact Your Leasing Company**: Ask for the current payoff amount (residual value + fees).

2. **Get a Vehicle Appraisal**: Use tools like Kelley Blue Book or Edmunds to see what the car is worth on the open market.

3. **Decide How to Pay**: You can pay cash, finance the buyout, or roll it into a new loan.

4. **Complete the Purchase**: Sign the title transfer and registration documents.

Example: Buying to Trade In

Mike leased a 2020 BMW X3 with a residual value of $22,000. After 24 months, he found a 2023 model he loved. He bought out his lease for $22,500 (including fees), then traded the X3 in at a dealership. The dealer offered $24,000—netting Mike a $1,500 profit and a smooth transition to his new car.

Watch Out for Hidden Costs

Buying out your lease isn’t always the cheapest option. You’ll still pay:

– Sales tax (in most states)

– Title and registration fees

– Possible early buyout fees

Always compare the total cost to other exit strategies before deciding.

Option 3: Negotiate with Your Leasing Company

Sometimes, the best way to get out of a car lease early is to **talk directly to your lender**. Many leasing companies would rather work with you than risk you defaulting or damaging the car.

When to Negotiate

Consider negotiation if:

– You’re facing financial hardship (job loss, medical bills, etc.).

– You’ve found a buyer but need the lender to waive fees.

– You’re willing to pay a lump sum to end the lease.

How to Approach the Conversation

Be honest, polite, and prepared. Here’s a script you can use:

> “Hi, I’m [Your Name], and I currently lease a [Year Make Model]. Due to [reason—e.g., job relocation, financial changes], I need to end my lease early. I’d like to discuss my options. Are there any programs or settlements available to help me exit without major penalties?”

What to Ask For

– **Early termination settlement**: A reduced lump-sum payment to end the lease.

– **Payment deferral or modification**: Temporary relief if you’re struggling but plan to continue.

– **Waiver of fees**: Ask if they’ll drop the disposition or transfer fee.

– **Lease extension with lower payments**: If you can’t leave yet, ask to stretch the term.

Real Example: A Win-Win Deal

Lisa lost her job and couldn’t afford her $450/month lease on a 2022 Nissan Altima. She called her lender and explained her situation. The company offered her a deal: pay 50% of the remaining 12 payments ($2,700) and return the car. Lisa saved $2,700 compared to the full termination fee and avoided default.

Option 4: Trade In the Leased Vehicle

If you’re planning to get a new car anyway, **trading in your leased vehicle** can be a smart way to exit early.

How It Works

1. Visit a dealership and get an appraisal for your leased car.

2. The dealer will contact your leasing company to arrange the payoff.

3. If the car is worth more than the residual value, you can use the equity toward your new car.

4. If it’s worth less, you may need to pay the difference (called “negative equity”).

Benefits of Trading In

– One-stop solution: end your old lease and start a new one.

– Potential to roll equity into your next vehicle.

– No need to find a private buyer or handle paperwork.

Things to Watch For

– **Negative equity**: If your car is worth less than the payoff amount, you’ll owe the difference. Some dealers will roll this into your new loan, but it increases your debt.

– **Fees**: The dealer may charge a transfer or documentation fee.

– **Credit check**: You’ll need good credit to qualify for a new lease or loan.

Example: Trading Up

James leased a 2021 Ford Escape with a residual value of $16,000. After 20 months, he found a 2023 model he loved. The dealer appraised his Escape at $17,500—$1,500 above the payoff. He used that equity as a down payment on his new lease and walked away with no out-of-pocket cost.

Option 5: Use a Lease Buyout Company

If you’re struggling to find a buyer or negotiate with your lender, **third-party lease buyout companies** can help.

What They Do

These companies specialize in purchasing leased vehicles—either to resell or to transfer the lease to a new buyer. They handle the paperwork, pay the leasing company, and often offer you a fair market value.

Popular Services

– **LeaseFetcher**: Buys out leases and resells the cars.

– **LeaseExit**: Helps you transfer or buy out your lease with minimal hassle.

– **CarLeaseTrader**: Connects you with buyers and handles the transfer.

Pros and Cons

Pros:

– Fast and convenient.

– No need to find a buyer yourself.

– Can get cash for your lease equity.

Cons:

– May offer less than private sale value.

– Fees can reduce your payout.

– Not all companies are reputable—research carefully.

Tip: Get Multiple Quotes

Always compare offers from at least two companies. Some may lowball you, while others offer competitive rates. Check reviews on Trustpilot or the BBB before signing anything.

Avoid These Common Mistakes

Even with the best intentions, people often make errors that cost them time and money. Here’s what to avoid:

Defaulting on Payments

Missing payments doesn’t end your lease—it damages your credit and can lead to repossession. Always explore legal exit options first.

Ignoring the Fine Print

Assuming you can just return the car early? Think again. Most leases require written notice and specific procedures.

Selling the Car Privately Without Permission

You don’t own the car, so you can’t sell it without the leasing company’s approval. Doing so could result in legal action.

Not Documenting Agreements

If you negotiate a deal, get it in writing. Verbal promises aren’t enforceable.

Final Thoughts: Choose the Right Path for You

Getting out of a car lease early is possible—but it requires strategy, patience, and attention to detail. Whether you transfer the lease, buy the car, or negotiate a settlement, the key is to act early and communicate openly with your lender.

Remember: every lease is different, and every situation is unique. What works for one person might not work for another. Take the time to review your options, compare costs, and choose the path that best fits your financial and personal goals.

And if you’re ever unsure, don’t hesitate to consult a financial advisor or attorney. A small investment in professional advice can save you thousands in the long run.

You’ve got this. With the right plan, you can exit your lease early—and move on to your next adventure.

Frequently Asked Questions

Can I get out of a car lease early without a penalty?

It depends on your lease agreement and the method you use. Some options, like lease transfer or buyout, may still involve fees, but they’re often lower than defaulting. Always check your contract and talk to your lender.

What happens if I just stop making payments?

Stopping payments can lead to repossession, damage to your credit score, and legal action. It’s always better to explore legal exit strategies like lease transfer or negotiation.

Can I trade in a leased car before the lease ends?

Yes, many dealerships allow early trade-ins. They’ll pay off your lease and apply any equity toward your new vehicle. Just be aware of potential negative equity or fees.

How much does it cost to transfer a lease?

Transfer fees typically range from $200 to $600, depending on the leasing company. Some platforms also charge listing or service fees, so read the terms carefully.

Can I buy my leased car early?

Yes, you can purchase the car at any time for the residual value plus fees. This ends the lease immediately and gives you ownership.

Will getting out of a lease early hurt my credit?

Exiting legally—through transfer, buyout, or settlement—won’t hurt your credit. But defaulting or missing payments will. Always communicate with your lender to avoid negative marks.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.