Choosing between leasing and financing a car depends on your financial goals, driving habits, and lifestyle preferences. Leasing offers lower monthly payments and the chance to drive a new vehicle every few years, while financing builds equity and gives you full ownership. Understanding the pros, cons, and hidden costs of each option helps you make a confident, informed decision.

Buying a car is one of the biggest financial decisions most people make—right after purchasing a home. But before you even start test-driving vehicles, you’ll face a critical choice: should you lease or finance a car? It’s a question that trips up even savvy shoppers. Both options have their perks and pitfalls, and the right answer depends on your personal situation, driving habits, and financial goals.

At first glance, leasing might seem like the easier path. Lower monthly payments, minimal down payments, and the thrill of driving a brand-new vehicle every few years sound pretty appealing. On the other hand, financing—taking out a loan to buy the car—means higher monthly costs upfront, but you eventually own the vehicle outright. No more payments, no mileage restrictions, and the freedom to modify or sell it as you please. Sounds great, right? But it’s not that simple.

The truth is, there’s no one-size-fits-all answer. What works for a busy commuter who drives 20,000 miles a year might be a terrible fit for someone who only uses their car for weekend trips. Your credit score, income stability, and how long you plan to keep the vehicle all play a role. And let’s not forget the fine print: early termination fees, excess wear charges, and depreciation rates can quietly eat into your savings if you’re not careful.

In this guide, we’ll break down everything you need to know about leasing versus financing a car. We’ll compare costs, explore real-life examples, and help you weigh the long-term implications of each choice. By the end, you’ll have the clarity and confidence to pick the option that truly fits your life—not just your budget.

In This Article

Key Takeaways

- Leasing typically has lower monthly payments than financing, making it attractive for those who want a newer car without a large upfront cost.

- Financing a car means you own it outright after the loan is paid off, allowing unlimited mileage, customization, and long-term savings.

- Leases come with mileage limits and wear-and-tear fees, which can add up if you drive a lot or aren’t careful with the vehicle.

- Down payments, interest rates, and credit scores affect both options, so improving your credit can save you thousands over time.

- Leasing may include maintenance packages and warranty coverage, reducing out-of-pocket repair costs during the lease term.

- Financing builds equity in the vehicle, which can be used as a trade-in or sold later for cash.

- Your long-term plans matter: if you like driving new cars every 2–3 years, leasing might suit you; if you keep cars for 5+ years, financing is usually better.

📑 Table of Contents

Understanding Car Leasing

Leasing a car is essentially renting it for a fixed period, usually 24 to 36 months. You pay for the vehicle’s depreciation during that time, plus interest and fees, but you never own it. At the end of the lease, you return the car—or sometimes buy it at a predetermined price. Think of it like a long-term rental with strict rules.

One of the biggest draws of leasing is the lower monthly payment. Because you’re only paying for the car’s loss in value during the lease term (not the full price), your payments are typically 20% to 40% lower than financing the same vehicle. For example, leasing a $35,000 SUV might cost $350 per month, while financing it could run $550 or more. That extra $200 a month can make a big difference in your monthly budget, especially if you’re juggling other expenses like student loans or childcare.

Leasing also appeals to people who love driving the latest models. With a lease, you can upgrade to a new car every two or three years and enjoy the latest safety features, tech upgrades, and styling. Many leases also include manufacturer warranty coverage for the entire term, so major repairs are often covered. Some luxury brands even bundle maintenance and roadside assistance into the lease, giving you peace of mind without extra hassle.

But leasing isn’t all smooth sailing. Most leases come with mileage limits—typically 10,000 to 15,000 miles per year. If you go over, you’ll pay a per-mile fee, usually between $0.10 and $0.25. For someone who commutes long distances or takes frequent road trips, those extra charges can add up fast. And while you might not care about dings and scratches when you’re returning the car, leases often charge for “excessive wear and tear,” like deep scratches, torn upholstery, or heavily stained carpets.

Another hidden cost? Early termination fees. If you need to end your lease early—say, because you’re moving abroad or switching jobs—you could face penalties that cost thousands of dollars. And unlike financing, you don’t build any equity in the vehicle. Once the lease ends, you walk away with nothing to show for your payments.

Who Should Consider Leasing?

Leasing makes the most sense for people who:

- Want lower monthly payments and can stay within mileage limits

- Prefer driving a new car every few years with the latest features

- Don’t want to deal with long-term maintenance or repair costs

- Have stable income and can commit to a 2–4 year contract

- Don’t plan to customize or heavily modify their vehicle

For example, Sarah, a marketing manager in Chicago, leases a compact luxury sedan. She drives about 12,000 miles a year, mostly for work and weekend errands. She loves having a reliable, stylish car with advanced safety tech and doesn’t want the hassle of selling it later. For her, leasing fits perfectly.

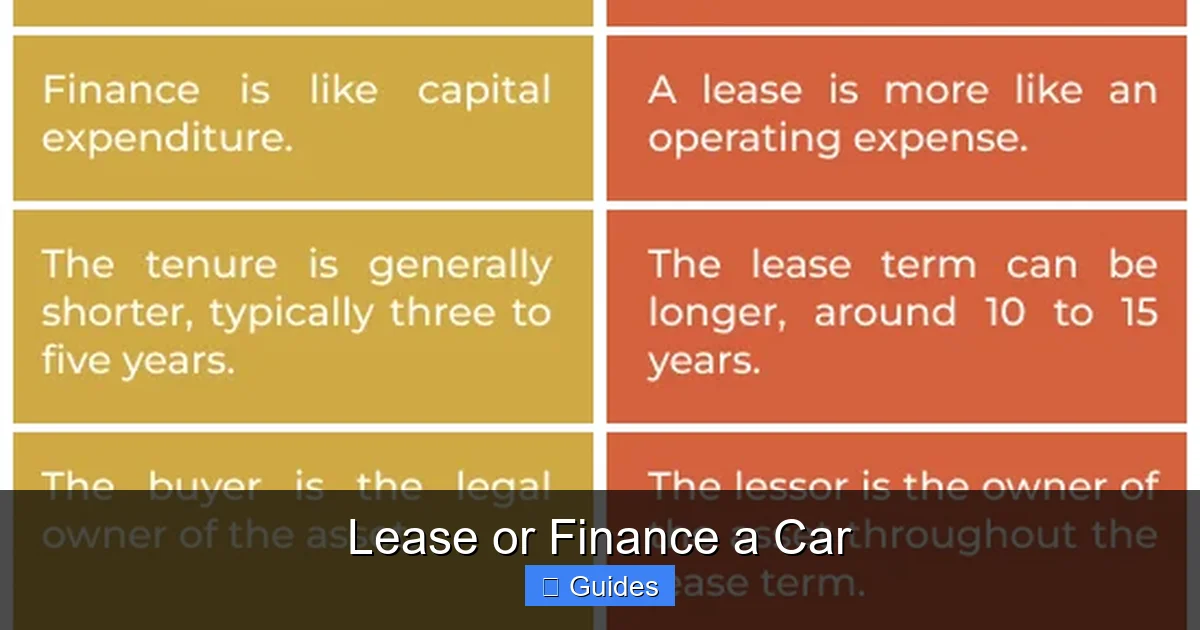

Understanding Car Financing

Visual guide about Lease or Finance a Car

Image source: thefinancesection.com

Financing a car means taking out a loan to purchase it. You make monthly payments over a set term—usually 36 to 72 months—and once the loan is paid off, the car is yours. Unlike leasing, financing builds equity in the vehicle, meaning you own an asset that you can sell, trade, or keep indefinitely.

The biggest advantage of financing is ownership. Once you’ve paid off the loan, you’re free of monthly payments and can enjoy years of “free” driving. You also have complete freedom: no mileage limits, no restrictions on modifications, and no fear of wear-and-tear fees. Want to install a roof rack, paint the car, or drive cross-country every summer? Go for it.

Financing also tends to be more cost-effective in the long run—if you keep the car for several years after the loan ends. While monthly payments are higher than leasing, you’re investing in an asset that retains some value. According to industry data, the average car is kept for about 8 years, and many owners keep their vehicles well beyond the loan term. That means you could save thousands compared to continuously leasing new cars.

Another benefit? You can sell or trade in the car at any time. If you find a better deal or your needs change, you have options. And if you’ve built up equity, you might even get a nice chunk of cash back.

But financing isn’t without drawbacks. Higher monthly payments can strain your budget, especially if you’re buying a more expensive vehicle. And if you sell the car before the loan is paid off, you might owe more than it’s worth—a situation known as being “upside down” on your loan. This is common with long loan terms (60+ months) and rapid depreciation, especially with new cars.

Depreciation is another factor. New cars lose about 20% of their value the moment you drive them off the lot and up to 50% after three years. If you finance a brand-new car and sell it after a few years, you could lose a significant amount of money. That’s why some buyers opt for certified pre-owned (CPO) vehicles—they’ve already taken the biggest depreciation hit, but still come with warranties and lower price tags.

Who Should Consider Financing?

Financing is ideal for people who:

- Plan to keep their car for 5+ years

- Drive more than 15,000 miles per year

- Want to customize or modify their vehicle

- Prefer building equity and owning an asset

- Have a stable income and can handle higher monthly payments

Take James, a teacher from Austin. He bought a reliable used SUV with a 5-year loan. He drives about 18,000 miles a year for work and family trips. After paying off the loan, he plans to keep the car for another 5 years. For him, financing saves money and gives him full control over his vehicle.

Cost Comparison: Lease vs. Finance

Visual guide about Lease or Finance a Car

Image source: logosandbrands.directory

Let’s put leasing and financing head-to-head with a real-world example. Say you’re looking at a 2024 Honda Accord EX, priced at $32,000.

If you lease it for 36 months with a $3,000 down payment and 12,000 miles per year, your monthly payment might be around $320. At the end of the lease, you return the car. Total out-of-pocket cost: about $14,520 ($320 x 36 + $3,000).

Now, if you finance the same car with a $5,000 down payment and a 60-month loan at 5% interest, your monthly payment could be around $520. After 5 years, you own the car outright. Total cost: about $36,200 ($520 x 60 + $5,000). But remember—you now own a vehicle worth roughly $18,000 (after depreciation), so your net cost is closer to $18,200.

Over the same 3-year period, the lease costs less upfront. But if you keep the financed car for 8 years, your total cost drops significantly—especially since you’re not making payments after year 5. Meanwhile, if you lease again after 3 years, you’re back to paying $320+ per month with no equity.

Hidden Costs to Watch For

Both leasing and financing come with fees that can sneak up on you:

- Acquisition fees: Charged at the start of a lease (typically $500–$1,000).

- Disposition fees: Paid when returning a leased car (around $400).

- Prepayment penalties: Some loans charge fees for paying off early.

- Documentation fees: Added by dealerships (can be $300–$800).

- Gap insurance: Recommended for both options to cover the difference if the car is totaled.

Always read the fine print and ask for a full breakdown of all costs before signing.

How Your Credit Score Affects Your Options

Visual guide about Lease or Finance a Car

Image source: companieslogo.com

Your credit score plays a major role in both leasing and financing. A higher score means lower interest rates, better terms, and more negotiating power.

For leasing, lenders (called lessors) check your credit to determine your monthly payment and whether you qualify. A score above 720 usually gets you the best rates. Below 650, you might face higher payments or be required to make a larger down payment.

With financing, your credit score directly affects your annual percentage rate (APR). For example, on a $30,000 loan over 60 months:

- Excellent credit (720+): ~4% APR → $552/month

- Good credit (660–719): ~6% APR → $579/month

- Fair credit (600–659): ~10% APR → $637/month

- Poor credit (below 600): ~15% APR → $718/month

That’s a difference of nearly $170 per month—over $10,000 over the life of the loan. Improving your credit before applying can save you thousands.

Tips to Boost Your Chances

- Check your credit report for errors and dispute inaccuracies

- Pay down credit card balances to lower your credit utilization

- Avoid applying for new credit in the months before buying

- Consider a co-signer if your score is low but income is stable

Even small improvements can open doors to better deals.

Long-Term Financial Impact

When deciding between lease or finance a car, think beyond the monthly payment. Consider the total cost of ownership over 5, 8, or 10 years.

Leasing keeps you in a cycle of payments. Every 2–3 years, you’re back at the dealership signing a new contract. Over a decade, that could mean paying for four different leases with no asset to show for it. However, if you value driving new cars and can afford the ongoing expense, this lifestyle may be worth it.

Financing, on the other hand, leads to a period of payment-free ownership. After the loan ends, you’re only responsible for insurance, fuel, and maintenance—costs that are predictable and often lower than lease payments. Over time, this can result in significant savings.

Let’s say you finance a $30,000 car and keep it for 10 years. After 5 years of payments, you own it. For the next 5 years, you save $500+ per month compared to leasing. That’s $30,000 in savings—money you can put toward retirement, a home, or your kids’ education.

But remember: maintenance costs rise as cars age. While newer leased cars are under warranty, older financed vehicles may need costly repairs. Budget for routine maintenance and set aside $500–$1,000 per year for unexpected issues.

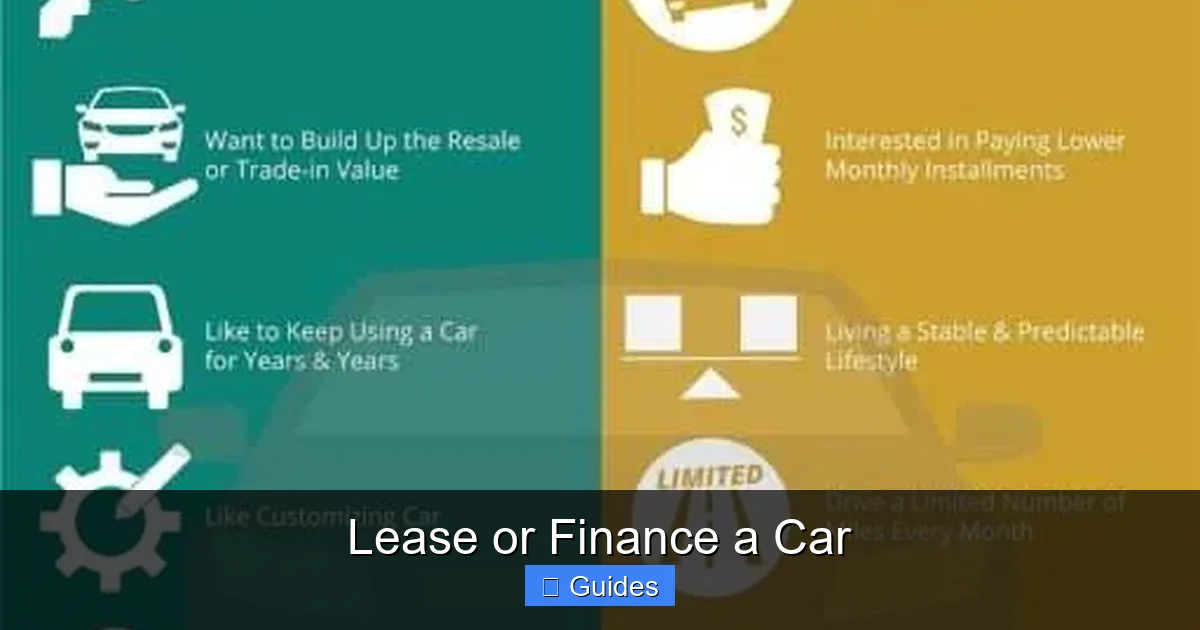

Making the Right Choice for Your Lifestyle

Ultimately, the decision to lease or finance a car comes down to your priorities.

If you:

- Value lower monthly payments and driving new cars

- Stay within mileage limits and treat your car well

- Don’t mind not owning the vehicle

Then leasing might be your best bet.

But if you:

- Drive a lot or plan to keep your car long-term

- Want to build equity and avoid endless payments

- Enjoy customizing or using your car freely

Then financing is likely the smarter financial move.

Don’t forget to consider your future. Are you planning a family? Changing jobs? Moving to a rural area with long commutes? These life changes can affect your transportation needs and should influence your decision.

Final Tips Before You Decide

- Get pre-approved for a loan from your bank or credit union before visiting the dealership

- Compare lease offers from multiple dealers—terms can vary widely

- Negotiate the capitalized cost (price of the car) just like you would when buying

- Ask about lease-end options: can you buy the car? Extend the lease?

- Use online calculators to model total costs over time

And remember: the cheapest monthly payment isn’t always the best deal. Look at the big picture.

Conclusion

Choosing whether to lease or finance a car isn’t just about numbers—it’s about aligning your decision with your lifestyle, values, and long-term goals. Leasing offers convenience, lower payments, and the joy of driving something new, while financing builds ownership, freedom, and long-term savings.

There’s no universal right answer, but there is a right answer for you. By understanding the costs, restrictions, and benefits of each option, you can make a confident choice that supports your financial health and driving needs.

Take your time, do your research, and don’t let sales pressure rush you. Whether you drive off in a leased luxury sedan or a financed family SUV, the best car deal is the one that fits your life—not just your budget.

Frequently Asked Questions

Is it better to lease or finance a car?

It depends on your financial situation and driving habits. Leasing is better if you want lower payments and enjoy driving new cars every few years. Financing is better if you plan to keep the car long-term and want to build equity.

Can I negotiate a lease deal?

Yes, you can negotiate the capitalized cost (price of the car), money factor (interest rate), and other terms—just like when buying. Dealers often advertise attractive lease payments, but the underlying price may still be negotiable.

What happens if I go over my lease mileage limit?

You’ll be charged a per-mile fee, usually between $0.10 and $0.25. For example, driving 2,000 extra miles could cost $200–$500. Some leases offer mileage buy-up options at signing to avoid this.

Can I pay off a car loan early?

Yes, most loans allow early payoff without penalty—but check your contract. Paying off early saves on interest and frees up your monthly budget faster.

Do I need gap insurance when leasing or financing?

Yes, it’s highly recommended. Gap insurance covers the difference between what you owe and the car’s value if it’s totaled or stolen. This is especially important in the early years of a loan or lease when depreciation is steep.

Can I lease a used car?

Yes, some dealerships and leasing companies offer certified pre-owned (CPO) vehicles for lease. These often come with warranties and lower prices than new cars, making them a smart middle ground.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.