Leasing a car offers lower monthly payments, access to newer vehicles, and fewer maintenance worries compared to buying. It’s a flexible, cost-effective option for drivers who want the latest features without long-term ownership commitments.

[FEATURED_IMAGE_PLACEOLDER]

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Are the Advantages of Leasing a Car?

- 4 Lower Monthly Payments: Stretch Your Budget Further

- 5 Drive Newer Cars with the Latest Features

- 6 Warranty Coverage and Lower Maintenance Costs

- 7 No Resale or Trade-In Hassles

- 8 Tax Benefits for Business Use

- 9 Predictable Costs and Financial Flexibility

- 10 Conclusion

- 11 Frequently Asked Questions

Key Takeaways

- Lower Monthly Payments: Lease payments are typically 30–50% lower than loan payments for the same vehicle, freeing up your budget.

- Drive Newer Cars More Often: Most leases last 2–4 years, letting you upgrade to a new model with the latest tech and safety features.

- Warranty Coverage: Leased vehicles are usually under manufacturer warranty, meaning major repairs are covered during your lease term.

- No Resale Hassle: At the end of the lease, you simply return the car—no need to sell or trade it in.

- Tax Benefits for Businesses: Businesses can often deduct lease payments as a business expense, reducing taxable income.

- Lower Down Payments: Many leases require little or no down payment, making it easier to get behind the wheel quickly.

- Predictable Costs: With fixed monthly payments and known mileage limits, leasing offers financial predictability.

📑 Table of Contents

What Are the Advantages of Leasing a Car?

So, you’re thinking about getting a new car—but you’re not sure whether to buy or lease. It’s a common dilemma, and one that millions of drivers face each year. While buying a car means owning it outright (after paying off the loan), leasing is more like renting it for a set period, usually two to four years. And while both options have their pros and cons, leasing has become an increasingly popular choice—especially for people who value flexibility, lower costs, and driving the latest models.

One of the biggest reasons people choose to lease is the financial advantage. Monthly lease payments are almost always lower than loan payments for the same vehicle. That’s because you’re only paying for the car’s depreciation during the lease term, plus fees and interest—not the full value of the car. This means you can drive a more expensive or higher-end vehicle for less money each month. Plus, many leases require little or no down payment, making it easier to get into a new car without draining your savings.

But the benefits go beyond just cost. Leasing also gives you access to newer technology, better safety features, and fewer repair worries—since most leased cars are still under warranty. And when the lease ends? You simply return the car and walk away, no strings attached. No need to worry about selling it, trading it in, or dealing with depreciation. It’s a clean, simple process that fits well with modern, fast-paced lifestyles.

In this guide, we’ll dive deep into the advantages of leasing a car, breaking down why it might be the right choice for you. Whether you’re a first-time lessee or just exploring your options, we’ll cover everything from cost savings and convenience to tax benefits and lifestyle perks. By the end, you’ll have a clear understanding of what leasing offers—and whether it aligns with your driving habits and financial goals.

Lower Monthly Payments: Stretch Your Budget Further

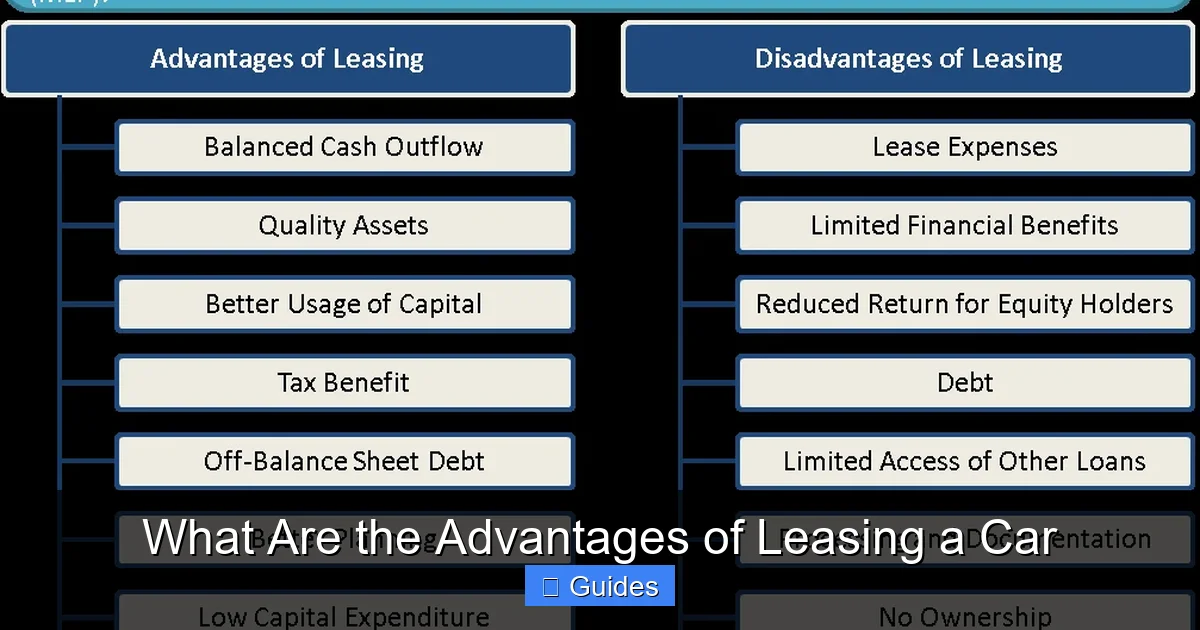

Visual guide about What Are the Advantages of Leasing a Car

Image source: efinancemanagement.com

Let’s talk money—because when it comes to choosing between leasing and buying, your budget is often the deciding factor. One of the most compelling advantages of leasing a car is the significantly lower monthly payment. On average, lease payments are 30% to 50% less than what you’d pay for a loan on the same vehicle. That’s a huge difference, especially if you’re driving a luxury sedan, SUV, or high-performance car.

Why are lease payments so much lower? It all comes down to what you’re actually paying for. When you buy a car with a loan, you’re financing the entire value of the vehicle (minus your down payment). But when you lease, you’re only paying for the car’s depreciation during the lease term—typically 24 to 36 months—plus a finance charge and fees. Since depreciation is the biggest cost of owning a car in the first few years, leasing lets you avoid paying for the full value upfront.

For example, imagine you’re looking at a $40,000 SUV. If you finance it with a 60-month loan at 5% interest, your monthly payment might be around $750. But if you lease the same SUV for 36 months with a 10,000-mile annual limit, your monthly payment could drop to around $450—over $300 less per month. That extra $300 could go toward savings, vacations, or even upgrading to a higher trim level with better features.

Another financial perk? Lower down payments. Many lease deals require little or nothing down—sometimes as little as $2,000 or even $0 at signing. Compare that to buying, where a 10% to 20% down payment on a $40,000 car would be $4,000 to $8,000. Leasing lets you keep more cash in your pocket while still driving a brand-new vehicle.

And don’t forget about sales tax. In many states, you only pay sales tax on the monthly lease payments, not the full value of the car. This can add up to significant savings over time. For instance, in a state with a 7% sales tax, you’d pay tax on $450 per month instead of $40,000 upfront—saving you hundreds of dollars.

Of course, lower payments don’t mean free driving. You’ll still have to stick to mileage limits, maintain the car, and return it in good condition. But for many drivers, the monthly savings make leasing a smart financial move—especially if you don’t plan to keep the car long-term.

Drive Newer Cars with the Latest Features

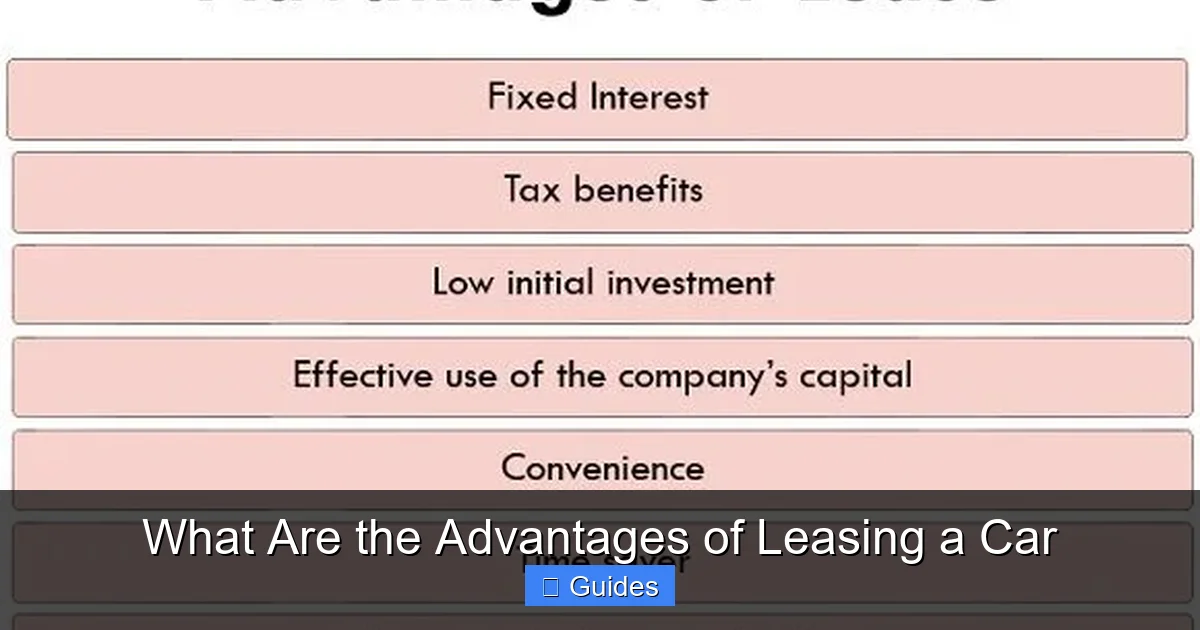

Visual guide about What Are the Advantages of Leasing a Car

Image source: theinvestorsbook.com

Let’s be honest—driving a brand-new car feels amazing. The smooth ride, the fresh scent, the responsive handling—it’s a experience that gets old fast. But when you buy a car, you’re stuck with it for years, even as newer models roll out with better tech, improved fuel efficiency, and advanced safety systems. Leasing, on the other hand, lets you enjoy that “new car” feeling again and again—every two to four years.

One of the biggest advantages of leasing a car is the ability to upgrade frequently. Most lease terms range from 24 to 36 months, which means you can trade in your current lease for a new model just as the latest versions hit the market. This is perfect for tech lovers, safety-conscious drivers, or anyone who simply enjoys having the newest ride on the block.

Take electric vehicles (EVs), for example. The EV market is evolving rapidly, with new models offering longer ranges, faster charging, and smarter features every year. If you buy an EV today, you might be driving a outdated model in just two years. But if you lease, you can switch to the latest version as soon as your lease ends—keeping you ahead of the curve without the hassle of selling your old car.

The same goes for safety technology. Features like adaptive cruise control, lane-keeping assist, blind-spot monitoring, and automatic emergency braking are becoming standard—but only on newer models. By leasing, you ensure your car is always equipped with the most up-to-date safety systems, giving you and your passengers extra peace of mind on the road.

And let’s not forget about infotainment and connectivity. Modern cars come with large touchscreens, wireless Apple CarPlay and Android Auto, premium sound systems, and even over-the-air software updates. These features enhance your driving experience and make daily commutes more enjoyable. With a lease, you’re more likely to have access to these amenities without paying a premium for them upfront.

Another bonus? Newer cars are generally more fuel-efficient and environmentally friendly. Whether you’re driving a hybrid, a plug-in, or a traditional gasoline engine, newer models are designed to use less fuel and produce fewer emissions. Leasing lets you take advantage of these improvements without being tied to an older, less efficient vehicle.

Of course, frequent upgrades mean you’ll never “own” your car—but for many drivers, that’s not a drawback. In fact, it’s a feature. You get to enjoy the best of what the automotive world has to offer, without the long-term commitment or depreciation worries. It’s like having a rotating wardrobe of cars, tailored to your lifestyle and preferences.

Warranty Coverage and Lower Maintenance Costs

One of the most overlooked advantages of leasing a car is the built-in protection that comes with warranty coverage. Most new cars come with a manufacturer’s warranty that covers repairs for 3 years or 36,000 miles—sometimes longer for powertrain components. Since lease terms typically fall within this window, you’ll likely enjoy full warranty protection for the entire duration of your lease.

This means that if something goes wrong—whether it’s a faulty transmission, a malfunctioning infotainment system, or an electrical issue—you won’t have to pay out of pocket. The dealership or manufacturer will cover the repair, often at no cost to you. That’s a huge relief, especially when you consider that unexpected repairs can cost hundreds or even thousands of dollars.

For example, imagine your leased SUV develops a problem with its turbocharger at 20,000 miles. If you owned the car, you might be facing a $1,500 repair bill. But since it’s under warranty, the dealer fixes it for free. That’s money you can keep in your pocket—or put toward your next lease.

Even routine maintenance is often covered or discounted during a lease. Many automakers offer complimentary maintenance programs for the first few years, including oil changes, tire rotations, and brake inspections. Some lease deals even include prepaid maintenance packages, so you don’t have to worry about budgeting for these services.

This level of coverage makes leasing especially appealing for drivers who want to avoid the stress and cost of car repairs. You get to drive a reliable, well-maintained vehicle without the fear of surprise expenses. And since leased cars are typically low-mileage and well-cared-for, they’re less likely to develop major issues in the first place.

Another benefit? You’re not responsible for long-term wear and tear. When you buy a car, you’re on the hook for repairs once the warranty expires—and those costs can add up quickly as the vehicle ages. But with a lease, you return the car before it reaches that point, passing the burden of aging components to the leasing company.

Of course, you’re still expected to follow the manufacturer’s maintenance schedule and keep the car in good condition. But as long as you do that, you’ll enjoy a hassle-free driving experience with minimal out-of-pocket costs.

No Resale or Trade-In Hassles

Let’s face it—selling a car is a pain. Whether you’re trading it in at a dealership or trying to sell it privately, the process can be time-consuming, stressful, and unpredictable. You have to clean it, fix minor issues, take photos, write a listing, respond to inquiries, negotiate prices, and handle paperwork. And even then, you might not get what you think the car is worth.

One of the biggest advantages of leasing a car is that you skip all of that. When your lease ends, you simply return the vehicle to the dealership—no selling, no haggling, no waiting for a buyer. It’s as easy as dropping off the keys and signing a few forms. The leasing company handles the resale, whether through auction, direct sale, or trade-in to another customer.

This is especially helpful if your car has depreciated more than expected. When you buy a car, you bear the full risk of depreciation. If the market shifts or the model loses popularity, you could end up owing more than the car is worth—a situation known as being “upside-down” on your loan. But with a lease, the leasing company absorbs that risk. You only pay for the depreciation during your term, and they deal with the rest.

For example, say you lease a luxury sedan that loses 50% of its value in three years. You’ve already paid for that depreciation through your monthly payments. When the lease ends, the leasing company takes the car back and sells it, regardless of market conditions. You walk away clean—no debt, no hassle.

And if you love your leased car and want to keep it? Most leases offer a buyout option at the end of the term. You can purchase the vehicle at its predetermined residual value, which is set when you sign the lease. This gives you flexibility—you can return it, lease a new one, or buy it outright, depending on your needs.

This simplicity is a major reason why leasing appeals to busy professionals, families, and anyone who values convenience. You get the benefits of driving a new car without the long-term responsibilities of ownership. It’s a clean, straightforward process that fits modern lifestyles.

Tax Benefits for Business Use

If you use your car for business, leasing can offer significant tax advantages that buying simply can’t match. For self-employed individuals, freelancers, and small business owners, this can mean thousands of dollars in savings each year.

One of the biggest benefits is the ability to deduct lease payments as a business expense. If you use your leased vehicle for work—whether it’s client meetings, deliveries, or site visits—you can write off a portion of your monthly payments based on your business use percentage. For example, if you use the car 70% for business, you can deduct 70% of each lease payment.

This deduction reduces your taxable income, which in turn lowers your overall tax bill. Depending on your tax bracket, this could save you hundreds of dollars per month. And unlike depreciation deductions for purchased vehicles—which are limited and complex—lease deductions are straightforward and easy to claim.

Another advantage? You may be able to deduct additional costs related to the lease, such as insurance, maintenance, and even mileage (if you choose the standard mileage rate method). These deductions can further reduce your tax burden and improve your cash flow.

For businesses, leasing also offers flexibility. You can lease multiple vehicles for employees, update your fleet regularly, and avoid the long-term commitment of ownership. This is especially useful for companies that need reliable transportation but don’t want to tie up capital in depreciating assets.

Of course, tax rules vary by country and state, so it’s important to consult a tax professional. But for many business owners, the tax benefits of leasing make it a smart financial strategy—one that supports growth while minimizing costs.

Predictable Costs and Financial Flexibility

One of the most underrated advantages of leasing a car is the predictability it offers. When you lease, your monthly payment is fixed for the entire term—no surprises, no fluctuations. This makes budgeting easier and helps you plan your finances with confidence.

Unlike buying, where you might face unexpected repair bills or rising insurance costs, leasing keeps your expenses stable. You know exactly what you’ll pay each month, and you’re protected from major mechanical failures thanks to warranty coverage. This stability is especially valuable for people on fixed incomes, freelancers with irregular earnings, or families managing tight budgets.

Leasing also offers financial flexibility. Since you’re not tied to a long-term loan, you can adjust your vehicle needs as your life changes. Need a bigger car for a growing family? Lease an SUV. Starting a new job with a longer commute? Switch to a more fuel-efficient model. With leasing, you’re not locked into one vehicle for a decade—you can adapt as needed.

And if your financial situation changes, many leases offer early termination options (though fees may apply). This gives you an exit strategy if you lose your job, move, or simply decide you no longer need the car.

In short, leasing provides a balance of affordability, convenience, and control—making it a smart choice for drivers who value financial clarity and lifestyle flexibility.

Conclusion

Leasing a car isn’t just about driving something new—it’s about making a smart, flexible, and financially sound decision. From lower monthly payments and warranty protection to the freedom of upgrading every few years, the advantages of leasing a car are hard to ignore. Whether you’re a business owner looking for tax savings, a tech enthusiast wanting the latest features, or simply someone who values convenience and predictability, leasing offers a compelling alternative to traditional car ownership.

While it’s not the right choice for everyone—especially those who drive a lot or want to build equity in a vehicle—it’s an excellent option for millions of drivers. By understanding the benefits and aligning them with your lifestyle, you can make an informed decision that saves you money, reduces stress, and keeps you behind the wheel of a reliable, modern car.

So the next time you’re in the market for a new vehicle, don’t just consider buying. Take a closer look at leasing—and discover how it could be the perfect fit for you.

Frequently Asked Questions

Is leasing a car cheaper than buying?

Yes, leasing is often cheaper in the short term. Monthly payments are lower because you’re only paying for the car’s depreciation during the lease term, not its full value. However, you don’t build equity, so long-term costs may be higher if you lease repeatedly.

Can I lease a car with bad credit?

It’s possible, but it may be more difficult. Some leasing companies work with subprime borrowers, though you may face higher interest rates or require a larger down payment. Improving your credit before leasing can help you get better terms.

What happens at the end of a car lease?

At the end of the lease, you return the car to the dealership. You’ll be charged for excess mileage, wear and tear, or any damage beyond normal use. Alternatively, you can often buy the car at its residual value or lease a new one.

Are there mileage limits when leasing?

Yes, most leases include an annual mileage limit—typically 10,000 to 15,000 miles. Exceeding this limit results in per-mile charges, usually $0.10 to $0.25. Choose a lease with a mileage allowance that matches your driving habits.

Can I modify a leased car?

Generally, no. Modifications like aftermarket parts or custom paint can violate lease terms and result in fees. Always check with your leasing company before making any changes.

Is leasing better for business use?

Often, yes. Businesses can deduct lease payments as an expense, reducing taxable income. This makes leasing a cost-effective way to maintain a fleet without large upfront investments. Consult a tax advisor for specifics.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.