Leasing a car offers lower monthly payments, access to newer vehicles, and reduced maintenance worries—all without the long-term commitment of ownership. It’s a smart financial choice for drivers who want flexibility, advanced features, and predictable costs.

[FEATURED_IMAGE_PLACEOLDER]

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Are the Benefits of Leasing a Car?

- 4 Lower Monthly Payments: Stretch Your Budget Further

- 5 Drive Newer Cars More Often: Stay Ahead of the Curve

- 6 Warranty Coverage: Peace of Mind on the Road

- 7 Minimal Down Payment: Get Behind the Wheel Faster

- 8 Tax Advantages for Businesses: Save on Taxes

- 9 No Hassle of Selling: Skip the Stress

- 10 Predictable Monthly Costs: Budget with Confidence

- 11 Is Leasing Right for You?

- 12 Conclusion: The Smart Way to Drive

- 13 Frequently Asked Questions

Key Takeaways

- Lower Monthly Payments: Lease payments are typically 30–50% lower than loan payments for the same vehicle, freeing up your budget for other expenses.

- Drive Newer Cars More Often: Most leases last 2–4 years, so you can upgrade to a new model with the latest tech, safety, and fuel efficiency every few years.

- Warranty Coverage Included: Most leased vehicles are under manufacturer warranty for the entire lease term, meaning repairs are usually covered at no extra cost.

- Minimal Down Payment: Many leases require little or no down payment, making it easier to get into a new car with less upfront cash.

- Tax Advantages for Businesses: Businesses can often deduct lease payments as a business expense, reducing taxable income.

- No Hassle of Selling: At the end of the lease, simply return the car—no need to worry about depreciation, trade-ins, or private sales.

- Predictable Monthly Costs: With fixed payments and known mileage limits, leasing makes budgeting easier than unpredictable ownership costs.

📑 Table of Contents

- What Are the Benefits of Leasing a Car?

- Lower Monthly Payments: Stretch Your Budget Further

- Drive Newer Cars More Often: Stay Ahead of the Curve

- Warranty Coverage: Peace of Mind on the Road

- Minimal Down Payment: Get Behind the Wheel Faster

- Tax Advantages for Businesses: Save on Taxes

- No Hassle of Selling: Skip the Stress

- Predictable Monthly Costs: Budget with Confidence

- Is Leasing Right for You?

- Conclusion: The Smart Way to Drive

What Are the Benefits of Leasing a Car?

Thinking about your next vehicle? You’ve probably heard the terms “lease” and “buy” thrown around, but do you really know what leasing a car means—and why it might be the better choice for you?

Leasing a car is like renting it for a long-term period, usually two to four years. Instead of paying to own the vehicle outright, you pay for the portion of its value that you use during the lease term. At the end of the lease, you return the car to the dealership—no strings attached (as long as you’ve followed the terms). It’s a popular option for people who want to drive newer cars without the long-term financial commitment of ownership.

But is leasing right for everyone? Not necessarily. However, for many drivers—especially those who value flexibility, lower payments, and the latest technology—leasing offers a host of compelling benefits. From saving money each month to enjoying peace of mind with warranty coverage, leasing can be a smart, practical way to get behind the wheel of a great car.

In this guide, we’ll explore the top benefits of leasing a car in detail. Whether you’re a first-time lessee or just comparing your options, you’ll walk away with a clear understanding of how leasing works and why it might be the perfect fit for your lifestyle and budget.

Lower Monthly Payments: Stretch Your Budget Further

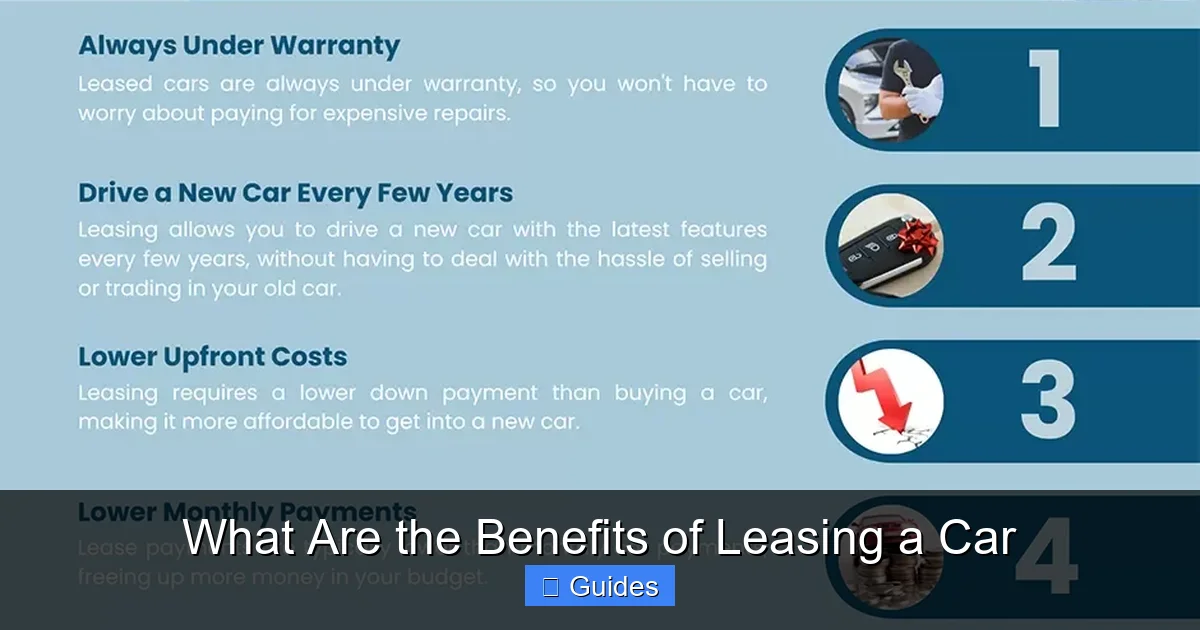

Visual guide about What Are the Benefits of Leasing a Car

Image source: eautolease.com

One of the biggest advantages of leasing a car is the significantly lower monthly payment compared to buying. Because you’re only paying for the vehicle’s depreciation during the lease term—not the full value—your monthly cost is much more manageable.

For example, let’s say you’re looking at a $40,000 SUV. If you finance it with a 60-month loan, you’re paying off the entire $40,000 plus interest. But if you lease it for 36 months, you’re only paying for the amount the car loses in value during those three years—typically around $15,000 to $20,000. That difference translates into hundreds of dollars saved each month.

How Lease Payments Are Calculated

Lease payments are based on three main factors:

- Depreciation: The difference between the car’s starting price and its estimated value at the end of the lease.

- Interest (Money Factor): The leasing company charges interest on the depreciation amount, similar to a loan APR.

- Fees and Taxes: Includes acquisition fees, disposition fees, and sales tax on the monthly payment.

Because you’re not paying for the full value of the car, your monthly out-of-pocket cost is much lower. This means you can afford a higher-end model or more features than you might be able to if you were buying.

Real-Life Example: Leasing vs. Buying

Let’s compare two scenarios for a 2024 Honda Accord EX-L:

- Buying: $38,000 purchase price, 60-month loan at 5% interest = ~$715/month

- Leasing: 36-month lease, $2,000 down, ~$399/month

That’s a savings of over $300 per month—money you could put toward savings, travel, or other financial goals. Over three years, that’s nearly $11,000 in extra cash flow.

Tips to Lower Your Lease Payment Even More

- Choose a longer lease term (e.g., 48 months instead of 36) to spread out depreciation.

- Negotiate the capitalized cost (the price of the car) just like you would when buying.

- Make a larger down payment (called a “cap cost reduction”) to reduce monthly payments.

- Look for lease specials or manufacturer incentives, which can lower the money factor or offer cash credits.

Lower payments don’t just mean more money in your pocket—they also reduce financial stress and give you greater flexibility in your monthly budget.

Drive Newer Cars More Often: Stay Ahead of the Curve

Visual guide about What Are the Benefits of Leasing a Car

Image source: talentproindia.com

Technology in cars is advancing faster than ever. From advanced driver-assistance systems (ADAS) like automatic emergency braking and lane-keeping assist to infotainment upgrades and electric powertrains, new features roll out every year. If you buy a car, you’re stuck with that model for years—even if better options become available.

Leasing solves this problem. Most leases last 24 to 36 months, meaning you can upgrade to a brand-new vehicle every few years. This gives you access to the latest safety tech, fuel efficiency improvements, and design trends without the hassle of selling or trading in an older car.

Enjoy the Latest Safety and Tech Features

Modern cars come packed with features that make driving safer and more enjoyable. When you lease, you’re almost always driving a vehicle that’s less than three years old—well within the window when these features are most advanced.

For example:

- Adaptive Cruise Control: Maintains a safe distance from the car ahead, reducing driver fatigue on long trips.

- Apple CarPlay and Android Auto: Seamlessly integrate your smartphone with the car’s infotainment system.

- Blind Spot Monitoring: Alerts you when a vehicle is in your blind spot, helping prevent accidents.

- Wireless Charging: Keeps your phone powered up without messy cables.

These aren’t just luxuries—they’re tools that improve safety, convenience, and overall driving experience. By leasing, you ensure you’re always driving a car equipped with the best available technology.

Switch Between Vehicle Types Easily

Life changes, and so do your vehicle needs. Maybe you start a family and need a larger SUV. Or perhaps you move to the city and want a compact, fuel-efficient hatchback. With leasing, you can adapt your vehicle choice to match your lifestyle—without being locked into a long-term ownership commitment.

For instance, a young professional might lease a sporty sedan for their daily commute. A few years later, after having kids, they can switch to a minivan or three-row SUV. Then, when the kids are older, they might go back to a smaller, more efficient car. Leasing makes this kind of flexibility possible.

Avoid the “Stale Car” Syndrome

Let’s face it—after a few years, even the most exciting car starts to feel… familiar. The new-car smell fades, the tech feels outdated, and you start noticing every little scratch. Leasing lets you avoid this “stale car” feeling by giving you a fresh, exciting vehicle every few years.

It’s like getting a new phone every two years instead of keeping the same one for five. You get the thrill of a new experience without the hassle of selling your old one.

Warranty Coverage: Peace of Mind on the Road

One of the most overlooked benefits of leasing a car is the built-in warranty protection. Most new cars come with a manufacturer’s warranty that covers repairs for 3 years/36,000 miles or more. Since most leases are 2–4 years long, your vehicle is almost always under warranty for the entire lease term.

This means that if something goes wrong—whether it’s a faulty transmission, a bad sensor, or an electrical issue—you won’t have to pay out of pocket. The dealership or manufacturer will cover the repair, often with loaner car service included.

No Surprise Repair Bills

One of the hidden costs of car ownership is unexpected repairs. Even well-maintained vehicles can develop issues as they age. Transmission failures, alternator problems, and suspension wear can cost hundreds or even thousands of dollars to fix.

With a leased car, these worries disappear. Because the vehicle is new and under warranty, major repairs are covered. You’ll still need to handle routine maintenance like oil changes and tire rotations (unless your lease includes a maintenance package), but you’re protected from costly surprises.

Maintenance Packages: Even More Convenience

Many leasing companies offer optional maintenance packages that cover routine services like oil changes, tire rotations, brake inspections, and fluid top-offs. These packages are often included in the monthly lease payment, so there’s no extra cost at the time of service.

For example, some luxury brands like BMW and Mercedes-Benz include complimentary maintenance for the first few years of the lease. This means you can drive with confidence, knowing that your car is being cared for by certified technicians.

Lower Risk of Mechanical Failure

Newer cars are simply more reliable. According to J.D. Power and Consumer Reports, vehicles in their first few years of life have significantly fewer problems than older models. By leasing, you’re driving a car at its peak reliability—before wear and tear start to take a toll.

This not only saves you money but also reduces stress. You’re less likely to be stranded on the side of the road or miss work due to car trouble.

Minimal Down Payment: Get Behind the Wheel Faster

Buying a car usually requires a substantial down payment—often 10% to 20% of the vehicle’s price. For a $40,000 car, that’s $4,000 to $8,000 upfront. That’s a big chunk of change that could otherwise be saved, invested, or used for emergencies.

Leasing, on the other hand, often requires little or no down payment. Many lease deals advertise “$0 down” or “$99/month” offers, making it easy to get into a new car with minimal upfront cost.

Preserve Your Cash Flow

Keeping more cash on hand is a smart financial move. It gives you a buffer for unexpected expenses, allows you to invest in higher-return opportunities, or simply reduces financial stress.

Instead of tying up thousands of dollars in a down payment, you can keep that money in a high-yield savings account, pay down high-interest debt, or contribute to your retirement fund. Over time, that can make a significant difference in your overall financial health.

Negotiate a Lower Cap Cost Reduction

If you do choose to make a down payment (called a “capitalized cost reduction”), you can often negotiate how much you pay. Some lessees roll their trade-in value or manufacturer incentives into the down payment, reducing or even eliminating the out-of-pocket cost.

For example, if you’re trading in an old car worth $5,000, that amount can be applied directly to reduce your lease payment—no cash needed.

Beware of “Money Down” Traps

While $0 down leases sound great, be cautious. Some dealers advertise low monthly payments by requiring a large upfront payment that includes the first month’s payment, security deposit, acquisition fee, and other charges—all rolled into the “down payment.”

Always ask for a full breakdown of what’s included in the upfront cost. True $0 down means no money out of pocket at signing.

Tax Advantages for Businesses: Save on Taxes

If you use your car for business, leasing can offer significant tax benefits. The IRS allows businesses to deduct lease payments as a business expense, reducing taxable income.

Deduct Lease Payments as a Business Expense

For self-employed individuals, small business owners, and independent contractors, lease payments can be written off as an ordinary and necessary business expense. This applies whether you use the car 100% for work or a portion of the time.

For example, if you drive a leased car 70% for business and 30% for personal use, you can deduct 70% of the lease payments on your tax return.

Section 179 Deduction: Bonus Savings

The IRS Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment—including vehicles—in the year it’s placed in service, up to a certain limit. While this deduction is more commonly used for purchased vehicles, some leased vehicles may also qualify if they meet specific criteria (e.g., heavy SUVs over 6,000 lbs).

Consult a tax professional to see if your leased vehicle qualifies for this deduction.

Keep Accurate Records

To claim lease deductions, you’ll need to maintain detailed records of your mileage, including business vs. personal use. Use a mileage tracking app or logbook to document every trip. This ensures you can back up your deductions if audited.

No Hassle of Selling: Skip the Stress

One of the biggest headaches of car ownership is selling the vehicle when you’re ready for an upgrade. You have to deal with depreciation, find a buyer, negotiate the price, handle paperwork, and possibly wait weeks or months to sell.

With leasing, the process is simple. When your lease ends, you return the car to the dealership—no selling required. As long as you’ve stayed within the mileage limit and the car is in good condition (normal wear and tear is allowed), you walk away with no further obligations.

Avoid Depreciation Worries

Cars lose value the moment they’re driven off the lot. In the first year alone, a new car can depreciate by 20% or more. Over three years, it might lose half its value. If you buy a car, you bear the full brunt of that depreciation.

When you lease, the leasing company absorbs the depreciation risk. You only pay for the portion of the car’s value you use, and the leasing company handles the resale.

No Need to Haggle with Buyers

Selling a car privately means taking photos, writing ads, responding to inquiries, meeting strangers, and negotiating prices. It’s time-consuming and stressful. Trade-ins are easier but often result in lower offers.

Leasing eliminates all of this. Just return the car, sign a few papers, and drive off in your new vehicle.

Upgrade Seamlessly

Many dealerships make it easy to lease a new car right after returning your old one. They’ll often waive disposition fees or offer loyalty incentives if you lease another vehicle from them. This creates a smooth, hassle-free transition.

Predictable Monthly Costs: Budget with Confidence

Leasing offers a level of financial predictability that buying doesn’t. Your monthly payment is fixed for the entire lease term, and you know exactly what your costs will be.

This makes budgeting easier. You don’t have to worry about rising interest rates, unexpected repair bills, or fluctuating insurance costs (though insurance is still required, it’s often lower for newer, safer cars).

Fixed Payments for the Lease Term

Unlike a variable-rate loan, lease payments don’t change. Whether it’s month one or month 36, you pay the same amount. This stability helps you plan your finances with confidence.

Know Your Mileage Limits

Most leases include a mileage allowance—typically 10,000 to 15,000 miles per year. If you stay within this limit, there are no extra charges. If you exceed it, you’ll pay a per-mile fee (e.g., $0.25 per mile).

By tracking your mileage, you can avoid surprise fees and keep your costs predictable.

Insurance and Registration Made Simple

While you’re responsible for insurance and registration, these costs are often lower for leased vehicles. Newer cars may qualify for safety discounts, and some leasing companies offer bundled insurance options.

Is Leasing Right for You?

Leasing isn’t for everyone. If you drive a lot of miles, prefer to own your car outright, or like to customize your vehicle, buying might be a better fit. But if you value lower payments, newer technology, and hassle-free transitions, leasing offers clear advantages.

Consider your driving habits, financial goals, and lifestyle. If you’re someone who likes driving the latest models, wants to minimize repair worries, and prefers predictable costs, leasing could be the smart choice.

Conclusion: The Smart Way to Drive

Leasing a car isn’t just about avoiding ownership—it’s about making a smarter, more flexible choice for your lifestyle and budget. From lower monthly payments and warranty protection to the joy of driving a new car every few years, the benefits of leasing are hard to ignore.

Whether you’re a busy professional, a growing family, or a business owner, leasing offers a practical way to enjoy the best vehicles without the long-term commitment. By understanding how leasing works and weighing the pros and cons, you can make an informed decision that puts you behind the wheel of a great car—on your terms.

So next time you’re in the market for a new vehicle, don’t just consider buying. Take a closer look at leasing. It might just be the best decision you make for your wallet—and your peace of mind.

Frequently Asked Questions

Is leasing a car cheaper than buying?

Leasing usually has lower monthly payments than buying because you’re only paying for the car’s depreciation during the lease term, not the full value. However, you don’t build equity, so it may cost more over the long run if you lease repeatedly.

Can you negotiate a car lease?

Yes, you can negotiate the capitalized cost (price of the car), money factor (interest rate), and other terms just like when buying. A lower price or better rate can significantly reduce your monthly payment.

What happens at the end of a car lease?

At the end of the lease, you return the car to the dealership. As long as you’ve stayed within the mileage limit and the vehicle is in good condition (normal wear and tear is allowed), you can walk away or lease a new car.

Can you lease a used car?

Most leases are for new cars, but some dealerships and leasing companies offer certified pre-owned (CPO) vehicles for lease. These often come with extended warranties and lower prices.

Do you need good credit to lease a car?

Yes, most leasing companies require a good to excellent credit score (typically 660 or higher) to qualify for the best rates. Lower scores may still qualify but with higher payments or fees.

Can you buy the car at the end of the lease?

Yes, most leases include a purchase option. At the end of the term, you can buy the car for its predetermined residual value, which is often lower than market price if the car has held its value well.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.