Choosing between leasing and buying a car can be confusing, but a car lease versus purchase calculator makes it simple. It helps you compare monthly payments, total costs, and ownership benefits so you can make a smart, personalized decision.

Deciding whether to lease or buy a car is one of the biggest financial choices many people face. It’s not just about which model you like or how shiny the paint is—it’s about understanding how each option affects your wallet now and in the future. With so many factors to consider—monthly payments, interest rates, mileage limits, depreciation, and more—it’s easy to feel overwhelmed. That’s where a car lease versus purchase calculator comes in. This handy tool takes the guesswork out of the equation by letting you plug in your specific numbers and see a clear, side-by-side comparison.

Think of it like a financial GPS for your car decision. Instead of driving blind, you get a map that shows you the cost of each route. Whether you’re eyeing a sleek new sedan or a rugged SUV, using a calculator helps you avoid surprises down the road. It’s especially useful if you’re on a tight budget or trying to decide between keeping your current car or upgrading. By inputting real-world details—like how much you can afford to put down, how many miles you drive yearly, and how long you plan to keep the vehicle—you get personalized insights that match your lifestyle.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is a Car Lease Versus Purchase Calculator?

- 4 Leasing vs. Buying: The Basics

- 5 How to Use a Car Lease Versus Purchase Calculator

- 6 Real-Life Example: Leasing vs. Buying a $35,000 Car

- 7 Factors That Influence the Decision

- 8 Common Mistakes to Avoid

- 9 Conclusion

- 10 Frequently Asked Questions

- 10.1 What is a car lease versus purchase calculator?

- 10.2 Is leasing always cheaper than buying?

- 10.3 Can I use a calculator if I have bad credit?

- 10.4 Do I need to know the exact car price to use the calculator?

- 10.5 What happens if I exceed the mileage limit on a lease?

- 10.6 Should I lease or buy if I plan to keep the car for 10 years?

Key Takeaways

- Use a calculator to compare costs: A car lease versus purchase calculator shows monthly payments, total expenses, and long-term financial impact side by side.

- Leasing often means lower monthly payments: Leases typically cost less per month than loans, but you don’t own the car at the end.

- Buying builds equity over time: When you buy, you own the vehicle after paying it off, which can be valuable if you keep it long-term.

- Consider mileage and wear: Leases have strict limits on mileage and condition, while owners have full freedom.

- Factor in taxes, fees, and insurance: Both options include extra costs that a good calculator will help you estimate.

- Your lifestyle matters: Frequent drivers or those who want the latest models may prefer leasing; long-term users often benefit from buying.

- Run multiple scenarios: Try different down payments, loan terms, and lease lengths to find the best fit for your budget.

📑 Table of Contents

What Is a Car Lease Versus Purchase Calculator?

A car lease versus purchase calculator is an online tool designed to help you compare the total cost of leasing a vehicle against buying it with a loan. It takes into account variables like the car’s price, down payment, loan or lease term, interest rate, residual value (for leases), and estimated depreciation. The result? A clear breakdown of monthly payments, total out-of-pocket costs, and long-term financial implications for both options.

These calculators are usually free and easy to use. You don’t need to be a finance expert to understand the results. Most tools walk you through each step, asking for information like the vehicle’s MSRP (Manufacturer’s Suggested Retail Price), your credit score range, and how many miles you expect to drive per year. Some even let you adjust for taxes, registration fees, and insurance differences.

The real power of these calculators lies in their ability to show you the “what ifs.” What if you put $5,000 down instead of $2,000? What if you choose a 36-month lease instead of a 60-month loan? By tweaking the numbers, you can explore different scenarios and find the option that best fits your financial goals.

How the Calculator Works

Most car lease versus purchase calculators operate on a simple principle: they calculate the total cost of ownership for both leasing and buying over a set period, then compare them. Here’s a quick look at how each side is calculated:

For leasing, the calculator estimates your monthly payment based on:

– The negotiated price of the car

– The residual value (what the car is expected to be worth at the end of the lease)

– The money factor (similar to an interest rate)

– The lease term (usually 24 to 36 months)

– Any down payment or trade-in value

For purchasing, it calculates:

– The loan amount (car price minus down payment and trade-in)

– The interest rate and loan term (typically 36 to 72 months)

– Monthly payments using standard amortization formulas

– Total interest paid over the life of the loan

The calculator then adds in estimated costs like sales tax, registration, and insurance—though these vary by state and insurer. Some advanced tools even factor in depreciation, maintenance, and fuel costs to give a fuller picture.

Why You Should Use One

Using a car lease versus purchase calculator isn’t just about saving money—it’s about making an informed decision. Too often, people choose based on monthly payment alone, without considering the long-term costs. For example, a lease might offer a lower monthly payment, but if you end up paying more over three years due to fees and mileage penalties, it may not be the best deal.

A calculator helps you avoid that trap. It shows you the full financial story, not just the headline number. It also helps you prepare for the future. If you lease, you’ll need to budget for a new car payment every few years. If you buy, you’ll have higher payments now but own an asset later. The calculator makes those trade-offs visible.

Plus, it’s a great negotiation tool. When you walk into a dealership with real numbers in hand, you’re in a stronger position to discuss terms. You’ll know what a fair lease rate or loan offer looks like, and you won’t be swayed by flashy promotions that hide high costs.

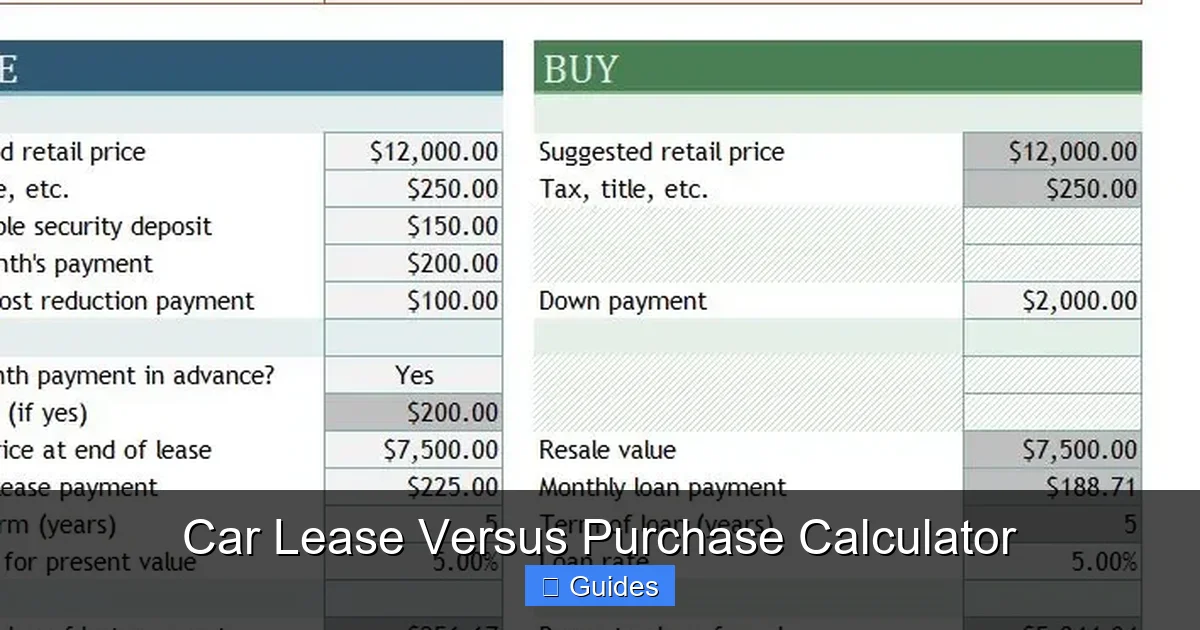

Leasing vs. Buying: The Basics

Visual guide about Car Lease Versus Purchase Calculator

Image source: 101businessinsights.com

Before diving into the calculator, it’s important to understand the fundamental differences between leasing and buying a car. Both have pros and cons, and the right choice depends on your priorities, driving habits, and financial situation.

Leasing is essentially renting a car for a fixed period, usually two to three years. You pay for the vehicle’s depreciation during that time, plus fees and interest. At the end of the lease, you return the car—no equity, no ownership. Buying, on the other hand, means you take out a loan to purchase the car and own it once the loan is paid off. You can drive it as long as you want, modify it, and sell it later.

Pros and Cons of Leasing

Leasing has several advantages. First, monthly payments are typically lower than loan payments because you’re only paying for the car’s use, not its full value. This can free up cash for other expenses or investments. Second, leases often come with warranties that cover repairs, so maintenance costs are minimal. Third, you can drive a newer car every few years with the latest features and technology.

But leasing isn’t perfect. You don’t build equity—every payment goes toward using the car, not owning it. There are strict mileage limits (usually 10,000 to 15,000 miles per year), and exceeding them results in hefty fees. You’re also responsible for keeping the car in good condition; excessive wear and tear can lead to additional charges at return. And if you fall in love with the car, buying it at the end of the lease often costs more than if you had financed it from the start.

Pros and Cons of Buying

Buying a car gives you full ownership and freedom. Once the loan is paid off, you own the vehicle outright—no more monthly payments. You can drive as many miles as you want, customize the car, and sell it whenever you choose. Over time, this can be more cost-effective, especially if you keep the car for five years or more.

However, buying usually means higher monthly payments than leasing. You’re responsible for all maintenance and repairs once the warranty expires. And cars depreciate quickly—most lose 20% of their value the moment you drive them off the lot. If you sell the car later, you might not get back what you paid.

Which Is Right for You?

There’s no one-size-fits-all answer. If you value lower monthly payments, enjoy driving new cars, and don’t mind returning the vehicle every few years, leasing might be a good fit. But if you drive a lot, plan to keep the car long-term, or want to build equity, buying is usually the better choice.

A car lease versus purchase calculator helps you weigh these factors with real numbers. Instead of guessing, you can see exactly how each option plays out for your situation.

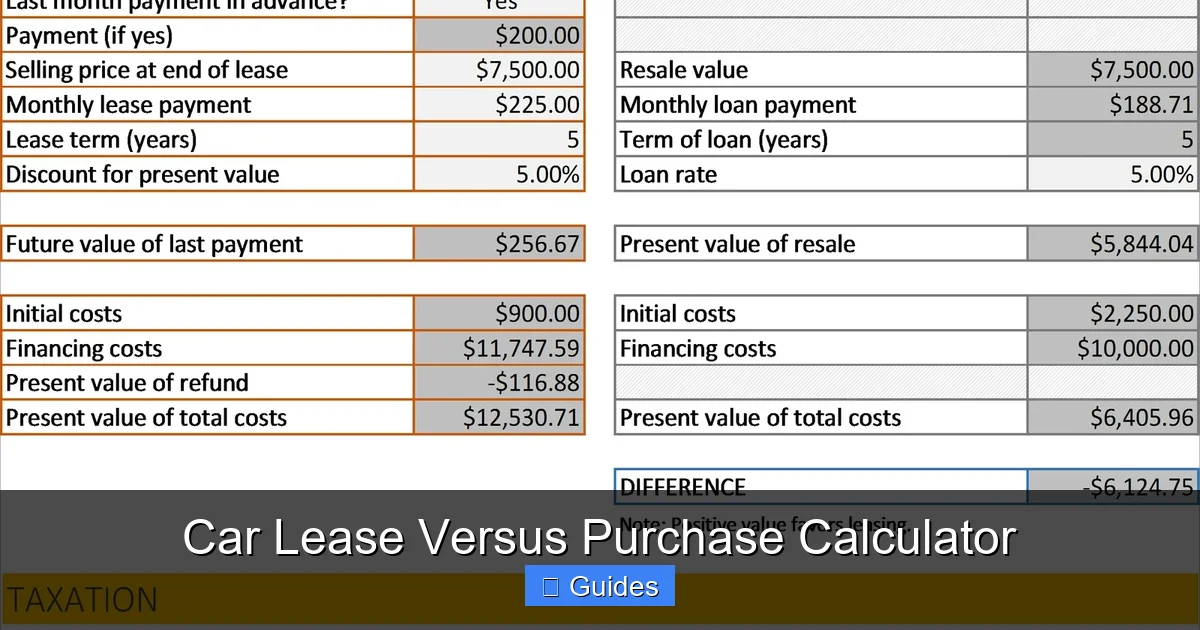

How to Use a Car Lease Versus Purchase Calculator

Visual guide about Car Lease Versus Purchase Calculator

Image source: cdn2.free-power-point-templates.com

Using a car lease versus purchase calculator is simple, but getting accurate results requires entering the right information. Here’s a step-by-step guide to help you get the most out of the tool.

Step 1: Gather Your Information

Before you start, collect the following details:

– The car’s price (MSRP or negotiated price)

– Down payment amount (cash or trade-in value)

– Loan or lease term (in months)

– Interest rate or money factor

– Estimated annual mileage

– Expected residual value (for leases)

– Sales tax rate (varies by state)

– Any additional fees (registration, documentation, etc.)

If you’re not sure about some numbers, use estimates. Most calculators allow you to adjust them later.

Step 2: Enter the Data

Open a reputable calculator (many are available on car manufacturer websites, financial sites, or auto loan platforms). Start by selecting whether you’re comparing a lease or a purchase. Then, input the car’s price, down payment, and term.

For leasing, you’ll need the residual value—the car’s expected worth at the end of the lease. This is usually a percentage of the MSRP (e.g., 60% for a 36-month lease). The money factor is similar to an interest rate; multiply it by 2,400 to get an approximate APR.

For purchasing, enter the loan interest rate and term. If you don’t know your rate, use a range based on your credit score (e.g., 3% for excellent credit, 6% for good, 10% for fair).

Step 3: Review the Results

The calculator will display monthly payments, total costs, and sometimes a breakdown of interest and fees. Look for:

– Monthly payment difference

– Total amount paid over the term

– Estimated depreciation

– Potential penalties (for leases)

Compare the two options side by side. Ask yourself: Can I afford the higher payments if I buy? Will I stay within the mileage limit if I lease? What happens at the end of the term?

Step 4: Run Multiple Scenarios

Don’t stop at one calculation. Try different down payments, terms, and mileage limits. For example:

– What if I put $3,000 down instead of $1,000?

– What if I choose a 48-month loan instead of 60 months?

– What if I drive 12,000 miles per year instead of 10,000?

Each change affects the outcome. Running multiple scenarios helps you find the sweet spot between affordability and flexibility.

Step 5: Make Your Decision

Once you’ve reviewed the numbers, consider your lifestyle and goals. If the calculator shows that leasing saves you $100 per month but you plan to keep the car for 10 years, buying might still be better in the long run. Use the data as a guide, not a rule.

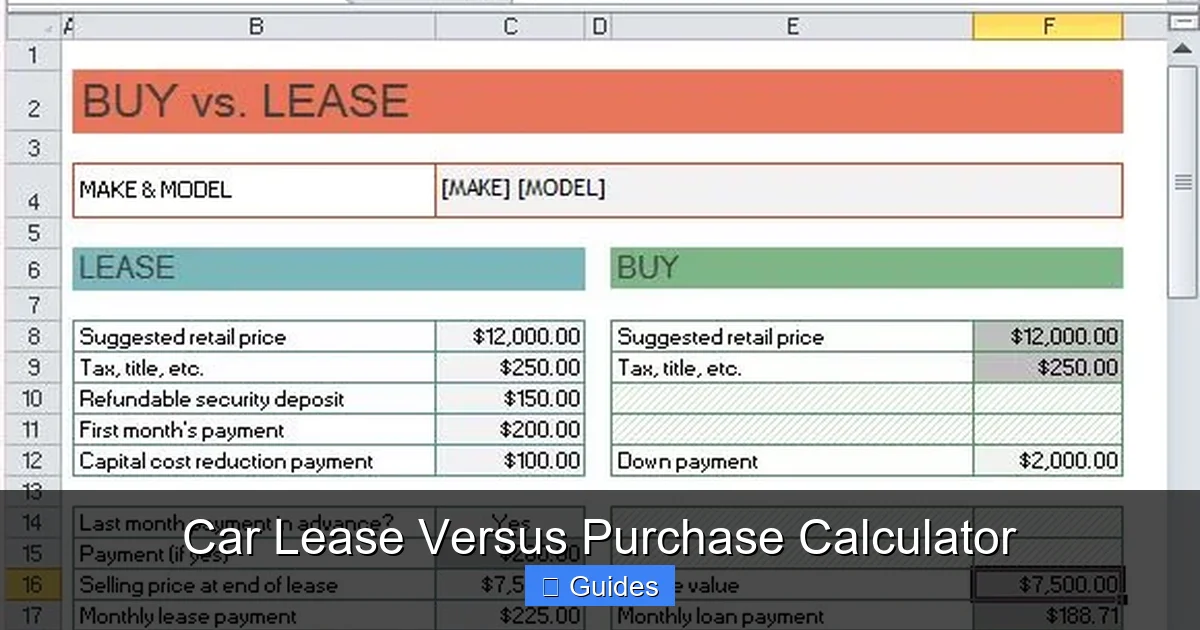

Real-Life Example: Leasing vs. Buying a $35,000 Car

Visual guide about Car Lease Versus Purchase Calculator

Image source: lease.io

Let’s walk through a practical example to see how a car lease versus purchase calculator works in real life.

Suppose you’re looking at a new SUV with an MSRP of $35,000. You can afford a $5,000 down payment and plan to drive 12,000 miles per year. Your credit score is good, so you qualify for a 5% auto loan rate. You’re considering a 36-month lease or a 60-month loan.

Lease Scenario

For the lease:

– Negotiated price: $34,000

– Down payment: $5,000

– Residual value: 60% of MSRP = $21,000

– Money factor: 0.002 (equivalent to 4.8% APR)

– Lease term: 36 months

– Mileage limit: 12,000 miles/year

Using the calculator, your monthly lease payment comes out to about $380. Total cost over three years: $18,680 ($380 x 36 + $5,000 down).

At the end of the lease, you return the car. If you want a new one, you’ll start another lease with similar payments.

Purchase Scenario

For the purchase:

– Loan amount: $30,000 ($35,000 – $5,000 down)

– Interest rate: 5%

– Loan term: 60 months

The calculator shows a monthly payment of about $566. Total cost over five years: $39,960 ($566 x 60 + $5,000 down).

After five years, you own the car. If you sell it for $15,000, your net cost is $24,960.

Comparison

Leasing: $18,680 over 3 years, then repeat.

Buying: $24,960 net cost over 5 years, then own the car.

At first glance, leasing seems cheaper. But over five years, you’d likely lease twice (total cost ~$37,360), which is more than buying. Plus, you’d have no asset at the end.

This example shows why a calculator is so valuable. It reveals the long-term impact that isn’t obvious from monthly payments alone.

Factors That Influence the Decision

While a car lease versus purchase calculator gives you hard numbers, your personal situation plays a big role in the final decision. Here are key factors to consider.

Driving Habits

How many miles do you drive per year? If it’s over 15,000, leasing may not be cost-effective due to mileage penalties. Buyers have no limits.

Financial Goals

Are you trying to minimize monthly expenses? Leasing might help. Do you want to build equity or reduce long-term costs? Buying is usually better.

Car Preferences

Do you love having the latest tech and safety features? Leasing lets you upgrade every few years. Prefer to customize your ride? Buying gives you full control.

Credit and Down Payment

A higher down payment reduces monthly costs for both options. Good credit lowers interest rates, making buying more affordable.

Resale Plans

If you plan to sell the car in 3–5 years, buying might make sense. If you’ll trade it in frequently, leasing could be simpler.

Maintenance and Repairs

Leased cars are usually under warranty, so repairs are covered. Older owned cars may need more maintenance, adding to costs.

Common Mistakes to Avoid

Even with a calculator, it’s easy to make errors that skew your results. Here are common pitfalls and how to avoid them.

Ignoring Total Cost

Focusing only on monthly payments can be misleading. Always look at the total cost over the term, including down payments, interest, and fees.

Overestimating Residual Value

Leases assume a certain residual value. If the car depreciates faster than expected, your lease payments may be higher than they should be.

Underestimating Mileage

Guessing low on annual mileage can lead to surprise fees. Be honest about your driving habits.

Forgetting Taxes and Fees

Sales tax, registration, and documentation fees add up. Include them in your calculation for accuracy.

Not Comparing Multiple Lenders

Dealerships may offer financing, but banks and credit unions often have better rates. Shop around before finalizing.

Skipping the Fine Print

Lease agreements have strict terms. Read the contract carefully to understand penalties, wear-and-tear rules, and purchase options.

Conclusion

Deciding between leasing and buying a car doesn’t have to be stressful. A car lease versus purchase calculator simplifies the process by giving you clear, personalized financial comparisons. It helps you see beyond monthly payments and understand the true cost of each option.

Whether you choose to lease or buy, the key is making a decision that aligns with your budget, lifestyle, and long-term goals. Use the calculator as a starting point, but also consider your driving habits, financial priorities, and how you plan to use the vehicle.

Remember, there’s no “right” answer for everyone. What works for a commuter who drives 8,000 miles a year might not suit a road-trip enthusiast logging 20,000 miles. By combining the power of a calculator with honest self-assessment, you can drive away with confidence—knowing you made the smartest choice for your situation.

So the next time you’re car shopping, don’t just rely on gut feeling or dealer advice. Fire up a car lease versus purchase calculator, plug in your numbers, and let the data guide you. Your future self will thank you.

Frequently Asked Questions

What is a car lease versus purchase calculator?

A car lease versus purchase calculator is a tool that compares the total cost of leasing a vehicle against buying it with a loan. It factors in monthly payments, down payments, interest rates, and other fees to help you make an informed decision.

Is leasing always cheaper than buying?

Not necessarily. While leasing often has lower monthly payments, the total cost over time can be higher due to fees and the lack of ownership. Buying may cost more upfront but can be cheaper in the long run if you keep the car for many years.

Can I use a calculator if I have bad credit?

Yes. Most calculators allow you to input different interest rates. If you have bad credit, use a higher rate (like 10% or more) to get a realistic estimate of your loan payments.

Do I need to know the exact car price to use the calculator?

No. You can use the MSRP or an estimated price. The calculator will still give you a useful comparison, and you can adjust the number later if you negotiate a better deal.

What happens if I exceed the mileage limit on a lease?

Most leases charge a per-mile fee (e.g., $0.25 per mile) for exceeding the limit. This can add hundreds or thousands of dollars to your total cost, so it’s important to choose a mileage allowance that matches your driving habits.

Should I lease or buy if I plan to keep the car for 10 years?

Buying is usually the better choice for long-term ownership. While leasing requires ongoing payments every few years, buying lets you own the car outright after the loan is paid off, saving money over time.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.