Leasing a pre owned car can save you thousands compared to buying new or leasing a brand-new model. It offers lower monthly payments, reduced depreciation, and often includes warranty coverage—making it a smart financial move for budget-conscious drivers who still want reliability and modern features.

Thinking about getting behind the wheel of a reliable car without breaking the bank? You’re not alone. More drivers are discovering the advantages of leasing a pre owned car—and for good reason. Unlike traditional car buying or even leasing a brand-new vehicle, opting for a used car lease combines affordability, flexibility, and peace of mind in one smart package.

Let’s be honest: new cars lose value fast. In fact, most vehicles shed 20–30% of their value the moment they’re driven off the lot. That means if you lease a new car, you’re essentially paying for depreciation you’ll never recover. But when you lease a pre owned car—especially one that’s 1–3 years old—you sidestep that initial value plunge. Instead, you pay for the car’s expected depreciation over your lease term, which is significantly lower. Plus, many certified pre owned (CPO) models come with manufacturer-backed warranties, roadside assistance, and rigorous inspection reports. So you’re not sacrificing quality for cost.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is a Pre Owned Car Lease?

- 4 Why Lease a Pre Owned Car? Top Benefits

- 5 How Does Leasing a Pre Owned Car Work?

- 6 Pre Owned vs. New Car Lease: A Side-by-Side Comparison

- 7 Tips for Getting the Best Deal on a Pre Owned Car Lease

- 8 Common Misconceptions About Leasing Pre Owned Cars

- 9 Is Leasing a Pre Owned Car Right for You?

- 10 Final Thoughts

- 11 Frequently Asked Questions

Key Takeaways

- Lower monthly payments: Pre owned car leases typically cost 20–40% less per month than new car leases.

- Reduced depreciation risk: The biggest drop in value happens in the first few years—leasing a used car avoids that steep loss.

- Certified pre owned (CPO) options: Many dealers offer CPO vehicles with extended warranties and thorough inspections.

- Shorter lease terms available: You can often find 12- to 24-month leases, giving you flexibility.

- Easier approval process: Lower vehicle values may mean less stringent credit requirements.

- Potential for equity at end of lease: Some programs allow you to buy the car at a favorable price if you love it.

- Eco-friendly choice: Extending a vehicle’s life reduces manufacturing demand and environmental impact.

📑 Table of Contents

- What Is a Pre Owned Car Lease?

- Why Lease a Pre Owned Car? Top Benefits

- How Does Leasing a Pre Owned Car Work?

- Pre Owned vs. New Car Lease: A Side-by-Side Comparison

- Tips for Getting the Best Deal on a Pre Owned Car Lease

- Common Misconceptions About Leasing Pre Owned Cars

- Is Leasing a Pre Owned Car Right for You?

- Final Thoughts

What Is a Pre Owned Car Lease?

A pre owned car lease is exactly what it sounds like: you agree to pay for the use of a used vehicle over a set period—usually 12 to 36 months—instead of purchasing it outright. At the end of the lease, you return the car (assuming you meet mileage and condition terms) or have the option to buy it at its residual value.

Unlike buying a used car with a loan, leasing doesn’t build equity. But it does offer predictable monthly payments, lower upfront costs (often just first month’s payment, security deposit, and fees), and the chance to drive a higher-end model than you might afford otherwise. For example, leasing a 2-year-old luxury sedan could cost less per month than buying a brand-new economy car.

It’s also worth noting that not all used cars are eligible for leasing. Most manufacturers and dealerships only offer lease programs on certified pre owned (CPO) vehicles or recent-model-year cars with low mileage and clean histories. This ensures reliability and protects both you and the leasing company.

Why Lease a Pre Owned Car? Top Benefits

Visual guide about Leasing a Pre Owned Car

Image source: bridget.ink

There are plenty of reasons savvy drivers are choosing to lease used vehicles. Let’s break down the biggest perks.

1. Significantly Lower Monthly Payments

This is the headline benefit. Because the car has already taken its biggest depreciation hit, the amount you’re financing (called the “capitalized cost”) is much lower. Combined with a lower residual value (the car’s estimated worth at lease end), your monthly payment shrinks dramatically.

For example:

– A new 2024 Honda Accord might lease for $450/month.

– A 2022 Honda Accord CPO with 20,000 miles could lease for $280/month—that’s a $170 savings every single month.

Over a 36-month lease, that’s over $6,000 back in your pocket.

2. Avoid the Steepest Depreciation

New cars lose value fastest in years one and two. By leasing a 1- or 2-year-old car, you let someone else absorb that initial drop. You only pay for the depreciation during your lease term, which is far gentler on your wallet.

Think of it like renting an apartment that’s already been lived in—you get the same space, but you didn’t pay for the “newness” premium.

3. Access to Higher-Quality Vehicles

With lower payments, you might afford a trim level, make, or model you couldn’t otherwise. Want leather seats, a sunroof, or advanced safety features? A pre owned lease on a well-equipped Toyota Camry or Subaru Outback could make that possible without stretching your budget.

4. Shorter Commitment, More Flexibility

Many pre owned leases offer 12- or 24-month terms—perfect if you’re unsure about long-term plans, job stability, or family needs. You’re not locked into a 5- or 6-year loan. When the lease ends, you can walk away, upgrade to a newer used model, or even switch to a different type of vehicle.

5. Often Includes Warranty Coverage

Most CPO programs include extended warranties that cover major components like the engine, transmission, and electrical systems. Some even offer complimentary maintenance for the first year. This means fewer surprise repair bills and more confidence on the road.

6. Eco-Friendly Driving

Manufacturing a new car uses massive amounts of energy and resources. By choosing a pre owned vehicle, you’re extending its useful life and reducing demand for new production—making it a greener choice for the planet.

How Does Leasing a Pre Owned Car Work?

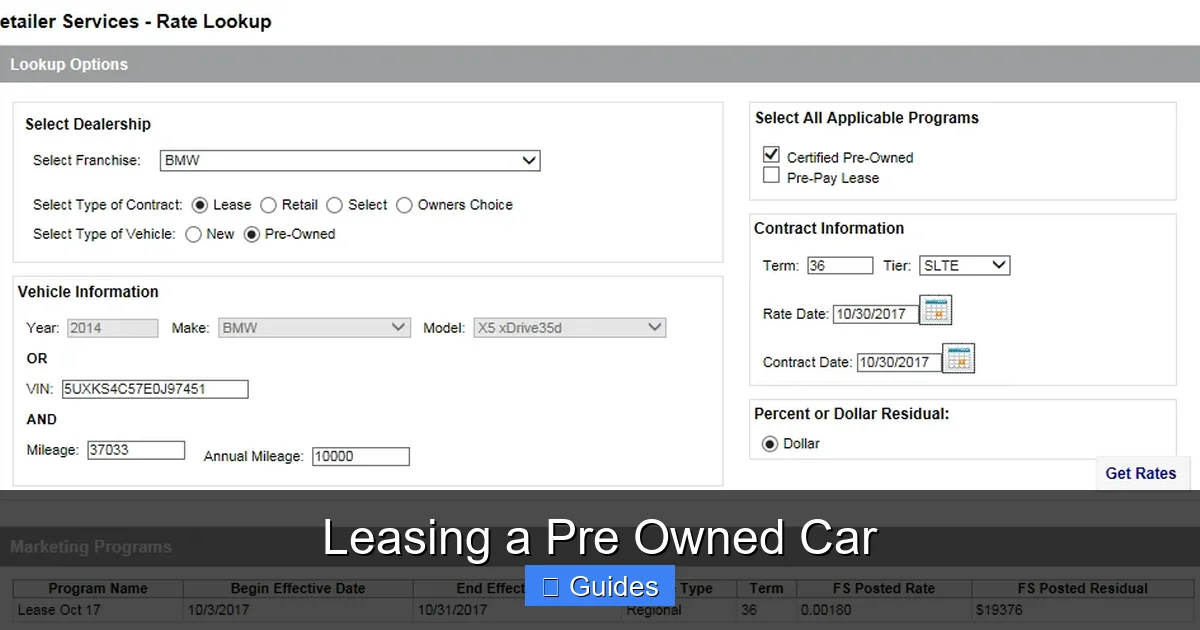

Visual guide about Leasing a Pre Owned Car

Image source: mexico-now.com

The process is similar to leasing a new car, but with a few key differences. Here’s what to expect:

Step 1: Find a Certified Pre Owned Vehicle

Start by browsing CPO inventory at franchised dealerships (like Ford, Honda, or BMW). These vehicles undergo multi-point inspections, have clean titles, and meet strict age and mileage limits (usually under 60,000 miles and less than 5 years old).

Avoid private sellers or non-certified used cars—they rarely qualify for lease programs.

Step 2: Negotiate the Capitalized Cost

This is the vehicle’s price—the starting point for your lease calculation. Even though it’s used, you can still negotiate! Research the car’s market value using tools like Kelley Blue Book or Edmunds, then aim to get the capitalized cost as low as possible.

Pro tip: Ask the dealer to include any remaining factory warranty or CPO benefits in the deal—this adds value without increasing your payment.

Step 3: Review the Residual Value

The residual value is the car’s estimated worth at the end of your lease. It’s set by the leasing company based on the vehicle’s age, mileage, and market trends. A higher residual means lower monthly payments because you’re only paying for the difference between the current price and the residual.

For example:

– Car price: $25,000

– Residual (after 3 years): $15,000

– Amount you’re financing: $10,000

That $10,000 (plus interest and fees) is spread over your lease term.

Step 4: Set Your Mileage Limit and Lease Term

Most leases include an annual mileage allowance—typically 10,000, 12,000, or 15,000 miles. Going over incurs a per-mile fee (often $0.10–$0.25). Choose a limit that matches your driving habits.

Lease terms for pre owned cars are often shorter: 12, 24, or 30 months. Shorter terms mean higher monthly payments but less long-term commitment.

Step 5: Sign the Lease Agreement

Once everything’s agreed upon, you’ll sign the contract. Be sure to review:

– Monthly payment amount

– Down payment (if any)

– Mileage allowance and excess fees

– Wear-and-tear guidelines

– Early termination penalties

– Purchase option at lease end

Keep a copy for your records!

Pre Owned vs. New Car Lease: A Side-by-Side Comparison

Visual guide about Leasing a Pre Owned Car

Image source: forum.leasehackr.com

Still on the fence? Let’s compare leasing a new car versus a pre owned one using real-world examples.

| Factor | New Car Lease | Pre Owned Car Lease |

|——–|—————|———————|

| **Monthly Payment** | $450–$600 | $250–$380 |

| **Down Payment** | $2,000–$5,000 | $0–$2,500 |

| **Depreciation Risk** | High (you pay for first 2–3 years of loss) | Low (already absorbed) |

| **Warranty** | Full factory warranty | CPO extended warranty (often 1–2 years) |

| **Mileage Limit** | 10K–15K/year | Same, but shorter terms available |

| **Vehicle Age** | Brand new | 1–4 years old |

| **Customization** | Full options | Limited to available inventory |

Let’s say you’re looking at a 2024 Toyota RAV4 Hybrid. A new lease might run $520/month with $3,000 down. A 2022 RAV4 Hybrid CPO with 25,000 miles could lease for $310/month with just $1,500 down. Over three years, you’d save over $8,000—enough for a vacation, home improvement, or emergency fund boost.

And here’s another advantage: because pre owned leases are less common, dealers may be more willing to negotiate to move inventory. That means better deals for you.

Tips for Getting the Best Deal on a Pre Owned Car Lease

Ready to lease? Follow these expert tips to maximize value and avoid pitfalls.

1. Stick to Certified Pre Owned (CPO) Vehicles

CPO cars come with inspections, warranties, and often roadside assistance. They’re the safest bet for leasing. Avoid “as-is” or non-certified used cars—they won’t qualify for most lease programs and could cost you more in repairs.

2. Time Your Lease Right

Dealers often have quotas and incentives. Shop at the end of the month, quarter, or year when they’re trying to meet sales goals. You might snag a better rate or waived fees.

Also, consider leasing in late summer or early fall—new model years arrive then, pushing down demand (and prices) for slightly older used cars.

3. Negotiate Everything

Don’t accept the first offer. Negotiate:

– The capitalized cost (car price)

– The money factor (interest rate equivalent)

– Any acquisition or disposition fees

– Mileage allowance

Even small reductions can save hundreds over the lease term.

4. Check Your Credit Score

While pre owned leases may have more flexible credit requirements, a higher score still gets you better rates. Check your credit report beforehand and correct any errors. Aim for a score above 650 for the best terms.

5. Read the Fine Print on Wear and Tear

Leases have strict guidelines on what counts as “excessive” wear. Minor scratches? Usually fine. Large dents or stained upholstery? Could cost you.

Take photos before and after the lease, and consider purchasing a wear-and-tear protection plan if you’re a messy eater or have kids/pets.

6. Consider Gap Insurance

If your car is totaled or stolen, standard insurance may not cover the full lease balance. Gap insurance covers the difference—worth it for peace of mind, especially on higher-value used cars.

7. Plan for the End of Lease

Decide early whether you’ll return the car, buy it, or lease another. If you love the car, the purchase price (residual value) is often fair—sometimes even below market value. But if you walk away, budget for the disposition fee (typically $300–$500).

Common Misconceptions About Leasing Pre Owned Cars

Despite growing popularity, some myths still surround pre owned leases. Let’s clear them up.

Myth 1: “Only junk cars are available for lease.”

False. Most pre owned leases are CPO vehicles—late-model, low-mileage, and thoroughly inspected. Many are former lease returns or rental cars that were well-maintained.

Myth 2: “You can’t negotiate a used car lease.”

Actually, you can! Dealers want to move inventory. Negotiate the price, money factor, and fees just like with a new car.

Myth 3: “Leasing used means no warranty.”

Most CPO programs include extended warranties—sometimes up to 7 years/100,000 miles total coverage. Always ask what’s included.

Myth 4: “You’ll pay more in the long run.”

Not necessarily. While you don’t build equity, your total out-of-pocket cost is often far lower than buying—especially if you lease multiple used cars over time instead of taking on a 6-year loan.

Myth 5: “It’s hard to qualify.”

Pre owned leases often have more lenient credit requirements because the vehicle value is lower. If you’re borderline on a new car lease, you might easily qualify for a used one.

Is Leasing a Pre Owned Car Right for You?

This option isn’t for everyone—but it’s perfect for many. Ask yourself:

– Do I want lower monthly payments?

– Am I okay with not owning the car?

– Do I drive fewer than 15,000 miles per year?

– Do I prefer driving newer models without long-term commitment?

– Am I concerned about depreciation?

If you answered “yes” to most, leasing a pre owned car could be a smart move.

It’s ideal for:

– Young professionals starting their careers

– Families needing reliable transportation on a budget

– Commuters who want safety and tech features without high costs

– People who like changing cars every 2–3 years

But it may not suit you if:

– You drive a lot (over 15K miles/year)

– You want to customize or modify your vehicle

– You plan to keep a car for 10+ years

– You’re looking to build automotive equity

Ultimately, leasing a pre owned car is about smart financial choices—not settling for less. You get quality, reliability, and modern features at a fraction of the cost.

Final Thoughts

Leasing a pre owned car is no longer the “second-best” option—it’s a strategic, money-savvy alternative to traditional car ownership or new-car leasing. With lower payments, reduced depreciation risk, and the backing of certified pre owned programs, it offers real value for today’s drivers.

Whether you’re looking to save money, drive a nicer vehicle, or simply enjoy more flexibility, a pre owned lease could be the perfect fit. Just remember to shop CPO, negotiate terms, understand your mileage needs, and read the fine print.

At the end of the day, the best car decision is the one that aligns with your lifestyle, budget, and goals. And for millions of drivers, leasing a pre owned car checks all the boxes.

Frequently Asked Questions

Can I lease any used car?

No, most lease programs only apply to certified pre owned (CPO) vehicles from franchised dealerships. These cars meet strict age, mileage, and condition standards. Private-sale or non-certified used cars typically don’t qualify.

Is leasing a pre owned car cheaper than buying used?

It depends on your timeline. Leasing usually has lower monthly payments and upfront costs, but you don’t build equity. Buying with a loan costs more per month but results in ownership. For short-term use, leasing is often cheaper overall.

What happens if I go over my mileage limit?

You’ll be charged a per-mile fee, typically $0.10 to $0.25. For example, driving 2,000 extra miles on a 12,000-mile/year lease could cost $200–$500 at lease end. Choose a mileage allowance that matches your habits.

Can I buy the car at the end of the lease?

Yes! Most leases include a purchase option at the residual value listed in your contract. This price is often fair—sometimes below market value—especially if the car has held its value well.

Do I need gap insurance on a pre owned lease?

It’s highly recommended. If the car is totaled or stolen, your insurance may not cover the full lease balance. Gap insurance pays the difference, protecting you from a large out-of-pocket expense.

Are pre owned leases available for all car brands?

Most major manufacturers (Toyota, Honda, Ford, BMW, etc.) offer CPO lease programs, but availability varies by dealership and region. Check with local dealers or the brand’s website to see current offerings.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.