Looking for a used car lease in Seattle with 0 down? You’re in the right place. This guide breaks down everything you need to know—from finding trustworthy dealers to understanding lease terms—so you can drive off in a quality pre-owned vehicle without spending a dime upfront.

Thinking about leasing a used car in Seattle with no money down? You’re not alone. More drivers are discovering the smart financial advantages of leasing pre-owned vehicles—especially when they can skip the hefty down payment. Whether you’re commuting through downtown traffic, heading up to Mount Rainier for the weekend, or just need a reliable ride without the long-term commitment of ownership, a used car lease with $0 down could be your best move.

But here’s the truth: “0 down” doesn’t mean “free.” It simply means you’re not paying a large lump sum at the start of your lease. Instead, the cost is spread across your monthly payments. And while that sounds great, it’s important to understand how these deals work, what to look for, and how to avoid common pitfalls. In this guide, we’ll walk you through everything you need to know about used car lease Seattle 0 down options—so you can make a confident, informed decision.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Why Choose a Used Car Lease in Seattle?

- 4 How Does a 0 Down Used Car Lease Work?

- 5 Finding the Best Used Car Lease Deals in Seattle

- 6 Understanding Lease Terms and Fine Print

- 7 Tips to Save Money on a Used Car Lease

- 8 Common Mistakes to Avoid

- 9 Final Thoughts: Is a Used Car Lease with 0 Down Right for You?

- 10 Frequently Asked Questions

- 10.1 Can I lease a used car with $0 down in Seattle?

- 10.2 Do I need good credit for a 0 down used car lease?

- 10.3 What’s included in a 0 down lease payment?

- 10.4 Can I negotiate a used car lease with 0 down?

- 10.5 What happens at the end of a used car lease?

- 10.6 Are used car leases cheaper than new car leases?

Key Takeaways

- Zero down doesn’t mean zero cost: While you won’t pay anything at signing, monthly payments and fees still apply—budget wisely.

- Credit matters: Most 0-down lease offers require good to excellent credit; check your score before applying.

- Used leases offer better value: Pre-owned vehicles depreciate slower, making them ideal for low-cost leasing.

- Shop certified pre-owned (CPO): CPO cars come with warranties and inspections, reducing long-term risks.

- Compare lease terms: Mileage limits, wear-and-tear policies, and early termination fees vary—read the fine print.

- Negotiate even with 0 down: You can still haggle on monthly payments, mileage allowances, or included services.

- Local Seattle dealers offer specials: Many dealerships run seasonal promotions—timing your lease can save hundreds.

📑 Table of Contents

Why Choose a Used Car Lease in Seattle?

Leasing a new car has always been popular, but used car leases are gaining serious traction—and for good reason. In a city like Seattle, where traffic, weather, and parking challenges are part of daily life, a used vehicle often makes more practical and financial sense than a brand-new model.

One of the biggest advantages? Depreciation. New cars lose up to 20% of their value the moment you drive them off the lot. Used cars, especially those that are 2–3 years old, have already taken the biggest depreciation hit. That means you’re leasing a vehicle that holds its value better, which translates to lower monthly payments.

Another perk? Lower insurance costs. Since used cars are typically valued lower than new ones, your insurance premiums are often cheaper. And in Seattle, where insurance rates can be high due to population density and weather-related claims, every dollar counts.

Plus, many used cars available for lease are certified pre-owned (CPO). These vehicles have been inspected, refurbished, and backed by manufacturer or dealer warranties—giving you peace of mind without the new-car price tag.

The Seattle Market Advantage

Seattle’s competitive automotive market works in your favor. With a high concentration of dealerships in areas like Renton, Bellevue, and Southcenter, there’s plenty of inventory and incentive to attract customers. Many dealers offer special promotions, especially during slower months like January or July, to move used inventory.

You’ll also find a strong selection of fuel-efficient and hybrid models—perfect for Seattle’s eco-conscious drivers and stop-and-go traffic. Brands like Toyota, Honda, and Subaru are especially popular in the Pacific Northwest, and many offer attractive lease deals on their certified used fleets.

How Does a 0 Down Used Car Lease Work?

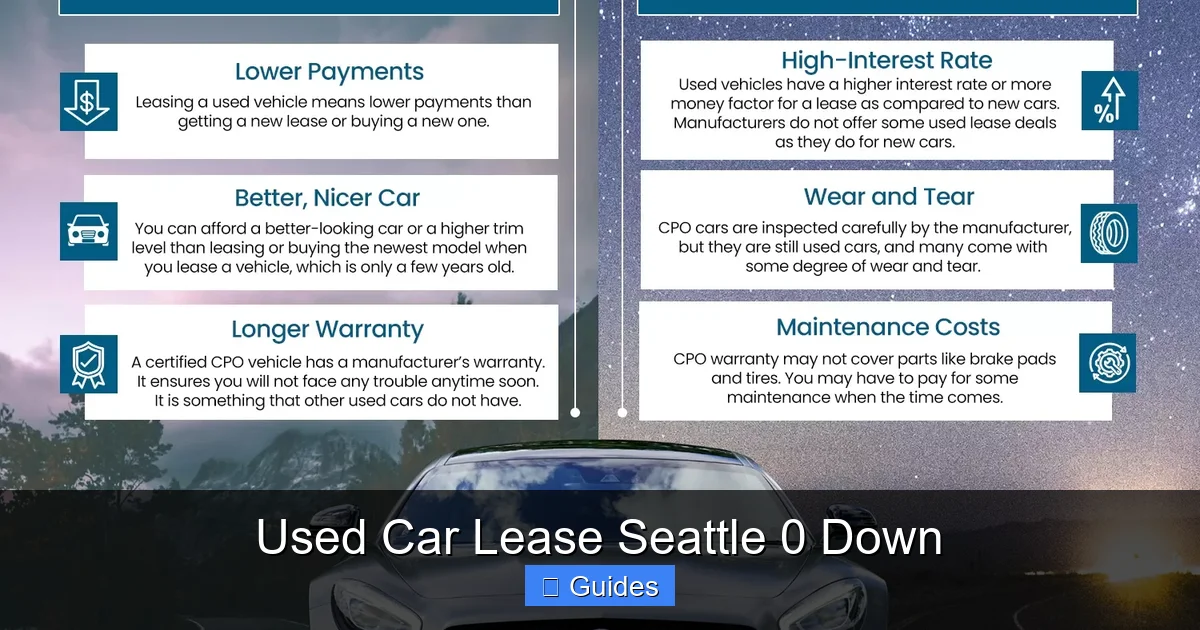

Visual guide about Used Car Lease Seattle 0 Down

Image source: brokernews.co.uk

Let’s clear up a common misconception: “0 down” doesn’t mean you pay nothing. It means you’re not required to make a large upfront payment—typically called a “down payment” or “cap cost reduction”—at the time you sign the lease.

Instead, the cost of the vehicle is spread over the lease term, usually 24 to 36 months. You’ll still pay monthly lease payments, which include depreciation, interest (called the “money factor”), taxes, and fees. But you won’t hand over $2,000 or $3,000 at signing.

Here’s a simple breakdown of what you’ll typically pay with a 0 down lease:

– **Monthly lease payment:** Based on the car’s residual value, money factor, and term.

– **Acquisition fee:** A one-time fee charged by the leasing company (usually $500–$1,000).

– **Security deposit:** Sometimes waived with good credit, but may still be required.

– **First month’s payment:** Often due at signing, even with 0 down.

– **Taxes and registration:** Added to your monthly payment or paid upfront.

For example, let’s say you lease a used 2021 Honda CR-V with a 0 down offer. Your monthly payment might be $299 for 36 months. At signing, you’d pay the first month’s payment ($299), an acquisition fee ($795), and maybe a small documentation fee ($150). That’s about $1,244 total at signing—not zero, but far less than a traditional down payment.

What “0 Down” Really Means

It’s important to read the fine print. Some dealers advertise “$0 due at signing,” which sounds even better—but that usually means they’ve rolled the first month’s payment and fees into the lease, increasing your monthly cost. Others may require a security deposit or charge higher interest rates to offset the lack of down payment.

Always ask: “What is the total amount due at signing?” and “Are there any fees being rolled into the lease?” Transparency is key.

Finding the Best Used Car Lease Deals in Seattle

Visual guide about Used Car Lease Seattle 0 Down

Image source: insurancecentermo.com

Now that you understand how 0 down leases work, it’s time to find the best deals. The good news? Seattle has no shortage of options. The challenge is knowing where to look and what to avoid.

Start with Certified Pre-Owned (CPO) Programs

Your best bet for a reliable used lease is a certified pre-owned vehicle. CPO cars are typically 1–3 years old, have low mileage (under 40,000 miles), and have passed a rigorous multi-point inspection. They also come with extended warranties—often covering powertrain, roadside assistance, and even complimentary maintenance.

Major brands like Toyota, Honda, Hyundai, and Subaru offer strong CPO programs. For example, a 2022 Toyota RAV4 CPO might lease for $279/month with $0 down and include a 7-year/100,000-mile warranty. That’s peace of mind you won’t get with a private sale or non-certified used car.

Shop at Reputable Seattle Dealerships

Stick with well-known dealerships that have strong customer reviews and transparent pricing. Some top-rated options in the Seattle area include:

– **University Honda** – Known for excellent customer service and a wide CPO inventory.

– **Carson Cars** – Offers a large selection of used vehicles with flexible leasing options.

– **Honda of Burien** – Frequently runs lease specials on certified used models.

– **Toyota of Renton** – Great for hybrid and fuel-efficient used leases.

Avoid “buy-here-pay-here” lots or dealers with poor online reviews. These places may advertise 0 down leases but often charge inflated interest rates or hide fees in the contract.

Use Online Tools and Filters

Websites like Edmunds, Kelley Blue Book (KBB), and Cars.com let you filter used car listings by lease availability, price, mileage, and location. You can search specifically for “lease specials” or “$0 down” offers in the Seattle area.

Pro tip: Set up price alerts. When a new 0 down lease deal pops up on a used car you like, you’ll get notified instantly.

Time Your Lease Right

Dealerships often run promotions at the end of the month, quarter, or year to meet sales goals. January and July are especially good months to find deals, as inventory turnover slows and dealers are eager to clear out older models.

Also, keep an eye on manufacturer incentives. Brands like Hyundai and Kia frequently offer $0 down lease deals on their certified used vehicles, especially during holiday weekends or back-to-school seasons.

Understanding Lease Terms and Fine Print

Visual guide about Used Car Lease Seattle 0 Down

Image source: i.ytimg.com

Leasing a car—even a used one—is a legal contract. That means you need to understand the terms before you sign. Here’s what to watch for when reviewing a used car lease Seattle 0 down offer.

Mileage Limits

Most leases come with an annual mileage limit—typically 10,000, 12,000, or 15,000 miles. If you exceed this limit, you’ll be charged a per-mile fee, usually $0.10 to $0.25. For example, driving 18,000 miles in a year on a 12,000-mile lease could cost you $1,500 in overage fees.

If you commute long distances or plan to road-trip often, consider a higher mileage allowance—even if it means a slightly higher monthly payment. Some dealers let you prepay for extra miles at a discounted rate.

Wear and Tear Guidelines

At the end of your lease, the car will be inspected for excessive wear and tear. Minor scratches or dings are usually fine, but significant damage—like large dents, torn upholstery, or windshield cracks—could result in repair charges.

To avoid surprises, take photos of the car before you drive it off the lot. Keep records of any maintenance or repairs. And if you’re a pet owner or have kids, consider a lease-friendly car with durable interiors.

Early Termination and Buyout Options

Life happens. If you need to end your lease early, you may face steep penalties—sometimes thousands of dollars. However, some leases allow you to transfer the contract to another qualified driver (called a lease assumption), which can save you money.

At the end of the lease, you usually have three options:

1. Return the car and walk away (after paying any fees).

2. Buy the car at its residual value (the pre-set purchase price).

3. Lease a new vehicle from the same dealer.

Know your options before you sign.

Money Factor and Interest Rates

The “money factor” is the lease equivalent of an interest rate. It’s a small decimal (like 0.00250) that determines how much you’ll pay in finance charges. To convert it to an approximate APR, multiply by 2,400. So 0.00250 = 6% APR.

A lower money factor means lower monthly payments. If you have excellent credit, you’ll qualify for the best rates. If your credit is fair, you may still get approved—but expect a higher money factor.

Tips to Save Money on a Used Car Lease

Even with a 0 down offer, there are ways to reduce your overall cost. Here are some smart strategies to keep more money in your pocket.

Improve Your Credit Score

Your credit score directly impacts your lease terms. A score of 720 or higher qualifies you for the best deals. If your score is lower, take a few months to pay down debt, correct errors on your credit report, and avoid new credit applications.

Even a 50-point increase can save you $20–$30 per month on a typical lease.

Negotiate the Capitalized Cost

The “cap cost” is the negotiated price of the car—similar to the purchase price when buying. Even with a 0 down lease, you can (and should) negotiate this number down.

Use KBB or Edmunds to find the fair market value of the used car you want. Then, ask the dealer to match or beat that price. Every $1,000 you reduce the cap cost saves you about $30 per month on a 36-month lease.

Ask About Incentives and Rebates

Manufacturers and dealers often offer hidden incentives—like loyalty bonuses, conquest cash, or lease cash—that can reduce your monthly payment. These aren’t always advertised, so ask directly.

For example, if you’re leasing a used Hyundai, you might qualify for a $500 lease cash bonus just for being a first-time lessee.

Consider a Shorter Lease Term

While 36-month leases are common, a 24-month lease often has lower monthly payments because the car depreciates less over a shorter period. Just be aware that you’ll need to lease or buy again sooner.

Bundle Services

Some dealers offer discounts if you bundle maintenance, GAP insurance, or tire protection into your lease. While these add-ons cost extra, they can save you money in the long run—especially if you drive in Seattle’s rainy, pothole-prone streets.

Common Mistakes to Avoid

Even experienced drivers can fall into traps when leasing a used car. Here are the top mistakes to avoid.

Not Reading the Contract

It’s tempting to skim the lease agreement and sign quickly—especially when you’re excited to drive away. But skipping the fine print can cost you hundreds or thousands.

Always read every section, including the terms, fees, and end-of-lease conditions. If something isn’t clear, ask for clarification.

Overestimating Your Mileage Needs

Choosing a 10,000-mile lease when you drive 15,000 miles a year is a recipe for overage fees. Be honest about your driving habits and choose a mileage allowance that fits your lifestyle.

Ignoring the Total Cost

A $299/month lease sounds great—until you realize it’s $10,764 over 36 months, plus fees and taxes. Always calculate the total cost of the lease, not just the monthly payment.

Skipping the Test Drive

Even if a car looks perfect online, always take it for a test drive. Check for unusual noises, smooth shifting, and comfortable seating. A used car should feel reliable and responsive.

Not Comparing Offers

Don’t settle for the first 0 down deal you find. Get quotes from at least three different dealers. You might find a better rate, lower fees, or a more desirable vehicle just a few miles away.

Final Thoughts: Is a Used Car Lease with 0 Down Right for You?

Leasing a used car in Seattle with $0 down can be a smart, budget-friendly choice—if you do your homework. It’s ideal for drivers who want lower monthly payments, don’t want to commit to ownership, and prefer driving a newer vehicle without the steep depreciation of a new car.

But it’s not for everyone. If you drive a lot, prefer to own your vehicle, or have poor credit, a lease might not be the best fit. And remember: “0 down” doesn’t mean “no cost.” You’ll still pay for the lease, fees, and potential overages.

The key is to shop smart, read the contract, and choose a reliable certified pre-owned vehicle from a reputable dealer. With the right approach, you can enjoy a quality used car in Seattle—without spending a dime upfront.

So go ahead, explore your options, and drive with confidence. Your perfect used car lease with 0 down is out there.

Frequently Asked Questions

Can I lease a used car with $0 down in Seattle?

Yes, many Seattle dealerships offer used car lease deals with $0 down. These are often available on certified pre-owned vehicles and require good credit. Be sure to ask about total fees due at signing.

Do I need good credit for a 0 down used car lease?

Most 0 down lease offers require a credit score of 680 or higher. If your score is lower, you may still qualify but could face higher interest rates or require a co-signer.

What’s included in a 0 down lease payment?

Your monthly payment covers depreciation, interest (money factor), taxes, and fees. It does not include insurance, maintenance, or fuel—those are your responsibility.

Can I negotiate a used car lease with 0 down?

Absolutely. You can negotiate the vehicle price, money factor, mileage allowance, and even fees—even with a 0 down offer. Always compare multiple quotes.

What happens at the end of a used car lease?

You can return the car (after inspection), buy it at the residual value, or lease a new vehicle. Be aware of wear-and-tear charges and mileage overages.

Are used car leases cheaper than new car leases?

Yes, used car leases typically have lower monthly payments because the vehicle has already depreciated. This makes them a great value, especially with 0 down offers.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.