A car lease month to month offers unmatched flexibility for drivers who need a vehicle without long-term commitment. Ideal for temporary jobs, travel, or testing a car before buying, this short-term option comes with unique benefits and trade-offs. Understanding the costs, availability, and alternatives helps you decide if it’s the right choice for your lifestyle.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is a Car Lease Month to Month?

- 4 Pros and Cons of Month-to-Month Car Leasing

- 5 How Much Does a Month-to-Month Car Lease Cost?

- 6 Where to Find Month-to-Month Car Leases

- 7 Alternatives to Month-to-Month Leasing

- 8 Tips for Getting the Best Deal

- 9 Is a Month-to-Month Car Lease Right for You?

- 10 Frequently Asked Questions

- 10.1 Can I really return the car anytime with a month-to-month lease?

- 10.2 Are there mileage limits on month-to-month leases?

- 10.3 Do I need a special insurance policy?

- 10.4 Can I buy the car at the end of a month-to-month lease?

- 10.5 Are electric vehicles available for month-to-month leasing?

- 10.6 What happens if I damage the car?

Key Takeaways

- Flexibility: Month-to-month car leases allow you to return the vehicle at any time, making them perfect for uncertain schedules or temporary needs.

- Higher Monthly Cost: These leases typically cost more per month than traditional 24- or 36-month leases due to shorter terms and less predictable usage.

- Limited Availability: Not all dealerships or leasing companies offer month-to-month options, and inventory may be restricted to certain models.

- No Mileage Caps (Usually): Unlike standard leases, many month-to-month agreements don’t enforce strict mileage limits, giving you more freedom.

- Maintenance Responsibility: You’re often responsible for routine maintenance and repairs, so budgeting for upkeep is essential.

- Ideal for Short-Term Scenarios: Great for internships, seasonal work, military deployments, or trying out an electric vehicle before committing.

- Alternatives Exist: If a true month-to-month lease isn’t available, consider rental programs, subscription services, or short-term lease buyouts.

📑 Table of Contents

What Is a Car Lease Month to Month?

Imagine needing a car for just a few months—maybe you’re between jobs, relocating temporarily, or simply want to test drive a new model without signing a three-year contract. That’s where a car lease month to month comes in. Unlike traditional leases that lock you into 24, 36, or even 48 months, a month-to-month lease lets you pay for a vehicle on a rolling monthly basis with the freedom to return it at the end of any billing cycle.

This arrangement is rare but growing in popularity, especially as more people seek flexible transportation solutions. While not every dealership offers it, some independent leasing companies, luxury car brands, and even certain automakers (like Tesla and Volvo) have started experimenting with short-term leasing models. The core idea is simple: you get access to a new or nearly new car without the long-term financial or contractual commitment.

How It Differs from Traditional Leasing

Standard car leases are structured like loans—you agree to pay a fixed monthly amount for a set period, usually 2–4 years. At the end, you return the car (assuming you’ve stayed within mileage and wear limits) or buy it outright. In contrast, a car lease month to month has no fixed end date. You can cancel with as little as 30 days’ notice in many cases, though specific terms vary by provider.

Another key difference? Depreciation. Traditional leases factor in predictable depreciation over time, which keeps monthly payments lower. With month-to-month leases, the leasing company takes on more risk—they don’t know how long you’ll keep the car—so they charge a premium to offset potential losses. That’s why your monthly payment might be noticeably higher than if you’d signed a standard lease.

Who Should Consider This Option?

This model isn’t for everyone—but it’s a game-changer for certain lifestyles. Freelancers with fluctuating workloads, digital nomads, students on co-op programs, or professionals on short-term assignments often find month-to-month leases ideal. It’s also a smart move if you’re waiting for a new car delivery (like an EV with long waitlists) and need wheels in the meantime.

Even car enthusiasts love it: want to drive a Porsche 911 for the summer? A month-to-month lease lets you enjoy high-performance driving without a multi-year tie-down. Just remember—this flexibility comes at a price, so weigh your needs carefully.

Pros and Cons of Month-to-Month Car Leasing

Like any financial decision, a car lease month to month has clear advantages and drawbacks. Let’s break them down so you can make an informed choice.

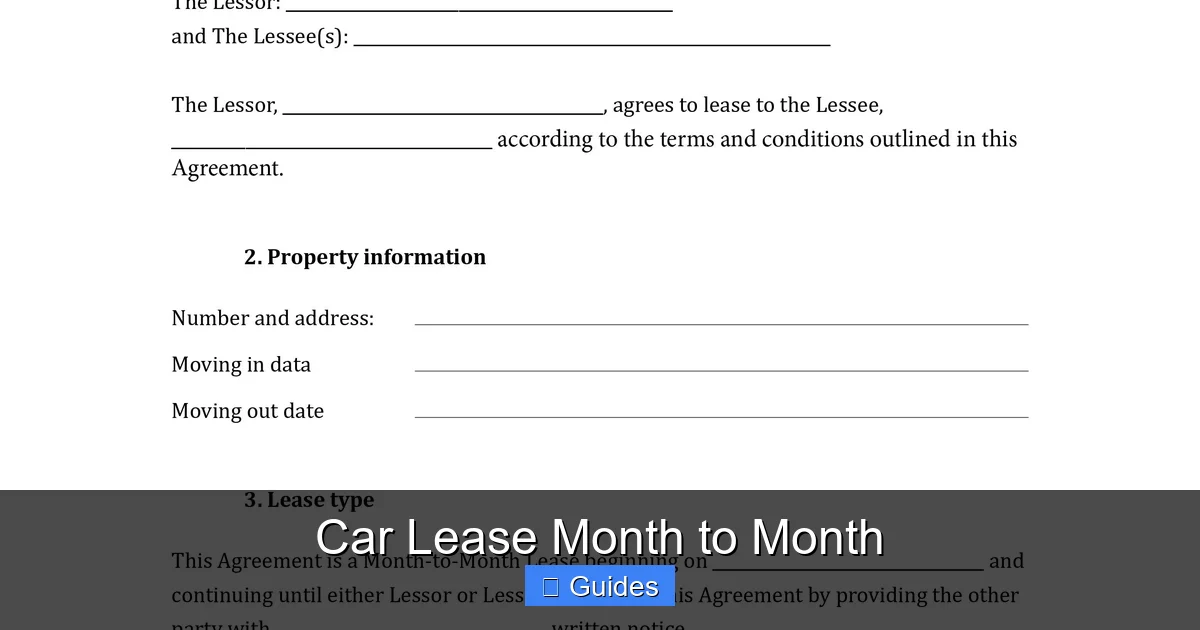

Visual guide about Car Lease Month to Month

Image source: images.template.net

Top Benefits

Ultimate Flexibility: The biggest perk is freedom. Need the car for three months? Six? A year? You decide. No penalties for early return (beyond possible notice requirements), and no fear of being stuck with a vehicle you no longer need.

No Long-Term Commitment: Traditional leases often include hefty early termination fees—sometimes thousands of dollars. With month-to-month, you avoid that trap entirely. This is especially valuable in uncertain economic times or personal situations.

Access to Newer Vehicles: Many month-to-month programs offer late-model or even brand-new cars with the latest tech and safety features. You’re not limited to older, high-mileage models like with some rentals.

Simplified Insurance: Unlike daily rentals, you typically insure the car under your own policy (or add it to an existing one), which can be cheaper and more convenient than paying daily insurance fees.

Potential Downsides

Higher Monthly Payments: Expect to pay 20–50% more per month compared to a standard lease. For example, a $300/month 36-month lease might cost $450–$550 on a month-to-month basis. This premium covers the leasing company’s risk and administrative costs.

Limited Vehicle Selection: Not all cars are available for short-term leasing. Luxury brands, EVs, and high-demand models are more likely to offer this option, while economy cars may not. Inventory can also fluctuate based on market conditions.

Maintenance and Wear Responsibility: While some programs include basic maintenance, most hold you accountable for routine upkeep—oil changes, tire rotations, brake pads—and any damage beyond “normal wear.” Neglecting maintenance could lead to extra charges upon return.

Less Predictable Total Cost: Because you’re paying a premium each month, the total cost over time can exceed buying or even renting. If you end up keeping the car for 18+ months, a traditional lease or purchase might have been cheaper.

How Much Does a Month-to-Month Car Lease Cost?

Cost is often the deciding factor—and with good reason. A car lease month to month isn’t cheap, but it’s not necessarily outrageous either. Let’s look at real-world examples and what drives the pricing.

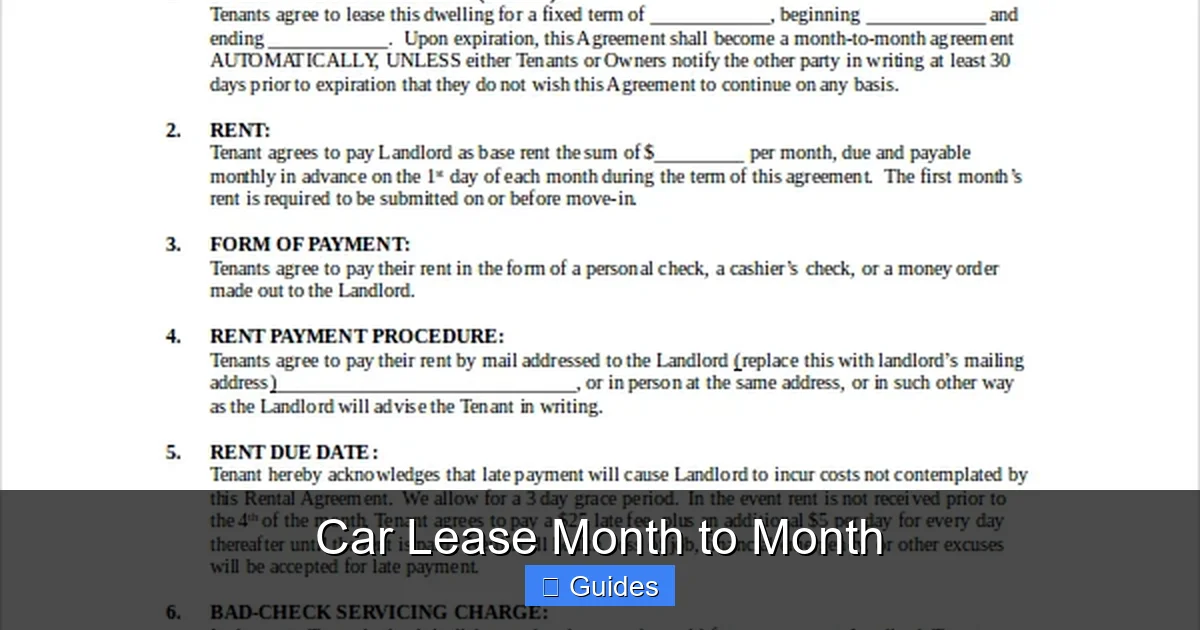

Visual guide about Car Lease Month to Month

Image source: templatelab.com

Typical Price Ranges

For a midsize sedan like a Honda Accord or Toyota Camry, expect to pay $400–$600 per month. Compact SUVs (e.g., Mazda CX-5, Subaru Forester) run $500–$700. Luxury vehicles—think BMW 3 Series, Mercedes C-Class, or Tesla Model 3—can easily hit $800–$1,200+ monthly.

Compare that to a standard 36-month lease: the same Accord might lease for $280/month, and the Tesla for $550/month. The month-to-month premium is real—but so is the flexibility.

What’s Included (and What’s Not)

Most month-to-month leases include:

- Use of the vehicle with full manufacturer warranty coverage

- Basic roadside assistance (varies by provider)

- No mileage restrictions (or very high caps, like 2,000 miles/month)

But you’ll likely pay extra for:

- Comprehensive maintenance packages (e.g., oil changes, tire rotations)

- Excess wear-and-tear repairs

- Insurance (though you can use your own policy)

- Administrative or processing fees (sometimes $200–$500 upfront)

Hidden Costs to Watch For

Always read the fine print. Some providers charge a “rollover fee” if you extend beyond your initial term, or impose penalties for late returns. Others require a security deposit (refundable, but ties up cash). And while mileage is usually unrestricted, excessive use might trigger re-inspection fees.

Pro Tip: Ask for a written breakdown of all potential charges before signing. If the provider can’t give you a clear answer, consider it a red flag.

Where to Find Month-to-Month Car Leases

Don’t expect to walk into your local Ford dealership and walk out with a month-to-month lease—most mainstream dealers don’t offer them. But options do exist if you know where to look.

Visual guide about Car Lease Month to Month

Image source: img.sixt.com

Specialized Leasing Companies

Companies like LeaseLink, FlexDrive, and Clutch specialize in flexible leasing. They partner with dealerships nationwide and offer online applications, transparent pricing, and curated vehicle selections. Many focus on EVs and premium brands, appealing to tech-savvy and environmentally conscious drivers.

Manufacturer Programs

A few automakers have launched their own short-term initiatives. Tesla offers “Lease-to-Own” and flexible terms through its website, especially for Model 3 and Y. Volvo’s “Care by Volvo” program includes month-to-month options with maintenance and insurance bundled. Even BMW and Mercedes-Benz have trial programs in select markets.

Dealership Exceptions

Some independent or high-end dealerships may accommodate custom lease requests, especially if you’re leasing a luxury or specialty vehicle. It never hurts to ask—especially if you’re a repeat customer or willing to pay a slightly higher rate.

Bonus Option: If a true month-to-month lease isn’t available, consider a short-term lease buyout. Some companies allow you to purchase a vehicle that’s nearing the end of its original lease term, then re-lease it to you on a monthly basis. It’s a workaround, but it can deliver similar flexibility.

Alternatives to Month-to-Month Leasing

If you can’t find a true car lease month to month, don’t panic—several alternatives deliver comparable flexibility.

Car Subscription Services

Services like Care by Volvo, Canvas (by Ford), and Clutch let you “subscribe” to a car for a monthly fee that includes insurance, maintenance, and roadside assistance. You can swap vehicles or cancel with 30 days’ notice. While not technically a lease, the experience is nearly identical—and often more convenient.

Long-Term Rentals

Major rental companies (Hertz, Enterprise, Avis) now offer monthly rental plans. These are ideal for 30+ days and often include maintenance. Rates are competitive with leasing, especially for economy cars. Just note: you won’t build equity, and you’re limited to available inventory.

Peer-to-Peer Car Sharing

Platforms like Turo or Getaround let you rent cars directly from owners. You can often negotiate monthly rates, and many hosts offer discounts for longer rentals. It’s budget-friendly and flexible, but coverage and reliability vary by owner.

Final Thought: If your primary need is short-term access without ownership, these alternatives may offer better value than a traditional month-to-month lease—especially if you prioritize cost over having the latest model.

Tips for Getting the Best Deal

Ready to explore a car lease month to month? Keep these strategies in mind to maximize value and avoid pitfalls.

Negotiate Upfront

Even though month-to-month leases are premium products, there’s often room to negotiate. Ask about waiving the security deposit, reducing the monthly rate, or including free maintenance for the first few months. Providers want your business—especially if you’re leasing a high-margin vehicle.

Check Your Credit

Most providers run a credit check. A score above 700 will help you qualify for better rates. If your credit is fair or poor, expect higher fees or a larger deposit. Consider pre-qualifying online to see estimated terms without a hard credit pull.

Read the Contract Thoroughly

Pay special attention to:

- Notice period for cancellation (usually 30 days)

- Definition of “normal wear and tear”

- Maintenance responsibilities

- Fees for late returns or extensions

Insure Properly

While you can use your existing auto policy, ensure it covers the leased vehicle fully. Gap insurance is also wise—it covers the difference between what you owe and the car’s value if it’s totaled. Some leasing companies require it.

Plan for the End

Before returning the car, schedule a pre-inspection. Clean it inside and out, fix minor dings, and document its condition with photos. This minimizes disputes over wear-and-tear charges.

Is a Month-to-Month Car Lease Right for You?

Ultimately, a car lease month to month is a niche solution—but a powerful one when matched to the right situation. Ask yourself:

- Do I need a car for less than 12 months?

- Is my schedule unpredictable or likely to change?

- Am I willing to pay a premium for flexibility?

- Do I prefer driving newer models without long-term ties?

If you answered “yes” to most, this option could be a perfect fit. But if you’re planning to keep a car for two years or more, a traditional lease or purchase will almost always save you money.

Remember: flexibility has a price—but for many, that price is worth it. Whether you’re navigating a career transition, exploring a new city, or just craving the thrill of a new ride every few months, a month-to-month car lease puts you in the driver’s seat—on your own terms.

Frequently Asked Questions

Can I really return the car anytime with a month-to-month lease?

Most providers require 30 days’ written notice before returning the vehicle, so it’s not truly “anytime.” However, you won’t face early termination penalties like with standard leases, giving you far more control over your commitment.

Are there mileage limits on month-to-month leases?

Generally, no—or the limits are very high (e.g., 2,000+ miles per month). This makes them ideal for road trips or commuters who drive more than average. Always confirm with your provider, though, as policies vary.

Do I need a special insurance policy?

No, you can usually add the leased vehicle to your existing auto insurance policy. However, you must meet the leasing company’s minimum coverage requirements, which often include comprehensive and collision coverage.

Can I buy the car at the end of a month-to-month lease?

Sometimes, yes—but it’s not guaranteed. Some programs allow you to purchase the vehicle at market value, while others require you to return it. Ask about purchase options before signing.

Are electric vehicles available for month-to-month leasing?

Yes! In fact, many month-to-month programs specialize in EVs due to high demand and rapid tech updates. Tesla, Hyundai, and Polestar are among the brands offering flexible EV leasing options.

What happens if I damage the car?

You’re responsible for repairs beyond normal wear and tear. Minor scratches or dents might be waived, but significant damage will incur charges. Always document the car’s condition at pickup and return to avoid disputes.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.