Leasing a car lets you drive a new vehicle for a set period—usually 24 to 36 months—with lower monthly payments than buying. Instead of owning the car, you pay for its depreciation during the lease term, plus fees and interest. At the end, you return the vehicle or buy it at a pre-set price.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is a Car Lease?

- 4 How Does a Lease on a Car Work? The Step-by-Step Process

- 5 Costs Involved in Leasing a Car

- 6 Pros and Cons of Leasing a Car

- 7 End-of-Lease Options: What Happens When Your Lease Ends?

- 8 Tips for Getting the Best Car Lease Deal

- 9 Is Leasing Right for You?

- 10 Frequently Asked Questions

Key Takeaways

- Lease payments are lower than loan payments: Since you’re only paying for the car’s depreciation during the lease term, monthly costs are typically cheaper than financing a purchase.

- You don’t own the car: At the end of the lease, the vehicle returns to the dealer unless you choose to buy it at the residual value.

- Mileage limits apply: Most leases cap annual mileage (e.g., 10,000–15,000 miles); exceeding this results in per-mile fees.

- Wear and tear matters: Excessive damage or modifications can lead to additional charges when returning the vehicle.

- Early termination is costly: Ending a lease early usually triggers penalties, making it expensive compared to selling a purchased car.

- Gap insurance is often included: Most leases include gap coverage, protecting you if the car is totaled and insurance payout falls short.

- Leasing works best for frequent upgraders: Ideal for those who want a new car every few years with minimal maintenance concerns.

📑 Table of Contents

What Is a Car Lease?

Leasing a car is like renting it long-term. Instead of buying the vehicle outright, you agree to use it for a fixed period—typically 24, 36, or 48 months—and make monthly payments based on how much the car is expected to lose in value during that time. Think of it as paying for the car’s “use,” not its ownership.

When you lease, you’re essentially covering the difference between the car’s starting price (called the capitalized cost) and its estimated worth at the end of the lease (the residual value). For example, if a $30,000 car is expected to be worth $18,000 after three years, your payments will cover that $12,000 drop in value, plus fees and interest.

Unlike buying, where you build equity and eventually own the car, leasing means you return the vehicle when the term ends—unless you decide to purchase it. This setup appeals to people who enjoy driving newer models with the latest tech and safety features without committing to long-term ownership.

How Leasing Differs from Buying

The biggest difference between leasing and buying is ownership. When you buy a car—whether with cash or a loan—you own it once the payments are done. With a lease, you never own the car; you’re just borrowing it for a while.

Monthly payments for leases are almost always lower than auto loan payments because you’re not paying off the entire vehicle—just its depreciation. However, once the lease ends, you have nothing to show for your payments unless you buy the car. In contrast, buying builds equity, and you can sell or trade in the car later.

Another key distinction is flexibility. Leasing lets you switch cars every few years with relative ease, while buying ties you to one vehicle for longer. But if you love your car and want to keep it for 10 years, buying is almost always the smarter financial move.

How Does a Lease on a Car Work? The Step-by-Step Process

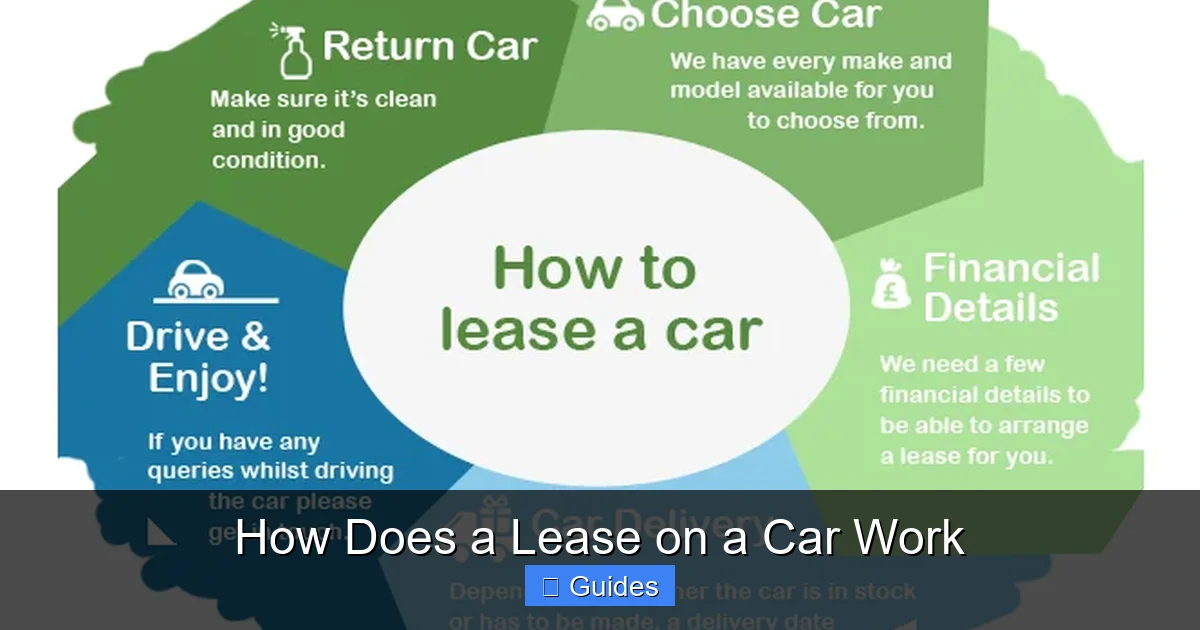

Leasing a car involves several clear steps, from choosing your vehicle to returning it at the end. Understanding this process helps you avoid surprises and make informed decisions.

Visual guide about How Does a Lease on a Car Work

Image source: autozonic.com

1. Choose the Right Vehicle

Start by picking a car that fits your lifestyle, budget, and needs. Popular lease choices include sedans, SUVs, and hybrids—especially models known for strong resale value, like Toyota, Honda, or Subaru. These cars depreciate slower, which can lead to lower monthly payments.

Consider what features matter most: fuel efficiency, cargo space, tech packages, or all-wheel drive. Keep in mind that luxury brands (like BMW or Mercedes) often have attractive lease deals to move inventory, but they may come with higher fees or stricter terms.

2. Negotiate the Capitalized Cost

The capitalized cost is the price of the car you agree to lease—similar to the purchase price when buying. Just like with a purchase, you can (and should) negotiate this number. Dealers may advertise “low lease payments,” but those are often based on inflated prices or hidden fees.

Tip: Research the car’s invoice price and current market value using tools like Kelley Blue Book or Edmunds. Aim to lease at or below the invoice price to get the best deal. Every dollar you reduce the capitalized cost saves you money over the life of the lease.

3. Agree on the Residual Value

The residual value is the car’s estimated worth at the end of the lease. It’s expressed as a percentage of the car’s MSRP (manufacturer’s suggested retail price). For example, a 60% residual on a $30,000 car means it’s expected to be worth $18,000 after three years.

Higher residual values mean lower monthly payments because you’re paying for less depreciation. Residuals are set by the leasing company and depend on the car’s make, model, and lease term. Generally, shorter leases have higher residuals.

4. Set the Money Factor (Interest Rate)

The money factor is the lease equivalent of an interest rate. It’s a small decimal (like 0.00250) that determines how much you’ll pay in finance charges. To convert it to an approximate APR, multiply by 2,400. So 0.00250 × 2,400 = 6% APR.

Your credit score heavily influences the money factor. Better credit = lower money factor = lower payments. Always ask for the money factor upfront—it’s not always disclosed clearly in ads.

5. Determine Mileage Limits and Fees

Most leases include an annual mileage limit—commonly 10,000, 12,000, or 15,000 miles. If you drive more, you’ll pay extra—often $0.10 to $0.25 per mile. Estimate your yearly driving honestly. If you commute long distances or take frequent road trips, consider a higher mileage allowance upfront to avoid surprise charges.

Other common fees include an acquisition fee (up to $1,000, sometimes rolled into payments), disposition fee (charged when returning the car), and security deposit (often waived with good credit).

6. Sign the Lease Agreement

Once all terms are set, you’ll sign a lease contract outlining everything: monthly payment, term length, mileage cap, wear-and-tear guidelines, and end-of-lease options. Read it carefully. Ask questions about anything unclear—especially penalties or optional add-ons.

Tip: Avoid unnecessary extras like “maintenance packages” or “excess wear protection” unless you really need them. Many are overpriced and duplicate coverage you already have.

Costs Involved in Leasing a Car

Leasing isn’t just about monthly payments. Several upfront and ongoing costs add up. Knowing them helps you budget accurately and avoid sticker shock.

Visual guide about How Does a Lease on a Car Work

Image source: tffn.net

Upfront Costs

- Down payment (cap cost reduction): Some leases require a down payment to lower monthly costs. However, putting money down increases your risk if the car is totaled—you may not get it back.

- Acquisition fee: A one-time charge (usually $500–$1,000) to set up the lease. Sometimes negotiable or rollable into payments.

- First month’s payment: Due at signing.

- Security deposit: Often refundable, but not always required with good credit.

- Taxes and registration: Vary by state but typically due upfront.

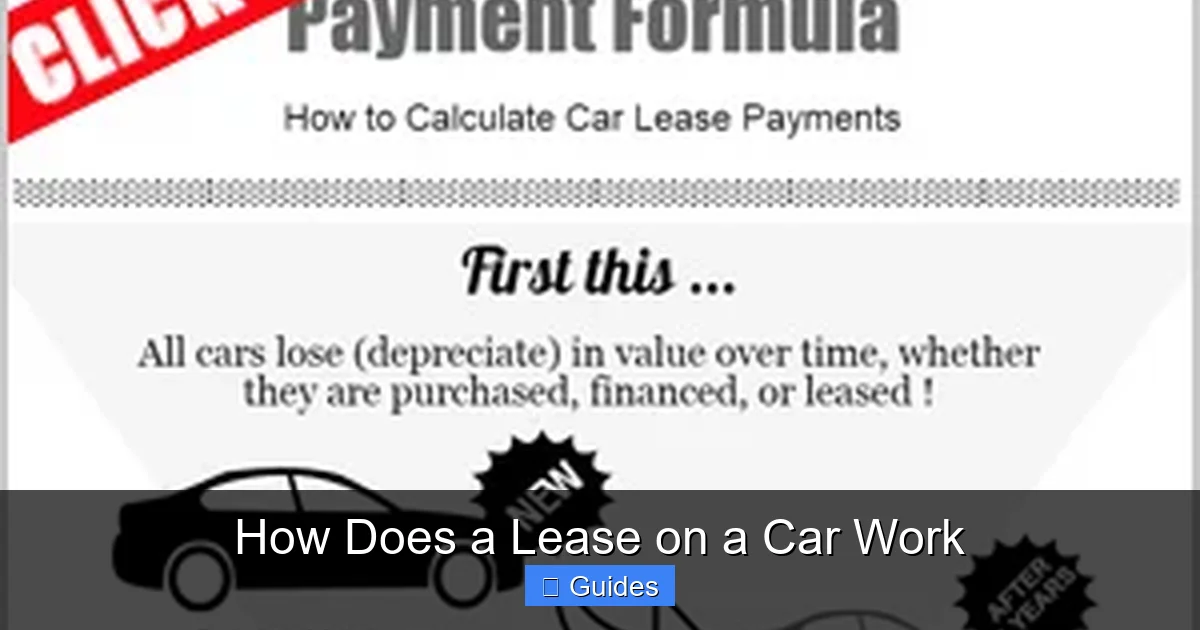

Monthly Payments

Your monthly lease payment consists of three parts:

- Depreciation (capitalized cost minus residual value, divided by lease term)

- Finance charge (money factor × (capitalized cost + residual value))

- Taxes (sales tax on the payment, if applicable)

For example, leasing a $30,000 car with a $18,000 residual over 36 months, a money factor of 0.00200, and 6% tax might cost around $320/month. That’s often $100–$200 less than a comparable loan payment.

End-of-Lease Costs

- Disposition fee: $300–$500 charged when returning the car.

- Excess mileage fees: If you drove over your limit.

- Wear and tear charges: For dents, scratches, tire wear, or interior damage beyond “normal.”

- Early termination fees: Can be thousands of dollars if you end the lease early.

Tip: Take photos of the car before returning it to document its condition. This can help dispute unfair charges.

Pros and Cons of Leasing a Car

Leasing isn’t for everyone. It has clear advantages and drawbacks depending on your driving habits, budget, and long-term goals.

Visual guide about How Does a Lease on a Car Work

Image source: leaseguide.com

Advantages of Leasing

- Lower monthly payments: You’re paying for depreciation, not the full value, so costs are typically lower than buying.

- Drive a new car every few years: Enjoy the latest safety tech, infotainment, and fuel-efficient engines.

- Lower repair costs: Most leases fall within the manufacturer’s warranty period, so major repairs are covered.

- No resale hassle: Return the car at the end—no need to sell or trade it yourself.

- Tax benefits for business use: If you use the car for work, you may deduct a portion of lease payments (consult a tax professional).

Disadvantages of Leasing

- No ownership: You don’t build equity. After years of payments, you have nothing to show.

- Mileage restrictions: Exceeding limits leads to steep fees.

- Wear and tear penalties: Even minor damage can cost extra.

- Long-term costlier: If you lease repeatedly, you’ll always have a car payment—unlike owning a paid-off vehicle.

- Customization limits: You can’t modify the car (e.g., lift kits, custom paint) without risking charges.

- Early exit penalties: Breaking a lease early is expensive and complicated.

Ask yourself: Do I drive a lot? Do I love my car and want to keep it long-term? If yes, buying might suit you better. If you prefer low payments and new models every few years, leasing could be ideal.

End-of-Lease Options: What Happens When Your Lease Ends?

When your lease term ends, you typically have three choices: return the car, buy it, or lease a new one. Each option has implications for your wallet and lifestyle.

Option 1: Return the Car

This is the most common path. You bring the vehicle back to the dealership, have it inspected, and pay any applicable fees (mileage, wear, disposition). As long as you’re within limits, you walk away with no further obligation—except possibly signing a new lease on a different car.

Tip: Schedule the inspection ahead of time and clean the car thoroughly. Small fixes (like replacing burnt-out bulbs or worn wiper blades) can prevent unnecessary charges.

Option 2: Buy the Car

You can purchase the vehicle at its residual value—the pre-set price agreed upon in your lease. This amount is listed in your contract, so there’s no negotiation. If the car’s market value is higher than the residual, you’re getting a deal. If it’s lower, you might be overpaying.

Example: Your lease says the car is worth $18,000 at the end. If similar models sell for $20,000, buying it saves you $2,000. But if they’re only worth $16,000, you’d pay $2,000 more than market rate.

You can finance the purchase through the dealer or your bank. Some lessees choose this route if they’ve grown attached to the car or want to avoid a new lease payment.

Option 3: Lease a New Car

Many people roll from one lease into another. Dealers often encourage this with incentives like waived fees or reduced down payments. It’s convenient—you drive off in a new model with minimal hassle.

But be cautious: perpetual leasing means you’ll always have a car payment. Over 10 years, you could pay far more in lease payments than if you’d bought one car and kept it.

Tip: Use the end of your lease as a chance to reassess. Could buying make more sense now? Have your driving habits changed? Take time to evaluate before signing another agreement.

Tips for Getting the Best Car Lease Deal

A great lease starts with preparation. Follow these practical tips to save money and avoid common pitfalls.

Check Your Credit Score

Your credit score affects your money factor. Aim for a score of 700 or higher to qualify for the best rates. Check your credit report for errors and pay down debts before applying.

Shop Multiple Dealers

Lease terms vary widely between dealerships—even for the same car. Get quotes from at least three dealers. Use online tools like Leasehackr or Edmunds to compare offers side by side.

Negotiate Everything

Don’t accept the first offer. Negotiate the capitalized cost, money factor, and fees just like you would when buying. Remember: lower cap cost = lower payments.

Consider a “Walk-Away” Lease

Some leases allow you to return the car early with a small fee—useful if your needs change. Ask about early termination clauses before signing.

Read the Fine Print

Understand all terms: mileage limits, wear guidelines, insurance requirements, and end-of-lease options. If something isn’t clear, ask for clarification in writing.

Avoid Over-Insuring

While gap insurance is usually included, don’t pay for unnecessary add-ons like “excess wear protection” or “maintenance packages.” You likely already have coverage through your auto insurer or warranty.

Is Leasing Right for You?

Leasing a car works well for certain drivers but not others. Ask yourself these questions to decide:

- Do I drive fewer than 12,000 miles per year?

- Do I prefer driving a new car every 2–3 years?

- Am I comfortable never owning the vehicle?

- Can I afford potential end-of-lease fees?

- Do I want lower monthly payments and minimal repair worries?

If you answered “yes” to most, leasing might be a smart choice. But if you drive a lot, love modifying your car, or want to build equity, buying is likely better.

Ultimately, a lease on a car is a financial tool—not a one-size-fits-all solution. When used wisely, it offers flexibility, affordability, and access to newer technology. But it requires discipline, awareness of limits, and careful planning.

Take your time, do your research, and don’t rush into a decision. The right lease can make driving enjoyable and budget-friendly. The wrong one can leave you paying more than necessary with nothing to show for it.

Frequently Asked Questions

Can you negotiate a car lease?

Yes, you can negotiate several aspects of a lease, including the capitalized cost, money factor, and fees. Just like buying a car, the advertised terms aren’t always set in stone. Research and compare offers to get the best deal.

What happens if you go over your mileage limit?

If you exceed your annual mileage limit, you’ll be charged a per-mile fee—typically $0.10 to $0.25—when you return the car. To avoid this, choose a higher mileage allowance upfront or consider buying if you drive a lot.

Can you end a car lease early?

Yes, but it’s usually expensive. Early termination fees can cost thousands of dollars, depending on how much time is left. Some leases offer “walk-away” options with smaller penalties, so check your contract.

Do you need full coverage insurance on a leased car?

Yes, leasing companies require comprehensive and collision coverage with low deductibles. This protects their asset since they technically own the car during the lease term.

Can you lease a used car?

Most leases are for new vehicles, but some dealerships and leasing companies offer certified pre-owned (CPO) car leases. These are less common and may have different terms, so shop carefully.

Is it better to lease or buy a car?

It depends on your priorities. Leasing offers lower payments and new cars every few years, while buying builds equity and eliminates long-term payments. Consider your driving habits, budget, and goals before deciding.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.