Deciding whether to lease or buy a car depends on your financial goals and driving habits—buying builds equity and offers long-term savings, while leasing provides lower monthly payments and the latest features with less commitment. If you prefer driving a new vehicle every few years and want lower upfront costs, leasing may be ideal; however, if you plan to keep a car long-term and avoid mileage restrictions, buying is the smarter financial move.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Is Better to Lease or Buy a Car? A Real Talk Guide to Making the Right Choice

- 4 Understanding the Basics: What Does Leasing and Buying Actually Mean?

- 5 The Financial Breakdown: Cost Comparison Over Time

- 6 Lifestyle and Usage: How Your Driving Habits Matter

- 7 Pros and Cons: A Balanced Look at Leasing vs. Buying

- 8 Real-Life Scenarios: When Leasing or Buying Makes the Most Sense

- 9 Tips to Make the Smartest Decision for You

- 10 Final Thoughts: Is Better to Lease or Buy a Car?

- 11 Frequently Asked Questions

- 11.1 Is it better to lease or buy a car if I want lower monthly payments?

- 11.2 What are the pros and cons of leasing vs buying a car?

- 11.3 Is it smarter to lease or buy a car if I drive a lot?

- 11.4 Can I customize a leased car like I would a purchased one?

- 11.5 Is leasing or buying better for my credit score?

- 11.6 Should I lease or buy a car if I want to avoid long-term maintenance costs?

Key Takeaways

- Leasing offers lower monthly payments: Ideal if you prefer affordability and driving new cars often.

- Buying builds equity over time: Better long-term value if you keep the car for years.

- Leasing limits mileage and modifications: Penalties apply for excess use or custom changes.

- Buying avoids usage restrictions: Drive freely and personalize without extra fees.

- Leasing includes warranty coverage: Repairs are typically covered during the lease term.

- Buying costs more upfront: Higher down payment and monthly payments compared to leasing.

📑 Table of Contents

- Is Better to Lease or Buy a Car? A Real Talk Guide to Making the Right Choice

- Understanding the Basics: What Does Leasing and Buying Actually Mean?

- The Financial Breakdown: Cost Comparison Over Time

- Lifestyle and Usage: How Your Driving Habits Matter

- Pros and Cons: A Balanced Look at Leasing vs. Buying

- Real-Life Scenarios: When Leasing or Buying Makes the Most Sense

- Tips to Make the Smartest Decision for You

- Final Thoughts: Is Better to Lease or Buy a Car?

Is Better to Lease or Buy a Car? A Real Talk Guide to Making the Right Choice

So, you’re in the market for a new car. Maybe your old ride finally gave up the ghost after 150,000 miles and three cross-country road trips. Or maybe you’re just ready for something newer, shinier, and with better gas mileage. Whatever your reason, you’ve probably already started wondering: Is better to lease or buy a car?

It’s a question that trips up even the most financially savvy people. On one hand, leasing sounds tempting—lower monthly payments, driving a new car every few years, and minimal repair worries. On the other, buying feels more permanent and “adult”—you own it, you can drive it into the ground, and eventually, you’re not making car payments anymore. But which path actually makes the most sense for you?

The truth is, there’s no one-size-fits-all answer. Whether it’s better to lease or buy a car depends on your lifestyle, budget, driving habits, and long-term goals. Some people thrive with the flexibility of leasing; others feel more secure owning their wheels outright. In this guide, we’ll break down the pros and cons of each option, share real-life examples, and help you figure out which route aligns with your needs. No fluff, no sales pitch—just honest, practical advice to help you make a smart decision.

Understanding the Basics: What Does Leasing and Buying Actually Mean?

Before we dive into which is better, let’s make sure we’re on the same page about what leasing and buying really involve. These aren’t just buzzwords—they represent two very different financial relationships with your vehicle.

Visual guide about Is Better to Lease or Buy a Car

Image source: blog.taxact.com

What Is Leasing a Car?

Leasing a car is essentially renting it for a fixed period, usually 24 to 36 months. You pay a monthly fee to use the vehicle, but you don’t own it. Think of it like an extended test drive. At the end of the lease term, you return the car to the dealership (assuming you’ve followed the rules), and you can either walk away or lease a new model.

Leases often come with mileage limits (typically 10,000 to 15,000 miles per year), and you may face fees for excess wear and tear or going over your mileage allowance. However, because you’re only paying for the car’s depreciation during the lease period (not the full value), monthly payments are usually lower than loan payments for the same vehicle.

What Is Buying a Car?

Buying a car means you’re purchasing it outright—either with cash or through a loan. Once the loan is paid off (usually over 3 to 7 years), the car is 100% yours. You can drive it as much as you want, modify it, sell it, or keep it until it won’t start anymore.

While monthly payments are typically higher than lease payments, you build equity in the vehicle over time. And once the loan is done, you’re free of car payments—a huge financial win in the long run. Plus, you avoid mileage restrictions and penalties for wear and tear.

Key Differences at a Glance

- Ownership: Leasing = temporary use; Buying = full ownership

- Monthly Cost: Leasing = usually lower; Buying = usually higher

- Mileage Limits: Leasing = strict limits; Buying = no limits

- Customization: Leasing = limited; Buying = full freedom

- Long-Term Cost: Leasing = ongoing payments; Buying = one-time cost (after loan)

Now that we’ve covered the basics, let’s explore the financial side of things—because money talks.

The Financial Breakdown: Cost Comparison Over Time

When deciding whether it’s better to lease or buy a car, cost is usually the biggest factor. But it’s not just about monthly payments. You need to look at the total cost of ownership over time, including depreciation, interest, insurance, maintenance, and resale value.

Visual guide about Is Better to Lease or Buy a Car

Image source: thebalancemoney.com

Upfront and Monthly Costs

Leasing often requires a lower down payment—sometimes as little as $0 to $2,000—compared to buying, where a 10% to 20% down payment is typical. Monthly lease payments are also generally 20% to 30% lower than loan payments for the same car. For example, leasing a $35,000 SUV might cost $350/month, while buying it with a loan could run $550/month.

But here’s the catch: with leasing, you’re always making payments. You never own the car, so you’re essentially paying forever to drive. With buying, once the loan is paid off, those payments stop—and you still have a valuable asset (even if it’s used).

Long-Term Ownership Costs

Let’s say you keep a car for 10 years. If you buy it with a 5-year loan, you’ll have 5 years of payments followed by 5 years of driving payment-free. If you lease, you’ll likely lease three different cars over that same period—each with its own 3-year payment cycle. Over 10 years, leasing could cost you significantly more in total.

For example:

| Option | Monthly Payment | Term | Total Paid Over 10 Years |

|---|---|---|---|

| Lease (3 leases, 3 years each) | $400 | 9 years (with 1 year gap) | $43,200 |

| Buy (5-year loan, keep 10 years) | $600 | 5 years | $36,000 |

In this scenario, buying saves you $7,200 over a decade—and you still own a car worth several thousand dollars at the end.

Depreciation: The Silent Cost

All cars lose value the moment they’re driven off the lot. In fact, a new car can lose 20% to 30% of its value in the first year. Leasing actually works in your favor here because you’re only paying for the depreciation during the lease term, not the full value.

But if you buy, you absorb the full brunt of that depreciation. However, once the steepest drop is over (usually after 3–5 years), the rate of depreciation slows. So if you keep the car long-term, the impact evens out.

Tip: If you’re buying, consider a slightly used car that’s 2–3 years old. You’ll avoid the worst of the depreciation hit and still get a reliable vehicle with modern features.

Insurance and Maintenance Differences

Insurance costs are often higher for leased cars because lenders require full coverage (comprehensive and collision). With buying, you can drop comprehensive coverage once the car is paid off and older.

Maintenance is another factor. Leased cars are typically under warranty for the entire lease term, so repairs are usually covered. But if you buy and keep the car past the warranty period, you’ll be responsible for all maintenance and repairs—which can add up.

That said, many people offset this by setting aside a small amount each month into a “car maintenance fund” once their loan is paid off.

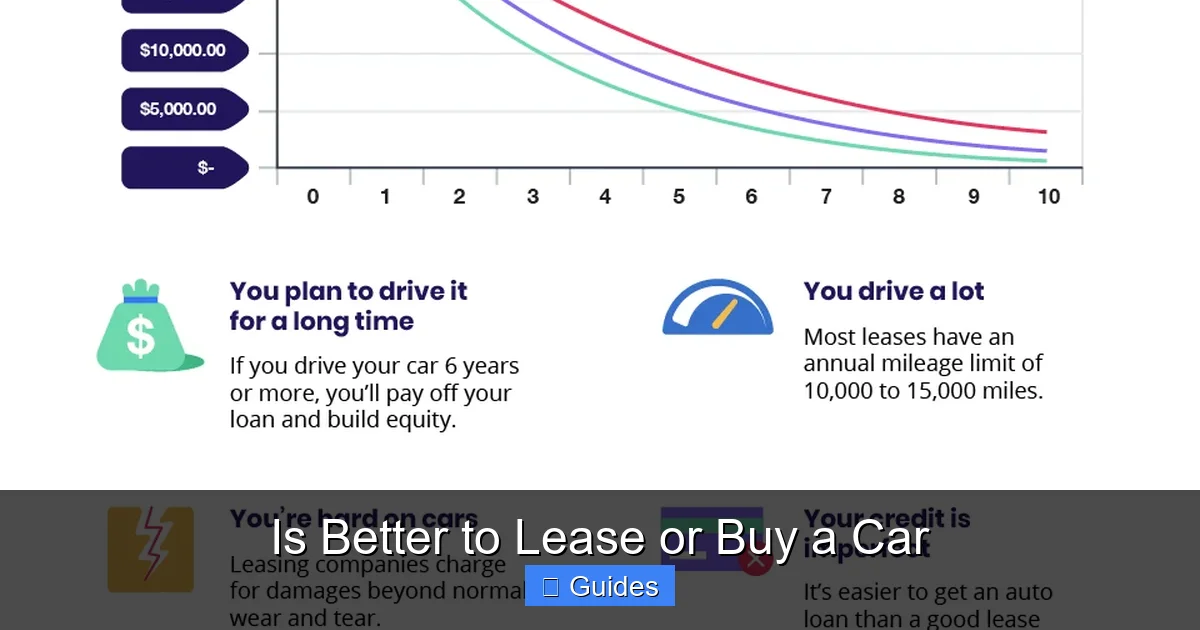

Lifestyle and Usage: How Your Driving Habits Matter

Money isn’t the only thing to consider. Your lifestyle and how you use your car play a huge role in whether it’s better to lease or buy a car.

Visual guide about Is Better to Lease or Buy a Car

Image source: savings.com.au

Mileage: The Lease Killer

If you drive a lot—say, 20,000 miles a year for work or road trips—leasing is probably not for you. Most leases cap mileage at 10,000 to 15,000 miles annually. Go over, and you’ll pay 15 to 25 cents per extra mile. That can add up fast.

For example, driving 18,000 miles on a 12,000-mile lease means 6,000 extra miles. At 20 cents per mile, that’s $1,200 in penalties—on top of your monthly payments.

Buying, on the other hand, has no mileage limits. Drive 50,000 miles a year? No problem. The car is yours.

Car Enthusiasts vs. Practical Drivers

Do you love having the latest tech, safety features, and a shiny new interior every few years? Leasing might be your jam. You can upgrade to a new model every 2–3 years without the hassle of selling your old car.

But if you’re the type who drives a car until the transmission gives out, buying is likely the better fit. You’ll avoid the cycle of endless payments and enjoy the freedom of ownership.

Customization and Personalization

Love tinted windows, custom rims, or a loud exhaust? Leasing restricts modifications. Most leases require you to return the car in near-original condition. Any permanent changes can result in fees.

Buying gives you full creative control. Want to turn your sedan into a weekend rally car? Go for it. It’s your ride.

Job Stability and Long-Term Plans

If your income is steady and you plan to stay in one place for years, buying makes sense. You’ll build equity and eventually enjoy payment-free driving.

But if you’re in a transitional phase—starting a new job, moving cities, or unsure about your future—leasing offers flexibility. You can return the car at the end of the term without worrying about resale value or trade-ins.

Pros and Cons: A Balanced Look at Leasing vs. Buying

Let’s lay it all out. Here’s a clear breakdown of the advantages and disadvantages of each option to help you decide: is better to lease or buy a car?

Pros of Leasing

- Lower monthly payments: Free up cash for other expenses or savings.

- Drive a new car more often: Enjoy the latest features, safety tech, and styling.

- Warranty coverage: Most repairs are covered during the lease term.

- No resale hassle: Just return the car and walk away.

- Tax benefits for businesses: Lease payments may be deductible if used for work.

Cons of Leasing

- No ownership: You’re always paying to use, never to own.

- Mileage restrictions: Penalties for going over the limit.

- Wear and tear fees: Charges for excessive damage.

- Customization limits: Can’t modify the car freely.

- Long-term cost: You’ll always have a car payment.

Pros of Buying

- Ownership: The car is yours once the loan is paid off.

- No mileage limits: Drive as much as you want.

- Freedom to customize: Make it truly yours.

- Equity building: The car retains some value you can sell or trade.

- Payment freedom: No more car payments after the loan ends.

Cons of Buying

- Higher monthly payments: Can strain your budget.

- Depreciation: The car loses value quickly, especially new ones.

- Maintenance costs: You’re responsible for repairs after warranty.

- Resale hassle: Selling a used car takes time and effort.

- Tech becomes outdated: Newer models may have better features.

As you can see, both options have real trade-offs. The “better” choice depends on what matters most to you.

Real-Life Scenarios: When Leasing or Buying Makes the Most Sense

Let’s look at a few real-world examples to help you see how these decisions play out in everyday life.

Scenario 1: The Commuter Who Drives 12,000 Miles a Year

Sarah works in the city and drives about 12,000 miles annually. She likes having a reliable, low-maintenance car with the latest safety features. She doesn’t care about customizing her vehicle and prefers lower monthly payments.

Verdict: Leasing is a great fit. She stays within mileage limits, enjoys warranty coverage, and can upgrade every few years. Her monthly cost is manageable, and she avoids the stress of selling a used car.

Scenario 2: The Family Road-Tripper

Mike and his wife have three kids and take long road trips every summer. They drive around 20,000 miles a year and want a spacious SUV they can rely on for at least 10 years. They also like to install roof racks and tow a small trailer.

Verdict: Buying is the way to go. The high mileage would trigger steep penalties with a lease. Plus, they need the freedom to modify and use the car heavily. Buying allows them to build equity and eventually drive payment-free.

Scenario 3: The Recent Graduate

Jamie just landed her first job and is moving to a new city. She’s not sure how long she’ll stay or if she’ll need a car long-term. She wants something reliable but doesn’t want to commit to a big financial obligation.

Verdict: Leasing offers flexibility. She can drive a new car for 2–3 years, then reassess her needs. If she decides to stay, she can buy the car or lease another. If she moves abroad, she can return it easily.

Scenario 4: The Car Enthusiast

Tom loves cars and enjoys tinkering with engines, upgrading sound systems, and painting custom designs. He drives about 10,000 miles a year and plans to keep his next car for at least 8 years.

Verdict: Buying is a no-brainer. He wants full control over modifications and doesn’t want to worry about lease restrictions. Plus, he’ll save money in the long run by avoiding perpetual payments.

Tips to Make the Smartest Decision for You

Still unsure? Here are some practical tips to help you decide whether it’s better to lease or buy a car.

- Calculate your annual mileage: If it’s over 15,000, leaning toward buying is wise.

- Compare total costs over 5–10 years: Don’t just look at monthly payments—look at the big picture.

- Check your credit score: Better credit means lower interest rates on loans and better lease terms.

- Negotiate the capitalized cost: Whether leasing or buying, the price you pay for the car matters. Always negotiate.

- Read the fine print: Understand mileage limits, wear-and-tear policies, and early termination fees.

- Consider certified pre-owned (CPO): A CPO car gives you warranty protection and lower depreciation—best of both worlds.

- Think about your long-term goals: Are you building wealth? Leasing doesn’t help. Want flexibility? Leasing delivers.

And remember: there’s no shame in either choice. What matters is that it fits your life.

Final Thoughts: Is Better to Lease or Buy a Car?

So, is better to lease or buy a car? The answer isn’t black and white—it’s shades of gray that depend on your personal situation.

If you value lower monthly payments, driving new cars, and avoiding long-term commitments, leasing might be the right path. It’s ideal for people with stable incomes, moderate driving habits, and a preference for hassle-free ownership.

But if you drive a lot, want to build equity, enjoy customizing your ride, or plan to keep a car for many years, buying is likely the smarter financial move. You’ll pay more upfront, but you’ll reap the rewards of ownership down the road.

Ultimately, the best choice is the one that aligns with your lifestyle, budget, and goals. Take the time to run the numbers, think about your habits, and don’t rush the decision. Whether you lease or buy, the goal is the same: to get behind the wheel of a car that serves you well—without breaking the bank.

Now go forth, do your research, and drive happy.

Frequently Asked Questions

Is it better to lease or buy a car if I want lower monthly payments?

Leasing a car often results in lower monthly payments compared to buying, since you’re only paying for the vehicle’s depreciation during the lease term. However, you won’t own the car at the end of the lease, which may not be ideal if you prefer long-term value.

What are the pros and cons of leasing vs buying a car?

Leasing offers lower payments and the ability to drive a new car every few years, but comes with mileage limits and no ownership. Buying involves higher payments but builds equity, and you can keep the car as long as you want without restrictions.

Is it smarter to lease or buy a car if I drive a lot?

If you drive more than 12,000 to 15,000 miles per year, buying is usually the better option. Leasing contracts include mileage limits, and exceeding them can result in costly penalties.

Can I customize a leased car like I would a purchased one?

Customizing a leased car is generally discouraged, as you must return it in near-original condition. When you buy a car, you have full freedom to modify it without worrying about lease-end inspections.

Is leasing or buying better for my credit score?

Both leasing and buying can impact your credit score if payments are made on time, but buying builds equity and may improve your credit mix over time. Leasing doesn’t build ownership, so its long-term financial benefits are limited.

Should I lease or buy a car if I want to avoid long-term maintenance costs?

Leasing can be advantageous if you want to avoid major repairs, since most leases fall within the manufacturer’s warranty period. Buying may lead to higher maintenance costs as the car ages, but you won’t face lease-end fees.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.