Choosing between financing a car or leasing depends on your financial goals, driving habits, and long-term plans. Financing lets you own the vehicle after payments, while leasing offers lower monthly costs and the chance to drive newer models—but with mileage limits and no ownership.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: The Big Decision – Finance or Lease?

- 4 What Is Car Financing?

- 5 What Is Car Leasing?

- 6 Cost Comparison: Financing vs. Leasing

- 7 Lifestyle and Driving Habits: Which Option Fits You?

- 8 Hidden Fees and Fine Print: What to Watch For

- 9 Tax, Insurance, and Maintenance Considerations

- 10 Resale Value and Long-Term Financial Impact

- 11 Making the Right Choice for You

- 12 Final Thoughts

- 13 Frequently Asked Questions

Key Takeaways

- Financing builds equity: You own the car after paying off the loan, which can be sold or traded later.

- Leasing offers lower monthly payments: Monthly costs are typically 20–30% less than financing, freeing up cash flow.

- Leasing includes mileage restrictions: Most leases limit you to 10,000–15,000 miles per year, with fees for going over.

- Financing has no usage limits: You can drive as much as you want, modify the car, and keep it for years.

- Leasing means always making payments: You never own the car and must return it or lease another at the end of the term.

- Financing may cost more upfront: Down payments and interest can add up, but you gain long-term value.

- Your lifestyle matters: Frequent upgraders may prefer leasing; long-term drivers often benefit from financing.

📑 Table of Contents

- Introduction: The Big Decision – Finance or Lease?

- What Is Car Financing?

- What Is Car Leasing?

- Cost Comparison: Financing vs. Leasing

- Lifestyle and Driving Habits: Which Option Fits You?

- Hidden Fees and Fine Print: What to Watch For

- Tax, Insurance, and Maintenance Considerations

- Resale Value and Long-Term Financial Impact

- Making the Right Choice for You

- Final Thoughts

Introduction: The Big Decision – Finance or Lease?

So, you’re ready for a new car. You’ve done your research, test-driven a few models, and now you’re standing at the dealership—ready to sign on the dotted line. But wait. There’s one more big question: should you finance the car or lease it?

It’s a decision that can impact your budget, your lifestyle, and your financial future. And while it might seem like a simple choice between two options, the truth is, it’s more nuanced than that. Both financing and leasing have their pros and cons, and the “better” option really depends on what you value most: ownership, flexibility, lower payments, or long-term savings.

In this guide, we’ll break down everything you need to know about financing versus leasing a car. We’ll compare costs, explain the fine print, and help you figure out which path aligns best with your goals. Whether you’re a first-time buyer or a seasoned car owner, this article will give you the clarity you need to make a confident decision.

What Is Car Financing?

Visual guide about Is It Better to Finance a Car or Lease

Image source: i0.wp.com

Financing a car means you’re taking out a loan to buy the vehicle. You make a down payment (usually 10–20% of the car’s value), and then you pay back the loan—plus interest—over a set period, typically 36 to 72 months. Once the loan is paid off, the car is 100% yours.

How Car Loans Work

When you finance a car, the lender (usually a bank, credit union, or the dealership’s finance department) loans you the money to purchase the vehicle. The car itself acts as collateral, meaning the lender can repossess it if you stop making payments. Each month, you pay back a portion of the principal (the amount borrowed) plus interest.

For example, let’s say you buy a $30,000 car with a $6,000 down payment. That leaves a $24,000 loan. If you get a 5-year loan at 5% interest, your monthly payment would be around $452. Over 60 months, you’d pay about $27,120—$3,120 in interest.

Pros of Financing a Car

One of the biggest advantages of financing is ownership. Once you’ve paid off the loan, the car is yours to keep, sell, or trade in. That means you’re building equity—something you don’t get with a lease.

You also have complete freedom with the vehicle. Want to drive 20,000 miles a year? Go for it. Planning to install a custom sound system or lift kit? No problem. With financing, there are no restrictions on how you use your car.

Another benefit is long-term savings. While monthly payments are higher than leasing, you’re not stuck in a cycle of endless payments. After the loan ends, you own a valuable asset—or at least a car that’s paid for, which can save you money on future transportation costs.

Cons of Financing a Car

Of course, financing isn’t perfect. The biggest downside is the higher monthly payment. Since you’re paying off the full value of the car (plus interest), your monthly bill will be significantly higher than a lease payment.

There’s also the risk of being “upside down” on your loan. This happens when you owe more on the car than it’s worth—a common issue in the first few years of ownership. If you need to sell the car early, you might not get enough to cover the loan balance.

And let’s not forget depreciation. Cars lose value fast—often 20% or more in the first year. With financing, you’re absorbing that loss, whereas with a lease, the leasing company bears most of it.

What Is Car Leasing?

Visual guide about Is It Better to Finance a Car or Lease

Image source: images.ctfassets.net

Leasing a car is like renting it for a long period—typically 24 to 36 months. You pay for the car’s depreciation during the lease term, plus fees and interest, but you never own the vehicle. At the end of the lease, you return the car to the dealership (unless you choose to buy it).

How Leasing Works

When you lease, you’re essentially paying for the difference between the car’s current value and its estimated value at the end of the lease—this is called the “residual value.” For example, if a $30,000 car is expected to be worth $18,000 after three years, you’re paying for that $12,000 in depreciation, plus interest and fees.

Your monthly lease payment is usually much lower than a finance payment because you’re not paying off the entire car—just the portion you’re using. In the same $30,000 car example, a 36-month lease might cost around $350 per month, depending on the terms.

Pros of Leasing a Car

The biggest draw of leasing is affordability. Lower monthly payments mean you can drive a newer, more expensive car for less money. This is especially appealing if you want a luxury vehicle or the latest tech without the high price tag.

Leasing also offers peace of mind. Most leases come with full manufacturer warranties that cover repairs for the entire term. That means you’re less likely to face unexpected maintenance costs. Plus, at the end of the lease, you can simply walk away—no need to worry about selling or trading in the car.

Another perk is the ability to drive a new car every few years. If you enjoy having the latest features, safety tech, and styling, leasing lets you upgrade regularly without the hassle of ownership.

Cons of Leasing a Car

But leasing isn’t all smooth driving. One major drawback is that you never own the car. You’re essentially paying to use it, and once the lease ends, you have nothing to show for your payments.

There are also strict rules. Most leases come with mileage limits—typically 10,000 to 15,000 miles per year. If you go over, you’ll be charged 10 to 25 cents per mile. That can add up fast if you drive a lot.

You’re also responsible for keeping the car in good condition. Excessive wear and tear—like deep scratches, dents, or stained upholstery—can result in hefty fees when you return the vehicle.

And while lower payments sound great, leasing can be more expensive in the long run. Since you’re always making payments and never building equity, you could end up spending more over time than if you had financed and kept the car.

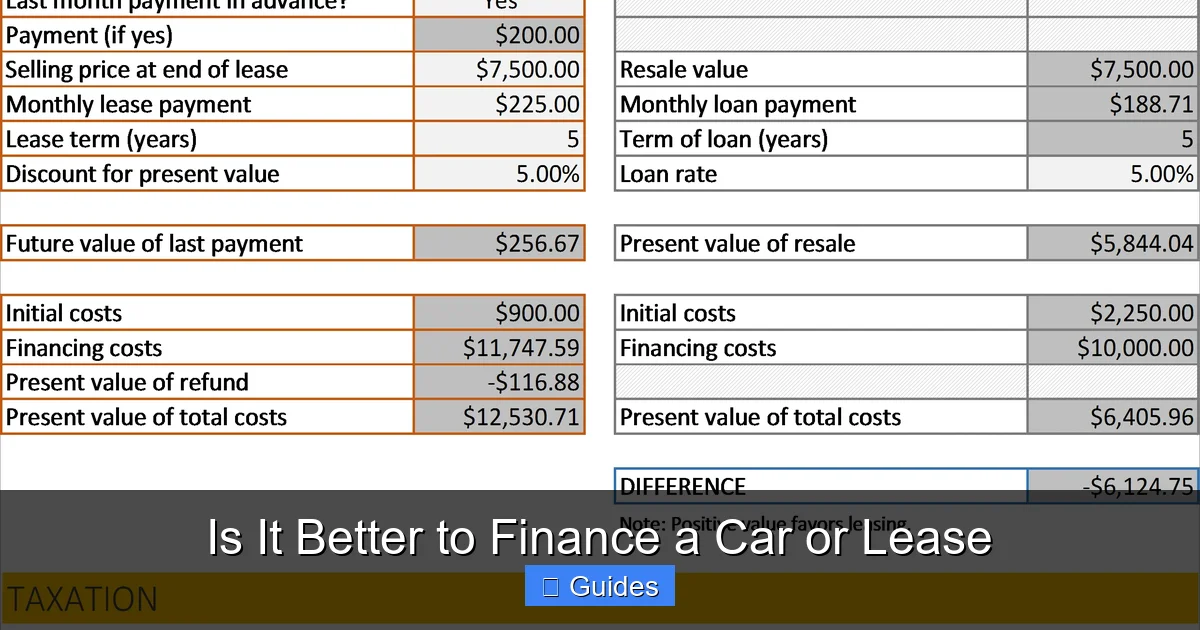

Cost Comparison: Financing vs. Leasing

Visual guide about Is It Better to Finance a Car or Lease

Image source: vantastec.co.uk

Let’s put financing and leasing head-to-head with a real-world example.

Say you’re looking at a $35,000 sedan. Here’s how the numbers might break down:

Financing Scenario

- Down payment: $7,000 (20%)

- Loan amount: $28,000

- Interest rate: 5%

- Loan term: 60 months

- Monthly payment: ~$525

- Total paid over 5 years: ~$31,500

After 5 years, you own the car. If it’s worth $15,000 at that point, your net cost is $16,500 ($31,500 paid minus $15,000 resale value).

Leasing Scenario

- Down payment: $3,000 (cap cost reduction)

- Monthly payment: $400

- Lease term: 36 months

- Total paid over 3 years: ~$14,400

At the end of the lease, you return the car. If you lease another car for another 3 years at the same rate, you’ll pay another $14,400. Over 6 years, that’s $28,800—and you still don’t own anything.

Which Is Cheaper?

In the short term, leasing is cheaper. But over time, financing usually wins. After 5–6 years, a financed car is paid off, and you’re driving for free (aside from maintenance and insurance). A lessee, on the other hand, is still making payments.

However, if you only plan to keep a car for 2–3 years and drive within mileage limits, leasing can be the more economical choice—especially if you value driving newer models.

Lifestyle and Driving Habits: Which Option Fits You?

Your personal situation plays a huge role in whether financing or leasing is better for you.

Who Should Finance?

Financing makes sense if:

- You drive a lot—more than 15,000 miles per year

- You plan to keep the car for 5+ years

- You want to build equity and eventually own the vehicle

- You like customizing or modifying your car

- You prefer predictable long-term costs

For example, a delivery driver who logs 25,000 miles a year would quickly exceed lease limits and face steep overage fees. Financing gives them the freedom to drive without penalties.

Similarly, someone who plans to keep their car for a decade will benefit from paying it off and enjoying years of no car payments.

Who Should Lease?

Leasing is ideal if:

- You want lower monthly payments

- You prefer driving a new car every 2–3 years

- You don’t drive much—under 12,000 miles per year

- You want the latest safety and tech features

- You don’t want to deal with long-term maintenance

A young professional who commutes 10 miles a day and loves having the newest infotainment system might thrive with a lease. They get a shiny new car every few years with minimal hassle.

But if you’re someone who drives cross-country frequently or uses your car for work, leasing could end up costing you more in the long run.

Hidden Fees and Fine Print: What to Watch For

Both financing and leasing come with fine print that can trip up the unprepared.

Common Lease Fees

- Acquisition fee: A one-time charge (often $500–$1,000) to set up the lease.

- Disposition fee: Charged when you return the car (typically $300–$500).

- Excess wear and tear charges: Fees for damage beyond “normal” use.

- Mileage overage fees: 10–25 cents per mile over your limit.

- Early termination fees: Costly if you end the lease early.

Always ask for a full breakdown of fees before signing.

Common Financing Fees

- Origination fee: Some lenders charge a fee to process the loan.

- Prepayment penalty: Rare, but some loans charge if you pay off early.

- Late fees: Charged if you miss a payment.

- Documentation fees: Charged by dealerships (often $300–$800).

Read your loan agreement carefully and negotiate fees where possible.

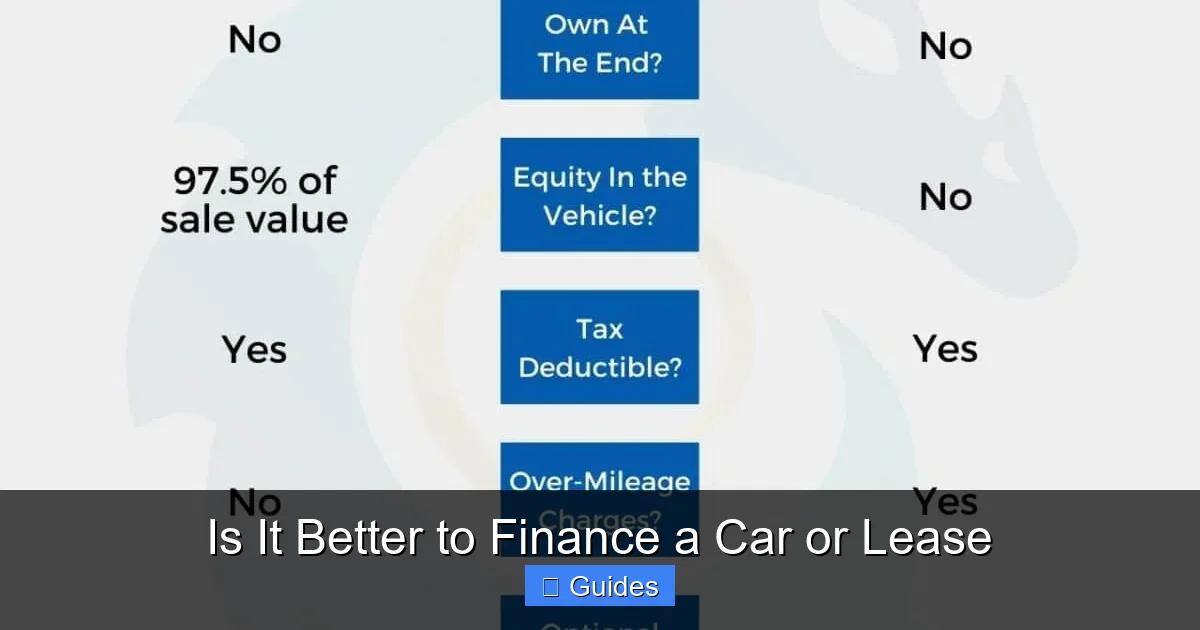

Tax, Insurance, and Maintenance Considerations

Taxes, insurance, and maintenance also differ between financing and leasing.

Sales Tax

In most states, you pay sales tax on the full purchase price when you finance. With leasing, you only pay tax on the monthly payments—which can save you money upfront. However, you’ll pay tax on every lease payment over time, so the total may be similar.

Insurance

Leased cars often require higher insurance coverage—including gap insurance—since the leasing company wants full protection. This can increase your monthly premium.

Financed cars also require full coverage until the loan is paid off, but once you own the car, you can drop comprehensive and collision if you choose (though it’s not recommended).

Maintenance and Repairs

Leased cars are usually under warranty for the entire lease term, so major repairs are covered. However, you’re still responsible for routine maintenance like oil changes and tire rotations.

With financed cars, you’re on the hook for all maintenance and repairs—especially once the warranty expires. But this also means you can choose your own mechanic and shop around for the best prices.

Resale Value and Long-Term Financial Impact

One of the biggest differences between financing and leasing is what happens at the end of the term.

With Financing: You Own the Asset

Once your loan is paid off, the car is yours. You can:

- Sell it and pocket the cash

- Trade it in for a new car

- Keep driving it with no payments

Even if the car has high mileage, it still has value. A paid-off car can save you thousands in future transportation costs.

With Leasing: You Walk Away

At the end of the lease, you return the car (assuming it’s in good condition). You can:

- Lease a new car

- Buy the leased car at its residual value

- Walk away with no further obligation

But you’ve built no equity. All those payments? Gone. Unless you buy the car, you have nothing to show for it.

Which Builds Wealth?

Financing builds wealth over time. Even though cars depreciate, owning a paid-off vehicle reduces your cost of living. Leasing, on the other hand, is more like paying rent—you’re consuming the car, not investing in it.

Making the Right Choice for You

So, is it better to finance a car or lease? The answer isn’t one-size-fits-all.

If you value ownership, drive a lot, and plan to keep your car for years, financing is likely the better choice. You’ll pay more each month, but you’ll gain equity and long-term savings.

If you prefer lower payments, enjoy driving new cars, and don’t mind never owning, leasing could be the way to go. Just be mindful of mileage limits and fees.

The best approach? Do the math. Compare total costs over 3, 5, and 7 years. Consider your driving habits, financial goals, and lifestyle. And don’t be afraid to negotiate—both financing terms and lease agreements are often flexible.

Final Thoughts

Deciding between financing and leasing a car is one of the most important financial decisions you’ll make as a car buyer. Both options have their place, and the “better” choice depends entirely on your needs.

Financing gives you ownership, freedom, and long-term value. Leasing offers affordability, convenience, and the thrill of driving something new. There’s no right or wrong answer—only the one that fits your life.

Take your time, ask questions, and crunch the numbers. And remember: the best car deal isn’t just about the lowest monthly payment—it’s about what makes sense for your future.

Frequently Asked Questions

Is it better to finance or lease a car if I drive a lot?

If you drive more than 15,000 miles per year, financing is usually the better option. Leases come with strict mileage limits, and going over can result in expensive per-mile fees.

Can I buy the car at the end of a lease?

Yes, most leases allow you to purchase the car at its residual value at the end of the term. This can be a good option if you’ve grown attached to the vehicle or if its market value is higher than the residual.

Do I pay sales tax when leasing a car?

Yes, but you typically pay sales tax only on your monthly lease payments, not the full value of the car. This can reduce your upfront tax burden compared to financing.

What happens if I total a leased car?

If your leased car is totaled, your insurance will pay the actual cash value. If it’s less than what you owe, gap insurance (often included in leases) covers the difference.

Can I negotiate a lease agreement?

Yes, lease terms—including monthly payments, mileage limits, and fees—are often negotiable. Always ask for a breakdown and try to lower the capitalized cost or reduce fees.

Is it cheaper to lease or finance in the long run?

Generally, financing is cheaper over the long term because you eventually own the car. Leasing keeps you in a cycle of payments with no equity buildup.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.