Leasing a car doesn’t have to break the bank. The least expensive car to lease offers low monthly payments, great fuel economy, and modern features—without the long-term commitment of ownership. Whether you’re a first-time lessee or looking to downsize your budget, this guide helps you find the best affordable lease deals available today.

[FEATURED_IMAGE_PLACEOLDER]

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Why Leasing Can Be the Smartest Move for Budget-Conscious Drivers

- 4 What Makes a Car the Least Expensive to Lease?

- 5 Top 5 Least Expensive Cars to Lease in 2024

- 6 How to Find the Best Lease Deals on Budget Cars

- 7 Leasing vs. Buying: Which Is Cheaper in the Long Run?

- 8 Tips to Keep Your Lease Costs Low

- 9 Final Thoughts: Is the Least Expensive Car to Lease Right for You?

- 10 Frequently Asked Questions

Key Takeaways

- Compact cars dominate the cheapest leases: Models like the Nissan Versa, Hyundai Accent, and Kia Rio consistently offer the lowest monthly payments due to their low MSRP and high residual values.

- Leasing is often cheaper than buying: With lower monthly payments, no long-term ownership costs, and warranty coverage, leasing can be a smart financial move for budget-conscious drivers.

- Credit score matters: A higher credit score can significantly reduce your lease rate, so check your credit before applying and consider improving it if needed.

- Mileage limits affect cost: Most leases include 10,000–15,000 miles per year. Exceeding this can result in steep per-mile fees, so choose a plan that matches your driving habits.

- Negotiate the capitalized cost: Just like buying, you can negotiate the price of a leased vehicle. A lower capitalized cost means lower monthly payments.

- Watch for incentives and promotions: Manufacturers often offer lease specials, cash rebates, or waived fees—especially at the end of the model year.

- Consider total cost, not just monthly payment: Factor in down payments, fees, insurance, and potential wear-and-tear charges to get the full picture of affordability.

📑 Table of Contents

- Why Leasing Can Be the Smartest Move for Budget-Conscious Drivers

- What Makes a Car the Least Expensive to Lease?

- Top 5 Least Expensive Cars to Lease in 2024

- How to Find the Best Lease Deals on Budget Cars

- Leasing vs. Buying: Which Is Cheaper in the Long Run?

- Tips to Keep Your Lease Costs Low

- Final Thoughts: Is the Least Expensive Car to Lease Right for You?

Why Leasing Can Be the Smartest Move for Budget-Conscious Drivers

If you’re looking to drive a new car without the long-term financial burden of ownership, leasing might be your best bet. Unlike buying, where you’re paying off the entire value of the vehicle over several years, leasing only requires you to pay for the car’s depreciation during the lease term—typically 24 to 36 months. This means lower monthly payments, often hundreds of dollars less than a loan payment for the same vehicle.

But the benefits don’t stop there. Leasing also lets you drive a new car every few years with the latest safety features, tech upgrades, and fuel-efficient engines. You’ll also enjoy the peace of mind that comes with being under warranty for the entire lease period, so repairs are usually covered. And if you don’t want to deal with selling a car or worrying about its resale value, leasing eliminates those headaches entirely.

Of course, leasing isn’t for everyone. If you drive a lot, prefer to customize your vehicle, or want to build equity, buying might be better. But for people who want a reliable, low-cost way to drive new cars regularly, leasing—especially the least expensive car to lease—can be a game-changer.

What Makes a Car the Least Expensive to Lease?

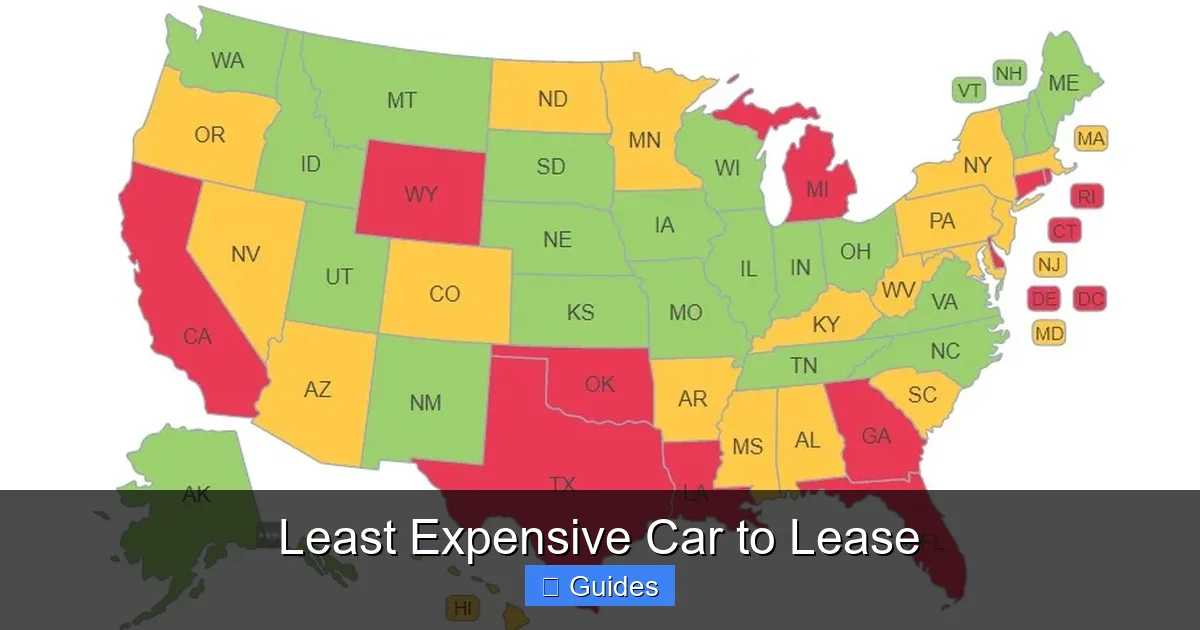

Visual guide about Least Expensive Car to Lease

Image source: images.hgmsites.net

Not all cars are created equal when it comes to leasing costs. Several key factors determine which models offer the lowest monthly payments. Understanding these can help you spot a great deal and avoid overpaying.

Low Manufacturer’s Suggested Retail Price (MSRP)

The starting price of a car is one of the biggest factors in lease affordability. Vehicles with a lower MSRP naturally have lower depreciation, which translates to lower monthly payments. For example, the 2024 Nissan Versa starts around $16,000, making it one of the cheapest new cars on the market—and one of the least expensive to lease.

High Residual Value

Residual value is the estimated worth of the car at the end of the lease. Cars that hold their value well—like the Honda Fit or Toyota Yaris—have higher residuals, meaning you’re paying for less depreciation. This directly lowers your monthly payment.

Strong Manufacturer Incentives

Automakers often offer lease specials to move inventory, especially at the end of a model year or when introducing a new version. These can include reduced money factors (the lease equivalent of an interest rate), cash allowances, or waived acquisition fees. For instance, Hyundai frequently runs “Lease Cash” promotions that knock hundreds off the total cost.

Low Money Factor (Interest Rate)

The money factor determines how much interest you pay on the lease. It’s usually a tiny decimal like 0.00125, but it has a big impact. A lower money factor means lower payments. This is often tied to your credit score—so improving your credit can save you money.

Minimal Down Payment Options

Some leases require little or no down payment, which keeps your out-of-pocket costs low. These “sign-and-drive” deals are common on budget-friendly models and can make the least expensive car to lease even more accessible.

Top 5 Least Expensive Cars to Lease in 2024

Visual guide about Least Expensive Car to Lease

Image source: cdn-fastly.autoguide.com

Now that you know what to look for, here are the top five most affordable cars to lease right now. These models combine low monthly payments, strong reliability, and modern features—all without breaking the bank.

1. Nissan Versa

The Nissan Versa consistently ranks as one of the least expensive cars to lease. With a starting MSRP under $17,000, it’s one of the most affordable new sedans available. Current lease deals often feature monthly payments under $200 with little or no down payment.

The 2024 Versa comes standard with a 122-horsepower engine, a 7-inch touchscreen, Apple CarPlay, Android Auto, and advanced safety features like automatic emergency braking. It’s not the most exciting car to drive, but it’s reliable, fuel-efficient (up to 35 mpg highway), and perfect for city commuters or first-time drivers.

2. Hyundai Accent

Another standout in the budget segment, the Hyundai Accent offers a smooth ride, a well-designed interior, and a generous warranty—all for a low lease cost. Lease offers frequently include payments around $180–$210 per month with minimal upfront costs.

The Accent’s 1.6-liter engine delivers 120 horsepower and gets up to 38 mpg on the highway. It also includes a 5-inch display, Bluetooth, and a rearview camera. Plus, Hyundai’s 10-year/100,000-mile powertrain warranty gives you extra peace of mind.

3. Kia Rio

The Kia Rio is a close cousin to the Accent (both are built on the same platform) and offers similar value. It’s stylish, efficient, and one of the least expensive cars to lease, with monthly payments often dipping below $200.

The Rio comes with a 1.6-liter engine, a 7-inch touchscreen, and standard smartphone integration. It also earns high marks for safety and reliability. Kia frequently runs lease promotions with low money factors and cash incentives, making it a smart pick for budget-minded lessees.

4. Mitsubishi Mirage

If you’re looking for the absolute cheapest new car to lease, the Mitsubishi Mirage is hard to beat. With a starting price under $15,000, it’s one of the most affordable vehicles on the market. Lease deals often feature payments under $170 per month.

The Mirage is a three-cylinder hatchback that’s tiny, efficient (up to 43 mpg highway), and perfect for urban driving. It’s not fast or luxurious, but it gets the job done—and saves you money at the pump and on your lease payment.

5. Chevrolet Spark

Though Chevrolet has discontinued the Spark for 2024, many dealers still have leftover 2023 models available at deep discounts. This makes it one of the least expensive cars to lease right now, with some deals under $160 per month.

The Spark is a compact hatchback with a 1.4-liter engine, a 7-inch infotainment system, and standard safety features. It’s ideal for short commutes and tight parking spaces. Just be sure to check availability in your area.

How to Find the Best Lease Deals on Budget Cars

Visual guide about Least Expensive Car to Lease

Image source: i.pinimg.com

Finding the least expensive car to lease isn’t just about picking the cheapest model—it’s about timing, negotiation, and knowing where to look. Here’s how to maximize your savings.

Shop at the End of the Month, Quarter, or Model Year

Dealerships often have sales quotas to meet. Shopping at the end of the month, quarter, or model year increases your chances of finding special promotions, reduced money factors, or extra incentives. Manufacturers are especially eager to clear out old inventory before new models arrive.

Compare Multiple Dealerships

Don’t settle for the first offer you get. Get lease quotes from at least three different dealerships. Use online tools like Edmunds, Kelley Blue Book, or TrueCar to compare offers side by side. Even small differences in the money factor or capitalized cost can save you hundreds over the lease term.

Negotiate the Capitalized Cost

The capitalized cost is the price you’re leasing the car for—similar to the purchase price when buying. Just like with a loan, you can negotiate this number down. Research the invoice price (what the dealer paid) and aim to lease the car for close to that amount. Every dollar you reduce the cap cost saves you money every month.

Ask About Incentives and Rebates

Manufacturers often offer hidden incentives like lease cash, loyalty bonuses, or conquest offers (for switching from a competitor’s brand). These can be applied directly to reduce your monthly payment or down payment. Always ask what’s available—even if it’s not advertised.

Consider a Shorter Lease Term

While 36-month leases are standard, shorter terms (like 24 months) can sometimes offer lower monthly payments because the car depreciates less in a shorter time. However, this isn’t always the case, so run the numbers to see what works best for your budget.

Watch Out for Excess Fees

Some leases come with high acquisition fees, disposition fees, or excessive wear-and-tear charges. Ask for a full breakdown of all fees before signing. If a deal seems too good to be true, it might be hiding extra costs.

Leasing vs. Buying: Which Is Cheaper in the Long Run?

One of the biggest debates in car ownership is whether leasing or buying is more cost-effective. The answer depends on your driving habits, financial goals, and how long you plan to keep the car.

Leasing: Lower Monthly Payments, No Ownership

Leasing wins when it comes to monthly affordability. Because you’re only paying for depreciation, not the entire value of the car, payments are significantly lower. For example, leasing a $25,000 car might cost $250/month, while buying it with a loan could be $400/month or more.

Leasing also means you’re always under warranty, so repairs are covered. And you can drive a new car every few years with the latest tech and safety features. However, you don’t build equity, and you’ll always have a car payment unless you stop leasing altogether.

Buying: Higher Payments, Long-Term Savings

Buying a car means higher monthly payments, but once the loan is paid off, you own the vehicle outright. This can save you money in the long run, especially if you keep the car for 7–10 years. You also have the freedom to customize, drive unlimited miles, and sell it whenever you want.

However, once the warranty expires, repair costs fall on you. And depreciation hits hardest in the first few years—something you’re paying for whether you lease or buy.

When Leasing Makes the Most Sense

Leasing is ideal if:

– You want lower monthly payments

– You drive fewer than 12,000 miles per year

– You prefer driving a new car every 2–3 years

– You don’t want to deal with maintenance or resale

For many people, especially those on a tight budget, leasing the least expensive car to lease is the smarter financial choice.

Tips to Keep Your Lease Costs Low

Even after you’ve found a great deal, there are ways to keep your lease costs down throughout the term.

Stay Within Your Mileage Limit

Most leases allow 10,000–15,000 miles per year. Exceeding this can cost $0.15–$0.25 per mile—adding up quickly. If you know you’ll drive more, consider a higher mileage lease upfront, which is cheaper than paying overage fees later.

Maintain the Car Properly

Regular oil changes, tire rotations, and inspections help prevent excessive wear. At the end of the lease, you’ll be charged for dents, scratches, or interior damage beyond “normal wear and tear.” Keeping the car in good condition minimizes these charges.

Avoid Unnecessary Upgrades

Dealers may try to upsell you on extras like fabric protection, VIN etching, or extended warranties. These add to your monthly payment and often aren’t worth the cost. Stick to the basics unless you really need the upgrade.

Refinance or Transfer the Lease

If your financial situation changes, you may be able to refinance the lease or transfer it to someone else through a lease takeover site like Swapalease. This can help you get out of the lease early without penalties.

Plan for the End of the Lease

At the end of your lease, you can return the car, buy it, or lease a new one. Returning it is the easiest option, but buying it might make sense if the residual value is low and the car is in great shape. Weigh your options carefully.

Final Thoughts: Is the Least Expensive Car to Lease Right for You?

Leasing a car—especially the least expensive car to lease—can be a smart, budget-friendly way to enjoy a new vehicle without the long-term commitment of ownership. Models like the Nissan Versa, Hyundai Accent, and Kia Rio offer low monthly payments, modern features, and reliable performance, all for under $200 a month in many cases.

But leasing isn’t a one-size-fits-all solution. It works best for people who drive moderately, want lower payments, and don’t mind not owning their car. If you’re someone who drives a lot, loves to customize, or wants to build equity, buying might be the better path.

The key is to do your research, compare offers, and understand the total cost—not just the monthly payment. With the right strategy, you can drive a great car for less and keep more money in your pocket.

So whether you’re a student, a young professional, or just looking to save, the least expensive car to lease could be the perfect fit for your lifestyle and budget.

Frequently Asked Questions

What is the cheapest car to lease right now?

The Nissan Versa, Hyundai Accent, and Kia Rio are currently among the cheapest cars to lease, with monthly payments often under $200. These models offer low MSRPs, strong incentives, and high residual values.

Can I lease a car with bad credit?

Yes, but your monthly payment will likely be higher due to a higher money factor. Some subprime lenders offer lease programs, but it’s best to improve your credit score first to get better terms.

Is it better to lease or buy a cheap car?

It depends on your goals. Leasing offers lower payments and no long-term ownership, while buying builds equity and saves money over time if you keep the car for many years.

Yes, some leases include high acquisition fees, disposition fees, or excessive wear-and-tear charges. Always ask for a full breakdown of costs before signing.

Can I negotiate a lease deal?

Absolutely. You can negotiate the capitalized cost, money factor, and fees—just like when buying a car. Research and compare offers to get the best deal.

What happens if I go over my mileage limit?

You’ll be charged a per-mile fee, typically $0.15–$0.25. If you know you’ll drive more, consider a higher mileage lease upfront to avoid surprise charges.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.