Choosing between leasing and buying a car can be confusing, but a car lease vs buy calculator makes it simple. By comparing monthly payments, depreciation, maintenance, and long-term costs, you can make a smart financial decision tailored to your lifestyle and budget.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Should You Lease or Buy Your Next Car? A Smart Guide

- 4 What Is a Car Lease vs Buy Calculator?

- 5 Leasing a Car: Pros, Cons, and Real-World Examples

- 6 Buying a Car: Long-Term Value and Ownership Benefits

- 7 How to Use a Car Lease vs Buy Calculator Effectively

- 8 When Leasing Makes Sense (and When It Doesn’t)

- 9 Final Tips for Making the Right Choice

- 10 Frequently Asked Questions

Key Takeaways

- Use a car lease vs buy calculator to compare total costs: These tools factor in monthly payments, interest, depreciation, and fees to show which option saves you more over time.

- Leasing often means lower monthly payments: You’re only paying for the car’s depreciation during the lease term, not the full value, which can free up cash flow.

- Buying builds equity and offers long-term savings: Once the loan is paid off, you own the car outright and avoid ongoing payments—ideal if you drive a lot or keep cars for years.

- Consider mileage and wear limits with leasing: Most leases restrict annual mileage (usually 10,000–15,000 miles) and charge fees for excess wear and tear.

- Down payments and credit matter in both options: A strong credit score and larger down payment can significantly reduce costs whether you lease or buy.

- Technology and model updates favor leasing: If you love driving the latest features every few years, leasing lets you upgrade easily without selling a used car.

- Long-term ownership is usually cheaper: After 5–7 years, buying typically costs less than repeatedly leasing new vehicles.

📑 Table of Contents

- Should You Lease or Buy Your Next Car? A Smart Guide

- What Is a Car Lease vs Buy Calculator?

- Leasing a Car: Pros, Cons, and Real-World Examples

- Buying a Car: Long-Term Value and Ownership Benefits

- How to Use a Car Lease vs Buy Calculator Effectively

- When Leasing Makes Sense (and When It Doesn’t)

- Final Tips for Making the Right Choice

Should You Lease or Buy Your Next Car? A Smart Guide

So you’re in the market for a new car. You’ve narrowed down the make and model, but now comes the big question: should you lease or buy? It’s a decision that affects your wallet, your lifestyle, and your long-term financial health. And let’s be honest—most of us don’t have a finance degree, so figuring out which path is better can feel overwhelming.

That’s where a car lease vs buy calculator comes in handy. This simple yet powerful tool takes the guesswork out of the equation. Instead of relying on gut feelings or dealership pitches, you can plug in real numbers—like your down payment, loan term, interest rate, and expected mileage—and see a side-by-side comparison of leasing versus buying. Whether you’re eyeing a sleek sedan, a rugged SUV, or an eco-friendly hybrid, this calculator helps you make a confident, informed choice.

What Is a Car Lease vs Buy Calculator?

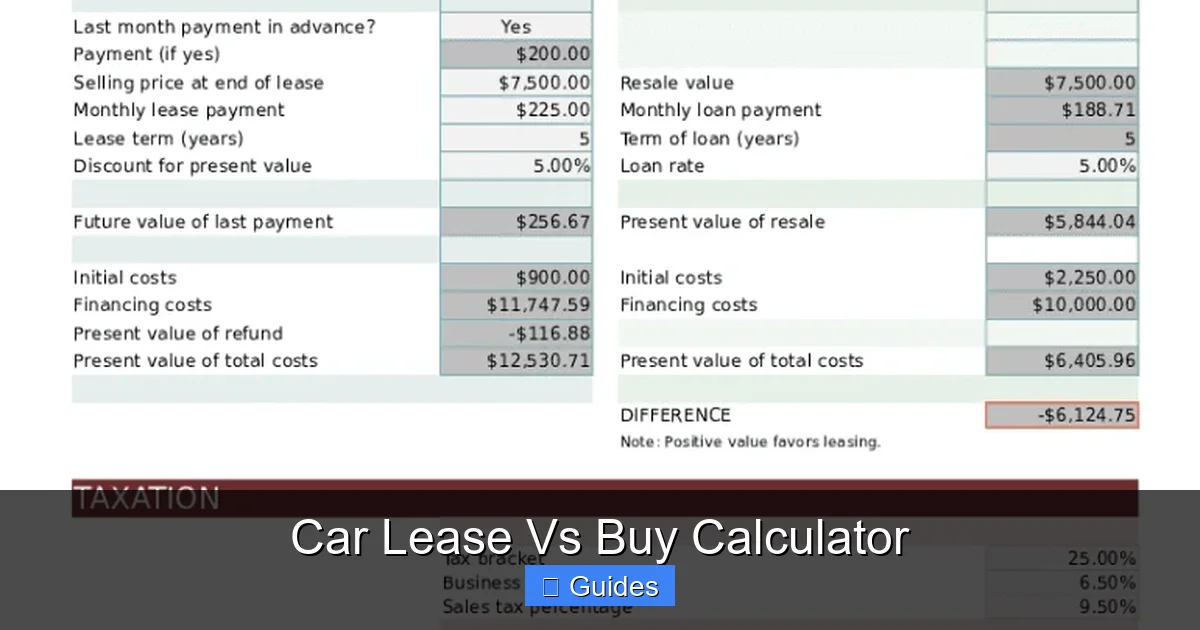

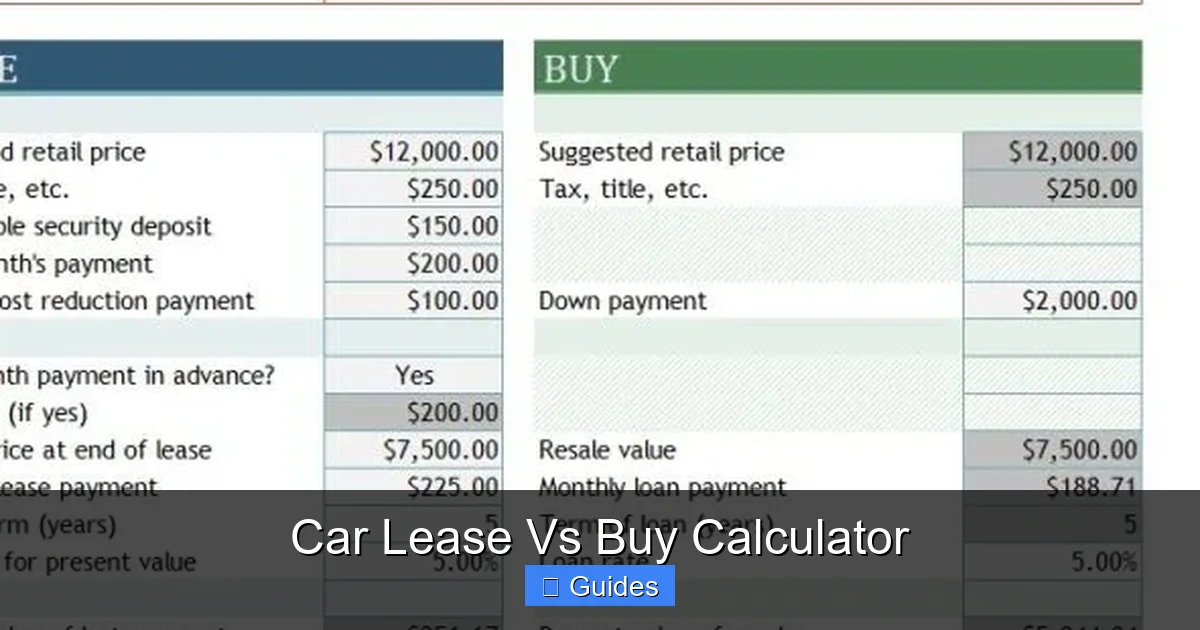

A car lease vs buy calculator is an online tool designed to help you compare the total cost of leasing a vehicle versus purchasing it with a loan. It considers multiple financial factors, including monthly payments, interest rates, depreciation, taxes, fees, and even estimated resale value. By inputting your specific details, the calculator generates a clear breakdown showing which option is more cost-effective over a set period—usually 3 to 5 years.

Visual guide about Car Lease Vs Buy Calculator

Image source: pdffiller.com

How Does It Work?

Most calculators ask for basic information such as:

- The car’s purchase price or MSRP

- Down payment amount

- Loan or lease term (e.g., 36, 48, or 60 months)

- Interest rate or money factor (for leases)

- Estimated annual mileage

- Expected resale value (for buying)

- Lease-end fees or disposition charges

Once you enter these details, the calculator crunches the numbers and displays two scenarios: one for leasing and one for buying. It often includes graphs or charts to visualize the cost difference over time, making it easier to spot trends like when buying becomes cheaper than leasing.

Why Use a Calculator Instead of Guessing?

It’s easy to assume that lower monthly payments mean leasing is the better deal. But that’s not always true. For example, a lease might cost $300 a month, while a loan payment is $450. At first glance, leasing looks better. But over five years, the lease totals $18,000 with no ownership, while the loan totals $27,000—but you own the car outright at the end. If the car is worth $15,000 in trade-in value, your net cost is only $12,000. That’s a $6,000 difference!

A car lease vs buy calculator reveals these hidden savings and helps you avoid costly mistakes. It also lets you test different scenarios—like increasing your down payment or choosing a shorter lease term—so you can find the best fit for your budget.

Leasing a Car: Pros, Cons, and Real-World Examples

Leasing a car is like renting it for a fixed period, typically 24 to 36 months. You pay for the vehicle’s depreciation during that time, plus fees and interest, but you don’t own it at the end. At the conclusion of the lease, you return the car (assuming you’ve stayed within mileage and condition limits) or buy it at a predetermined price.

Visual guide about Car Lease Vs Buy Calculator

Image source: templateral.com

Advantages of Leasing

One of the biggest perks of leasing is lower monthly payments. Since you’re only financing the car’s loss in value—not its entire price—your payments are often significantly less than a loan. For example, leasing a $35,000 car might cost $320/month, while buying it with a loan could run $520/month.

Leasing also means driving newer cars more often. Most leases last 2–3 years, so you can upgrade to the latest model with updated safety features, infotainment systems, and fuel efficiency. This is ideal if you enjoy having the newest technology or want to avoid the hassle of selling a used car.

Additionally, many leases include warranty coverage for the entire term, so major repairs are usually covered. You also avoid the stress of long-term maintenance and depreciation, which can be a relief for drivers who don’t want to worry about resale value.

Disadvantages of Leasing

However, leasing isn’t perfect. One major downside is mileage restrictions. Most leases cap annual mileage at 10,000 to 15,000 miles. If you exceed that, you’ll pay 10 to 25 cents per extra mile—which can add up fast. For example, driving 20,000 miles a year on a 12,000-mile lease could cost an extra $1,000 per year.

You also face wear and tear charges. Leased cars must be returned in good condition. Scratches, dents, or stained upholstery can result in fees. And unlike owning a car, you don’t build any equity—you’re essentially paying to use the vehicle, not own it.

Finally, leasing can become expensive in the long run. If you lease every few years, you’ll always have a car payment. Over 10 years, you could pay $30,000 or more just to drive new cars, with nothing to show for it.

Real Example: Leasing a Honda Accord

Let’s say you’re considering a 2024 Honda Accord with an MSRP of $32,000. You lease it for 36 months with a $3,000 down payment and a money factor of 0.002 (equivalent to 4.8% APR). Your monthly payment comes out to $310. Over three years, you pay $14,160 ($310 x 36 + $3,000 down).

At the end, you return the car. If you leased another Accord, your new payment might be $330/month. Over the next three years, that’s another $14,880. In six years, you’ve paid over $29,000 and own nothing.

Now, compare that to buying. With the same $3,000 down and a 5-year loan at 5% interest, your monthly payment is $540. Over five years, you pay $35,400. But after that, you own the car. If it’s worth $12,000 in trade-in value, your net cost is $23,400—over $5,000 less than leasing twice.

Buying a Car: Long-Term Value and Ownership Benefits

Buying a car means taking out a loan to purchase it outright. Once the loan is paid off, the car is yours—no more payments, no mileage limits, and no return inspections. This path is ideal for people who plan to keep their vehicle for many years or drive high mileage.

Visual guide about Car Lease Vs Buy Calculator

Image source: i.pinimg.com

Advantages of Buying

The biggest benefit of buying is ownership and equity. Every payment you make builds value in the car. Once the loan is done, you’re driving for free—except for gas, insurance, and maintenance. This can save thousands over time, especially if you keep the car for 7–10 years.

Buying also offers freedom and flexibility. You can drive as much as you want, customize the car, and sell it whenever you choose. There are no penalties for wear and tear or excess mileage, which is great for road trips, rideshare driving, or growing families.

Additionally, long-term costs are usually lower. While monthly payments are higher upfront, the total cost of ownership often beats leasing after 5–7 years. According to industry data, the average car owner keeps their vehicle for over 8 years—making buying the smarter financial move for most.

Disadvantages of Buying

Of course, buying isn’t without drawbacks. Higher monthly payments can strain your budget, especially for newer or luxury models. You’re also responsible for depreciation—the car loses value the moment you drive it off the lot. In the first year, a new car can lose 20% of its value.

Maintenance and repairs can also add up, particularly after the warranty expires. While newer cars are reliable, older models may need costly fixes like transmission work or engine repairs. And if you want the latest tech, you’ll have to sell or trade in your car—which can be time-consuming and costly.

Real Example: Buying a Toyota Camry

Let’s revisit the Toyota Camry, priced at $30,000. You put $4,000 down and finance the rest with a 60-month loan at 4.5% interest. Your monthly payment is $475. Over five years, you pay $32,500. After the loan, you own the car.

Assume you drive it for another 5 years. Maintenance costs average $500/year, so that’s $2,500. At the end of 10 years, the Camry is worth $5,000. Your total cost is $32,500 (loan) + $2,500 (maintenance) – $5,000 (resale) = $30,000.

Compare that to leasing two Camrys over 10 years. Each 36-month lease costs $300/month with a $3,000 down payment. Total cost: ($300 x 36 x 2) + ($3,000 x 2) = $32,400. You own nothing. Buying saved you $2,400—and you had a car to drive for free in years 6–10.

How to Use a Car Lease vs Buy Calculator Effectively

Now that you understand the basics, let’s talk about how to get the most out of a car lease vs buy calculator. These tools are only as good as the data you input, so accuracy is key.

Step 1: Gather Accurate Information

Before using the calculator, collect the following:

- The car’s exact price (including taxes and fees)

- Your credit score (to estimate interest rates)

- Down payment amount

- Desired loan or lease term

- Estimated annual mileage

- Resale value estimates (check Kelley Blue Book or Edmunds)

The more precise your inputs, the more reliable your results will be.

Step 2: Compare Multiple Scenarios

Don’t just run one calculation. Test different options:

- What if you put $5,000 down instead of $2,000?

- How does a 48-month lease compare to a 36-month one?

- What happens if interest rates rise by 1%?

This helps you see how sensitive the outcome is to changes and find the sweet spot for your budget.

Step 3: Factor in Hidden Costs

A good calculator should include:

- Sales tax

- Acquisition fees (for leases)

- Disposition fees

- Maintenance and repair estimates

- Insurance differences (newer cars often cost more to insure)

If the calculator doesn’t account for these, adjust the results manually or use a more advanced tool.

Step 4: Think About Your Lifestyle

Numbers matter, but so do your habits. Ask yourself:

- Do I drive more than 15,000 miles a year?

- Do I like upgrading my car every few years?

- Can I afford higher monthly payments now for long-term savings?

- Do I plan to keep the car for 7+ years?

If you answered “yes” to the first or last question, buying is likely better. If you prefer low payments and new tech, leasing might suit you.

When Leasing Makes Sense (and When It Doesn’t)

Leasing isn’t inherently bad—it’s just not right for everyone. Here’s when it shines—and when it falls short.

Best Cases for Leasing

- You want lower monthly payments: Ideal for budget-conscious drivers or those with tight cash flow.

- You drive under 12,000 miles a year: Staying within limits avoids extra fees.

- You love new cars and tech: Leasing lets you upgrade every 2–3 years.

- You use the car for business: Lease payments may be tax-deductible for business use.

- You don’t want to deal with selling a car: Returning a lease is simple and hassle-free.

When to Avoid Leasing

- You drive a lot: High mileage leads to steep overage charges.

- You keep cars for 7+ years: Buying is cheaper in the long run.

- You customize your vehicle: Modifications can violate lease terms.

- You want to build equity: Leasing offers no ownership or resale value.

- You’re on a tight long-term budget: perpetual payments add up over time.

Final Tips for Making the Right Choice

Deciding between leasing and buying doesn’t have to be stressful. With the right tools and mindset, you can choose the option that fits your life and wallet.

Start by using a car lease vs buy calculator to compare real numbers. Don’t rely on dealer estimates—do your own research. Consider your driving habits, financial goals, and how long you plan to keep the car.

Remember: leasing offers short-term savings and convenience, while buying builds long-term value. There’s no one-size-fits-all answer—only the choice that’s right for you.

And when in doubt, talk to a financial advisor or use multiple calculators to cross-check results. The more informed you are, the better your decision will be.

Frequently Asked Questions

What is a car lease vs buy calculator?

A car lease vs buy calculator is an online tool that compares the total cost of leasing a vehicle versus purchasing it with a loan. It factors in payments, interest, depreciation, and fees to help you decide which option is more affordable.

Is it cheaper to lease or buy a car?

It depends on your situation. Leasing usually has lower monthly payments, but buying is often cheaper in the long run—especially if you keep the car for 7+ years. Use a calculator to compare your specific scenario.

Can I negotiate a lease deal?

Yes! Just like buying, lease terms—including monthly payments, mileage limits, and fees—can often be negotiated. Research invoice prices and money factors to get the best deal.

What happens at the end of a car lease?

At the end of a lease, you can return the car (if it’s in good condition and within mileage limits), buy it at the residual value, or lease a new vehicle. Be aware of potential disposition or excess wear fees.

Do I need good credit to lease or buy a car?

Yes, your credit score affects interest rates and approval. A higher score means lower payments for both leasing and buying. Check your credit before shopping and consider improving it if needed.

Can I buy my leased car at the end of the term?

Yes, most leases allow you to purchase the vehicle at the end for the predetermined residual value. This can be a good option if you love the car and want to keep it long-term.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.