Car accidents can lead to serious financial risks, including lawsuits and medical bills. Protecting your assets starts with smart insurance choices, quick documentation, and legal planning. This guide walks you through every step to keep your finances safe.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: Why Asset Protection Matters After a Car Accident

- 4 Step 1: Understand Your Insurance Coverage

- 5 Step 2: Document the Accident Thoroughly

- 6 Step 3: Notify Your Insurance Company Promptly

- 7 Step 4: Consult a Personal Injury Attorney

- 8 Step 5: Consider an Umbrella Insurance Policy

- 9 Step 6: Use Legal Tools to Shield Your Assets

- 10 Step 7: Avoid Common Mistakes That Put Your Assets at Risk

- 11 Conclusion: Take Control of Your Financial Future

- 12 Frequently Asked Questions

Key Takeaways

- Carry adequate liability insurance: Minimum coverage may not be enough—opt for higher limits to shield your savings and property.

- Document everything immediately: Take photos, gather witness info, and file a police report to strengthen your case.

- Notify your insurer right away: Delaying a claim can hurt your coverage and expose you to out-of-pocket costs.

- Consult a personal injury attorney: Legal advice helps you understand your rights and avoid costly mistakes.

- Consider an umbrella policy: This extra layer of protection kicks in when your auto insurance limits are exceeded.

- Protect your home and investments: Use legal tools like trusts or LLCs to separate personal assets from potential liability.

- Stay calm and avoid admitting fault: Saying “I’m sorry” at the scene can be used against you in court.

📑 Table of Contents

- Introduction: Why Asset Protection Matters After a Car Accident

- Step 1: Understand Your Insurance Coverage

- Step 2: Document the Accident Thoroughly

- Step 3: Notify Your Insurance Company Promptly

- Step 4: Consult a Personal Injury Attorney

- Step 5: Consider an Umbrella Insurance Policy

- Step 6: Use Legal Tools to Shield Your Assets

- Step 7: Avoid Common Mistakes That Put Your Assets at Risk

- Conclusion: Take Control of Your Financial Future

Introduction: Why Asset Protection Matters After a Car Accident

A car accident is more than just a traffic incident—it can become a financial disaster if you’re not prepared. Even a minor fender bender can lead to thousands in medical bills, vehicle repairs, and legal fees. Worse, if you’re found at fault, you could be sued for damages that far exceed your insurance coverage. That’s why knowing how to protect your assets after a car accident is essential.

Many drivers assume their auto insurance will cover everything. But the truth is, minimum liability limits in most states are dangerously low—often just $25,000 per person for bodily injury. If you cause an accident that results in serious injuries, that amount can be gone in a heartbeat. And if the other party sues you for more, your personal savings, home equity, and even future wages could be at risk. The good news? With the right steps, you can shield your hard-earned assets and avoid financial ruin.

Step 1: Understand Your Insurance Coverage

Your first line of defense after a car accident is your auto insurance policy. But not all policies are created equal. Understanding what your coverage includes—and what it doesn’t—can mean the difference between financial security and disaster.

Visual guide about How to Protect Your Assets After a Car Accident

Image source: journeybycar.com

Know the Types of Auto Insurance

Most states require at least liability insurance, which covers damage you cause to others. This includes:

- Bodily injury liability: Pays for medical expenses, lost wages, and pain and suffering of others if you’re at fault.

- Property damage liability: Covers repairs to another person’s vehicle or property.

However, liability insurance does not cover your own injuries or vehicle damage. That’s where collision and comprehensive coverage come in. Collision pays to repair or replace your car after an accident, regardless of fault. Comprehensive covers non-collision events like theft, vandalism, or weather damage.

Why Minimum Coverage Isn’t Enough

Let’s say you live in a state with a $25,000/$50,000 liability limit. That means your insurance will pay up to $25,000 per person for injuries, with a total cap of $50,000 per accident. Sounds okay—until you consider that a single night in the ICU can cost $30,000 or more. If you cause an accident involving multiple people with serious injuries, your policy could max out quickly.

For example, imagine you rear-end a car at a stoplight. The driver and passenger both suffer whiplash and require physical therapy. Their combined medical bills total $70,000. Your $50,000 liability limit won’t cover it. The remaining $20,000? That could come out of your pocket—unless you have additional protection.

Upgrade to Higher Liability Limits

The best way to protect your assets is to carry liability limits well above the state minimum. Many financial advisors recommend at least $100,000 per person and $300,000 per accident. Some even suggest $250,000/$500,000 or higher, especially if you own a home, have significant savings, or earn a high income.

Higher limits cost more, but the increase is usually modest. For instance, upgrading from $25,000/$50,000 to $100,000/$300,000 might only raise your premium by $50–$100 per year. That’s a small price to pay for peace of mind.

Step 2: Document the Accident Thoroughly

The moments after a car accident are critical. What you do—or don’t do—can impact your ability to file a claim, defend yourself in court, and protect your assets. Proper documentation creates a clear record of what happened and helps establish fault.

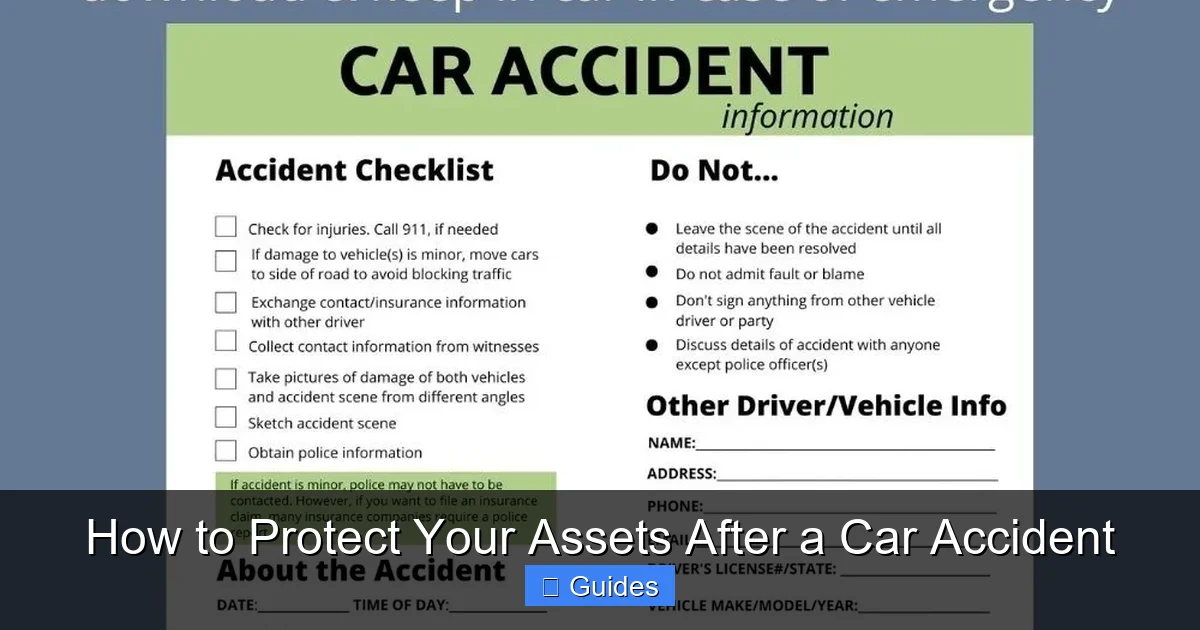

Visual guide about How to Protect Your Assets After a Car Accident

Image source: i0.wp.com

Take Photos and Videos

Use your smartphone to capture everything. Take pictures of:

- All vehicles involved, from multiple angles

- License plates

- Damage to each car

- Skid marks, traffic signs, and road conditions

- Injuries (if safe and appropriate)

These images can be crucial evidence if there’s a dispute about how the accident occurred. For example, if the other driver claims you ran a red light, but your photo shows the light was green, it could save you from a costly lawsuit.

Gather Witness Information

If anyone saw the accident, ask for their name and contact details. Witnesses can provide unbiased accounts that support your version of events. Even a passing pedestrian or driver who didn’t stop can be helpful later.

Say a witness saw the other driver texting before the crash. That testimony could prove negligence and reduce your liability—protecting your assets from unnecessary claims.

File a Police Report

Always call the police, even for minor accidents. A police report creates an official record that includes officer observations, diagrams, and statements from involved parties. Insurance companies and courts rely on these reports to determine fault.

In some states, failing to report an accident can result in fines or license suspension. Plus, without a report, the other party might later claim you caused more damage than actually occurred.

Keep a Personal Accident Journal

Write down everything you remember as soon as possible. Include:

- Date, time, and location

- Weather and road conditions

- What you were doing before the crash (e.g., braking, changing lanes)

- What the other driver did

- Any injuries you or passengers experienced

This journal can help you recall details accurately during insurance interviews or legal proceedings. Memory fades over time, so the sooner you write it down, the better.

Step 3: Notify Your Insurance Company Promptly

After an accident, time is of the essence. Most insurance policies require you to report accidents “as soon as practicable”—usually within 24 to 72 hours. Delaying can give the insurer grounds to deny your claim or reduce coverage.

Visual guide about How to Protect Your Assets After a Car Accident

Image source: driverknowledge.co.uk

How to Report the Accident

Contact your insurance agent or company’s claims department by phone or online. Be ready to provide:

- Policy number

- Date, time, and location of the accident

- Names and contact info of other drivers

- Police report number (if available)

- Description of what happened

Be honest, but avoid speculating. Stick to the facts you know. For example, say “I braked suddenly because the car in front stopped” instead of “The other driver slammed on their brakes for no reason.”

Why Timing Matters

Insurance companies investigate claims quickly. The sooner you report, the faster they can assign an adjuster, inspect vehicles, and interview witnesses. Delays can lead to lost evidence or conflicting stories.

Imagine you wait a week to report a minor accident. The other driver now claims they had a concussion and missed work. Without timely documentation, your insurer may question the validity of their claim—or worse, deny yours.

Work with Your Claims Adjuster

Once you file a claim, an adjuster will contact you. They’ll review the evidence, assess damages, and determine fault. Be cooperative, but don’t rush to accept a settlement.

Adjusters often offer quick payouts to close cases fast. But these offers may not cover all your expenses—especially if injuries develop later. For example, whiplash symptoms can appear days after an accident. If you settle too soon, you lose the right to seek more compensation.

Step 4: Consult a Personal Injury Attorney

Even if you’re not at fault, a car accident can lead to complex legal issues. A personal injury attorney can help you navigate the system, protect your rights, and maximize your compensation.

When to Hire a Lawyer

You don’t need a lawyer for every fender bender. But consider hiring one if:

- Someone was seriously injured

- There’s a dispute over who caused the accident

- The insurance company denies your claim or offers a low settlement

- You’re being sued for damages

- The accident involved a commercial vehicle or government entity

For example, if you’re sued for $200,000 but your insurance only covers $100,000, a lawyer can help negotiate a settlement or defend you in court—potentially saving your home or savings.

How Lawyers Protect Your Assets

Attorneys do more than just file lawsuits. They:

- Investigate the accident thoroughly

- Negotiate with insurance companies

- Gather medical records and expert testimony

- Ensure you don’t miss legal deadlines (statute of limitations)

- Advise on asset protection strategies

Many personal injury lawyers work on a contingency basis—meaning they only get paid if you win. This makes legal help accessible, even if you’re facing financial strain.

Choosing the Right Attorney

Look for a lawyer with experience in car accident cases. Check reviews, ask about their success rate, and schedule a free consultation. A good attorney will explain your options clearly and help you make informed decisions.

Don’t just pick the first name you see on a billboard. Ask questions like: “How many car accident cases have you handled?” and “What’s your approach to protecting clients’ assets?”

Step 5: Consider an Umbrella Insurance Policy

Even with high liability limits, you might still be exposed to financial risk. That’s where an umbrella policy comes in—a type of extra liability insurance that kicks in when your auto or home insurance limits are exhausted.

How Umbrella Policies Work

An umbrella policy typically starts at $1 million in coverage and can go much higher. It covers not just car accidents, but also other liabilities like dog bites, slip-and-fall injuries on your property, or defamation lawsuits.

For example, if you’re found liable for $1.5 million in a car accident, your auto insurance pays the first $300,000. Your umbrella policy covers the next $1 million. You’re only responsible for the remaining $200,000—unless you have even more coverage.

Who Needs Umbrella Insurance?

Anyone with assets to protect should consider it. This includes:

- Homeowners

- People with significant savings or investments

- High-income earners

- Parents (children can sometimes cause accidents)

- Pet owners (dog bites can lead to lawsuits)

Umbrella policies are surprisingly affordable. A $1 million policy might cost $150–$300 per year—less than a monthly streaming subscription. For the protection it offers, it’s one of the best investments you can make.

Requirements for Umbrella Coverage

Most insurers require you to have certain minimum liability limits on your auto and home insurance before issuing an umbrella policy. For example, you might need $250,000 in auto liability and $300,000 in homeowners liability.

Check with your insurance agent to see what’s required. Upgrading your base policies may be necessary—but it’s worth it for the added security.

Step 6: Use Legal Tools to Shield Your Assets

Insurance is your first line of defense, but it’s not the only tool. Smart legal planning can help separate your personal assets from potential liability, making it harder for creditors or plaintiffs to reach them.

Create a Trust

A trust is a legal arrangement that holds assets on your behalf. Certain types, like irrevocable trusts, can protect your home, investments, and savings from lawsuits.

For example, if you transfer your home into an irrevocable trust, it’s no longer considered your personal asset. If you’re sued after a car accident, the plaintiff can’t force the sale of the home to satisfy the judgment.

Note: Trusts must be set up well in advance. Transferring assets after an accident can be seen as fraudulent and may not hold up in court.

Form a Limited Liability Company (LLC)

If you own rental property, a business, or investment real estate, placing it in an LLC can limit your personal liability. The LLC owns the asset, not you directly. So if someone sues you, they can’t go after the LLC’s property unless they pierce the corporate veil—which is difficult to do.

For instance, if you own a vacation rental and a guest slips and falls, they can sue the LLC—but not your personal bank account. This keeps your savings safe even if the business faces legal trouble.

Keep Personal and Business Finances Separate

Never mix personal and business funds. Use separate bank accounts, credit cards, and accounting records. This makes it clear which assets belong to you and which belong to your business or LLC.

If you’re self-employed and get into a car accident, a creditor might try to claim your business income. Keeping finances separate helps prove that certain assets aren’t personally liable.

Consider Homestead Exemptions

Many states offer homestead exemptions that protect a portion of your home’s equity from creditors. The amount varies by state—some protect up to $500,000, while others offer unlimited protection.

For example, in Florida, your primary residence is fully protected from most creditors, including lawsuit judgments. This means even if you lose a big court case, you can’t be forced to sell your home.

Check your state’s laws and file the necessary paperwork to claim your exemption.

Step 7: Avoid Common Mistakes That Put Your Assets at Risk

Even with the best preparation, a few missteps can undo all your efforts. Avoid these common pitfalls to keep your assets safe.

Don’t Admit Fault at the Scene

It’s natural to say “I’m sorry” after an accident, but those words can be used against you. In court, an apology can be interpreted as an admission of guilt.

Instead, stick to neutral statements like “Are you okay?” or “Let’s exchange insurance information.” Let the police and insurance companies determine fault.

Don’t Ignore Medical Injuries

Some injuries, like concussions or internal bleeding, don’t show symptoms right away. Delaying medical care can worsen your condition—and hurt your claim.

See a doctor even if you feel fine. Medical records link your injuries to the accident, which is crucial for insurance and legal purposes.

Don’t Talk to the Other Driver’s Insurance Company

The other driver’s insurer may call you asking for a statement. They’re not on your side—they want to minimize their payout.

Politely decline to speak without your lawyer or your own insurance adjuster present. Anything you say can be used to reduce or deny your claim.

Don’t Delay Legal or Financial Planning

Asset protection isn’t something you can do overnight. Set up trusts, LLCs, and umbrella policies before an accident happens. Once you’re sued, it’s often too late.

Talk to a financial advisor or estate planning attorney about your options. The earlier you act, the better protected you’ll be.

Conclusion: Take Control of Your Financial Future

A car accident can happen to anyone—but financial devastation doesn’t have to follow. By understanding your insurance, documenting the incident, seeking legal help, and using smart asset protection strategies, you can safeguard your home, savings, and future income.

Protecting your assets after a car accident isn’t about avoiding responsibility. It’s about being prepared. With the right steps, you can handle the aftermath with confidence, knowing your hard-earned wealth is secure. Don’t wait for disaster to strike—start protecting your assets today.

Frequently Asked Questions

What should I do immediately after a car accident?

Check for injuries, move to safety if possible, call the police, and document the scene with photos and witness info. Notify your insurance company as soon as possible.

Can I be sued even if I have insurance?

Yes. If damages exceed your policy limits, the other party can sue you for the difference. That’s why higher liability limits and umbrella insurance are important.

How much liability insurance should I carry?

Experts recommend at least $100,000 per person and $300,000 per accident. If you have significant assets, consider $250,000/$500,000 or more.

Is an umbrella policy worth it?

Yes, especially if you own a home, have savings, or earn a high income. It provides extra liability coverage at a low cost—typically $150–$300 per year for $1 million.

Can I protect my home from a car accident lawsuit?

Yes, through tools like homestead exemptions, trusts, or LLCs. These legal structures can shield your home equity from creditors and lawsuit judgments.

Should I hire a lawyer after a minor accident?

It depends. If there are injuries, disputes over fault, or large damages, a lawyer can help protect your rights and assets. Many offer free consultations.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.