Buying a car isn’t just about the sticker price—taxes and fees can add hundreds or even thousands to your total cost. This guide breaks down every charge you might face, from state sales tax to registration fees, so you can plan your budget with confidence.

Buying a car is exciting—but it’s easy to get blindsided by hidden costs. You find the perfect vehicle, agree on a price, and then… bam! The final bill includes taxes, registration, title fees, and a handful of other charges that weren’t obvious at first glance. If you’re not prepared, these extras can throw off your budget and leave you feeling frustrated.

Understanding how much taxes and fees on a car really cost is essential for any smart buyer. These aren’t optional add-ons—they’re required by law in most cases—and they vary widely depending on where you live, what kind of car you’re buying, and even how you’re paying for it. Whether you’re purchasing new or used, financing or paying cash, leasing or buying outright, these costs will impact your bottom line.

The good news? With a little research and planning, you can anticipate these expenses and avoid surprises at the dealership. This guide will walk you through every major fee and tax you might encounter, explain how they’re calculated, and offer practical tips to minimize their impact. By the end, you’ll know exactly what to expect—and how to keep more money in your pocket.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Understanding Sales Tax on Car Purchases

- 4 Registration and Title Fees: What You Need to Know

- 5 Documentation Fees (Doc Fees): Are They Negotiable?

- 6 Additional Fees and Taxes You Might Encounter

- 7 How Trade-Ins, Rebates, and Financing Affect Your Total Cost

- 8 Budgeting Tips: How Much Should You Expect to Pay?

- 9 Final Thoughts: Be Prepared, Not Surprised

- 10 Frequently Asked Questions

- 10.1 Do I have to pay sales tax if I buy a car out of state?

- 10.2 Are documentation fees the same everywhere?

- 10.3 Can I avoid paying registration fees?

- 10.4 Does leasing a car mean lower taxes and fees?

- 10.5 Are taxes and fees higher for used cars?

- 10.6 What happens if I don’t pay my car taxes or fees on time?

Key Takeaways

- Sales tax varies by state: Rates range from 0% in states like Oregon and New Hampshire to over 7% in places like California and Indiana.

- Registration and title fees are mandatory: These one-time and annual costs depend on your vehicle’s value, weight, and location.

- Documentation fees can be negotiable: Often called “doc fees,” these dealer charges typically range from $100 to $800 and may be reduced or waived.

- Additional fees may apply: Some states charge emissions testing, luxury taxes, or environmental fees based on vehicle type.

- Trade-ins and rebates affect tax calculations: In most states, trade-in value reduces the taxable amount, lowering your overall tax burden.

- Budget 8–12% extra beyond the car price: A safe rule of thumb is to expect taxes and fees to add roughly 8% to 12% to your vehicle’s purchase price.

- Research your state’s rules early: Use online calculators or contact your local DMV to get accurate estimates before signing any paperwork.

📑 Table of Contents

- Understanding Sales Tax on Car Purchases

- Registration and Title Fees: What You Need to Know

- Documentation Fees (Doc Fees): Are They Negotiable?

- Additional Fees and Taxes You Might Encounter

- How Trade-Ins, Rebates, and Financing Affect Your Total Cost

- Budgeting Tips: How Much Should You Expect to Pay?

- Final Thoughts: Be Prepared, Not Surprised

Understanding Sales Tax on Car Purchases

One of the biggest—and most variable—costs when buying a car is sales tax. Unlike the fixed price of the vehicle itself, sales tax depends heavily on your state (and sometimes even your city or county). It’s calculated as a percentage of the purchase price, and it’s usually collected at the time of sale.

How Sales Tax Is Calculated

In most states, sales tax is applied to the final negotiated price of the car. For example, if you buy a $30,000 vehicle in a state with a 6% sales tax rate, you’ll pay $1,800 in tax. Simple, right? But it gets trickier when trade-ins, rebates, or incentives come into play.

In many states—including California, Texas, and Florida—the trade-in value of your old car is subtracted from the purchase price before tax is calculated. So if you trade in a $10,000 car toward that $30,000 vehicle, you’ll only pay tax on $20,000, saving you $600 in this example. However, not all states allow this deduction. In places like Arizona and Kansas, you pay tax on the full purchase price regardless of trade-in value.

Rebates and manufacturer incentives can also affect your tax bill. Generally, cash rebates reduce the taxable amount, while low-interest financing or lease incentives do not. Always ask your dealer how rebates are being applied—some may roll them into the financing, which could increase your taxable base.

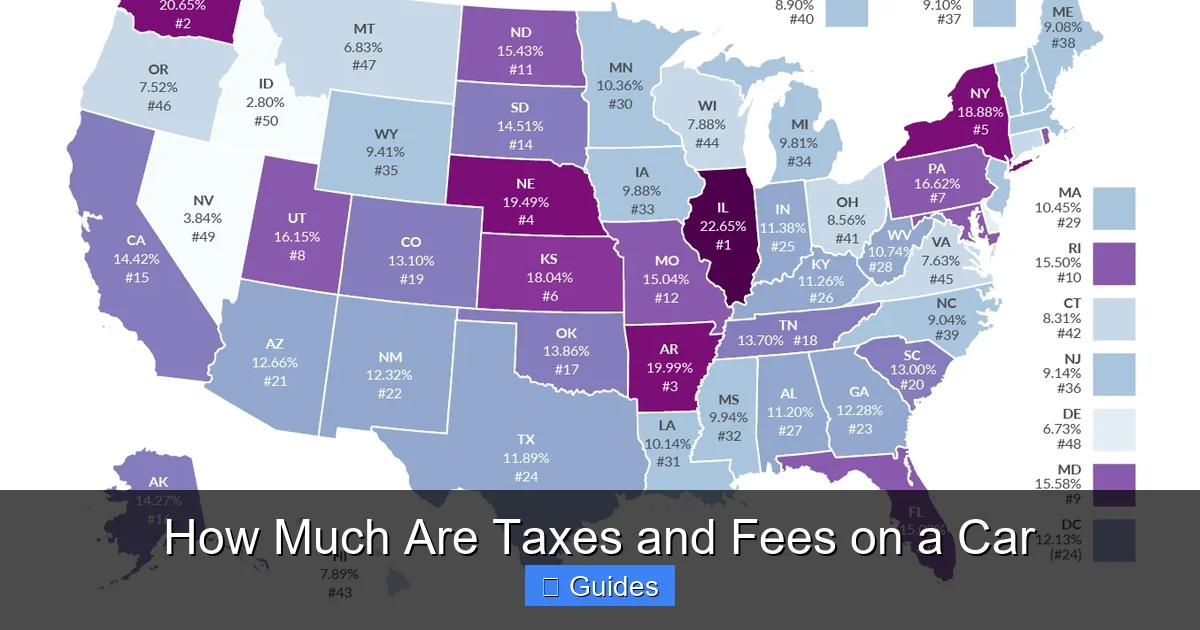

State-by-State Variations

Sales tax rates vary dramatically across the U.S.:

– **No sales tax:** Oregon, New Hampshire, Delaware, Montana, and Alaska (though some local jurisdictions in Alaska may impose taxes).

– **Low rates (under 5%):** Colorado (2.9%), Alabama (4%), and Virginia (4.1%).

– **Moderate rates (5–7%):** Texas (6.25%), Florida (6%), and Illinois (6.25%).

– **High rates (over 7%):** California (7.25% base, plus local additions that can push it over 10%), Indiana (7%), and Tennessee (7%).

Keep in mind that many states allow local cities or counties to add their own sales tax on top of the state rate. For instance, while California’s base rate is 7.25%, drivers in Los Angeles might pay closer to 9.5% due to local district taxes.

Tips to Minimize Sales Tax

– **Negotiate the out-the-door price:** Ask dealers for the total cost including all taxes and fees, not just the sticker price. This gives you a clearer picture of what you’ll actually pay.

– **Use trade-ins wisely:** If your state allows trade-in deductions, make sure the dealer applies it correctly before calculating tax.

– **Time your purchase:** Some states offer tax holidays or reduced rates during certain periods (e.g., back-to-school seasons), though these rarely apply to vehicles.

– **Consider buying in a lower-tax state:** If you live near a state border with lower taxes, it might be worth purchasing there—but be aware of registration and use tax implications when bringing the car home.

Registration and Title Fees: What You Need to Know

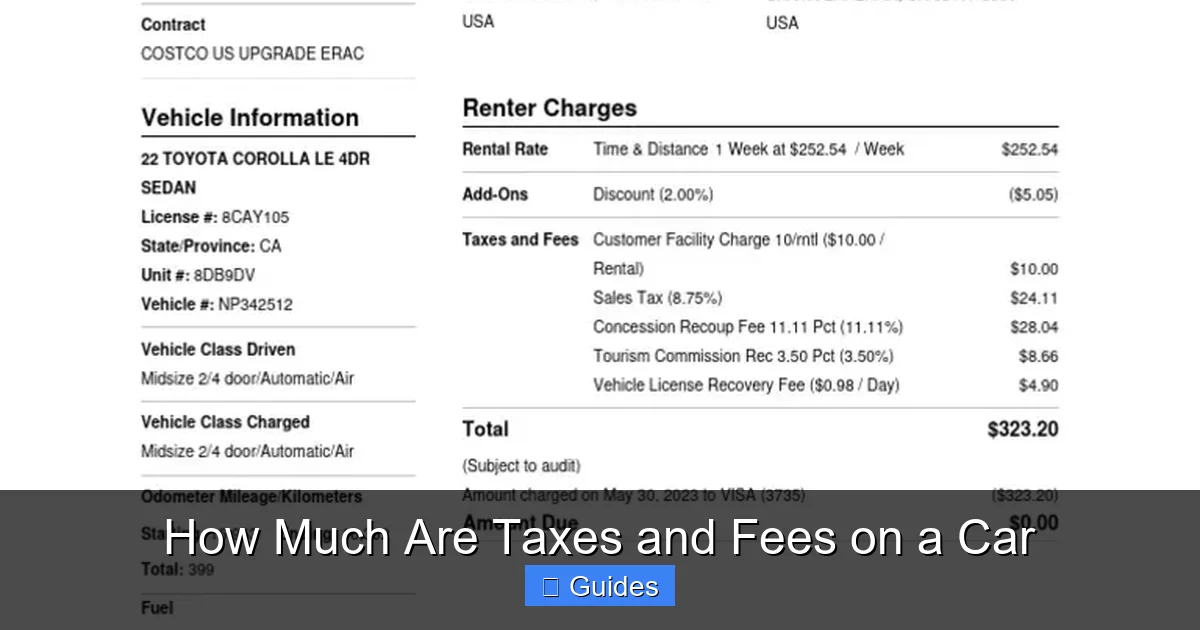

Visual guide about How Much Are Taxes and Fees on a Car

Image source: taxcalculatorusa.com

After paying sales tax, the next major expense is registration and title fees. These are mandatory costs required to legally drive your car on public roads. While they’re not as large as sales tax, they can still add up—especially if you’re buying a high-value or heavy vehicle.

What Are Registration Fees?

Registration fees are annual charges that allow your vehicle to be legally operated. They typically cover license plates, registration stickers, and administrative processing. The cost depends on several factors:

– **Vehicle type:** Passenger cars, trucks, motorcycles, and RVs all have different fee structures.

– **Weight or value:** Many states base registration fees on the car’s weight (e.g., $50 for under 3,000 lbs, $100 for over 4,000 lbs) or its assessed value.

– **Location:** Urban areas often charge higher fees than rural ones due to infrastructure demands.

For example, in New York, registration for a standard passenger car starts around $83, while in Texas, it’s based on weight and can range from $50 to $200+. In California, registration includes a vehicle license fee (VLF) based on the car’s value, which can cost hundreds annually for newer or luxury vehicles.

Title Fees Explained

A title fee is a one-time charge to legally transfer ownership of the vehicle to your name. This document proves you own the car and is required for registration. Title fees are usually flat rates, ranging from $10 to $100 depending on the state.

Some states also charge additional fees for duplicate titles, lien recordings (if you’re financing), or expedited processing. If you’re buying from a private seller, you may need to pay both the seller’s title transfer fee and your own registration fee.

Renewal and Late Fees

Don’t forget about renewal costs! Most states require annual or biennial registration renewals. If you miss the deadline, late fees can apply—sometimes as much as 1.5% of the registration cost per month. Set calendar reminders or sign up for email alerts from your state’s DMV to avoid penalties.

Documentation Fees (Doc Fees): Are They Negotiable?

Visual guide about How Much Are Taxes and Fees on a Car

Image source: imgv2-1-f.scribdassets.com

You’ve probably heard the term “doc fee” thrown around at dealerships. Officially known as documentation fees, these charges cover the cost of preparing and processing paperwork for your purchase—titles, registrations, financing documents, etc.

Typical Doc Fee Ranges

Doc fees vary by state and dealership, but they generally fall between $100 and $800. Some states cap these fees by law:

– **Capped states:** California ($85 max), New York ($75 max), Texas ($150 max).

– **Uncapped states:** Florida, Georgia, and Illinois allow dealers to set their own rates, which can exceed $500.

While doc fees sound legitimate, many consumer advocates argue they’re often inflated beyond actual administrative costs. In reality, processing a car sale doesn’t require $600 worth of work—especially with digital systems in place.

Can You Negotiate Doc Fees?

Yes—and you should! Unlike taxes or registration fees, doc fees are set by the dealership, not the government. That means they’re negotiable. Here’s how:

– **Ask for an itemized breakdown:** Request a list of what the fee covers. If it includes vague items like “prep” or “processing,” push back.

– **Compare dealers:** Get quotes from multiple dealerships and use lower doc fees as leverage.

– **Request a waiver:** Some dealers will reduce or eliminate the fee if you’re paying cash, trading in a vehicle, or financing through them.

Remember: Just because a fee is listed on the contract doesn’t mean it’s non-negotiable. Politely but firmly ask to have it reduced or removed.

Additional Fees and Taxes You Might Encounter

Visual guide about How Much Are Taxes and Fees on a Car

Image source: files.taxfoundation.org

Beyond the big three—sales tax, registration, and doc fees—there are several other charges that can pop up during your car purchase. While not universal, they’re common enough that you should be aware of them.

Emissions and Safety Inspection Fees

Many states require vehicles to pass emissions and/or safety inspections before registration. These aren’t always included in the purchase price and may require a separate trip to an inspection station.

– **Emissions testing:** Common in urban areas with air quality concerns (e.g., California, Texas, Colorado). Fees range from $15 to $50.

– **Safety inspections:** Required in states like Virginia, Pennsylvania, and New York. Costs typically run $10–$30.

Some dealerships include inspection fees in their pricing, while others pass them on to you. Always ask upfront.

Luxury and Environmental Fees

High-end or environmentally impactful vehicles may incur special taxes:

– **Luxury tax:** A few states (like Michigan) impose additional taxes on vehicles above a certain price threshold (e.g., $50,000).

– **Gas guzzler tax:** The federal government charges this on new cars with poor fuel economy (under 22.5 mpg). It ranges from $1,000 to $7,700 and is usually built into the manufacturer’s price.

– **Hybrid/electric incentives:** While not a fee, some states offer rebates or tax credits for eco-friendly vehicles—check your state’s clean vehicle program.

Destination and Delivery Charges

For new cars, you’ll often see a “destination charge” (sometimes called a delivery fee). This covers the cost of transporting the vehicle from the factory to the dealership. It’s typically $1,000–$1,500 and is set by the manufacturer—not negotiable. However, it’s usually included in advertised prices, so don’t let dealers add it separately.

Financing and Processing Fees

If you’re financing through the dealership, watch out for:

– **Loan origination fees:** Rare for auto loans, but some lenders charge them.

– **Credit check fees:** Usually absorbed by the dealer, but occasionally passed to the buyer.

– **Electronic filing fees:** A small charge (under $20) for submitting documents digitally.

Always read the fine print on your financing agreement.

How Trade-Ins, Rebates, and Financing Affect Your Total Cost

Your method of payment and any incentives can significantly influence how much you pay in taxes and fees.

Trade-Ins Reduce Taxable Amount (in Most States)

As mentioned earlier, trade-ins can lower your sales tax burden—but only if your state allows it. In states like California, New York, and Florida, the trade-in value is subtracted from the purchase price before tax is calculated. This can save you hundreds.

However, in states like Arizona, Kansas, and Oklahoma, you pay tax on the full purchase price regardless of trade-in value. If you’re in one of these states, consider selling your old car privately instead of trading it in—you’ll likely get more money, and avoid increasing your taxable base.

Rebates and Incentives: Timing Matters

Manufacturer rebates (e.g., $2,000 cash back) usually reduce the taxable amount if applied at the time of purchase. But if the rebate is deferred or rolled into financing, it might not lower your tax bill. Always confirm how rebates are being handled.

Low-interest financing deals (e.g., 0% APR) don’t reduce the purchase price, so they won’t lower your tax. But they can save you money on interest over time.

Cash vs. Financing: Does It Matter?

Paying cash doesn’t exempt you from taxes or fees—but it can simplify the process and eliminate financing-related charges. Dealers may also be more willing to negotiate doc fees or throw in extras (like free oil changes) if you’re paying upfront.

That said, financing can help preserve your cash flow, especially if you qualify for a low-rate loan. Just remember: the total cost includes interest, so factor that into your budget.

Budgeting Tips: How Much Should You Expect to Pay?

So, how much are taxes and fees on a car, really? While exact amounts depend on your situation, here’s a realistic estimate:

– **Low end (no tax state + low fees):** ~5% of purchase price (e.g., $1,500 on a $30,000 car).

– **Average (6% tax + typical fees):** ~10% of purchase price (e.g., $3,000 on a $30,000 car).

– **High end (high-tax state + luxury vehicle):** ~15% or more (e.g., $6,000+ on a $40,000 car).

To budget effectively:

1. **Use online calculators:** Many state DMV websites and car-buying sites (like Edmunds or Kelley Blue Book) offer tax and fee estimators.

2. **Get an “out-the-door” quote:** Ask dealers for the total price including all taxes, fees, and add-ons.

3. **Add a buffer:** Plan for at least 10% extra beyond the car’s price to cover unexpected charges.

4. **Check for exemptions:** Military members, disabled drivers, and seniors may qualify for reduced fees in some states.

Final Thoughts: Be Prepared, Not Surprised

Buying a car is a major financial decision, and taxes and fees are a natural part of the process. But they don’t have to be a mystery—or a money trap. By understanding how these charges work, knowing your state’s rules, and negotiating where possible, you can take control of your purchase and avoid last-minute shocks.

Remember: the sticker price is just the beginning. The real cost includes everything from sales tax to title fees, and sometimes even emissions tests or luxury surcharges. Do your homework, ask questions, and never sign anything until you understand every line item.

With the right preparation, you’ll walk away not just with a great car—but also with peace of mind and a budget that still has room for gas, insurance, and those weekend road trips.

Frequently Asked Questions

Do I have to pay sales tax if I buy a car out of state?

Yes, in most cases. Even if you buy a car in a no-tax state like Oregon, you’ll likely owe use tax when you register the vehicle in your home state. This tax is usually equivalent to your state’s sales tax rate.

Are documentation fees the same everywhere?

No. Doc fees vary by dealership and state. Some states cap them by law, while others let dealers set their own rates—so always ask and negotiate.

Can I avoid paying registration fees?

No, registration fees are mandatory to legally drive your car. However, some states offer discounts for seniors, veterans, or low-income drivers.

Does leasing a car mean lower taxes and fees?

Not necessarily. While you only pay tax on the leased portion of the car (not the full value), you may still face acquisition fees, disposition fees, and higher monthly costs that offset any savings.

Are taxes and fees higher for used cars?

Generally no—but it depends. Some states base registration fees on age or value, so older cars may cost less to register. However, sales tax is usually applied the same way regardless of vehicle age.

What happens if I don’t pay my car taxes or fees on time?

You may face late fees, registration suspension, or even fines. In extreme cases, your vehicle could be impounded. Always renew on time or request an extension if needed.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.