Mercury Car Insurance does allow late payments in many cases, thanks to a standard grace period—but it’s not unlimited. Missing your due date can still lead to fees, coverage lapses, or policy cancellation if not handled quickly.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Will Mercury Car Insurance Allow You to Pay Late?

- 4 Understanding Mercury’s Grace Period Policy

- 5 Consequences of Paying Late with Mercury Insurance

- 6 How to Avoid Late Payments with Mercury Insurance

- 7 What to Do If You’ve Already Paid Late

- 8 State-Specific Rules and Regulations

- 9 Tips for Managing Your Mercury Insurance Payments

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 Can I pay my Mercury insurance premium after the due date?

- 11.2 Will I be charged a late fee if I pay my Mercury insurance late?

- 11.3 What happens if I don’t pay my Mercury insurance on time?

- 11.4 Can I reinstate my Mercury policy after it lapses?

- 11.5 Does Mercury offer payment plans for late payments?

- 11.6 How long is the grace period for Mercury insurance in my state?

Key Takeaways

- Grace Periods Are Standard: Most Mercury policies include a 10- to 15-day grace period after your due date before coverage is affected.

- Late Fees May Apply: Paying after the due date often results in a late fee, typically $10–$25 depending on your state and policy.

- Coverage Can Be Suspended: If you go beyond the grace period without paying, Mercury may suspend your coverage, leaving you uninsured.

- Automatic Payments Prevent Issues: Enrolling in auto-pay ensures you never miss a payment and avoids late fees or lapses.

- Contact Customer Service Immediately: If you know you’ll be late, call Mercury right away—they may offer payment extensions or hardship options.

- Reinstatement Is Possible: If your policy lapses, you can usually reinstate it by paying all overdue amounts plus possible reinstatement fees.

- State Laws Vary: Grace period lengths and late payment rules differ by state, so check your policy documents or contact Mercury directly.

📑 Table of Contents

- Will Mercury Car Insurance Allow You to Pay Late?

- Understanding Mercury’s Grace Period Policy

- Consequences of Paying Late with Mercury Insurance

- How to Avoid Late Payments with Mercury Insurance

- What to Do If You’ve Already Paid Late

- State-Specific Rules and Regulations

- Tips for Managing Your Mercury Insurance Payments

- Conclusion

Will Mercury Car Insurance Allow You to Pay Late?

Life happens. Maybe you forgot to check your bank account, had an unexpected expense, or simply lost track of the due date. Whatever the reason, if you’re a Mercury Car Insurance customer and you’ve missed your payment deadline, you’re probably wondering: *Will Mercury Car Insurance allow you to pay late?* The short answer is yes—but with important caveats.

Mercury Insurance understands that customers occasionally face financial hiccups. That’s why they offer a grace period for most auto insurance policies. This grace period gives you a small window of time after your due date to make your payment without immediate consequences like policy cancellation or coverage suspension. However, this doesn’t mean you can ignore the due date entirely. Late payments can still trigger fees, affect your credit, or even lead to a lapse in coverage if not resolved quickly.

In this guide, we’ll walk you through everything you need to know about late payments with Mercury Car Insurance—from how long you have to pay after the due date, to what happens if you don’t pay on time, and how to avoid future issues. Whether you’re dealing with a one-time delay or ongoing financial challenges, understanding your options can help you stay insured and avoid costly penalties.

Understanding Mercury’s Grace Period Policy

Visual guide about Will Mercury Car Insurance Allow You to Pay Late

Image source: mercuryinsurance.com

One of the most important things to know about Mercury Car Insurance is that they typically offer a grace period for late payments. This grace period is a set number of days after your premium due date during which your policy remains active—even if you haven’t paid yet.

How Long Is the Grace Period?

For most Mercury auto insurance policies, the grace period is **10 to 15 days** from the original due date. This means if your payment was due on the 1st of the month, you’d have until around the 11th or 16th to pay without losing coverage. However, the exact length can vary depending on your state of residence and the specific terms of your policy.

For example, in California, state law requires a minimum 10-day grace period for auto insurance payments. Mercury complies with this regulation, but some states may allow longer periods. It’s always best to check your policy documents or contact Mercury directly to confirm your grace period length.

What Happens During the Grace Period?

During the grace period, your coverage remains fully active. You’re still protected under your policy, and if you get into an accident or need to file a claim, Mercury will still honor it—as long as you pay before the grace period ends.

However, it’s important to note that **interest or late fees may start accruing immediately after the due date**, even during the grace period. So while you won’t lose coverage right away, you could still end up paying more than the original premium amount.

Why Grace Periods Matter

Grace periods are designed to protect consumers from sudden lapses in coverage due to minor oversights. Imagine missing your payment by just one day and suddenly being uninsured—that could lead to serious problems if you’re pulled over or involved in an accident. Mercury’s grace period helps prevent that kind of scenario, giving you a little breathing room to get your payment in.

But remember: the grace period is not a free pass. It’s a courtesy, not a right. Relying on it repeatedly can signal financial instability to the insurer and may affect your standing in the long run.

Consequences of Paying Late with Mercury Insurance

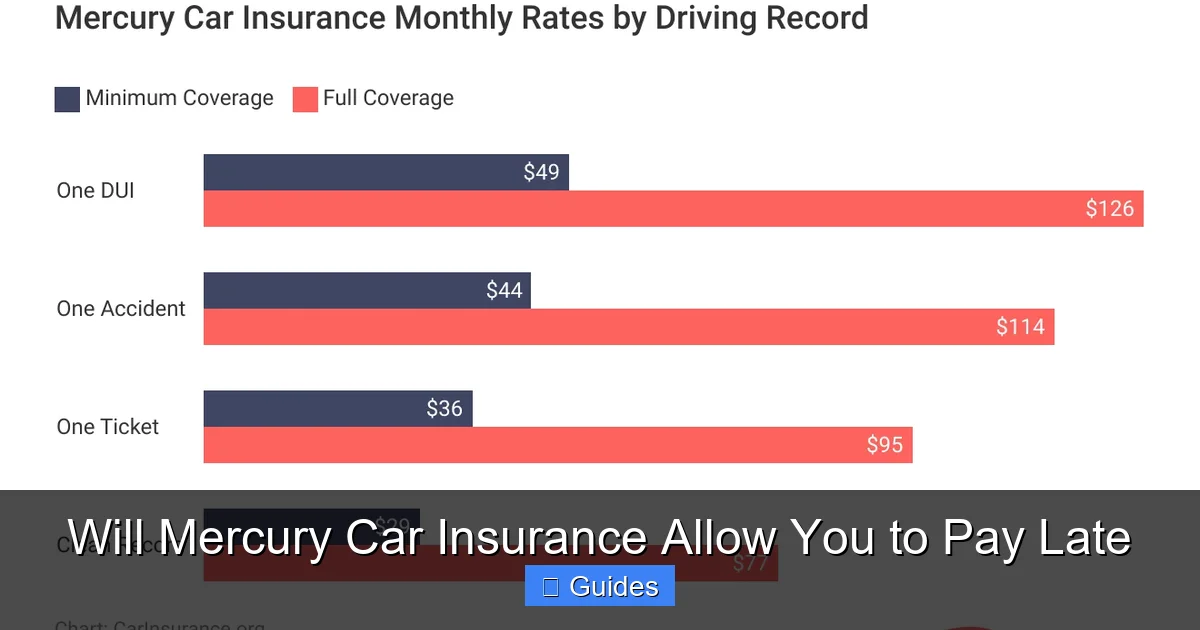

Visual guide about Will Mercury Car Insurance Allow You to Pay Late

Image source: carinsurance.org

While Mercury does allow late payments within the grace period, there are still consequences to consider. Understanding these can help you make informed decisions and avoid bigger problems down the road.

Late Payment Fees

One of the most common consequences of paying late is a **late fee**. Mercury typically charges a fee—usually between $10 and $25—for payments received after the due date. This fee is added to your next bill and is non-negotiable in most cases.

For example, if your monthly premium is $150 and you pay 5 days late, you might see a $15 late fee tacked on, bringing your total payment to $165. Over time, these fees can add up, especially if you’re frequently late.

Risk of Coverage Suspension

If you don’t pay by the end of the grace period, Mercury may **suspend your coverage**. This means your policy is no longer active, and you’re driving uninsured—even if your car is still registered and you have a valid license.

Driving without insurance is illegal in most states and can result in hefty fines, license suspension, or even vehicle impoundment. Plus, if you’re involved in an accident while uninsured, you could be personally liable for damages, medical bills, and legal fees.

Policy Cancellation

If your account remains unpaid for an extended period—typically 30 to 60 days beyond the due date—Mercury may **cancel your policy entirely**. Once canceled, you’ll need to reapply for coverage, which could be more expensive due to the lapse in insurance history.

A canceled policy can also affect your ability to get affordable rates in the future. Insurance companies view lapses in coverage as a red flag, often leading to higher premiums or difficulty finding a new insurer.

Impact on Credit and Renewal

While Mercury doesn’t typically report late payments to credit bureaus, repeated delinquency could lead to your account being sent to collections. This can negatively impact your credit score and make it harder to secure loans, apartments, or even jobs in some cases.

Additionally, if your policy lapses or is canceled, you may face higher rates when renewing or switching insurers. A clean payment history helps keep your premiums low, so staying on top of payments is always in your best interest.

How to Avoid Late Payments with Mercury Insurance

Visual guide about Will Mercury Car Insurance Allow You to Pay Late

Image source: thumbor.forbes.com

The best way to handle late payments is to avoid them altogether. Fortunately, Mercury offers several tools and options to help you stay on track.

Set Up Automatic Payments

One of the easiest and most effective ways to prevent late payments is to **enroll in automatic payments**. With auto-pay, your premium is deducted directly from your bank account or charged to your credit card on the due date each month.

This eliminates the risk of forgetting or missing a payment. Plus, many customers find that auto-pay helps them budget more effectively, since the amount is taken out automatically without requiring manual action.

To set up auto-pay, log in to your Mercury Insurance online account or call customer service. You’ll need your bank account or credit card information, and you can choose whether to pay the full premium or set up a payment plan.

Use Payment Reminders

If you prefer to pay manually, consider setting up **payment reminders**. You can use your phone’s calendar, email alerts, or budgeting apps to notify you a few days before your due date.

For example, you might set a reminder for 3 days before your payment is due, giving you time to check your account and ensure funds are available. This simple habit can prevent most late payments.

Choose a Convenient Payment Method

Mercury offers multiple payment options, including online payments, phone payments, mail-in checks, and in-person payments at authorized locations. Choose the method that works best for your lifestyle.

Online payments are fast and secure, while phone payments allow you to speak with a representative if you have questions. If you’re mailing a check, be sure to send it at least 5–7 days before the due date to account for delivery time.

Adjust Your Billing Cycle

If monthly payments are hard to manage, consider switching to a **semi-annual or annual payment plan**. Paying every six months or once a year can reduce the number of payments you need to remember and may even qualify you for a discount.

For instance, if your monthly premium is $150, paying $900 every six months might save you $30 in fees or administrative costs. Check with Mercury to see what options are available in your state.

What to Do If You’ve Already Paid Late

If you’ve already missed your payment, don’t panic—there are steps you can take to minimize the damage and get back on track.

Pay Immediately

The first and most important step is to **make your payment as soon as possible**. Log in to your Mercury account, call customer service, or visit a local office to submit your payment.

Even if you’re still within the grace period, paying right away can help avoid late fees and reduce stress. If you’re past the grace period, paying quickly may prevent coverage suspension or cancellation.

Contact Mercury Customer Service

If you’re unable to pay the full amount, **call Mercury’s customer service team** to explain your situation. They may be able to offer a payment extension, set up a short-term payment plan, or connect you with hardship assistance programs.

Be honest about your financial challenges—many insurers are willing to work with customers who communicate proactively. For example, if you’ve lost your job or faced a medical emergency, Mercury may allow you to defer a payment or reduce your premium temporarily.

Request a Waiver of Late Fees

In some cases, you can **request a waiver of late fees**, especially if this is your first late payment or you have a good payment history. While Mercury isn’t obligated to waive fees, they may do so as a courtesy.

When calling, be polite and explain your situation. Mention that you’ve been a loyal customer and that this is an isolated incident. Many representatives have the authority to remove fees at their discretion.

Reinstate Your Policy if Needed

If your policy has already lapsed or been canceled, you may be able to **reinstate it** by paying all overdue premiums plus any reinstatement fees. This process typically takes 1–3 business days, and your coverage will be restored retroactively in most cases.

However, reinstatement isn’t guaranteed—especially if your account has been delinquent for a long time. It’s always better to act quickly to avoid this step.

State-Specific Rules and Regulations

It’s important to remember that insurance regulations vary by state, and Mercury must comply with local laws. This means the grace period, late fees, and cancellation policies may differ depending on where you live.

California

In California, state law mandates a **minimum 10-day grace period** for auto insurance payments. Mercury follows this rule, and customers are protected during this time. However, late fees may still apply after the due date.

Texas

Texas allows insurers to set their own grace periods, but most—including Mercury—offer at least 10 days. If you’re in Texas, check your policy documents for the exact terms.

Florida

Florida requires a 10-day grace period for new policies and 30 days for renewals. This gives Mercury customers in the Sunshine State more time to pay without losing coverage.

New York

New York has strict insurance laws, and Mercury must provide a **30-day grace period** for all auto insurance policies. This is one of the most generous grace periods in the country.

Always verify your state’s rules by reviewing your policy or contacting Mercury directly. Knowing your rights can help you avoid surprises.

Tips for Managing Your Mercury Insurance Payments

Staying on top of your insurance payments doesn’t have to be stressful. With a few smart habits, you can keep your policy active and your premiums affordable.

Budget for Your Premium

Treat your insurance payment like any other essential bill—rent, utilities, or groceries. Include it in your monthly budget and prioritize it to avoid late payments.

Review Your Policy Annually

Life changes—so should your insurance. Review your policy each year to ensure you’re not overpaying or underinsured. You might qualify for discounts based on safe driving, low mileage, or bundling with home insurance.

Keep Contact Information Updated

Make sure Mercury has your current phone number, email, and mailing address. This ensures you receive payment reminders, renewal notices, and important policy updates.

Use the Mercury Mobile App

The Mercury Insurance mobile app lets you view your policy, make payments, and receive alerts—all from your smartphone. It’s a convenient way to stay connected and manage your account on the go.

Conclusion

So, will Mercury Car Insurance allow you to pay late? The answer is yes—within reason. Thanks to standard grace periods, most customers have 10 to 15 days after the due date to make their payment without losing coverage. However, late fees may apply, and going beyond the grace period can lead to suspension or cancellation of your policy.

The key to avoiding problems is proactive communication and smart payment habits. Set up auto-pay, use reminders, and contact Mercury immediately if you’re facing financial difficulties. Remember, a little planning goes a long way in keeping your insurance active and your costs low.

If you’ve already paid late, don’t wait—act quickly to minimize fees and protect your coverage. With the right approach, you can stay insured, maintain a good relationship with your insurer, and drive with confidence.

Frequently Asked Questions

Yes, you can pay after the due date, but only within the grace period—typically 10 to 15 days. After that, your coverage may be suspended or canceled.

Will I be charged a late fee if I pay my Mercury insurance late?

Yes, Mercury usually charges a late fee of $10–$25 if your payment is received after the due date, even during the grace period.

What happens if I don’t pay my Mercury insurance on time?

If you don’t pay by the end of the grace period, your coverage may be suspended. If unpaid for 30–60 days, your policy could be canceled.

Can I reinstate my Mercury policy after it lapses?

Yes, in most cases you can reinstate your policy by paying all overdue premiums and any reinstatement fees. Contact Mercury as soon as possible.

Does Mercury offer payment plans for late payments?

Mercury may offer short-term payment plans or extensions if you contact customer service and explain your financial hardship.

How long is the grace period for Mercury insurance in my state?

Grace periods vary by state—typically 10 to 30 days. Check your policy documents or call Mercury to confirm the exact length for your location.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.