Car insurance rates vary significantly between Fort Collins and Ventura due to location, traffic, and risk factors. This guide breaks down average costs, key influences, and practical tips to help you find affordable coverage in either city.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Is Car Insurance Higher in Fort Collins or Ventura?

- 4 Average Car Insurance Rates: Fort Collins vs. Ventura

- 5 Key Factors That Influence Car Insurance Costs

- 6 Personal Factors That Affect Your Premium

- 7 How to Save on Car Insurance in Fort Collins or Ventura

- 8 Final Thoughts: Which City Is More Affordable?

- 9 Frequently Asked Questions

- 9.1 Why is car insurance so expensive in Ventura?

- 9.2 Is Fort Collins really cheaper for car insurance?

- 9.3 Can I lower my car insurance rate if I move from Ventura to Fort Collins?

- 9.4 Do weather conditions really affect my car insurance?

- 9.5 How often should I shop for car insurance?

- 9.6 Does my credit score affect my car insurance in both states?

Key Takeaways

- Ventura generally has higher car insurance rates than Fort Collins: Due to higher population density, traffic congestion, and urban risk factors, Ventura drivers typically pay more for auto insurance.

- Location and population density play a major role: Urban areas like Ventura have more accidents, thefts, and claims, which drive up premiums compared to smaller cities like Fort Collins.

- Weather and natural risks impact premiums: Ventura’s coastal climate and earthquake risk can increase insurance costs, while Fort Collins faces winter weather challenges.

- Driving record and vehicle type matter most: Regardless of city, your personal driving history, age, and the car you drive heavily influence your rate.

- Shopping around saves money: Comparing quotes from multiple insurers can lead to significant savings, especially in high-cost areas like Ventura.

- Discounts and bundling help reduce costs: Many insurers offer discounts for safe driving, bundling home and auto policies, or installing safety features.

- State regulations affect pricing: Colorado and California have different insurance laws and minimum coverage requirements, which influence overall costs.

📑 Table of Contents

Is Car Insurance Higher in Fort Collins or Ventura?

If you’re comparing car insurance costs between Fort Collins, Colorado, and Ventura, California, you’re likely wondering which city will hit your wallet harder. The short answer? Ventura usually comes out on top when it comes to higher premiums. But why is that? And what can you do about it?

Car insurance isn’t just a one-size-fits-all expense. It’s shaped by a mix of local conditions, state laws, and personal factors. While both Fort Collins and Ventura are relatively safe, scenic cities with strong communities, their insurance landscapes differ in important ways. Understanding these differences can help you make smarter decisions about your coverage—and maybe even save you hundreds of dollars a year.

In this guide, we’ll dive deep into the factors that influence car insurance rates in both cities. We’ll look at average premiums, the role of location and risk, state-specific regulations, and practical tips to lower your costs. Whether you’re moving, comparing quotes, or just curious, this breakdown will give you the clarity you need.

Average Car Insurance Rates: Fort Collins vs. Ventura

Visual guide about Is Car Insurance Higher in Fort Collins or Ventura

Image source: carinsurancecomparison.com

Let’s start with the numbers. On average, drivers in Ventura pay more for car insurance than those in Fort Collins. According to recent data from insurance comparison sites and state reports, the typical annual premium in Ventura hovers around $2,200 to $2,600 for full coverage. In contrast, Fort Collins drivers usually pay between $1,600 and $2,000 per year for the same level of protection.

That’s a difference of $600 or more per year—money that could go toward gas, groceries, or a weekend getaway. But why the gap? It’s not just about geography. It’s about risk.

Why Ventura’s Rates Are Higher

Ventura, located along the Pacific Coast in Southern California, is part of a densely populated region. It’s close to Los Angeles and other major urban centers, which means more traffic, more accidents, and higher rates of vehicle theft and vandalism. Insurance companies see this as increased risk, and they adjust premiums accordingly.

Additionally, California has some of the highest insurance costs in the nation. The state requires higher minimum coverage limits than Colorado, and it also has a no-fault insurance system, which means drivers must carry personal injury protection (PIP). These factors contribute to higher base rates.

Why Fort Collins Is More Affordable

Fort Collins, nestled in northern Colorado, has a lower population density and less traffic congestion. It’s known for its bike-friendly streets, outdoor lifestyle, and relatively low crime rates—especially when it comes to auto-related incidents.

Colorado also has lower minimum coverage requirements and a different regulatory environment. While the state still requires liability insurance, the limits are less strict than in California. This helps keep base premiums lower for most drivers.

Key Factors That Influence Car Insurance Costs

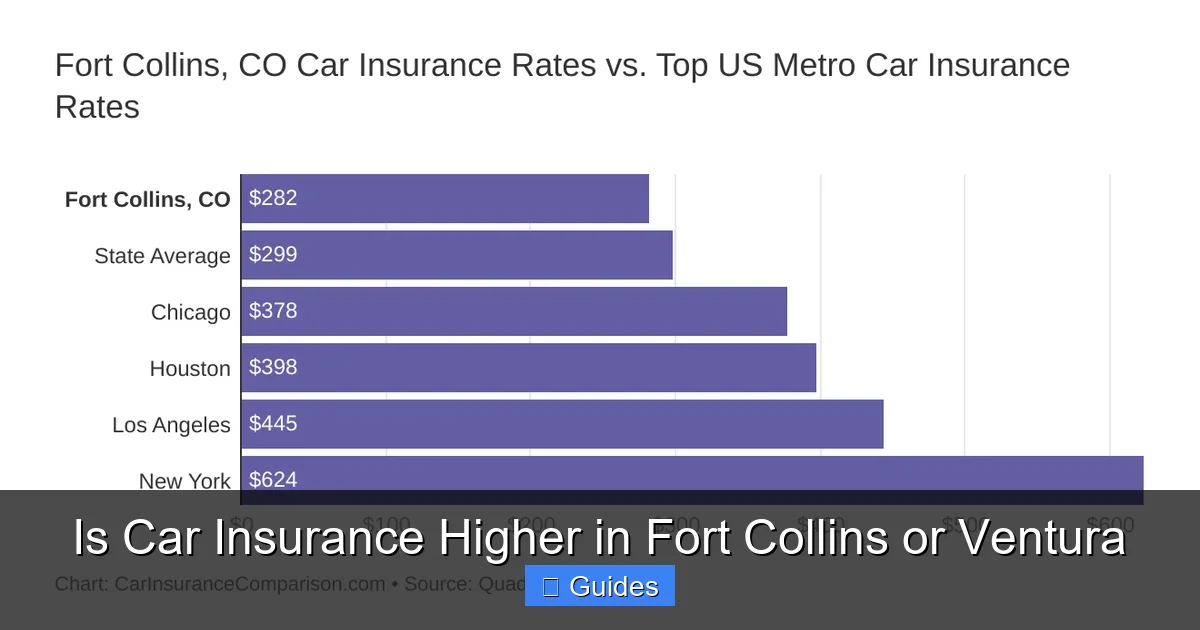

Visual guide about Is Car Insurance Higher in Fort Collins or Ventura

Image source: carinsurancecomparison.com

Now that we’ve seen the average numbers, let’s explore the real reasons behind the price difference. Car insurance isn’t just about where you live—it’s a complex calculation based on dozens of variables. Here are the biggest factors that affect your rate in both Fort Collins and Ventura.

1. Location and Urban Density

Where you live is one of the most powerful predictors of your insurance cost. Urban areas like Ventura have more cars on the road, more stop-and-go traffic, and higher chances of accidents. Parking in crowded lots or on busy streets also increases the risk of dings, dents, and theft.

In contrast, Fort Collins has a more spread-out layout. While it’s growing, it doesn’t have the same level of congestion as Ventura. This translates to fewer claims and lower risk assessments from insurers.

2. Crime Rates and Vehicle Theft

Vehicle theft and vandalism are major concerns in California. Ventura, while safer than nearby cities like Oxnard or Santa Barbara, still sees a higher rate of auto theft than Fort Collins. According to FBI crime data, Colorado has one of the lower vehicle theft rates in the U.S., especially in northern cities like Fort Collins.

Insurance companies factor in local crime statistics when setting rates. If your area has a history of break-ins or stolen cars, your comprehensive coverage—which protects against non-collision damage—will cost more.

3. Weather and Natural Disasters

Both cities face weather-related risks, but they’re very different.

In Ventura, coastal fog, heavy rain, and the ever-present threat of earthquakes can damage vehicles. Earthquake damage isn’t typically covered under standard auto policies, but insurers still consider the region’s seismic activity when assessing risk. Plus, flooding from winter storms can lead to water damage claims.

Fort Collins, on the other hand, deals with harsh winters. Snow, ice, and freezing temperatures increase the risk of accidents, especially on mountain roads or during sudden snowstorms. However, Colorado drivers are generally well-prepared for winter driving, and the state invests heavily in road maintenance.

Still, winter weather can spike claims during certain months, which insurers account for in their pricing models.

4. Traffic and Accident Rates

Traffic congestion directly correlates with accident frequency. Ventura sits along Highway 101, a major corridor that connects it to Los Angeles and Santa Barbara. Rush hour traffic, merging lanes, and high-speed interchanges all contribute to a higher chance of collisions.

Fort Collins has its share of busy roads, especially near Colorado State University and downtown, but overall traffic volume is much lower. The city also promotes alternative transportation, like biking and public transit, which reduces the number of vehicles on the road.

Insurance companies use accident data from local police reports and traffic studies to determine risk. Areas with more reported crashes will have higher premiums.

5. State Regulations and Minimum Coverage

California and Colorado have different insurance laws, and that affects what you pay.

In California, drivers must carry:

– $15,000 for injury/death to one person

– $30,000 for injury/death to more than one person

– $5,000 for property damage

Additionally, California requires uninsured motorist coverage and medical payments coverage. These add-ons increase the base cost of a policy.

Colorado’s minimums are lower:

– $25,000 for injury/death to one person

– $50,000 for injury/death to more than one person

– $15,000 for property damage

While Colorado’s bodily injury limits are higher, the overall package is less comprehensive than California’s, which helps keep premiums lower.

Personal Factors That Affect Your Premium

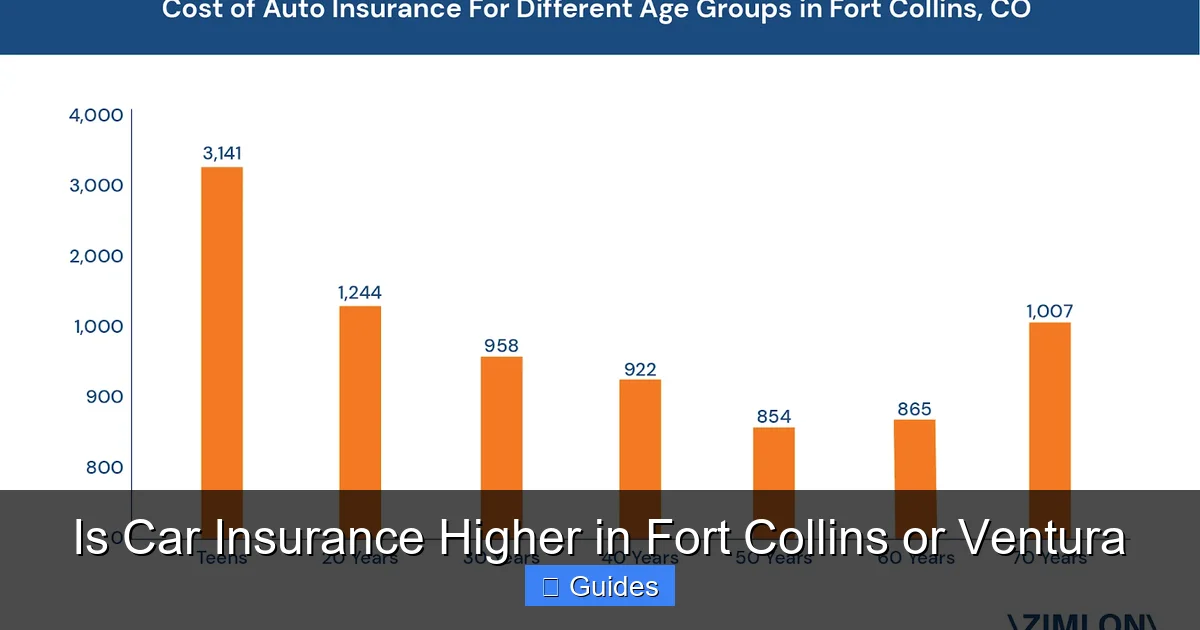

Visual guide about Is Car Insurance Higher in Fort Collins or Ventura

Image source: zimlon.com

While location and state rules set the stage, your personal profile is the star of the show when it comes to insurance pricing. Here’s how your individual details influence your rate in both cities.

Driving Record

Your driving history is one of the biggest factors. A clean record with no accidents or tickets will keep your rates low, no matter where you live. But if you’ve had a DUI, speeding ticket, or at-fault accident, expect to pay more—especially in high-risk areas like Ventura.

For example, a driver in Ventura with a recent speeding ticket might see their premium jump by 20–30%. In Fort Collins, the increase might be slightly lower, but it’s still significant.

Age and Experience

Young drivers, especially those under 25, pay the highest rates. Insurance companies see them as high-risk due to inexperience. A 19-year-old in Ventura might pay $4,000 or more per year for full coverage, while the same driver in Fort Collins could pay $3,200.

On the flip side, experienced drivers over 30 with clean records often enjoy the lowest rates.

Vehicle Type

The car you drive matters. High-performance vehicles, luxury cars, and models with high theft rates cost more to insure. For instance, insuring a Tesla in Ventura will be pricier than a Honda Civic—not just because of the car’s value, but also because of repair costs and theft risk.

In Fort Collins, SUVs and trucks are popular due to the outdoor lifestyle, but they can still be more expensive to insure than compact cars, especially if they’re newer or have advanced tech features.

Credit Score

In most states, including Colorado and California, insurers use credit-based insurance scores to help determine rates. Drivers with good credit typically pay less than those with poor credit.

A person with excellent credit in Fort Collins might pay $1,500 a year, while someone with poor credit in the same city could pay $2,200. The gap is similar in Ventura, but the starting point is higher.

How to Save on Car Insurance in Fort Collins or Ventura

Even if you live in a high-cost area like Ventura, there are ways to reduce your car insurance bill. Here are some proven strategies that work in both cities.

Shop Around and Compare Quotes

One of the easiest ways to save is by getting quotes from multiple insurers. Rates can vary by hundreds of dollars between companies, even for the same coverage.

Use online comparison tools or work with an independent agent who can check multiple carriers. Don’t just go with the first offer—take the time to compare.

Bundling Policies

Many insurers offer discounts if you bundle your auto policy with home, renters, or life insurance. This can save you 10–25% on your total premium.

For example, a driver in Ventura who bundles auto and home insurance might save $300 a year. The same discount applies in Fort Collins, but the base cost is lower, so the absolute savings might be smaller.

Safe Driver and Low-Mileage Discounts

If you drive safely and log fewer miles, you may qualify for discounts. Some insurers offer usage-based programs that track your driving habits through a mobile app or device.

Safe driving behaviors—like avoiding hard braking and speeding—can earn you lower rates over time. In both cities, these programs are widely available.

Improve Your Credit Score

Since credit affects your rate, improving your score can lead to lower premiums. Pay bills on time, reduce debt, and check your credit report for errors.

Even a small increase in your score—say, from “fair” to “good”—can shave $100 or more off your annual premium.

Choose the Right Coverage

Don’t over-insure your car. If you drive an older vehicle, consider dropping collision and comprehensive coverage if the cost exceeds the car’s value.

However, in high-theft areas like Ventura, comprehensive coverage might still be worth it. Weigh the cost against the risk.

Take Advantage of Local Discounts

Some insurers offer location-specific discounts. For example, Fort Collins drivers might get a discount for using public transit or biking to work. In Ventura, coastal residents might qualify for discounts if they park in secure garages.

Ask your insurer about available programs.

Final Thoughts: Which City Is More Affordable?

So, is car insurance higher in Fort Collins or Ventura? The answer is clear: Ventura is generally more expensive. But that doesn’t mean you’re stuck with high rates.

By understanding the factors that influence pricing—and taking steps to reduce your risk profile—you can find affordable coverage in either city. Whether you’re a student in Fort Collins or a commuter in Ventura, smart shopping, safe driving, and smart policy choices can make a big difference.

Remember, insurance is personal. Your rate depends on your unique situation. Don’t assume you’ll pay the average—get personalized quotes and explore your options.

Frequently Asked Questions

Why is car insurance so expensive in Ventura?

Ventura’s higher population density, traffic congestion, and proximity to urban areas increase the risk of accidents and theft. California’s strict insurance requirements and no-fault system also contribute to higher premiums.

Is Fort Collins really cheaper for car insurance?

Yes, on average, Fort Collins has lower car insurance rates than Ventura due to lower traffic, fewer claims, and less stringent state regulations. However, individual factors like driving record still play a major role.

Can I lower my car insurance rate if I move from Ventura to Fort Collins?

Possibly. Moving to a lower-risk area like Fort Collins could reduce your premium, especially if you maintain a clean driving record. Be sure to update your insurer with your new address to reflect the change.

Do weather conditions really affect my car insurance?

Yes. Areas prone to severe weather—like snow in Fort Collins or earthquakes in Ventura—may see higher premiums due to increased risk of damage. Insurers consider local climate data when setting rates.

How often should I shop for car insurance?

It’s wise to compare quotes at least once a year or when your policy renews. Rates change frequently, and new discounts or insurers may offer better deals.

Does my credit score affect my car insurance in both states?

Yes, both Colorado and California allow insurers to use credit-based insurance scores. Maintaining a good credit score can help you secure lower rates in either city.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.