Gap insurance doesn’t directly help you buy a new car, but it can prevent financial loss if your current car is totaled or stolen. By covering the difference between your car’s value and your loan balance, it keeps you from owing money on a vehicle you no longer have—freeing you to move forward with a new purchase without debt hanging over your head.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is Gap Insurance and How Does It Work?

- 4 Does Gap Insurance Help You Get a New Car?

- 5 Who Needs Gap Insurance the Most?

- 6 How Much Does Gap Insurance Cost?

- 7 When Can You Cancel Gap Insurance?

- 8 Common Misconceptions About Gap Insurance

- 9 Final Thoughts: Is Gap Insurance Right for You?

- 10 Frequently Asked Questions

Key Takeaways

- Gap insurance covers the “gap” between your car’s actual cash value and your outstanding loan balance. This is crucial if your car is totaled or stolen and you owe more than it’s worth.

- It doesn’t pay for a new car directly, but it removes financial obstacles. Without gap coverage, you might still owe thousands after an insurance payout, making it harder to afford a replacement.

- Gap insurance is most beneficial for new cars, long-term loans, or low down payments. These scenarios increase the risk of being “upside-down” on your loan.

- You can purchase gap insurance from lenders, dealerships, or third-party providers. Compare options to find the best price and coverage terms.

- Gap insurance typically costs between $200 and $700 over the life of a loan. This is far less than potentially owing $5,000–$10,000 out of pocket.

- Once your loan balance drops below your car’s value, gap insurance becomes unnecessary. You can often cancel it to save money.

- Gap insurance works alongside your auto insurance, not instead of it. You still need comprehensive and collision coverage for it to apply.

📑 Table of Contents

What Is Gap Insurance and How Does It Work?

Let’s start with the basics: gap insurance—short for “guaranteed asset protection” insurance—is a type of coverage designed to protect car owners from financial loss when their vehicle is totaled or stolen. It doesn’t pay for repairs or medical bills. Instead, it steps in when your standard auto insurance payout falls short of what you still owe on your car loan or lease.

Here’s how it works in real life: Imagine you buy a brand-new car for $30,000 with a small down payment and a 60-month loan. After just one year, your car is involved in a serious accident and declared a total loss by your insurer. At that point, your car might only be worth $22,000 due to depreciation—but you still owe $26,000 on your loan. That leaves a $4,000 “gap.” Without gap insurance, you’d have to pay that $4,000 out of pocket, even though you no longer have the car. With gap insurance? That $4,000 is covered, and you walk away debt-free.

Why Cars Lose Value So Fast

New cars depreciate rapidly—often losing 20% to 30% of their value the moment they’re driven off the lot. After one year, that number can climb to 40% or more. This steep drop in value is why so many people end up “underwater” on their loans early in the repayment period. Even if you make regular payments, your loan balance may not keep up with how fast your car loses worth.

For example, a $35,000 SUV might be worth just $24,000 after 12 months. If you financed $32,000 with a low down payment, you’re already $8,000 upside-down. Gap insurance exists precisely for situations like this—when life throws a curveball and your car is gone, but your debt remains.

When Does Gap Insurance Kick In?

Gap insurance only activates under specific conditions. First, your car must be declared a total loss (totaled) by your primary auto insurer, or it must be stolen and not recovered. Second, you must have comprehensive and collision coverage on your policy—gap insurance doesn’t work alone. It’s an add-on that complements your existing coverage, not a standalone solution.

Once those conditions are met, your standard insurer pays the actual cash value (ACV) of your car at the time of the incident. Then, gap insurance covers the remaining balance on your loan or lease, up to the policy limit. Some policies also cover your deductible, which can save you even more money.

Does Gap Insurance Help You Get a New Car?

This is the million-dollar question: Does gap insurance help you get a new car? The short answer is: not directly—but it removes a major financial barrier that could otherwise prevent you from buying your next vehicle.

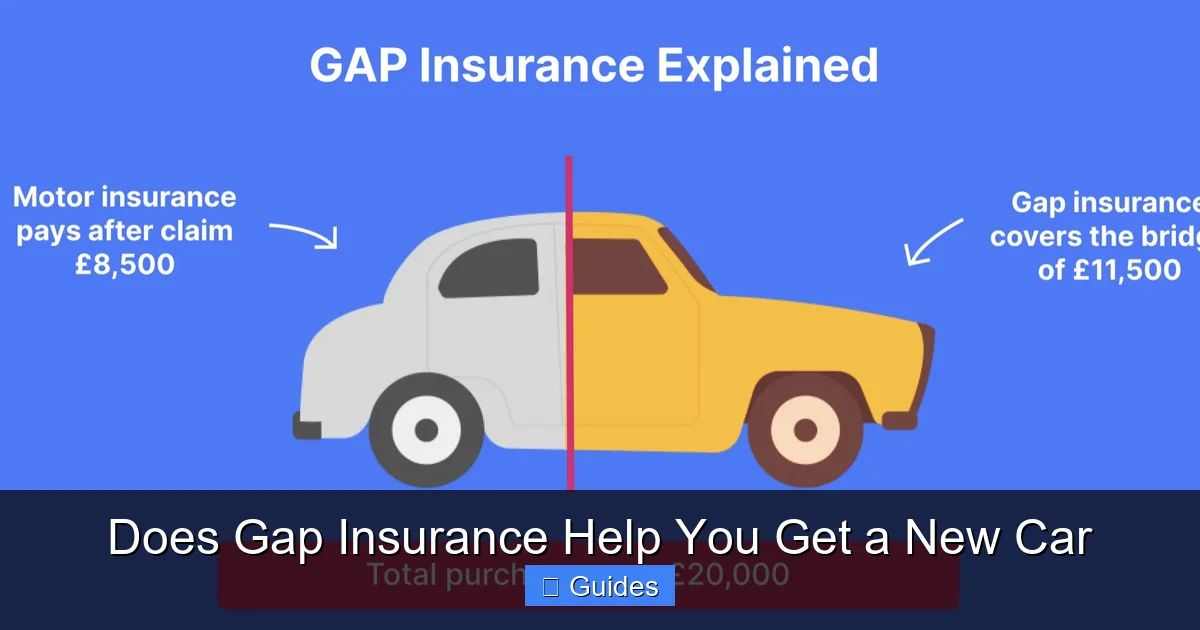

Visual guide about Does Gap Insurance Help You Get a New Car

Image source: bankrate.com

Think of it this way: If your car is totaled and you’re stuck paying off a $5,000 loan balance with no car to show for it, that $5,000 becomes a liability. You can’t easily qualify for a new auto loan while carrying that debt. Lenders see it as a red flag. But with gap insurance, that debt disappears. You’re free to walk into a dealership, trade in whatever’s left (if anything), and finance a new car without owing money on the old one.

The Real-World Impact on Your Next Purchase

Let’s revisit our earlier example. Sarah buys a $28,000 sedan with $2,000 down and a 72-month loan. After 18 months, her car is totaled in a flood. Her insurer pays $19,000—the current market value—but she still owes $23,000. Without gap insurance, Sarah owes $4,000. She can’t afford to pay that and put a down payment on a new car. She might delay her purchase, settle for a cheaper vehicle, or even fall behind on payments.

With gap insurance, Sarah owes nothing. She receives the $19,000 from her insurer, the gap policy covers the $4,000, and she’s clear. Now she can use any remaining funds (or savings) as a down payment on a new car. In this way, gap insurance doesn’t fund your new car—but it clears the path so you can afford one.

Gap Insurance vs. Rolling Negative Equity

One common mistake people make is assuming they can just “roll over” their negative equity into a new loan. While some lenders allow this, it’s rarely a good idea. Rolling $5,000 of debt into a new $30,000 loan means you’re financing $35,000—often at a higher interest rate. You start your new loan already underwater, and the cycle repeats.

Gap insurance breaks this cycle. By eliminating the leftover debt, it gives you a clean slate. You avoid rolling negative equity, reduce your monthly payments on the next car, and improve your chances of getting approved for better loan terms.

Who Needs Gap Insurance the Most?

Gap insurance isn’t necessary for everyone—but it’s highly recommended for certain drivers. If any of the following apply to you, gap coverage is worth serious consideration.

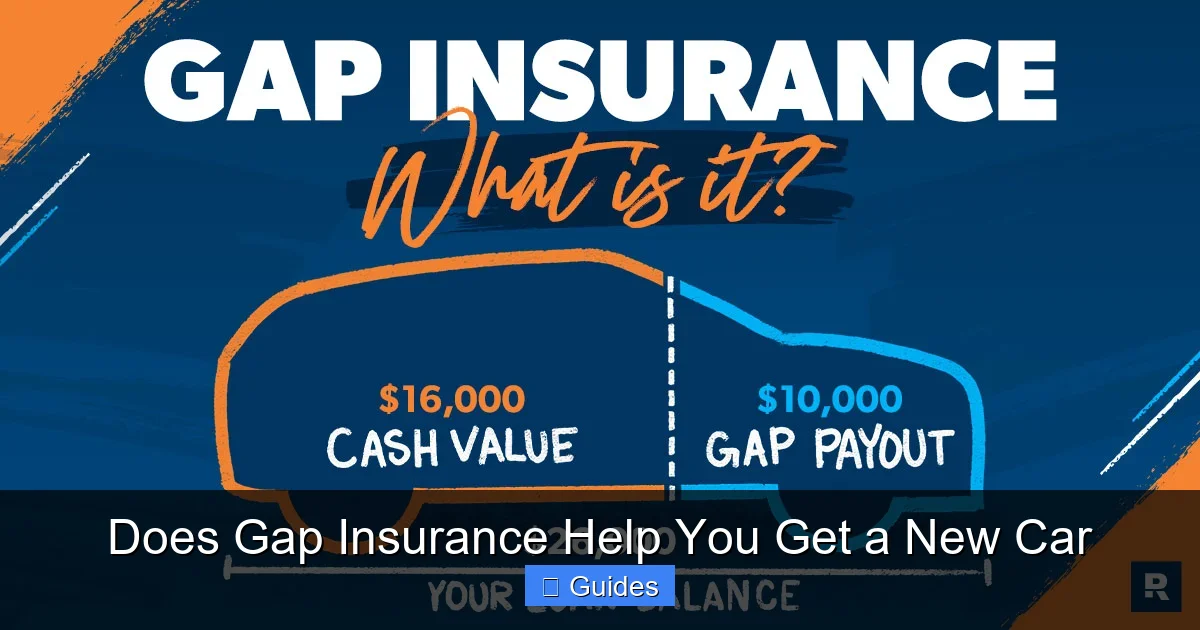

Visual guide about Does Gap Insurance Help You Get a New Car

Image source: caradviser.co.uk

Buyers of New Cars

New cars depreciate fastest in the first few years. If you’re buying a brand-new vehicle, especially with minimal down payment or a long loan term (60+ months), you’re at high risk of being upside-down. Gap insurance is almost always a smart move here.

Long-Term Loan Borrowers

Loans stretched over six or seven years mean slower equity buildup. Even with regular payments, your loan balance may stay above your car’s value for years. A 72-month loan on a $25,000 car could leave you owing $20,000 while the car is worth only $15,000 after two years.

Low or No Down Payment

If you put little or nothing down, you start your loan already behind. A $30,000 car with $0 down means you owe the full amount from day one—while the car’s value drops instantly. Gap insurance protects you during that vulnerable early period.

Leaseholders

Leased vehicles also benefit from gap insurance (sometimes called lease gap coverage). If your leased car is totaled, the insurer pays its ACV, but you may still owe early termination fees, excess mileage charges, or wear-and-tear costs. Gap coverage can cover these gaps, so you’re not stuck paying extra.

Used Car Buyers with High Loan-to-Value Ratios

Even used cars can benefit if you finance most of the purchase price. A $15,000 used car with a $14,000 loan and rapid depreciation can still create a gap. While the risk is lower than with new cars, it’s not zero.

How Much Does Gap Insurance Cost?

One of the biggest misconceptions about gap insurance is that it’s expensive. In reality, it’s quite affordable—especially when compared to the potential out-of-pocket cost it prevents.

Visual guide about Does Gap Insurance Help You Get a New Car

Image source: cdn.ramseysolutions.net

Most gap insurance policies cost between $200 and $700 over the life of a loan. This is typically paid upfront or rolled into your monthly car payment. For example, a $400 gap policy on a 60-month loan adds about $6.67 per month—less than the cost of a streaming subscription.

Where to Buy Gap Insurance

You have several options for purchasing gap insurance:

- Dealerships: Often offer gap coverage at the time of purchase. Convenient, but can be more expensive.

- Lenders: Many banks and credit unions provide gap insurance as part of their auto loan packages.

- Third-party providers: Companies like Endurance, Protect My Car, or standalone insurers may offer competitive rates.

- Credit card companies: Some premium cards include gap coverage as a benefit when you use the card to buy or lease a car.

Always compare prices and read the fine print. Dealerships may bundle gap insurance with other products (like extended warranties), increasing the total cost. Buying directly from a lender or third party often saves money.

Is It Worth the Cost?

Consider this: A $500 gap policy could save you $5,000 or more in out-of-pocket debt. Even if you never need it, the peace of mind is valuable. For most new car buyers, the answer is yes—it’s worth it.

However, if you put 20% or more down, have a short loan term (36–48 months), or drive a car that holds its value well (like certain trucks or hybrids), the risk is lower. In those cases, gap insurance may be optional.

When Can You Cancel Gap Insurance?

Gap insurance is only useful while you’re at risk of being upside-down on your loan. Once your loan balance drops below your car’s actual cash value, the “gap” no longer exists—and neither does the need for coverage.

Most policies allow you to cancel gap insurance once you’ve paid down a certain percentage of your loan—often around 75%. For example, if your loan is $24,000, you can usually cancel once you owe $18,000 or less. Some lenders automatically terminate coverage at this point, while others require a request.

How to Check If You Can Cancel

Start by reviewing your loan amortization schedule. This shows how much principal you’ve paid over time. Then, check your car’s current value using tools like Kelley Blue Book or Edmunds. If your loan balance is lower than the car’s value, you’re likely in the clear.

Contact your gap insurance provider or lender to confirm cancellation terms. Some policies are non-refundable, while others offer partial refunds for unused coverage. If you paid upfront, you might get money back.

Don’t Cancel Too Early

Be cautious about canceling too soon. Even if you’re close to equity, a sudden drop in your car’s value (due to market changes or damage) could put you back in the gap. Wait until you’re comfortably below the value threshold before canceling.

Common Misconceptions About Gap Insurance

Despite its benefits, gap insurance is often misunderstood. Let’s clear up some of the most common myths.

Myth 1: Gap Insurance Pays for a New Car

No—it pays the difference between your loan balance and your car’s value. It doesn’t give you cash to buy a new vehicle. You still need to secure financing or use savings for your next purchase.

Myth 2: It’s Only for New Cars

While new cars benefit most, used cars with high loan-to-value ratios can also be at risk. If you finance 90% of a used car’s price, gap insurance may still be wise.

Myth 3: My Regular Insurance Covers the Gap

Standard auto insurance only pays the actual cash value of your car. It does not cover loan balances. You need separate gap coverage for that.

Myth 4: Gap Insurance Is Automatically Included

It’s not. You must purchase it separately. Some lenders or dealerships may bundle it, but it’s not mandatory unless required by your lease agreement.

Myth 5: It Covers Mechanical Breakdowns

No. Gap insurance only applies to total loss or theft. It does not cover repairs, maintenance, or mechanical failures. For that, you’d need an extended warranty or mechanical breakdown insurance.

Final Thoughts: Is Gap Insurance Right for You?

So, does gap insurance help you get a new car? Not in the literal sense—but it removes a critical financial hurdle that could otherwise delay or derail your next purchase. By covering the gap between what you owe and what your car is worth, it protects you from being stuck with debt on a vehicle you no longer have.

If you’re buying a new car, financing most of the cost, or signing a long-term loan, gap insurance is a smart, low-cost safeguard. It’s not about getting a new car—it’s about ensuring that when life throws a curveball, you’re not left paying for a car that’s gone.

Take the time to evaluate your loan terms, down payment, and risk tolerance. Talk to your lender or insurance agent. And remember: a few hundred dollars today could save you thousands tomorrow. In the world of car ownership, that’s a gap worth closing.

Frequently Asked Questions

Does gap insurance help you get a new car?

Gap insurance doesn’t directly pay for a new car, but it helps by eliminating any remaining loan balance if your current car is totaled or stolen. This prevents you from owing money on a vehicle you no longer have, making it easier to afford a replacement.

When should I buy gap insurance?

Buy gap insurance when purchasing a new car, especially if you’re making a small down payment, have a long loan term (60+ months), or financing most of the vehicle’s cost. It’s most valuable in the early years of ownership when depreciation is steep.

Can I cancel gap insurance early?

Yes, most gap insurance policies allow cancellation once your loan balance drops below your car’s actual cash value—typically after you’ve paid down about 75% of the loan. Contact your provider to confirm terms and request cancellation.

Is gap insurance required?

No, gap insurance is not legally required. However, some leasing companies may require it as part of your lease agreement. For loan holders, it’s optional but highly recommended in high-risk scenarios.

Does gap insurance cover my deductible?

Some gap insurance policies include coverage for your deductible, but not all do. Check your policy details to see if this benefit is included. If it is, you could save even more money in the event of a total loss.

Can I buy gap insurance after purchasing a car?

It depends on the provider. Some lenders and third-party insurers allow you to add gap coverage within a short window after purchase (e.g., 30–60 days). However, dealerships typically only offer it at the time of sale, so act quickly if you’re interested.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.