Car insurance in Louisiana per month typically ranges from $150 to $300, making it one of the most expensive states in the U.S. Rates depend on factors like location, driving history, age, and coverage type. With high accident rates and strict minimum requirements, Louisiana drivers pay more—but smart shopping can help lower costs.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How Much Is Car Insurance in Louisiana per Month?

- 4 Louisiana Car Insurance: Average Monthly Costs

- 5 Factors That Affect Your Car Insurance Rate in Louisiana

- 6 Louisiana’s Minimum Car Insurance Requirements

- 7 How to Save Money on Car Insurance in Louisiana

- 8 Best Car Insurance Companies in Louisiana

- 9 Filing a Claim in Louisiana: What to Know

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 How much is car insurance in Louisiana per month for a new driver?

- 11.2 Is car insurance required in Louisiana?

- 11.3 Can I get car insurance in Louisiana with a bad driving record?

- 11.4 Does Louisiana use credit scores to determine insurance rates?

- 11.5 What happens if I drive without insurance in Louisiana?

- 11.6 How can I lower my car insurance premium in Louisiana?

Key Takeaways

- Average monthly cost: Louisiana drivers pay between $150 and $300 per month for full coverage, significantly higher than the national average.

- Minimum coverage required: Louisiana law mandates liability insurance with 15/30/25 coverage (bodily injury per person, per accident, and property damage).

- High-risk factors: Frequent accidents, severe weather, and high population density in cities like New Orleans contribute to elevated premiums.

- Age and driving history matter: Young drivers under 25 and those with tickets or accidents face much higher rates.

- Shop around annually: Comparing quotes from at least three insurers can save hundreds per year.

- Discounts help: Safe driver, multi-policy, and good student discounts can reduce your monthly bill.

- Credit score impacts rates: Louisiana allows insurers to use credit-based insurance scores, so maintaining good credit can lower premiums.

📑 Table of Contents

- How Much Is Car Insurance in Louisiana per Month?

- Louisiana Car Insurance: Average Monthly Costs

- Factors That Affect Your Car Insurance Rate in Louisiana

- Louisiana’s Minimum Car Insurance Requirements

- How to Save Money on Car Insurance in Louisiana

- Best Car Insurance Companies in Louisiana

- Filing a Claim in Louisiana: What to Know

- Conclusion

How Much Is Car Insurance in Louisiana per Month?

If you’re a driver in Louisiana, you’ve probably noticed that car insurance isn’t cheap. In fact, Louisiana consistently ranks among the top five most expensive states for auto insurance in the U.S. So, how much is car insurance in Louisiana per month? On average, drivers pay between $150 and $300 per month for full coverage, and even basic liability-only policies can cost $100 or more monthly. That’s nearly double the national average, which hovers around $150 per month for full coverage.

But why is car insurance so expensive in Louisiana? It’s not just one thing—it’s a combination of state laws, weather risks, traffic conditions, and economic factors. Louisiana has high rates of uninsured drivers, frequent severe weather like hurricanes and flooding, and dense urban areas with heavy traffic. All of these contribute to more claims, which means higher premiums for everyone. Plus, the state requires higher minimum coverage than many others, which drives up the baseline cost.

The good news? You’re not stuck paying top dollar forever. By understanding what affects your rate and knowing how to shop smart, you can find more affordable options. In this guide, we’ll break down the average costs, explore the factors that influence your premium, and share practical tips to help you save money on car insurance in Louisiana.

Louisiana Car Insurance: Average Monthly Costs

Visual guide about How Much Is Car Insurance in Louisiana per Month

Image source: general.com

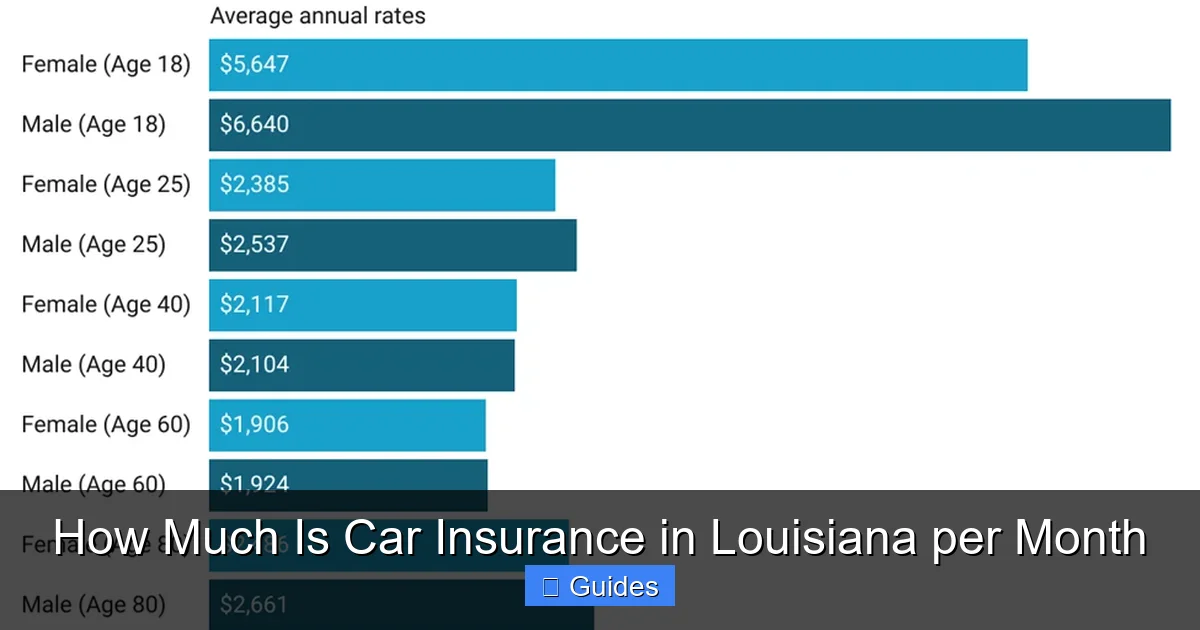

Let’s get straight to the numbers. When people ask, “How much is car insurance in Louisiana per month?” they want real, actionable data. Based on recent industry reports and state insurance filings, here’s what Louisiana drivers are actually paying.

For full coverage—which includes liability, collision, and comprehensive—the average monthly premium is around $220. That’s about $2,640 per year. For minimum liability coverage only, the average drops to about $120 per month, or $1,440 annually. But keep in mind, these are averages. Your actual rate could be much higher or lower depending on your personal profile.

To put this in perspective, the national average for full coverage is about $177 per month, and for minimum coverage, it’s around $54. So Louisiana drivers are paying roughly 25% more for full coverage and over 120% more for minimum coverage. That’s a significant difference.

Here’s a quick breakdown by age and coverage type:

– **Young drivers (18–24):** Expect to pay $300–$500 per month for full coverage. Teens and new drivers are considered high-risk, so premiums are steep.

– **Adults (25–64):** This group sees the most reasonable rates, averaging $180–$250 per month for full coverage.

– **Seniors (65+):** Rates may rise again due to age-related risk factors, averaging $200–$280 per month.

Location also plays a big role. Drivers in New Orleans, Baton Rouge, and Shreveport typically pay more than those in smaller towns or rural areas. For example, a 35-year-old driver with a clean record might pay $190 per month in Lafayette but $260 in New Orleans due to higher traffic density and accident rates.

Why Are Louisiana Insurance Rates So High?

Several factors contribute to Louisiana’s high insurance costs. First, the state has a high rate of uninsured drivers—nearly 14%, according to the Insurance Research Council. When uninsured drivers cause accidents, insured drivers often end up covering the costs through their own policies, which drives up premiums for everyone.

Second, Louisiana is prone to severe weather. Hurricanes, tropical storms, and flooding are common, especially along the Gulf Coast. These events lead to a surge in comprehensive claims—like hail damage, fallen trees, or flood-related repairs—which insurers pass on to customers in the form of higher rates.

Third, Louisiana has strict minimum coverage requirements. The state mandates 15/30/25 liability coverage, meaning $15,000 for bodily injury per person, $30,000 per accident, and $25,000 for property damage. While this protects drivers better than lower limits, it also increases the cost of even basic policies.

Finally, the state’s legal environment plays a role. Louisiana allows for “bad faith” lawsuits against insurers, which can lead to higher legal costs and settlements. Insurers factor these risks into their pricing models.

Factors That Affect Your Car Insurance Rate in Louisiana

Visual guide about How Much Is Car Insurance in Louisiana per Month

Image source: lh4.googleusercontent.com

Your monthly premium isn’t just a random number—it’s calculated based on a mix of personal and external factors. Understanding these can help you see why your rate is what it is and how you might reduce it.

Driving Record

Your driving history is one of the biggest factors. A clean record with no accidents or tickets can qualify you for significant discounts. But even one speeding ticket can increase your rate by 20–30%. A DUI or at-fault accident can double your premium or more.

For example, a 30-year-old driver with a clean record might pay $180 per month. The same driver with a recent at-fault accident could see their rate jump to $320 or higher.

Age and Experience

Young drivers pay the most. Insurance companies see teens and young adults as high-risk due to inexperience and higher accident rates. A 19-year-old male in Louisiana might pay $400+ per month for full coverage, while a 45-year-old with the same profile could pay half that.

As you gain experience and maintain a clean record, your rates typically decrease. Many insurers offer discounts for drivers over 25 or those who complete defensive driving courses.

Location

Where you live in Louisiana makes a big difference. Urban areas like New Orleans, Baton Rouge, and Metairie have higher traffic volumes, more accidents, and greater risks of theft and vandalism. As a result, premiums are significantly higher than in rural parishes.

Even within a city, your ZIP code matters. A driver in a high-crime neighborhood may pay more than someone in a safer suburb, even if they live just a few miles apart.

Vehicle Type

The car you drive affects your rate. Sports cars, luxury vehicles, and models with high repair costs or theft rates typically come with higher premiums. For example, insuring a Toyota Camry will be much cheaper than insuring a BMW 3 Series or a Ford Mustang.

Safety features can help lower your rate. Vehicles with advanced safety tech—like automatic emergency braking, lane departure warnings, and blind-spot monitoring—may qualify for discounts.

Credit Score

In Louisiana, insurers can use your credit-based insurance score to set rates. Drivers with poor credit often pay significantly more than those with excellent credit. For example, someone with a credit score below 600 might pay $100 more per month than someone with a score above 750.

Improving your credit—by paying bills on time, reducing debt, and checking for errors on your report—can lead to lower insurance costs over time.

Coverage Level and Deductibles

The more coverage you buy, the higher your premium. Full coverage with low deductibles costs the most, while minimum liability with high deductibles is cheaper.

For example, choosing a $1,000 deductible instead of $500 can reduce your premium by 15–20%. But remember, you’ll pay more out of pocket if you file a claim.

Louisiana’s Minimum Car Insurance Requirements

Visual guide about How Much Is Car Insurance in Louisiana per Month

Image source: cdn.wallethub.com

Louisiana law requires all drivers to carry minimum liability insurance. This coverage pays for injuries and property damage you cause to others in an accident. It does not cover your own vehicle or medical expenses.

The state’s minimum requirements are:

– $15,000 bodily injury per person

– $30,000 bodily injury per accident

– $25,000 property damage per accident

This is often written as 15/30/25.

While this is the legal minimum, it’s often not enough. Medical bills can easily exceed $15,000, and serious accidents can result in much higher costs. That’s why many financial advisors recommend higher limits—such as 100/300/100—or even umbrella policies for added protection.

Do You Need More Than the Minimum?

Yes, in most cases. The minimum coverage in Louisiana is designed to meet legal requirements, not to fully protect you financially. If you cause an accident that results in $50,000 in medical bills, your $15,000 limit won’t cover it. The injured party could sue you for the difference, putting your savings, home, or future income at risk.

Additionally, minimum coverage doesn’t include collision or comprehensive, so you won’t be reimbursed if your car is damaged in a crash, stolen, or destroyed by a hurricane.

For most drivers, especially those with newer cars or assets to protect, full coverage is a smarter choice—even if it costs more upfront.

How to Save Money on Car Insurance in Louisiana

Paying $200+ per month for car insurance can feel overwhelming, but there are proven ways to reduce your costs. Here are practical tips to help you save.

Shop Around and Compare Quotes

One of the easiest ways to save is by comparing quotes from multiple insurers. Rates can vary widely—sometimes by hundreds of dollars—even for the same coverage. Use online comparison tools or work with an independent agent to get quotes from at least three companies.

Don’t just look at the price. Check customer service ratings, claims satisfaction, and financial stability. A cheap policy isn’t worth it if the insurer drags its feet on claims.

Take Advantage of Discounts

Most insurers offer a range of discounts. Common ones include:

– **Safe driver discount:** For drivers with no accidents or violations in the past 3–5 years.

– **Multi-policy discount:** Save 10–25% by bundling auto and home or renters insurance.

– **Good student discount:** Full-time students with a B average or higher may qualify.

– **Defensive driving course:** Completing an approved course can reduce your rate by 5–10%.

– **Low mileage discount:** If you drive fewer than 7,500 miles per year.

– **Pay-in-full discount:** Pay your annual premium upfront instead of monthly.

Ask your insurer about all available discounts—you might be missing out on savings.

Raise Your Deductible

Increasing your deductible from $500 to $1,000 can lower your premium by 15–30%. Just make sure you can afford to pay the higher amount if you need to file a claim.

Improve Your Credit Score

Since Louisiana allows credit-based pricing, improving your credit can lead to lower rates. Pay bills on time, keep credit card balances low, and check your credit report for errors.

Drive Safely and Maintain a Clean Record

Avoiding accidents and tickets is one of the best long-term strategies. Many insurers offer accident forgiveness or rate protection programs, but they’re not available to everyone.

Consider Usage-Based Insurance

Some insurers offer telematics programs that track your driving habits—like speed, braking, and mileage—through a mobile app or device. Safe drivers can earn discounts of 10–20%.

Best Car Insurance Companies in Louisiana

Not all insurers are created equal. Some offer better rates, customer service, or claims handling than others. Based on customer satisfaction, financial strength, and affordability, here are some top options for Louisiana drivers.

State Farm

State Farm is the largest auto insurer in the U.S. and a popular choice in Louisiana. It offers competitive rates, excellent customer service, and a wide range of discounts. Its local agents provide personalized support, which many drivers appreciate.

GEICO

GEICO is known for low rates and a user-friendly online experience. It’s often one of the cheapest options for drivers with clean records. However, customer service can be hit-or-miss, and not all discounts are available in Louisiana.

Allstate

Allstate offers strong coverage options and a variety of discounts, including a unique “Claim RateGuard” feature that prevents your rate from increasing after your first claim. It’s a good choice for drivers who want extra protection.

Progressive

Progressive is great for high-risk drivers or those with past accidents. Its Name Your Price® tool helps you find a policy within your budget. It also offers Snapshot, a usage-based program that can save safe drivers money.

USAA

If you’re eligible (military members, veterans, and their families), USAA consistently ranks as the top insurer for customer satisfaction and low rates. However, it’s not available to the general public.

Filing a Claim in Louisiana: What to Know

Accidents happen, and when they do, knowing how to file a claim can save you time and stress. Louisiana is a “fault” state, meaning the driver responsible for the accident pays for the damages—either through their insurance or out of pocket.

Steps to Take After an Accident

1. **Ensure safety:** Move to a safe location and call 911 if there are injuries.

2. **Exchange information:** Get the other driver’s name, contact info, license plate, and insurance details.

3. **Document the scene:** Take photos of the vehicles, damage, and surroundings.

4. **File a police report:** Required for accidents with injuries or significant damage.

5. **Contact your insurer:** Report the claim as soon as possible. Most insurers have 24/7 claims lines.

What to Expect During the Claims Process

After filing, an adjuster will assess the damage and determine fault. You may need to get repair estimates or take your car to a approved shop. If the other driver is at fault, your insurer may pursue reimbursement from their company.

Be honest and thorough when providing information. Misrepresenting facts can lead to claim denial or policy cancellation.

Conclusion

So, how much is car insurance in Louisiana per month? The answer isn’t simple—it depends on your age, driving history, location, vehicle, and coverage needs. But on average, Louisiana drivers pay $150 to $300 per month, making it one of the most expensive states for auto insurance.

While high premiums are partly due to state-specific risks like severe weather and uninsured drivers, you’re not powerless. By shopping around, maintaining a clean driving record, improving your credit, and taking advantage of discounts, you can reduce your monthly bill.

Remember, the cheapest policy isn’t always the best. Focus on finding a balance between affordability and reliable coverage. And don’t forget to review your policy annually—your needs and rates can change over time.

With the right approach, you can drive confidently in Louisiana, knowing you’re protected without breaking the bank.

Frequently Asked Questions

How much is car insurance in Louisiana per month for a new driver?

New drivers in Louisiana, especially teens, can expect to pay $300 to $500 per month for full coverage. Rates are high due to lack of experience and higher accident risk. Shopping around and adding a young driver to a parent’s policy can help reduce costs.

Is car insurance required in Louisiana?

Yes, Louisiana law requires all drivers to carry minimum liability insurance of 15/30/25. Driving without insurance can result in fines, license suspension, and vehicle impoundment.

Can I get car insurance in Louisiana with a bad driving record?

Yes, but it will cost more. High-risk drivers may need to use non-standard insurers or state-assigned risk pools. Improving your record over time and completing defensive driving courses can help lower rates.

Does Louisiana use credit scores to determine insurance rates?

Yes, Louisiana allows insurers to use credit-based insurance scores. Drivers with poor credit typically pay higher premiums, so maintaining good credit can lead to savings.

What happens if I drive without insurance in Louisiana?

Driving uninsured in Louisiana can result in fines up to $500, license suspension, and vehicle registration suspension. Repeat offenses carry harsher penalties, including possible jail time.

You can lower your premium by shopping around, raising your deductible, maintaining a clean driving record, improving your credit, and taking advantage of discounts like safe driver or multi-policy offers.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.