Car insurance in NY per month typically ranges from $150 to $300, but costs vary widely based on location, driving history, and coverage needs. Understanding the factors that influence your premium can help you find affordable, reliable coverage.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How Much Is Car Insurance in NY per Month? A Complete Guide

- 4 What Is the Average Cost of Car Insurance in NY?

- 5 Top Factors That Affect Your Car Insurance Premium in NY

- 6 How to Save Money on Car Insurance in NY

- 7 What Coverage Do You Actually Need in NY?

- 8 Why NY Car Insurance Is So Expensive

- 9 Final Tips for Getting the Best Rate in NY

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 What is the average cost of car insurance in NY per month?

- 11.2 Why is car insurance so expensive in New York?

- 11.3 Can I lower my car insurance premium in NY?

- 11.4 Do I need full coverage in New York?

- 11.5 Does my credit score affect my car insurance rate in NY?

- 11.6 How often should I compare car insurance quotes in NY?

Key Takeaways

- Average monthly cost: Most New York drivers pay between $150 and $300 per month for car insurance, with urban areas like NYC being significantly more expensive.

- Location matters: Where you live in NY—especially if you’re in a high-traffic or high-theft area—can drastically increase your premium.

- Coverage level impacts price: Minimum liability coverage is cheaper, but full coverage (including collision and comprehensive) costs more but offers better protection.

- Driving record is key: A clean driving history can lower your rates, while accidents, tickets, or DUIs can spike your monthly cost.

- Age and vehicle type affect rates: Younger drivers and luxury or high-performance cars typically face higher premiums.

- Discounts can save you money: Safe driver, multi-policy, good student, and low-mileage discounts can reduce your monthly bill.

- Shop around annually: Comparing quotes from multiple insurers each year ensures you’re getting the best rate for your situation.

📑 Table of Contents

- How Much Is Car Insurance in NY per Month? A Complete Guide

- What Is the Average Cost of Car Insurance in NY?

- Top Factors That Affect Your Car Insurance Premium in NY

- How to Save Money on Car Insurance in NY

- What Coverage Do You Actually Need in NY?

- Why NY Car Insurance Is So Expensive

- Final Tips for Getting the Best Rate in NY

- Conclusion

How Much Is Car Insurance in NY per Month? A Complete Guide

If you’re driving in New York, you already know it’s not the cheapest state to own a car. From tolls and parking fees to high gas prices, the costs add up fast. But one of the biggest expenses? Car insurance. So, how much is car insurance in NY per month, really?

The short answer: it depends. While the average New Yorker pays around $200 to $250 per month, your actual cost could be much higher or lower. A lot of factors go into determining your premium—your age, where you live, your driving history, the type of car you drive, and even your credit score.

In this guide, we’ll break down everything you need to know about car insurance costs in New York. We’ll look at average rates, what drives up your premium, how to save money, and what kind of coverage you actually need. Whether you’re a new driver in Buffalo or a seasoned commuter in Brooklyn, this guide will help you understand what you’re paying for—and how to get the best deal.

What Is the Average Cost of Car Insurance in NY?

Visual guide about How Much Is Car Insurance in Ny per Month

Image source: livewell.com

So, what’s the real number? According to recent data from the National Association of Insurance Commissioners (NAIC) and consumer reports, the average monthly cost of car insurance in New York is about $225. That’s higher than the national average of around $180 per month.

But averages don’t tell the whole story. In New York City, for example, drivers often pay $300 or more per month. Why? High population density, heavy traffic, more accidents, and a higher risk of theft and vandalism all contribute to steeper premiums. In contrast, drivers in upstate areas like Albany or Syracuse might pay closer to $150 per month.

Let’s look at some real-world examples:

– A 35-year-old driver with a clean record and a mid-size sedan in Manhattan might pay $320 per month for full coverage.

– The same driver in Rochester could pay just $170 for the same coverage.

– A 22-year-old driver with a sports car in Queens might see rates jump to $400 or more.

These differences show how much your location and personal profile matter. But it’s not just about where you live. Your age, gender (in some states), credit score, and even your job can influence your rate.

Minimum vs. Full Coverage: What’s the Difference?

New York requires all drivers to carry at least the state minimum liability coverage. This includes:

– $25,000 for bodily injury per person

– $50,000 for bodily injury per accident

– $10,000 for property damage

– $50,000 for personal injury protection (PIP)

This minimum coverage is the cheapest option—often under $100 per month for some drivers. But it only covers damage you cause to others. It doesn’t protect your own car.

That’s where full coverage comes in. Full coverage includes liability, plus collision and comprehensive insurance. Collision covers damage to your car from accidents, while comprehensive covers theft, fire, weather, and other non-collision events.

Full coverage is more expensive—typically $150 to $300+ per month—but it’s highly recommended if you have a newer car, a loan, or live in a high-risk area.

For example, if you drive a 2022 Honda Accord and get into a fender bender, liability insurance won’t pay to fix your car. But full coverage will. That peace of mind is worth the extra cost for most drivers.

Top Factors That Affect Your Car Insurance Premium in NY

Visual guide about How Much Is Car Insurance in Ny per Month

Image source: doubxab0r1mke.cloudfront.net

Now that you know the average cost, let’s dig into what actually determines how much you pay. Insurance companies use a complex formula to calculate your risk—and your premium. Here are the biggest factors that influence your monthly rate.

1. Where You Live

Location is one of the most powerful factors in determining your car insurance cost. In New York, ZIP code can make a huge difference.

New York City drivers pay the highest premiums in the state. Why? More cars on the road mean more accidents. Higher crime rates mean more theft and vandalism. And dense urban areas make parking and driving riskier.

For example, a driver in the Bronx might pay $50 to $100 more per month than someone in Westchester County, even if they have the same car and driving record.

Even within NYC, rates vary. Drivers in Brooklyn or Queens often pay less than those in Manhattan, where traffic is heaviest and parking is tightest.

2. Your Driving Record

Your driving history is a major red flag—or green light—for insurers. A clean record with no accidents or tickets can earn you significant discounts. But even one speeding ticket can raise your rate by 10% to 20%.

A DUI? That’s a game-changer. In New York, a DUI can double or even triple your premium. Some insurers may even drop you, forcing you into the high-risk market.

Let’s say you get a speeding ticket for going 15 mph over the limit. Your $200 monthly premium might jump to $240. If you get into an at-fault accident, it could go up to $300 or more.

On the flip side, maintaining a clean record for three to five years can unlock safe driver discounts, lowering your rate over time.

3. Age and Experience

Young drivers pay the most. Teens and drivers in their early 20s are statistically more likely to get into accidents, so insurers charge them higher rates.

A 19-year-old driver in NYC might pay $500 or more per month for full coverage. But by age 25, that rate often drops significantly—sometimes by 30% or more.

Age isn’t the only factor—experience matters too. A 30-year-old with only two years of driving experience may pay more than a 30-year-old with 10 years behind the wheel.

4. Type of Vehicle

The car you drive has a big impact on your insurance cost. Sports cars, luxury vehicles, and high-performance models are more expensive to insure because they’re costlier to repair and more attractive to thieves.

For example, insuring a Toyota Camry will be much cheaper than insuring a BMW 3 Series or a Ford Mustang. Even SUVs and trucks can vary—larger, more powerful models cost more to insure.

Newer cars also tend to have higher premiums because they’re more valuable and often come with advanced safety features that are expensive to replace.

But don’t assume older cars are always cheaper. A 10-year-old sports car might still cost more to insure than a new compact sedan.

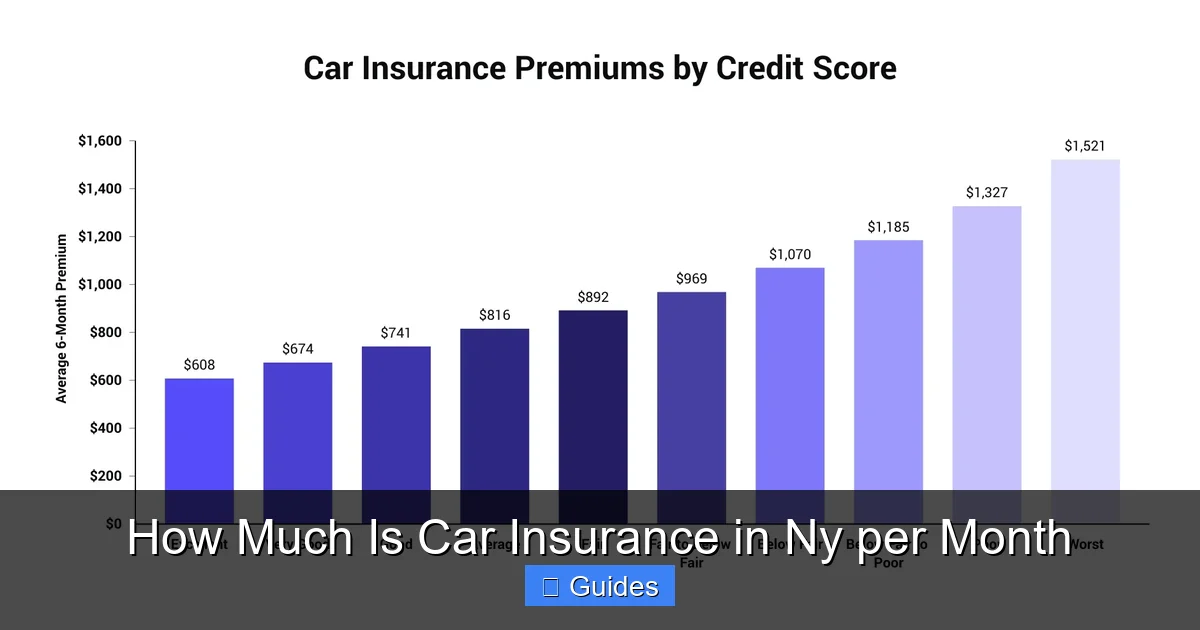

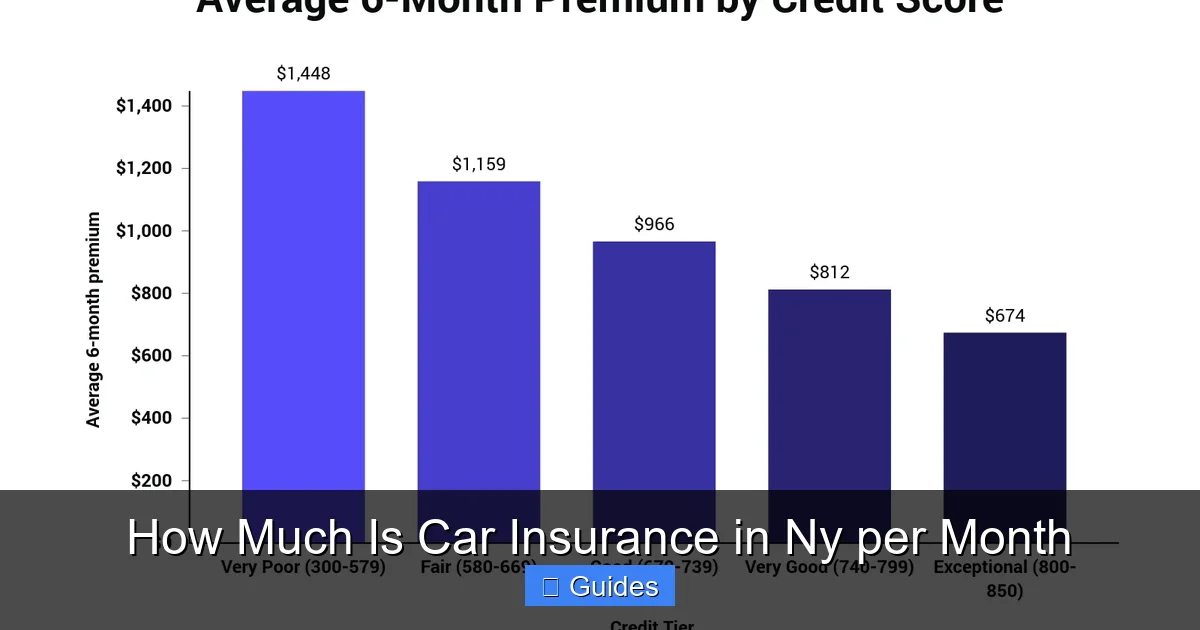

5. Credit Score

In New York, insurers can use your credit-based insurance score to determine your premium—though the state has placed some restrictions on how much weight it carries.

Studies show that people with lower credit scores tend to file more claims, so insurers charge them more. A driver with a credit score below 600 might pay 20% to 40% more than someone with a score above 750.

Improving your credit can save you hundreds over time. Paying bills on time, reducing debt, and checking your credit report for errors are all smart moves.

6. Annual Mileage

The more you drive, the higher your risk of an accident. That’s why insurers ask how many miles you drive per year.

If you commute 50 miles a day in NYC traffic, you’ll likely pay more than someone who drives 5,000 miles a year for weekend trips.

Some insurers offer low-mileage discounts for drivers who put fewer than 7,500 or 10,000 miles on their car annually. If you work from home or use public transit, this could save you money.

7. Coverage Limits and Deductibles

The amount of coverage you choose directly affects your premium. Higher liability limits and lower deductibles mean higher monthly payments.

For example, raising your liability coverage from $50,000 to $100,000 per person might add $20 to $40 per month. Choosing a $500 deductible instead of $1,000 could add another $30 to $50.

But higher coverage and lower deductibles mean better protection. If you’re in a serious accident, you’ll be glad you paid a little more each month.

How to Save Money on Car Insurance in NY

Visual guide about How Much Is Car Insurance in Ny per Month

Image source: livewell.com

Now that you know what drives up your premium, let’s talk about how to lower it. There are plenty of ways to reduce your monthly cost without sacrificing coverage.

1. Shop Around and Compare Quotes

This is the #1 way to save. Every insurer uses a different formula, so rates can vary by hundreds of dollars for the same driver.

Don’t just renew with your current company. Get quotes from at least three to five insurers each year. Use online comparison tools or work with an independent agent who can check multiple companies.

For example, you might find that Geico offers you $180 per month, while Progressive quotes $220, and State Farm $250. That’s a $70 difference—over $800 per year.

2. Take Advantage of Discounts

Most insurers offer a variety of discounts. Make sure you’re getting every one you qualify for.

Common discounts include:

– Safe driver discount (no accidents or tickets)

– Multi-policy discount (bundling auto and home insurance)

– Good student discount (for students with B averages or higher)

– Low-mileage discount

– Anti-theft device discount

– Defensive driving course discount (especially for seniors)

Some companies even offer discounts for paying your premium in full, going paperless, or having a vehicle with advanced safety features.

For example, bundling your auto and renters insurance could save you 10% to 25%. That’s $20 to $50 off your monthly bill.

3. Raise Your Deductible

Increasing your deductible—the amount you pay out of pocket before insurance kicks in—can lower your premium.

Switching from a $500 to a $1,000 deductible might save you $15 to $30 per month. Just make sure you can afford the higher deductible if you ever need to file a claim.

4. Improve Your Credit Score

Since credit affects your rate, boosting your score can lead to lower premiums. Pay bills on time, keep credit card balances low, and check your credit report annually for errors.

Even a 50-point increase in your credit score could save you $20 to $40 per month.

5. Drive Less

If you can reduce your annual mileage, you might qualify for a low-mileage discount. Consider carpooling, using public transit, or working from home a few days a week.

Some insurers even offer pay-per-mile programs, where you pay based on how much you drive. These are great for people who drive under 10,000 miles a year.

6. Maintain a Clean Driving Record

This one’s obvious but worth repeating: safe driving pays off. Avoid speeding, distracted driving, and aggressive behavior.

Many insurers offer accident forgiveness programs, which prevent your rate from increasing after your first at-fault accident. But these programs vary, so ask your agent.

7. Consider Usage-Based Insurance

Some companies offer telematics programs that track your driving habits through a smartphone app or device. If you drive safely—smooth braking, no hard acceleration, low nighttime driving—you can earn discounts.

Programs like Progressive’s Snapshot or Allstate’s Drivewise can save safe drivers 10% to 30%.

What Coverage Do You Actually Need in NY?

New York requires minimum liability and PIP coverage, but is that enough? For most drivers, the answer is no.

Minimum coverage leaves you exposed. If you cause a serious accident, $25,000 in bodily injury coverage won’t go far. Medical bills can exceed that in a single emergency room visit.

That’s why experts recommend higher liability limits—at least $100,000 per person, $300,000 per accident, and $100,000 for property damage.

You should also consider:

– Uninsured/underinsured motorist coverage: Protects you if you’re hit by a driver with no or insufficient insurance.

– Collision and comprehensive: Essential if you have a newer car or a loan.

– Medical payments coverage: Helps pay for your medical bills after an accident, regardless of fault.

If you lease or finance your car, your lender will likely require full coverage.

And if you have significant assets—like a home or savings—higher liability limits protect you from lawsuits.

Example: Choosing the Right Coverage

Let’s say you’re a 30-year-old driver in Brooklyn with a 2020 Honda CR-V. You own your car outright and have a clean record.

Minimum coverage might cost $120 per month. But with higher liability limits, uninsured motorist coverage, and full coverage, your premium could be $220.

That extra $100 per month gives you much better protection. If you’re in a serious accident, you won’t have to worry about maxing out your coverage or paying out of pocket.

Why NY Car Insurance Is So Expensive

New York consistently ranks among the most expensive states for car insurance. Why?

First, it’s densely populated. More cars on the road mean more accidents. In NYC alone, there are over 2 million registered vehicles.

Second, traffic is brutal. Congestion leads to fender benders, rear-end collisions, and road rage incidents.

Third, theft and vandalism are higher in urban areas. Luxury cars and high-end SUVs are prime targets.

Fourth, medical costs are high. New York’s no-fault insurance system requires PIP coverage, which pays for medical expenses regardless of who caused the accident. But medical care in NY is expensive, driving up claims costs.

Finally, litigation is common. New York allows lawsuits for serious injuries, and legal fees add to the cost of claims.

All these factors combine to push premiums higher than in rural or less congested states.

Final Tips for Getting the Best Rate in NY

To wrap up, here are some final tips to help you get the best car insurance rate in New York:

– **Compare quotes annually.** Rates change, and new discounts may be available.

– **Ask about discounts.** Don’t assume you’re getting them—ask your agent.

– **Consider your deductible.** A higher deductible can lower your premium, but only if you can afford it.

– **Maintain a clean record.** Safe driving is the best way to keep rates low.

– **Improve your credit.** It can have a big impact on your premium.

– **Drive a safer, more affordable car.** Avoid high-performance or luxury vehicles if you’re trying to save.

– **Use telematics programs.** They reward safe driving with discounts.

Conclusion

So, how much is car insurance in NY per month? For most drivers, it’s between $150 and $300. But your actual cost depends on where you live, how you drive, and what kind of car you have.

While New York is one of the more expensive states for car insurance, there are plenty of ways to save. Shop around, take advantage of discounts, and choose the right coverage for your needs.

Remember, the cheapest policy isn’t always the best. Make sure you’re protected—not just meeting the legal minimum. A few extra dollars a month could save you thousands in the long run.

By understanding the factors that affect your premium and taking steps to reduce risk, you can find affordable, reliable car insurance that gives you peace of mind on the road.

Frequently Asked Questions

What is the average cost of car insurance in NY per month?

The average cost of car insurance in NY per month is around $225, but it can range from $150 to $300 or more depending on your location, driving history, and coverage level.

Why is car insurance so expensive in New York?

Car insurance is expensive in NY due to high population density, heavy traffic, higher accident rates, costly medical care, and a higher risk of theft and vandalism—especially in NYC.

Yes, you can lower your premium by shopping around, maintaining a clean driving record, improving your credit score, raising your deductible, and taking advantage of available discounts.

Do I need full coverage in New York?

While only liability and PIP are required by law, full coverage (including collision and comprehensive) is recommended if you have a newer car, a loan, or live in a high-risk area.

Does my credit score affect my car insurance rate in NY?

Yes, in New York, insurers can use your credit-based insurance score to determine your rate. A higher credit score typically leads to lower premiums.

How often should I compare car insurance quotes in NY?

You should compare quotes at least once a year, or whenever your driving situation changes (like moving, getting married, or buying a new car), to ensure you’re getting the best rate.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.