Car insurance in California costs an average of $150–$250 per month, but rates vary widely based on age, location, driving history, and coverage level. By comparing quotes, maintaining a clean record, and choosing the right policy, you can find affordable options that meet state requirements and your personal needs.

If you’re driving in California—whether cruising down Pacific Coast Highway or navigating rush hour in the Bay Area—you know one thing for sure: car insurance isn’t optional. It’s the law. But beyond legal compliance, having the right coverage gives you peace of mind, financial protection, and confidence on the road. So, how much is car insurance in California per month? That’s the million-dollar question—well, maybe not a million, but it definitely feels that way when you see your premium bill.

The truth is, there’s no single answer. Car insurance rates in California vary widely depending on who you are, where you live, what you drive, and how you drive. Two people with identical cars might pay drastically different premiums based on their zip code, age, or even their credit score. But don’t worry—this guide breaks it all down. We’ll explore the average costs, the factors that influence your rate, and practical tips to help you save money without sacrificing coverage.

Whether you’re a new driver, a parent adding a teen to your policy, or just looking to lower your current premium, understanding how car insurance pricing works in the Golden State is the first step toward smarter, more affordable coverage. Let’s dive in.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is the Average Cost of Car Insurance in California?

- 4 Top Factors That Affect Your Car Insurance Rate in California

- 5 How to Save Money on Car Insurance in California

- 6 California’s Unique Insurance Rules and Requirements

- 7 What to Do If Your Premium Increases

- 8 Final Thoughts: Finding the Right Balance

- 9 Frequently Asked Questions

- 9.1 How much is car insurance in California per month for a new driver?

- 9.2 Can I drive without car insurance in California?

- 9.3 Does my credit score affect my car insurance rate in California?

- 9.4 What is the cheapest car insurance in California?

- 9.5 Can I lower my car insurance by moving to a different part of California?

- 9.6 Do I need full coverage if my car is paid off?

Key Takeaways

- Average monthly cost: Most Californians pay between $150 and $250 for car insurance, with full coverage averaging around $200 per month.

- Location matters: Urban areas like Los Angeles and San Francisco often have higher premiums due to traffic density and theft rates.

- Age and experience: Young drivers under 25 typically pay significantly more, while experienced drivers with clean records enjoy lower rates.

- Coverage type impacts price: Minimum liability coverage is cheaper, but full coverage (including collision and comprehensive) offers better protection at a higher cost.

- Credit score influence: California allows insurers to use credit-based insurance scores, so maintaining good credit can help reduce premiums.

- Discounts add up: Safe driver, multi-policy, good student, and low-mileage discounts can save you 10–30% on your monthly bill.

- Shop around annually: Rates change frequently—comparing quotes from at least three insurers each year ensures you’re getting the best deal.

📑 Table of Contents

What Is the Average Cost of Car Insurance in California?

So, what’s the real number? According to recent data from the California Department of Insurance and national rate tracking services, the average monthly cost of car insurance in California ranges from **$150 to $250**. That’s for a typical driver with full coverage—meaning liability, collision, and comprehensive protection. If you’re only carrying the state-mandated minimum liability coverage, you might pay closer to $80–$120 per month.

Let’s put that into perspective. Say you’re a 35-year-old driver with a clean record, driving a mid-size sedan in a suburban area like Irvine or Sacramento. You might pay around $180 per month for full coverage. But if you’re a 20-year-old in downtown Los Angeles driving a sports car, that same coverage could easily jump to $300 or more per month.

Why such a big difference? It all comes down to risk. Insurance companies use complex algorithms to assess how likely you are to file a claim. Younger drivers, high-crash areas, expensive vehicles, and poor credit all signal higher risk—and higher premiums.

Full Coverage vs. Minimum Coverage

Understanding the difference between full and minimum coverage is key to knowing what you’re paying for.

Minimum coverage in California includes:

– $15,000 for injury/death to one person

– $30,000 for injury/death to more than one person

– $5,000 for property damage

This is the bare minimum required by law. It covers damages you cause to others, but not your own vehicle. If you get into an accident, you’ll be on the hook for repairs to your car—which can be thousands of dollars.

Full coverage, on the other hand, includes:

– Liability (same as minimum)

– Collision (covers damage to your car from accidents)

– Comprehensive (covers theft, vandalism, weather, animals, etc.)

Because full coverage protects you financially in more situations, it costs more—but it’s often worth it, especially if you have a newer or financed vehicle.

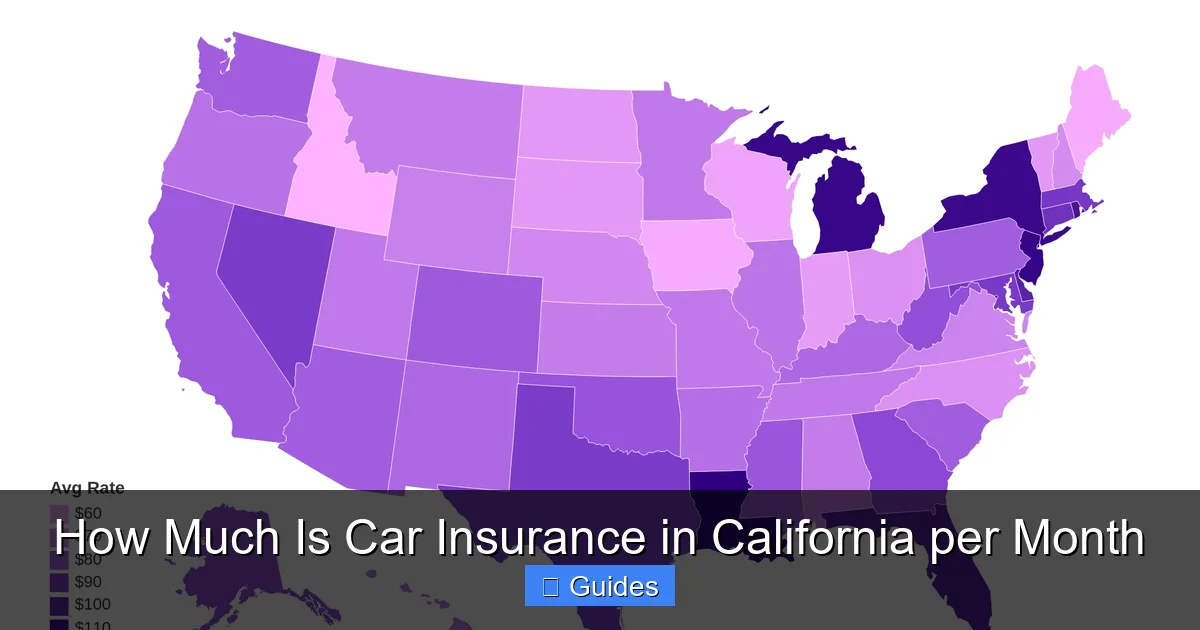

How California Compares Nationally

California’s average car insurance rates are slightly above the national average. The U.S. average for full coverage is about $170 per month, while California sits around $200. That puts the state in the upper third of most expensive states for auto insurance—but not the highest. States like Michigan, Louisiana, and Florida often have much higher premiums due to no-fault laws, high litigation rates, or extreme weather risks.

California’s relatively moderate climate and strong consumer protection laws help keep rates in check compared to other high-cost states. Still, factors like population density, traffic congestion, and vehicle theft rates in major cities push premiums higher than in rural or less populated states.

Top Factors That Affect Your Car Insurance Rate in California

Visual guide about How Much Is Car Insurance in California per Month

Image source: carinsurance.org

Now that you know the average cost, let’s look at what actually determines your personal rate. Insurance companies in California consider a wide range of factors when calculating your premium. Some you can control, others you can’t—but understanding them all helps you make smarter decisions.

1. Your Driving Record

This is one of the biggest factors. A clean driving record with no accidents, tickets, or DUIs signals to insurers that you’re a low-risk driver. On the flip side, even one speeding ticket can increase your premium by 10–20%. A DUI? That could double your rate—or worse, get you dropped by your insurer.

For example, a 30-year-old driver with a clean record might pay $160 per month. The same driver with a recent at-fault accident could see their rate jump to $220 or more. The good news? Most insurers offer accident forgiveness or safe driver discounts after a few years of clean driving.

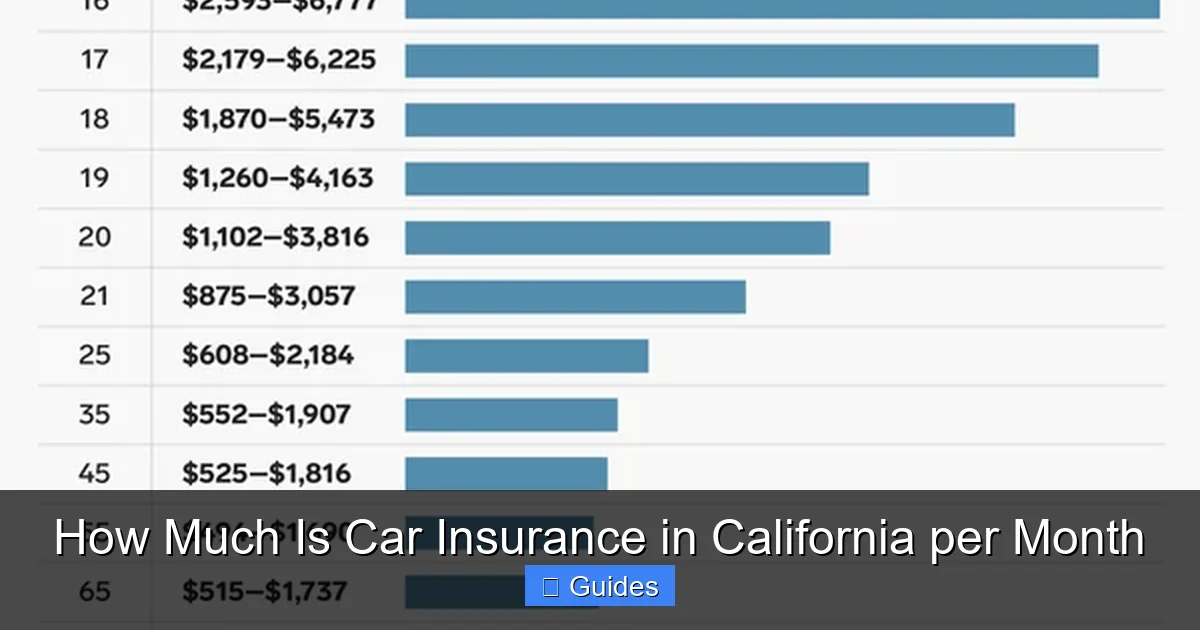

2. Age and Gender

Young drivers, especially teens and those under 25, pay the highest rates. Why? Statistics show that younger drivers are more likely to be involved in accidents due to inexperience, distraction, or risk-taking behavior.

In California, a 16-year-old driver might pay $400–$600 per month for full coverage. By age 25, that often drops to $200–$300. After 30, rates continue to decline—especially for drivers with clean records.

Gender also plays a role, though California law limits how much insurers can use it. Historically, young male drivers paid more than young female drivers due to higher accident rates. However, recent trends show the gap narrowing, and some insurers no longer consider gender at all.

3. Where You Live

Your zip code can have a huge impact on your premium. Urban areas like Los Angeles, San Francisco, and Oakland tend to have higher rates due to:

– More traffic and congestion

– Higher accident rates

– Increased vehicle theft and vandalism

– Greater likelihood of lawsuits

For example, a driver in downtown San Francisco might pay $250 per month, while someone in a rural area like Redding or Bakersfield could pay $150 for the same coverage. Even within cities, rates can vary by neighborhood. Insurers use detailed data on crime, traffic patterns, and claim frequency to set local rates.

4. Your Vehicle

What you drive matters—a lot. Insurers look at:

– Make, model, and year

– Safety ratings and crash test results

– Repair and replacement costs

– Theft rates

A luxury SUV or sports car will cost more to insure than a reliable, mid-size sedan. For instance, insuring a Tesla Model 3 might cost more than a Toyota Camry—not just because of the price tag, but because electric vehicles can be more expensive to repair and have higher theft rates in some areas.

Newer cars may also come with advanced safety features like automatic emergency braking or lane departure warnings, which can qualify you for discounts.

5. Credit Score

Yes, your credit score affects your car insurance rate in California. Unlike some states that ban the practice, California allows insurers to use credit-based insurance scores to assess risk. Studies show a correlation between lower credit scores and higher claim frequency.

A driver with excellent credit (750+) might pay 15–25% less than someone with poor credit (below 600). Improving your credit score by paying bills on time, reducing debt, and checking for errors on your report can lead to noticeable savings over time.

6. Annual Mileage

The more you drive, the higher your risk of an accident. Insurers ask how many miles you drive per year—typically categorized as low (under 7,500), average (7,500–15,000), or high (over 15,000).

If you work from home or have a short commute, you may qualify for a low-mileage discount. Conversely, long commutes or frequent road trips can increase your premium.

7. Coverage Limits and Deductibles

The amount of coverage you choose directly affects your rate. Higher liability limits (like $100,000/$300,000 instead of $15,000/$30,000) cost more but offer better protection. Similarly, choosing a lower deductible (e.g., $250 vs. $1,000) means you pay less out of pocket when you file a claim—but your monthly premium will be higher.

It’s a balancing act. Choose coverage that protects your assets without overpaying for protection you don’t need.

How to Save Money on Car Insurance in California

Visual guide about How Much Is Car Insurance in California per Month

Image source: i.pinimg.com

Now for the good news: there are many ways to lower your car insurance premium in California. With a little effort and smart choices, you can save hundreds of dollars per year without sacrificing coverage.

Shop Around and Compare Quotes

This is the single most effective way to save. Insurance rates vary widely between companies—even for identical drivers and vehicles. A quote from State Farm might be $180 per month, while GEICO offers the same coverage for $150, and Progressive quotes $165.

Experts recommend getting quotes from at least three different insurers once a year. Use online comparison tools or work with an independent agent who can check multiple companies for you.

Pro tip: Don’t just look at the monthly premium. Compare deductibles, coverage limits, customer service ratings, and claims satisfaction scores. The cheapest policy isn’t always the best value.

Take Advantage of Discounts

Most insurers offer a variety of discounts. Common ones in California include:

– **Safe driver discount:** For drivers with no accidents or violations in the past 3–5 years.

– **Multi-policy discount:** Save 10–25% by bundling auto and home or renters insurance.

– **Good student discount:** Full-time students with a B average or higher can save 10–20%.

– **Low-mileage discount:** For drivers who put fewer than 7,500 miles per year on their car.

– **Defensive driving course discount:** Completing an approved course can reduce your rate by 5–10%.

– **Anti-theft device discount:** Vehicles with alarms, tracking systems, or VIN etching may qualify.

– **Pay-in-full discount:** Pay your annual premium upfront instead of monthly to save on fees.

Ask your insurer for a full list of available discounts—you might be surprised by what you qualify for.

Improve Your Credit Score

Since credit affects your rate, taking steps to boost your score can lead to lower premiums. Pay bills on time, keep credit card balances low, and avoid opening too many new accounts. Check your credit report annually at AnnualCreditReport.com to spot errors or signs of fraud.

Even a 50-point increase in your credit score can make a noticeable difference in your insurance rate over time.

Choose the Right Vehicle

If you’re in the market for a new car, consider insurance costs before you buy. Use online tools to estimate insurance rates for different models. Generally, safer, more reliable, and less expensive-to-repair vehicles cost less to insure.

Avoid high-performance cars, luxury brands, and models with high theft rates unless you’re prepared for higher premiums.

Increase Your Deductible

Raising your deductible from $500 to $1,000 can lower your premium by 10–20%. Just make sure you have enough savings to cover the higher out-of-pocket cost if you need to file a claim.

This strategy works best for drivers with a clean record and emergency savings.

Maintain Continuous Coverage

Lapses in coverage—even for a few days—can lead to higher rates. Insurers see gaps as a red flag, assuming you were driving uninsured. Always renew your policy on time, and if you need to switch insurers, make sure there’s no gap between policies.

Some insurers offer a “continuous coverage” discount for drivers who’ve been insured for several years without interruption.

California’s Unique Insurance Rules and Requirements

Visual guide about How Much Is Car Insurance in California per Month

Image source: i.insider.com

California has some of the strictest consumer protection laws in the nation when it comes to auto insurance. Understanding these rules can help you avoid surprises and ensure you’re getting fair treatment.

Mandatory Coverage Requirements

As mentioned earlier, California requires all drivers to carry at least:

– $15,000 bodily injury per person

– $30,000 bodily injury per accident

– $5,000 property damage

You must show proof of insurance when:

– Registering your vehicle

– Getting pulled over by police

– Involved in an accident

– Renewing your registration

Driving without insurance can result in fines, license suspension, and even vehicle impoundment.

No-Fault Insurance (PIP) Is Not Required

Unlike some states, California is an “at-fault” state. This means the driver responsible for an accident pays for the damages—either through their insurance or out of pocket. There’s no requirement for Personal Injury Protection (PIP), though you can add it for extra coverage.

However, California does require Uninsured/Underinsured Motorist (UM/UIM) coverage if you choose to add it. This protects you if you’re hit by a driver with no insurance or insufficient coverage.

Consumer Protections

The California Department of Insurance (CDI) oversees the industry and enforces rules to protect consumers. Insurers must:

– Justify rate increases with data

– Provide clear explanations for premium changes

– Allow you to appeal denied claims

You have the right to file a complaint with the CDI if you believe an insurer is acting unfairly. The department can investigate and help resolve disputes.

Usage-Based Insurance Options

Many insurers in California now offer usage-based insurance (UBI) programs, also known as “pay-as-you-drive” or “telematics” programs. These use a mobile app or device to track your driving habits—like speed, braking, and mileage.

Safe drivers can earn discounts of 10–30%. Popular programs include:

– Progressive’s Snapshot

– Allstate’s Drivewise

– State Farm’s Drive Safe & Save

These programs are optional and can be a great way to save if you’re a cautious, low-mileage driver.

What to Do If Your Premium Increases

Even if you’ve been a loyal customer for years, you might see your premium go up at renewal. Don’t panic—this is common. But you do have options.

Ask Why

Call your insurer and ask for a detailed explanation. Common reasons include:

– A recent accident or ticket

– A change in your credit score

– Increased rates in your area

– Your vehicle’s age or depreciation

Sometimes, the increase is due to a mistake—like an incorrect mileage entry or outdated driver information. Correcting it could lower your rate.

Negotiate or Switch

If your rate increase seems unfair, ask if there are discounts you qualify for or if they can offer a loyalty discount. If they won’t budge, it’s time to shop around.

Switching insurers is easier than ever. Most companies allow you to start a new policy mid-term, and you can often transfer your no-claims bonus or other benefits.

Consider a Different Policy

If you’re on a tight budget, you might consider:

– Dropping collision or comprehensive if your car is older and not worth much

– Increasing your deductible

– Reducing coverage limits (but stay above the legal minimum)

Just remember: cutting coverage too much can leave you vulnerable in an accident.

Final Thoughts: Finding the Right Balance

So, how much is car insurance in California per month? The answer depends on you. While the average is around $200 for full coverage, your personal rate could be higher or lower based on your unique situation.

The key is to find the right balance between cost and coverage. Don’t just go for the cheapest policy—make sure it protects you, your family, and your assets. At the same time, don’t overpay for coverage you don’t need.

By understanding the factors that affect your rate, taking advantage of discounts, and shopping around regularly, you can keep your car insurance affordable without sacrificing peace of mind. Remember, the best policy isn’t just the one with the lowest price—it’s the one that gives you confidence every time you hit the road.

Whether you’re driving through the redwoods, along the coast, or across the desert, having the right car insurance means you can focus on the journey—not the what-ifs.

Frequently Asked Questions

How much is car insurance in California per month for a new driver?

New drivers, especially teens, typically pay $300–$600 per month for full coverage due to lack of experience and higher accident risk. Rates drop significantly after age 25 and with a clean driving record.

Can I drive without car insurance in California?

No. California law requires all drivers to carry at least minimum liability coverage. Driving without insurance can result in fines, license suspension, and vehicle impoundment.

Does my credit score affect my car insurance rate in California?

Yes. California allows insurers to use credit-based insurance scores. Drivers with higher credit scores often receive lower premiums, while those with poor credit may pay more.

What is the cheapest car insurance in California?

GEICO, State Farm, and Progressive often offer competitive rates, but the cheapest option varies by driver. Comparing quotes from multiple insurers is the best way to find the lowest price.

Can I lower my car insurance by moving to a different part of California?

Yes. Moving from a high-risk urban area like Los Angeles to a lower-risk rural area like Eureka can reduce your premium due to lower accident and theft rates.

Do I need full coverage if my car is paid off?

It’s not required, but recommended if your car is still valuable. Full coverage protects against theft, weather damage, and accidents—costs that could outweigh the premium if you’re not covered.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.