Car insurance in Florida per month averages between $150 and $300, but costs vary widely based on age, location, driving history, and coverage level. Florida’s no-fault insurance laws and high population density contribute to some of the highest premiums in the U.S., making it essential to shop around and understand your options.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 How Much Is Car Insurance in Florida per Month? A Complete Guide for 2024

- 4 What Is the Average Cost of Car Insurance in Florida?

- 5 Why Is Car Insurance So Expensive in Florida?

- 6 Factors That Affect Your Car Insurance Premium in Florida

- 7 What Does Florida Require for Car Insurance?

- 8 How to Save Money on Car Insurance in Florida

- 9 Final Thoughts: Is Car Insurance in Florida Worth the Cost?

- 10 Frequently Asked Questions

- 10.1 How much is car insurance in Florida per month for a new driver?

- 10.2 Is car insurance required in Florida?

- 10.3 Can I get car insurance in Florida with a suspended license?

- 10.4 Does Florida require full coverage car insurance?

- 10.5 How often should I shop for car insurance in Florida?

- 10.6 What happens if I drive without insurance in Florida?

Key Takeaways

- Average monthly cost: Florida drivers pay around $200–$250 per month for full coverage, one of the highest in the nation.

- Minimum coverage is cheaper but risky: State-required PIP and PDL coverage starts at $80–$120/month but offers limited protection.

- Location matters: Urban areas like Miami and Tampa have higher premiums due to traffic, theft, and accident rates.

- Age and driving history impact rates: Young drivers under 25 and those with accidents or tickets face significantly higher costs.

- Shop around annually: Comparing quotes from at least 3–5 insurers can save hundreds per year.

- Discounts help reduce costs: Safe driver, multi-policy, and good student discounts can lower your monthly premium.

- Florida’s no-fault system affects claims: You must carry Personal Injury Protection (PIP) to cover your own medical bills regardless of who caused the accident.

📑 Table of Contents

- How Much Is Car Insurance in Florida per Month? A Complete Guide for 2024

- What Is the Average Cost of Car Insurance in Florida?

- Why Is Car Insurance So Expensive in Florida?

- Factors That Affect Your Car Insurance Premium in Florida

- What Does Florida Require for Car Insurance?

- How to Save Money on Car Insurance in Florida

- Final Thoughts: Is Car Insurance in Florida Worth the Cost?

How Much Is Car Insurance in Florida per Month? A Complete Guide for 2024

If you’re driving in the Sunshine State, you’ve probably wondered: *How much is car insurance in Florida per month?* The short answer? It depends—but on average, Floridians pay more than drivers in most other states. In fact, Florida consistently ranks among the top three most expensive states for car insurance in the U.S.

Why is car insurance so costly in Florida? A mix of factors—including high population density, frequent traffic accidents, a no-fault insurance system, and a rising number of uninsured drivers—drives up premiums. Add in the risk of hurricanes and flooding, and it’s easy to see why insurers charge more here than in many other parts of the country.

But that doesn’t mean you’re stuck paying sky-high rates. By understanding how premiums are calculated, knowing what coverage you actually need, and taking advantage of discounts, you can find affordable car insurance in Florida without sacrificing protection. This guide breaks down everything you need to know—from average costs to money-saving strategies—so you can make smart decisions and keep more money in your pocket.

What Is the Average Cost of Car Insurance in Florida?

Visual guide about How Much Is Car Insurance in Florida per Month

Image source: carinsurance.org

So, how much is car insurance in Florida per month, really? According to recent data from sources like the National Association of Insurance Commissioners (NAIC) and independent quote comparison tools, the average Floridian pays between **$150 and $300 per month** for full coverage car insurance. That’s roughly **$1,800 to $3,600 per year**.

For minimum coverage—just the state-required Personal Injury Protection (PIP) and Property Damage Liability (PDL)—the average monthly cost drops to around **$80 to $120**. But here’s the catch: minimum coverage won’t protect your vehicle or cover major medical bills if you’re seriously injured. It’s the legal bare minimum, not the smart choice for most drivers.

Let’s put this into perspective with a few real-world examples:

– A 35-year-old driver in Orlando with a clean record, driving a 2020 Honda Civic, might pay about **$180/month** for full coverage.

– The same driver in Miami could pay closer to **$250/month** due to higher accident rates and theft.

– A 19-year-old new driver in Tampa might see premiums jump to **$350–$450/month**, even with a good student discount.

These numbers show how much location, age, and vehicle type influence your rate. But they also highlight an important truth: *you have control*. Shopping around, improving your credit score, and choosing a safer car can all help lower your monthly bill.

How Florida Compares to Other States

When you look at national averages, Florida stands out—and not in a good way. The U.S. average for full coverage car insurance is about **$140 per month**, while Florida’s average is nearly **$220**. That’s over 50% higher than the national norm.

Only a handful of states—like Louisiana, Michigan, and New York—consistently beat Florida for the highest premiums. But unlike Michigan, which has even higher rates due to unlimited PIP benefits, Florida has made efforts to reform its no-fault system to reduce costs. Still, the state’s unique insurance laws and high claims frequency keep prices elevated.

Why Is Car Insurance So Expensive in Florida?

Visual guide about How Much Is Car Insurance in Florida per Month

Image source: lh5.googleusercontent.com

If you’ve gotten a quote and gasped at the number, you’re not alone. Many drivers are shocked when they first see how much car insurance in Florida per month can cost. But the price tag isn’t arbitrary—it’s based on real risks and state-specific rules. Here are the top reasons why Florida premiums are so high.

Florida’s No-Fault Insurance System

Florida is one of 12 “no-fault” states, meaning that after an accident, each driver’s own insurance pays for their medical expenses—up to the policy limit—regardless of who caused the crash. This is handled through **Personal Injury Protection (PIP)** coverage, which is mandatory in Florida.

While no-fault laws were designed to reduce lawsuits and speed up claims, they’ve had unintended consequences. Fraudulent claims, especially for soft-tissue injuries like whiplash, are common. Some clinics and providers inflate bills or perform unnecessary treatments, driving up costs for insurers—and ultimately, for all drivers.

In response, Florida has implemented PIP reforms, including a $10,000 cap on non-emergency medical benefits and stricter rules for treatment. But the system still contributes to higher premiums because insurers must cover a wide range of medical claims, even when fault isn’t clear.

High Population Density and Traffic

Florida is home to over 22 million people, with major urban centers like Miami, Fort Lauderdale, Tampa, and Orlando packed with drivers. More cars on the road mean more accidents, more claims, and higher insurance costs.

Cities like Miami and Hialeah have some of the highest accident rates in the nation. According to the Florida Department of Highway Safety and Motor Vehicles, there were over **400,000 traffic crashes** in the state in 2022 alone. That’s more than 1,000 accidents per day.

High traffic density also increases the risk of theft, vandalism, and hit-and-run incidents—all of which are covered under comprehensive insurance and can raise your premium.

Severe Weather and Natural Disasters

Florida is no stranger to hurricanes, tropical storms, flooding, and hail. These weather events can cause massive damage to vehicles, leading to a surge in claims after major storms.

For example, after Hurricane Ian in 2022, insurance companies processed tens of thousands of auto claims for flood damage, fallen trees, and debris impact. These large-scale losses force insurers to raise rates across the board to stay solvent.

Even if you live inland, you’re not immune. Insurers consider the entire state’s risk profile when setting rates, so coastal storm risks affect premiums statewide.

High Rates of Uninsured Drivers

Believe it or not, nearly **20% of Florida drivers are uninsured**, according to the Insurance Research Council. That’s one in five drivers on the road without coverage.

When an uninsured driver causes an accident, your own insurance may have to cover the damages—especially if you have uninsured motorist (UM) coverage. To protect themselves, insurers charge higher premiums to offset the risk of paying out claims for accidents caused by drivers who don’t carry insurance.

Medical Costs and Fraud

Healthcare costs in Florida are among the highest in the country. When combined with the no-fault system, this creates a perfect storm for inflated insurance claims.

Some individuals exploit the system by staging accidents or exaggerating injuries to collect PIP benefits. While law enforcement and insurers are cracking down on fraud, these practices still drive up costs for honest drivers.

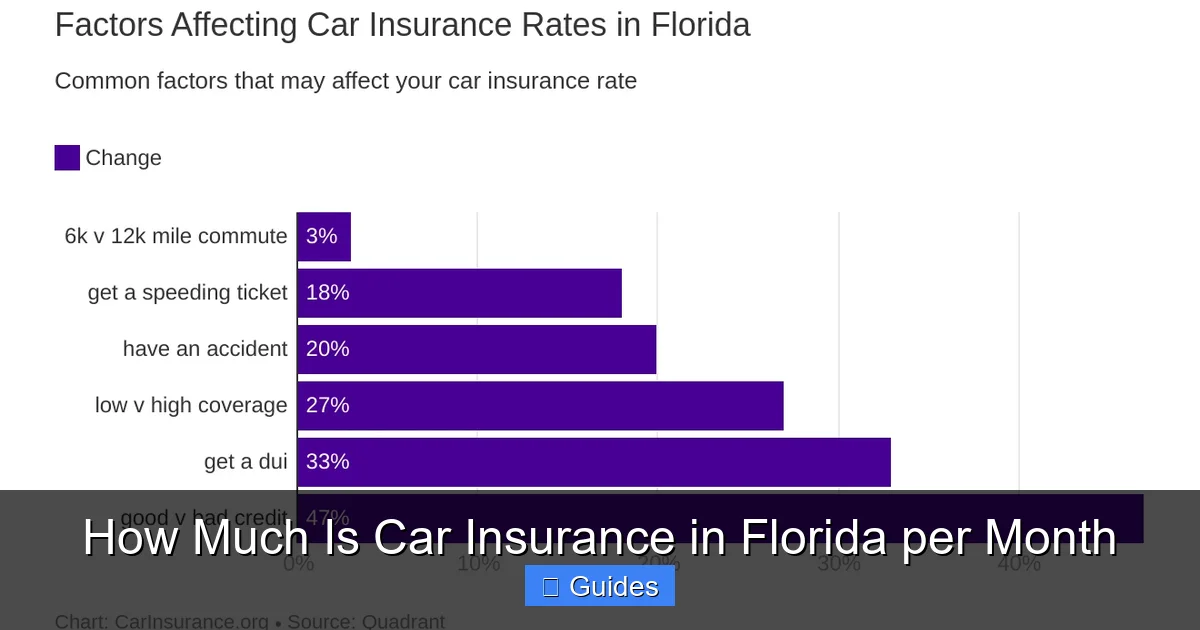

Factors That Affect Your Car Insurance Premium in Florida

Visual guide about How Much Is Car Insurance in Florida per Month

Image source: harrylevineinsurance.com

Now that you know why car insurance in Florida per month is so expensive, let’s talk about what *you* can control. Your personal profile plays a huge role in determining your rate. Here are the key factors insurers use to calculate your premium.

Your Driving Record

This is one of the biggest factors. A clean driving record with no accidents, tickets, or DUIs can significantly lower your rate. On the flip side, even one speeding ticket can increase your premium by 10–20%, and a DUI can double it.

For example:

– A 30-year-old with a clean record might pay $180/month.

– The same driver with a recent at-fault accident could pay $240/month or more.

Some insurers offer accident forgiveness programs, but they’re not available everywhere. Safe driving is your best bet for keeping rates low.

Age and Gender

Young drivers, especially those under 25, pay the highest premiums. Insurance companies see teens and young adults as high-risk due to inexperience and higher accident rates.

Here’s a rough breakdown of average monthly costs by age (for full coverage):

– **18-year-old:** $350–$500

– **25-year-old:** $200–$280

– **35-year-old:** $170–$230

– **50-year-old:** $150–$200

– **65-year-old:** $140–$190

Gender also plays a role—historically, young male drivers pay more than young females—but some states, including Florida, have started to limit gender-based pricing.

Where You Live

Your ZIP code matters more than you think. Urban areas with high traffic, crime, and accident rates have higher premiums than rural areas.

For example:

– **Miami:** Average full coverage = $280/month

– **Tampa:** $240/month

– **Orlando:** $210/month

– **Jacksonville:** $190/month

– **Gainesville (college town):** $220/month

– **Rural North Florida:** $150–$170/month

Even within the same city, rates can vary. Living in a high-theft neighborhood or near a busy highway can increase your risk—and your premium.

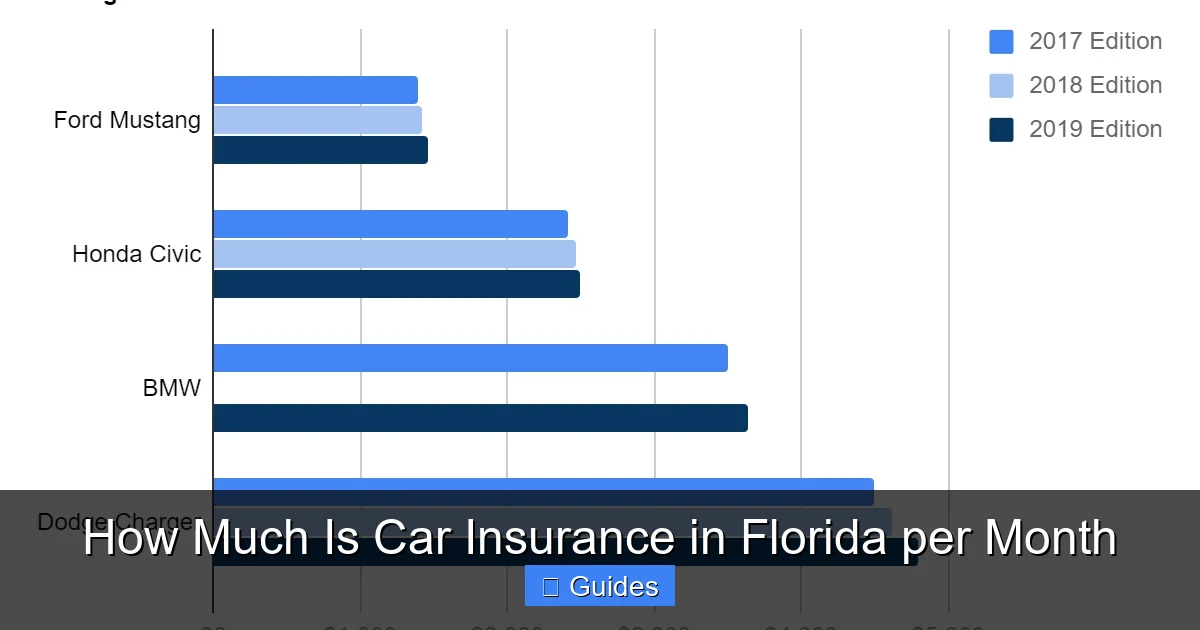

Your Vehicle

The car you drive affects your insurance cost. Insurers consider:

– **Make and model:** Sports cars and luxury vehicles cost more to insure.

– **Age of the car:** Newer cars often have higher premiums due to repair costs.

– **Safety features:** Cars with advanced safety tech (like automatic braking and lane assist) may qualify for discounts.

– **Theft rate:** Vehicles that are frequently stolen (like certain Honda and Toyota models) cost more to insure.

For example, insuring a 2023 BMW M3 will cost far more than a 2018 Toyota Camry—even if both drivers have identical records.

Credit Score

In Florida, insurers can use your credit-based insurance score to determine your rate. Drivers with poor credit often pay significantly more than those with excellent credit.

A study by the Consumer Federation of America found that a driver with poor credit could pay **$500–$1,000 more per year** than someone with good credit, even with the same driving record.

Improving your credit score—by paying bills on time, reducing debt, and checking for errors on your report—can lead to lower insurance premiums over time.

Coverage Level and Deductible

The more coverage you buy, the higher your premium. But there’s a trade-off: higher deductibles (the amount you pay out of pocket before insurance kicks in) can lower your monthly cost.

For example:

– A $500 deductible might cost $200/month.

– A $1,000 deductible could drop your premium to $170/month.

Just make sure you can afford the deductible if you ever need to file a claim.

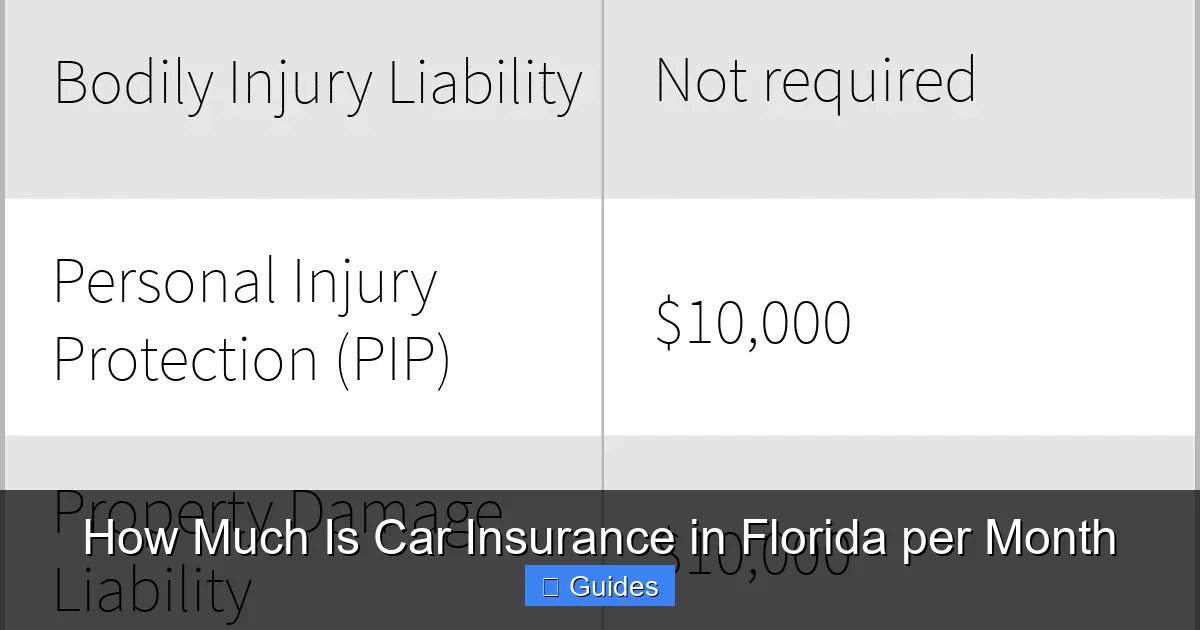

What Does Florida Require for Car Insurance?

Before you can legally drive in Florida, you must carry a minimum amount of insurance. Understanding these requirements is key to answering “how much is car insurance in Florida per month” without breaking the law.

Minimum Required Coverage

Florida law requires all drivers to carry:

– **Personal Injury Protection (PIP):** $10,000 minimum

– **Property Damage Liability (PDL):** $10,000 minimum

That’s it. Unlike most states, Florida does *not* require bodily injury liability (BIL) coverage. This means you’re not legally required to carry insurance that pays for the other driver’s medical bills if you cause an accident.

But here’s the problem: if you cause a serious crash and the other driver is injured, you could be personally sued for medical expenses, lost wages, and pain and suffering. Without BIL coverage, you’re on the hook.

Why Minimum Coverage Isn’t Enough

While minimum coverage keeps you legal, it leaves you dangerously underprotected. Consider this scenario:

You rear-end another car at a stoplight. The other driver suffers a broken leg and needs surgery. Their medical bills total $50,000. Your PIP covers only $10,000 of your own medical costs. You have no BIL coverage, so you’re responsible for the other driver’s $50,000 in bills—plus their car repairs.

That’s why most financial advisors and insurance experts recommend carrying **at least $100,000/$300,000 in bodily injury liability** and **$100,000 in property damage liability**, plus comprehensive and collision coverage if you own a newer car.

Optional but Recommended Coverage

To truly protect yourself, consider adding:

– **Bodily Injury Liability (BIL):** Covers medical costs for others if you’re at fault.

– **Uninsured/Underinsured Motorist (UM/UIM):** Pays your bills if the other driver has no or insufficient insurance.

– **Collision Coverage:** Pays for damage to your car from accidents.

– **Comprehensive Coverage:** Covers theft, vandalism, fire, and weather damage.

– **Rental Reimbursement:** Helps pay for a rental car while yours is being repaired.

These add-ons increase your monthly premium but provide peace of mind and financial protection.

How to Save Money on Car Insurance in Florida

Yes, car insurance in Florida per month is expensive—but you don’t have to overpay. With smart strategies, you can reduce your premium without sacrificing coverage.

Shop Around and Compare Quotes

Insurance rates vary widely between companies. A quote from GEICO might be $180/month, while State Farm quotes $240 for the same coverage. That’s a $60/month difference—$720 per year!

Get quotes from at least 3–5 insurers, including national brands (like Progressive, Allstate, and USAA) and regional companies (like Florida Farm Bureau or Tower Hill). Use online comparison tools or work with an independent agent who can check multiple carriers.

Take Advantage of Discounts

Most insurers offer discounts that can save you 10–30% on your premium. Common ones include:

– **Safe driver discount:** For accident- and violation-free records.

– **Multi-policy discount:** Bundle auto with home or renters insurance.

– **Good student discount:** For students with a B average or higher.

– **Defensive driving course:** Completing an approved course can lower your rate.

– **Low mileage discount:** If you drive fewer than 7,500 miles per year.

– **Anti-theft device discount:** For vehicles with alarms or tracking systems.

Ask your insurer about available discounts—you might be missing out on savings.

Raise Your Deductible

Increasing your deductible from $500 to $1,000 can reduce your premium by 10–20%. Just make sure you have enough savings to cover the higher out-of-pocket cost if you file a claim.

Improve Your Credit Score

Since credit affects your rate, take steps to boost your score:

– Pay bills on time.

– Keep credit card balances low.

– Check your credit report for errors (get a free report at AnnualCreditReport.com).

Even a 50-point increase can lead to lower insurance costs.

Drive Less, Pay Less

Some insurers offer pay-per-mile or low-mileage programs. If you work from home or don’t drive often, these plans can save you money based on actual usage.

Maintain Continuous Coverage

Letting your insurance lapse—even for a few days—can lead to higher rates when you reinstate. Always keep continuous coverage to avoid the “high-risk” label.

Final Thoughts: Is Car Insurance in Florida Worth the Cost?

So, how much is car insurance in Florida per month? On average, $200–$250 for full coverage—but your actual cost depends on your profile, location, and choices.

While Florida’s premiums are high, the coverage is essential. With no-fault laws, high accident rates, and frequent storms, going without proper insurance is a financial risk you can’t afford.

The good news? You’re not powerless. By understanding the factors that affect your rate, shopping around, and taking advantage of discounts, you can find affordable car insurance in Florida that fits your budget and protects your future.

Don’t just accept the first quote you get. Be proactive. Compare options. Ask questions. And remember: the cheapest policy isn’t always the best—make sure you’re getting the right coverage for your needs.

Drive safe, stay insured, and keep more of your hard-earned money in your pocket.

Frequently Asked Questions

How much is car insurance in Florida per month for a new driver?

New drivers under 25 typically pay $300–$500 per month for full coverage in Florida due to their lack of experience and higher accident risk. Rates drop significantly after a few years of safe driving.

Is car insurance required in Florida?

Yes, Florida law requires all drivers to carry at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL) coverage. Driving without insurance can result in fines, license suspension, and vehicle impoundment.

Can I get car insurance in Florida with a suspended license?

It’s difficult but possible. Some high-risk insurers may offer coverage, but premiums will be very high. You’ll need to resolve the suspension and show proof of reinstatement before most standard insurers will consider you.

Does Florida require full coverage car insurance?

No, Florida does not require full coverage (collision and comprehensive). However, if you have a car loan or lease, your lender will likely require it to protect their investment.

How often should I shop for car insurance in Florida?

It’s wise to compare quotes at least once a year, especially after life changes like moving, getting married, or improving your credit score. Rates change frequently, and you could save hundreds.

What happens if I drive without insurance in Florida?

Driving uninsured in Florida can lead to fines up to $500, license and registration suspension, and even vehicle impoundment. If you cause an accident, you could face lawsuits and be personally responsible for damages.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.