Yes, you must have car insurance in Florida—but not the traditional liability coverage you might expect. Florida is a no-fault state, meaning drivers must carry Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. Driving without it can lead to fines, license suspension, and financial risk.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Do You Have to Have Car Insurance in Florida?

- 4 Understanding Florida’s No-Fault Insurance System

- 5 Florida’s Minimum Car Insurance Requirements

- 6 Consequences of Driving Without Insurance in Florida

- 7 How to Prove You Have Car Insurance in Florida

- 8 Tips for Finding Affordable Car Insurance in Florida

- 9 Common Misconceptions About Florida Car Insurance

- 9.1 “I Don’t Need Insurance If I’m Not Driving Often”

- 9.2 “My Friend or Family Member’s Insurance Covers Me” Not necessarily. While some policies extend coverage to occasional drivers, it’s not guaranteed. If you regularly drive someone else’s car, you should be listed on their policy or have your own. “Minimum Coverage Is Enough” As discussed earlier, $10,000 in PIP and PDL may not cover serious accidents. Medical bills, vehicle repairs, and legal fees can quickly exceed these limits. Consider higher coverage or supplemental policies. “I Can’t Be Fined If I’m Not at Fault” You can still be penalized for lacking insurance, even if another driver caused the accident. The law requires you to carry coverage regardless of fault. “Electric or Hybrid Cars Are Cheaper to Insure” Not always. While some green vehicles qualify for discounts, others—especially high-end models—can be more expensive due to repair costs and battery replacement. Conclusion Yes, you have to have car insurance in Florida—and it’s not optional. The state’s no-fault system requires every driver to carry at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). Driving without it can lead to fines, license suspension, and serious financial risk. But meeting the minimums isn’t the end of the story. Given Florida’s high accident rates and costly medical care, it’s wise to consider additional coverage like Bodily Injury Liability, uninsured motorist protection, and collision/comprehensive insurance. Shopping around, taking advantage of discounts, and maintaining continuous coverage can help you stay protected without breaking the bank. Ultimately, car insurance isn’t just about following the law—it’s about peace of mind. Whether you’re commuting to work, road-tripping down I-95, or just running errands, having the right coverage means you can focus on the drive, not the what-ifs. Frequently Asked Questions Do you have to have car insurance in Florida if you don’t drive often?

- 9.3 Can I drive in Florida with out-of-state insurance?

- 9.4 What happens if my car insurance lapses in Florida?

- 9.5 Is bodily injury liability required in Florida?

- 9.6 Can I be sued in Florida even with no-fault insurance?

- 9.7 How can I lower my car insurance costs in Florida?

Key Takeaways

- Florida requires car insurance: All registered vehicles must carry at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL).

- It’s a no-fault state: Your own insurance covers your medical expenses after an accident, regardless of who caused it.

- Minimum coverage isn’t always enough: The state minimums may not cover serious injuries or vehicle damage, so consider higher limits or additional coverage.

- Proof of insurance is mandatory: You must carry proof of insurance in your vehicle and show it during traffic stops or after accidents.

- Penalties for no insurance are steep: Driving uninsured can result in fines, license suspension, vehicle registration suspension, and even impoundment.

- You can be fined even if not at fault: Even if another driver caused the accident, you can still face penalties for lacking proper coverage.

- Shopping around saves money: Comparing quotes from multiple insurers can help you find affordable, compliant coverage that fits your needs.

📑 Table of Contents

- Do You Have to Have Car Insurance in Florida?

- Understanding Florida’s No-Fault Insurance System

- Florida’s Minimum Car Insurance Requirements

- Consequences of Driving Without Insurance in Florida

- How to Prove You Have Car Insurance in Florida

- Tips for Finding Affordable Car Insurance in Florida

- Common Misconceptions About Florida Car Insurance

- Conclusion

Do You Have to Have Car Insurance in Florida?

If you’re driving on Florida roads, the short answer is yes—you absolutely need car insurance. But unlike many other states, Florida has a unique system that might surprise new drivers or those moving from out of state. It’s not just about liability coverage for injuries or damages you cause to others. Instead, Florida operates under a “no-fault” insurance model, which changes how claims are handled and what kind of coverage you’re required to carry.

This doesn’t mean you can skip insurance if you’re careful or think accidents won’t happen to you. The law is strict, and the consequences of driving without proper coverage can be severe—even if you’re not at fault in a crash. From fines to license suspension, the risks far outweigh any perceived savings from going uninsured. Whether you’re a longtime resident or just moved to the Sunshine State, understanding Florida’s car insurance requirements is essential for staying legal, protected, and stress-free on the road.

Understanding Florida’s No-Fault Insurance System

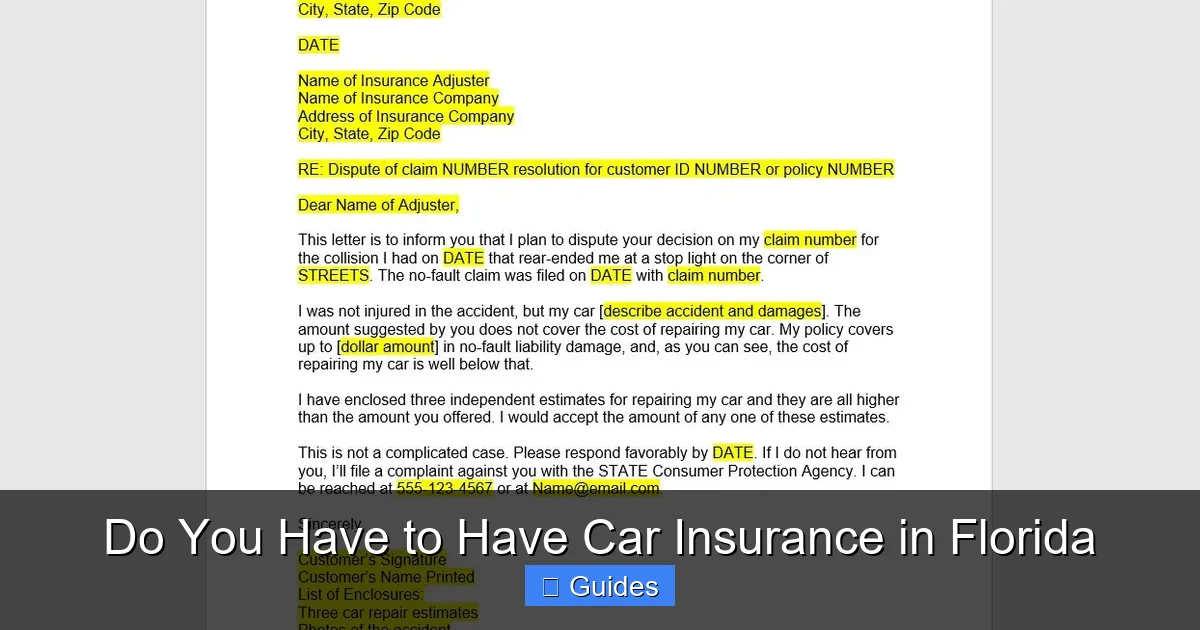

Visual guide about Do You Have to Have Car Insurance in Florida

Image source: blogger.googleusercontent.com

Florida is one of only a handful of states that follow a no-fault insurance system. This means that after a car accident, each driver’s own insurance company pays for their medical expenses and certain other losses—regardless of who caused the crash. The goal is to reduce lawsuits and speed up claim payments, but it also comes with specific requirements that every driver must meet.

Under this system, your Personal Injury Protection (PIP) coverage kicks in first. It covers medical bills, lost wages, and other related expenses for you and your passengers—up to your policy limit. Because fault isn’t immediately determined, you don’t have to wait for the other driver’s insurance to respond. This can be a huge relief in the chaotic moments after an accident.

However, no-fault doesn’t mean you’re completely shielded from lawsuits. If your injuries are severe—such as significant disfigurement, permanent injury, or death—you may step outside the no-fault system and sue the at-fault driver for additional damages. But for minor fender benders and soft-tissue injuries, the no-fault rules apply, and your PIP coverage is your first line of defense.

How No-Fault Affects Your Coverage Needs

Because Florida’s system prioritizes your own insurance paying for your injuries, it’s crucial to have adequate PIP coverage. The state minimum is $10,000, but that might not go far if you’re hospitalized or need ongoing treatment. For example, a single night in the hospital can easily exceed $10,000, leaving you with out-of-pocket expenses.

Additionally, no-fault doesn’t cover property damage to your vehicle. That’s where Property Damage Liability (PDL) comes in. You’re required to carry at least $10,000 in PDL, which pays for damage you cause to someone else’s car or property. But again, this minimum might not be enough if you total a luxury vehicle or damage public property like a guardrail or traffic light.

Understanding how no-fault works helps you see why simply meeting the minimums might not be enough. It also explains why Florida drivers often benefit from adding extra coverage like Bodily Injury Liability (BI), uninsured motorist protection, and collision or comprehensive insurance.

Florida’s Minimum Car Insurance Requirements

Visual guide about Do You Have to Have Car Insurance in Florida

Image source: i.etsystatic.com

So, what exactly are you required to carry? Florida law mandates that all registered vehicles have two types of coverage: Personal Injury Protection (PIP) and Property Damage Liability (PDL). Let’s break down each one.

Personal Injury Protection (PIP)

PIP is the cornerstone of Florida’s no-fault system. Every driver must carry at least $10,000 in PIP coverage. This pays for medical expenses, lost wages, and other related costs for you and your passengers—up to 80% of medical bills and 60% of lost income. It also covers funeral expenses and survivor benefits in the event of a fatal accident.

It’s important to note that PIP only covers injuries, not vehicle damage. And while $10,000 sounds like a lot, it can be used up quickly. For instance, if you’re in a serious accident and require surgery, physical therapy, and time off work, that $10,000 may not last long. That’s why many Floridians choose to increase their PIP limits or add supplemental coverage.

Property Damage Liability (PDL)

PDL covers damage you cause to someone else’s property. This includes their vehicle, fence, mailbox, or even a building if you crash into it. The minimum required is $10,000, but again, this might not be enough in a serious collision. If you rear-end a Tesla and cause $25,000 in damage, you’d be personally responsible for the $15,000 difference.

Unlike PIP, PDL does not cover your own vehicle. If you want coverage for your car, you’ll need to add collision and comprehensive insurance separately.

What’s Not Required (But Highly Recommended)

Florida does not require Bodily Injury Liability (BI) coverage, which pays for injuries you cause to others. This is unusual compared to most states, but it’s part of the no-fault design. However, skipping BI can be risky. If you cause an accident that results in serious injuries, the other party could sue you for medical bills, pain and suffering, and other damages—potentially wiping out your savings or assets.

Other optional but smart additions include:

– Uninsured/underinsured motorist coverage (UM/UIM): Protects you if the at-fault driver has no insurance or insufficient coverage.

– Collision coverage: Pays for damage to your car from accidents, regardless of fault.

– Comprehensive coverage: Covers non-collision events like theft, vandalism, or weather damage.

While these aren’t required by law, they provide critical financial protection that the minimums simply can’t match.

Consequences of Driving Without Insurance in Florida

Visual guide about Do You Have to Have Car Insurance in Florida

Image source: forbes.com

Driving without the required car insurance in Florida isn’t just a minor offense—it’s a serious violation with real consequences. The state takes compliance seriously, and the penalties can affect your wallet, your driving privileges, and even your vehicle.

Fines and Fees

If you’re caught driving without insurance, you can face fines ranging from $150 to $500 for a first offense. That’s on top of court costs and reinstatement fees. And if you’re involved in an accident while uninsured, the fines can increase significantly.

License and Registration Suspension

One of the harshest penalties is the suspension of your driver’s license and vehicle registration. The Florida Department of Highway Safety and Motor Vehicles (FLHSMV) can suspend your license for up to three years if you’re found driving without insurance. To reinstate it, you’ll need to provide proof of insurance and pay a reinstatement fee—often $150 or more.

Your vehicle registration can also be suspended, meaning you can’t legally drive the car until you show proof of coverage. If your car is impounded, you’ll have to pay towing and storage fees on top of everything else.

Financial Liability in Accidents

Even if you’re not at fault in an accident, driving without insurance can leave you exposed. While the at-fault driver’s insurance should cover your damages, they might dispute the claim or go bankrupt. Without your own coverage—especially uninsured motorist protection—you could be stuck paying for medical bills, car repairs, and lost wages out of pocket.

And if you cause an accident while uninsured, you’re personally responsible for all damages. That could mean lawsuits, wage garnishment, or even bankruptcy. The $10,000 minimums exist for a reason—they’re a baseline to protect everyone on the road.

Repeat Offenses and Criminal Charges

If you’re caught driving uninsured multiple times, the penalties get worse. A second offense can result in higher fines, longer license suspensions, and even misdemeanor charges. In extreme cases, repeat offenders may face jail time.

The state also uses automated systems to track insurance compliance. If your policy lapses and you don’t renew it within 30 days, the FLHSMV will be notified, and your registration could be suspended automatically.

How to Prove You Have Car Insurance in Florida

It’s not enough to just buy a policy—you must be able to prove it. Florida law requires all drivers to carry proof of insurance in their vehicle at all times. This usually comes in the form of an insurance ID card provided by your insurer.

What Counts as Valid Proof?

Your insurance card must include:

– Your name and vehicle information

– Policy number

– Effective and expiration dates

– Name of the insurance company

Digital copies are acceptable. Most insurers offer mobile apps or online portals where you can access your ID card instantly. Just make sure your phone is charged and accessible during a traffic stop.

What Happens If You Can’t Show Proof?

If you’re pulled over or involved in an accident and can’t show proof of insurance, you can be cited—even if you actually have coverage. The officer may issue a ticket, and you’ll have to appear in court to prove you were insured at the time. While the charge may be dismissed, you’ll still face court costs and potential fines.

To avoid this, keep your insurance card in your glove compartment or wallet. If you switch insurers, update your card immediately. And if your policy expires, renew it before driving—don’t wait until the last minute.

Insurance Verification System

Florida uses an electronic insurance verification system called the **Florida Insurance Verification System (FIVS)**. Insurers report policy information to the state, and law enforcement can check your coverage in real time. If your policy lapses, the system flags it, and your registration may be suspended automatically.

This means there’s no hiding. Even if you think you’re covered, a missed payment or administrative error could leave you uninsured in the eyes of the law.

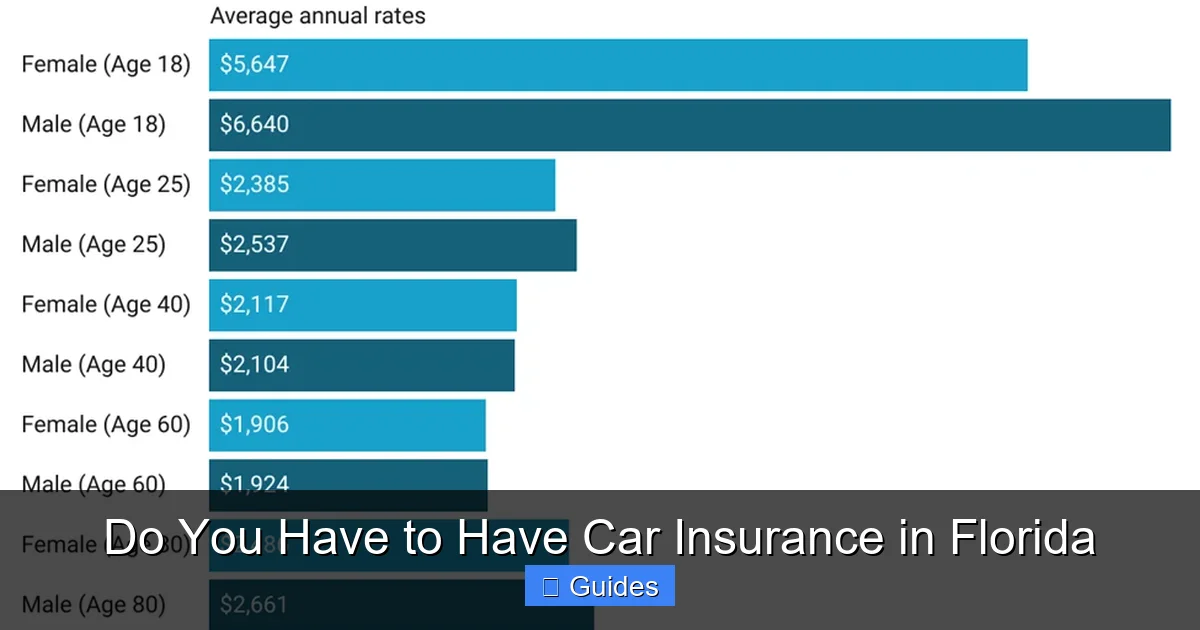

Tips for Finding Affordable Car Insurance in Florida

Car insurance in Florida can be expensive—especially in cities like Miami, Orlando, and Tampa. But that doesn’t mean you have to overpay. With a few smart strategies, you can find compliant, affordable coverage that still offers strong protection.

Shop Around and Compare Quotes

Insurance rates vary widely between companies. What’s cheap for one driver might be costly for another. Get quotes from at least three to five insurers, including national brands like State Farm, GEICO, and Progressive, as well as regional companies like Florida Farm Bureau or Southern Fidelity.

Use online comparison tools or work with an independent agent who can access multiple carriers. Be sure to compare apples to apples—same coverage limits, deductibles, and discounts.

Take Advantage of Discounts

Most insurers offer discounts that can significantly lower your premium. Common ones include:

– Safe driver discount (for clean records)

– Multi-car discount

– Good student discount

– Defensive driving course completion

– Anti-theft device or safety feature discounts

– Pay-in-full or paperless billing discounts

Ask your agent about all available discounts—you might be surprised how much you can save.

Consider Your Vehicle and Driving Habits

The type of car you drive affects your rates. Sports cars, luxury vehicles, and models with high theft rates cost more to insure. If you’re buying a new car, check insurance costs before you buy.

Your driving habits matter too. If you don’t drive much, ask about low-mileage discounts. Some insurers offer usage-based programs that track your driving via a mobile app or device and reward safe behavior with lower rates.

Raise Your Deductible (Carefully)

Increasing your deductible—the amount you pay out of pocket before insurance kicks in—can lower your premium. For example, raising your collision deductible from $500 to $1,000 might save you $100 or more per year.

But only do this if you can afford the higher out-of-pocket cost in case of an accident. Don’t choose a deductible that would break your budget.

Maintain Continuous Coverage

Lapses in coverage can lead to higher rates. Insurers see gaps as a red flag, assuming you were driving uninsured. Even a few days without coverage can trigger a rate increase.

Set up automatic payments or calendar reminders to renew your policy on time. If you’re switching insurers, make sure the new policy starts before the old one ends.

Common Misconceptions About Florida Car Insurance

There’s a lot of misinformation about car insurance in Florida, especially among new drivers or those moving from other states. Let’s clear up some of the most common myths.

“I Don’t Need Insurance If I’m Not Driving Often”

False. If your vehicle is registered in Florida, it must be insured—even if it’s parked in the garage most of the time. The only exception is if you officially cancel your registration and surrender your license plates.

“My Friend or Family Member’s Insurance Covers Me”

Not necessarily. While some policies extend coverage to occasional drivers, it’s not guaranteed. If you regularly drive someone else’s car, you should be listed on their policy or have your own.

“Minimum Coverage Is Enough”

As discussed earlier, $10,000 in PIP and PDL may not cover serious accidents. Medical bills, vehicle repairs, and legal fees can quickly exceed these limits. Consider higher coverage or supplemental policies.

“I Can’t Be Fined If I’m Not at Fault”

You can still be penalized for lacking insurance, even if another driver caused the accident. The law requires you to carry coverage regardless of fault.

“Electric or Hybrid Cars Are Cheaper to Insure”

Not always. While some green vehicles qualify for discounts, others—especially high-end models—can be more expensive due to repair costs and battery replacement.

Conclusion

Yes, you have to have car insurance in Florida—and it’s not optional. The state’s no-fault system requires every driver to carry at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). Driving without it can lead to fines, license suspension, and serious financial risk.

But meeting the minimums isn’t the end of the story. Given Florida’s high accident rates and costly medical care, it’s wise to consider additional coverage like Bodily Injury Liability, uninsured motorist protection, and collision/comprehensive insurance. Shopping around, taking advantage of discounts, and maintaining continuous coverage can help you stay protected without breaking the bank.

Ultimately, car insurance isn’t just about following the law—it’s about peace of mind. Whether you’re commuting to work, road-tripping down I-95, or just running errands, having the right coverage means you can focus on the drive, not the what-ifs.

Frequently Asked Questions

Do you have to have car insurance in Florida if you don’t drive often?

Yes, if your vehicle is registered in Florida, it must be insured—even if you only drive occasionally. The only way to avoid this is to cancel your registration and surrender your license plates.

Can I drive in Florida with out-of-state insurance?

Yes, as long as the policy meets Florida’s minimum requirements for PIP and PDL coverage. However, it’s best to notify your insurer and ensure your policy is compliant.

What happens if my car insurance lapses in Florida?

If your policy lapses, the state will be notified, and your vehicle registration may be suspended. You’ll need to reinstate your insurance and pay fees to get your registration back.

Is bodily injury liability required in Florida?

No, Florida does not require Bodily Injury Liability (BI) coverage. However, it’s highly recommended to protect yourself from lawsuits if you cause serious injuries in an accident.

Can I be sued in Florida even with no-fault insurance?

Yes, if your injuries meet the state’s threshold for serious injury—such as permanent disability, significant disfigurement, or death—you can step outside the no-fault system and sue the at-fault driver.

How can I lower my car insurance costs in Florida?

Shop around for quotes, take advantage of discounts, maintain a clean driving record, consider raising your deductible, and keep continuous coverage to avoid rate hikes.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.

As discussed earlier, $10,000 in PIP and PDL may not cover serious accidents. Medical bills, vehicle repairs, and legal fees can quickly exceed these limits. Consider higher coverage or supplemental policies.

“I Can’t Be Fined If I’m Not at Fault”

You can still be penalized for lacking insurance, even if another driver caused the accident. The law requires you to carry coverage regardless of fault.

“Electric or Hybrid Cars Are Cheaper to Insure”

Not always. While some green vehicles qualify for discounts, others—especially high-end models—can be more expensive due to repair costs and battery replacement.

Conclusion

Yes, you have to have car insurance in Florida—and it’s not optional. The state’s no-fault system requires every driver to carry at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). Driving without it can lead to fines, license suspension, and serious financial risk.

But meeting the minimums isn’t the end of the story. Given Florida’s high accident rates and costly medical care, it’s wise to consider additional coverage like Bodily Injury Liability, uninsured motorist protection, and collision/comprehensive insurance. Shopping around, taking advantage of discounts, and maintaining continuous coverage can help you stay protected without breaking the bank.

Ultimately, car insurance isn’t just about following the law—it’s about peace of mind. Whether you’re commuting to work, road-tripping down I-95, or just running errands, having the right coverage means you can focus on the drive, not the what-ifs.

Frequently Asked Questions

Do you have to have car insurance in Florida if you don’t drive often?

Yes, if your vehicle is registered in Florida, it must be insured—even if you only drive occasionally. The only way to avoid this is to cancel your registration and surrender your license plates.

Can I drive in Florida with out-of-state insurance?

Yes, as long as the policy meets Florida’s minimum requirements for PIP and PDL coverage. However, it’s best to notify your insurer and ensure your policy is compliant.

What happens if my car insurance lapses in Florida?

If your policy lapses, the state will be notified, and your vehicle registration may be suspended. You’ll need to reinstate your insurance and pay fees to get your registration back.

Is bodily injury liability required in Florida?

No, Florida does not require Bodily Injury Liability (BI) coverage. However, it’s highly recommended to protect yourself from lawsuits if you cause serious injuries in an accident.

Can I be sued in Florida even with no-fault insurance?

Yes, if your injuries meet the state’s threshold for serious injury—such as permanent disability, significant disfigurement, or death—you can step outside the no-fault system and sue the at-fault driver.

How can I lower my car insurance costs in Florida?

Shop around for quotes, take advantage of discounts, maintain a clean driving record, consider raising your deductible, and keep continuous coverage to avoid rate hikes.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.

Not always. While some green vehicles qualify for discounts, others—especially high-end models—can be more expensive due to repair costs and battery replacement.

Conclusion

Yes, you have to have car insurance in Florida—and it’s not optional. The state’s no-fault system requires every driver to carry at least $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL). Driving without it can lead to fines, license suspension, and serious financial risk.

But meeting the minimums isn’t the end of the story. Given Florida’s high accident rates and costly medical care, it’s wise to consider additional coverage like Bodily Injury Liability, uninsured motorist protection, and collision/comprehensive insurance. Shopping around, taking advantage of discounts, and maintaining continuous coverage can help you stay protected without breaking the bank.

Ultimately, car insurance isn’t just about following the law—it’s about peace of mind. Whether you’re commuting to work, road-tripping down I-95, or just running errands, having the right coverage means you can focus on the drive, not the what-ifs.

Frequently Asked Questions

Do you have to have car insurance in Florida if you don’t drive often?

Yes, if your vehicle is registered in Florida, it must be insured—even if you only drive occasionally. The only way to avoid this is to cancel your registration and surrender your license plates.

Can I drive in Florida with out-of-state insurance?

Yes, as long as the policy meets Florida’s minimum requirements for PIP and PDL coverage. However, it’s best to notify your insurer and ensure your policy is compliant.

What happens if my car insurance lapses in Florida?

If your policy lapses, the state will be notified, and your vehicle registration may be suspended. You’ll need to reinstate your insurance and pay fees to get your registration back.

Is bodily injury liability required in Florida?

No, Florida does not require Bodily Injury Liability (BI) coverage. However, it’s highly recommended to protect yourself from lawsuits if you cause serious injuries in an accident.

Can I be sued in Florida even with no-fault insurance?

Yes, if your injuries meet the state’s threshold for serious injury—such as permanent disability, significant disfigurement, or death—you can step outside the no-fault system and sue the at-fault driver.

How can I lower my car insurance costs in Florida?

Shop around for quotes, take advantage of discounts, maintain a clean driving record, consider raising your deductible, and keep continuous coverage to avoid rate hikes.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.