When buying a car, government fees are mandatory charges set by state and local authorities. These include registration, title, and emissions fees, and they vary by location and vehicle type. Understanding these costs helps you budget accurately and avoid last-minute surprises.

Buying a car is exciting—new keys, fresh scent, that first drive home. But behind the thrill lies a less glamorous reality: government fees. These aren’t optional add-ons or dealer markups. They’re mandatory charges imposed by state and local authorities to legally register, title, and operate your vehicle. Whether you’re purchasing a brand-new sedan or a used SUV, you’ll encounter these fees at some point in the process.

Understanding what is government fee when buying a car isn’t just about avoiding sticker shock—it’s about making informed financial decisions. These fees can add up quickly, sometimes totaling over $1,000 depending on where you live and what you’re buying. And because they vary so much from state to state (and even county to county), it’s easy to feel confused or caught off guard. But with the right knowledge, you can anticipate these costs, compare them across regions, and even negotiate smarter with dealerships.

In this guide, we’ll break down every major type of government fee you might face when buying a car. We’ll explain how they’re calculated, why they exist, and how to estimate them before you sign on the dotted line. Whether you’re a first-time buyer or a seasoned car owner, this information will help you budget accurately and drive away with confidence—not confusion.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Are Government Fees When Buying a Car?

- 4 Types of Government Fees You’ll Encounter

- 5 How Government Fees Vary by State and Vehicle

- 6 How Dealerships Handle Government Fees

- 7 How to Estimate and Budget for Government Fees

- 8 Common Mistakes to Avoid

- 9 Conclusion

- 10 Frequently Asked Questions

- 10.1 What is included in government fees when buying a car?

- 10.2 Are government fees the same in every state?

- 10.3 Can I avoid paying government fees when buying a car?

- 10.4 Do dealerships mark up government fees?

- 10.5 Are electric vehicles exempt from government fees?

- 10.6 How can I estimate government fees before buying a car?

Key Takeaways

- Government fees are mandatory: You must pay these fees to legally register and title your vehicle in your state.

- Fees vary by state and county: Costs depend on where you live, the vehicle’s value, weight, and type (new or used).

- Common fees include registration, title, and taxes: These cover DMV processing, license plates, and sales or use tax.

- Some fees are based on vehicle value or weight: Luxury or heavy vehicles often incur higher charges.

- Emissions and safety inspections may add costs: Required in certain states before registration.

- Dealerships often collect fees on your behalf: But you should verify the amounts to avoid overpaying.

- Budget for government fees upfront: They can add hundreds to your total car-buying cost.

📑 Table of Contents

What Are Government Fees When Buying a Car?

Government fees are charges levied by state, county, or municipal authorities as part of the legal process of owning and operating a vehicle. These fees are not profit-driven; instead, they fund essential public services like road maintenance, driver licensing, vehicle safety programs, and environmental compliance. Think of them as your contribution to the infrastructure that keeps your car on the road—literally.

When people ask, “What is government fee when buying a car?” they’re usually referring to a bundle of mandatory costs that kick in once you finalize your purchase. These aren’t hidden fees tucked into a finance contract—they’re transparent (or should be) charges tied directly to government agencies like your state’s Department of Motor Vehicles (DMV) or equivalent. The most common include registration fees, title fees, sales or use taxes, and sometimes additional assessments for emissions testing or special programs.

It’s important to note that these fees are separate from dealer documentation fees, financing charges, or extended warranties—those are typically set by the dealership or lender. Government fees, by contrast, go straight to public coffers. They’re non-negotiable and must be paid before you can legally drive your new or used vehicle off the lot (in most cases).

Why Do These Fees Exist?

These fees serve several key purposes. Registration fees, for example, help fund highway patrol, road repairs, and traffic safety initiatives. Title fees cover the administrative cost of transferring ownership and maintaining accurate vehicle records. Sales or use taxes contribute to general state and local revenues, which support schools, emergency services, and public transportation.

In some states, additional fees go toward environmental programs—like California’s smog check fees—or support for alternative fuel vehicles. Others may include a small portion for disability access programs or veteran services. While it might feel like you’re paying for bureaucracy, these funds ultimately support systems that benefit all drivers.

Who Sets These Fees?

Government fees are established by state legislatures and administered by agencies like the DMV. However, counties and cities can sometimes add their own surcharges. For instance, Los Angeles County might tack on an extra fee for air quality management, while rural counties may charge less due to lower administrative overhead. This is why two people buying identical cars in different parts of the same state can pay very different totals.

Dealerships often collect these fees on your behalf and remit them to the appropriate agencies. While convenient, this means you rely on the dealer to calculate and disclose them accurately. That’s why it’s crucial to review your itemized bill and ask questions if something seems off.

Types of Government Fees You’ll Encounter

Visual guide about What Is Government Fee When Buying a Car

Image source: c1.wallpaperflare.com

Not all government fees are created equal. Some are flat rates, while others scale with your vehicle’s value, weight, or age. Below are the most common types you’ll encounter when buying a car—whether new or used.

Registration Fees

Registration fees are perhaps the most familiar government charge. They allow your vehicle to be legally driven on public roads and typically include the cost of license plates, registration stickers, and processing. In most states, you must renew this registration annually or biennially.

These fees can be flat (e.g., $50 in Arizona) or variable. In states like Texas or New York, registration costs depend on your vehicle’s weight. Heavier trucks or SUVs pay more because they cause more wear and tear on roads. For example, a 3,000-pound sedan might cost $80 to register, while a 6,000-pound pickup could run $200 or more.

Some states also base registration on the vehicle’s age or value. Florida, for instance, charges a percentage of the car’s depreciated value each year. A brand-new $40,000 SUV might incur a $200 registration fee, but after five years, that drops to around $100.

Title Fees

A title fee covers the cost of issuing a new certificate of title in your name. This document proves legal ownership and is required whenever you buy, sell, or transfer a vehicle. Title fees are usually flat—ranging from $10 to $50—but can vary by state.

For example, California charges $21 for a standard title, while Alaska charges $15. If you’re transferring a title from out of state or correcting an error, additional fees may apply. Some states also charge extra for expedited processing if you need your title quickly.

Sales Tax or Use Tax

This is often the largest government fee when buying a car. Sales tax is applied to the purchase price (or trade-in adjusted price) and varies significantly by location. States like Oregon and Montana have no sales tax, while California, Indiana, and Tennessee can exceed 7–9%.

But even in no-tax states, you might still pay a “use tax” if you buy from an out-of-state dealer. Use tax ensures that vehicles purchased elsewhere but used within the state still contribute to local revenues. The rate usually matches the local sales tax where you register the car.

Important note: Some states allow you to deduct the value of your trade-in from the taxable amount. In Texas, for example, if you trade in a $10,000 car toward a $30,000 purchase, you only pay sales tax on $20,000. Always ask your dealer how they calculate this—it can save you hundreds.

Emissions and Safety Inspection Fees

In certain states—like Massachusetts, Virginia, and much of the Northeast—you must pass emissions and/or safety inspections before registering your vehicle. These aren’t technically “government fees” if done at private shops, but many states require them as a condition of registration, so they’re often grouped with other mandatory costs.

Emissions tests check your car’s pollution output and typically cost $20–$50. Safety inspections verify brakes, lights, tires, and other critical systems and may run $15–$40. Some states bundle both into one inspection for a single fee.

If your car fails, repairs must be completed before you can register it—adding unexpected costs. That’s why it’s wise to get a pre-purchase inspection if you’re buying used, especially in inspection-required states.

Other Possible Fees

Depending on where you live, you might also encounter:

– **Wheel tax or personal property tax**: Charged annually in some counties (e.g., parts of Virginia and Wisconsin), based on vehicle value.

– **Environmental fees**: Added in states like California for smog abatement or recycling programs.

– **Special plate fees**: If you want personalized or specialty plates (e.g., university logos, conservation themes), these can add $25–$100+.

– **Late fees**: If you miss your registration renewal deadline, penalties can apply.

Always check your state’s DMV website for the most current fee schedule.

How Government Fees Vary by State and Vehicle

Visual guide about What Is Government Fee When Buying a Car

Image source: upload.wikimedia.org

One of the biggest misconceptions about government fees is that they’re standardized. In reality, they’re anything but. Two people buying the same car model in different states can pay vastly different totals due to local tax rates, fee structures, and exemptions.

State-by-State Differences

Let’s compare three states to illustrate the variation:

– **California**: High sales tax (up to 10.25% in some areas), registration based on vehicle value and weight, plus smog fees (~$43). Total government fees for a $35,000 car could exceed $1,200.

– **New Hampshire**: No sales tax, but registration fees based on weight ($35–$150), and no annual inspections. Total fees might be under $200.

– **Texas**: Sales tax of 6.25% (plus local additions), registration by weight ($50–$250), and optional inspections in major metro areas. Fees for a $35,000 SUV could total $800–$1,000.

Even within a state, county-level taxes can change the total. For example, Chicago adds a 1.25% home rule tax on top of Illinois’s 6.25% state rate.

Vehicle-Specific Factors

Your car’s characteristics also affect fees:

– **New vs. used**: New cars often incur higher registration fees because they’re valued higher. Some states offer reduced rates for used vehicles.

– **Electric or hybrid vehicles**: Many states charge extra registration fees for EVs to offset lost gas tax revenue (e.g., $100–$200 annually in Georgia or Colorado). Ironically, these “green” cars pay more in fees despite being environmentally friendly.

– **Luxury or high-value vehicles**: States like New York and Illinois impose additional taxes or fees on cars above a certain price threshold (e.g., $60,000).

– **Commercial or fleet vehicles**: Trucks, vans, and business-use vehicles often face higher registration and weight-based fees.

Always use your state’s online fee calculator (most DMVs have one) to estimate costs based on your specific vehicle and location.

How Dealerships Handle Government Fees

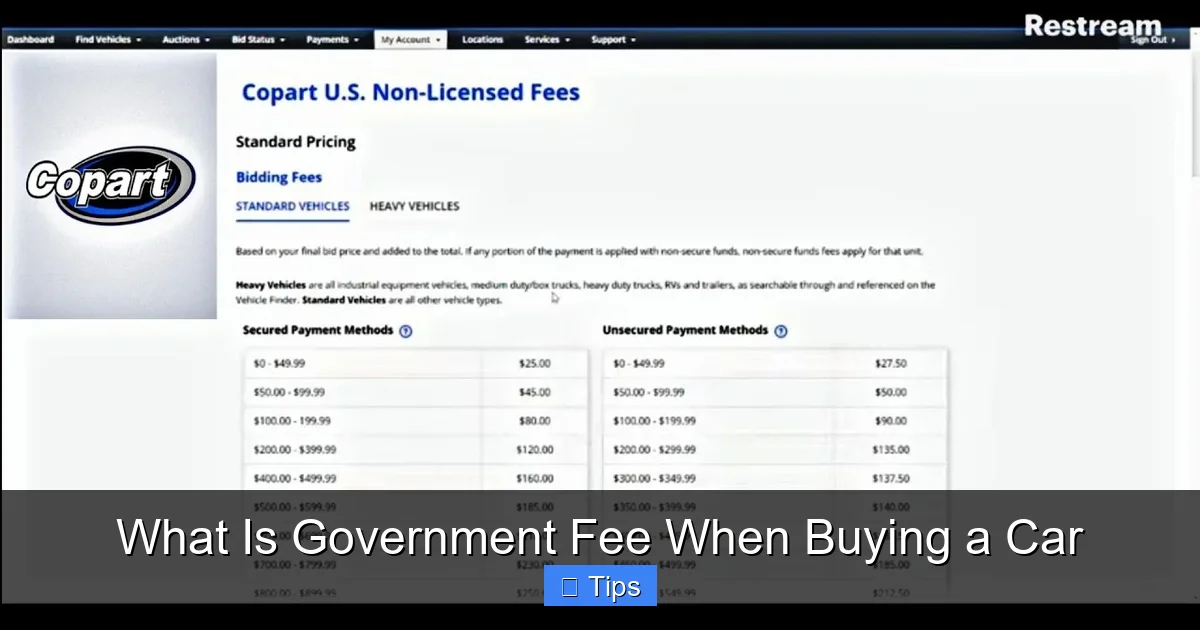

Visual guide about What Is Government Fee When Buying a Car

Image source: copartfeecalculators.com

Most buyers don’t pay government fees directly to the DMV. Instead, dealerships collect them at the time of purchase and submit the payments on your behalf. This streamlines the process but introduces room for confusion—or error.

Itemized Fees on Your Contract

When you sign your purchase agreement, you should receive a detailed breakdown of all charges. Look for line items labeled “Registration,” “Title,” “Tax,” and “DMV Fees.” If anything is lumped together under “miscellaneous” or “processing,” ask for clarification.

Reputable dealers will provide transparent pricing. But some may inflate fees slightly to cover administrative costs—though this is technically not allowed in many states. For example, California prohibits dealers from charging more than the actual government fee plus a small handling charge (usually $5–$10).

Tips for Verifying Fees

To avoid overpaying:

– Cross-check fees with your state’s official DMV website.

– Ask for a copy of the fee schedule used by the dealer.

– Compare quotes from multiple dealerships—even within the same state, fees can differ.

– If buying online or out of state, confirm who pays the fees and how they’re calculated.

Remember: You have the right to pay government fees directly if you prefer. Some buyers choose to handle registration themselves to ensure accuracy, especially if they’re familiar with the process.

Financing and Government Fees

Can you roll government fees into your auto loan? In most cases, yes—but it’s not always wise. While rolling fees into financing spreads the cost over time, it also increases your loan amount and total interest paid. For example, adding $1,000 in fees to a 5-year loan at 5% APR costs an extra ~$130 in interest.

If possible, pay fees upfront with cash or a separate check. This keeps your loan balance lower and may help you qualify for better rates.

How to Estimate and Budget for Government Fees

The best way to avoid surprise costs is to estimate government fees before you shop. Here’s how:

Use Online Calculators

Most state DMV websites offer free fee calculators. Simply enter your vehicle’s make, model, year, and purchase price (or trade-in value), and the tool will estimate registration, title, and tax costs. Some even factor in local tax rates based on your ZIP code.

For example, the Texas DMV’s “Registration Fee Estimator” lets you input your vehicle weight and county to get a precise quote. California’s “Vehicle Registration Fee Calculator” includes smog and CHP fees.

Ask the Dealer Early

During negotiations, ask the salesperson for a full fee breakdown. A good dealer will provide this without hesitation. If they seem evasive, it could be a red flag.

You can also call the dealership’s finance department ahead of time and request an estimate based on a hypothetical purchase. This gives you leverage during negotiations and helps you compare total out-the-door prices across dealers.

Factor Fees Into Your Total Cost

When comparing cars, don’t just look at the sticker price. Calculate the “total cost of ownership” including:

– Purchase price

– Trade-in value

– Sales/use tax

– Registration and title fees

– Inspection costs

– Financing interest

This holistic view prevents you from falling in love with a “cheap” car that ends up costing more after fees.

Set Aside a Buffer

Even with careful planning, unexpected fees can arise—especially if you’re moving to a new state or buying a specialty vehicle. Experts recommend setting aside 5–10% of the car’s purchase price as a buffer for government and administrative costs.

For a $30,000 car, that’s $1,500–$3,000—more than enough to cover most fee scenarios.

Common Mistakes to Avoid

Even savvy buyers can stumble when it comes to government fees. Here are pitfalls to watch for:

Assuming All Fees Are the Same

Don’t assume fees from your last car purchase apply to your new one. A used compact car has very different fee implications than a new luxury SUV. Always recalculate.

Ignoring Local Tax Rates

Sales tax isn’t just a state rate—it often includes county, city, and special district taxes. A 6% state tax might become 8.5% in your hometown. Use your exact address (not just city) when estimating.

Overlooking Trade-In Deductions

If your state allows trade-in deductions from taxable value, make sure the dealer applies it correctly. Failing to do so could cost you hundreds in unnecessary tax.

Paying Fees Without Verification

Never accept a lump-sum “DMV fee” without an itemized breakdown. Request documentation and verify each charge against official sources.

Forgetting Renewal Costs

Government fees aren’t one-time. Registration renewals, wheel taxes, and inspection re-tests recur annually. Factor these into your long-term budget.

Conclusion

Understanding what is government fee when buying a car is essential for any smart car buyer. These mandatory charges—covering registration, title, taxes, and inspections—can significantly impact your total cost, often adding hundreds or even thousands of dollars to your purchase. While they may seem like a bureaucratic hassle, they fund vital services that keep our roads safe and functional.

The key takeaway? Don’t treat government fees as an afterthought. Research them early, compare them across dealers and locations, and budget accordingly. Use online tools, ask questions, and always request itemized breakdowns. By doing so, you’ll avoid surprises, negotiate from a position of knowledge, and drive away with not just a great car—but peace of mind.

Remember, the cheapest car on the lot isn’t always the best deal once fees are factored in. Take the time to understand the full picture, and you’ll make a decision that’s financially sound and legally compliant. Happy driving!

Frequently Asked Questions

What is included in government fees when buying a car?

Government fees typically include registration, title, sales or use tax, and sometimes emissions or safety inspection costs. These are mandatory charges set by state and local authorities to legally operate your vehicle.

Are government fees the same in every state?

No, government fees vary widely by state, county, and even city. Factors like vehicle value, weight, age, and local tax rates all influence the total amount you’ll pay.

Can I avoid paying government fees when buying a car?

No, these fees are legally required. However, you can minimize costs by choosing a lower-tax state, trading in your old car (if allowed), or selecting a vehicle with lower registration fees.

Do dealerships mark up government fees?

Most states prohibit dealers from charging more than the actual government fee plus a small handling charge. Always request an itemized breakdown to ensure transparency.

Are electric vehicles exempt from government fees?

Not usually. Many states actually charge higher registration fees for EVs to compensate for lost gas tax revenue, even though they produce fewer emissions.

How can I estimate government fees before buying a car?

Use your state DMV’s online fee calculator, enter your vehicle details and location, and review the estimated costs. You can also ask dealerships for a detailed fee quote during negotiations.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.