An insurance company totals a car when repair costs exceed a set percentage of its actual cash value—typically 70% to 100%, depending on state rules and policy terms. This decision helps insurers manage risk and costs while ensuring fair compensation for policyholders.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 When Does an Insurance Company Total a Car? A Complete Guide

- 4 What Does “Totaled” Actually Mean?

- 5 How Do Insurers Decide to Total a Car?

- 6 Factors That Influence the Total Loss Decision

- 7 What Happens After Your Car Is Declared Totaled?

- 8 How to Dispute a Total Loss Decision

- 9 Tips to Navigate the Total Loss Process

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 How is a car’s value determined after an accident?

- 11.2 Can I drive my car if it’s declared totaled?

- 11.3 What if I disagree with the insurance payout amount?

- 11.4 Does gap insurance help if my car is totaled?

- 11.5 Can I keep my totaled car and still get paid?

- 11.6 How long does it take to get a total loss payout?

Key Takeaways

- Total loss threshold varies by state: Most states define a totaled car when repair costs reach 70–100% of the vehicle’s actual cash value (ACV).

- Actual Cash Value (ACV) is key: Insurers base their decision on the car’s pre-accident market value, not the original purchase price.

- Salvage value matters: If the damaged car can be sold for parts or scrap, that value is subtracted from your payout.

- Your policy type affects the outcome: Comprehensive, collision, and liability coverage each handle total loss differently.

- You may keep the car in some cases: In certain states, you can buy back your totaled vehicle as “salvage” and repair it yourself.

- Document everything: Photos, repair estimates, and communication with your insurer help ensure a fair evaluation.

- Know your rights: You can dispute the insurer’s valuation using independent appraisals or comparable vehicle listings.

📑 Table of Contents

- When Does an Insurance Company Total a Car? A Complete Guide

- What Does “Totaled” Actually Mean?

- How Do Insurers Decide to Total a Car?

- Factors That Influence the Total Loss Decision

- What Happens After Your Car Is Declared Totaled?

- How to Dispute a Total Loss Decision

- Tips to Navigate the Total Loss Process

- Conclusion

When Does an Insurance Company Total a Car? A Complete Guide

Imagine this: You’re driving home from work on a rainy Tuesday, and suddenly—bam!—another driver runs a red light and T-bones your car. The damage is severe. Your airbags deployed, the frame is bent, and the engine won’t turn over. You’re shaken but unharmed, which is the most important thing. But now comes the next big question: Will your insurance company declare your car a total loss?

This is a common scenario for thousands of drivers every year. And while it’s stressful, understanding how insurers decide whether to repair or total a vehicle can save you time, money, and frustration. The process isn’t always straightforward, and it depends on a mix of state laws, your insurance policy, and the specific condition of your car after the accident. But one thing is clear: knowing when an insurance company totals a car empowers you to make informed decisions and advocate for yourself during a vulnerable time.

What Does “Totaled” Actually Mean?

Before diving into the specifics, let’s clarify what “totaled” really means. When an insurance company says a car is “totaled,” they’re not using casual slang—they’re making a formal declaration that the vehicle is a total loss. This doesn’t necessarily mean the car is completely destroyed. In fact, many totaled cars are still drivable. What it means is that the cost to repair the vehicle exceeds a certain threshold compared to its value before the accident.

Visual guide about When Does an Insurance Company Total a Car

Image source: elmersautobody.com

The Legal Definition of a Total Loss

Each state has its own legal definition of a total loss, but most follow one of two models:

- Total Loss Threshold (TLT): The repair cost must exceed a set percentage (e.g., 70%, 75%, or 100%) of the car’s actual cash value (ACV).

- Total Loss Formula (TLF): The repair cost plus the salvage value (what the damaged car can be sold for) exceeds the ACV.

For example, in California, a car is considered totaled if the repair cost is 75% or more of its ACV. In contrast, in Texas, the threshold is 100%—meaning the repair cost must equal or exceed the full value of the car. This variation is why it’s crucial to know your state’s rules.

Why Do Insurers Total Cars?

Insurance companies aren’t trying to be difficult—they’re managing risk and costs. Repairing a severely damaged car can be expensive, and if the repairs aren’t done perfectly, the vehicle may have hidden safety issues. By totaling the car, insurers avoid liability for future problems and streamline the claims process. Plus, they can recover some value by selling the salvage to a recycler or parts dealer.

How Do Insurers Decide to Total a Car?

So, how exactly do insurance adjusters determine whether your car is totaled? It’s not just a gut feeling—there’s a structured process involving inspections, estimates, and calculations. Here’s how it typically works.

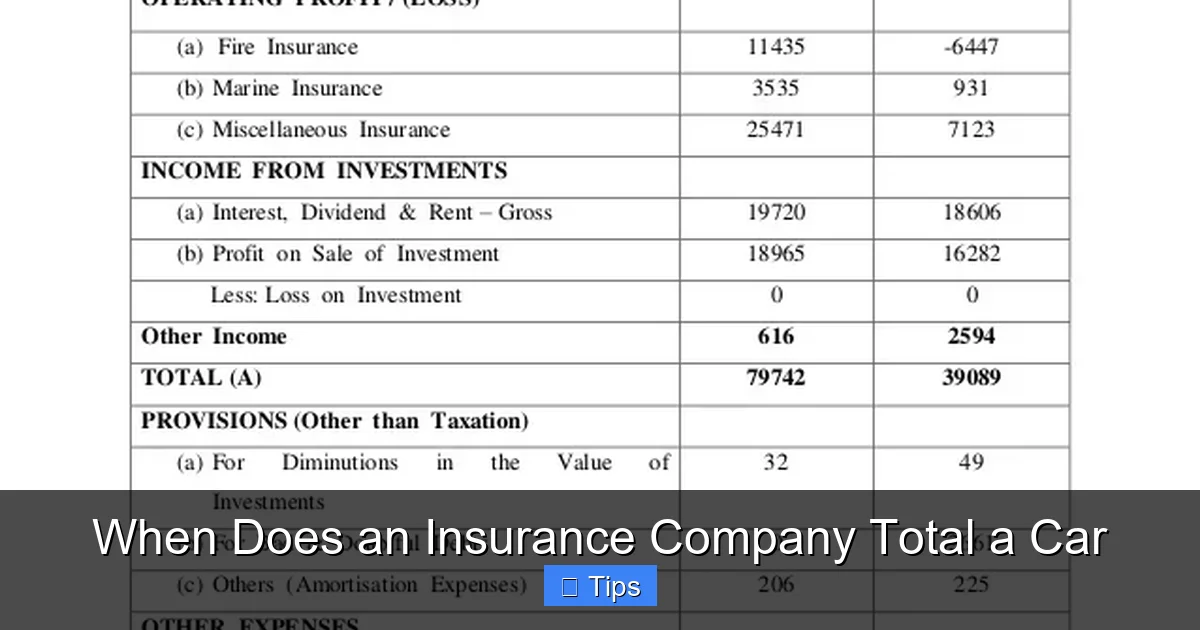

Visual guide about When Does an Insurance Company Total a Car

Image source: growappalachia.berea.edu

Step 1: The Insurance Inspection

After you file a claim, an insurance adjuster will inspect your vehicle. This might happen at a repair shop, a drive-in claims center, or even at your home. The adjuster looks for visible damage, checks the vehicle’s history (using tools like Carfax), and assesses whether the car is safe to drive.

During the inspection, the adjuster will also take photos and note any pre-existing damage. This is important because insurers only pay for damage caused by the recent accident—not for old dents or worn brakes.

Step 2: Getting Repair Estimates

Next, the adjuster (or a trusted repair shop) will generate a detailed estimate of the repair costs. This includes parts, labor, paint, and any necessary frame straightening or electronics recalibration. Modern cars are packed with sensors and safety systems, so even minor collisions can lead to high repair bills.

For example, replacing a front bumper on a newer SUV might cost $1,500, but if the radar sensor for adaptive cruise control is damaged, that could add another $800. These hidden costs can quickly push a repair estimate over the total loss threshold.

Step 3: Calculating Actual Cash Value (ACV)

This is where things get technical. The insurer will determine your car’s Actual Cash Value—its market value just before the accident. They use databases like Kelley Blue Book (KBB), National Automobile Dealers Association (NADA), or CCC One to find comparable vehicles in your area.

Factors that affect ACV include:

- Mileage

- Age of the vehicle

- Condition (excellent, good, fair)

- Trim level and options (e.g., leather seats, sunroof)

- Local market demand

Let’s say your 2018 Honda Accord has 60,000 miles and is in good condition. The insurer finds three similar cars for sale locally at $18,000, $17,500, and $18,200. They might average these to determine your ACV at $17,900.

Step 4: Applying the Total Loss Formula

Now comes the math. Using your state’s rules, the insurer compares the repair estimate to the ACV.

Example (California, 75% threshold):

- Repair estimate: $14,000

- ACV: $17,900

- 75% of ACV: $13,425

Since $14,000 > $13,425, the car is declared a total loss.

In a state with a 100% threshold (like Texas), the same car would not be totaled because $14,000 is less than $17,900. The insurer would approve repairs instead.

Factors That Influence the Total Loss Decision

While the formula seems straightforward, several real-world factors can influence whether your car is totaled. Understanding these can help you anticipate the outcome and prepare accordingly.

Visual guide about When Does an Insurance Company Total a Car

Image source: image.slidesharecdn.com

Vehicle Age and Value

Older or low-value cars are more likely to be totaled. Why? Because even minor damage can exceed a high percentage of their worth. For instance, a 15-year-old sedan worth $3,000 might be totaled if repairs cost $2,500—that’s over 80% of its value.

Conversely, luxury or high-end vehicles often have higher repair costs due to specialized parts and labor, but their higher ACV can keep them below the total loss threshold.

Type of Damage

Not all damage is equal in the eyes of an insurer. Structural damage—like a bent frame or compromised unibody—is often more expensive to fix and harder to do safely. This type of damage is a strong indicator that a car will be totaled.

On the other hand, cosmetic damage (dents, scratches) or minor mechanical issues might be cheaper to repair, increasing the chance the car will be fixed rather than totaled.

Availability of Parts

If your car is rare, discontinued, or imported, finding replacement parts can be difficult and costly. Insurers may total the vehicle simply because the repair timeline is too long or the parts aren’t available.

For example, a vintage Porsche or a limited-edition Japanese import might be totaled after a minor collision simply because OEM (original equipment manufacturer) parts are backordered for months.

Your Insurance Policy

Your coverage type plays a big role. If you only have liability insurance, your insurer won’t pay for your car’s damage at all—so the question of totaling doesn’t apply. But if you have collision or comprehensive coverage, your policy will cover repairs or a total loss payout, minus your deductible.

Some policies also include “diminished value” coverage, which compensates you if your car’s resale value drops after repairs—even if it’s not totaled. This is rare but worth asking about.

What Happens After Your Car Is Declared Totaled?

Once your insurer declares your car a total loss, the process shifts from repair to settlement. Here’s what you can expect.

Receiving Your Payout

The insurer will offer you a settlement based on the ACV minus your deductible and any salvage value they expect to recover. For example:

- ACV: $17,900

- Deductible: $500

- Estimated salvage value: $2,000

- Payout: $17,900 – $500 – $2,000 = $15,400

This is the amount you’ll receive to buy a replacement vehicle.

Salvage Title and What It Means

When a car is totaled, it receives a salvage title. This is a red flag to future buyers and insurers that the vehicle has been severely damaged. If you choose to keep the car (more on that below), you’ll need to rebuild it and pass a state inspection to get a rebuilt title.

A salvage title can reduce a car’s resale value by 20–40%, even if it’s been fully repaired. Some insurers won’t cover salvage-title vehicles at all, or they’ll charge much higher premiums.

Can You Keep Your Totaled Car?

In many states, you have the option to buy back your totaled vehicle from the insurer. This is called “retaining the salvage.” You’ll receive a reduced payout (the ACV minus the salvage value), and the insurer will transfer the title to you with a salvage designation.

This makes sense if:

- You’re a DIY mechanic and can repair the car yourself

- The car has sentimental value

- You plan to use it for parts or as a project vehicle

But be cautious: Driving a salvage-title car can be risky if it’s not properly repaired. And if you finance the car, your lender may not allow you to keep it.

How to Dispute a Total Loss Decision

What if you disagree with your insurer’s decision? Maybe you think they undervalued your car or overestimated repair costs. You have rights, and there are steps you can take.

Gather Evidence

Start by collecting documentation that supports a higher ACV. This includes:

- Recent maintenance records

- Photos of the car in good condition

- Listings of similar vehicles for sale (with lower mileage or better features)

- Receipts for aftermarket upgrades (e.g., new tires, stereo system)

Present this to your adjuster and request a reevaluation.

Get an Independent Appraisal

If the insurer won’t budge, you can hire an independent appraiser. Some states require insurers to accept a licensed appraiser’s valuation. Even if not required, a professional opinion can strengthen your case.

File a Complaint

If you believe the insurer is acting in bad faith, you can file a complaint with your state’s insurance department. Regulators can investigate and mediate disputes.

Dealing with a totaled car is never fun, but these practical tips can make the process smoother.

Act Quickly

Don’t delay filing your claim. Most policies require prompt reporting, and the longer you wait, the harder it may be to prove the extent of the damage.

Document Everything

Take photos of the accident scene, your injuries (if any), and the damage from multiple angles. Keep copies of all communications with your insurer, including emails and claim numbers.

Know Your State’s Rules

Research your state’s total loss threshold and title laws. This knowledge helps you understand what to expect and advocate for yourself.

Negotiate the Settlement

Insurers often start with a low offer. Don’t accept the first number. Use comparable vehicle listings and your documentation to negotiate a fair payout.

Consider Gap Insurance

If you owe more on your car loan than it’s worth, gap insurance can cover the difference. Without it, you could be stuck paying thousands out of pocket after a total loss.

Conclusion

So, when does an insurance company total a car? The answer depends on a mix of state laws, your car’s value, repair costs, and your insurance policy. In most cases, a car is totaled when the cost to fix it exceeds 70% to 100% of its actual cash value. While the process can feel overwhelming, understanding how it works gives you the power to make smart decisions, protect your financial interests, and move forward with confidence.

Remember: A totaled car doesn’t have to be the end of the road. With the right knowledge and preparation, you can navigate the claims process, get a fair settlement, and find your next reliable ride. Stay informed, stay proactive, and don’t be afraid to ask questions—your insurer works for you.

Frequently Asked Questions

How is a car’s value determined after an accident?

Insurers use tools like Kelley Blue Book and NADA to assess a car’s actual cash value (ACV) based on age, mileage, condition, and local market prices. They compare your vehicle to similar models for sale in your area.

Can I drive my car if it’s declared totaled?

Technically yes, but it’s not recommended unless it’s been properly repaired and inspected. A totaled car may have hidden safety issues, and driving it could be illegal or void your insurance.

What if I disagree with the insurance payout amount?

You can dispute the valuation by providing evidence of your car’s higher value, such as recent upgrades or lower-mileage comparables. You may also request an independent appraisal.

Does gap insurance help if my car is totaled?

Yes. Gap insurance covers the difference between your car’s ACV and what you owe on your loan or lease, so you’re not stuck paying the balance out of pocket.

Can I keep my totaled car and still get paid?

In many states, yes. You can “retain the salvage” and receive a reduced payout equal to the ACV minus the estimated salvage value. The car will then have a salvage title.

How long does it take to get a total loss payout?

Most insurers issue a settlement within 5 to 10 business days after declaring a total loss, assuming all paperwork is complete and there are no disputes.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.