Car insurance in Texas is among the most expensive in the U.S., with drivers paying well above the national average. This high cost stems from a mix of factors including frequent severe weather, high traffic density, rising vehicle repair expenses, and a litigious culture that drives up claims. Understanding these causes can help Texas drivers make smarter choices and find ways to reduce their premiums.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Why Is Car Insurance So Expensive in Texas?

- 4 Severe Weather and Natural Disasters

- 5 High Population and Traffic Density

- 6 Rising Vehicle Repair and Medical Costs

- 7 Litigation Culture and Lawsuit Risks

- 8 Uninsured and Underinsured Drivers

- 9 Insurance Fraud and Staged Accidents

- 10 State Regulations and Minimum Coverage Requirements

- 11 How to Save on Car Insurance in Texas

- 12 Conclusion

- 13 Frequently Asked Questions

- 13.1 Why is car insurance so expensive in Texas compared to other states?

- 13.2 Does where I live in Texas affect my car insurance rates?

- 13.3 Is comprehensive coverage worth it in Texas?

- 13.4 How can I lower my car insurance premium in Texas?

- 13.5 Why do I need uninsured motorist coverage in Texas?

- 13.6 Are car insurance rates going up in Texas?

Key Takeaways

- Severe weather increases claims: Texas faces hurricanes, hailstorms, and flooding, leading to more comprehensive claims and higher premiums.

- High population and traffic density: Urban areas like Houston and Dallas have heavy traffic, increasing accident risks and insurance costs.

- Rising vehicle repair and medical costs: Modern cars with advanced tech cost more to fix, and medical expenses inflate bodily injury claims.

- Litigation culture drives up costs: Texas allows lawsuits for car accidents, leading to higher settlements and increased liability coverage needs.

- Uninsured and underinsured drivers: Over 14% of Texas drivers lack insurance, forcing insurers to charge more to cover potential losses.

- Insurance fraud adds to expenses: Staged accidents and false claims increase costs for all policyholders.

- State regulations and minimum coverage: Texas requires higher minimum liability limits than some states, contributing to baseline premium costs.

📑 Table of Contents

- Why Is Car Insurance So Expensive in Texas?

- Severe Weather and Natural Disasters

- High Population and Traffic Density

- Rising Vehicle Repair and Medical Costs

- Litigation Culture and Lawsuit Risks

- Uninsured and Underinsured Drivers

- Insurance Fraud and Staged Accidents

- State Regulations and Minimum Coverage Requirements

- How to Save on Car Insurance in Texas

- Conclusion

Why Is Car Insurance So Expensive in Texas?

If you’ve ever shopped for car insurance in Texas, you’ve probably noticed something: the prices are steep. In fact, Texas consistently ranks among the top five most expensive states for auto insurance in the U.S. According to recent data from the National Association of Insurance Commissioners (NAIC), the average annual premium in Texas is over $2,000—nearly 30% higher than the national average.

So why is car insurance so expensive in Texas? It’s not just one thing. Instead, it’s a perfect storm of factors that drive up costs for insurers—and those costs get passed on to you, the driver. From unpredictable weather to high population density and a culture of litigation, Texas presents unique challenges that make insuring a vehicle more costly than in many other states.

But understanding these factors isn’t just about frustration—it’s about empowerment. When you know what’s driving up your premiums, you can make smarter decisions. Whether it’s choosing the right coverage, improving your driving record, or shopping around for better rates, knowledge is your best tool for saving money.

Severe Weather and Natural Disasters

Visual guide about Why Is Car Insurance So Expensive in Texas

Image source: bluehighways.net

One of the biggest reasons car insurance is expensive in Texas is the state’s vulnerability to extreme weather. Texas isn’t just big—it’s diverse. From the Gulf Coast to the Panhandle, the state experiences hurricanes, tornadoes, hailstorms, flooding, and even winter storms. Each of these events can cause massive damage to vehicles, leading to a surge in insurance claims.

Hailstorms: A Texas Tragedy for Car Owners

Hailstorms are especially notorious in Texas. Cities like Dallas, Fort Worth, and San Antonio are part of “Hail Alley,” a region that sees some of the most frequent and severe hailstorms in the country. In 2021 alone, a single hailstorm in North Texas caused over $1.5 billion in vehicle damage. That’s not a typo—$1.5 billion.

When thousands of cars are damaged in a single storm, insurance companies face enormous payouts. To prepare for future events, they raise premiums across the board. Even if your car wasn’t damaged, you’re still paying for the risk. Comprehensive coverage—which pays for non-collision damage like hail—is a must in Texas, but it’s also one of the priciest parts of your policy.

Hurricanes and Flooding

The Gulf Coast, including Houston and Galveston, is no stranger to hurricanes. Hurricane Harvey in 2017 caused catastrophic flooding, submerging tens of thousands of vehicles. Many of those cars were declared total losses, costing insurers hundreds of millions of dollars.

Flood damage isn’t covered under standard collision or liability policies—only comprehensive coverage protects against it. But because flooding is so common in parts of Texas, insurers factor that risk into their pricing. If you live near the coast or in a flood-prone area, your comprehensive premium will be significantly higher.

Winter Storms and Icy Roads

Even winter weather can drive up costs. The 2021 winter storm Uri left much of Texas without power and caused icy roads that led to hundreds of accidents. While snow is rare, ice and freezing rain can create dangerous driving conditions, especially since many Texas drivers aren’t accustomed to winter driving.

These sudden weather events increase the likelihood of accidents and vehicle damage, prompting insurers to adjust rates accordingly. Even if you live in a milder part of the state, you’re still part of the statewide risk pool.

High Population and Traffic Density

Visual guide about Why Is Car Insurance So Expensive in Texas

Image source: insurancepanda.com

Texas is the second-most populous state in the U.S., with over 30 million residents. And many of them live in major metropolitan areas like Houston, Dallas, San Antonio, and Austin. These cities are hubs of economic activity, but they’re also hotspots for traffic congestion, accidents, and insurance claims.

Urban Traffic Increases Accident Risk

More people mean more cars on the road. In cities like Houston, drivers spend an average of over 60 hours per year stuck in traffic. That’s a lot of time behind the wheel—and a lot of opportunities for fender benders, rear-end collisions, and other accidents.

High traffic density doesn’t just increase the chance of minor accidents. It also raises the risk of serious collisions, especially during rush hour. And when accidents happen in densely populated areas, the likelihood of multiple vehicles being involved—and of injuries occurring—goes up.

Insurance companies know this. They use location as a major factor in determining premiums. If you live in a busy city, your rates will likely be higher than someone in a rural area, even if you have a clean driving record.

Commuting Distances and Vehicle Use

Texans also tend to drive long distances. Whether it’s commuting from the suburbs to downtown or traveling between cities for work, many residents log high annual mileage. The more you drive, the greater your exposure to risk.

Insurance companies charge more for drivers who use their vehicles frequently. If you drive more than 12,000 miles a year, you’ll likely pay a higher premium than someone who drives less. And in sprawling cities like Dallas or Houston, long commutes are the norm—not the exception.

Rising Vehicle Repair and Medical Costs

Visual guide about Why Is Car Insurance So Expensive in Texas

Image source: insurancefortexans.com

Even if you avoid severe weather and heavy traffic, the cost of fixing a car—or treating injuries—has gone up dramatically in recent years. These rising expenses directly impact insurance premiums across the board.

Modern Cars Are More Expensive to Repair

Today’s vehicles are packed with advanced technology: sensors, cameras, lane-departure warnings, automatic emergency braking, and more. While these features improve safety, they also make repairs more complex and costly.

For example, a minor fender bender that once required a new bumper and paint job might now involve recalibrating a dozen sensors and replacing a camera system. A simple repair can easily cost thousands of dollars.

Insurance companies have to account for these higher repair costs when setting rates. Even a small accident can result in a large claim, so premiums go up to cover the increased risk.

Medical Inflation and Bodily Injury Claims

Medical costs in the U.S. have been rising for decades, and Texas is no exception. When someone is injured in a car accident, the cost of treatment—emergency room visits, surgeries, physical therapy, and ongoing care—can be astronomical.

Bodily injury liability coverage pays for these expenses when you’re at fault in an accident. But because medical costs are so high, even a moderate injury can lead to a claim worth tens of thousands of dollars.

Texas requires drivers to carry at least $30,000 in bodily injury coverage per person and $60,000 per accident. But many experts recommend higher limits, especially in a state with high medical costs. The more coverage you carry, the higher your premium—but the better protected you are.

Litigation Culture and Lawsuit Risks

Texas has a reputation for being a litigious state—and that extends to car accidents. Unlike some states that have no-fault insurance systems, Texas follows a traditional “at-fault” model. That means the driver responsible for an accident can be sued for damages, including pain and suffering.

High Settlement and Jury Award Trends

In Texas, juries have awarded massive settlements in personal injury cases. High-profile lawsuits involving car accidents have resulted in payouts in the millions. While these are extreme cases, they set a precedent that insurers must prepare for.

Even if you’re not sued directly, the threat of litigation increases the cost of doing business for insurance companies. They build in a buffer to cover potential legal fees and large settlements, and that buffer gets passed on to consumers.

The Role of Personal Injury Attorneys

Texas has a large number of personal injury lawyers who actively advertise for car accident cases. Billboards, TV commercials, and online ads encourage drivers to “call now” after an accident. This culture of legal action means more claims are filed, and more are pursued aggressively.

Insurance companies respond by raising premiums to cover the increased likelihood of lawsuits. Even if you’re not at fault, you’re still part of a system where legal costs are high.

Uninsured and Underinsured Drivers

Another major factor driving up car insurance costs in Texas is the high number of uninsured drivers. According to the Insurance Research Council, over 14% of Texas motorists don’t have auto insurance—one of the highest rates in the nation.

The Cost of Covering the Uninsured

When an uninsured driver causes an accident, the injured party often turns to their own insurance company for compensation—especially if they have uninsured motorist (UM) coverage. This shifts the financial burden from the at-fault driver (who has no insurance) to the victim’s insurer.

To protect themselves, insurance companies charge higher premiums to all policyholders to cover the risk of uninsured drivers. It’s a form of collective risk pooling: everyone pays a little more so that victims aren’t left footing the bill.

Underinsured Motorist Coverage Is Essential

Even more common than uninsured drivers are underinsured drivers—those who have insurance, but not enough to cover the full cost of an accident. If someone with minimum coverage causes a serious crash, their policy might only pay $30,000, but the actual damages could be $100,000 or more.

That’s where underinsured motorist (UIM) coverage comes in. It kicks in when the at-fault driver’s insurance isn’t enough. But like UM coverage, UIM adds to your premium. In Texas, where many drivers carry only the minimum required coverage, UIM is a smart—but costly—addition.

Insurance Fraud and Staged Accidents

Insurance fraud is a hidden but significant driver of high premiums in Texas. Fraudulent claims cost the industry billions each year, and those costs are passed on to honest policyholders.

Staged Accidents and “Swoop and Squat” Schemes

One common fraud tactic in Texas is the “swoop and squat” scheme. In this scam, two or more cars work together to cause a collision. One car (the “squat” car) drives in front of the victim and suddenly brakes. The other car (the “swoop” car) cuts in, forcing the victim to rear-end the squat car.

The fraudsters then file exaggerated injury claims, often with the help of corrupt medical providers. These claims can cost insurers tens of thousands of dollars—even when no real injury occurred.

Exaggerated Injury Claims

Even in legitimate accidents, some people inflate their injuries to get larger settlements. Soft tissue injuries like whiplash are hard to prove or disprove, making them a favorite target for fraud.

Insurance companies use investigators and data analytics to detect fraud, but it’s an ongoing battle. The more fraud they encounter, the more they raise premiums to cover losses.

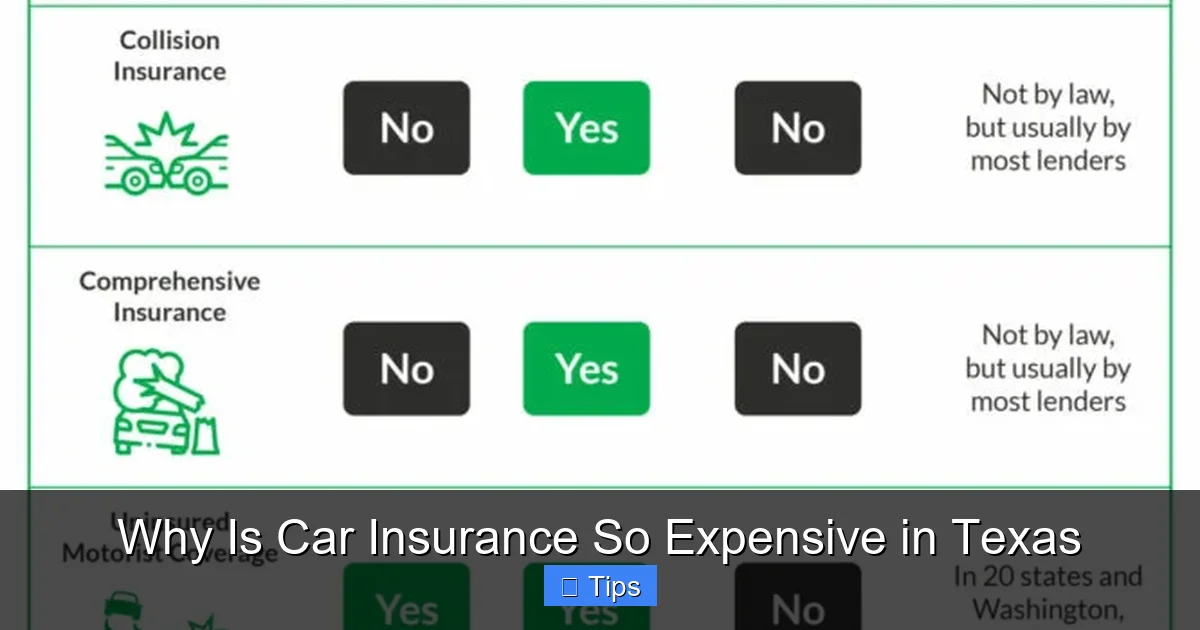

State Regulations and Minimum Coverage Requirements

Texas has specific laws that affect how much you pay for car insurance. While the state doesn’t set premium rates directly, its regulations influence the baseline cost of coverage.

Higher Minimum Liability Limits

Texas requires drivers to carry at least:

– $30,000 for bodily injury per person

– $60,000 for bodily injury per accident

– $25,000 for property damage

These are higher than the minimums in many other states. For example, some states only require $15,000 per person for bodily injury. Higher minimums mean higher baseline premiums, even for basic coverage.

Mandatory Proof of Insurance

Texas law requires drivers to carry proof of insurance and show it during traffic stops or after an accident. While this helps reduce uninsured driving, it also means insurers must verify coverage more rigorously, adding administrative costs.

No-Fault vs. At-Fault Systems

Unlike no-fault states (like Florida or Michigan), Texas uses an at-fault system. That means the driver responsible for an accident pays for the damages. This system can lead to more disputes and lawsuits, increasing administrative and legal costs for insurers.

How to Save on Car Insurance in Texas

Despite these challenges, there are ways to reduce your car insurance costs in Texas. Here are some practical tips:

Shop Around and Compare Quotes

Insurance rates vary widely between companies. A policy that costs $1,800 with one insurer might be $1,400 with another. Get quotes from at least three different companies—including national brands and local insurers—before making a decision.

Maintain a Clean Driving Record

Your driving history is one of the biggest factors in your premium. Avoid speeding tickets, accidents, and DUIs. Many insurers offer safe driver discounts for those with no violations over a certain period.

Increase Your Deductible

Raising your deductible—the amount you pay out of pocket before insurance kicks in—can lower your premium. Just make sure you can afford the higher deductible if you need to file a claim.

Bundling Policies

Many insurers offer discounts if you bundle your auto insurance with home, renters, or life insurance. This can save you 10–25% on your total premium.

Take Advantage of Discounts

Ask your insurer about available discounts. Common ones include:

– Good student discounts

– Low-mileage discounts

– Defensive driving course discounts

– Anti-theft device discounts

– Paperless billing or automatic payment discounts

Consider Usage-Based Insurance

Some companies offer telematics programs that track your driving habits through a smartphone app or device. If you drive safely and infrequently, you could earn significant discounts.

Review Your Coverage Annually

Your insurance needs change over time. If you’ve paid off your car or no longer drive frequently, you might be able to adjust your coverage and save money.

Conclusion

So, why is car insurance so expensive in Texas? The answer is complex, but it boils down to a combination of environmental risks, population density, rising costs, legal factors, and systemic challenges like uninsured drivers and fraud.

While you can’t control the weather or the number of lawsuits in your state, you can take steps to protect yourself and reduce your premiums. By understanding the factors that drive up costs, shopping around for the best rates, and taking advantage of discounts, you can find affordable coverage that meets your needs.

Remember, cheap insurance isn’t always the best insurance. Make sure you’re adequately protected—especially in a state as unpredictable as Texas. A little knowledge and proactive planning can go a long way in keeping your car insurance costs manageable.

Frequently Asked Questions

Why is car insurance so expensive in Texas compared to other states?

Car insurance is expensive in Texas due to a combination of severe weather, high traffic density, rising repair and medical costs, a litigious culture, and a high number of uninsured drivers. These factors increase the risk and cost of claims, leading to higher premiums for all drivers.

Does where I live in Texas affect my car insurance rates?

Yes, your location plays a major role. Urban areas like Houston, Dallas, and San Antonio have higher premiums due to traffic congestion and accident rates. Rural areas may have lower rates, but severe weather risks can still drive up costs.

Is comprehensive coverage worth it in Texas?

Absolutely. Given Texas’s frequent hailstorms, hurricanes, and flooding, comprehensive coverage is essential. It protects your vehicle from non-collision damage and can save you thousands in repair costs.

You can lower your premium by maintaining a clean driving record, increasing your deductible, bundling policies, taking advantage of discounts, and shopping around for quotes from multiple insurers.

Why do I need uninsured motorist coverage in Texas?

Over 14% of Texas drivers are uninsured. If one of them hits you, uninsured motorist coverage pays for your damages. Without it, you could be left with expensive bills and no way to recover.

Are car insurance rates going up in Texas?

Yes, rates have been rising due to inflation, higher vehicle repair costs, increased claims frequency, and natural disasters. Staying informed and reviewing your policy annually can help you manage these increases.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.