A declaration page for car insurance is a one-page summary of your policy that includes key details like coverage types, limits, premiums, and effective dates. It’s essential for understanding your protection, filing claims, and proving coverage when needed.

[FEATURED_IMAGE_PLACEHODEL]

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 What Is a Declaration Page for Car Insurance?

- 4 Why the Declaration Page Matters

- 5 What’s Included on a Declaration Page?

- 6 How to Read and Understand Your Declaration Page

- 7 When You’ll Need Your Declaration Page

- 8 Common Mistakes to Avoid

- 9 How to Get a Copy of Your Declaration Page

- 10 Tips for Managing Your Declaration Page

- 11 Conclusion

- 12 Frequently Asked Questions

- 12.1 What is a declaration page for car insurance?

- 12.2 Do I need to carry my declaration page in my car?

- 12.3 How often should I review my declaration page?

- 12.4 Can I get a copy of my declaration page online?

- 12.5 What if there’s an error on my declaration page?

- 12.6 Does the declaration page include my full insurance policy?

Key Takeaways

- What It Is: The declaration page is a snapshot of your car insurance policy, showing who’s covered, what’s covered, and how much it costs.

- Why It Matters: It’s your go-to document for verifying coverage, filing claims, and meeting legal requirements like proof of insurance.

- Key Information Included: Your name, vehicle details, policy number, coverage types, deductibles, limits, and premium amount.

- When You’ll Need It: During accidents, traffic stops, renewals, or when adding a new driver or vehicle to your policy.

- How to Access It: Available online through your insurer’s portal, via email, or by calling customer service.

- Common Mistakes to Avoid: Not reviewing it regularly, missing updates after life changes, or assuming all coverage is included.

- Pro Tip: Keep a digital and printed copy in your glove compartment for quick access in emergencies.

📑 Table of Contents

- What Is a Declaration Page for Car Insurance?

- Why the Declaration Page Matters

- What’s Included on a Declaration Page?

- How to Read and Understand Your Declaration Page

- When You’ll Need Your Declaration Page

- Common Mistakes to Avoid

- How to Get a Copy of Your Declaration Page

- Tips for Managing Your Declaration Page

- Conclusion

What Is a Declaration Page for Car Insurance?

If you’ve ever shopped for car insurance or filed a claim, you’ve probably come across the term “declaration page.” But what exactly is it, and why should you care? Think of the declaration page as your insurance policy’s cheat sheet—a single page that summarizes everything you need to know about your coverage. It’s not the full contract, but it contains the most important details in one easy-to-read format.

Whether you’re a new driver or have been behind the wheel for decades, understanding your declaration page can save you time, money, and stress. It’s the document you’ll pull out during a traffic stop, hand over at the scene of an accident, or reference when comparing policies at renewal time. And while it might look like a jumble of numbers and fine print at first glance, once you know what to look for, it becomes one of the most useful tools in your insurance toolkit.

In this guide, we’ll break down everything you need to know about a declaration page for car insurance—what it includes, why it’s important, and how to use it effectively. We’ll also share practical tips to help you keep your policy up to date and avoid common pitfalls. By the end, you’ll feel confident navigating your coverage and making informed decisions about your car insurance.

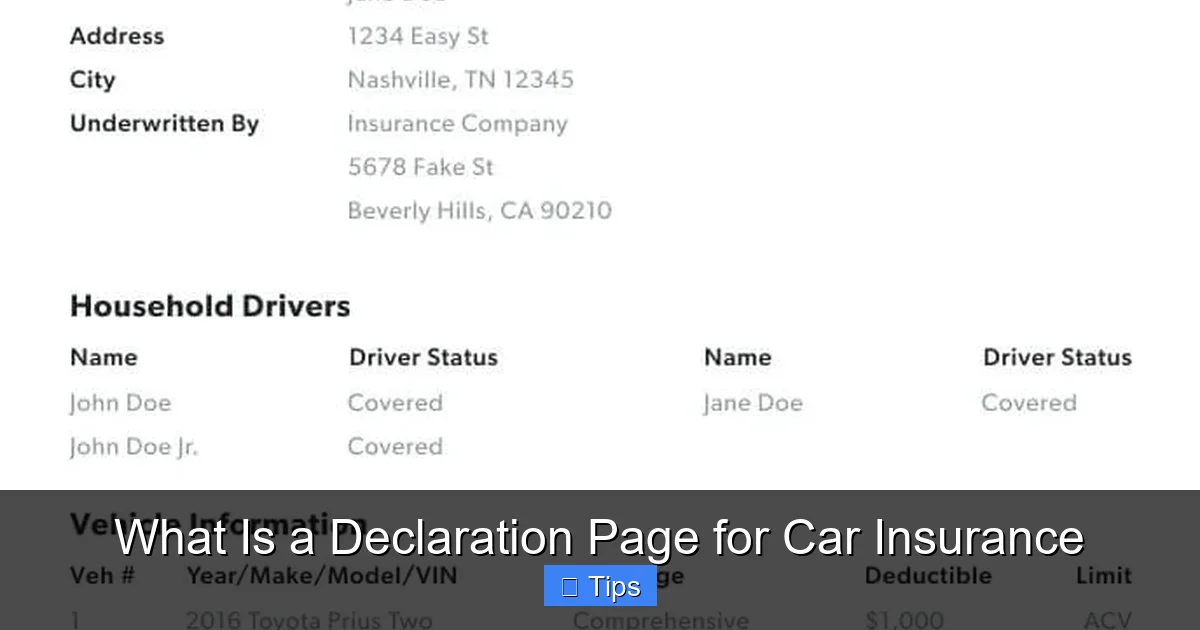

Why the Declaration Page Matters

Visual guide about What Is a Declaration Page for Car Insurance

Image source: cdn.ramseysolutions.net

You might be wondering: “Do I really need to understand my declaration page?” The short answer is yes. This document isn’t just a formality—it’s a critical part of your insurance experience. Here’s why it matters.

First, the declaration page serves as **proof of insurance**. In most states, you’re legally required to carry auto insurance, and law enforcement officers can ask to see proof during a traffic stop. If you’re involved in an accident, other drivers, police, and insurance adjusters will also need to verify your coverage. Without a valid declaration page (or an electronic copy), you could face fines, license suspension, or even legal trouble.

Second, it helps you **understand your coverage**. Insurance policies can be long and full of legal jargon. The declaration page cuts through the noise and gives you a clear, concise overview of what you’re paying for. It shows which types of coverage you have—like liability, collision, comprehensive, or uninsured motorist—and how much protection each one provides. This is especially helpful when deciding whether your current policy meets your needs or if you should adjust your limits.

Third, it’s essential for **filing claims**. When you report an accident or damage to your insurer, they’ll refer to your declaration page to determine what’s covered. For example, if your car is stolen, the comprehensive coverage listed on your declaration page will dictate whether you’re reimbursed and how much. Without this document, the claims process could be delayed or complicated.

Finally, the declaration page is a **valuable reference during life changes**. Getting married, moving to a new state, buying a new car, or adding a teen driver? These events can affect your insurance needs. Reviewing your declaration page helps you spot gaps in coverage and make timely updates.

What’s Included on a Declaration Page?

Visual guide about What Is a Declaration Page for Car Insurance

Image source: sebenchmark.com

Now that you know why the declaration page is important, let’s dive into what it actually contains. While the layout may vary slightly between insurers, most declaration pages include the same core information. Here’s a breakdown of the key sections you’ll typically find.

Policyholder Information

This section lists the name and address of the primary policyholder—the person who owns the policy. It may also include the names of any additional drivers covered under the policy, such as a spouse or family member. Make sure this information is accurate. If your name or address has changed, you’ll need to update your insurer to avoid issues later.

Vehicle Details

Your declaration page will include information about each vehicle covered by the policy. This usually includes:

– Make, model, and year of the vehicle

– Vehicle Identification Number (VIN)

– License plate number

– Usage type (e.g., personal, business, commute)

The VIN is especially important—it’s a unique identifier for your car and helps insurers verify ownership and track claims history. If you have multiple vehicles, each will be listed separately with its own coverage details.

Policy Number and Effective Dates

Every insurance policy has a unique policy number, which you’ll need when contacting your insurer or filing a claim. The declaration page also shows the policy’s effective dates—the start and end dates of your coverage. Most policies last six or twelve months, so it’s important to note when your policy renews. Missing a renewal could leave you uninsured.

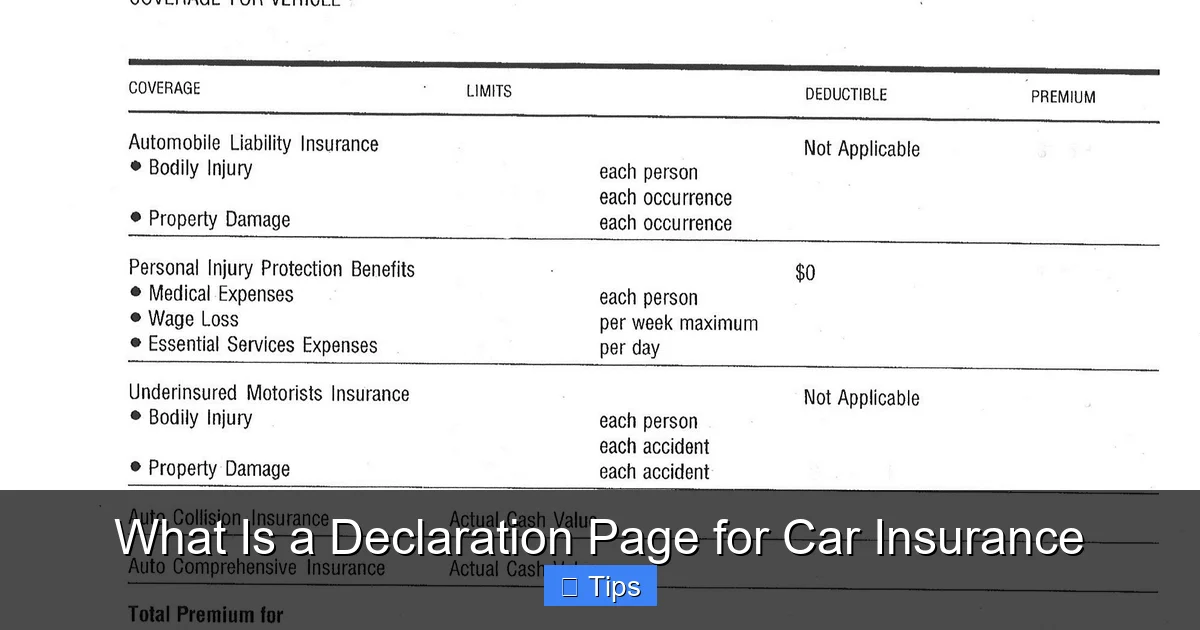

Coverage Types and Limits

This is where things get interesting. The declaration page outlines the types of coverage you’ve purchased and the maximum amounts your insurer will pay for each. Common coverage types include:

– **Liability Coverage**: Covers damages or injuries you cause to others. It’s usually listed as three numbers (e.g., 100/300/100), representing bodily injury per person, bodily injury per accident, and property damage.

– **Collision Coverage**: Pays for damage to your car from a collision, regardless of fault.

– **Comprehensive Coverage**: Covers non-collision events like theft, vandalism, fire, or weather damage.

– **Uninsured/Underinsured Motorist Coverage**: Protects you if you’re hit by a driver with no or insufficient insurance.

– **Medical Payments (MedPay) or Personal Injury Protection (PIP)**: Covers medical expenses for you and your passengers.

Each coverage type will show a limit (the maximum payout) and sometimes a deductible (the amount you pay out of pocket before insurance kicks in).

Premium Amount

The total cost of your policy—your premium—is listed on the declaration page. This is the amount you pay (monthly, quarterly, or annually) to keep your coverage active. It may also show any discounts you’re receiving, such as for safe driving, bundling home and auto insurance, or having anti-theft devices.

Additional Information

Some declaration pages include extra details, like:

– Named drivers and their restrictions (e.g., excluded drivers)

– Loan or lease information (if your car is financed)

– Endorsements or riders (added coverage options)

– State-specific requirements

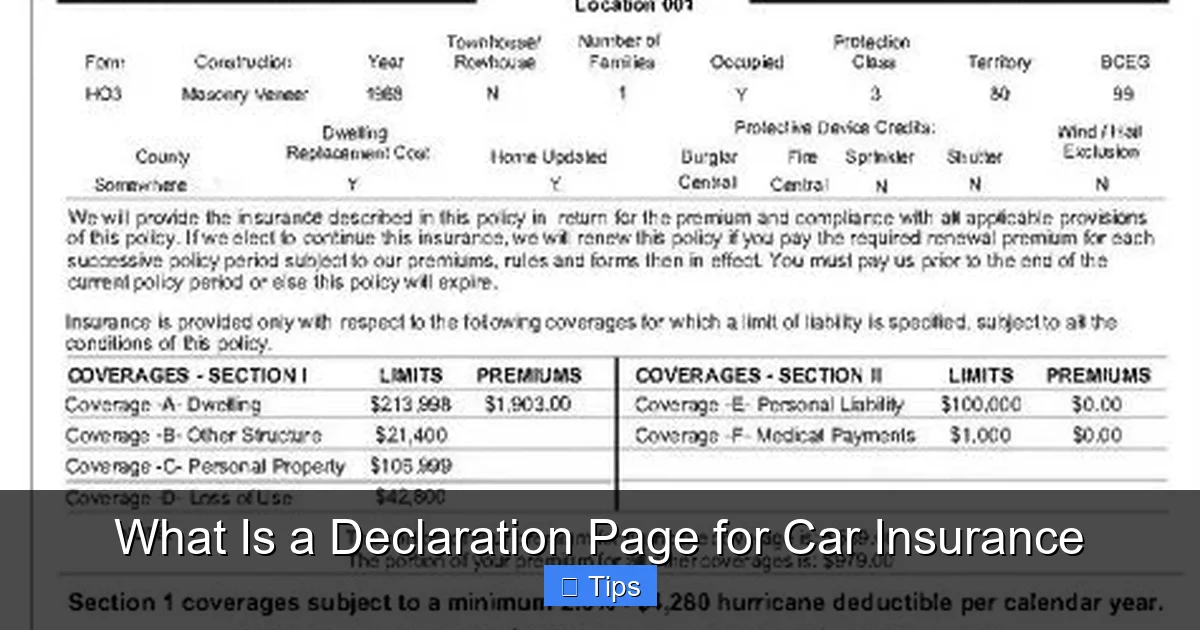

How to Read and Understand Your Declaration Page

Visual guide about What Is a Declaration Page for Car Insurance

Image source: elmlaw.com

Reading a declaration page doesn’t have to be intimidating. With a little know-how, you can quickly interpret the information and make sure your coverage aligns with your needs. Here’s a step-by-step guide to help you decode your policy.

Step 1: Verify Personal and Vehicle Information

Start by checking that your name, address, and vehicle details are correct. Even a small typo—like a misspelled name or incorrect VIN—can cause problems during a claim. If you spot an error, contact your insurer right away to get it fixed.

Step 2: Review Coverage Types and Limits

Look at the coverage section and ask yourself:

– Do I have the right types of coverage for my situation?

– Are my liability limits high enough to protect my assets?

– Do I need collision or comprehensive if my car is older?

For example, if you drive a brand-new SUV, you’ll likely want full coverage (liability, collision, and comprehensive). But if you drive a 15-year-old sedan with low market value, you might opt to drop collision and comprehensive to save money—just know you’ll be responsible for repair costs.

Step 3: Check Deductibles

Your deductible is the amount you pay before insurance covers the rest. Higher deductibles mean lower premiums, but more out-of-pocket costs if you file a claim. Make sure your deductible is affordable. If you choose a $1,000 deductible but can’t afford to pay that in an emergency, you might want to lower it—even if it means a slightly higher premium.

Step 4: Confirm Policy Dates and Renewal

Note when your policy starts and ends. Set a reminder a few weeks before renewal so you can review your coverage and shop around if needed. Some insurers auto-renew policies, but rates can increase without notice. Taking the time to compare quotes could save you hundreds.

Step 5: Look for Discounts

Check if you’re receiving all the discounts you qualify for. Common ones include:

– Safe driver discount

– Multi-car discount

– Good student discount

– Anti-theft device discount

– Paperless billing discount

If you’re not seeing these on your declaration page, ask your agent about eligibility.

When You’ll Need Your Declaration Page

Your declaration page isn’t just a document to file away and forget. You’ll need it in several real-life situations. Here are the most common times you’ll reach for it.

During a Traffic Stop

If a police officer pulls you over, they’ll likely ask for your license, registration, and proof of insurance. Your declaration page (or a digital copy on your phone) serves as that proof. Make sure it’s current—an expired policy won’t cut it.

After an Accident

At the scene of a crash, you’ll exchange insurance information with the other driver. Your declaration page has all the details they need: your name, policy number, and coverage limits. It also helps police and insurers determine fault and coverage.

When Filing a Claim

When you report damage or an accident to your insurer, they’ll ask for your policy number and details about your coverage. Having your declaration page handy speeds up the process and ensures accuracy.

When Buying or Selling a Car

If you’re purchasing a vehicle, the seller may ask for proof of insurance before letting you test drive it. And when selling your car, you’ll need to cancel or transfer coverage, which requires referencing your policy.

When Adding a Driver or Vehicle

Adding a teen driver or a new car to your policy? Your insurer will send an updated declaration page reflecting the changes. Review it carefully to ensure the new addition is properly covered.

During Policy Renewal

At renewal time, your insurer will send a new declaration page with any changes to your coverage, premiums, or discounts. This is your chance to review and adjust your policy before it renews.

Common Mistakes to Avoid

Even experienced drivers can make mistakes when it comes to their declaration page. Here are some common pitfalls and how to avoid them.

Not Reviewing It Regularly

Your life changes—and so should your insurance. Failing to review your declaration page annually can leave you underinsured or paying for coverage you don’t need. Make it a habit to check it at least once a year, or after major life events.

Assuming All Coverage Is Included

Just because you have car insurance doesn’t mean you’re fully protected. Many policies don’t include rental reimbursement, roadside assistance, or gap insurance unless you add them. Read your declaration page to see what’s included—and what’s not.

Ignoring Deductibles

A low deductible might sound great, but it often comes with a higher premium. Conversely, a high deductible can save money upfront but leave you with a big bill after a claim. Choose a deductible that balances affordability and risk.

Forgetting to Update Information

Moving, getting married, or buying a new car? These changes can affect your rates and coverage. Notify your insurer promptly to avoid gaps or inaccuracies on your declaration page.

Storing It in the Wrong Place

Keep a copy of your declaration page in your glove compartment—both printed and digital. If your phone dies or you’re in a remote area, a paper copy ensures you’re never without proof of insurance.

How to Get a Copy of Your Declaration Page

Need a copy of your declaration page? It’s easier than you think. Here are the most common ways to access it.

Online Portal or Mobile App

Most insurers offer online accounts where you can log in and view or download your declaration page. Many also have mobile apps that let you store a digital copy on your phone—perfect for quick access.

When you first purchase a policy or renew, your insurer typically sends a copy of the declaration page via email. Check your inbox (and spam folder) for a PDF attachment.

Customer Service

Can’t find it online? Call your insurer’s customer service line. They can email or mail you a copy within minutes.

Insurance Agent

If you work with an independent agent, they can provide a copy or help you understand your coverage.

Tips for Managing Your Declaration Page

To get the most out of your declaration page, follow these best practices.

Keep It Updated

Review your declaration page after any life change—marriage, move, new job, new car—and update your policy as needed.

Store It Safely

Keep a printed copy in your car and a digital copy on your phone and cloud storage. This ensures you’re never without it.

Use It to Compare Policies

When shopping for insurance, use your current declaration page as a baseline. Compare coverage types, limits, and premiums to find the best deal.

Ask Questions

If something on your declaration page doesn’t make sense, don’t guess—ask your agent or insurer for clarification. Understanding your coverage is key to making smart decisions.

Conclusion

A declaration page for car insurance might seem like just another piece of paperwork, but it’s one of the most important documents you’ll ever carry. It’s your proof of coverage, your guide to understanding your policy, and your first step in filing a claim. By taking the time to read, understand, and manage your declaration page, you’re not just following the rules—you’re protecting yourself, your family, and your financial future.

Don’t wait until an accident or traffic stop to look at it. Make it a habit to review your declaration page regularly, keep it updated, and store it where you can access it quickly. With this simple practice, you’ll be better prepared, more confident, and in control of your car insurance experience.

Frequently Asked Questions

What is a declaration page for car insurance?

A declaration page is a one-page summary of your car insurance policy that lists key details like your coverage types, limits, deductibles, vehicle information, and premium. It serves as proof of insurance and helps you understand what you’re covered for.

Do I need to carry my declaration page in my car?

Yes, in most states you’re required to carry proof of insurance while driving. Your declaration page (or a digital copy) fulfills this requirement and should be kept in your vehicle at all times.

How often should I review my declaration page?

You should review your declaration page at least once a year, or whenever you experience a major life change like moving, buying a new car, or adding a driver. This ensures your coverage stays up to date.

Can I get a copy of my declaration page online?

Yes, most insurers allow you to log into your online account or mobile app to view, download, or print your declaration page. You can also request a copy by calling customer service.

What if there’s an error on my declaration page?

If you notice a mistake—such as an incorrect name, address, or VIN—contact your insurer immediately to have it corrected. Errors can cause problems during claims or traffic stops.

Does the declaration page include my full insurance policy?

No, the declaration page is a summary, not the full policy. The complete contract includes detailed terms, conditions, and exclusions. You can request the full policy document from your insurer if needed.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.