Figuring out how much you can afford for a car isn’t just about the monthly payment—it’s about your entire financial picture. From income and expenses to insurance and maintenance, this guide breaks down everything you need to know to make a smart, sustainable car-buying decision without breaking the bank.

Buying a car is one of the biggest financial decisions most people make—second only to purchasing a home. But unlike a house, a car starts losing value the moment you drive it off the lot. That’s why it’s so important to ask yourself not just “Can I get approved for this car?” but “How much can I afford for a car without hurting my financial health?”

The truth is, many people focus only on the monthly payment when shopping for a vehicle. While that number matters, it’s just one piece of the puzzle. If you’re not careful, you could end up paying far more than you should—or worse, struggle to keep up with payments and damage your credit. The good news? With a little planning and realistic budgeting, you can find a reliable car that fits your lifestyle and your wallet.

In this guide, we’ll walk you through the steps to determine how much you can truly afford for a car. We’ll cover everything from calculating your income and expenses to understanding loan terms, insurance costs, and long-term maintenance. Whether you’re buying new, used, or leasing, these tips will help you make a confident, informed decision.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Step 1: Assess Your Financial Situation

- 4 Step 2: Use the 20/4/10 Rule as a Guideline

- 5 Step 3: Factor in All Car Ownership Costs

- 6 Step 4: Check Your Credit Score and Shop for Financing

- 7 Step 5: Decide Between New, Used, or Certified Pre-Owned

- 8 Step 6: Use Online Tools and Calculators

- 9 Step 7: Avoid Common Car-Buying Mistakes

- 10 Conclusion: Buy Smart, Drive Happy

- 11 Frequently Asked Questions

Key Takeaways

- Use the 20/4/10 rule: Put 20% down, finance for no more than 4 years, and keep total car costs under 10% of your gross monthly income.

- Calculate total ownership costs: Include insurance, fuel, maintenance, and repairs—not just the loan payment.

- Check your credit score: A higher score can save you thousands in interest over the life of your loan.

- Shop around for financing: Compare rates from banks, credit unions, and dealerships before committing.

- Consider certified pre-owned vehicles: They offer reliability and savings compared to brand-new models.

- Avoid stretching your budget: Buying a car that pushes your limits can lead to financial stress and missed payments.

- Test drive your budget: Use online calculators and real-world scenarios to simulate payments before you buy.

📑 Table of Contents

- Step 1: Assess Your Financial Situation

- Step 2: Use the 20/4/10 Rule as a Guideline

- Step 3: Factor in All Car Ownership Costs

- Step 4: Check Your Credit Score and Shop for Financing

- Step 5: Decide Between New, Used, or Certified Pre-Owned

- Step 6: Use Online Tools and Calculators

- Step 7: Avoid Common Car-Buying Mistakes

- Conclusion: Buy Smart, Drive Happy

Step 1: Assess Your Financial Situation

Before you even look at car listings, take a hard look at your finances. This isn’t about guessing—it’s about knowing exactly where your money goes each month.

Start by listing all your sources of income. That includes your salary, side gigs, freelance work, or any other regular cash flow. Use your gross income (before taxes) for initial calculations, but also consider your net income (take-home pay) when planning your budget.

Next, track your monthly expenses. Break them into fixed costs (like rent, utilities, and loan payments) and variable costs (like groceries, entertainment, and dining out). Don’t forget irregular expenses like car maintenance, medical bills, or holiday gifts—these can sneak up on you.

Once you have a clear picture, subtract your total expenses from your income. The amount left over is your discretionary income—the money you can use for savings, fun, or, in this case, a car payment.

Example: Sarah’s Monthly Budget

Let’s say Sarah earns $4,500 per month after taxes. Her fixed expenses include:

– Rent: $1,200

– Utilities: $150

– Student loan: $300

– Phone and internet: $100

– Groceries: $400

– Transportation (gas, public transit): $200

– Entertainment and dining: $300

– Savings: $500

That totals $3,150. She has $1,350 left each month. From that, she’ll need to cover any car-related costs.

This exercise shows that Sarah can comfortably afford a car payment—but only if it fits within her remaining budget. It also highlights the importance of not overextending. If she spends too much on a car, she might have to cut back on savings or essentials.

Step 2: Use the 20/4/10 Rule as a Guideline

Visual guide about How Much Can I Afford for a Car

Image source: notwaitingtolive.com

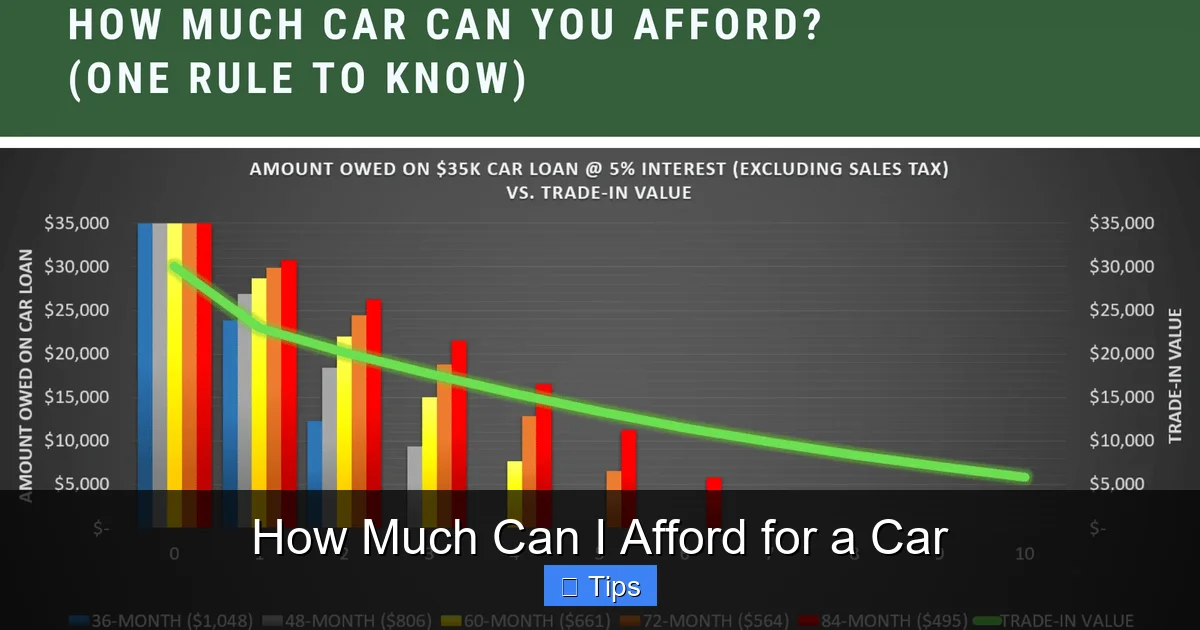

One of the most trusted rules in car buying is the 20/4/10 rule. It’s simple, practical, and helps prevent financial overreach.

Here’s how it works:

– 20% down payment: Put at least 20% of the car’s price down upfront. This reduces the amount you need to finance and lowers your monthly payments.

– 4-year loan term: Finance the car for no more than 4 years (48 months). Longer terms mean lower monthly payments, but you’ll pay more in interest over time.

– 10% of income: Keep your total car expenses—loan payment, insurance, fuel, and maintenance—under 10% of your gross monthly income.

Let’s apply this to Sarah. She earns $4,500 per month after taxes, so her gross income is roughly $5,600 (assuming about 20% in taxes). Ten percent of that is $560.

So, Sarah’s total monthly car costs should not exceed $560. That includes everything: loan payment, insurance, gas, and expected maintenance.

If she finds a car with a $350 monthly payment, $120 for insurance, $60 for gas, and $30 for maintenance, she’s at $560—right at the limit. That’s acceptable, but tight. If any of those costs go up, she could be in trouble.

Why the 20/4/10 Rule Works

This rule protects you from common pitfalls. A large down payment reduces the loan amount and builds equity faster. A shorter loan term saves you money on interest—on a $20,000 loan at 5% interest, a 4-year term costs about $2,100 in interest, while a 6-year term costs over $3,200.

And keeping total costs under 10% of income ensures you’re not “house-poor” but “car-poor.” You’ll still have room for emergencies, savings, and life’s unexpected twists.

Step 3: Factor in All Car Ownership Costs

Visual guide about How Much Can I Afford for a Car

Image source: notwaitingtolive.com

Too many buyers focus only on the sticker price or monthly payment. But a car’s true cost goes far beyond that.

Here’s a breakdown of the major expenses you’ll face:

- Loan payment: The amount you pay each month to the lender.

- Insurance: Required by law and varies by driver, location, and vehicle type.

- Fuel: Depends on your car’s fuel efficiency and how much you drive.

- Maintenance and repairs: Oil changes, tire rotations, brake pads, and unexpected fixes.

- Registration and taxes: One-time or annual fees based on your state and the car’s value.

- Depreciation: The loss in value over time—especially steep in the first few years.

Let’s say you’re considering a $25,000 sedan. Here’s what your annual costs might look like:

– Loan payment: $400/month × 12 = $4,800

– Insurance: $150/month × 12 = $1,800

– Fuel: $100/month × 12 = $1,200

– Maintenance: $50/month × 12 = $600

– Registration/taxes: $300/year

Total: $8,700 per year, or about $725 per month.

That’s a big chunk of change—especially if you didn’t plan for it.

Insurance Can Make or Break Your Budget

Insurance is often the most variable cost. A sports car or luxury vehicle will cost far more to insure than a compact sedan. Younger drivers, especially teens, also face higher premiums.

Get quotes from multiple insurers before you buy. Use online tools or call agents directly. Tell them the exact make, model, and year you’re considering. That way, you’ll know your real insurance cost upfront.

Also, consider raising your deductible to lower your premium—but only if you can afford to pay that amount out of pocket if you need to file a claim.

Maintenance: The Hidden Cost

New cars come with warranties, but even they don’t cover everything. And once the warranty expires, you’re on the hook for repairs.

Older or high-mileage cars may need more frequent maintenance. A used car with 80,000 miles might need new brakes or a transmission service soon.

Set aside $50–$100 per month for maintenance, even if your car is new. This creates a cushion for oil changes, tire rotations, and unexpected repairs.

Step 4: Check Your Credit Score and Shop for Financing

Visual guide about How Much Can I Afford for a Car

Image source: gajizmo.com

Your credit score plays a huge role in how much you’ll pay for a car loan. The higher your score, the lower your interest rate—and the less you’ll pay over time.

Check your credit report for free at AnnualCreditReport.com. Look for errors or outdated information. If you find mistakes, dispute them with the credit bureau.

Aim for a score of 700 or higher. Here’s how credit scores affect auto loan rates (as of 2024):

– 750+: Excellent – 4–5% APR

– 700–749: Good – 5–6% APR

– 650–699: Fair – 7–9% APR

– Below 650: Poor – 10%+ APR

On a $20,000, 4-year loan, a 5% rate means about $460/month. At 10%, it’s $475/month. That’s only $15 more per month—but over 48 months, you’ll pay $720 extra in interest.

Pre-Approval Is Your Best Friend

Before you visit a dealership, get pre-approved for a loan from a bank or credit union. This gives you a clear budget and negotiating power.

Dealerships often offer financing, but their rates can be higher—especially if they’re trying to make a sale. With a pre-approval, you can compare offers and choose the best deal.

When you get pre-approved, you’ll know:

– How much you can borrow

– Your interest rate

– Your monthly payment

This prevents you from falling in love with a car that’s out of your price range.

Watch Out for Add-Ons and Fees

Dealerships may try to sell you extras like extended warranties, paint protection, or VIN etching. These can add hundreds—or even thousands—to your loan.

Ask yourself: Do I really need this? Most add-ons are overpriced and unnecessary. An extended warranty might sound good, but many repairs are already covered by the manufacturer’s warranty.

Also, watch for documentation fees, dealer prep fees, and other charges. Some states cap these fees, but others don’t. Negotiate or walk away if the fees seem unreasonable.

Step 5: Decide Between New, Used, or Certified Pre-Owned

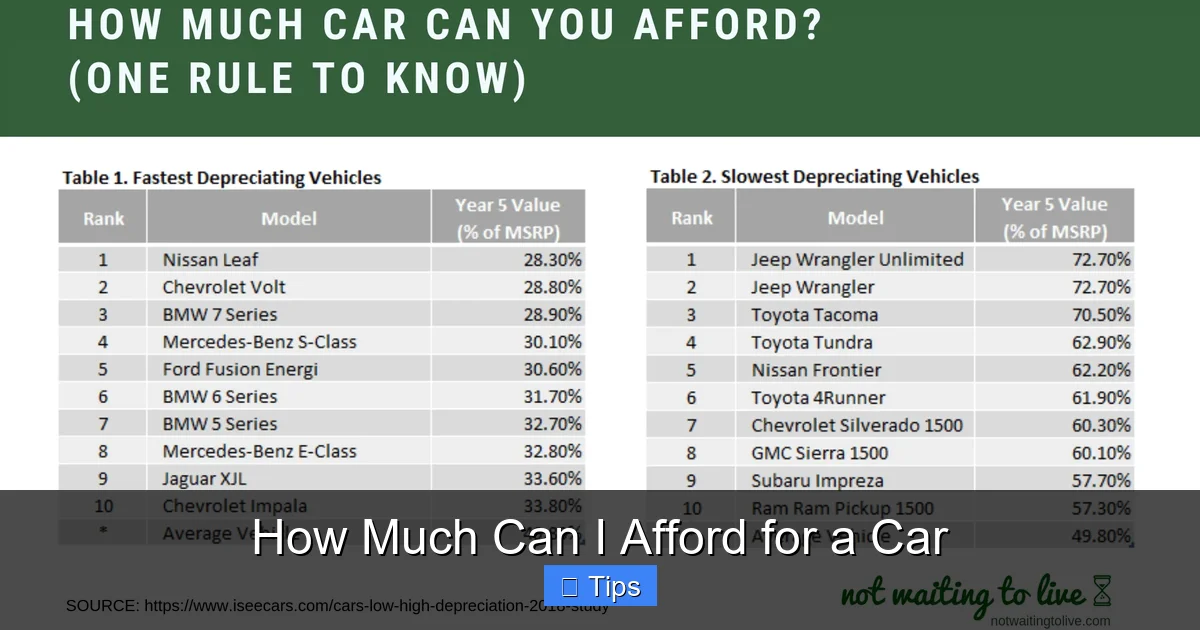

The type of car you buy affects how much you can afford. New cars offer the latest features and full warranties, but they depreciate fast. Used cars are cheaper but may need more repairs.

Here’s a quick comparison:

- New car: Full warranty, latest tech, highest depreciation (20–30% in the first year).

- Used car (3–5 years old): Lower price, moderate depreciation, may still have some warranty left.

- Certified pre-owned (CPO): Inspected, refurbished, and backed by a manufacturer warranty—often the best value.

For most buyers, a CPO vehicle offers the best balance of reliability and affordability. You get a nearly new car at a used price, with peace of mind.

Let’s say a new compact SUV costs $30,000. A 3-year-old CPO version might cost $22,000—and still have 2 years left on the warranty. That’s a $8,000 savings with minimal risk.

Leasing: Is It Right for You?

Leasing a car means paying for its use, not ownership. Monthly payments are usually lower than buying, but you don’t build equity. At the end of the lease, you return the car.

Leasing can make sense if:

– You like driving a new car every 2–3 years

– You don’t drive a lot of miles

– You want lower monthly payments

But leasing isn’t always cheaper in the long run. And if you go over the mileage limit or damage the car, you’ll pay extra fees.

Use a lease calculator to compare the total cost of leasing vs. buying. In many cases, buying—especially a used or CPO car—is the smarter financial move.

Step 6: Use Online Tools and Calculators

You don’t have to do all the math by hand. Plenty of free online tools can help you figure out how much you can afford for a car.

Try these:

– Auto loan calculator: Enter the loan amount, interest rate, and term to see your monthly payment.

– Total cost of ownership calculator: Estimate insurance, fuel, maintenance, and depreciation for specific models.

– Affordability calculator: Input your income, expenses, and down payment to see a recommended price range.

Websites like Edmunds, Kelley Blue Book (KBB), and Bankrate offer these tools for free. Plug in different scenarios—like a higher down payment or shorter loan term—to see how they affect your budget.

Test Drive Your Budget

Before you commit, simulate your new budget. Set aside the amount of your estimated monthly car payment in a separate account for a few months. See how it feels.

Can you still pay your bills? Save for emergencies? Enjoy life?

If the answer is no, you might be stretching too far. It’s better to wait or choose a less expensive car than to live paycheck to paycheck.

Step 7: Avoid Common Car-Buying Mistakes

Even with the best planning, it’s easy to make mistakes. Here are a few to watch out for:

- Focusing only on the monthly payment: Dealers can lower your payment by extending the loan term—but you’ll pay more in interest.

- Skipping the test drive: A car might look great online, but feel uncomfortable in person.

- Not researching the car’s value: Use KBB or Edmunds to check the fair market price. Don’t pay above it.

- Ignoring the total cost: A $200/month payment sounds great—until you add $150 for insurance and $100 for gas.

- Buying on emotion: It’s easy to fall in love with a shiny new car. Stay focused on your budget.

Take your time. Sleep on big decisions. And never feel pressured to sign anything on the spot.

Conclusion: Buy Smart, Drive Happy

Figuring out how much you can afford for a car isn’t about limiting your options—it’s about making a choice that supports your financial goals. By assessing your income, using the 20/4/10 rule, and factoring in all ownership costs, you can find a vehicle that fits your life without breaking the bank.

Remember, a car is a tool, not a status symbol. The best car for you is one that gets you where you need to go—safely, reliably, and affordably.

Take the time to plan, shop around, and compare options. Your future self will thank you when you’re not stressed about payments and can enjoy the ride instead.

Frequently Asked Questions

How much should I spend on a car if I make $50,000 a year?

If you earn $50,000 per year, your gross monthly income is about $4,167. Using the 10% rule, your total car costs should not exceed $417 per month. That includes loan payment, insurance, fuel, and maintenance.

Is it better to buy a new or used car?

It depends on your budget and needs. New cars have warranties and the latest features but depreciate quickly. Used or certified pre-owned cars offer better value and lower depreciation, making them ideal for most buyers.

Can I afford a car payment if I have student loans?

Yes, but you’ll need to factor your student loan payment into your monthly budget. Use the 20/4/10 rule and ensure your total debt payments—including the car—don’t exceed 36% of your income.

How does my credit score affect my car loan?

A higher credit score means lower interest rates. For example, a score of 750+ could save you thousands in interest over the life of the loan compared to a score below 650.

Should I lease or buy a car?

Buying is usually better if you plan to keep the car long-term and build equity. Leasing offers lower monthly payments but no ownership and mileage limits.

What if I can’t afford a 20% down payment?

If you can’t put 20% down, aim for at least 10%. A smaller down payment means a larger loan and higher monthly payments, so consider a less expensive car or save longer before buying.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.