Yes, you can write off car payments for an LLC—but not the payments themselves. Instead, the IRS allows deductions for business use of a vehicle through mileage or actual expense methods. Proper recordkeeping and meeting strict criteria are essential to avoid audits and maximize savings.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Can You Write Off Car Payments for LLC? The Truth About Vehicle Deductions

- 4 Understanding How LLCs Handle Vehicle Deductions

- 5 Standard Mileage Rate vs. Actual Expense Method

- 6 How to Track and Document Vehicle Expenses

- 7 Special Rules for Leased Vehicles

- 8 Common Mistakes to Avoid

- 9 Maximizing Your Deductions: Smart Strategies

- 10 Conclusion: Yes, You Can Benefit—But Do It Right

- 11 Frequently Asked Questions

Key Takeaways

- You cannot deduct car loan payments directly: The IRS does not allow deductions for principal or interest on car loans, but you can deduct vehicle expenses related to business use.

- Choose between standard mileage and actual expense methods: Each has pros and cons—mileage is simpler, while actual expenses may yield higher deductions for newer or high-cost vehicles.

- Business use percentage matters: Only the portion of vehicle use for business qualifies for deductions. Personal use is not deductible.

- Keep detailed records: Log mileage, fuel, repairs, insurance, and registration. Use apps or logs to prove business use during tax season or audits.

- LLC structure affects deductions: How your LLC is taxed (sole proprietorship, S-corp, etc.) impacts how and where you claim vehicle expenses.

- Leased vehicles have different rules: If you lease, you may deduct lease payments based on business use, but inclusion amounts may apply.

- Consult a tax professional: Vehicle deductions are complex. A CPA can help you choose the best method and stay compliant with IRS regulations.

📑 Table of Contents

- Can You Write Off Car Payments for LLC? The Truth About Vehicle Deductions

- Understanding How LLCs Handle Vehicle Deductions

- Standard Mileage Rate vs. Actual Expense Method

- How to Track and Document Vehicle Expenses

- Special Rules for Leased Vehicles

- Common Mistakes to Avoid

- Maximizing Your Deductions: Smart Strategies

- Conclusion: Yes, You Can Benefit—But Do It Right

Can You Write Off Car Payments for LLC? The Truth About Vehicle Deductions

So, you’ve started an LLC and you’re driving your car for business—client meetings, deliveries, site visits, maybe even picking up supplies. Naturally, you’re wondering: Can I write off my car payments? It’s a smart question, and one that many small business owners ask. The short answer? Not exactly. But don’t hit the brakes just yet.

While you can’t deduct your actual car loan payments—principal or interest—you can deduct a portion of your vehicle expenses based on how much you use the car for business. The IRS allows business owners to claim deductions for the business use of a vehicle, but it’s not as simple as writing off your monthly payment. Instead, you have two main options: the standard mileage rate or the actual expense method. Both can save you money, but they require careful tracking and documentation.

Understanding these rules is crucial. Mistakes can lead to missed deductions or, worse, IRS scrutiny. But with the right approach, you can legally reduce your taxable income and keep more of your hard-earned profits. In this guide, we’ll break down everything you need to know about writing off car-related expenses for your LLC—what’s allowed, what’s not, and how to do it the right way.

Understanding How LLCs Handle Vehicle Deductions

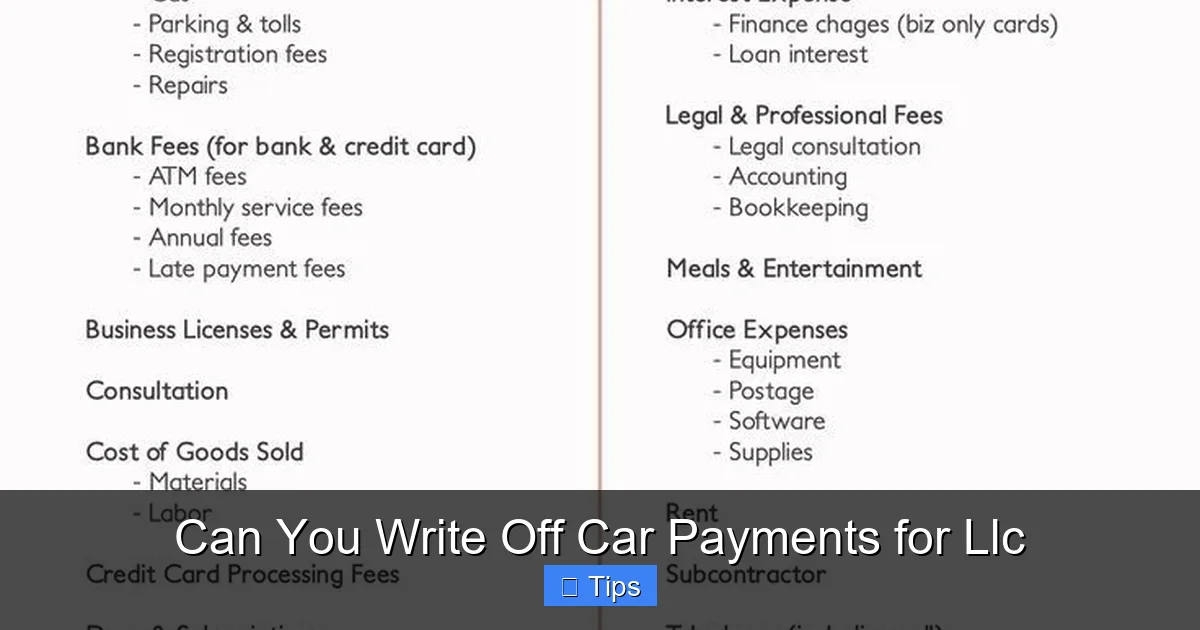

Visual guide about Can You Write Off Car Payments for Llc

Image source: capitalmotorcars.com

First, let’s clarify how your LLC’s tax structure affects vehicle deductions. An LLC itself doesn’t pay taxes—it’s a pass-through entity. That means profits and losses flow through to the owner’s personal tax return. But how you’ve elected to be taxed matters.

If your LLC is a single-member LLC, it’s typically treated as a sole proprietorship for tax purposes. You’ll report business income and expenses—including vehicle deductions—on Schedule C of your personal tax return. If you’ve elected to be taxed as an S-corporation, you’ll report vehicle expenses differently, often through employee reimbursements or as part of your business expenses on Form 1120-S.

Regardless of structure, the IRS allows deductions for the business use of a vehicle. But again, you’re not deducting the car payment itself. Instead, you’re deducting the cost of operating the vehicle for business purposes. This includes fuel, maintenance, insurance, depreciation, and even parking and tolls—but only the portion used for business.

For example, if you drive 15,000 miles a year and 10,000 of those are for business, you can deduct two-thirds of your vehicle expenses. That’s where the real savings come in.

Why You Can’t Deduct Car Loan Payments Directly

Let’s get this straight: the IRS does not allow you to deduct car loan payments—neither the principal nor the interest—as a business expense. Why? Because the loan itself is a financing cost, not an operating expense. Think of it like a mortgage: you can’t deduct your home loan payment, but you can deduct property taxes, repairs, and utilities if you use part of your home for business.

The same logic applies to vehicles. The car payment is how you finance the purchase, but the IRS wants you to deduct the cost of using the vehicle, not the cost of buying it on credit.

However, there’s a workaround: depreciation. If you use the actual expense method, you can deduct a portion of the vehicle’s depreciation each year based on business use. This effectively spreads the cost of the car over its useful life and allows you to deduct a piece of it annually. But again, this is not the same as writing off your monthly payment.

The Role of Business Use Percentage

One of the most important factors in claiming vehicle deductions is determining your business use percentage. This is the portion of total miles driven that are for business purposes. The IRS requires you to calculate this accurately and consistently.

For example:

– Total miles driven in a year: 12,000

– Business miles: 8,000

– Business use percentage: 8,000 ÷ 12,000 = 66.7%

You can only deduct 66.7% of your vehicle expenses. This applies to both the standard mileage rate and the actual expense method.

Keep in mind: commuting from home to your regular workplace is not considered business use. But driving from your office to a client’s location, or between job sites, is deductible. Also, if you use your car for both business and personal trips in the same day, you can only count the business portion.

Standard Mileage Rate vs. Actual Expense Method

Visual guide about Can You Write Off Car Payments for Llc

Image source: falconexpenses.com

Now that you know you can’t deduct car payments directly, let’s explore the two ways you can deduct vehicle expenses: the standard mileage rate and the actual expense method. Each has its advantages, and the best choice depends on your vehicle, usage, and recordkeeping habits.

Standard Mileage Rate: Simple and Straightforward

The standard mileage rate is set by the IRS each year. For 2024, it’s 67 cents per mile for business use. This rate covers all vehicle operating costs—fuel, maintenance, insurance, depreciation, and more.

To use this method:

– You must use it in the first year the vehicle is available for business use.

– You must operate five or fewer vehicles at the same time.

– You cannot have claimed Section 179 expensing or bonus depreciation on the vehicle.

The big advantage? Simplicity. You just track your business miles and multiply by the rate. For example, if you drive 10,000 business miles in 2024, your deduction is 10,000 × $0.67 = $6,700.

But there’s a catch: you can’t switch to the actual expense method later if you’ve used the standard mileage rate in the first year—unless you meet specific IRS exceptions.

Actual Expense Method: More Control, More Work

The actual expense method lets you deduct the real costs of operating your vehicle, including:

– Gas and oil

– Repairs and maintenance

– Tires

– Insurance

– Registration fees

– Depreciation (or lease payments, if applicable)

– Parking fees and tolls (for business trips)

You multiply each expense by your business use percentage. For example, if your annual insurance is $1,200 and your business use is 70%, you can deduct $840.

This method can yield a larger deduction, especially if you drive a lot or own a newer, more expensive vehicle. But it requires meticulous recordkeeping. You’ll need receipts, invoices, and a detailed mileage log.

Which Method Is Right for You?

So, which should you choose? Here’s a quick comparison:

| Factor | Standard Mileage | Actual Expense |

|——–|——————|—————-|

| Ease of use | Very easy | Requires detailed records |

| Best for | High-mileage drivers, older cars | Newer or luxury vehicles, low-mileage but high operating costs |

| Flexibility | Limited (can’t switch easily) | More flexible after first year |

| Potential deduction | Moderate | Can be higher |

Let’s say you drive a 2023 Tesla Model 3 for business. It’s expensive, but efficient. If you drive 15,000 business miles, the standard mileage deduction is $10,050 (15,000 × $0.67). But with the actual expense method, you might deduct more—especially if you factor in depreciation and lower fuel costs.

On the other hand, if you drive a 2015 Honda Civic and rack up 20,000 business miles, the standard rate might be better—simpler and still generous.

How to Track and Document Vehicle Expenses

Visual guide about Can You Write Off Car Payments for Llc

Image source: i.pinimg.com

No matter which method you choose, the IRS requires proof. Without proper documentation, your deductions could be disallowed—even if they’re legitimate. Here’s how to stay organized and audit-ready.

Keep a Mileage Log

A mileage log is essential. It should include:

– Date of trip

– Starting and ending odometer readings

– Purpose of trip (e.g., “client meeting,” “supply pickup”)

– Destination

– Business miles driven

You can use a notebook, spreadsheet, or a dedicated app like MileIQ, Everlance, or QuickBooks Self-Employed. Apps automatically track trips and categorize them as business or personal—saving you time and reducing errors.

Save Receipts and Invoices

For the actual expense method, keep every receipt related to your vehicle:

– Gas receipts

– Oil changes

– Repairs

– Insurance bills

– Registration fees

– Parking and toll receipts

Store them digitally using apps like Expensify or Shoeboxed, or scan and save them in a cloud folder labeled “Vehicle Expenses 2024.”

Separate Business and Personal Use

If you use your car for both business and personal trips, you must clearly separate the two. The IRS may question deductions if your logs show inconsistent patterns—like claiming 90% business use but only driving 5,000 miles a year.

Be realistic. If you drive mostly for work, great. But don’t inflate your numbers. The IRS uses algorithms to flag suspicious deductions.

Use Accounting Software

Integrate your vehicle expenses into your overall bookkeeping. Tools like QuickBooks, FreshBooks, or Xero let you categorize expenses, track mileage, and generate reports for tax time.

For example, in QuickBooks, you can set up a “Vehicle Expenses” account and link it to your mileage log. When you reconcile your bank statements, you can easily see which expenses are deductible.

Special Rules for Leased Vehicles

If you lease your car instead of buying, the rules change slightly—but the principle remains the same: you can deduct the business portion of your lease payments.

Deducting Lease Payments

You can deduct a percentage of your monthly lease payment based on business use. For example, if your lease is $500/month and you use the car 80% for business, you can deduct $400/month.

But there’s a catch: the IRS imposes “inclusion amounts” for leased vehicles. These are small reductions in your deduction to account for the tax benefits of leasing a luxury car. The amounts are based on the vehicle’s fair market value and are published annually in IRS guidelines.

For example, if you lease a $60,000 car, you may need to reduce your deduction by $10–$20 per month, depending on the year.

Standard Mileage vs. Actual Expense for Leases

You can use either method for leased vehicles, but the standard mileage rate is often simpler. However, if your lease payments are high and your business use is significant, the actual expense method might save you more.

Just remember: if you use the standard mileage rate in the first year, you’re locked into it for the life of the lease—unless you qualify for an exception.

Common Mistakes to Avoid

Even with the best intentions, it’s easy to make errors when claiming vehicle deductions. Here are some common pitfalls—and how to avoid them.

Claiming 100% Business Use Without Proof

It’s tempting to claim your car is used 100% for business, especially if you’re self-employed. But the IRS knows most people use their cars for personal trips too. If your logs show no personal miles, you’ll raise a red flag.

Be honest. If you drive to the grocery store or take weekend trips, count those as personal use. A realistic percentage—like 70–80%—is more credible and safer.

Mixing Personal and Business Expenses

Don’t lump all car costs into one category. Separate business and personal expenses clearly. For example, if you pay $100 for gas and $60 of it was for business trips, only deduct $60.

Forgetting to Track Miles from Day One

Start your mileage log as soon as you begin using the car for business. The IRS requires records from the first day of business use. If you wait until tax season, you’ll have to estimate—and estimates aren’t reliable.

Using the Wrong Method in the First Year

Your choice in the first year is critical. If you use the standard mileage rate, you can’t switch to actual expenses later—unless you meet strict conditions. Choose wisely based on your vehicle and usage.

Not Consulting a Tax Professional

Vehicle deductions are complex. A CPA or tax advisor can help you:

– Choose the best method

– Calculate depreciation correctly

– Stay compliant with IRS rules

– Maximize your deductions without risking an audit

It’s a small investment that can pay off big at tax time.

Maximizing Your Deductions: Smart Strategies

Now that you understand the rules, here are some smart ways to get the most out of your vehicle deductions.

Buy or Lease Strategically

If you’re in the market for a new vehicle, consider how it will affect your deductions. A more expensive car may allow for higher depreciation deductions under the actual expense method. But if you drive a lot, a fuel-efficient car with high mileage might be better for the standard rate.

Also, consider Section 179 expensing. This allows you to deduct up to $1,220,000 (2024 limit) of the cost of qualifying vehicles in the first year—but only if you use the actual expense method and the vehicle is used more than 50% for business.

Use a Separate Business Vehicle

If possible, use a dedicated vehicle for business. This makes tracking easier and reduces the risk of mixing personal and business use. You can still claim 100% business use—if it’s truly only used for work.

Combine with Other Deductions

Vehicle expenses often go hand-in-hand with other deductions. For example:

– Home office deduction (if you work from home and drive to clients)

– Travel expenses (hotels, meals, flights)

– Cell phone and internet (if used for business)

Keep all your business expenses organized together to maximize your overall tax savings.

Conclusion: Yes, You Can Benefit—But Do It Right

So, can you write off car payments for an LLC? Not directly—but you can deduct a significant portion of your vehicle expenses based on business use. Whether you choose the standard mileage rate or the actual expense method, the key is consistency, accuracy, and documentation.

Remember:

– You can’t deduct loan payments, but you can deduct operating costs.

– Business use percentage is everything.

– Keep detailed logs and receipts.

– Choose your method wisely in the first year.

– When in doubt, consult a tax pro.

By following these guidelines, you’ll not only stay compliant with the IRS but also keep more money in your pocket. Your LLC works hard—your vehicle deductions should work just as hard for you.

Frequently Asked Questions

Can I deduct my car payment if I’m self-employed?

No, you cannot deduct your car loan payment directly. However, you can deduct vehicle expenses like fuel, maintenance, and depreciation based on your business use percentage. Use either the standard mileage rate or actual expense method to claim these deductions.

What if I use my car 100% for business?

If your vehicle is used exclusively for business, you can deduct 100% of eligible expenses. But you must prove it—keep a mileage log showing no personal trips. The IRS may question claims of 100% business use, so documentation is critical.

Can I switch from standard mileage to actual expenses?

Generally, no—if you use the standard mileage rate in the first year the vehicle is available for business, you cannot switch to actual expenses later. Exceptions are rare and require IRS approval.

Do I need to report vehicle deductions on a specific form?

Yes. If your LLC is a sole proprietorship, report vehicle deductions on Schedule C (Form 1040). If taxed as an S-corp, they go on Form 1120-S. Keep all records in case of an audit.

Can I deduct parking and tolls?

Yes, parking fees and tolls incurred during business trips are fully deductible, regardless of which method you use. Just keep receipts and note the business purpose of each trip.

What happens if I get audited?

If audited, the IRS will ask for proof of your vehicle deductions—mileage logs, receipts, and expense records. Without proper documentation, your deductions may be disallowed, and you could face penalties or interest.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.