Featured image for How Much Is Car Insurance For A 16 Year Old Monthly

Image source: cdn-res.keymedia.com

For a 16-year-old, car insurance premiums are remarkably high, often costing hundreds of dollars monthly due to their lack of driving experience and increased accident risk. While these costs vary significantly based on factors like vehicle choice, location, and academic performance, there are effective strategies to significantly reduce these steep monthly expenses, including good student discounts, safe driving courses, and bundling policies.

The exhilarating moment a teenager earns their driver’s license is a milestone filled with dreams of independence, road trips, and endless possibilities. For many 16-year-olds, it’s a rite of passage, a symbol of newfound freedom. However, for parents and new drivers alike, the excitement often comes with a dose of reality: the significant cost of car insurance. Understanding how much is car insurance for a 16 year old monthly is crucial for budgeting and planning, as it can be a substantial expense.

Indeed, insuring a 16-year-old driver is notoriously expensive, often representing one of the highest premiums you’ll ever encounter. Insurance companies categorize young, inexperienced drivers as high-risk, and this classification directly translates into higher rates. Navigating the world of auto insurance can be complex, especially when you’re trying to figure out the monthly outlay for a brand-new driver. But fear not; with the right information and strategies, you can better understand these costs and potentially find ways to manage them.

This comprehensive guide will delve deep into the factors that determine how much is car insurance for a 16 year old monthly, provide realistic cost estimates, and offer practical, actionable tips to help reduce those premiums. Our goal is to empower you with the knowledge needed to make informed decisions, ensuring your young driver is adequately protected without breaking the bank.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Why Is Car Insurance So Expensive for 16-Year-Olds?

- 4 Key Factors Influencing 16-Year-Old Car Insurance Costs

- 5 Estimated Monthly Costs: What to Expect

- 6 Strategies to Lower Car Insurance for a 16-Year-Old

- 7 The Importance of Adequate Coverage

- 8 Long-Term Savings: Building a Responsible Driving History

- 9 Conclusion

- 10 Frequently Asked Questions

- 10.1 What is the typical monthly cost of car insurance for a 16 year old?

- 10.2 Why is car insurance for a 16 year old monthly so much more expensive than for older drivers?

- 10.3 What are effective ways to reduce the monthly car insurance cost for a 16 year old?

- 10.4 What type of car insurance coverage is recommended for a 16 year old driver?

- 10.5 Is it better for a 16 year old to get their own car insurance policy or be added to a parent’s?

- 10.6 Can a 16 year old’s grades or driving education impact their monthly car insurance rates?

Key Takeaways

- Expect High Premiums: 16-year-olds face the highest car insurance rates.

- Join a Parent’s Policy: This is generally the most affordable option.

- Seek Good Student Discounts: Maintain strong grades for potential savings.

- Complete Driver Education: Courses often qualify for significant premium reductions.

- Choose a Safe, Older Car: Less powerful, higher-rated safety vehicles cost less.

- Always Compare Quotes: Shop multiple insurers to find the best monthly rates.

- Explore Telematics Programs: Usage-based insurance can reward safe driving habits.

📑 Table of Contents

- Why Is Car Insurance So Expensive for 16-Year-Olds?

- Key Factors Influencing 16-Year-Old Car Insurance Costs

- Estimated Monthly Costs: What to Expect

- Strategies to Lower Car Insurance for a 16-Year-Old

- The Importance of Adequate Coverage

- Long-Term Savings: Building a Responsible Driving History

- Conclusion

Why Is Car Insurance So Expensive for 16-Year-Olds?

The primary reason car insurance premiums are so high for 16-year-olds stems from their statistical risk profile. Insurance companies base their rates on vast amounts of data, and this data consistently shows that young, inexperienced drivers are involved in more accidents and file more claims than older, more seasoned drivers. Understanding these underlying factors is key to grasping the high cost of car insurance for a 16 year old monthly.

Lack of Driving Experience

Inexperience is the single biggest determinant. A 16-year-old, by definition, has just started driving. They haven’t had the years on the road to develop the nuanced judgment, hazard perception, and defensive driving skills that come with experience. This lack of practical road time makes them more prone to errors, misjudgments, and slow reactions, all of which contribute to a higher likelihood of accidents. Insurance providers see this as a significant gamble, hence the elevated rates for monthly car insurance for a 16-year-old.

Higher Accident Rates

Statistics from organizations like the Centers for Disease Control and Prevention (CDC) consistently show that the risk of motor vehicle crashes is higher among 16-19 year olds than among any other age group. Per mile driven, teen drivers aged 16–19 are nearly three times as likely as drivers aged 20 and older to be in a fatal crash. This grim reality translates directly into higher premiums. Insurers aren’t being punitive; they are simply pricing the risk that these statistics present, which directly impacts how much is car insurance for a 16 year old monthly.

Greater Risk of Distracted Driving

While distracted driving is a problem across all age groups, it’s particularly prevalent among teenagers. The combination of inexperience and a heightened susceptibility to distractions — from cell phones and peer passengers to loud music — creates a dangerous cocktail. These distractions divert attention from the road, significantly increasing the chances of an accident. Insurance companies are acutely aware of this behavioral pattern, which adds another layer to the cost assessment for 16-year-old car insurance costs per month.

More Expensive Claims

When 16-year-olds are involved in accidents, the claims tend to be more severe. This could be due to higher speeds, more reckless maneuvers, or simply the nature of their inexperience leading to more impactful collisions. More severe accidents mean higher costs for vehicle repairs, medical expenses, and potential legal fees, all of which the insurance company has to cover. This potential for higher payout per claim further justifies the steeper rates you’ll encounter when looking for car insurance for a 16 year old monthly.

Key Factors Influencing 16-Year-Old Car Insurance Costs

While age and inexperience are major hurdles, they aren’t the only factors dictating how much is car insurance for a 16 year old monthly. A multitude of variables come into play, each capable of nudging premiums up or down. Understanding these elements can help you make more informed decisions.

Visual guide about How Much Is Car Insurance For A 16 Year Old Monthly

Image source: insuraviz.com

Geographic Location

Where you live has a significant impact on insurance rates. Urban areas with higher traffic density, greater rates of theft, and more accidents generally have higher premiums than rural areas. State-specific regulations, minimum coverage requirements, and local claim trends also play a role. For example, a 16-year-old in a busy city like Los Angeles will likely pay more for monthly car insurance than one in a quiet Midwestern town.

Type of Car (Make, Model, Year)

The vehicle a 16-year-old drives is a critical factor. Sports cars, high-performance vehicles, and luxury cars are more expensive to insure due to their higher repair costs, greater likelihood of theft, and the perception that they encourage aggressive driving. Conversely, older, safer, and less powerful sedans or SUVs are generally cheaper to insure. Vehicles with advanced safety features might also qualify for discounts. Opting for a sensible, used car can significantly reduce car insurance for a 16 year old monthly.

Driving Record (Even as a New Driver)

Even though a 16-year-old is a new driver, their initial interactions with the law can impact future rates. Any traffic violations, even minor ones like speeding tickets, received shortly after getting a license can immediately raise premiums. A clean driving record from the outset is paramount for keeping 16-year-old car insurance costs per month manageable.

Gender

In most states, gender can influence insurance rates. Historically, young male drivers have faced higher premiums than young female drivers due to statistics indicating higher rates of risky driving behavior and severe accidents among young men. However, some states (like California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania) prohibit the use of gender as a rating factor, so this impact varies by location when considering how much is car insurance for a 16 year old monthly.

Coverage Levels and Deductibles

The amount and type of coverage you choose directly affect the premium. Opting for minimal state-mandated liability coverage will be cheaper than comprehensive coverage that includes collision, comprehensive, uninsured motorist, and medical payments. Similarly, choosing a higher deductible (the amount you pay out-of-pocket before your insurance kicks in) will lower your monthly premium, but it means you’ll pay more upfront if an accident occurs. Finding the right balance between affordability and adequate protection is key for car insurance for a 16 year old monthly.

Insurer and Discounts

Different insurance companies use different algorithms and weighting factors for their risk assessments, meaning quotes can vary significantly between providers for the exact same coverage. Some insurers are more aggressive in attracting young drivers with specific discounts. Shopping around and comparing quotes from multiple companies is essential to find the best rate for how much is car insurance for a 16 year old monthly.

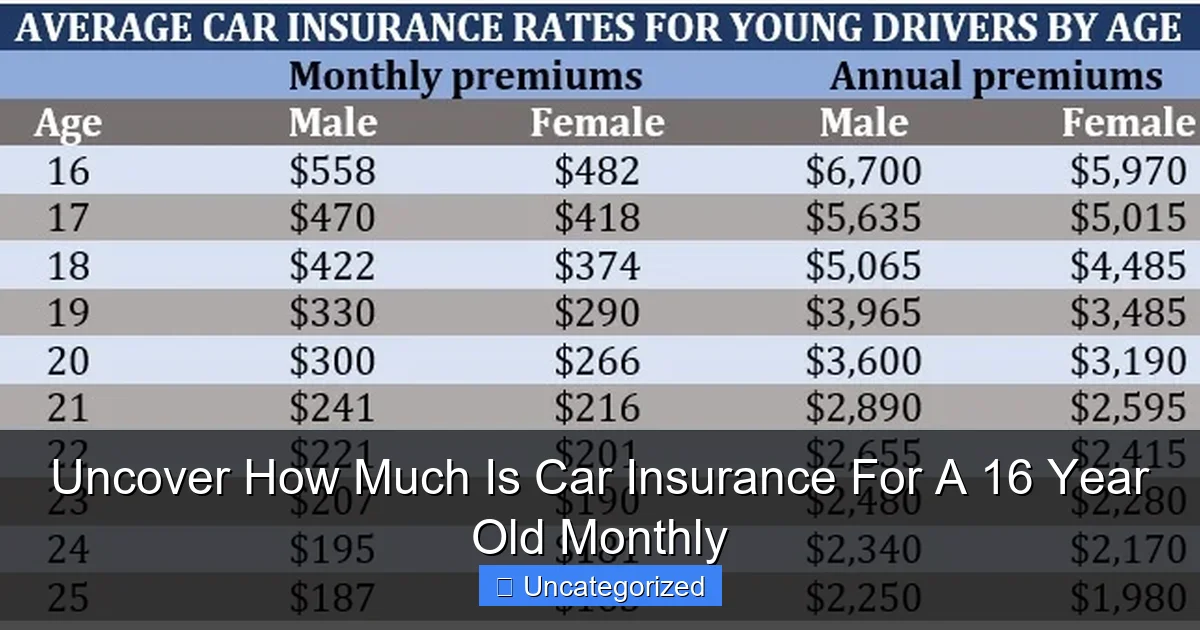

Estimated Monthly Costs: What to Expect

Pinpointing an exact figure for how much is car insurance for a 16 year old monthly is challenging due to the numerous variables involved. However, we can provide general estimates and scenarios to give you a realistic expectation. It’s important to remember that these are averages, and your actual costs could be higher or lower.

Average National Monthly Costs

Nationally, the average monthly cost to add a 16-year-old to an existing family policy can range anywhere from $150 to $400+ per month. If a 16-year-old were to seek their own independent policy (which is less common and often not advisable), the costs could skyrocket to $500 to $800+ per month, or even higher in some high-risk areas or with high-performance vehicles. These figures represent the significant financial commitment involved in insuring a young driver.

Impact of Adding to a Parent’s Policy vs. Independent Policy

One of the most crucial decisions for reducing costs is whether to add the 16-year-old to an existing family policy or for them to get their own. Adding a 16-year-old to a parent’s policy is almost always the more affordable option. This is because the teen benefits from the parent’s established driving history, multi-car discounts, and other bundled savings. An independent policy for a 16-year-old would mean they have no track record, no associated discounts, and are viewed as an even higher individual risk. This alone can differentiate between a manageable car insurance for a 16 year old monthly cost and an exorbitant one.

Factors that can significantly raise/lower costs

- Significantly Higher:

- Living in a high-crime, urban area with a high accident rate.

- Driving a brand new, high-value, or sports car.

- Having received a traffic ticket or been in an at-fault accident shortly after getting a license.

- Opting for maximum coverage limits with a low deductible.

- Significantly Lower:

- Living in a rural area with lower traffic and crime rates.

- Driving an older, very safe, and modest sedan or SUV.

- Maintaining excellent grades and enrolling in an approved driver education course.

- Utilizing usage-based insurance programs.

Practical Example:

- Scenario 1 (Optimized Cost): A 16-year-old female living in a suburban area, added to her parents’ policy (which already has multi-car and homeowner discounts). She drives a 2010 Honda Civic, maintains a B+ average, and completed a certified driver’s ed course. Her parents chose a moderate coverage level with a $1,000 deductible. In this case, the additional car insurance for a 16 year old monthly could be around $180-$250.

- Scenario 2 (Higher Cost): A 16-year-old male living in a busy metropolitan area, seeking an independent policy for a 2023 Ford Mustang GT. He has no prior driving history with an insurer, minimal discounts, and opts for full coverage with a $500 deductible. His monthly car insurance for a 16-year-old could easily be $600-$900+.

These examples highlight the vast difference that choices and circumstances can make in determining how much is car insurance for a 16 year old monthly.

Strategies to Lower Car Insurance for a 16-Year-Old

While the cost of insuring a 16-year-old can seem daunting, there are numerous proactive steps families can take to mitigate the expense. Implementing these strategies can make a significant difference in how much is car insurance for a 16 year old monthly.

Good Student Discount

Many insurance companies offer discounts for students who maintain a B average (3.0 GPA) or higher. This discount acknowledges that students who are responsible in their academic life are often more responsible behind the wheel. Always ask your insurer about this discount and be prepared to provide proof of grades, as it can often shave 5-25% off the premium for car insurance for a 16 year old monthly.

Driver Education Discount

Completing an accredited driver education course beyond the basic requirements for a license can also lead to discounts. These courses often teach advanced defensive driving techniques and reinforce safe habits. Insurers view this additional training as reducing risk. Ensure the course is approved by your insurance provider to qualify for the discount.

Telematics/Usage-Based Insurance

Many insurers offer telematics programs, also known as usage-based insurance (UBI) or “drive safe” programs. These involve installing a small device in the car or using a smartphone app to monitor driving habits like speed, braking, acceleration, and time of day driven. Safe driving can lead to significant discounts, especially beneficial for a young driver who can demonstrate responsible behavior. This is an excellent way to directly influence how much is car insurance for a 16 year old monthly based on actual performance.

Choosing the Right Car (Safe, Older, Less Powerful)

As discussed earlier, the vehicle choice is paramount. Opt for a car with a strong safety rating, lower horsepower, and a modest market value. Older, reliable models that are less attractive to thieves and cheaper to repair will result in lower premiums. Avoid sports cars, luxury vehicles, or even high-end SUVs, as these will invariably increase the cost of 16-year-old car insurance costs per month.

Increasing Deductibles (with caution)

Raising your deductible from, say, $500 to $1,000 will lower your monthly premium. However, this strategy requires careful consideration. You must be prepared to pay the higher deductible out-of-pocket if an accident occurs. Ensure you have an emergency fund available for this purpose.

Bundling Policies

If you already have other insurance policies with the same provider (e.g., homeowners, renters, or life insurance), bundling your auto insurance can lead to significant multi-policy discounts. This is another reason why adding a 16-year-old to an existing family policy is often the most cost-effective solution.

Maintaining a Clean Driving Record

This is perhaps the most impactful, albeit long-term, strategy. Every ticket, at-fault accident, or moving violation will not only raise premiums but can also make it harder to qualify for discounts. Emphasize to your 16-year-old the critical importance of defensive driving, obeying traffic laws, and avoiding distractions. A clean record will gradually lead to lower premiums as they gain experience and age, positively impacting how much is car insurance for a 16 year old monthly in the future.

Shopping Around for Quotes

Never settle for the first quote you receive. Insurance rates vary widely between companies. Get quotes from at least three to five different insurers, including national carriers and local independent agents. Each company has its own underwriting criteria and discount programs, so what’s expensive with one might be affordable with another. This due diligence is crucial for finding the best rate for car insurance for a 16 year old monthly.

The Importance of Adequate Coverage

While the focus on reducing premiums for car insurance for a 16 year old monthly is understandable, it’s equally important not to compromise on adequate coverage. Skimping on coverage to save a few dollars can lead to devastating financial consequences in the event of a serious accident.

Minimum State Requirements

Every state has minimum liability insurance requirements, which dictate the smallest amount of coverage you must carry by law. This usually covers bodily injury and property damage to others if you are at fault in an accident. While meeting these minimums makes your policy cheaper, they are often insufficient to cover the actual costs of a serious collision, especially with rising medical and vehicle repair expenses.

Why More Than Minimum is Often Necessary

Consider a scenario where your 16-year-old is at fault in an accident, and the damages to another vehicle or medical bills for injured parties exceed your state’s minimum liability limits. You would be personally responsible for paying the difference out-of-pocket. Given the higher accident rates and potential severity of collisions involving young drivers, opting for higher liability limits is a prudent decision. It provides a greater financial buffer and peace of mind.

Understanding Different Coverage Types

Beyond basic liability, several other coverage types are crucial:

- Collision Coverage: Pays for damage to your own vehicle resulting from an accident, regardless of fault. Essential if your 16-year-old is driving a car you want to repair or replace.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events like theft, vandalism, fire, natural disasters, or hitting an animal.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Protects you if you’re hit by a driver who has no insurance or not enough insurance to cover the damages. Given the number of uninsured drivers on the road, this is vital.

- Medical Payments (MedPay) or Personal Injury Protection (PIP): Covers medical expenses for you and your passengers after an accident, regardless of who was at fault. This can be critical for quick access to care.

These additional coverages will increase how much is car insurance for a 16 year old monthly, but they offer crucial protection against potentially bankrupting expenses.

Protecting Your Investment and Future

Adequate insurance isn’t just about covering current costs; it’s about protecting your financial future. A major at-fault accident with insufficient coverage could lead to lawsuits, asset forfeiture, and significant long-term debt. Investing a little more upfront in robust coverage for your 16-year-old can save you an immense amount of stress and money down the line. It’s an investment in safety and financial security, not just another bill for car insurance for a 16 year old monthly.

Long-Term Savings: Building a Responsible Driving History

While the initial outlay for car insurance for a 16 year old monthly can be daunting, it’s important to remember that these high costs are not permanent. With time, experience, and responsible behavior, premiums will gradually decrease. Establishing a solid driving history from day one is the most effective long-term strategy for reducing insurance costs.

Consistency is Key

The consistent demonstration of safe driving habits is paramount. Avoiding traffic violations, speeding tickets, and — most importantly — accidents will build a positive driving record. Every year your 16-year-old goes without incident, they become less of a risk in the eyes of insurers. This steady accumulation of experience without claims is the most powerful factor in reducing monthly car insurance for a 16-year-old over time. The longer the clean record, the more significant the savings will become.

Regular Policy Reviews

As your 16-year-old matures and gains experience, their risk profile changes. It’s beneficial to review your insurance policy annually, or at least every few years. Your insurer might automatically adjust rates based on age, but it’s always worth asking if new discounts apply. For instance, once your teen turns 18 or 20, they might qualify for lower rates purely based on their age demographic, assuming a clean record. Moreover, as they accumulate more years of licensed driving experience, they move out of the “inexperienced driver” category, which positively impacts how much is car insurance for a 16 year old monthly.

Impact of Age and Experience

Insurance premiums tend to decrease significantly once a driver reaches 18, and then again around 20-25 years old, assuming they maintain a clean driving record. This is because statistics show a notable drop in accident rates for drivers in these older age brackets. Therefore, viewing the initial high costs as a temporary phase is helpful. Encourage your young driver to understand that their current diligence on the road directly contributes to future financial savings. Emphasize that every safe mile driven is an investment in lower car insurance for a 16 year old monthly in the years to come, eventually making car ownership more affordable.

By focusing on long-term responsibility and consistently demonstrating safe driving, your 16-year-old can effectively “earn” lower premiums as they transition into more experienced and less risky driver categories. This shift not only benefits your wallet but also cultivates a safer, more confident driver.

Conclusion

Navigating the costs of car insurance for a 16 year old monthly is undoubtedly one of the more significant financial challenges parents face when their child begins driving. The reality is that young, inexperienced drivers pose a higher risk, and this is reflected in higher premiums. On average, you can expect to pay anywhere from $150 to $400+ per month to add a 16-year-old to an existing family policy, with independent policies costing substantially more.

However, understanding the factors that influence these costs — from geographic location and vehicle choice to coverage levels and driving record — empowers you to make informed decisions. By proactively implementing strategies such as taking advantage of good student and driver education discounts, choosing a safe and modest car, exploring telematics programs, and diligently shopping around for quotes, you can significantly mitigate the financial burden. Crucially, prioritizing adequate coverage, even if it means a slightly higher upfront cost for monthly car insurance for a 16-year-old, is essential for protecting your family’s financial well-being.

Ultimately, the journey of insuring a 16-year-old driver is a marathon, not a sprint. While the initial costs for car insurance for a 16 year old monthly may be steep, a consistent commitment to safe driving, responsible choices, and regular policy reviews will lead to substantial savings over time. Encourage your young driver to embrace this responsibility, knowing that every safe mile driven is an investment in their future on the road and in their wallet.

Frequently Asked Questions

What is the typical monthly cost of car insurance for a 16 year old?

The average cost of car insurance for a 16 year old can range significantly, often between $200 to $400 or more per month, depending on various factors. This amount is considerably higher than for experienced drivers due to their perceived higher risk.

Why is car insurance for a 16 year old monthly so much more expensive than for older drivers?

Insurance companies charge more because 16-year-olds are statistically among the highest-risk drivers, lacking experience and having higher accident rates. Their inexperience makes them more prone to collisions, leading to more frequent and costly claims.

What are effective ways to reduce the monthly car insurance cost for a 16 year old?

To lower costs, consider good student discounts, taking a defensive driving course, or choosing a safer, older vehicle. Adding the 16-year-old to a parent’s existing policy is almost always cheaper than a standalone policy for them.

What type of car insurance coverage is recommended for a 16 year old driver?

At a minimum, a 16-year-old needs the state-mandated liability coverage to cover damages or injuries they might cause. It’s also highly recommended to add comprehensive and collision coverage, especially if the car is valuable or financed, to protect against damage to their own vehicle.

Is it better for a 16 year old to get their own car insurance policy or be added to a parent’s?

It is almost always more cost-effective to add a 16-year-old to a parent’s existing car insurance policy rather than purchasing a separate one. This is because family policies can often leverage multi-car discounts and the parent’s established driving history.

Can a 16 year old’s grades or driving education impact their monthly car insurance rates?

Absolutely! Many insurance companies offer “good student discounts” for teenagers maintaining a B average or higher, recognizing their responsibility. Completing an approved driver’s education course can also signify lower risk and lead to additional premium reductions.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.