Car insurance for a 23-year-old averages between $200 and $300 monthly, but this figure is highly variable. Premiums are significantly influenced by factors such as driving history, location, vehicle type, and chosen coverage limits. To secure the best rate, it’s crucial to compare quotes from multiple insurers and actively seek out available discounts.

The dawn of 23 is often met with a unique blend of excitement and responsibility. You’re likely navigating the exhilarating waters of career building, perhaps still pursuing higher education, or simply reveling in a newfound sense of independence. Along with these milestones comes the realization that adulting involves a fair share of financial commitments – and for many, one of the most significant is securing affordable car insurance. The question, “How much is car insurance for a 23 year old per month?” isn’t just a casual query; it’s a critical financial consideration that can heavily impact your budget and lifestyle.

For young drivers, particularly those under 25, car insurance premiums are notoriously high. Insurers view this age group, unfortunately, as carrying a higher risk of accidents, and this perception translates directly into steeper costs. While you might feel penalized for simply being young, understanding the underlying factors contributing to these rates is the first step towards managing them effectively. This comprehensive guide aims to demystify the complexities of obtaining car insurance for a 23 year old, breaking down the costs, revealing the influencing factors, and equipping you with practical strategies to significantly reduce your monthly payments.

Whether you’re buying your first policy, looking to switch providers, or simply curious about what impacts your current rates, this post will provide valuable insights. We’ll explore everything from the demographic data that shapes insurance policies to the specific choices you can make to lower your monthly outlay. Navigating the world of car insurance can seem daunting, but armed with the right information and a proactive approach, you can find a policy that protects you without breaking the bank. Let’s dive into how much car insurance for a a 23 year old typically costs and, more importantly, how you can make it more affordable.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Understanding the High Cost: Why 23-Year-Olds Pay More

- 4 Key Factors Influencing Your Car Insurance Premium

- 5 Average Costs: What to Expect for Car Insurance For A 23 Year Old Per Month

- 6 Strategies to Lower Your Car Insurance Costs

- 6.1 Shop Around & Compare Quotes Diligently

- 6.2 Leverage Discounts (Good Student, Multi-Policy, Telematics, Safety Features)

- 6.3 Choose Your Vehicle Wisely

- 6.4 Increase Your Deductible

- 6.5 Maintain a Clean Driving Record

- 6.6 Consider Usage-Based Insurance

- 6.7 Improve Your Credit Score

- 6.8 Review Your Policy Regularly

- 7 Building a Smart Insurance Profile for Long-Term Savings

- 8 Data Table Section: Estimated Monthly Premiums for a 23-Year-Old (Example Scenarios)

- 9 Frequently Asked Questions

- 9.1 What is the average car insurance cost for a 23-year-old per month?

- 9.2 What factors primarily influence car insurance rates for a 23-year-old?

- 9.3 How can a 23-year-old reduce their monthly car insurance premium?

- 9.4 Is car insurance for a 23-year-old typically more expensive than for older drivers?

- 9.5 Does the type of car impact how much a 23-year-old pays for car insurance?

- 9.6 What discounts are available to help lower car insurance costs for a 23-year-old?

Key Takeaways

- Expect higher premiums at 23: Age still marks you as a higher risk.

- Average costs vary widely: Factors like location and car type dominate.

- Get multiple insurance quotes: Compare providers for your best rate.

- Maintain a clean driving record: Accidents and tickets hike your premiums.

- Seek available discounts actively: Good student or telematics can save you money.

- Evaluate your coverage needs: Balance protection with your budget.

- Your vehicle type impacts cost: Insurers charge more for expensive cars.

📑 Table of Contents

- Understanding the High Cost: Why 23-Year-Olds Pay More

- Key Factors Influencing Your Car Insurance Premium

- Average Costs: What to Expect for Car Insurance For A 23 Year Old Per Month

- Strategies to Lower Your Car Insurance Costs

- Building a Smart Insurance Profile for Long-Term Savings

- Data Table Section: Estimated Monthly Premiums for a 23-Year-Old (Example Scenarios)

Understanding the High Cost: Why 23-Year-Olds Pay More

It’s an undeniable fact: if you’re 23, your car insurance for a 23 year old premium will likely be higher than someone a decade older. This isn’t arbitrary; it’s rooted in actuarial science and statistical data that insurance companies rely on to assess risk. Understanding these core reasons is essential to grasping why your rates are what they are.

The “Risky Driver” Perception

Insurance companies are in the business of assessing and managing risk. Their data consistently shows that drivers under the age of 25, including 23-year-olds, are involved in more accidents and file more claims than older, more experienced drivers. This isn’t to say every young driver is reckless, but the aggregated statistics paint a picture of higher statistical probability for incidents. Factors like less experience, a tendency for riskier driving behaviors, and sometimes, impaired judgment contribute to this perception, making car insurance for a 23 year old inherently more expensive.

Lack of Driving History

Even if you’ve been driving since you were 16, by age 23, you still have a relatively short driving history compared to someone who’s been on the road for 20 years. A longer, clean driving record is a powerful indicator of responsible driving, which translates to lower premiums. A 23-year-old simply hasn’t had enough time to build up that extensive, trustworthy history. This lack of a lengthy track record, combined with the general risk profile for the age group, means insurers have less data to base a favorable rate upon, making car insurance for a 23 year old a significant expense.

Statistics Don’t Lie

According to organizations like the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS), drivers in their late teens and early twenties have a disproportionately high rate of fatal crashes and traffic violations. While rates decrease significantly after age 19, they typically don’t stabilize until around age 25. This cold, hard data is the primary driver behind the elevated cost of car insurance for a 23 year old. Insurers are simply pricing their policies to reflect the statistical likelihood of claims.

Impact of Gender (Historical Context, State-Specific Nuances)

Historically, gender played a role in car insurance premiums, with young males often paying more due to higher statistical accident rates. However, many states, including California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania, have banned the use of gender as a factor in setting insurance rates. Even in states where it is still permitted, the impact has lessened significantly as insurers focus more on individual driving habits, vehicle types, and other factors. Nonetheless, it’s worth being aware of this historical context as you research car insurance for a 23 year old, though its direct impact is diminishing.

Key Factors Influencing Your Car Insurance Premium

While age is a significant factor in the cost of car insurance for a 23 year old, it’s far from the only one. Insurers consider a multitude of variables when calculating your premium. Understanding these can empower you to make informed decisions that positively impact your rates.

Your Driving Record & Claims History

This is arguably the most critical factor. A clean driving record, free of accidents, speeding tickets, or other moving violations, will always lead to lower premiums. Conversely, a single speeding ticket or at-fault accident can significantly increase your car insurance for a 23 year old premium, sometimes for several years. Insurers look at your claims history, too; frequent claims, even minor ones, signal a higher risk.

Vehicle Type & Model

The car you drive has a direct bearing on your insurance costs. Generally, expensive, high-performance, or luxury vehicles cost more to insure because they are more expensive to repair or replace, and they are often targeted by thieves. Cars with higher safety ratings and lower theft rates tend to have lower premiums. Additionally, vehicles with advanced safety features (e.g., automatic emergency braking, lane-keeping assist) can sometimes qualify for discounts. When shopping for car insurance for a 23 year old, consider the insurance implications of your chosen vehicle.

Location, Location, Location

Where you live and park your car makes a difference. Urban areas typically have higher rates due to increased traffic density, higher rates of theft and vandalism, and a greater likelihood of accidents. Rural areas often see lower rates. Even within the same city, premiums can vary street by street based on local crime rates, traffic patterns, and accident statistics. Your zip code is a crucial piece of data for any car insurance for a 23 year old quote.

Coverage Levels & Deductibles

The type and amount of coverage you choose directly impact your premium. State minimum liability coverage will always be the cheapest option, but it offers minimal protection. Opting for full coverage (which includes collision and comprehensive) provides much broader protection but comes at a higher cost. Your deductible—the amount you pay out-of-pocket before your insurance kicks in—also matters. A higher deductible usually means a lower monthly premium for car insurance for a 23 year old, but you’ll pay more if you file a claim.

Credit Score (Where Applicable)

In most states, insurance companies use a credit-based insurance score as a factor in determining premiums. Studies have shown a correlation between a higher credit score and a lower likelihood of filing claims. While not every state permits the use of credit scores for insurance rating (California, Hawaii, and Massachusetts are notable exceptions), in those that do, a good credit score can lead to lower rates for car insurance for a 23 year old. Therefore, maintaining good credit is beneficial beyond just loans and mortgages.

Marital Status

Statistically, married individuals tend to have fewer accidents and file fewer claims than single individuals. For this reason, married drivers often receive slightly lower car insurance premiums. While it might not be a reason to rush to the altar, it’s a factor that insurance companies consider when calculating the cost of car insurance for a 23 year old.

Average Costs: What to Expect for Car Insurance For A 23 Year Old Per Month

Pinpointing an exact national average for car insurance for a 23 year old per month can be misleading due to the vast number of influencing factors. However, we can provide some general ranges and illustrate how different scenarios impact these averages. It’s important to remember these are estimates and your actual rate will depend on your unique profile.

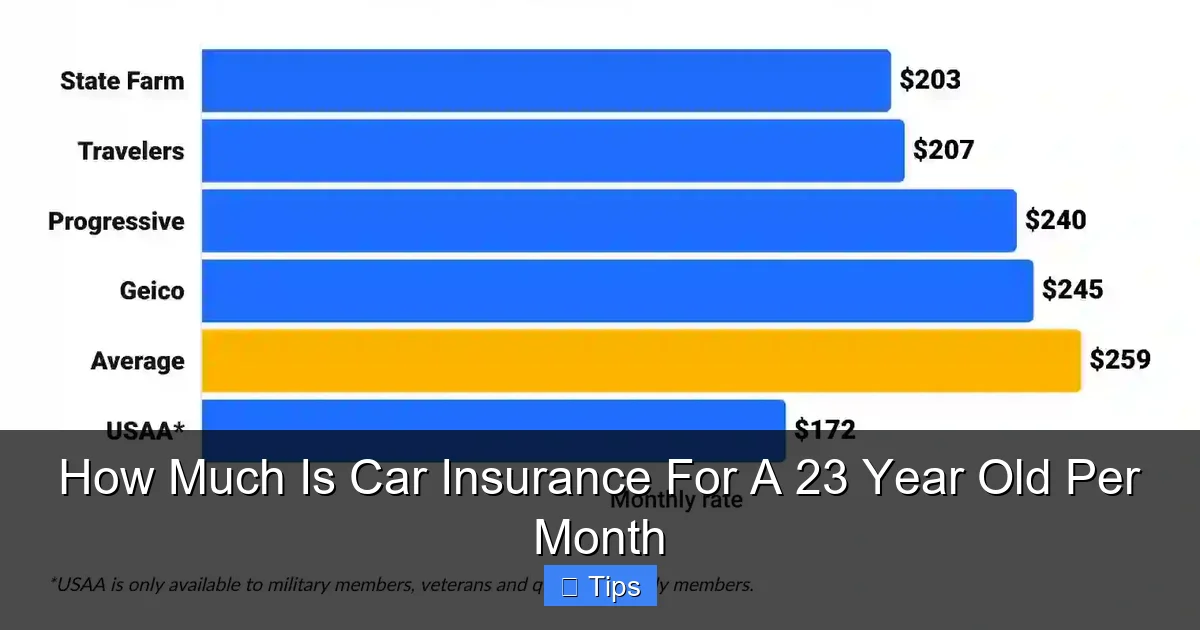

Visual guide about Car Insurance For 23 Year Old

Image source: res.cloudinary.com

State-by-State Variations

The cost of car insurance for a 23 year old varies dramatically by state, and even by zip code within a state. States with a high cost of living, dense populations, higher rates of uninsured drivers, or more severe weather events often have higher average premiums. For instance, a 23-year-old in Michigan might pay significantly more than one in North Carolina due to state-specific regulations and claims frequency. You could expect monthly premiums anywhere from $150 to $400+ depending on your state and other factors. For instance, in states like Louisiana, Florida, or New York, a 23-year-old could easily see premiums topping $300-$400 per month, whereas in states like Idaho or Iowa, it might hover around $150-$250.

Full Coverage vs. Liability Only

This is one of the most significant determinants of your monthly premium for car insurance for a 23 year old.

- Liability-Only Coverage: This is the minimum legally required insurance, covering damages and injuries you cause to others. It’s the cheapest option. For a 23-year-old, liability-only might range from $100 to $250 per month, depending on the state and other personal factors.

- Full Coverage: This includes liability, collision (damage to your car in an accident), and comprehensive (damage to your car from non-collision events like theft, vandalism, natural disasters). While offering far greater protection, it comes at a substantially higher cost. A 23-year-old opting for full coverage could expect to pay anywhere from $200 to $500+ per month, again with wide variations based on location, vehicle, and driving record.

Impact of Driving Record on Averages

A clean driving record is your best friend when it comes to lowering the cost of car insurance for a 23 year old.

- Clean Record: For a 23-year-old with no accidents or tickets, average full coverage might be in the $200-$350 range per month, assuming an average vehicle and location.

- One Minor Violation (e.g., speeding ticket): This could increase your premium by 10-20% or more. Your full coverage could jump to $250-$450 per month.

- One At-Fault Accident: An at-fault accident can lead to a 20-50% increase, or even more, in your rates. A 23-year-old with an at-fault accident might face premiums of $300-$600+ per month for full coverage.

Practical Example Scenarios (Monthly Breakdown for Different Profiles)

Let’s consider a few hypothetical 23-year-old drivers to illustrate potential monthly costs for car insurance for a 23 year old:

- Scenario 1: The Responsible Student

- Location: Suburban Ohio (average cost state)

- Vehicle: 2018 Honda Civic (modestly priced, safe)

- Driving Record: Clean, good student discount

- Coverage: Full coverage (mid-range deductibles)

- Estimated Monthly Premium: $200 – $280

- Scenario 2: The City Professional

- Location: Urban California (high cost state)

- Vehicle: 2020 Toyota Camry (reliable, but higher theft risk in urban areas)

- Driving Record: One minor speeding ticket from 2 years ago

- Coverage: Full coverage (standard deductibles)

- Estimated Monthly Premium: $300 – $450

- Scenario 3: The Young Adventurer

- Location: Rural Texas (mid-range cost state)

- Vehicle: 2015 Ford F-150 (higher cost to insure due to size/power)

- Driving Record: One at-fault fender bender 1 year ago

- Coverage: Full coverage (lower deductibles for peace of mind)

- Estimated Monthly Premium: $350 – $550+

Strategies to Lower Your Car Insurance Costs

While the initial quotes for car insurance for a 23 year old might seem disheartening, there are numerous proactive steps you can take to significantly reduce your monthly premiums. Diligence and smart choices can lead to substantial savings.

Shop Around & Compare Quotes Diligently

This is perhaps the most impactful advice. Insurance rates vary wildly between providers. Don’t settle for the first quote you receive. Use online comparison tools, call different agencies, and get at least 3-5 quotes. What one insurer considers a high risk, another might view more favorably. This simple act of comparison shopping can save hundreds, if not thousands, of dollars annually on your car insurance for a 23 year old.

Leverage Discounts (Good Student, Multi-Policy, Telematics, Safety Features)

Insurance companies offer a wide array of discounts, and 23-year-olds are often eligible for several:

- Good Student Discount: If you maintain a B average or better in college, you could qualify for a significant discount. Provide your insurer with proof of your academic performance.

- Multi-Policy Discount: Bundle your car insurance with other policies like renters or home insurance from the same provider. This is one of the easiest ways to save.

- Telematics/Usage-Based Insurance: Many insurers offer devices or apps that monitor your driving habits (speed, braking, mileage, time of day you drive). Safe drivers can earn substantial discounts. This is an excellent option for responsible drivers looking to lower their car insurance for a 23 year old premium.

- Vehicle Safety Features: Discounts are often available for cars equipped with anti-lock brakes, airbags, anti-theft devices, blind-spot monitoring, or automatic emergency braking.

- Defensive Driving Course: Completing an approved defensive driving course can sometimes earn you a discount.

- Paid-in-Full Discount: If you can afford to pay your annual premium upfront, many companies offer a discount for doing so.

- Anti-Theft Discount: If your vehicle has an alarm system or other anti-theft devices.

Choose Your Vehicle Wisely

Before buying a car, research its insurance costs. Sports cars, high-end luxury vehicles, and models with high theft rates will almost always be more expensive to insure. Opt for a safe, reliable, and moderately priced vehicle. Cars with excellent safety ratings and lower repair costs are generally cheaper to insure, directly impacting how much car insurance for a 23 year old will cost you.

Increase Your Deductible

Raising your deductible from, say, $500 to $1,000 can significantly lower your monthly premium. Just make sure you have enough in savings to comfortably cover the higher deductible if you need to file a claim. This is a trade-off that many consider for more affordable car insurance for a 23 year old.

Maintain a Clean Driving Record

This cannot be stressed enough. Avoid speeding tickets, reckless driving, and accidents. A clean record over time is the single most effective way to reduce your car insurance for a 23 year old rates. Each year you go without incidents, your “experience discount” effectively grows, pushing your premiums down.

Consider Usage-Based Insurance

If you’re a careful driver and don’t drive excessive mileage, a telematics program might be perfect for you. These programs track your driving habits, and if you demonstrate safe behavior, you can earn discounts. This is especially beneficial for those who drive less often or mostly during low-risk hours, directly influencing the cost of car insurance for a 23 year old.

Improve Your Credit Score

As mentioned, in states where it’s permitted, a better credit score can lead to lower insurance premiums. Work on paying bills on time, reducing debt, and monitoring your credit report. A strong credit score signals financial responsibility, which insurers often equate with lower risk for car insurance for a 23 year old.

Review Your Policy Regularly

Don’t just set it and forget it. Your insurance needs and circumstances change. Annually, review your policy to ensure you still have the right coverage, that you’re utilizing all eligible discounts, and that your rates are still competitive. Factors like a vehicle’s depreciation might mean you no longer need certain coverages (e.g., if an old car isn’t worth much, you might drop collision/comprehensive). This regular review is crucial for managing the cost of car insurance for a 23 year old.

Building a Smart Insurance Profile for Long-Term Savings

While immediate savings are important, a smart approach to car insurance for a 23 year old also involves building a profile that will yield long-term benefits. Think of your insurance choices now as an investment in lower rates for your future.

The Value of Continuous Coverage

Having a gap in your insurance coverage can be a red flag for insurers and can lead to higher premiums when you try to get a new policy. Even if you don’t own a car for a period, maintaining a non-owner policy can help demonstrate continuous coverage. Insurers view continuous coverage as a sign of responsible financial behavior, which can contribute to lower rates for car insurance for a 23 year old and beyond.

Defensive Driving Courses

Beyond potential discounts, taking a certified defensive driving course can genuinely make you a safer driver. Better driving skills reduce your risk of accidents, which is the ultimate long-term strategy for keeping your insurance costs down. Many states allow these courses to remove points from your license or reduce premiums, making it a double win for your car insurance for a 23 year old budget.

Understanding Your Policy (What You’re Paying For)

It’s vital to understand what each component of your policy covers. Don’t just look at the total premium. Know your liability limits, your collision and comprehensive deductibles, and any optional coverages you’ve selected. This knowledge empowers you to make informed decisions about what coverage you truly need and where you might be able to adjust to save money on car insurance for a 23 year old without compromising essential protection.

Planning for Future Milestones (Marriage, Moving)

As your life evolves, so will your insurance needs and potential rates. Getting married, moving to a new neighborhood, or even changing jobs can all impact your premiums. Stay proactive by updating your insurer about these life changes. As noted earlier, married individuals often receive lower rates, and moving to a safer, less congested area can also lead to significant savings on car insurance for a 23 year old as you mature.

Data Table Section: Estimated Monthly Premiums for a 23-Year-Old (Example Scenarios)

To further illustrate the variability in car insurance costs, here’s a hypothetical data table presenting estimated monthly premiums for car insurance for a 23 year old under different common scenarios. Please remember these are generalized estimates and actual rates will depend on specific providers, exact location, vehicle model, and individual circumstances.

| Scenario Profile | Vehicle Type | Driving Record | Location (Example) | Coverage Type | Estimated Monthly Premium Range |

|---|---|---|---|---|---|

| Clean Driver, Good Student | 2018 Honda Civic (Sedan) | Clean; 3.5 GPA | Suburban Ohio | Full Coverage ($1000 Deductible) | $200 – $280 |

| Average Driver, Urban Setting | 2020 Toyota Corolla (Sedan) | One Minor Speeding Ticket | Urban California | Full Coverage ($500 Deductible) | $300 – $450 |

| Young Professional, New Policy | 2022 Subaru Outback (SUV) | Clean; First Time Buying Own Policy | Mid-sized City, Colorado | Full Coverage ($750 Deductible) | $250 – $370 |

| Driver with Accident History | 2015 Ford F-150 (Pickup Truck) | One At-Fault Accident | Rural Texas | Full Coverage ($1000 Deductible) | $350 – $550+ |

| Budget-Conscious Driver | 2010 Toyota Camry (Older Sedan) | Clean Record | Small Town, Iowa | Liability Only (State Minimum) | $100 – $180 |

| High-Performance Vehicle Enthusiast | 2021 Ford Mustang GT (Sports Car) | Clean Record | Major City, Florida | Full Coverage ($500 Deductible) | $450 – $700+ |

These figures emphasize that the cost of car insurance for a 23 year old is highly individualized and subject to a wide range of variables. Using this table as a rough guide can help you contextualize quotes you receive.

Navigating the cost of car insurance for a 23 year old can indeed feel like a significant financial hurdle. However, by understanding the factors that influence your premiums and proactively implementing smart strategies, you are well-equipped to find coverage that fits both your needs and your budget. Remember that while age is a static factor for now, your driving habits, coverage choices, and vigilance in shopping around are dynamic elements entirely within your control.

Don’t let the initial sticker shock deter you. Every ticket avoided, every discount applied, and every comparison quote obtained contributes to meaningful savings. The journey to more affordable car insurance for a 23 year old is a marathon, not a sprint. By consistently maintaining a clean driving record, exploring all available discounts, and regularly reviewing your policy, you’ll pave the way for increasingly lower rates as you gain experience and move beyond the statistically “risky” age bracket.

Ultimately, securing suitable car insurance for a 23 year old is about balancing protection with affordability. Take the time to educate yourself, compare options, and make informed decisions. Your wallet will thank you, and you’ll gain peace of mind knowing you’re well-covered on the road ahead. Start today by getting multiple quotes and actively seeking out those savings – your future self will appreciate the effort!

Frequently Asked Questions

What is the average car insurance cost for a 23-year-old per month?

The average car insurance cost for a 23-year-old can vary significantly, often falling between $150 and $300 per month. This figure is highly dependent on individual factors like location, driving record, and the type of vehicle insured.

What factors primarily influence car insurance rates for a 23-year-old?

Several key factors influence car insurance rates for a 23-year-old, including their driving history, credit score (in some states), the make and model of their car, and their geographical location. Insurance providers also consider the specific coverage limits and deductibles chosen.

A 23-year-old can reduce their car insurance premium by maintaining a clean driving record, taking defensive driving courses, and actively exploring various discounts. Bundling policies, increasing deductibles, and driving a safer, less expensive car can also significantly help lower costs.

Is car insurance for a 23-year-old typically more expensive than for older drivers?

Yes, car insurance for a 23-year-old is generally more expensive than for drivers in their late 20s or 30s. Insurers perceive younger drivers, even those past their teen years, as having a higher risk of accidents, leading to elevated premiums.

Does the type of car impact how much a 23-year-old pays for car insurance?

Absolutely, the type of car significantly impacts how much a 23-year-old pays for car insurance. Vehicles that are expensive to repair, have high theft rates, or are considered high-performance will typically result in higher premiums due to increased risk.

What discounts are available to help lower car insurance costs for a 23-year-old?

Many discounts can help lower car insurance costs for a 23-year-old, such as good student discounts, multi-policy discounts, and discounts for safe driving or completing defensive driving courses. It’s always beneficial to ask your insurer about all available options to maximize savings.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.