Featured image for Car Insurance For 20 Year Old

Image source: sarticle.com

Car insurance for 20-year-olds is typically expensive, often averaging hundreds of dollars monthly, due to their perceived higher risk. However, your exact premium is heavily influenced by factors like your vehicle type, location, driving history, and chosen coverage limits. Exploring various providers and leveraging potential discounts are crucial steps to finding more affordable rates.

Turning 20 is a milestone. You’re officially out of your teens, potentially navigating college, a new career, or simply enjoying the freedom that comes with young adulthood. For many, this also means increased independence, and often, that includes driving your own car. The open road beckons, promising adventure and convenience. However, before you hit the gas, there’s a significant financial hurdle that often catches young drivers by surprise: car insurance.

The cost of car insurance for a 20 year old can feel like a steep price to pay, especially when compared to what older, more experienced drivers might be paying. It’s a common source of frustration, leading many to wonder why it’s so expensive and, more importantly, how they can possibly afford it. This isn’t just a trivial expense; it’s a legal requirement in most places and a crucial financial safeguard in the event of an accident.

If you’re a 20-year-old or the parent of one, trying to figure out how much you’ll pay for car insurance for a 20 year old can be a daunting task. The good news is that while premiums are generally higher for this age group, there are concrete reasons why, and more importantly, actionable strategies you can employ to significantly reduce your monthly costs. This comprehensive guide will break down everything you need to know about car insurance for a 20 year old per month, offering insights, practical examples, and tips to help you secure affordable and adequate coverage.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Why Is Car Insurance So Expensive for 20-Year-Olds? Understanding the Risk Factors

- 4 Average Car Insurance Costs for a 20-Year-Old (Monthly Breakdown)

- 5 Factors That Influence Your Car Insurance Premium

- 6 Strategies to Lower Your Car Insurance Costs as a 20-Year-Old

- 7 Choosing the Right Coverage: What a 20-Year-Old Needs to Know

- 8 The Process of Getting Car Insurance Quotes

- 9 Conclusion

- 10 Frequently Asked Questions

- 10.1 Why is car insurance so much higher for a 20-year-old compared to older drivers?

- 10.2 What are effective strategies to reduce how much car insurance is for a 20-year-old per month?

- 10.3 What is the typical average of how much car insurance is for a 20-year-old per month?

- 10.4 Beyond age, what key factors determine how much car insurance a 20-year-old will pay?

- 10.5 Does choosing a specific type of car impact how much car insurance a 20-year-old will pay?

- 10.6 What is the best approach for a 20-year-old to find the most affordable car insurance?

Key Takeaways

- 20-Year-Olds Face Higher Rates: Expect significantly higher premiums due to age and perceived risk.

- Shop Around Extensively: Compare quotes from multiple insurers to find the best deal.

- Explore Available Discounts: Ask about good student, safe driver, and multi-policy options.

- Consider Your Vehicle Choice: Car type heavily impacts cost; choose a cheaper-to-insure model.

- Maintain a Clean Record: Avoid accidents and tickets to prevent premium increases.

- Increase Your Deductible: Opting for a higher deductible can lower your monthly premium.

- Evaluate Coverage Needs: Balance comprehensive protection with affordability for your budget.

📑 Table of Contents

- Why Is Car Insurance So Expensive for 20-Year-Olds? Understanding the Risk Factors

- Average Car Insurance Costs for a 20-Year-Old (Monthly Breakdown)

- Factors That Influence Your Car Insurance Premium

- Strategies to Lower Your Car Insurance Costs as a 20-Year-Old

- Choosing the Right Coverage: What a 20-Year-Old Needs to Know

- The Process of Getting Car Insurance Quotes

- Conclusion

Why Is Car Insurance So Expensive for 20-Year-Olds? Understanding the Risk Factors

It’s no secret that young drivers, including 20-year-olds, typically face some of the highest car insurance premiums. This isn’t an arbitrary penalty; it’s a reflection of statistical realities and the insurance industry’s risk assessment models. To truly understand how much car insurance for a 20 year old costs, you first need to grasp why insurers perceive this age group as a higher risk. This understanding is key to unlocking strategies for lower rates.

Lack of Driving Experience

One of the primary reasons for elevated rates is simply a lack of extensive driving experience. While a 20-year-old may have been driving for a few years, they typically haven’t accumulated the same number of safe driving miles as someone who has been on the road for decades. Insurers look at long-term driving records, and without a substantial history of incident-free driving, they classify you as a higher risk. Less experience often translates to slower reaction times in unexpected situations, less developed hazard perception, and a greater likelihood of misjudging conditions.

Higher Accident Rates

Statistical data consistently shows that drivers in the 16-24 age bracket, which includes 20-year-olds, have a significantly higher rate of accidents compared to older, more experienced drivers. This isn’t just anecdotal; it’s backed by research from organizations like the National Highway Traffic Safety Administration (NHTSA). Young drivers are more prone to errors, often due to inexperience, but also because of factors like:

- Distracted Driving: Increased use of mobile phones and other in-car distractions.

- Speeding and Reckless Driving: A higher tendency to engage in risky behaviors such as speeding, aggressive driving, and not wearing seatbelts.

- Night Driving: Young drivers are involved in a disproportionate number of fatal crashes at night.

- Impaired Driving: While not exclusive to young drivers, statistics show concerning rates of driving under the influence of alcohol or drugs among this age group.

When an insurer calculates the cost of car insurance for a 20 year old, these statistics weigh heavily. A higher likelihood of filing a claim means a higher premium to offset that potential cost.

Severity of Accidents

Not only are young drivers involved in more accidents, but these accidents can also be more severe, leading to higher payout costs for insurers. This is partly linked to the types of risky behaviors mentioned above. Accidents at higher speeds or due to reckless maneuvers often result in more extensive vehicle damage, more serious injuries, and therefore, larger medical and repair bills.

Lack of a Established Claims History

A long history of responsible driving and no claims is a powerful tool for lowering insurance costs. A 20-year-old, by definition, has not had the opportunity to build up such a history. Without this track record, insurers have less data to evaluate individual risk, relying instead on broader demographic statistics. This contributes to the baseline higher cost of car insurance for a 20 year old.

Average Car Insurance Costs for a 20-Year-Old (Monthly Breakdown)

Pinpointing an exact average cost for car insurance for a 20 year old per month is challenging because it’s influenced by so many variables. However, we can provide a general range and break down the factors that lead to these figures. It’s important to understand that the numbers presented here are estimates and can vary wildly based on your specific circumstances.

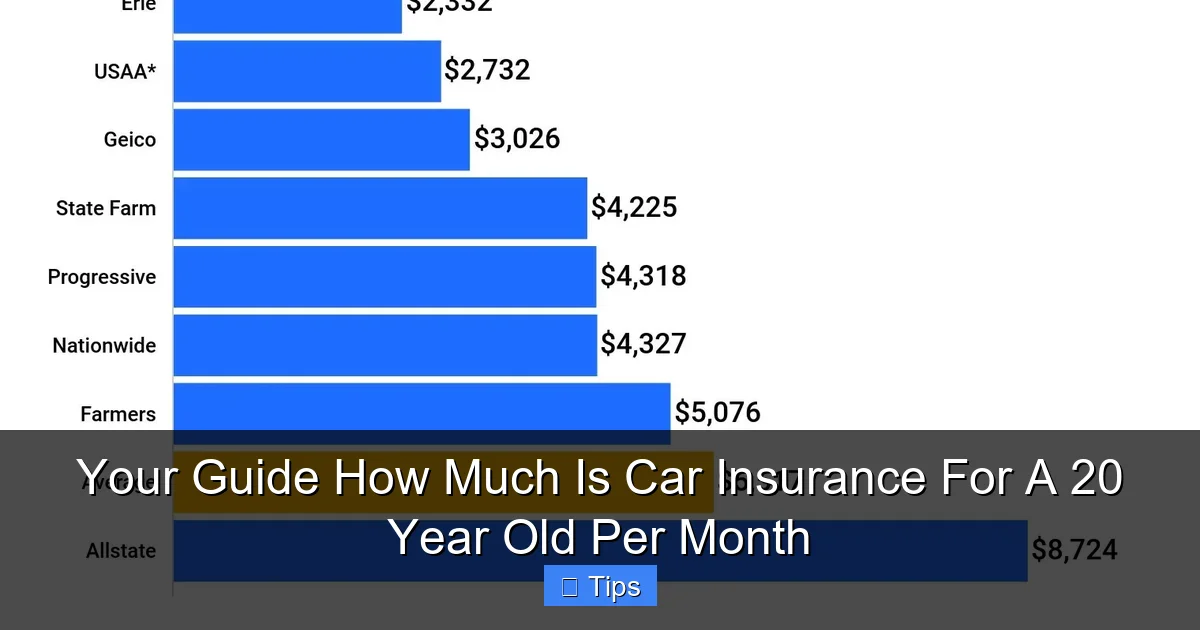

Visual guide about Car Insurance For 20 Year Old

Image source: autoinsurance.org

General Monthly Averages

On average, a 20-year-old can expect to pay anywhere from $150 to $400+ per month for full coverage car insurance. This range is broad because state, city, specific vehicle, driving record, and chosen coverage limits all play a significant role. For basic liability-only coverage, the costs might be lower, potentially ranging from $80 to $250+ per month, but it’s crucial to remember that liability-only provides minimal protection.

Illustrative Breakdown of Factors Affecting Monthly Costs

To give you a better idea of how these numbers can fluctuate, consider the following hypothetical scenarios. These are illustrative and should not be taken as exact quotes, but rather as examples of how different factors impact the cost of car insurance for a 20 year old.

| Scenario | Key Characteristics | Estimated Monthly Premium Range (Full Coverage) |

|---|---|---|

| Rural, Clean Record | 20-year-old, male/female, no accidents/tickets, older sedan, rural area, good student. | $150 – $250 |

| Suburban, Minor Infraction | 20-year-old, male/female, one minor speeding ticket, mid-range sedan, suburban area. | $200 – $350 |

| Urban, Recent Accident | 20-year-old, male/female, one at-fault accident, newer sports car, urban area. | $300 – $500+ |

| On Parent’s Policy | 20-year-old, male/female, clean record, driving a shared family car, on a multi-car family policy with discounts. | $100 – $200 (portion attributable to 20-year-old) |

Note: These figures are highly generalized and for illustrative purposes only. Actual rates for car insurance for a 20 year old will vary significantly based on your specific profile and chosen insurer.

Impact of Gender (State-Dependent)

Historically, gender played a significant role in insurance premiums, with young males often paying more than young females due to higher statistical accident rates. However, many states (e.g., California, Hawaii, Massachusetts, Michigan, North Carolina, Pennsylvania) have banned the use of gender as a rating factor. In states where it is still permitted, young men may still find themselves paying a higher premium for car insurance for a 20 year old. It’s crucial to check local regulations.

Factors That Influence Your Car Insurance Premium

Beyond your age and general risk profile as a 20-year-old, numerous specific factors contribute to your monthly car insurance for a 20 year old premium. Understanding these can help you make informed decisions and potentially lower your costs. Each element plays a role in how an insurer assesses your individual risk.

Visual guide about Car Insurance For 20 Year Old

Image source: res.cloudinary.com

Your Driving Record

This is arguably the most impactful factor. A clean driving record, free of accidents, speeding tickets, or other moving violations, will result in significantly lower premiums. Conversely, even a single speeding ticket or minor at-fault accident can cause your rates to spike and stay elevated for several years. Insurers see your past driving behavior as the best predictor of future risk.

The Vehicle You Drive

The car itself is a major premium determinant.

- Make, Model, and Year: Sports cars, luxury vehicles, or cars with high horsepower are more expensive to insure due to higher theft rates, higher repair costs, and a perception of being driven more aggressively. Older, safer, and less powerful sedans or SUVs are generally cheaper.

- Safety Features: Cars equipped with advanced safety features (e.g., anti-lock brakes, airbags, adaptive cruise control, lane-keeping assist) can sometimes qualify for discounts.

- Theft Rates: Vehicles that are commonly stolen or vandalized will carry higher comprehensive coverage costs.

Your Location

Where you live and park your car makes a big difference.

- Urban vs. Rural: City dwellers typically pay more for car insurance for a 20 year old than those in rural areas due to higher traffic density, increased accident rates, and higher rates of theft and vandalism.

- Local Claims History: Insurers analyze accident and theft statistics for specific zip codes. If your area has a high rate of claims, your premiums will reflect that.

- Weather Risks: Areas prone to severe weather (e.g., hail, hurricanes, floods) will have higher comprehensive coverage costs.

Your Coverage Choices and Deductibles

The type and amount of coverage you choose directly impact your premium.

- Liability Limits: Opting for higher liability limits (recommended for better protection) will increase your premium compared to state minimums.

- Collision and Comprehensive: Adding these coverages significantly increases costs, but they are essential if you want your own car to be repaired or replaced after an incident.

- Deductible Amount: This is the amount you pay out of pocket before your insurance kicks in. A higher deductible (e.g., $1,000 instead of $500) will lower your premium, but means you pay more initially if you file a claim.

- Add-ons: Features like roadside assistance, rental car reimbursement, or gap insurance add to your monthly bill.

Credit Score (Where Permitted)

In many states, insurers use a credit-based insurance score as a factor in setting premiums. Studies have shown a correlation between a person’s credit history and their likelihood of filing claims. A good credit score can lead to lower premiums, while a poor one can increase the cost of car insurance for a 20 year old. (Note: States like California, Hawaii, and Massachusetts prohibit the use of credit scores for insurance rating).

Annual Mileage

How much you drive annually influences your risk exposure. The more miles you log, the higher the chance of being involved in an accident. Drivers with very low mileage (e.g., less than 7,500 miles per year) might qualify for low-mileage discounts.

Strategies to Lower Your Car Insurance Costs as a 20-Year-Old

While car insurance for a 20 year old can be expensive, you’re not powerless against high premiums. There are numerous proactive steps you can take to significantly reduce your monthly costs. Implementing even a few of these strategies can make a substantial difference in your budget.

Visual guide about Car Insurance For 20 Year Old

Image source: forbes.com

Shop Around and Compare Quotes Extensively

This is perhaps the single most important piece of advice. Do not settle for the first quote you receive. Insurance companies use different underwriting models, meaning they weigh risk factors differently. What one insurer considers high-risk, another might find more acceptable. Get quotes from at least 3-5 different providers – including large national carriers, regional companies, and even online-only insurers. Use comparison websites, but also contact individual agents, as they may have access to exclusive rates or companies not listed elsewhere.

Take Advantage of Every Available Discount

Discounts are your best friend as a young driver. Be proactive and ask every insurer about all possible discounts. Common ones for 20-year-olds include:

- Good Student Discount: If you maintain a B average (3.0 GPA) or higher in high school or college, you can often qualify for a significant discount. Provide proof of your academic achievements.

- Driver Education/Defensive Driving Course Discount: Completing an approved defensive driving course can not only improve your skills but also earn you a discount, especially if you’ve recently had a violation.

- Telematics/Usage-Based Insurance Programs: Many insurers offer programs (e.g., “drive safe” apps or devices) that monitor your driving habits (speed, braking, mileage). Safe drivers can earn substantial discounts.

- Multi-Policy Discount (Bundling): If you rent, consider bundling your auto insurance with a renters insurance policy from the same provider. This can lead to savings on both.

- Multi-Car Discount: If you’re on a family policy with multiple vehicles, this discount often applies automatically.

- Passive Restraint/Anti-Theft Device Discounts: Cars with factory-installed airbags, anti-lock brakes, and alarm systems can qualify for reduced rates.

- Paid-in-Full Discount: If you can afford to pay your premium for six months or a year upfront, many insurers offer a small discount.

Choose Your Vehicle Wisely

The type of car you drive has a massive impact on your premiums.

- Opt for Safe, Practical Vehicles: Cars with high safety ratings, low theft rates, and affordable repair costs will be cheaper to insure. Think older, reliable sedans or compact SUVs rather than sports cars or luxury models.

- Avoid Modifications: Aftermarket modifications can increase premiums and may even void certain coverage if not declared.

Increase Your Deductible

Raising your deductible on collision and comprehensive coverage means you’ll pay more out-of-pocket if you file a claim, but it will lower your monthly premium. Only do this if you have enough emergency savings to comfortably cover the higher deductible. For example, moving from a $500 deductible to a $1,000 deductible can significantly reduce your monthly payments for car insurance for a 20 year old.

Maintain a Clean Driving Record

This is a long-term strategy but the most effective. Avoiding accidents and traffic violations is the best way to keep your rates low and even see them decrease over time. Every year of incident-free driving builds a positive claims history, making you a less risky driver in the eyes of insurers.

Consider Remaining on a Family Policy

If possible, staying on your parents’ policy as a listed driver is often the most cost-effective solution for car insurance for a 20 year old. Family policies typically benefit from multi-car discounts and the combined lower risk profile of older, experienced drivers, effectively subsidizing your higher individual risk. Be honest with your insurer about who drives which car the most to ensure proper coverage.

Review Your Coverage Annually

Your insurance needs and your financial situation can change. Annually, review your policy to ensure you’re not over-insured or under-insured. For instance, if your car has significantly depreciated in value, you might consider dropping collision or comprehensive coverage if the cost of the premium outweighs the potential payout for the car’s actual cash value.

Choosing the Right Coverage: What a 20-Year-Old Needs to Know

Understanding the different types of car insurance coverage is critical, not just for compliance but for your financial protection. As a 20-year-old, you need to balance cost with adequate protection. Skimping too much on coverage to save a few dollars can leave you in a devastating financial situation after an accident. Here’s a breakdown of essential coverages:

Liability Coverage (Bodily Injury & Property Damage)

This is the most fundamental and universally required type of coverage. It pays for damages and injuries you cause to others if you are at fault in an accident.

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for people injured in an accident you cause.

- Property Damage Liability: Covers damage to other people’s vehicles or property (e.g., fences, mailboxes) you cause.

Most states have minimum liability requirements, but these are often woefully inadequate for serious accidents. Financial advisors often recommend carrying much higher limits (e.g., 100/300/50, meaning $100,000 for one person’s injuries, $300,000 for all injuries in an accident, and $50,000 for property damage). While higher limits increase the cost of car insurance for a 20 year old, they protect your future earnings and assets from potential lawsuits.

Collision Coverage

This coverage pays for damage to your own vehicle resulting from a collision with another car, an object (like a tree or pole), or even if you roll your car over. It applies regardless of who is at fault. If you have a car loan or lease, your lender will almost certainly require you to carry collision coverage.

Comprehensive Coverage

Often paired with collision, comprehensive coverage protects your vehicle from non-collision-related incidents. This includes damage from:

- Theft or vandalism

- Fire

- Natural disasters (hail, floods, wind, falling objects)

- Hitting an animal

Like collision, if your car is financed, comprehensive coverage is typically mandatory. For older, fully paid-off vehicles, you might consider dropping collision and comprehensive if the annual premium cost approaches or exceeds the car’s actual cash value.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

This is a critical, often overlooked, coverage, especially if you’re trying to save on car insurance for a 20 year old. It protects you if you’re hit by a driver who has no insurance or insufficient insurance to cover your damages and medical bills. This coverage can pay for your medical expenses, lost wages, and pain and suffering. Given the number of uninsured drivers on the road, UM/UIM is highly recommended.

Personal Injury Protection (PIP) or Medical Payments (MedPay)

These coverages pay for medical expenses for you and your passengers, regardless of who caused the accident.

- PIP: More comprehensive, often including lost wages and rehabilitation costs, and is mandatory in “no-fault” states.

- MedPay: A more basic version, covering medical bills and funeral expenses.

If you have good health insurance, these might seem redundant, but they can cover deductibles or co-pays and often pay out more quickly than health insurance for accident-related injuries.

Optional Add-ons

Consider these based on your needs and budget:

- Roadside Assistance: For breakdowns, flat tires, or lockouts.

- Rental Car Reimbursement: Pays for a rental car while yours is being repaired after a covered claim.

- Gap Insurance: If you have a new car loan, this covers the “gap” between what your car is worth (and what collision/comprehensive would pay out) and the remaining balance on your loan if it’s totaled. Highly recommended for financed new cars.

The Process of Getting Car Insurance Quotes

Navigating the world of car insurance quotes can seem complex, but by following a structured approach, you can efficiently find the best car insurance for a 20 year old at a competitive price. Being prepared and thorough will streamline the process and lead to better results.

Gather All Necessary Information Before You Start

Before you begin reaching out to insurers, have all your pertinent details organized. This will ensure accurate quotes and prevent delays. You’ll typically need:

- Personal Information: Full name, date of birth, driver’s license number, social security number (for credit check in allowed states), marital status, occupation, and current address for all drivers to be listed on the policy.

- Vehicle Information: Make, model, year, VIN (Vehicle Identification Number), current mileage, and primary use of the vehicle (e.g., commute, pleasure, business).

- Driving History: Details of any accidents (at-fault or not, dates, damages), traffic violations (speeding tickets, DUIs, dates), and completion of any driver education courses.

- Current Insurance Information: If you have existing coverage, the name of your current insurer and policy number can be helpful for continuity and potential discounts.

- Academic Records: If you’re a student, have proof of your GPA (report card or transcript) ready for good student discounts.

Contact Multiple Insurers (At Least 3-5)

As stressed before, comparison shopping is paramount. Do not rely on a single quote.

- Online Comparison Tools: Websites like The Zebra, QuoteWizard, or Bankrate allow you to input your information once and receive multiple quotes from various carriers. This is a great starting point to get a general idea of the market.

- Directly with Major Carriers: Visit the websites or call the customer service lines of well-known insurers like State Farm, GEICO, Progressive, Allstate, Farmers, Liberty Mutual, etc.

- Independent Agents: These agents work with multiple insurance companies and can often find competitive rates by shopping around for you. They can also offer personalized advice and help you understand complex policy details.

Be Honest and Thorough When Providing Information

It’s crucial to provide accurate and complete information. Misrepresenting facts (e.g., forgetting a ticket, listing a different primary driver) might give you a lower quote initially, but it can lead to serious problems down the line. If an insurer discovers discrepancies, they can deny claims, cancel your policy, or even retroactively charge you for the correct premium, potentially with penalties. This is especially important when getting car insurance for a 20 year old, as temptations to bend the truth for lower rates can be high.

Understand and Compare Your Quotes Carefully

Don’t just look at the bottom-line premium. Ensure you are comparing apples to apples.

- Coverage Levels: Are the liability limits, deductibles, and additional coverages (collision, comprehensive, UM/UIM, etc.) identical across all quotes?

- Discounts Applied: Make sure all eligible discounts have been included in each quote.

- Policy Terms: Are you looking at a 6-month or 12-month policy? What are the payment options (monthly, quarterly, semi-annually)?

Ask questions if anything is unclear. It’s important to know exactly what you’re getting for your money.

Don’t Be Afraid to Negotiate or Ask for More Discounts

While insurance rates aren’t typically negotiable in the traditional sense, you can always ask if there are any additional discounts you might qualify for. Sometimes, specific programs or temporary offers might not be automatically applied. A quick call to an agent can reveal savings you didn’t know existed for car insurance for a 20 year old.

Read the Fine Print Before Committing

Once you’ve chosen an insurer, read the policy documents carefully before signing. Understand the terms, conditions, exclusions, and how claims are processed. Knowing your policy inside and out can save you headaches and financial strain later.

Conclusion

Navigating the world of car insurance for a 20 year old can feel like a daunting financial challenge. The reality is that young drivers, due to statistical risk factors, face higher premiums than almost any other age group. However, understanding why these costs are high is the first step toward effectively managing them.

This guide has outlined the key factors influencing your monthly premium, from your driving record and vehicle choice to your location and coverage selections. More importantly, it has equipped you with a robust set of strategies to significantly reduce your costs. From diligently shopping around and maximizing every conceivable discount – especially good student and telematics programs – to making smart choices about your vehicle and coverage levels, you have the power to make car insurance for a 20 year old more affordable.

Remember, a clean driving record is your most valuable asset, accumulating years of safe driving will progressively lower your rates. Be patient, be proactive, and don’t hesitate to seek advice from independent insurance agents. By combining informed decisions with responsible driving habits, you can secure the essential protection you need without breaking the bank. Your financial independence and peace of mind on the road are worth the effort.

Frequently Asked Questions

Why is car insurance so much higher for a 20-year-old compared to older drivers?

Car insurance premiums are significantly higher for 20-year-olds primarily due to their lack of extensive driving experience and statistically higher accident rates. Insurers perceive this age group as a greater risk, leading to elevated costs to cover potential claims.

What are effective strategies to reduce how much car insurance is for a 20-year-old per month?

To lower costs, a 20-year-old can consider enrolling in a telematics (usage-based insurance) program, maintaining good grades for a student discount, or taking a defensive driving course. Choosing a safer, less expensive car and opting for a higher deductible can also significantly reduce monthly premiums.

What is the typical average of how much car insurance is for a 20-year-old per month?

The average cost can vary widely, often ranging from $200 to $400 or more per month, depending on numerous factors. It’s crucial to remember that this is just an estimate, and your actual rate will be unique to your specific circumstances and location.

Beyond age, what key factors determine how much car insurance a 20-year-old will pay?

Your driving record, the type of vehicle you drive, your geographical location, and even your credit score (in some states) significantly impact premiums. The specific coverage limits, deductibles, and discounts you qualify for also play a major role in the final cost.

Does choosing a specific type of car impact how much car insurance a 20-year-old will pay?

Absolutely. Insuring a high-performance sports car or an expensive luxury vehicle will typically result in much higher premiums than insuring an older, safer, and less powerful model. Cars with good safety ratings and anti-theft devices can sometimes qualify for discounts, helping to reduce costs.

What is the best approach for a 20-year-old to find the most affordable car insurance?

The most effective method is to shop around diligently and compare quotes from at least three to five different insurance providers. Utilize online comparison tools and consider consulting with an independent insurance agent who can help you navigate various options and identify potential discounts.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.