Leasing a car offers lower monthly payments, access to newer vehicles, and fewer long-term responsibilities compared to buying. It’s ideal for drivers who want the latest features, minimal maintenance, and flexibility to upgrade every few years.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Introduction: Should You Lease or Buy Your Next Car?

- 4 Lower Monthly Payments: Stretch Your Budget Further

- 5 Drive Newer, Safer, and More Efficient Vehicles

- 6 Lower Maintenance and Repair Costs

- 7 No Resale or Trade-In Hassle

- 8 Tax Benefits for Business Use

- 9 Flexibility and Lifestyle Fit

- 10 Conclusion: Is Leasing Right for You?

- 11 Frequently Asked Questions

Key Takeaways

- Lower Monthly Payments: Lease payments are typically 30-50% lower than loan payments for the same vehicle, freeing up cash for other expenses.

- Drive Newer Cars More Often: Most leases last 2-4 years, letting you enjoy the latest safety tech, fuel efficiency, and design trends regularly.

- Lower Maintenance Costs: Leased vehicles are usually under warranty, so repairs are covered, and you avoid costly long-term upkeep.

- No Resale Hassle: At the end of the lease, you simply return the car—no need to sell, trade, or worry about depreciation.

- Tax Benefits for Business Use: Businesses can often deduct a portion of lease payments, making it a smart financial move for entrepreneurs.

- Predictable Budgeting: Fixed monthly payments and known mileage limits help you plan your finances without surprise costs.

- Flexibility to Upgrade: Leasing lets you switch to a new model every few years, perfect for those who love change or need different vehicle types seasonally.

📑 Table of Contents

- Introduction: Should You Lease or Buy Your Next Car?

- Lower Monthly Payments: Stretch Your Budget Further

- Drive Newer, Safer, and More Efficient Vehicles

- Lower Maintenance and Repair Costs

- No Resale or Trade-In Hassle

- Tax Benefits for Business Use

- Flexibility and Lifestyle Fit

- Conclusion: Is Leasing Right for You?

Introduction: Should You Lease or Buy Your Next Car?

Deciding between leasing and buying a car is one of the biggest financial choices many drivers face. It’s not just about which model you like or how much horsepower it has—it’s about your lifestyle, budget, and long-term goals. While buying a car means owning it outright (after paying off the loan), leasing is more like renting it for a set period, usually two to four years. Both options have their perks, but leasing has quietly become a smart choice for a growing number of drivers.

So why are so many people choosing to lease? For starters, leasing often comes with lower monthly payments. That means you can drive a newer, more premium vehicle without stretching your budget. Plus, you’re not stuck with a car that loses value the moment you drive it off the lot. With leasing, you get to enjoy the latest tech, safety features, and fuel-efficient engines—without the headache of selling or trading in a used car later. And let’s be honest: who doesn’t love the idea of driving a shiny new car every few years?

Lower Monthly Payments: Stretch Your Budget Further

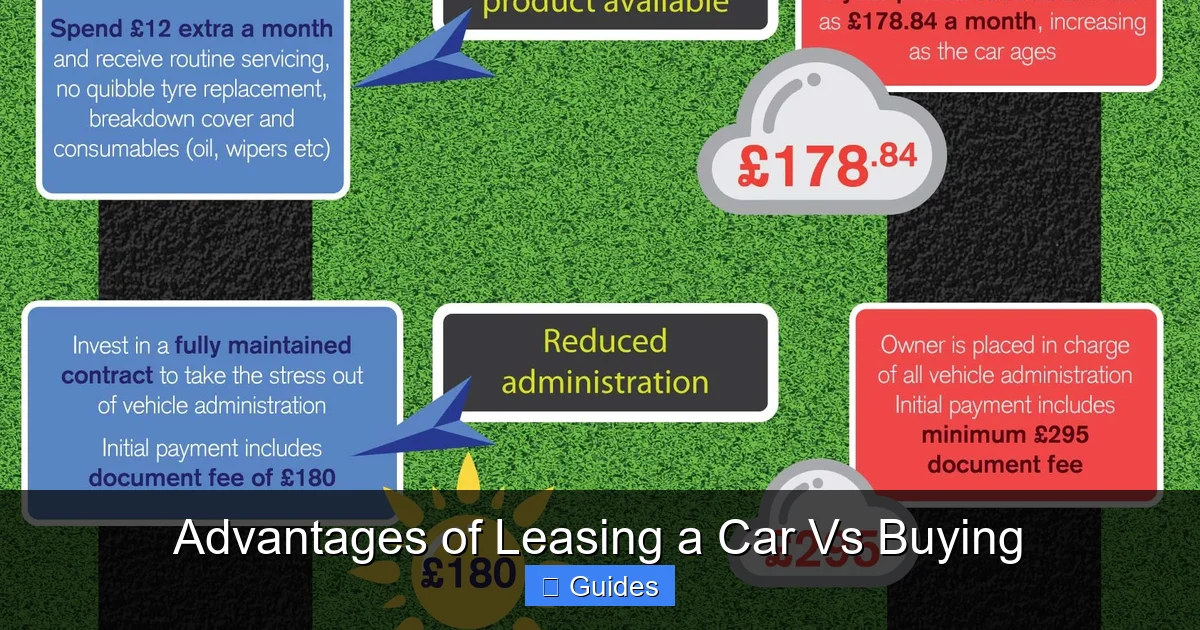

One of the biggest advantages of leasing a car vs buying is the significantly lower monthly payment. When you lease, you’re only paying for the vehicle’s depreciation during the lease term, plus interest and fees—not the full value of the car. This means your monthly out-of-pocket cost is often 30% to 50% less than what you’d pay with a traditional auto loan.

Let’s look at a real-world example. Say you’re eyeing a 2024 Honda Accord with a sticker price of $35,000. If you finance it with a 60-month loan at 5% interest, your monthly payment could be around $660. But if you lease the same car for 36 months with a $3,000 down payment, your monthly payment might drop to just $350. That’s a savings of over $300 per month—money you could put toward savings, travel, or even a vacation.

This lower payment structure makes leasing especially attractive for people who want a higher-end vehicle but don’t want to commit to a large loan. Want a luxury sedan or an SUV with all the bells and whistles? Leasing lets you enjoy those features without the financial burden of ownership. And because you’re not tied to a long-term loan, you have more flexibility to adjust your vehicle choice as your needs change.

How Lease Payments Are Calculated

Understanding how lease payments are calculated can help you make smarter decisions. Lease payments are based on three main factors: the car’s capitalized cost (what you agree to pay), its residual value (how much it’s expected to be worth at the end of the lease), and the money factor (similar to an interest rate).

For example, if a car costs $40,000 and has a residual value of 60% after three years, the depreciation is $16,000. Spread over 36 months, that’s about $444 per month in depreciation. Add in interest and fees, and your total monthly payment might land around $500. Compare that to a $40,000 loan at 5% over five years—your payment would be nearly $755. The difference is clear.

Tips to Lower Your Lease Payment

Want to get the best deal on your lease? Here are a few practical tips:

- Negotiate the Capitalized Cost: Just like with a purchase, you can haggle on the price of the car. A lower starting price means lower monthly payments.

- Choose a Higher Residual Value: Cars that hold their value well (like Toyotas, Hondas, and Subarus) often come with better lease terms.

- Put Down a Larger Down Payment: A bigger down payment (sometimes called a “cap cost reduction”) reduces your monthly obligation, but be cautious—this money is non-refundable if you end the lease early.

- Shop Around for Lease Deals: Dealerships often run special lease promotions with low or even $0 down. Timing your lease during end-of-year sales can save you hundreds.

Drive Newer, Safer, and More Efficient Vehicles

Technology in cars is advancing faster than ever. From advanced driver-assistance systems (ADAS) like automatic emergency braking and lane-keeping assist to electric powertrains and smartphone integration, today’s vehicles are smarter, safer, and more efficient. But if you buy a car and keep it for 10 years, you might miss out on these innovations. Leasing solves that problem.

Because most leases last between 24 and 48 months, you can upgrade to a new model every few years. This means you’re always driving a car that’s under warranty, packed with the latest features, and built with the most up-to-date safety standards. For families, this could mean access to better crash ratings and child safety features. For commuters, it might mean improved fuel economy or all-electric range.

Imagine leasing a 2023 Toyota RAV4 Hybrid and then upgrading to the 2026 model in three years. You’ll benefit from newer battery technology, enhanced infotainment systems, and possibly even Level 2 autonomous driving capabilities—without ever dealing with a used car sale.

The Safety Advantage

Safety is a top concern for most drivers, and leasing gives you a consistent advantage. Newer vehicles consistently earn higher safety ratings from organizations like the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS). Features like blind-spot monitoring, adaptive cruise control, and rear cross-traffic alert are now standard on many new models—but they weren’t available just a few years ago.

By leasing, you ensure your vehicle is always equipped with the best protection available. This is especially valuable for parents, older drivers, or anyone who drives in high-traffic areas.

Fuel Efficiency and Environmental Benefits

Fuel-efficient and electric vehicles (EVs) are becoming more common, and leasing makes it easier to try them out. Many automakers offer attractive lease deals on hybrids and EVs to encourage adoption. For example, you might lease a Chevrolet Bolt EV for under $200 a month with minimal down—giving you access to zero-emission driving without the high upfront cost of buying.

Even if you’re not ready to go fully electric, leasing a hybrid like the Honda CR-V Hybrid or Toyota Prius can save you hundreds on gas each year. And because you’re not tied to the vehicle long-term, you can switch back to a gas-powered car if your driving needs change.

Lower Maintenance and Repair Costs

One of the hidden perks of leasing is peace of mind when it comes to maintenance and repairs. Most leased vehicles are covered by the manufacturer’s warranty for the entire lease term—typically 3 years or 36,000 miles, whichever comes first. This means that if something breaks or needs repair, it’s usually covered at no extra cost to you.

Compare that to owning a car. Once your warranty expires, you’re on the hook for everything—from brake pads to transmission issues. According to AAA, the average annual cost of car maintenance and repairs is over $1,200. Over five years, that’s more than $6,000. With a lease, you avoid most of these expenses.

Routine Maintenance Made Easy

Many lease agreements also include scheduled maintenance packages. These cover oil changes, tire rotations, brake inspections, and other routine services. Some luxury brands, like BMW and Mercedes-Benz, even offer complimentary maintenance for the first few years. This not only saves you money but also ensures your car is always in top condition.

For example, a 36-month lease on a Lexus RX might include free oil changes, air filter replacements, and multi-point inspections. That’s hundreds of dollars in savings and one less thing to worry about.

What Happens If Something Breaks?

Even with a warranty, it’s important to understand your lease terms. Most leases require you to follow the manufacturer’s recommended maintenance schedule. If you skip oil changes or ignore warning lights, the lease company may charge you for excess wear or damage.

However, if a part fails due to a manufacturing defect—like a faulty transmission or electrical issue—the repair is typically covered. Just make sure to take your car to an authorized dealer or certified mechanic to avoid voiding the warranty.

No Resale or Trade-In Hassle

Selling a used car is a hassle. You have to clean it, fix minor issues, list it online, meet with potential buyers, negotiate the price, and handle paperwork. And even then, you might not get what you want for it. Trade-ins are easier, but dealerships often offer less than market value.

Leasing eliminates this entire process. When your lease ends, you simply return the car to the dealership (as long as it’s in good condition and within mileage limits). No ads, no test drives, no haggling. You walk away clean—and can immediately start looking for your next vehicle.

This is a huge advantage for people who don’t want the stress of ownership. Whether you’re a busy professional, a parent, or someone who just prefers simplicity, leasing lets you focus on driving, not selling.

Understanding Wear and Tear

At the end of your lease, the dealership will inspect the car for excessive wear and tear. Normal wear—like minor scratches or worn floor mats—is expected and won’t cost you extra. But significant damage, such as large dents, torn seats, or paint damage, may result in fees.

To avoid surprises:

- Keep detailed records of maintenance and repairs.

- Take photos of the car before returning it.

- Clean the interior and exterior thoroughly.

- Consider purchasing a wear-and-tear protection plan when you sign the lease.

What If You Want to Keep the Car?

Sometimes, you fall in love with your leased car and want to keep it. Most leases allow you to buy the vehicle at the end of the term for its residual value. This price is set at the beginning of the lease, so you know exactly what it will cost.

For example, if your car’s residual value is $18,000 and the market value is $20,000, you’re getting a great deal. But if the market value drops to $15,000, it might be smarter to return the car and lease a new one. Either way, you have options.

Tax Benefits for Business Use

If you use your car for business, leasing can offer significant tax advantages. The IRS allows businesses to deduct a portion of lease payments as a business expense, which can lower your taxable income.

For example, if you’re self-employed and use your leased car 80% for work, you can deduct 80% of your monthly payments. This can add up to thousands of dollars in annual savings. Additionally, some states offer tax credits for leasing electric or hybrid vehicles used for business.

How to Claim the Deduction

To claim the deduction, you’ll need to:

- Keep a mileage log showing business vs. personal use.

- Save all lease agreements and payment receipts.

- Consult a tax professional to ensure compliance with IRS rules.

Note: The rules can be complex, especially for leased vehicles over a certain value. Always seek advice from a qualified accountant.

Section 179 Deduction and Leasing

The Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment (including vehicles) in the year it’s placed in service. While this typically applies to purchased vehicles, some lease structures—like capital leases—may also qualify. Again, professional guidance is essential.

Flexibility and Lifestyle Fit

Leasing offers a level of flexibility that buying simply can’t match. Life changes fast—jobs, families, commutes, and hobbies evolve. With a lease, you’re not locked into one vehicle for a decade. You can adapt as your needs change.

For example, a young professional might lease a compact sedan for city driving. A few years later, they get married and need a larger SUV for family trips. With a lease, they can upgrade easily. Another person might lease a convertible for summer fun and switch to an all-wheel-drive SUV in winter.

Perfect for Frequent Upgraders

If you love new technology or simply enjoy driving different cars, leasing is ideal. You can experience different brands, models, and features every few years. Want to try an electric car? Lease a Tesla Model 3. Curious about a luxury brand? Lease a Genesis GV70. The options are endless.

Ideal for Short-Term Residents

People who move frequently—like military personnel, digital nomads, or contract workers—benefit greatly from leasing. You don’t have to worry about selling a car in a new city or losing money on a trade-in. Just return the vehicle and move on.

Conclusion: Is Leasing Right for You?

Leasing a car isn’t for everyone, but for many drivers, the advantages of leasing a car vs buying are hard to ignore. Lower monthly payments, access to newer technology, minimal maintenance, and no resale hassle make leasing a smart, flexible, and financially sound choice.

If you value driving a new car every few years, want to avoid long-term repair costs, and prefer predictable monthly expenses, leasing could be the perfect fit. It’s especially beneficial for business owners, tech enthusiasts, and anyone who wants to enjoy the latest in automotive innovation without the burden of ownership.

Of course, leasing isn’t perfect. You don’t build equity, mileage is limited, and you’ll always have a car payment. But for the right person, those trade-offs are worth it.

Before you decide, assess your driving habits, budget, and long-term goals. Talk to a trusted dealer, compare lease offers, and consider your lifestyle. Whether you choose to lease or buy, the most important thing is making a decision that works for you.

Frequently Asked Questions

Is leasing a car cheaper than buying in the long run?

Leasing is often cheaper in the short term due to lower monthly payments and no large down payment. However, over many years, you’ll always have a car payment, whereas buying allows you to own the vehicle outright after the loan is paid off.

Can you negotiate a car lease?

Yes, you can negotiate the capitalized cost, money factor, and other terms of a lease—just like when buying a car. Research fair market values and be prepared to walk away if the deal isn’t right.

What happens if you go over your mileage limit?

Most leases charge a per-mile fee (typically $0.10 to $0.25) for exceeding the agreed mileage. To avoid fees, choose a higher mileage limit upfront or return the car early if you’re close to the limit.

Can you lease a used car?

Yes, some dealerships offer certified pre-owned (CPO) lease programs. These can be a great way to get a reliable, slightly used car with lower payments and full warranty coverage.

Is it better to lease or buy an electric car?

Leasing an electric car can be a smart choice because battery technology improves rapidly. Leasing lets you upgrade to newer models with longer range and better efficiency every few years.

Can you end a car lease early?

Yes, but it usually comes with penalties. Early termination fees can be high, though some leases offer transfer options or buyout clauses. Always read the fine print before signing.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.