Deciding between buying a car and leasing a car comes down to your lifestyle, budget, and long-term goals. Buying builds equity and offers freedom, while leasing provides lower payments and the latest features—but with restrictions. Understanding the pros and cons helps you choose wisely.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Buying a Car vs Leasing a Car Pros and Cons: Which Is Right for You?

- 4 Understanding the Basics: What Does Buying a Car Mean?

- 5 Understanding the Basics: What Does Leasing a Car Mean?

- 6 Cost Comparison: Buying vs Leasing Over Time

- 7 Lifestyle and Usage: Which Option Fits Your Life?

- 8 Long-Term Value and Equity: The Ownership Advantage

- 9 Making the Right Choice: Tips for Deciding Between Buying and Leasing

- 10 Conclusion: Buying a Car vs Leasing a Car—What’s Best for You?

- 11 Frequently Asked Questions

Key Takeaways

- Buying builds ownership: You own the car outright after paying it off, allowing unlimited mileage, customization, and long-term savings.

- Leasing offers lower monthly payments: Monthly lease costs are typically 30–50% lower than loan payments for the same vehicle.

- Leasing includes mileage limits: Most leases restrict annual mileage (usually 10,000–15,000 miles), with fees for overages.

- Buying avoids wear-and-tear fees: When you own, you don’t pay extra for dents, scratches, or tire wear—common charges at lease end.

- Leasing keeps you in newer cars: You can upgrade every 2–4 years to the latest models with advanced safety and tech features.

- Buying has higher upfront costs: Down payments, taxes, and registration fees are often higher when financing a purchase.

- Leasing doesn’t build equity: You’re paying to use the car, not own it, so you gain no asset value at the end of the term.

📑 Table of Contents

- Buying a Car vs Leasing a Car Pros and Cons: Which Is Right for You?

- Understanding the Basics: What Does Buying a Car Mean?

- Understanding the Basics: What Does Leasing a Car Mean?

- Cost Comparison: Buying vs Leasing Over Time

- Lifestyle and Usage: Which Option Fits Your Life?

- Long-Term Value and Equity: The Ownership Advantage

- Making the Right Choice: Tips for Deciding Between Buying and Leasing

- Conclusion: Buying a Car vs Leasing a Car—What’s Best for You?

Buying a Car vs Leasing a Car Pros and Cons: Which Is Right for You?

So, you’re in the market for a new car. Exciting, right? But before you fall in love with that shiny SUV or sleek sedan, there’s a big decision to make: should you buy or lease? It’s one of the most common dilemmas car shoppers face, and the answer isn’t always clear-cut. The choice between buying a car and leasing a car depends on your financial situation, driving habits, and personal preferences.

Some people love the idea of owning their vehicle outright—no monthly payments after the loan is paid off, the freedom to modify the car, and the satisfaction of building equity. Others prefer the lower monthly costs, the ability to drive a new car every few years, and the peace of mind that comes with warranty coverage. But both options come with trade-offs. Buying means higher upfront costs and responsibility for maintenance as the car ages. Leasing means you’re always making payments and can’t keep the car forever unless you buy it out.

In this guide, we’ll break down the pros and cons of buying a car vs leasing a car in plain, easy-to-understand terms. We’ll cover everything from cost comparisons and mileage limits to long-term value and lifestyle fit. By the end, you’ll have the tools to decide which path makes the most sense for your life—whether you’re a daily commuter, a weekend adventurer, or someone who just wants reliable transportation without the hassle.

Understanding the Basics: What Does Buying a Car Mean?

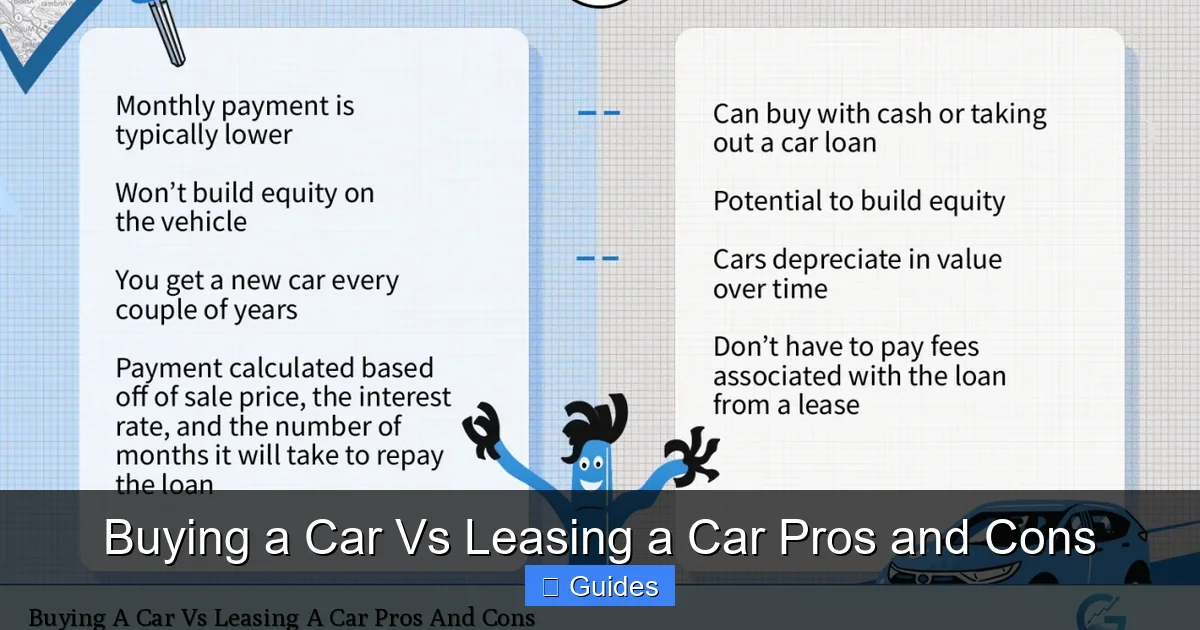

When you buy a car, you’re purchasing it—either with cash or through financing. If you finance, you take out an auto loan and make monthly payments until the balance is paid off. Once that happens, the car is 100% yours. You can drive it as much as you want, modify it, sell it, or keep it for 10+ years. Ownership gives you full control.

Visual guide about Buying a Car Vs Leasing a Car Pros and Cons

Image source: greylabelforex.com

How Car Buying Works

Buying a car typically involves a down payment (usually 10–20% of the car’s price), monthly loan payments, and interest charges. The loan term can range from 36 to 84 months, and the longer the term, the lower the monthly payment—but the more interest you’ll pay overall. For example, a $30,000 car with a $6,000 down payment and a 60-month loan at 5% interest would cost about $450 per month.

Once the loan is paid off, you own the car free and clear. That means no more payments, and you can keep driving it for as long as it’s roadworthy. Many people keep their cars for 8–12 years, especially if they maintain them well. This long-term ownership can lead to significant savings compared to always making car payments.

Pros of Buying a Car

- You own the asset: After the loan is paid, the car is yours. You can sell it, trade it, or keep it.

- No mileage restrictions: Drive as much as you want—great for road trips, long commutes, or rideshare driving.

- Customization freedom: Want to add a spoiler, tint the windows, or upgrade the sound system? Go for it.

- No wear-and-tear fees: Scratches, dents, and worn tires? No extra charges—you’re responsible, but it’s your car.

- Long-term cost savings: Once the loan is paid, you’re only paying for insurance, gas, and maintenance—no monthly car payment.

Cons of Buying a Car

- Higher monthly payments: Loan payments are usually much higher than lease payments for the same vehicle.

- Higher upfront costs: Down payments, taxes, and fees can add up quickly.

- Depreciation hits hard: New cars lose 20–30% of their value in the first year and about 50% after three years.

- Maintenance costs rise over time: As the car ages, repairs become more frequent and expensive.

- You’re stuck with the car: If your needs change (e.g., you need a bigger vehicle), you’re responsible for selling or trading it.

Understanding the Basics: What Does Leasing a Car Mean?

Leasing a car is like renting it for a long-term period—typically 24 to 36 months. You pay for the car’s depreciation during the lease term, plus fees and interest. At the end of the lease, you return the car (unless you choose to buy it). You never own the vehicle unless you exercise the purchase option.

Visual guide about Buying a Car Vs Leasing a Car Pros and Cons

Image source: content.carsgenius.com

How Car Leasing Works

When you lease, you’re essentially paying for the car’s loss in value during your time with it. For example, if a $40,000 car is expected to be worth $24,000 after three years, your lease payments cover that $16,000 depreciation, plus a monthly finance charge (similar to interest) and fees.

Lease terms usually include:

- A set mileage limit (e.g., 12,000 miles per year)

- Wear-and-tear guidelines

- An option to buy the car at the end

Monthly lease payments are generally 30–50% lower than loan payments for the same car. For instance, leasing that $40,000 car might cost $350/month, while buying it could cost $600/month. That’s a big difference—especially if you’re on a tight budget.

Pros of Leasing a Car

- Lower monthly payments: You pay less each month compared to buying, freeing up cash for other expenses.

- Drive a new car every few years: Leasing lets you upgrade to the latest models with updated safety, tech, and design.

- Warranty coverage: Most leases fall within the manufacturer’s warranty period, so major repairs are covered.

- Lower sales tax: In many states, you only pay sales tax on the monthly lease payment, not the full car price.

- No hassle selling: At the end of the lease, you simply return the car—no need to deal with private sales or trade-ins.

Cons of Leasing a Car

- No ownership: You’re paying to use the car, not own it. At the end, you have nothing to show for your payments.

- Mileage limits: Exceed the limit (e.g., 12,000 miles/year), and you’ll pay 10–25 cents per extra mile.

- Wear-and-tear charges: Dents, scratches, or stained upholstery can result in fees at lease return.

- Customization restrictions: Most leases don’t allow modifications—no aftermarket parts or paint jobs.

- Early termination fees: Ending a lease early can cost thousands in penalties.

- You’re always making payments: Unlike buying, you never “own” the car, so you’re always paying for transportation.

Cost Comparison: Buying vs Leasing Over Time

One of the biggest factors in the buying a car vs leasing a car debate is cost. Let’s look at a real-world example to see how the numbers stack up.

Visual guide about Buying a Car Vs Leasing a Car Pros and Cons

Image source: fundssavvy.com

Example: $35,000 Car Over 6 Years

Imagine you’re choosing between buying and leasing a $35,000 car. Here’s how the costs might break down:

Buying:

- Down payment: $7,000

- Loan: $28,000 at 5% over 60 months = ~$525/month

- Total paid over 5 years: $38,500

- After 5 years, you own the car (worth ~$15,000)

- Year 6: No car payment, only insurance, gas, and maintenance (~$200/month)

- Total 6-year cost: ~$41,700

Leasing (then leasing again):

- First lease: 36 months, $350/month = $12,600

- Second lease: Another 36 months, $350/month = $12,600

- Total paid over 6 years: $25,200

- But you have no car at the end—just ongoing payments

- Total 6-year cost: ~$25,200 (but no asset)

At first glance, leasing seems cheaper—$25,200 vs $41,700. But remember: when you buy, you still have a car worth $15,000 at the end. So your net cost is $41,700 – $15,000 = $26,700. That’s only $1,500 more than leasing over six years.

However, if you lease again after six years, you’re back to making payments. If you keep leasing every 3 years, you’ll always have a car payment. Over 10 years, leasing could cost $42,000, while buying might cost $45,000—but you’d own a car worth $10,000. Net cost: $35,000. That’s $7,000 less than leasing.

When Leasing Makes Financial Sense

Leasing can be a smart financial move if:

- You want lower monthly payments

- You drive fewer than 12,000 miles per year

- You prefer driving new cars with the latest tech

- You don’t want to deal with long-term maintenance

- You can afford to always have a car payment

When Buying Makes Financial Sense

Buying is better if:

- You plan to keep the car for 6+ years

- You drive a lot (over 15,000 miles/year)

- You want to avoid perpetual payments

- You like customizing your vehicle

- You want to build equity and eventually own an asset

Lifestyle and Usage: Which Option Fits Your Life?

Beyond money, your lifestyle plays a huge role in whether buying or leasing is right for you. Let’s look at different scenarios.

For Commuters and High-Mileage Drivers

If you drive 20,000+ miles a year—maybe for work, deliveries, or frequent road trips—leasing is probably not for you. Most leases cap mileage at 10,000–15,000 miles per year. Going over can cost $0.25 per mile. That’s $1,250 in fees for just 5,000 extra miles.

Buying gives you unlimited mileage. You can drive as much as you want without penalties. Plus, once the loan is paid off, your only costs are fuel, insurance, and maintenance. For high-mileage drivers, buying almost always wins.

For Tech Enthusiasts and Early Adopters

Love having the latest infotainment system, adaptive cruise control, or a hybrid engine? Leasing lets you upgrade every 2–4 years. You’ll always be driving a car under warranty with the newest features. For people who value innovation and don’t mind always paying, leasing is ideal.

Buying means you’re stuck with the same tech for years. Even if a new model comes out with better features, you’re still driving your older car. If you upgrade, you’ll need to sell or trade it—which can be a hassle.

For Families and Growing Needs

Families often need more space, safety features, and reliability. If you’re planning to have kids or already have a growing family, buying might be better. You can keep the car through all life stages—from car seats to soccer practice to college drop-offs.

Leasing a minivan or SUV for three years might work, but what happens when you need a bigger vehicle? You’d have to return the lease and start a new one—possibly with higher payments. Buying gives you stability and long-term value.

For Minimalists and Urban Dwellers

If you live in a city with good public transit and only need a car occasionally, leasing a small, fuel-efficient vehicle could make sense. You get a reliable car for weekend trips without the burden of ownership. Just be mindful of mileage limits.

Alternatively, some urban drivers skip car ownership altogether and use car-sharing services. But if you need a car regularly, leasing a compact model with low payments might be a smart middle ground.

Long-Term Value and Equity: The Ownership Advantage

One of the strongest arguments for buying a car is long-term value. When you buy, you’re investing in an asset. Even though cars depreciate, you still own something of value.

Building Equity Through Ownership

After paying off your loan, you own the car. That means no more monthly payments. Over time, this can save you thousands. For example, if your car payment was $500/month, paying it off after 5 years saves you $6,000 in year 6 alone.

You can also sell the car or trade it in when you’re ready for a new one. Even a 10-year-old car might be worth $5,000–$8,000, depending on the model and condition. That’s money in your pocket—something leasing can’t offer.

The “Endless Payment” Trap of Leasing

With leasing, you’re always making payments. There’s no finish line. Even if you lease the same car model repeatedly, you’re still paying for depreciation, fees, and interest—without building equity.

Think of it like renting an apartment vs buying a house. Renting gives you flexibility, but you’re not building wealth. Buying a home builds equity over time. The same logic applies to cars.

Depreciation: The Hidden Cost

All cars lose value over time—this is called depreciation. But when you lease, you’re only paying for the depreciation during your term. When you buy, you absorb the full depreciation—but you also benefit from ownership.

For example, a $40,000 car might be worth $24,000 after three years. If you lease, you pay for that $16,000 loss. If you buy, you also lose $16,000 in value—but you still own a $24,000 asset. If you keep it another three years, it might be worth $12,000. Your total loss is $28,000, but you’ve had six years of use and no payments after year five.

In contrast, leasing for six years means paying for two full depreciation cycles—with nothing to show at the end.

Making the Right Choice: Tips for Deciding Between Buying and Leasing

So how do you decide? Here are some practical tips to help you choose between buying a car and leasing a car.

1. Assess Your Driving Habits

How many miles do you drive per year? If it’s over 15,000, buying is usually better. If it’s under 10,000, leasing could save you money.

2. Look at Your Budget

Can you afford higher monthly payments? If not, leasing might be the way to go. But remember: you’ll always have a car payment.

3. Consider Your Long-Term Plans

Do you plan to keep a car for 6+ years? Buy. Do you like driving new models every few years? Lease.

4. Think About Customization

Want to personalize your car? Buying gives you full freedom. Leasing restricts modifications.

5. Evaluate Maintenance Preferences

Prefer having warranty coverage and minimal repair worries? Leasing keeps you in newer cars. Buying means handling repairs as the car ages.

6. Run the Numbers

Use online calculators to compare total costs over 3, 5, and 10 years. Include down payments, monthly costs, mileage fees, and resale value.

7. Test Both Options

Some dealerships offer lease-to-own programs or flexible financing. You might be able to lease first and buy later if your situation changes.

Conclusion: Buying a Car vs Leasing a Car—What’s Best for You?

The decision between buying a car and leasing a car isn’t about which option is universally better—it’s about which one fits your life. Buying offers ownership, long-term savings, and freedom. Leasing offers lower payments, newer cars, and less hassle.

If you value stability, drive a lot, and want to avoid endless payments, buying is likely the right choice. You’ll build equity, enjoy full control, and eventually own a valuable asset. On the other hand, if you prefer lower monthly costs, love having the latest features, and don’t mind always making payments, leasing could be a smart move.

Ultimately, the best decision is the one that aligns with your financial goals, driving needs, and lifestyle. Take the time to compare costs, read the fine print, and think about your future. Whether you choose to buy or lease, you’re making an investment in your mobility—and that’s something worth getting right.

Frequently Asked Questions

Is it better to buy or lease a car?

It depends on your needs. Buying is better if you drive a lot, want to own your car, and plan to keep it long-term. Leasing is better if you prefer lower payments and like driving new cars every few years.

Can you negotiate a car lease?

Yes, you can negotiate the capitalized cost (price of the car), money factor (interest rate), and mileage allowance. Just like buying, leasing terms are not always set in stone.

What happens at the end of a car lease?

You return the car to the dealership, pay any excess mileage or wear-and-tear fees, and can choose to lease a new car, buy the current one, or walk away.

Do you build equity when you lease a car?

No, leasing does not build equity. You’re paying to use the car, not own it, so you have no asset value at the end of the lease.

Can you lease a used car?

Yes, some dealerships and leasing companies offer certified pre-owned vehicles for lease. These often come with warranties and lower prices than new cars.

Is leasing a car worth it in the long run?

Leasing can be worth it if you value lower payments and new technology, but it’s generally more expensive over time since you never own the car and always have payments.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.