Featured image for Car Insurance For 17 Year Old

Image source: usinsuranceagents.com

The truth is, a 17-year-old generally cannot legally obtain car insurance solely in their own name due to being a minor and lacking contractual capacity. Instead, they are almost universally required to be added as a driver to an existing policy held by a parent or legal guardian. This ensures proper legal coverage and fulfills insurer requirements for young drivers.

The exhilarating freedom of getting your driver’s license at 16 or 17 is often quickly followed by a stark reality check: the cost and complexity of car insurance. For many young drivers and their parents, the question isn’t just about passing the driving test, but about navigating the intricate world of insurance policies. One of the most common and often confusing queries that arises is: Can a 17 year old get car insurance in their name?

It’s a question that brings with it a mix of hope for independence and dread over potential costs. The truth, as with many aspects of insurance, is not a simple yes or no. It’s a nuanced landscape shaped by legal age, risk assessment, state regulations, and the specific policies of individual insurance providers. Understanding these factors is crucial for any 17-year-old aspiring to drive and for their parents who will invariably be involved in the process.

This comprehensive guide aims to peel back the layers of misconception and provide clarity on whether a 17-year-old can indeed secure car insurance under their own name. We’ll delve into the legalities, the insurer’s perspective, practical solutions, and strategies to make car insurance for a 17-year-old as manageable as possible. Prepare to uncover the truth behind securing insurance as a young driver and empower yourself with the knowledge to make informed decisions.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 The Legal Landscape: Can a Minor Enter an Insurance Contract?

- 4 Why Insurers See 17-Year-Olds as High-Risk Drivers

- 5 The Common Pathways: How 17-Year-Olds *Actually* Get Insured

- 6 Strategies for Making 17-Year-Old Car Insurance Affordable

- 7 The Pros and Cons: Weighing an Own Policy vs. Parent’s Policy

- 8 Building a Responsible Driving and Insurance History for the Future

- 9 Factors Affecting 17-Year-Old Car Insurance Premiums (Illustrative)

- 10 Frequently Asked Questions

- 10.1 Can a 17-year-old legally get car insurance in their own name?

- 10.2 Is it cheaper for a 17-year-old to be on a parent’s policy or get their own car insurance?

- 10.3 What documents and information does a 17-year-old need to get car insurance?

- 10.4 Why is car insurance so expensive for a 17-year-old driver?

- 10.5 Are there ways a 17-year-old can lower their car insurance premiums?

- 10.6 Can a 17-year-old completely independently get car insurance in their name without any parental involvement?

Key Takeaways

- Yes, They Can: A 17-year-old can legally obtain car insurance in their name.

- Expect High Costs: Standalone policies for teens are typically very expensive.

- Parental Policy Often Best: Adding to a parent’s existing policy is usually cheaper.

- Co-Signer May Be Required: Some insurers necessitate a parent as a co-signer.

- Shop Around Thoroughly: Always compare quotes from multiple insurance providers.

- Seek All Available Discounts: Good student and driver’s education discounts significantly help.

📑 Table of Contents

- The Legal Landscape: Can a Minor Enter an Insurance Contract?

- Why Insurers See 17-Year-Olds as High-Risk Drivers

- The Common Pathways: How 17-Year-Olds *Actually* Get Insured

- Strategies for Making 17-Year-Old Car Insurance Affordable

- The Pros and Cons: Weighing an Own Policy vs. Parent’s Policy

- Building a Responsible Driving and Insurance History for the Future

- Factors Affecting 17-Year-Old Car Insurance Premiums (Illustrative)

The Legal Landscape: Can a Minor Enter an Insurance Contract?

Before diving into the specifics of insurance policies, it’s essential to understand the fundamental legal principles that govern contracts, especially when it comes to minors. The ability to legally bind oneself to a contract, such as an insurance policy, is directly tied to one’s age and legal status.

Contractual Capacity: The Age of Majority

In most jurisdictions across the United States, the legal “age of majority” is 18. This means that individuals under the age of 18 are generally considered minors and do not possess the full legal capacity to enter into binding contracts. An insurance policy is a legal contract, and if a minor signs it, the contract is often considered “voidable” at the minor’s discretion. This means the minor could potentially back out of the agreement without penalty, which presents a significant risk for the insurance company.

Due to this legal principle, insurance companies are typically very reluctant to issue a policy solely in the name of a 17-year-old. While the 17-year-old can be listed as a driver on a policy, having them as the sole “named insured” on a new, independent policy is usually not an option for this very reason. The insurer needs a legally responsible adult to be the primary policyholder, someone who is of legal age and has the contractual capacity to uphold the terms of the agreement.

Emancipation and Special Cases

There are rare exceptions to the age of majority rule. A 17-year-old who has been legally “emancipated” by a court would have the legal capacity to enter into contracts, including car insurance policies, in their own name. Emancipation typically occurs when a minor is deemed self-sufficient and capable of managing their own affairs, often due to marriage, military service, or a court order. However, these cases are uncommon and require specific legal proceedings.

For the vast majority of 17-year-olds, emancipation is not a factor. Therefore, the general rule holds: a parent or legal guardian will almost always need to be the primary policyholder for the car insurance that covers a 17-year-old driver. This arrangement provides the necessary legal backing for the insurance contract, ensuring that there is an adult responsible for fulfilling its terms, including premium payments and adherence to policy conditions.

Why Insurers See 17-Year-Olds as High-Risk Drivers

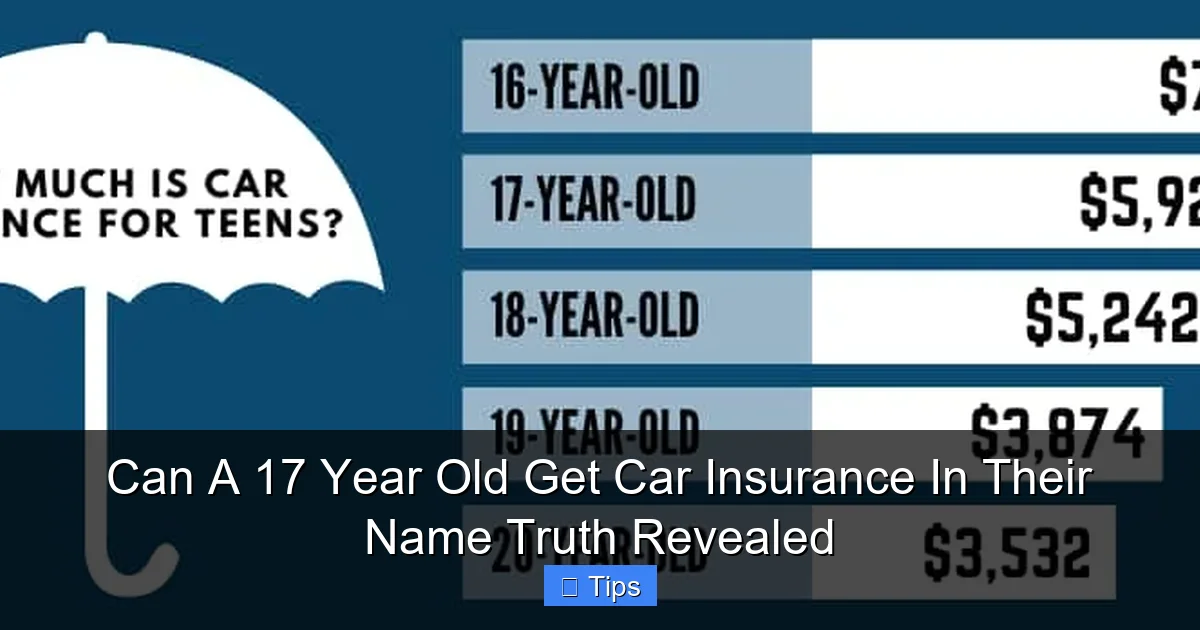

Beyond the legal hurdles, the primary reason car insurance for a 17-year-old is expensive and often requires parental involvement stems from a cold, hard truth: statistics. Insurance companies operate on risk assessment, and young drivers, particularly those under 20, represent a significantly higher risk demographic.

Visual guide about Car Insurance For 17 Year Old

Image source: i.ytimg.com

Statistics Don’t Lie: Accident Rates

Numerous studies and insurance industry data consistently show that new and young drivers, especially 16- and 17-year-olds, have the highest crash rates per mile driven compared to any other age group. The Centers for Disease Control and Prevention (CDC) highlights that motor vehicle crashes are a leading cause of death for teenagers in the United States. This heightened risk is a major driver of insurance premiums.

- Inexperience: Young drivers simply haven’t accumulated enough hours behind the wheel to develop advanced hazard recognition and evasive driving skills.

- Risk-Taking Behavior: Teenagers are statistically more prone to risky behaviors, such as speeding, distracted driving (texting, peer passengers), and driving under the influence.

- Lower Perception of Risk: The frontal lobe, responsible for judgment and impulse control, is still developing in teenagers, leading to a poorer assessment of dangerous situations.

For an insurance company, these statistics translate directly into a higher likelihood of paying out a claim for accidents, injuries, or vehicle damage. This elevated risk is why teen driver insurance is priced at a premium, regardless of whether the policy is in their name or a parent’s.

Lack of Driving Experience and Maturity Factors

While a 17-year-old may feel confident behind the wheel, their actual experience is still very limited. Navigating complex traffic situations, reacting to sudden emergencies, and understanding the nuances of road conditions take time and practice. Insurers factor in this lack of experience heavily.

Furthermore, maturity plays a role. Decision-making processes, impulse control, and the ability to remain calm under pressure are still developing. These factors can influence a young driver’s response in critical moments, potentially leading to errors that result in accidents. Insurance algorithms are designed to account for these developmental stages and the associated risks.

Vehicle Type and Performance Concerns

The type of vehicle a 17-year-old drives also significantly impacts their insurance premium. Insurers know that young drivers are sometimes drawn to high-performance, sports cars, or vehicles with powerful engines. These types of cars are not only more expensive to repair but also inherently encourage higher speeds and more aggressive driving, amplifying the existing risk factors for a young driver.

Conversely, choosing a safer, older, and less powerful vehicle can help mitigate some of these concerns. Cars with strong safety ratings, anti-lock brakes, and multiple airbags are often cheaper to insure because they reduce the risk of injury and severe damage in an accident. Insurers prefer vehicles that are less likely to be involved in high-speed incidents and are cheaper to replace or repair if they are.

The Common Pathways: How 17-Year-Olds *Actually* Get Insured

Given the legal and risk-related challenges, it becomes clear that a 17-year-old obtaining car insurance solely in their own name is highly improbable, if not impossible, in most standard scenarios. So, how do 17-year-olds legally get behind the wheel with proper coverage?

Visual guide about Car Insurance For 17 Year Old

Image source: image.slidesharecdn.com

The Preferred Method: Adding to a Parent’s Policy

The overwhelming majority of 17-year-olds get their car insurance by being added as a named driver to their parent’s or legal guardian’s existing auto insurance policy. This is the most practical, cost-effective, and legally sound solution for several reasons:

- Legal Capacity: The parent or guardian, being of legal age, serves as the primary policyholder, fulfilling the contractual requirements.

- Cost Savings: Families often qualify for multi-car and multi-driver discounts when everyone is on the same policy, which can significantly reduce the overall cost compared to a separate policy.

- Existing Relationship: The parent likely has an established relationship with an insurer, potentially leading to better rates and simpler administration.

- Comprehensive Coverage: The entire family can benefit from consistent coverage limits and types (e.g., liability, collision, comprehensive) under one umbrella.

When a 17-year-old gets their license, parents should immediately contact their insurance provider to add them to the policy. Failing to do so can result in denied claims if the teen is involved in an accident, as they would be an undisclosed driver. The insurer will typically ask for the teen’s driver’s license number and other pertinent information.

While a 17-year-old can be listed as a “driver” on a parent’s policy, they are generally not the “named insured” or “primary policyholder.” The named insured is the individual who owns the policy and is legally responsible for it. The 17-year-old will be listed as an “additional driver” or “household member” who uses the insured vehicles.

If a 17-year-old owns their own car (which is also rare, as parents often co-sign loans for minors), that vehicle would typically be added to the parent’s policy, with the 17-year-old still listed as the primary driver of that specific vehicle. The parent remains the named insured on the overall policy, responsible for its terms, even if the teen is the primary operator of one of the insured cars.

When an Independent Policy *Might* Be Possible (with Adult Co-Signing)

In extremely rare circumstances, usually involving 17-year-olds living independently (e.g., emancipated or living away from home with specific guardian arrangements), an insurer might consider an independent policy. However, even in these cases, an adult co-signer would almost certainly be required. This co-signer would become a named insured on the policy, effectively taking on the legal and financial responsibility for the contract alongside the 17-year-old. This adult would be legally liable for premium payments and any potential legal ramifications if the policy terms are breached.

The complexity and heightened risk associated with this approach mean that most insurance companies would still strongly advise adding the 17-year-old to an existing family policy or would offer a much higher premium for a standalone policy with an adult co-signer. The availability of such policies can also vary significantly by state and individual insurer.

Strategies for Making 17-Year-Old Car Insurance Affordable

The sticker shock associated with adding a 17-year-old to an insurance policy can be substantial. However, there are numerous strategies that parents and young drivers can employ to help mitigate these costs and make insurance for 17-year-old drivers more manageable.

Visual guide about Car Insurance For 17 Year Old

Image source: insurance.com

Harnessing the Power of Discounts

Many insurance companies offer specific discounts aimed at young drivers or families with young drivers. Proactively seeking and qualifying for these can significantly reduce premiums:

- Good Student Discount: This is one of the most common and effective discounts. If a 17-year-old maintains a B average (3.0 GPA) or higher, they can often qualify for a notable discount. Insurers view good academic performance as an indicator of responsibility, which they hope translates to responsible driving.

- Driver’s Education Discount: Completing an accredited driver’s education course can not only equip a teen with better driving skills but also unlock discounts. This demonstrates a commitment to learning safe driving practices beyond basic licensing requirements.

- Telematics/Usage-Based Insurance (UBI): Many insurers offer programs where a device is plugged into the car’s diagnostic port or a smartphone app tracks driving habits (speed, braking, mileage, time of day). Safe driving can lead to significant discounts. This is particularly beneficial for young driver insurance as it allows insurers to assess individual risk more accurately than broad demographic data.

- Multi-Vehicle/Multi-Policy Discounts: As mentioned, bundling all family cars and potentially other insurance types (homeowner’s, renter’s) with the same insurer almost always results in a discount.

- Passive Safety Features Discount: Cars equipped with anti-lock brakes (ABS), airbags, electronic stability control, and other advanced safety features can qualify for discounts.

- Anti-Theft Device Discount: Vehicles with alarms, tracking systems, or immobilizers may receive a small discount.

Smart Vehicle Choices

The type of car a 17-year-old drives is a huge factor in insurance costs. To keep premiums down:

- Opt for Older, Safer Models: A used sedan or compact SUV with a good safety rating and a modest engine size is ideal. Avoid sports cars, luxury vehicles, or cars with powerful engines, as these are significantly more expensive to insure for young drivers.

- Check Safety Ratings: Before purchasing a vehicle, research its safety ratings from organizations like the IIHS (Insurance Institute for Highway Safety) or NHTSA (National Highway Traffic Safety Administration). Cars with higher safety ratings often come with lower insurance premiums.

- Consider Repair Costs: Some vehicles, even if older, can have expensive parts or be complex to repair, leading to higher collision and comprehensive premiums. Research typical repair costs for potential vehicles.

Increasing Deductibles (with Caution)

A higher deductible means you pay more out-of-pocket if you have a claim, but it can significantly lower your premium. While tempting, this strategy requires careful consideration, especially for a young driver. Ensure the family can comfortably afford the chosen deductible amount in case of an accident. For a 17-year-old, who is statistically more likely to be involved in a minor fender bender, a very high deductible might not always be the most practical choice unless balanced with significant premium savings and a robust emergency fund.

Parental Involvement and Co-signing Benefits

While the goal might be for a 17-year-old to get car insurance in their name, the reality is that parental involvement is key to affordability and practicality. By keeping the 17-year-old on the parent’s policy, the family benefits from existing discounts and the parent’s established driving record and credit history. If a separate policy is somehow obtained (e.g., with an adult co-signer), the co-signer’s good financial standing can positively influence rates, though this route is less common and often more expensive than a family policy.

The Pros and Cons: Weighing an Own Policy vs. Parent’s Policy

While the option for a 17-year-old to get an independent policy is rare, understanding the theoretical advantages and disadvantages of each scenario helps in making informed decisions about young driver insurance.

Benefits of Being on a Parent’s Policy

- Lower Premiums: This is the most significant advantage. Families benefit from multi-car, multi-driver, and loyalty discounts that dramatically reduce the overall cost compared to a standalone policy for a high-risk young driver.

- Established Coverage: The parent’s policy likely has robust coverage limits and types already in place, ensuring the 17-year-old is well-protected without needing to build a new policy from scratch.

- Simpler Administration: All insurance matters are handled under one account, simplifying payments, renewals, and claims processes.

- Parental Oversight: Parents can monitor the coverage, ensuring adequate protection and making adjustments as needed. They also have direct control over the policy terms.

- No Credit History Requirement: A 17-year-old typically doesn’t have an established credit history, which is a factor in insurance rates. Being on a parent’s policy bypasses this issue.

Potential Advantages of an Independent Policy (Highly Conditional)

For the sake of thoroughness, if an independent policy were somehow feasible (e.g., via emancipation or a rare co-signer scenario), here are the theoretical advantages:

- Building Own Insurance History: The 17-year-old would start building their own insurance history and potential no-claims bonus earlier, which could lead to better rates in the long run (though initial rates would be extremely high).

- Complete Independence: The 17-year-old would have full control over their policy choices, coverage levels, and insurer, fostering a sense of responsibility.

- Privacy: Insurance matters would be separate from family finances (though still likely linked by a co-signer).

It’s crucial to reiterate that these “advantages” are almost always outweighed by the significantly higher costs and legal complexities involved, making them impractical for the vast majority of 17-year-olds.

Financial and Legal Implications for Parents

When a 17-year-old is on a parent’s policy, the financial and legal implications for the parents are substantial:

- Increased Premiums: Parents will see a noticeable increase in their insurance premiums, sometimes by hundreds or even thousands of dollars annually, due to the high-risk nature of a young driver.

- Shared Liability: As the primary policyholders, parents are legally and financially responsible for the policy. If the 17-year-old causes an accident, the parent’s insurance will cover the damages (up to policy limits), and any subsequent rate increases will affect the entire family’s policy.

- “Permissive Use” Implications: If a 17-year-old drives a car owned by a parent, even if not explicitly listed on the policy, they might be covered under “permissive use” clauses, but it’s always best to list them explicitly to avoid claim denials.

- Impact on Driving Record: While the accident or violation goes on the 17-year-old’s driving record, the financial consequences (increased premiums) fall directly on the parents who own the policy.

Open communication about these implications is vital for families. Understanding the shared responsibility can help encourage safe driving habits in the 17-year-old and ensure financial preparedness for parents.

Building a Responsible Driving and Insurance History for the Future

While the immediate goal might be simply getting insured, 17-year-olds (and their parents) should think long-term. Developing a clean driving record and understanding how insurance works can lead to significant savings and peace of mind down the road when they eventually transition to their own policy.

The Importance of a Clean Driving Record

This cannot be stressed enough: a clean driving record is the single most powerful factor in keeping insurance costs down for young drivers. Every ticket, every accident, and every claim significantly impacts premiums for years to come. For a 17-year-old, even a minor infraction can cause their rates (and thus their parents’ rates) to skyrocket.

- Avoid Tickets: Speeding, reckless driving, and distracted driving tickets are major red flags for insurers.

- Prevent Accidents: Driving defensively, avoiding distractions, and adhering to all traffic laws are paramount. Even minor at-fault accidents will raise premiums.

- Consequences of Violations: Many states have graduated driver licensing (GDL) programs with strict penalties for young drivers who accrue violations, including license suspension, which further complicates insurance.

Encouraging responsible driving from day one is an investment in future affordability.

Understanding No-Claims Bonuses and Their Accumulation

A “no-claims bonus” (or safe driver discount) is a reduction in your premium for each year you go without making a claim. While a 17-year-old typically won’t be the primary policyholder accruing this bonus directly, being on a parent’s policy that maintains a no-claims bonus can still benefit the family’s overall rate. More importantly, when the 17-year-old eventually gets their own policy, their clean driving history will act as their “no-claims bonus equivalent,” leading to lower initial rates.

Some insurers might even consider the time a young driver spent on a parent’s policy with a clean record when they transition to their own, offering a small introductory discount based on that “experience.” It’s worth asking your insurer about this possibility.

The Role of Credit Scores (Indirectly for Now)

While a 17-year-old won’t have a developed credit score impacting their immediate car insurance rates (since they’re on a parent’s policy), it’s important to understand for the future. Insurance companies often use credit-based insurance scores (where permitted by law) to help determine premiums. A strong credit history generally correlates with more responsible behavior and lower rates. Encouraging good financial habits early on can indirectly set a 17-year-old up for more affordable insurance once they become the primary policyholder later in life.

Graduated Driver Licensing (GDL) Programs and Their Impact

Most states have GDL programs designed to gradually introduce driving privileges to young drivers. These programs typically involve multiple stages:

- Learner’s Permit: Supervised driving only.

- Intermediate License: Restrictions on nighttime driving, number of passengers, and sometimes cell phone use.

- Full License: Unrestricted driving privileges.

These restrictions, particularly passenger limits and nighttime curfews, are directly aimed at reducing high-risk situations for young drivers. Adhering to GDL rules not only keeps the 17-year-old on the right side of the law but can also be seen favorably by insurers, potentially influencing rates positively over time. Ignoring these rules can lead to tickets, license suspension, and significantly increased insurance costs.

Factors Affecting 17-Year-Old Car Insurance Premiums (Illustrative)

The cost of car insurance for a 17-year-old is influenced by a multitude of factors. Below is an illustrative table showcasing how different elements can impact premiums. Please note that these are hypothetical examples and actual rates vary widely by insurer, location, vehicle, and individual circumstances.

| Factor | Impact on Premium (Illustrative) | Notes/Explanation |

|---|---|---|

| Driver’s Age (17 vs. 30) | ↑↑↑ (Significant Increase) | Highest risk group due to inexperience; often 150-250% higher than an experienced adult. |

| Gender | ↑ (Slight Increase for Males) | Historically, young males have slightly higher accident rates than young females, though some states prohibit gender as a rating factor. |

| Vehicle Type (Sports Car) | ↑↑↑ (Major Increase) | Higher repair/replacement costs, perceived encouragement of risky driving. |

| Vehicle Type (Safe Sedan) | ↓↓ (Moderate Decrease) | Lower repair/replacement costs, strong safety ratings reduce injury risk. |

| Good Student Discount | ↓↓ (10-25% Discount) | GPA of B or higher; indicates responsibility. |

| Driver’s Ed Discount | ↓ (5-15% Discount) | Completion of an approved driver’s education course. |

| Telematics Program Use | ↓↓↓ (Up to 30% Discount, or more) | Rewards safe driving habits tracked by a device or app; initial discount often provided upon enrollment. |

| Clean Driving Record | ↓↓↓ (Essential for Lowest Rates) | No tickets, no accidents = best rates. Critical for long-term affordability. |

| 1 At-Fault Accident | ↑↑↑ (Significant Increase for 3-5 years) | A major red flag, signals increased risk for future claims. |

| State/Zip Code | Varies Widely | Urban areas, high crime rates, high accident rates in area increase premiums. |

| Coverage Limits (High) | ↑↑ (Moderate Increase) | More protection comes at a higher cost. Recommended for young drivers due to higher accident risk. |

| Deductible (High) | ↓↓ (Moderate Decrease) | You pay more out-of-pocket if there’s a claim, reducing insurer’s risk. |

This table illustrates why a multi-faceted approach, combining safe driving with strategic choices and taking advantage of available discounts, is crucial for managing the cost of 17-year-old car insurance.

The journey to car insurance for a 17-year-old is often perceived as daunting, but by understanding the underlying principles and leveraging available strategies, it can be navigated successfully. While the dream of a 17-year-old having car insurance solely in their name is largely a legal and practical impossibility for most, the path to being a safely and affordably insured young driver is clear: parental involvement, responsible driving, and strategic planning.

The truth revealed is that while direct legal ownership of an insurance policy is out of reach for most 17-year-olds, being an insured, responsible driver is absolutely within grasp. By being added to a parent’s policy, taking advantage of discounts, choosing a sensible vehicle, and committing to a spotless driving record, 17-year-olds can embark on their driving journey with confidence, knowing they are well-covered and setting themselves up for a future of affordable car insurance.

Remember, open communication between teens and parents, along with proactive engagement with insurance providers, will pave the smoothest road ahead. Drive safely, plan wisely, and the independence of the open road awaits.

Frequently Asked Questions

Can a 17-year-old legally get car insurance in their own name?

Yes, it is generally possible for a 17-year-old to obtain car insurance in their own name, though specific state laws and insurer policies can vary. However, because a 17-year-old is a minor, a parent or legal guardian will typically need to co-sign the policy or provide consent to form a binding contract.

Is it cheaper for a 17-year-old to be on a parent’s policy or get their own car insurance?

In most cases, it is significantly cheaper for a 17-year-old to be added as a driver on a parent’s existing car insurance policy. Insuring a 17-year-old on their own policy often results in very high premiums due to their lack of driving history and perceived higher risk by insurance companies.

What documents and information does a 17-year-old need to get car insurance?

To get car insurance, a 17-year-old will typically need a valid driver’s license, vehicle information (make, model, VIN), and personal details. If they are getting insurance in their own name, a parent or legal guardian will almost certainly need to be involved to co-sign the contract due to their minor status.

Why is car insurance so expensive for a 17-year-old driver?

Car insurance for a 17-year-old is expensive because insurers view new, young drivers as a higher risk due to their inexperience and a statistically higher likelihood of accidents. Factors like age, limited driving record, vehicle type, and coverage choices all contribute to the higher premium costs.

Yes, a 17-year-old can potentially lower their car insurance costs by maintaining good grades (qualifying for a good student discount), taking a defensive driving course, choosing a safer and less expensive vehicle to insure, and opting for higher deductibles. Being added to a parent’s policy remains the most effective cost-saving measure.

Can a 17-year-old completely independently get car insurance in their name without any parental involvement?

While a policy can ultimately be *in their name*, a 17-year-old, being a minor, generally cannot legally enter into a binding contract like an insurance policy without parental or guardian consent or co-signature. Therefore, some form of adult involvement is almost always required to finalize car insurance for a minor.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.