Yes, a car can be registered in two names—whether you’re married, co-owning with a friend, or buying with a family member. This setup offers shared responsibility and legal protection, but it also comes with important financial and legal considerations. Understanding your state’s rules and choosing the right ownership structure is key.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Can a Car Be Registered in Two Names? A Complete Guide

- 4 Why Register a Car in Two Names?

- 5 Types of Joint Ownership: Joint Tenants vs. Tenants in Common

- 6 How to Register a Car in Two Names

- 7 Insurance Implications of Joint Registration

- 8 Financial and Legal Risks of Joint Registration

- 9 Tips for a Smooth Joint Registration Experience

- 10 Conclusion

- 11 Frequently Asked Questions

- 11.1 Can a car be registered in two names in all states?

- 11.2 Do both owners need to be on the insurance policy?

- 11.3 Can one owner sell the car without the other’s permission?

- 11.4 What happens if one owner stops paying the loan?

- 11.5 Can I remove my name from a jointly registered car?

- 11.6 Is joint registration a good idea for friends or roommates?

Key Takeaways

- Joint registration is allowed: Most states permit two people to register a car together, whether as spouses, partners, or co-owners.

- Two ownership types exist: You can register as “joint tenants” (equal shares, right of survivorship) or “tenants in common” (unequal shares, no automatic inheritance).

- Both names appear on the title and registration: This means both parties have legal rights and responsibilities for the vehicle.

- Insurance must include both owners: Most insurers require all registered owners to be listed on the policy.

- Credit and liability are shared: Missed payments or accidents can affect both parties’ credit and financial standing.

- State rules vary: Always check your local DMV or motor vehicle agency for specific requirements and forms.

- Selling or transferring requires both signatures: Unless one owner is removed legally, both must agree to sell or transfer ownership.

📑 Table of Contents

- Can a Car Be Registered in Two Names? A Complete Guide

- Why Register a Car in Two Names?

- Types of Joint Ownership: Joint Tenants vs. Tenants in Common

- How to Register a Car in Two Names

- Insurance Implications of Joint Registration

- Financial and Legal Risks of Joint Registration

- Tips for a Smooth Joint Registration Experience

- Conclusion

Can a Car Be Registered in Two Names? A Complete Guide

So, you’re thinking about buying a car—maybe with your spouse, a sibling, a friend, or a business partner. You’ve probably wondered: *Can a car be registered in two names?* The short answer is yes. But the longer, more important answer involves understanding how it works, what it means legally and financially, and whether it’s the right choice for your situation.

Registering a car in two names is more common than you might think. Couples often do it when purchasing a family vehicle. Parents sometimes add their child’s name when buying a first car. Business partners may co-register a work vehicle. Even roommates or close friends might go in together on a used car. But while it sounds simple, joint registration comes with real consequences—both good and bad.

In this guide, we’ll walk you through everything you need to know about registering a car in two names. We’ll cover the legal options, the paperwork involved, insurance implications, and what happens if things go south. Whether you’re planning to buy a car together or just curious about the process, this article will give you the clarity and confidence to make the right decision.

Why Register a Car in Two Names?

Visual guide about Can a Car Be Registered in Two Names

Image source: dollarbreak.com

There are several practical and emotional reasons why people choose to register a car in two names. Let’s break down the most common ones.

One of the biggest reasons people co-register a car is to split the cost. Whether you’re buying a new SUV or a used sedan, vehicle expenses add up fast—purchase price, taxes, registration fees, insurance, maintenance, and fuel. By registering the car in two names, both parties share the financial burden from day one.

For example, imagine you and your partner are buying a $25,000 car. Instead of one person taking on the full loan, you both apply for financing together. This can improve your chances of approval and may even secure a better interest rate. Plus, if one person loses their job or faces a financial setback, the other can help cover payments.

Legal Protection and Ownership Rights

When a car is registered in two names, both individuals have legal ownership. This means neither person can sell, transfer, or refinance the vehicle without the other’s consent. That’s a big deal if you’re co-owning with someone who isn’t your spouse.

Think about it: if you buy a car with a friend and only your name is on the title, they have no legal claim—even if they paid half. But if both names are on the registration and title, they’re protected. This reduces the risk of disputes down the road.

Estate Planning and Inheritance

Another benefit is what happens when one owner passes away. If the car is registered as “joint tenants with right of survivorship,” the surviving owner automatically inherits the vehicle. There’s no need for probate or court involvement.

For married couples, this is especially helpful. If one spouse dies, the car seamlessly transfers to the other. Without joint registration, the vehicle could become part of the estate, delaying access and adding legal complexity.

Building Credit Together

If you’re financing the car, having both names on the loan can help build credit for both parties. As long as payments are made on time, both credit scores can improve. This is particularly useful for younger buyers or those rebuilding credit.

However, this works both ways. If one person misses payments or defaults, it can hurt both credit reports. So while joint registration can be a credit-building tool, it also requires trust and reliability.

Types of Joint Ownership: Joint Tenants vs. Tenants in Common

Visual guide about Can a Car Be Registered in Two Names

Image source: images.squarespace-cdn.com

Not all joint registrations are the same. The way you structure ownership affects your rights, responsibilities, and what happens if you decide to sell or if one owner passes away. There are two main types of joint ownership: joint tenants and tenants in common.

Joint Tenants (With Right of Survivorship)

This is the most common option for married couples and close family members. When you register as joint tenants, both owners have equal shares in the vehicle. More importantly, if one owner dies, their share automatically transfers to the surviving owner.

For example, if you and your spouse register your car as joint tenants and one of you passes away, the car becomes the sole property of the survivor. No will or court order is needed.

This structure is simple and offers peace of mind. But it also means you can’t leave your share of the car to someone else in your will—it goes directly to the co-owner.

Tenants in Common

With tenants in common, owners can hold unequal shares. One person might own 70%, the other 30%. This is useful when one person contributes more to the purchase price or when co-owners aren’t in a close relationship.

Unlike joint tenants, tenants in common do not have the right of survivorship. If one owner dies, their share of the car goes to their heirs or beneficiaries—not automatically to the co-owner.

For instance, if you and your sibling buy a car as tenants in common and you own 60%, your 60% share would pass to your children or spouse upon your death, not to your sibling.

This option offers more flexibility but can lead to complications if the co-owners don’t see eye to eye later.

Choosing the Right Structure

So, which one should you choose? It depends on your relationship and goals.

– Married couples usually go with joint tenants for simplicity and inheritance benefits.

– Business partners or friends may prefer tenants in common to reflect unequal contributions.

– Parents adding a child might use tenants in common if they’re funding most of the purchase.

Always discuss your choice with the other owner and consider consulting a legal or financial advisor, especially for high-value vehicles.

How to Register a Car in Two Names

Visual guide about Can a Car Be Registered in Two Names

Image source: okassembly.org

Ready to register your car in two names? The process is straightforward, but it varies slightly by state. Here’s a step-by-step guide to help you navigate it smoothly.

Gather Required Documents

Before heading to the DMV, make sure you have everything you need. Typically, you’ll need:

– Valid driver’s licenses for both owners

– Proof of insurance (both names should be on the policy)

– Vehicle title (if used) or Manufacturer’s Certificate of Origin (if new)

– Bill of sale or purchase agreement

– Odometer disclosure statement (for used cars)

– Application for title and registration (Form VR-1 or similar)

– Payment for registration fees, taxes, and title fees

Some states may also require a VIN inspection or emissions test, especially for out-of-state vehicles.

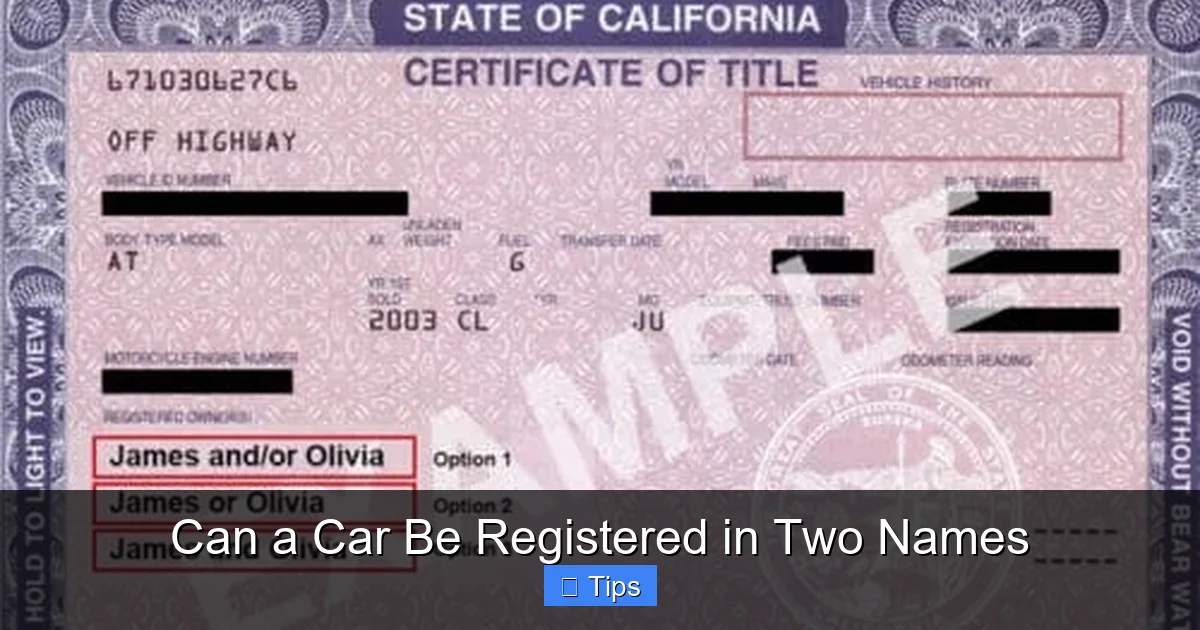

Complete the Title and Registration Application

When filling out the forms, you’ll need to specify the type of ownership: joint tenants or tenants in common. Be clear and consistent—mistakes here can cause problems later.

Both owners must sign the application. In most states, both signatures must be notarized or witnessed at the DMV. Some states allow one owner to sign if the other is unavailable, but this often requires a power of attorney.

Visit the DMV or Submit Online

Many states allow you to register a car online, but if both owners need to sign in person, you’ll have to visit a local DMV office. Bring all documents, IDs, and payment (cash, check, or card—check your state’s accepted methods).

After processing, you’ll receive:

– A new title with both names

– Registration certificate

– License plates (if new)

– Stickers for your plates

Keep these documents safe. You’ll need them for insurance, renewals, and future sales.

Update Your Insurance Policy

Once the car is registered in two names, contact your insurance company. Both owners must be listed on the policy. Most insurers require this to ensure full coverage.

You can choose to have both names as primary drivers or list one as the main driver and the other as an occasional driver. But for full protection, it’s best to include both as primary.

State-Specific Rules

Every state has its own rules. For example:

– In California, you can register as “AND” (both must sign to sell) or “OR” (either can sell alone).

– In Texas, joint registration is common, but both owners must be present unless one has a notarized affidavit.

– In New York, you can register online, but both owners must provide signatures.

Always check your state’s DMV website for the latest forms and requirements.

Insurance Implications of Joint Registration

Insurance is a critical part of joint car ownership. When a car is registered in two names, insurers expect both owners to be covered. Here’s what you need to know.

Both Owners Must Be on the Policy

Most insurance companies require all registered owners to be listed on the policy. This protects the insurer and ensures full coverage.

If one owner is left off, the policy could be considered invalid in the event of a claim. For example, if you’re in an accident and your name isn’t on the policy, the insurer might deny coverage—even if your partner is listed.

Impact on Premiums

Adding a second owner can affect your insurance rates. Insurers look at both drivers’ records, ages, and credit scores. If one person has a clean record and the other has accidents or tickets, the higher-risk driver may increase the premium.

However, some insurers offer discounts for multiple drivers or married couples. So while rates might go up slightly, there could be savings too.

Claims and Liability

If an accident occurs, both owners are potentially liable—even if only one was driving. This is because both have a financial stake in the vehicle.

For example, if your co-owner causes a serious accident and the damages exceed insurance limits, the other party could sue both of you. Joint registration means shared liability.

This is why it’s crucial to choose co-owners wisely and maintain adequate coverage—especially liability and uninsured motorist protection.

What Happens If One Owner Drops Coverage?

If one owner tries to remove themselves from the policy, the insurer may cancel the entire policy. Most companies won’t allow partial coverage for jointly registered vehicles.

If you need to remove an owner, you’ll likely need to re-register the car in one name first—then update the insurance.

Financial and Legal Risks of Joint Registration

While joint registration has benefits, it’s not without risks. Before you sign on the dotted line, consider these potential downsides.

If you finance the car, both names are on the loan. That means both are responsible for payments. If one person stops paying, the lender can go after both.

Missed payments will show up on both credit reports and can lower your credit scores. Even if you’re not the one missing payments, your credit can still suffer.

Difficulty Selling or Transferring

To sell or transfer the car, both owners must agree and sign the title. If one person refuses or can’t be located, you’re stuck.

For example, if you and your ex-partner co-own a car and you want to sell it, they must consent. If they disappear or refuse, you may need to go to court to force a sale.

Disputes Over Use and Maintenance

Who drives the car? Who pays for repairs? Who handles registration renewals? Without clear agreements, conflicts can arise.

One person might drive more, leading to wear and tear. The other might feel they’re paying more than their fair share. These small issues can escalate into major disagreements.

Tax and Gift Implications

In some cases, adding someone to a car title can be considered a gift—especially if they didn’t contribute to the purchase. This could trigger gift tax reporting, though most people won’t owe taxes due to annual exemptions.

Also, if you sell the car later, capital gains tax may apply if the value has increased significantly. Joint ownership doesn’t eliminate tax responsibilities.

What If the Relationship Ends?

Breakups, divorces, or falling out with a friend can make joint ownership messy. The car becomes a point of contention.

In a divorce, the court may divide the car as part of asset distribution. But if you’re not married, you’ll need a legal agreement to determine ownership.

To avoid this, consider drafting a co-ownership agreement that outlines usage, payments, maintenance, and what happens if you part ways.

Tips for a Smooth Joint Registration Experience

Want to make joint car ownership work? Follow these practical tips to reduce stress and avoid common pitfalls.

Communicate Clearly from the Start

Talk openly about expectations. Who will drive the car? How will expenses be split? What happens if one person wants to sell?

Putting things in writing—even a simple agreement—can prevent misunderstandings.

Choose the Right Ownership Structure

Think carefully about joint tenants vs. tenants in common. Your choice affects inheritance, selling, and liability.

If you’re unsure, consult a lawyer or financial advisor.

Keep Records of Payments

Even if you’re splitting costs 50/50, keep receipts and bank records. This proves contributions if a dispute arises.

Use a shared spreadsheet or app to track payments, repairs, and insurance.

Review Insurance Annually

As your situation changes, so should your coverage. Review your policy each year to ensure it still meets your needs.

Consider adding roadside assistance, rental reimbursement, or gap insurance if you have a loan.

Plan for the Future

What happens if one owner moves away? Gets sick? Passes away?

Discuss these scenarios in advance. Update your ownership structure if needed, and make sure your wills reflect your wishes.

Know Your State’s Rules

DMV requirements change. Bookmark your state’s motor vehicle website and check for updates before registering.

Conclusion

So, can a car be registered in two names? Absolutely. It’s a legal, common, and often smart way to share the cost and responsibility of vehicle ownership. Whether you’re buying with a spouse, family member, or friend, joint registration offers financial benefits, legal protection, and peace of mind.

But it’s not a decision to take lightly. You’re tying your financial and legal fate to another person. Missed payments, accidents, disputes, and life changes can all impact both parties. That’s why it’s essential to choose your co-owner wisely, understand the ownership structure, and communicate openly.

Before you register that car in two names, ask yourself: Do we trust each other? Are we on the same page about money and responsibility? Have we considered what happens if things go wrong?

If the answer is yes, joint registration can be a great option. Just make sure you go in with your eyes open—and your paperwork in order.

With the right preparation, registering a car in two names can be a smooth, beneficial experience for everyone involved.

Frequently Asked Questions

Can a car be registered in two names in all states?

Yes, most states allow a car to be registered in two names. However, the specific rules, forms, and requirements vary by state. Always check with your local DMV for accurate information.

Do both owners need to be on the insurance policy?

Yes, in most cases, both registered owners must be listed on the insurance policy. Insurers require this to ensure full coverage and protect their interests in case of a claim.

Can one owner sell the car without the other’s permission?

No, unless the registration specifies “OR” ownership (meaning either can act alone), both owners must sign off on any sale or transfer. Joint registration typically requires mutual agreement.

What happens if one owner stops paying the loan?

Both owners are legally responsible for the loan. If one stops paying, the lender can pursue both for the debt, and both credit scores may be affected.

Can I remove my name from a jointly registered car?

Yes, but it usually requires the other owner’s consent and a formal title transfer. You may need to visit the DMV together or provide a notarized release form, depending on your state.

Is joint registration a good idea for friends or roommates?

It can be, but it comes with risks. Without a clear agreement, disputes over use, payments, and selling can arise. Consider a written co-ownership contract to protect both parties.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.