Yes, you can pay more on your car loan — and it’s one of the smartest financial moves you can make. Making extra payments reduces your principal balance faster, cuts total interest paid, and shortens your loan term. Whether you have a little extra each month or a one-time windfall, putting more toward your car loan can save you money and get you debt-free sooner.

In This Article

- 1 Key Takeaways

- 2 📑 Table of Contents

- 3 Can I Pay More on My Car Loan? The Short Answer Is Yes — and You Should

- 4 How Car Loans Work: Why Extra Payments Make a Difference

- 5 Benefits of Paying More on Your Car Loan

- 6 How to Pay Extra on Your Car Loan: Step-by-Step Guide

- 7 When Paying Extra Makes the Most Sense

- 8 Potential Downsides and What to Watch Out For

- 9 Real-Life Example: Sarah’s Story

- 10 Conclusion: Yes, You Can — and You Should

- 11 Frequently Asked Questions

- 11.1 Can I pay more on my car loan without penalties?

- 11.2 Will paying extra on my car loan reduce my monthly payment?

- 11.3 How do I make sure my extra payment goes toward the principal?

- 11.4 Is it better to pay extra on my car loan or save the money?

- 11.5 Can I pay off my car loan early?

- 11.6 What happens if I stop making payments after paying extra?

Key Takeaways

- Yes, you can pay extra on your car loan: Most lenders allow additional payments without penalties, but always check your loan agreement first.

- Extra payments reduce interest significantly: Since car loans use amortization, paying more early reduces the principal, which lowers the interest charged over time.

- Paying more shortens your loan term: Even small extra payments can cut months or even years off your repayment period.

- Specify that extra payments go toward principal: If you don’t, the lender might apply the extra amount to future payments instead of reducing your balance.

- Use windfalls wisely: Tax refunds, bonuses, or gifts can be powerful tools to make lump-sum payments and accelerate payoff.

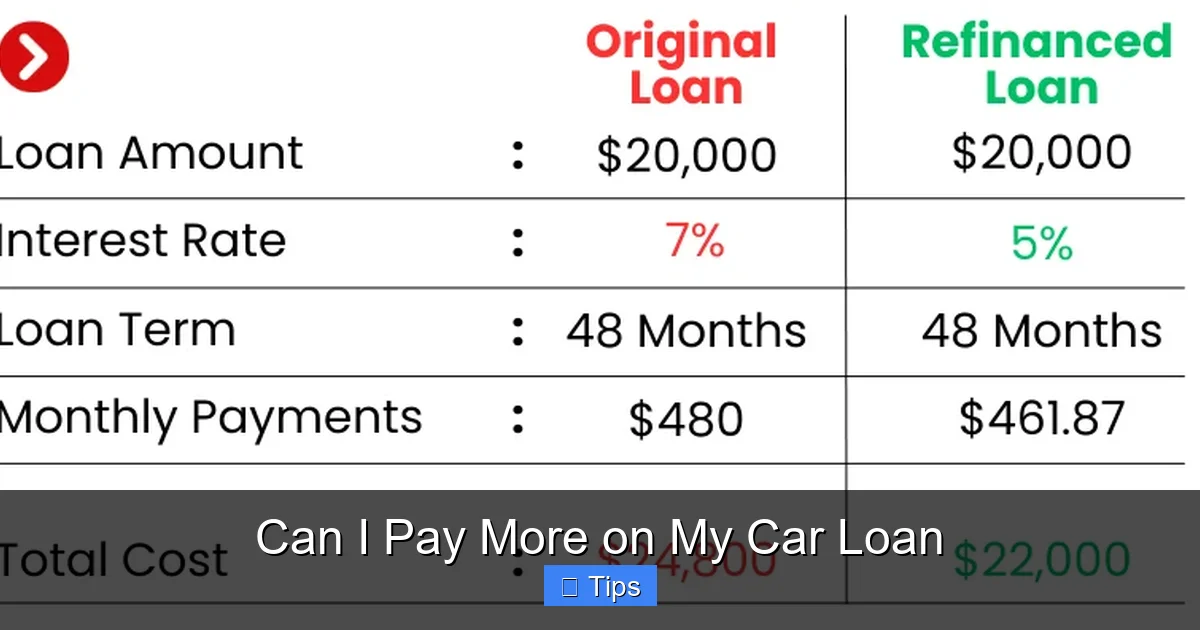

- Consider refinancing if rates are lower: If interest rates have dropped, refinancing could lower your rate and monthly payment, freeing up more cash to pay extra.

- Balance with other financial goals: While paying off your car loan faster is great, don’t neglect high-interest debt, emergency savings, or retirement contributions.

📑 Table of Contents

- Can I Pay More on My Car Loan? The Short Answer Is Yes — and You Should

- How Car Loans Work: Why Extra Payments Make a Difference

- Benefits of Paying More on Your Car Loan

- How to Pay Extra on Your Car Loan: Step-by-Step Guide

- When Paying Extra Makes the Most Sense

- Potential Downsides and What to Watch Out For

- Real-Life Example: Sarah’s Story

- Conclusion: Yes, You Can — and You Should

Can I Pay More on My Car Loan? The Short Answer Is Yes — and You Should

If you’ve ever looked at your car loan statement and thought, “I wish I could pay this off faster,” you’re not alone. Many car owners feel the same way. The good news? You absolutely can pay more on your car loan — and doing so can save you real money. In fact, making extra payments is one of the simplest and most effective ways to reduce debt and gain financial freedom.

Car loans are typically amortizing loans, meaning each payment covers both interest and a portion of the principal (the original amount borrowed). Early in the loan term, a larger chunk of your payment goes toward interest, while later payments chip away more at the principal. This structure means that paying extra early can have a big impact. By reducing the principal faster, you reduce the amount of interest you’ll pay over the life of the loan. It’s like getting a discount on your debt.

But before you start sending in extra cash, it’s important to understand how it works, what to watch out for, and how to make sure your extra payments count. In this guide, we’ll walk you through everything you need to know about paying more on your car loan — from the benefits and potential pitfalls to practical tips and real-life examples. Whether you’re looking to save a few hundred dollars or pay off your car years early, this article will help you do it smartly and safely.

How Car Loans Work: Why Extra Payments Make a Difference

Visual guide about Can I Pay More on My Car Loan

Image source: images.ctfassets.net

To understand why paying more on your car loan is so powerful, let’s first break down how car loans actually work. When you take out a car loan, the lender gives you a lump sum to buy the vehicle, and you agree to pay it back over a set period — usually 36, 48, 60, or even 72 months — with interest.

Each monthly payment is calculated using a formula that spreads out the principal and interest over the loan term. This is called amortization. At the beginning of the loan, most of your payment goes toward interest. As time goes on, the interest portion shrinks, and more of your payment goes toward reducing the principal.

For example, let’s say you have a $25,000 car loan at 5% interest over 60 months (5 years). Your monthly payment would be about $472. In the first month, around $104 of that goes toward interest, and only $368 reduces your principal. By month 36, the interest portion drops to about $45, and $427 goes toward principal. This gradual shift is normal, but it also means that early payments don’t reduce your debt as much as you might hope.

Now, imagine you pay an extra $100 each month starting from the very first payment. That extra $100 goes directly toward the principal (assuming you tell the lender to apply it that way). This reduces your balance faster, which in turn reduces the amount of interest you’ll be charged in future months. Over time, this snowballs. You end up paying less interest overall and paying off the loan sooner.

Let’s look at the numbers. With the $25,000 loan at 5% over 60 months:

– Without extra payments: Total interest paid = ~$3,322

– With $100 extra per month: Total interest paid = ~$2,365

– You save $957 and pay off the loan in about 50 months instead of 60.

That’s a big difference — and it’s just from $100 extra per month. If you can pay $200 extra, the savings grow even more. The key takeaway? Every extra dollar you pay reduces the principal, which reduces future interest. It’s a simple concept, but one that can have a huge impact on your financial health.

Understanding Amortization and Its Impact

Amortization is the process of paying off debt with regular payments over time. Each payment is split between interest and principal, but the split changes over the life of the loan. Early payments are mostly interest, which is why paying extra early is so effective.

Think of it like a snowball rolling downhill. At first, it’s small and slow. But as it picks up snow, it grows bigger and faster. Extra payments are like adding snow to the ball early — they help it grow faster, so it reaches the bottom (loan payoff) sooner.

Here’s a quick example to illustrate:

– Loan: $20,000 at 6% interest over 60 months

– Monthly payment: $387

– Total interest: ~$3,220

Now, add $50 extra per month:

– New total interest: ~$2,680

– Savings: $540

– Payoff time: ~55 months

Add $150 extra per month:

– New total interest: ~$1,920

– Savings: $1,300

– Payoff time: ~47 months

As you can see, even modest extra payments can lead to significant savings. The earlier you start, the better. That’s because interest is calculated on the remaining balance each month. The lower the balance, the less interest you pay.

How Interest Is Calculated on Car Loans

Car loans typically use simple interest, meaning interest is calculated only on the outstanding principal balance, not on previously accrued interest (unlike compound interest). This makes it easier to understand and manage.

The formula for monthly interest is:

Interest = (Principal Balance × Annual Interest Rate) ÷ 12

For example, if your balance is $15,000 and your interest rate is 5%, your monthly interest charge is:

($15,000 × 0.05) ÷ 12 = $62.50

If you make a $500 payment, $62.50 goes to interest, and $437.50 reduces the principal. Next month, your balance is $14,562.50, so your interest charge drops to about $60.68. This gradual reduction is why paying extra early has such a big effect — you’re reducing the balance before interest has a chance to build up.

Benefits of Paying More on Your Car Loan

Visual guide about Can I Pay More on My Car Loan

Image source: clicktodrive.ca

Paying extra on your car loan isn’t just about getting rid of debt faster — it comes with several real, tangible benefits. Let’s explore the top reasons why you should consider making additional payments.

Save Thousands in Interest

This is the biggest benefit. Interest is essentially the cost of borrowing money. The longer you take to pay off your loan, the more interest you pay. By paying extra, you reduce the principal faster, which reduces the amount of interest charged each month.

Let’s say you have a $30,000 car loan at 7% interest over 72 months. Your monthly payment is about $497, and you’ll pay around $6,800 in total interest. Now, add $100 extra per month. Your total interest drops to about $5,200 — a savings of $1,600. And you pay off the loan in about 62 months instead of 72.

That’s $1,600 back in your pocket — money you can use for savings, travel, or other goals. Over the life of a loan, these savings can add up to thousands of dollars.

Pay Off Your Car Sooner

Who doesn’t want to own their car outright sooner? Paying extra accelerates your payoff date. Instead of making payments for five or six years, you could be done in three or four. That means more financial freedom and less stress.

Imagine being able to redirect that $400 monthly car payment toward a vacation fund, retirement savings, or a down payment on a house. Paying off your car early frees up cash flow for other important goals.

Reduce Financial Stress

Debt can be a major source of stress. Knowing you have a car payment every month can weigh on your mind, especially if money is tight. Paying off your car early reduces this burden. You’ll feel more in control of your finances and less dependent on monthly payments.

Plus, once your car is paid off, you own it free and clear. No more worrying about repossession or missed payments. It’s a huge psychological win.

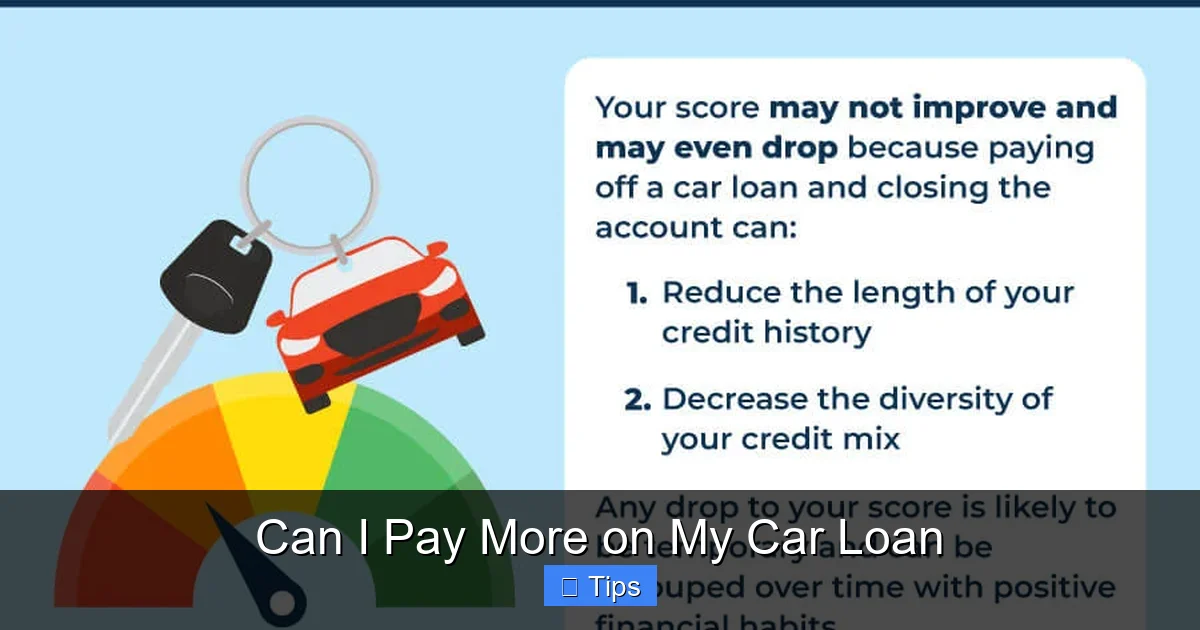

Improve Your Credit Score Over Time

While paying off your car loan won’t instantly boost your credit score, it can help in the long run. Paying down debt reduces your credit utilization ratio (the amount of credit you’re using compared to your total available credit), which is a factor in your credit score. Additionally, consistently making on-time payments — including extra ones — shows lenders you’re responsible with credit.

Once the loan is paid off, you’ll have one less debt on your credit report, which can improve your overall credit profile. Just remember that closing an installment loan (like a car loan) might cause a small, temporary dip in your score, but it’s usually short-lived.

Build Positive Financial Habits

Making extra payments requires discipline and planning. It forces you to look at your budget, prioritize spending, and make intentional financial decisions. These habits can spill over into other areas of your life, like saving for emergencies, investing, or paying off other debts.

Over time, you’ll develop a mindset of financial responsibility that can lead to long-term wealth and security.

How to Pay Extra on Your Car Loan: Step-by-Step Guide

Visual guide about Can I Pay More on My Car Loan

Image source: images.ctfassets.net

Now that you know the benefits, let’s talk about how to actually pay more on your car loan. It’s not as simple as just sending in extra cash — you need to do it the right way to make sure the money counts.

Check Your Loan Agreement for Prepayment Penalties

Before you start making extra payments, review your loan agreement. Most car loans today don’t have prepayment penalties — fees charged for paying off the loan early — but some older loans or certain lenders might still include them.

A prepayment penalty could be a flat fee (e.g., $200) or a percentage of the remaining balance. If your loan has one, calculate whether the savings from paying early still outweigh the penalty. In most cases, they do, but it’s worth checking.

If your loan does have a penalty, you might still benefit from paying extra — just not necessarily paying it off entirely. Focus on reducing the balance without triggering the penalty.

Contact Your Lender to Confirm Payment Instructions

Not all lenders apply extra payments the same way. Some automatically apply extra money to the principal, while others might apply it to future payments (called “prepaid payments”) instead.

To make sure your extra payment reduces your principal, contact your lender and ask:

– How do you apply additional payments?

– Do I need to specify that the extra amount goes toward principal?

– Is there a specific form or note I need to include?

Most lenders allow you to specify this when you make a payment online or by mail. For example, you might check a box that says “Apply extra to principal” or write “Principal reduction” in the memo line.

If you don’t specify, the lender might treat the extra payment as a prepayment of future installments, which doesn’t reduce your balance or save you interest.

Make Extra Payments Consistently

Consistency is key. Even small extra payments can add up over time. Here are a few strategies:

– Round up your payment: If your payment is $387, pay $400. That extra $13 per month might not seem like much, but over 60 months, it adds up to $780 — all going toward principal.

– Pay biweekly instead of monthly: Instead of one payment per month, split it in half and pay every two weeks. You’ll make 26 half-payments per year (equivalent to 13 full payments), which accelerates payoff.

– Use windfalls: Tax refunds, bonuses, or gifts can be used for lump-sum payments. A $1,000 bonus could save you hundreds in interest.

Track Your Progress

Keep an eye on your loan balance and amortization schedule. Many lenders offer online portals where you can see how much you’ve paid and how much is left. You can also use a loan payoff calculator to see how extra payments affect your timeline.

Seeing your balance drop faster than expected can be incredibly motivating. It’s a visual reminder that your efforts are paying off — literally.

When Paying Extra Makes the Most Sense

While paying more on your car loan is generally a good idea, it’s not always the best use of your money. Here’s when it makes the most sense — and when you might want to prioritize other financial goals.

You Have a High-Interest Car Loan

If your car loan has an interest rate above 6% or 7%, paying extra is almost always worth it. High interest means you’re paying a lot just to borrow money. Reducing that balance quickly saves you real cash.

For example, a $20,000 loan at 8% over 60 months costs about $4,300 in interest. Paying an extra $100 per month cuts that to around $3,200 — a savings of $1,100.

You Have Extra Cash and No High-Interest Debt

If you’ve already paid off credit cards or other high-interest debt (like personal loans), then putting extra money toward your car loan is a smart move. But if you still have credit card debt at 18% or 20%, that should be your priority. The interest on credit cards is usually much higher than on car loans, so paying those off first gives you a better return.

You Want to Improve Cash Flow Soon

If you’re planning a big life change — like buying a house, starting a family, or changing jobs — paying off your car loan early can free up your monthly budget. That extra $400 per month can go toward a down payment, childcare, or emergency savings.

You’re Close to Payoff

If you’re in the last year or two of your loan, even small extra payments can help you finish strong. You might be able to pay it off in a few months instead of a few years.

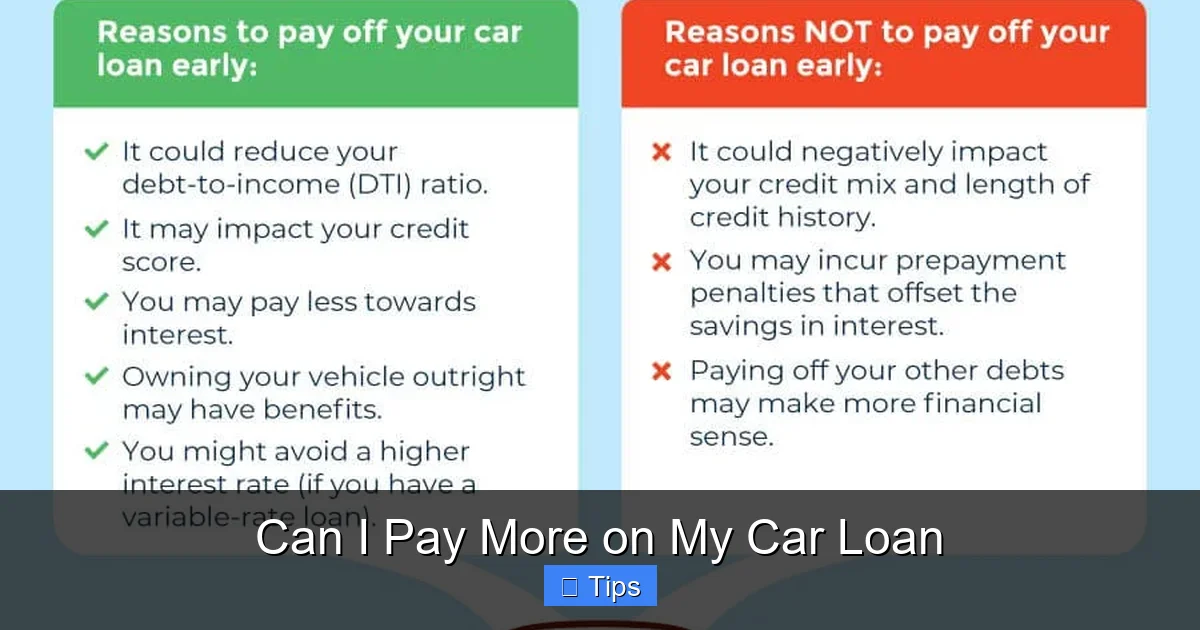

Potential Downsides and What to Watch Out For

Paying extra on your car loan is usually a great idea, but there are a few things to keep in mind.

Opportunity Cost

Every dollar you put toward your car loan is a dollar you can’t use elsewhere. If you have high-interest debt, low emergency savings, or no retirement contributions, those might be better uses of your money.

For example, if you have a credit card balance at 20% interest, paying that off gives you a 20% return — much better than the 5% you’d save on a car loan.

Liquidity Risk

Once you pay extra on your car loan, that money is gone. You can’t easily get it back if an emergency comes up. That’s why it’s important to have an emergency fund (3–6 months of expenses) before making large extra payments.

Depreciation vs. Loan Balance

Cars lose value quickly. In the first few years, your car might be worth less than what you owe — a situation called “being upside down” or “underwater.” Paying extra can help you get to a point where you owe less than the car is worth, which is helpful if you plan to sell or trade it in.

But if you’re already underwater, paying extra might not change the fact that the car is depreciating. In that case, focus on getting to a positive equity position rather than paying off the loan entirely.

Real-Life Example: Sarah’s Story

Let’s look at a real-world example. Sarah bought a used car for $18,000 with a 5-year loan at 6% interest. Her monthly payment is $348.

For the first year, she makes only the minimum payments. She pays about $1,000 in interest and reduces her principal by $3,176.

Then she gets a raise and decides to pay an extra $150 per month. She also uses her $1,200 tax refund to make a lump-sum payment.

Here’s what happens:

– Without extra payments: Total interest = ~$2,880; Payoff in 60 months

– With extra payments: Total interest = ~$1,950; Payoff in 48 months

Sarah saves $930 and owns her car two years earlier. She also feels more confident about her finances and starts saving for a down payment on a house.

Her story shows how small changes can lead to big results — especially when you start early and stay consistent.

Conclusion: Yes, You Can — and You Should

So, can you pay more on your car loan? Absolutely. And in most cases, you should. Making extra payments is one of the simplest, most effective ways to save money, reduce debt, and gain financial freedom.

By understanding how car loans work, knowing how to apply extra payments correctly, and staying consistent, you can pay off your car faster and keep more money in your pocket. Whether you add $20 or $200 to your payment, every extra dollar counts.

Just remember to balance this goal with other financial priorities. Pay off high-interest debt first, build an emergency fund, and don’t neglect retirement savings. But once those bases are covered, putting extra money toward your car loan is a smart, strategic move.

Start small if you need to. Round up your payment, use a bonus, or switch to biweekly payments. Over time, these small steps add up to big savings. And the best part? One day, you’ll make your final payment — and that car will truly be yours.

Frequently Asked Questions

Can I pay more on my car loan without penalties?

Yes, most car loans today do not have prepayment penalties, meaning you can pay extra or pay off the loan early without fees. However, always check your loan agreement to be sure.

Will paying extra on my car loan reduce my monthly payment?

No, paying extra does not reduce your required monthly payment. It reduces the principal balance and shortens the loan term, but your monthly payment stays the same unless you refinance.

How do I make sure my extra payment goes toward the principal?

Contact your lender and specify that the extra amount should be applied to the principal. You may need to note this on your payment check or select an option in your online account.

Is it better to pay extra on my car loan or save the money?

It depends on your financial situation. If you have high-interest debt or no emergency fund, prioritize those first. Otherwise, paying extra on a high-interest car loan can save you more in interest than you’d earn in savings.

Can I pay off my car loan early?

Yes, you can pay off your car loan early by making a lump-sum payment for the remaining balance. Contact your lender to get the exact payoff amount, which may include a small per-diem interest charge.

What happens if I stop making payments after paying extra?

Paying extra doesn’t change your obligation to make regular payments. If you stop paying, you risk late fees, damage to your credit, and repossession of the vehicle. Always stay current on your loan.

At CarLegit, we believe information should be clear, factual, and genuinely helpful. That’s why every guide, review, and update on our website is created with care, research, and a strong focus on user experience.